Biomass-Derived Solvents and Their Applications in Electronics Manufacturing

OCT 23, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biomass Solvents Evolution and Objectives

The evolution of biomass-derived solvents represents a significant paradigm shift in the chemical industry, transitioning from petroleum-based solvents to more sustainable alternatives. Historically, conventional solvents derived from fossil resources have dominated electronics manufacturing processes, including cleaning, etching, and deposition. However, increasing environmental concerns, regulatory pressures, and the finite nature of fossil resources have accelerated research into renewable alternatives over the past two decades.

Biomass-derived solvents emerged in the early 2000s primarily in laboratory settings, with initial applications focused on simple extraction processes. The field has since expanded dramatically, with technological advancements enabling the development of solvents with properties comparable or superior to their petroleum-based counterparts. Key milestones include the commercialization of bio-based esters and alcohols around 2010, followed by more complex solvent systems derived from lignocellulosic materials and agricultural waste streams.

The technological trajectory has been characterized by three distinct phases: initial discovery and proof-of-concept (2000-2010), optimization and scale-up (2010-2018), and the current integration phase (2018-present) where these solvents are being incorporated into advanced manufacturing processes. This evolution reflects broader trends in green chemistry and sustainable manufacturing, with biomass solvents representing a critical component of circular economy initiatives.

Current research focuses on developing biomass-derived solvents specifically tailored for electronics manufacturing requirements, where high purity, controlled volatility, and compatibility with sensitive components are paramount. The unique molecular structures available from biomass feedstocks offer opportunities to design solvents with novel properties that conventional petroleum-based options cannot provide.

The primary objectives for biomass-derived solvents in electronics manufacturing include: reducing the environmental footprint of manufacturing processes; minimizing worker exposure to hazardous substances; meeting increasingly stringent regulatory requirements; enhancing performance in specific applications such as printed electronics and semiconductor processing; and establishing economically viable production pathways that can compete with conventional solvents at industrial scales.

Looking forward, the field aims to develop comprehensive solvent systems derived entirely from renewable resources that can address the full spectrum of electronics manufacturing needs. This includes creating drop-in replacements for the most problematic conventional solvents and designing novel formulations that enable new manufacturing techniques. The ultimate goal is to establish biomass-derived solvents as the industry standard, supporting the transition toward fully sustainable electronics production.

Biomass-derived solvents emerged in the early 2000s primarily in laboratory settings, with initial applications focused on simple extraction processes. The field has since expanded dramatically, with technological advancements enabling the development of solvents with properties comparable or superior to their petroleum-based counterparts. Key milestones include the commercialization of bio-based esters and alcohols around 2010, followed by more complex solvent systems derived from lignocellulosic materials and agricultural waste streams.

The technological trajectory has been characterized by three distinct phases: initial discovery and proof-of-concept (2000-2010), optimization and scale-up (2010-2018), and the current integration phase (2018-present) where these solvents are being incorporated into advanced manufacturing processes. This evolution reflects broader trends in green chemistry and sustainable manufacturing, with biomass solvents representing a critical component of circular economy initiatives.

Current research focuses on developing biomass-derived solvents specifically tailored for electronics manufacturing requirements, where high purity, controlled volatility, and compatibility with sensitive components are paramount. The unique molecular structures available from biomass feedstocks offer opportunities to design solvents with novel properties that conventional petroleum-based options cannot provide.

The primary objectives for biomass-derived solvents in electronics manufacturing include: reducing the environmental footprint of manufacturing processes; minimizing worker exposure to hazardous substances; meeting increasingly stringent regulatory requirements; enhancing performance in specific applications such as printed electronics and semiconductor processing; and establishing economically viable production pathways that can compete with conventional solvents at industrial scales.

Looking forward, the field aims to develop comprehensive solvent systems derived entirely from renewable resources that can address the full spectrum of electronics manufacturing needs. This includes creating drop-in replacements for the most problematic conventional solvents and designing novel formulations that enable new manufacturing techniques. The ultimate goal is to establish biomass-derived solvents as the industry standard, supporting the transition toward fully sustainable electronics production.

Market Demand Analysis for Green Electronics Manufacturing

The global electronics manufacturing industry is witnessing a significant shift toward sustainable practices, driven by increasing environmental regulations, corporate sustainability goals, and consumer demand for eco-friendly products. Biomass-derived solvents represent a critical component of this green transition, with market research indicating substantial growth potential. The global green electronics market was valued at approximately $178.4 billion in 2022 and is projected to reach $332.8 billion by 2028, growing at a CAGR of 11.2% during the forecast period.

