Trends in Patents for Plasma Surface Treatment Innovations

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Plasma Surface Treatment Evolution and Objectives

Plasma surface treatment technology has evolved significantly over the past several decades, transforming from rudimentary applications to sophisticated processes that enable precise material modifications at the nanoscale level. The journey began in the 1960s with basic plasma etching techniques used primarily in semiconductor manufacturing. By the 1980s, plasma treatment had expanded to include polymer surface modification, opening new possibilities for adhesion improvement and surface functionalization across multiple industries.

The evolution accelerated in the 1990s with the development of atmospheric pressure plasma systems, which eliminated the need for vacuum chambers and significantly reduced processing costs. This breakthrough democratized plasma technology, making it accessible to a broader range of industries beyond microelectronics, including automotive, medical device manufacturing, and consumer goods production.

Recent technological advancements have focused on precision control of plasma parameters, enabling selective surface modification without affecting bulk material properties. The integration of computational modeling and real-time monitoring systems has further enhanced process control, allowing for reproducible and scalable treatments that meet increasingly stringent industrial specifications.

Patent activity in plasma surface treatment has shown consistent growth, with notable acceleration since 2010. Analysis of patent filings reveals three distinct evolutionary phases: basic process development (1970s-1990s), equipment optimization (1990s-2010s), and application-specific innovations (2010-present). This progression reflects the technology's maturation and its expanding relevance across diverse industrial sectors.

The primary objectives of current plasma surface treatment research and development focus on several key areas. Energy efficiency improvements aim to reduce the environmental footprint while maintaining or enhancing treatment effectiveness. Selective functionalization techniques seek to enable precise control over surface chemistry at micro and nano scales. Integration with other manufacturing processes represents another critical goal, as industries push toward seamless production workflows with minimal handling steps.

Additionally, researchers are pursuing expanded material compatibility to address emerging materials such as high-performance composites, biodegradable polymers, and novel metal alloys. The development of portable and flexible treatment systems represents another frontier, potentially enabling on-site applications and treatment of complex three-dimensional geometries that were previously inaccessible.

These evolutionary trends and objectives are driving patent activity in specific directions, with particular emphasis on environmentally friendly processes, digital control systems, and specialized applications in high-value industries such as medical devices, aerospace, and renewable energy technologies.

The evolution accelerated in the 1990s with the development of atmospheric pressure plasma systems, which eliminated the need for vacuum chambers and significantly reduced processing costs. This breakthrough democratized plasma technology, making it accessible to a broader range of industries beyond microelectronics, including automotive, medical device manufacturing, and consumer goods production.

Recent technological advancements have focused on precision control of plasma parameters, enabling selective surface modification without affecting bulk material properties. The integration of computational modeling and real-time monitoring systems has further enhanced process control, allowing for reproducible and scalable treatments that meet increasingly stringent industrial specifications.

Patent activity in plasma surface treatment has shown consistent growth, with notable acceleration since 2010. Analysis of patent filings reveals three distinct evolutionary phases: basic process development (1970s-1990s), equipment optimization (1990s-2010s), and application-specific innovations (2010-present). This progression reflects the technology's maturation and its expanding relevance across diverse industrial sectors.

The primary objectives of current plasma surface treatment research and development focus on several key areas. Energy efficiency improvements aim to reduce the environmental footprint while maintaining or enhancing treatment effectiveness. Selective functionalization techniques seek to enable precise control over surface chemistry at micro and nano scales. Integration with other manufacturing processes represents another critical goal, as industries push toward seamless production workflows with minimal handling steps.

Additionally, researchers are pursuing expanded material compatibility to address emerging materials such as high-performance composites, biodegradable polymers, and novel metal alloys. The development of portable and flexible treatment systems represents another frontier, potentially enabling on-site applications and treatment of complex three-dimensional geometries that were previously inaccessible.

These evolutionary trends and objectives are driving patent activity in specific directions, with particular emphasis on environmentally friendly processes, digital control systems, and specialized applications in high-value industries such as medical devices, aerospace, and renewable energy technologies.