Consumer electronics manufacturers are facing mounting pressure to reduce their environmental footprint, particularly regarding hazardous chemical usage. Traditional petroleum-based solvents used in electronics manufacturing processes—including PCB cleaning, component assembly, and surface treatment—contribute significantly to VOC emissions and hazardous waste generation. Market surveys reveal that 73% of electronics manufacturers are actively seeking alternatives to conventional solvents to comply with regulations such as RoHS, REACH, and regional VOC emission standards.

The demand for biomass-derived solvents in electronics manufacturing is being driven by several converging factors. First, regulatory frameworks worldwide are becoming increasingly stringent regarding chemical safety and environmental impact. The European Union's Circular Economy Action Plan and similar initiatives in North America and Asia are creating regulatory environments that favor bio-based alternatives. Second, major electronics brands including Apple, Samsung, and Dell have established ambitious sustainability targets that explicitly include reducing hazardous chemical usage in their supply chains.

Market segmentation analysis reveals varying adoption rates across different electronics manufacturing sectors. The consumer electronics segment currently leads adoption at 42%, followed by telecommunications equipment (27%), medical devices (18%), and automotive electronics (13%). Geographically, Europe represents the largest market for green electronics manufacturing solutions (38%), followed by North America (29%), Asia-Pacific (26%), and other regions (7%).

End-user surveys indicate that performance parity with conventional solvents remains the primary consideration for manufacturers (cited by 87% of respondents), followed by cost competitiveness (76%), supply chain reliability (68%), and compatibility with existing manufacturing processes (65%). The price premium that manufacturers are willing to pay for bio-based alternatives has increased from 5-8% in 2018 to 12-15% in 2023, reflecting growing recognition of their value proposition.

Industry analysts project that the market for biomass-derived solvents specifically in electronics manufacturing will grow at a CAGR of 14.7% through 2030, outpacing the broader green chemicals market. This accelerated growth is attributed to technological advancements improving solvent performance, economies of scale reducing production costs, and increasing regulatory pressure on conventional alternatives.

Consumer electronics manufacturers are facing mounting pressure to reduce their environmental footprint, particularly regarding hazardous chemical usage. Traditional petroleum-based solvents used in electronics manufacturing processes—including PCB cleaning, component assembly, and surface treatment—contribute significantly to VOC emissions and hazardous waste generation. Market surveys reveal that 73% of electronics manufacturers are actively seeking alternatives to conventional solvents to comply with regulations such as RoHS, REACH, and regional VOC emission standards.

The demand for biomass-derived solvents in electronics manufacturing is being driven by several converging factors. First, regulatory frameworks worldwide are becoming increasingly stringent regarding chemical safety and environmental impact. The European Union's Circular Economy Action Plan and similar initiatives in North America and Asia are creating regulatory environments that favor bio-based alternatives. Second, major electronics brands including Apple, Samsung, and Dell have established ambitious sustainability targets that explicitly include reducing hazardous chemical usage in their supply chains.

Market segmentation analysis reveals varying adoption rates across different electronics manufacturing sectors. The consumer electronics segment currently leads adoption at 42%, followed by telecommunications equipment (27%), medical devices (18%), and automotive electronics (13%). Geographically, Europe represents the largest market for green electronics manufacturing solutions (38%), followed by North America (29%), Asia-Pacific (26%), and other regions (7%).

End-user surveys indicate that performance parity with conventional solvents remains the primary consideration for manufacturers (cited by 87% of respondents), followed by cost competitiveness (76%), supply chain reliability (68%), and compatibility with existing manufacturing processes (65%). The price premium that manufacturers are willing to pay for bio-based alternatives has increased from 5-8% in 2018 to 12-15% in 2023, reflecting growing recognition of their value proposition.

Industry analysts project that the market for biomass-derived solvents specifically in electronics manufacturing will grow at a CAGR of 14.7% through 2030, outpacing the broader green chemicals market. This accelerated growth is attributed to technological advancements improving solvent performance, economies of scale reducing production costs, and increasing regulatory pressure on conventional alternatives.