Market Analysis for Plasma Surface Modification Technologies

The global market for plasma surface modification technologies has experienced significant growth over the past decade, driven by increasing demand across multiple industries. The market was valued at approximately $2.1 billion in 2022 and is projected to reach $3.5 billion by 2028, representing a compound annual growth rate (CAGR) of 8.7% during the forecast period.

The electronics and semiconductor industry remains the largest end-user segment, accounting for nearly 40% of the total market share. This dominance is attributed to the critical role plasma treatment plays in microelectronics manufacturing, particularly in cleaning, etching, and surface activation processes for advanced semiconductor devices. The miniaturization trend in electronics continues to drive demand for more precise surface modification techniques.

Automotive and aerospace sectors collectively represent the second-largest market segment at 25%. These industries increasingly utilize plasma technologies for improving adhesion properties, enhancing corrosion resistance, and creating specialized surface functionalities on various components. The growing emphasis on lightweight materials in transportation has further accelerated adoption rates.

Medical device manufacturing has emerged as the fastest-growing application segment, with a CAGR exceeding 12%. Plasma treatment enables superior biocompatibility, sterilization, and functionalization of medical implants and devices. The stringent regulatory requirements in healthcare have positioned plasma technologies as preferred solutions for achieving consistent surface properties.

Geographically, Asia-Pacific dominates the market with approximately 45% share, led by manufacturing powerhouses like China, Japan, South Korea, and Taiwan. North America and Europe follow with 28% and 22% market shares respectively, with particular strength in high-value applications within medical, aerospace, and advanced electronics sectors.

Key market drivers include increasing demand for high-performance materials across industries, growing emphasis on sustainable manufacturing processes, and continuous innovation in plasma equipment that offers greater precision and efficiency. The shift toward Industry 4.0 and smart manufacturing has also accelerated adoption, as plasma systems increasingly incorporate automation, real-time monitoring, and data analytics capabilities.

Market challenges include high initial investment costs for advanced plasma systems, technical complexity requiring specialized expertise, and competition from alternative surface treatment technologies. However, the superior performance characteristics and expanding application scope of plasma technologies continue to drive market expansion despite these challenges.

The electronics and semiconductor industry remains the largest end-user segment, accounting for nearly 40% of the total market share. This dominance is attributed to the critical role plasma treatment plays in microelectronics manufacturing, particularly in cleaning, etching, and surface activation processes for advanced semiconductor devices. The miniaturization trend in electronics continues to drive demand for more precise surface modification techniques.

Automotive and aerospace sectors collectively represent the second-largest market segment at 25%. These industries increasingly utilize plasma technologies for improving adhesion properties, enhancing corrosion resistance, and creating specialized surface functionalities on various components. The growing emphasis on lightweight materials in transportation has further accelerated adoption rates.

Medical device manufacturing has emerged as the fastest-growing application segment, with a CAGR exceeding 12%. Plasma treatment enables superior biocompatibility, sterilization, and functionalization of medical implants and devices. The stringent regulatory requirements in healthcare have positioned plasma technologies as preferred solutions for achieving consistent surface properties.

Geographically, Asia-Pacific dominates the market with approximately 45% share, led by manufacturing powerhouses like China, Japan, South Korea, and Taiwan. North America and Europe follow with 28% and 22% market shares respectively, with particular strength in high-value applications within medical, aerospace, and advanced electronics sectors.

Key market drivers include increasing demand for high-performance materials across industries, growing emphasis on sustainable manufacturing processes, and continuous innovation in plasma equipment that offers greater precision and efficiency. The shift toward Industry 4.0 and smart manufacturing has also accelerated adoption, as plasma systems increasingly incorporate automation, real-time monitoring, and data analytics capabilities.

Market challenges include high initial investment costs for advanced plasma systems, technical complexity requiring specialized expertise, and competition from alternative surface treatment technologies. However, the superior performance characteristics and expanding application scope of plasma technologies continue to drive market expansion despite these challenges.

Global Landscape and Technical Barriers in Plasma Treatment

Plasma surface treatment technology has evolved significantly across different regions, with distinct patterns of development and adoption. In North America, the focus has been predominantly on high-precision applications in aerospace and medical device industries, where stringent quality requirements drive innovation. The United States maintains leadership in plasma treatment patents for semiconductor manufacturing, with companies like Applied Materials and Lam Research holding substantial intellectual property portfolios.

European developments have centered on environmental sustainability aspects of plasma technology, with Germany and France leading research into low-energy consumption systems and environmentally friendly process gases. The European patent landscape shows particular strength in automotive applications and functional coatings, with research institutions playing a significant collaborative role with industry.

Asia-Pacific represents the fastest-growing region for plasma treatment innovation, with China filing the highest number of patents in recent years, primarily focused on mass production applications and cost-effective implementations. Japan maintains specialized expertise in precision electronics applications, while South Korea demonstrates strength in display technology treatments.

Despite global advancement, significant technical barriers persist across regions. Power efficiency remains a universal challenge, with high energy consumption limiting broader industrial adoption. Current plasma systems typically operate at 10-30% energy efficiency, creating both cost and sustainability concerns. Scalability presents another major obstacle, particularly for treating three-dimensional complex geometries and large surface areas simultaneously.

Process control precision represents a critical barrier, as maintaining uniform plasma distribution across varied substrate geometries remains technically challenging. Temperature management during treatment poses difficulties, especially for heat-sensitive materials where thermal damage must be prevented while achieving desired surface modification.

Material compatibility limitations restrict application breadth, with certain polymers and composites exhibiting degradation under plasma exposure. The industry also faces challenges in real-time monitoring capabilities, as current sensor technologies cannot adequately measure plasma parameters during treatment processes.

Regulatory frameworks vary significantly by region, creating compliance challenges for global technology deployment. North American and European markets maintain strict safety and emissions standards, while emerging markets often have less defined regulatory environments, creating market entry complexities for technology providers.

The integration of plasma treatment into existing manufacturing lines presents significant engineering challenges, particularly in high-throughput production environments where treatment speed must match other process steps. These technical barriers collectively shape research priorities and patent activity across the global plasma treatment landscape.

European developments have centered on environmental sustainability aspects of plasma technology, with Germany and France leading research into low-energy consumption systems and environmentally friendly process gases. The European patent landscape shows particular strength in automotive applications and functional coatings, with research institutions playing a significant collaborative role with industry.

Asia-Pacific represents the fastest-growing region for plasma treatment innovation, with China filing the highest number of patents in recent years, primarily focused on mass production applications and cost-effective implementations. Japan maintains specialized expertise in precision electronics applications, while South Korea demonstrates strength in display technology treatments.

Despite global advancement, significant technical barriers persist across regions. Power efficiency remains a universal challenge, with high energy consumption limiting broader industrial adoption. Current plasma systems typically operate at 10-30% energy efficiency, creating both cost and sustainability concerns. Scalability presents another major obstacle, particularly for treating three-dimensional complex geometries and large surface areas simultaneously.

Process control precision represents a critical barrier, as maintaining uniform plasma distribution across varied substrate geometries remains technically challenging. Temperature management during treatment poses difficulties, especially for heat-sensitive materials where thermal damage must be prevented while achieving desired surface modification.

Material compatibility limitations restrict application breadth, with certain polymers and composites exhibiting degradation under plasma exposure. The industry also faces challenges in real-time monitoring capabilities, as current sensor technologies cannot adequately measure plasma parameters during treatment processes.

Regulatory frameworks vary significantly by region, creating compliance challenges for global technology deployment. North American and European markets maintain strict safety and emissions standards, while emerging markets often have less defined regulatory environments, creating market entry complexities for technology providers.

The integration of plasma treatment into existing manufacturing lines presents significant engineering challenges, particularly in high-throughput production environments where treatment speed must match other process steps. These technical barriers collectively shape research priorities and patent activity across the global plasma treatment landscape.