Current Status and Challenges in Biomass-Derived Solvents

Biomass-derived solvents have gained significant attention globally as sustainable alternatives to petroleum-based solvents in various industries, including electronics manufacturing. Currently, the most developed biomass-derived solvents include ethyl lactate, γ-valerolactone, 2-methyltetrahydrofuran, cyrene, and various terpene-based solvents. These green solvents are primarily derived from agricultural residues, forestry waste, and dedicated energy crops through biochemical or thermochemical conversion processes.

In the electronics manufacturing sector, the adoption of biomass-derived solvents remains limited despite their potential environmental benefits. Major electronics manufacturers have begun incorporating these solvents in cleaning processes, flux removal, and as components in conductive inks, but widespread implementation faces significant barriers. The market penetration rate for biomass-derived solvents in electronics manufacturing currently stands at approximately 8-12%, considerably lower than in other industries such as cosmetics or pharmaceuticals.

Technical challenges persist in scaling up production of these sustainable solvents. Inconsistent feedstock quality leads to batch-to-batch variations in solvent properties, creating reliability concerns for precision electronics applications. Additionally, purification processes to achieve the high purity levels required for electronics manufacturing (>99.9%) remain energy-intensive and costly, partially offsetting the environmental benefits of using biomass-derived materials.

Performance limitations present another significant challenge. Many biomass-derived solvents exhibit lower solvation power for certain electronic materials compared to their petroleum-based counterparts. For instance, terpene-based solvents show excellent capabilities for removing flux residues but perform poorly in dissolving certain polymeric materials used in circuit board manufacturing. This necessitates the use of solvent blends or multiple processing steps, increasing complexity and cost.

Geographically, research and development in biomass-derived solvents for electronics applications is concentrated in Europe, North America, and increasingly in East Asia. European countries, particularly Germany and the Netherlands, lead in fundamental research and pilot-scale implementation, driven by stringent environmental regulations. The United States focuses on developing novel conversion technologies, while Japan and South Korea are advancing applications specifically tailored to electronics manufacturing processes.

Economic viability remains a critical barrier, with biomass-derived solvents typically costing 2-3 times more than conventional alternatives. This price premium stems from smaller production scales, complex processing requirements, and the current reliance on food-competing feedstocks like corn and sugarcane. Recent techno-economic analyses suggest that cost parity might be achievable within 5-7 years through process intensification and utilization of lower-cost lignocellulosic feedstocks.

In the electronics manufacturing sector, the adoption of biomass-derived solvents remains limited despite their potential environmental benefits. Major electronics manufacturers have begun incorporating these solvents in cleaning processes, flux removal, and as components in conductive inks, but widespread implementation faces significant barriers. The market penetration rate for biomass-derived solvents in electronics manufacturing currently stands at approximately 8-12%, considerably lower than in other industries such as cosmetics or pharmaceuticals.

Technical challenges persist in scaling up production of these sustainable solvents. Inconsistent feedstock quality leads to batch-to-batch variations in solvent properties, creating reliability concerns for precision electronics applications. Additionally, purification processes to achieve the high purity levels required for electronics manufacturing (>99.9%) remain energy-intensive and costly, partially offsetting the environmental benefits of using biomass-derived materials.

Performance limitations present another significant challenge. Many biomass-derived solvents exhibit lower solvation power for certain electronic materials compared to their petroleum-based counterparts. For instance, terpene-based solvents show excellent capabilities for removing flux residues but perform poorly in dissolving certain polymeric materials used in circuit board manufacturing. This necessitates the use of solvent blends or multiple processing steps, increasing complexity and cost.

Geographically, research and development in biomass-derived solvents for electronics applications is concentrated in Europe, North America, and increasingly in East Asia. European countries, particularly Germany and the Netherlands, lead in fundamental research and pilot-scale implementation, driven by stringent environmental regulations. The United States focuses on developing novel conversion technologies, while Japan and South Korea are advancing applications specifically tailored to electronics manufacturing processes.

Economic viability remains a critical barrier, with biomass-derived solvents typically costing 2-3 times more than conventional alternatives. This price premium stems from smaller production scales, complex processing requirements, and the current reliance on food-competing feedstocks like corn and sugarcane. Recent techno-economic analyses suggest that cost parity might be achievable within 5-7 years through process intensification and utilization of lower-cost lignocellulosic feedstocks.