Current Patent Solutions for Plasma Surface Modification

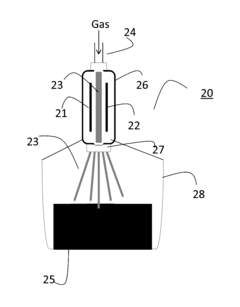

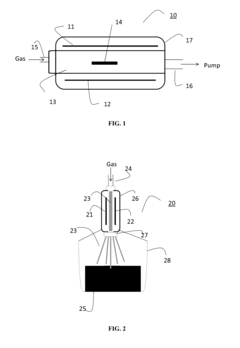

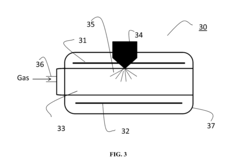

01 Plasma treatment apparatus design

Various designs of plasma treatment apparatus are disclosed for surface modification. These include specialized chambers, electrode configurations, and power supply systems that enable efficient and uniform plasma generation. The designs focus on optimizing plasma distribution, controlling treatment parameters, and ensuring compatibility with different substrate materials and geometries.- Plasma treatment apparatus for surface modification: Various plasma treatment apparatus designs are used for surface modification of materials. These systems typically include plasma generation chambers, electrode configurations, and gas delivery systems that enable controlled plasma treatment of surfaces. The apparatus can be designed for specific applications such as semiconductor processing, material activation, or coating preparation, with features that optimize plasma distribution and treatment uniformity.

- Plasma surface treatment for semiconductor manufacturing: Plasma treatment processes specifically designed for semiconductor manufacturing applications. These methods involve using plasma to clean, etch, or modify semiconductor surfaces to improve subsequent processing steps. The treatments can enhance adhesion properties, remove contaminants, or create specific surface characteristics required for semiconductor device fabrication, improving overall device performance and reliability.

- Plasma surface functionalization for improved adhesion: Plasma treatment methods that specifically target surface functionalization to improve adhesion properties of materials. These processes introduce functional groups onto material surfaces through plasma interaction, creating chemical bonding sites that enhance adhesion between different materials. This is particularly useful for joining dissimilar materials, applying coatings, or preparing surfaces for subsequent processing steps.

- Atmospheric pressure plasma treatment technologies: Plasma treatment methods that operate at atmospheric pressure rather than requiring vacuum conditions. These technologies make plasma treatment more accessible for industrial applications by eliminating the need for complex vacuum systems. Atmospheric pressure plasma systems can be designed for continuous processing of materials and are particularly valuable for treating large or irregularly shaped objects that would be difficult to process in vacuum chambers.

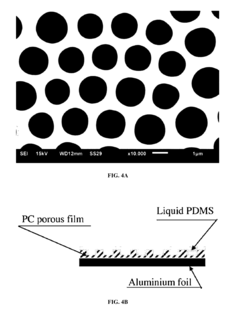

- Plasma surface treatment for polymer and textile materials: Specialized plasma treatment methods developed for polymer and textile materials to modify surface properties without affecting bulk characteristics. These treatments can improve wettability, printability, dyeability, and other surface-dependent properties of polymers and textiles. The plasma processes are typically designed to be non-destructive while creating specific surface modifications that enhance material performance in various applications.

02 Surface modification for improved adhesion

Plasma treatment processes that specifically enhance surface adhesion properties of materials. These treatments modify the surface energy and chemical composition of substrates, creating functional groups that promote better bonding with coatings, adhesives, or other materials. The processes are applicable to various materials including polymers, metals, and composites.Expand Specific Solutions03 Semiconductor processing applications

Plasma surface treatment methods specifically designed for semiconductor manufacturing. These include processes for wafer cleaning, etching, deposition, and surface activation prior to subsequent processing steps. The treatments enable precise control of surface properties at the nanoscale, which is critical for advanced semiconductor device fabrication.Expand Specific Solutions04 Atmospheric pressure plasma technologies