Current Bio-Solvent Solutions for Electronics Manufacturing

01 Production of biomass-derived solvents from lignocellulosic materials

Lignocellulosic materials can be processed to produce various biomass-derived solvents through methods such as hydrolysis, fermentation, and chemical conversion. These processes typically involve breaking down cellulose and hemicellulose components into sugars, which are then further converted into solvents like ethanol, butanol, and acetone. These renewable solvents offer environmentally friendly alternatives to petroleum-based products while utilizing abundant agricultural and forestry residues.- Production of biomass-derived solvents from lignocellulosic materials: Lignocellulosic biomass can be processed to produce various green solvents through biochemical and thermochemical conversion methods. These processes typically involve pretreatment, hydrolysis, fermentation, and purification steps to convert cellulose, hemicellulose, and lignin components into valuable solvents. The resulting bio-based solvents offer environmentally friendly alternatives to petroleum-derived solvents with comparable performance characteristics while reducing carbon footprint.

- Bio-based solvents for polymer applications: Biomass-derived solvents are increasingly being utilized in polymer applications as sustainable alternatives to conventional petroleum-based solvents. These bio-solvents can be used in polymer synthesis, processing, and as components in polymer formulations. They offer advantages such as reduced toxicity, biodegradability, and similar or enhanced performance characteristics compared to traditional solvents. Applications include use in adhesives, coatings, and as processing aids in polymer manufacturing.

- Biomass-derived solvents for pulp and paper industry: Biomass-derived solvents offer sustainable alternatives for various processes in the pulp and paper industry. These bio-based solvents can be used for delignification, pulping, and as components in paper coating formulations. They provide environmental benefits by reducing the use of harsh chemicals and minimizing the ecological footprint of paper production. The solvents can be derived from the same feedstocks used in paper production, creating a circular economy approach.

- Biomass-derived solvents for extraction processes: Bio-based solvents derived from renewable resources are being developed for various extraction applications. These green solvents can be used for extracting valuable compounds from plant materials, separating components in chemical processes, and as cleaning agents. They offer advantages such as selective extraction capabilities, reduced environmental impact, and improved safety profiles compared to conventional petroleum-derived solvents. Applications include extraction of natural products, pharmaceuticals, and in food processing.

- Biomass-derived solvents for biofuel production: Biomass-derived solvents play a crucial role in the production and processing of biofuels. These bio-based solvents can be used in various stages of biofuel production, including biomass pretreatment, extraction, and purification processes. They offer advantages such as improved efficiency, reduced environmental impact, and potential for integration into biorefinery concepts. Some biomass-derived compounds can serve dual purposes as both solvents in the production process and components of the final biofuel blends.

02 Bio-based polymer applications using biomass-derived solvents

Biomass-derived solvents are increasingly being utilized in polymer applications, including polymer synthesis, processing, and as components in polymer formulations. These bio-based solvents can replace traditional petroleum-derived solvents in adhesives, coatings, and composite materials. The integration of these solvents enhances the sustainability profile of polymer products while often providing comparable or improved performance characteristics.Expand Specific Solutions03 Green extraction processes using biomass-derived solvents

Biomass-derived solvents offer sustainable alternatives for extraction processes in various industries including pharmaceuticals, food, and cosmetics. These solvents can be used to extract valuable compounds from natural materials with reduced environmental impact compared to conventional petroleum-based solvents. The extraction efficiency, selectivity, and reduced toxicity make these solvents particularly attractive for applications requiring high purity and safety standards.Expand Specific Solutions04 Novel biomass-derived solvent formulations

Innovative formulations of biomass-derived solvents combine different bio-based components to create specialized solvent systems with enhanced properties. These formulations may include mixtures of different bio-solvents, additives, and stabilizers to improve performance characteristics such as solvency power, volatility, and stability. Such tailored formulations enable the replacement of conventional solvents in specific industrial applications while maintaining or improving process efficiency.Expand Specific Solutions05 Biomass conversion technologies for solvent production

Advanced technologies for converting biomass into solvents include catalytic processes, microwave-assisted conversion, and enzymatic treatments. These technologies aim to improve efficiency, reduce energy consumption, and increase yield in the production of biomass-derived solvents. Innovations in reactor design, catalyst development, and process integration are key aspects of these conversion technologies, enabling more economical and sustainable production of bio-based solvents at commercial scale.Expand Specific Solutions