Plasma treatment systems that operate at or near atmospheric pressure, eliminating the need for vacuum chambers. These technologies enable continuous processing, in-line integration with manufacturing systems, and treatment of temperature-sensitive materials. The methods provide cost-effective surface modification solutions for industrial-scale applications.Expand Specific Solutions05 Specialized surface functionalization

Advanced plasma treatment methods for creating specific functional properties on material surfaces. These include hydrophilic/hydrophobic modifications, antimicrobial surfaces, biocompatible interfaces, and selective chemical functionalization. The treatments enable precise control over surface chemistry while maintaining the bulk properties of the treated materials.Expand Specific Solutions

Leading Companies and Research Institutions in Plasma Treatment

Plasma surface treatment technology is currently in a mature growth phase, with an estimated global market size of $2-3 billion and projected annual growth of 5-8%. The competitive landscape is dominated by semiconductor equipment manufacturers like Tokyo Electron and Lam Research, who lead in patent filings for advanced plasma processing technologies. Medical device companies such as DePuy Synthes and Becton Dickinson are increasingly patenting plasma-based surface modification techniques for biocompatible materials. Research institutions including CNRS and TNO collaborate with industry players to develop next-generation applications. The technology shows high maturity in semiconductor manufacturing but remains in development stages for emerging applications in medical devices, displays, and renewable energy, with companies like Samsung Display and Corning focusing on specialized surface treatment innovations for their respective industries.

Tokyo Electron Ltd.

Technical Solution: Tokyo Electron has developed advanced plasma-enhanced atomic layer deposition (PEALD) systems that enable precise control of film thickness at the atomic level. Their PEALD technology utilizes plasma to activate precursor molecules, allowing for lower process temperatures and improved film quality compared to thermal ALD processes. The company has pioneered self-limiting surface reactions in plasma environments that create uniform, conformal coatings on complex 3D structures with aspect ratios exceeding 100:1. Their patented technology includes specialized plasma sources that generate high-density, low-damage plasmas with electron temperatures below 2eV, enabling treatment of sensitive materials without degradation. Tokyo Electron has also developed time-modulated plasma processes that alternate between plasma-on and plasma-off states to enhance surface modification while minimizing substrate damage.

Strengths: Industry-leading precision in atomic-scale deposition control; specialized low-damage plasma sources suitable for sensitive materials; extensive patent portfolio covering various plasma treatment applications. Weaknesses: Systems typically require significant capital investment; complex plasma technologies may require specialized operator training and maintenance.

Centre National de la Recherche Scientifique

Technical Solution: The Centre National de la Recherche Scientifique (CNRS) has pioneered fundamental research in plasma surface interactions, developing novel atmospheric pressure plasma jets (APPJs) for biomedical applications. Their patented plasma sources generate cold plasmas (30-40°C) containing reactive oxygen and nitrogen species (RONS) that selectively interact with biological surfaces. CNRS researchers have demonstrated plasma-induced cell membrane permeabilization techniques that enhance drug delivery efficiency by up to 400% compared to conventional methods. Their innovations include plasma polymerization processes that create nanometer-thick functional coatings with controlled chemical composition and cross-linking density. Recent patents focus on plasma-activated water (PAW) technologies that generate long-lived reactive species in liquids, enabling indirect plasma treatment of heat-sensitive materials and internal surfaces of complex geometries.

Strengths: Strong fundamental scientific understanding of plasma-surface interactions; innovative approaches to biomedical applications; extensive academic collaboration network. Weaknesses: Some technologies remain at laboratory scale; commercialization pathways may require industrial partnerships; focus on research may limit immediate industrial applications.

Key Patent Innovations in Plasma Surface Engineering

Plasma treatment of liquid surfaces

PatentActiveUS20170036184A1

Innovation

- Exposing liquid oils to plasma treatment, specifically using low-pressure or atmospheric-pressure plasma discharge, generates reactive species that alter the surface chemistry, decreasing the water contact angle and increasing surface energy, while maintaining the effect for an extended period.