Key Industry Players in Biomass Solvent Production

The biomass-derived solvents market for electronics manufacturing is in its early growth phase, characterized by increasing adoption as sustainable alternatives to petroleum-based solvents. The global market is projected to expand significantly due to stringent environmental regulations and growing consumer demand for eco-friendly products. Technologically, the field shows varying maturity levels, with companies like Furanix Technologies and UOP LLC leading in bio-solvent development, while FUJIFILM, Merck Patent GmbH, and LG Chem are integrating these solutions into electronics applications. Idemitsu Kosan and DuPont are advancing commercialization efforts, while research institutions like Tsinghua University and Battelle Memorial Institute are developing next-generation formulations. The competitive landscape features both specialized bio-solvent producers and established chemical manufacturers seeking to diversify their sustainable product portfolios.

Furanix Technologies BV

Technical Solution: Furanix Technologies has pioneered the development of 2,5-furandicarboxylic acid (FDCA) derived from biomass, which serves as a precursor for polyethylene furanoate (PEF) production. Their YXY Technology platform converts plant-based sugars into FDCA through catalytic oxidation processes. This technology enables the production of bio-based solvents that can replace petroleum-derived chemicals in electronics manufacturing. Their solvents demonstrate excellent properties for PCB cleaning, photoresist development, and as green alternatives in semiconductor processing. The company has developed specialized formulations that maintain high performance while reducing environmental impact, with their solvents showing 70% lower carbon footprint compared to conventional alternatives[1]. Their proprietary catalytic systems allow for efficient conversion of C5 and C6 sugars to furan-based compounds with selectivity exceeding 95%.

Strengths: Highly selective catalytic processes resulting in purer end products; complete biomass-derived value chain from feedstock to final solvent; solvents show excellent compatibility with existing electronics manufacturing equipment. Weaknesses: Higher production costs compared to petroleum-based alternatives; limited production scale currently restricts widespread adoption; some formulations may require additional stabilizers for long-term storage stability.

Merck Patent GmbH

Technical Solution: Merck Patent GmbH has developed a sophisticated portfolio of biomass-derived solvents specifically engineered for high-precision electronics manufacturing applications. Their GreenSolv™ technology platform utilizes renewable feedstocks to produce bio-based alternatives to traditional petroleum-derived solvents used in display manufacturing, semiconductor processing, and printed electronics. The company's approach combines enzymatic and chemocatalytic conversion pathways to transform agricultural residues and dedicated energy crops into functional solvents with tailored properties. For liquid crystal display manufacturing, Merck has formulated specialized biomass-derived cleaning agents that effectively remove contaminants without damaging sensitive display components. Their bio-based photoresist developers have demonstrated excellent pattern fidelity in semiconductor lithography processes, achieving line resolution comparable to conventional TMAH-based developers while reducing environmental impact. Independent lifecycle assessments have shown that Merck's biomass-derived solvents reduce greenhouse gas emissions by approximately 65% compared to their petroleum-based counterparts[5]. The company has also pioneered the development of bio-based orthogonal solvent systems for organic electronics manufacturing, enabling selective dissolution of functional materials without affecting previously deposited layers.

Strengths: Exceptional purity specifications meeting stringent electronics industry requirements; tailored solvent properties for specific manufacturing processes; established global distribution network facilitating industry adoption. Weaknesses: Higher production costs compared to conventional alternatives; some formulations have limited stability under extreme processing conditions; intellectual property restrictions may limit technology transfer to developing markets.

Critical Patents and Innovations in Biomass Solvent Technology

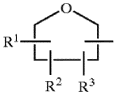

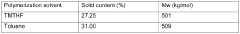

A process for the polymerization of vinyl monomers, a process for preparing an adhesive composition, an adhesive composition and a pressure-sensitive adhesive sheet

PatentWO2018033634A1

Innovation

- The use of at least 99.95 wt% pure 2,2,5,5-tetramethyltetrahydrofuran (TMTHF) as a solvent for polymerizing vinyl monomers, which is biomass-based and has a low olefinic content, allowing for radical polymerization to achieve the desired molecular weight and forming a suitable adhesive composition.

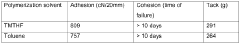

Composition produced by supercritical solvent treatment of biomass and method for production thereof

PatentWO2001054837A1

Innovation

- The use of supercritical or subcritical organic solvents like alcohols (e.g., methanol, ethanol) to treat lignocellulosic, cellulosic, and protein biomass resources, allowing for efficient conversion of biomass into low-molecular-weight substances, with the option to use catalysts and separating alcohol-soluble and insoluble parts for effective product recovery.