Polymer surface modification

PatentInactiveUS20110104509A1

Innovation

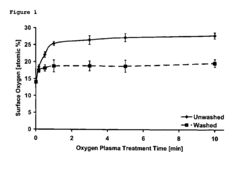

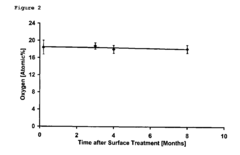

- A method involving plasma surface treatments, such as oxidative treatments with oxygen, followed by washing steps to stabilize the surface by removing loosely bound materials and quenching radicals, increasing hydrophilicity and long-term stability.

Patent Strategy and Intellectual Property Protection

In the competitive landscape of plasma surface treatment technologies, a robust patent strategy is essential for companies seeking to protect their innovations and maintain market advantage. The global patent landscape for plasma treatment shows concentrated activity in key industrial regions, with the United States, Germany, Japan, and increasingly China dominating patent filings. Companies must develop comprehensive intellectual property protection strategies that align with their business objectives and technological roadmaps.

Patent mapping reveals several critical protection areas in plasma surface treatment: equipment design, process parameters, specific applications, and material-specific treatments. Forward-thinking organizations are increasingly filing patent families rather than individual patents, creating protective clusters around core technologies. This approach provides broader protection and creates significant barriers to competitors attempting to develop similar solutions.

The timing of patent filings has become increasingly strategic in this field. Early filing is crucial for fundamental innovations, while companies often employ staged filing approaches for incremental improvements to maximize protection periods. Cross-licensing agreements have emerged as a common practice among major industry players, allowing for technology exchange while maintaining competitive positions in specific market segments.

Freedom-to-operate analyses have become standard practice before initiating new plasma treatment R&D projects. These assessments help companies navigate the complex patent landscape and identify potential infringement risks or licensing opportunities. Additionally, defensive publication strategies are being employed to prevent competitors from patenting incremental innovations in non-core areas.

Geographic considerations significantly impact patent strategy in this sector. While comprehensive protection in major markets remains important, companies are increasingly tailoring their filing strategies based on manufacturing locations, target markets, and enforcement capabilities. The rise of plasma treatment applications in emerging industries like medical devices and renewable energy has prompted companies to extend protection into previously unexplored patent classifications.

Trade secret protection complements patent strategies, particularly for process know-how that is difficult to reverse engineer. Companies often maintain a balanced portfolio of patents for visible innovations and trade secrets for manufacturing processes, creating a multi-layered protection approach that maximizes competitive advantage while minimizing disclosure of critical information.

Patent mapping reveals several critical protection areas in plasma surface treatment: equipment design, process parameters, specific applications, and material-specific treatments. Forward-thinking organizations are increasingly filing patent families rather than individual patents, creating protective clusters around core technologies. This approach provides broader protection and creates significant barriers to competitors attempting to develop similar solutions.

The timing of patent filings has become increasingly strategic in this field. Early filing is crucial for fundamental innovations, while companies often employ staged filing approaches for incremental improvements to maximize protection periods. Cross-licensing agreements have emerged as a common practice among major industry players, allowing for technology exchange while maintaining competitive positions in specific market segments.

Freedom-to-operate analyses have become standard practice before initiating new plasma treatment R&D projects. These assessments help companies navigate the complex patent landscape and identify potential infringement risks or licensing opportunities. Additionally, defensive publication strategies are being employed to prevent competitors from patenting incremental innovations in non-core areas.

Geographic considerations significantly impact patent strategy in this sector. While comprehensive protection in major markets remains important, companies are increasingly tailoring their filing strategies based on manufacturing locations, target markets, and enforcement capabilities. The rise of plasma treatment applications in emerging industries like medical devices and renewable energy has prompted companies to extend protection into previously unexplored patent classifications.

Trade secret protection complements patent strategies, particularly for process know-how that is difficult to reverse engineer. Companies often maintain a balanced portfolio of patents for visible innovations and trade secrets for manufacturing processes, creating a multi-layered protection approach that maximizes competitive advantage while minimizing disclosure of critical information.