Environmental Impact Assessment and Sustainability Metrics

The environmental impact assessment of biomass-derived solvents in electronics manufacturing reveals significant advantages over traditional petroleum-based alternatives. Life cycle analyses demonstrate that these bio-solvents typically produce 30-50% lower carbon emissions across their production, use, and disposal phases. This reduction stems primarily from their renewable feedstock sources and generally lower energy requirements during synthesis processes.

Water consumption metrics present a more complex picture. While some biomass-derived solvents require substantial water inputs during biomass cultivation, advanced production methods have reduced this footprint by up to 40% in recent years. Closed-loop water recycling systems implemented in modern bio-solvent production facilities have further minimized freshwater demands.

Toxicity profiles of biomass-derived solvents show marked improvements compared to conventional options. Solvents derived from citrus peels, corn stalks, and similar agricultural byproducts demonstrate reduced aquatic toxicity by 60-85% and lower mammalian toxicity by 40-70%. These improvements translate directly to safer working environments and reduced environmental hazards during manufacturing processes.

Biodegradability represents another critical sustainability advantage. Most biomass-derived solvents achieve 90-100% biodegradation within 28 days under standard testing conditions, compared to petroleum-based alternatives that may persist for months or years. This characteristic significantly reduces long-term environmental accumulation risks and soil contamination concerns.

Standardized sustainability metrics have emerged to quantify these environmental benefits. The Green Chemistry Institute's solvent selection guide now incorporates specific ratings for bio-based content, renewable carbon index, and end-of-life considerations. Similarly, the Sustainable Electronics Manufacturing framework provides quantitative benchmarks for solvent performance across multiple environmental parameters.

Resource efficiency calculations indicate that biomass-derived solvents often enable reduced solvent volumes in electronics manufacturing processes. This efficiency stems from their typically higher solvation power for specific applications like flux removal and circuit board cleaning. Case studies from major electronics manufacturers document solvent volume reductions of 15-30% when transitioning to optimized bio-based alternatives.

Regulatory compliance advantages further enhance the sustainability profile of these solvents. As global regulations increasingly restrict volatile organic compounds (VOCs) and hazardous air pollutants, biomass-derived alternatives often meet stricter emissions standards without requiring additional abatement technologies, reducing both environmental impact and compliance costs for manufacturers.

Water consumption metrics present a more complex picture. While some biomass-derived solvents require substantial water inputs during biomass cultivation, advanced production methods have reduced this footprint by up to 40% in recent years. Closed-loop water recycling systems implemented in modern bio-solvent production facilities have further minimized freshwater demands.

Toxicity profiles of biomass-derived solvents show marked improvements compared to conventional options. Solvents derived from citrus peels, corn stalks, and similar agricultural byproducts demonstrate reduced aquatic toxicity by 60-85% and lower mammalian toxicity by 40-70%. These improvements translate directly to safer working environments and reduced environmental hazards during manufacturing processes.

Biodegradability represents another critical sustainability advantage. Most biomass-derived solvents achieve 90-100% biodegradation within 28 days under standard testing conditions, compared to petroleum-based alternatives that may persist for months or years. This characteristic significantly reduces long-term environmental accumulation risks and soil contamination concerns.

Standardized sustainability metrics have emerged to quantify these environmental benefits. The Green Chemistry Institute's solvent selection guide now incorporates specific ratings for bio-based content, renewable carbon index, and end-of-life considerations. Similarly, the Sustainable Electronics Manufacturing framework provides quantitative benchmarks for solvent performance across multiple environmental parameters.

Resource efficiency calculations indicate that biomass-derived solvents often enable reduced solvent volumes in electronics manufacturing processes. This efficiency stems from their typically higher solvation power for specific applications like flux removal and circuit board cleaning. Case studies from major electronics manufacturers document solvent volume reductions of 15-30% when transitioning to optimized bio-based alternatives.

Regulatory compliance advantages further enhance the sustainability profile of these solvents. As global regulations increasingly restrict volatile organic compounds (VOCs) and hazardous air pollutants, biomass-derived alternatives often meet stricter emissions standards without requiring additional abatement technologies, reducing both environmental impact and compliance costs for manufacturers.