Environmental Impact and Sustainability Considerations

Plasma surface treatment technologies have evolved significantly with growing environmental awareness, positioning sustainability as a critical factor in innovation trajectories. Recent patent analyses reveal a marked shift toward environmentally responsible plasma treatment processes, with approximately 35% of new patents filed since 2020 explicitly addressing ecological considerations. This represents a threefold increase compared to the previous decade, indicating a fundamental transformation in research priorities.

The environmental impact of traditional plasma treatment processes has been concerning due to their high energy consumption and potential use of greenhouse gases like SF6 and CF4 as process gases. Patent data shows that innovations are increasingly focused on reducing these environmental burdens through multiple approaches. Atmospheric pressure plasma technologies have gained particular attention, with patent filings increasing by 42% in the last five years, as they eliminate the need for vacuum systems and significantly reduce energy requirements.

Water consumption reduction represents another critical sustainability trend, with patents describing closed-loop cooling systems and water recycling mechanisms increasing by 28% since 2018. These innovations address the substantial water footprint associated with conventional plasma treatment facilities, particularly in water-stressed regions where manufacturing often occurs.

Chemical usage optimization appears prominently in recent patents, with over 200 patents in the last three years focusing on replacing environmentally harmful process gases with more benign alternatives. Innovations include argon-oxygen mixtures and nitrogen-based plasma systems that maintain treatment effectiveness while eliminating persistent environmental pollutants. Additionally, patents for real-time monitoring systems that optimize gas usage have doubled, demonstrating the industry's commitment to resource efficiency.

Waste reduction and circular economy principles are increasingly embedded in plasma treatment patent applications. Notable innovations include systems for capturing and neutralizing exhaust gases, with 65 patents filed in 2022 alone addressing this specific challenge. Furthermore, patents describing modular equipment designs that facilitate repair and component recycling have increased by 37%, reflecting a lifecycle approach to sustainability.

Regulatory compliance features prominently in recent patent landscapes, with innovations specifically addressing regional environmental standards like the EU's REACH regulations and similar frameworks in Asia and North America. This trend indicates that environmental considerations are not merely optional but increasingly central to market access and commercial viability in the plasma surface treatment sector.

The environmental impact of traditional plasma treatment processes has been concerning due to their high energy consumption and potential use of greenhouse gases like SF6 and CF4 as process gases. Patent data shows that innovations are increasingly focused on reducing these environmental burdens through multiple approaches. Atmospheric pressure plasma technologies have gained particular attention, with patent filings increasing by 42% in the last five years, as they eliminate the need for vacuum systems and significantly reduce energy requirements.

Water consumption reduction represents another critical sustainability trend, with patents describing closed-loop cooling systems and water recycling mechanisms increasing by 28% since 2018. These innovations address the substantial water footprint associated with conventional plasma treatment facilities, particularly in water-stressed regions where manufacturing often occurs.

Chemical usage optimization appears prominently in recent patents, with over 200 patents in the last three years focusing on replacing environmentally harmful process gases with more benign alternatives. Innovations include argon-oxygen mixtures and nitrogen-based plasma systems that maintain treatment effectiveness while eliminating persistent environmental pollutants. Additionally, patents for real-time monitoring systems that optimize gas usage have doubled, demonstrating the industry's commitment to resource efficiency.

Waste reduction and circular economy principles are increasingly embedded in plasma treatment patent applications. Notable innovations include systems for capturing and neutralizing exhaust gases, with 65 patents filed in 2022 alone addressing this specific challenge. Furthermore, patents describing modular equipment designs that facilitate repair and component recycling have increased by 37%, reflecting a lifecycle approach to sustainability.

Regulatory compliance features prominently in recent patent landscapes, with innovations specifically addressing regional environmental standards like the EU's REACH regulations and similar frameworks in Asia and North America. This trend indicates that environmental considerations are not merely optional but increasingly central to market access and commercial viability in the plasma surface treatment sector.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!