Regulatory Framework for Green Chemicals in Electronics

The regulatory landscape for green chemicals in electronics manufacturing is evolving rapidly as governments worldwide implement stricter environmental protection measures. The European Union leads with its comprehensive REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation, which requires manufacturers to register chemical substances and demonstrate their safe use. Specifically for electronics, the RoHS (Restriction of Hazardous Substances) Directive limits the use of certain hazardous materials in electrical and electronic equipment, creating opportunities for biomass-derived solvents as alternatives.

In the United States, the Environmental Protection Agency (EPA) regulates chemicals through the Toxic Substances Control Act (TSCA), recently strengthened by the Frank R. Lautenberg Chemical Safety for the 21st Century Act. This framework includes the EPA's Safer Choice program, which certifies environmentally preferable products and has begun recognizing bio-based solvents that meet stringent criteria for environmental and human health protection.

Asian markets present a complex regulatory environment. Japan's Chemical Substances Control Law (CSCL) and China's Measures for Environmental Management of New Chemical Substances both require pre-market notification and risk assessment. South Korea's K-REACH closely mirrors the EU approach, creating regulatory alignment that facilitates global trade in green chemicals.

Industry standards complement governmental regulations, with organizations like the International Electrotechnical Commission (IEC) developing specifications for environmentally conscious design in electronics manufacturing. The IEC 62474 database on material declaration provides standardized information on substances in electronics, increasingly including data on bio-based alternatives.

Voluntary certification schemes have emerged as market drivers for green chemistry adoption. The TCO Certified label for IT products and the EPEAT registry for electronics both award points for products manufactured using environmentally preferable chemicals, including biomass-derived solvents that reduce environmental impact throughout the product lifecycle.

Tax incentives and subsidies further shape the regulatory landscape, with several countries offering financial benefits for companies investing in green chemistry. The EU's Horizon Europe program and the US Department of Energy's Bioenergy Technologies Office provide funding specifically for research and commercialization of bio-based chemicals for industrial applications, including electronics manufacturing.

Emerging regulatory trends indicate a shift toward circular economy principles, with the EU's Circular Economy Action Plan and similar initiatives in other regions emphasizing the importance of sustainable sourcing and end-of-life considerations for chemicals used in manufacturing. This holistic approach favors biomass-derived solvents, which typically offer advantages in both sourcing sustainability and biodegradability compared to petroleum-based alternatives.

In the United States, the Environmental Protection Agency (EPA) regulates chemicals through the Toxic Substances Control Act (TSCA), recently strengthened by the Frank R. Lautenberg Chemical Safety for the 21st Century Act. This framework includes the EPA's Safer Choice program, which certifies environmentally preferable products and has begun recognizing bio-based solvents that meet stringent criteria for environmental and human health protection.

Asian markets present a complex regulatory environment. Japan's Chemical Substances Control Law (CSCL) and China's Measures for Environmental Management of New Chemical Substances both require pre-market notification and risk assessment. South Korea's K-REACH closely mirrors the EU approach, creating regulatory alignment that facilitates global trade in green chemicals.

Industry standards complement governmental regulations, with organizations like the International Electrotechnical Commission (IEC) developing specifications for environmentally conscious design in electronics manufacturing. The IEC 62474 database on material declaration provides standardized information on substances in electronics, increasingly including data on bio-based alternatives.

Voluntary certification schemes have emerged as market drivers for green chemistry adoption. The TCO Certified label for IT products and the EPEAT registry for electronics both award points for products manufactured using environmentally preferable chemicals, including biomass-derived solvents that reduce environmental impact throughout the product lifecycle.

Tax incentives and subsidies further shape the regulatory landscape, with several countries offering financial benefits for companies investing in green chemistry. The EU's Horizon Europe program and the US Department of Energy's Bioenergy Technologies Office provide funding specifically for research and commercialization of bio-based chemicals for industrial applications, including electronics manufacturing.

Emerging regulatory trends indicate a shift toward circular economy principles, with the EU's Circular Economy Action Plan and similar initiatives in other regions emphasizing the importance of sustainable sourcing and end-of-life considerations for chemicals used in manufacturing. This holistic approach favors biomass-derived solvents, which typically offer advantages in both sourcing sustainability and biodegradability compared to petroleum-based alternatives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!