How Biomass-Derived Solvents Support Eco-Friendly Production

OCT 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biomass-Derived Solvents Background and Objectives

Biomass-derived solvents have emerged as a promising alternative to conventional petroleum-based solvents, marking a significant shift in industrial chemistry over the past two decades. The evolution of these eco-friendly solvents traces back to early research in the 1990s, which explored the potential of plant-based materials as renewable chemical feedstocks. However, it was not until the early 2000s that substantial progress was made in developing viable biomass-derived solvent technologies, driven by increasing environmental concerns and stricter regulations on volatile organic compounds (VOCs).

The technological trajectory has been characterized by a steady progression from simple bio-alcohols to more complex and functionally diverse solvents derived from various biomass sources including agricultural residues, forestry waste, and dedicated energy crops. This evolution reflects the growing sophistication in biorefinery processes and the expanding understanding of biomass chemistry.

Current research trends indicate a convergence of green chemistry principles with industrial scalability requirements, focusing on developing solvents that not only minimize environmental impact but also maintain or enhance process efficiency. The integration of advanced catalytic systems and novel separation technologies has been pivotal in overcoming earlier limitations related to purity and performance consistency.

The primary objective in this field is to establish biomass-derived solvents as mainstream alternatives across multiple industries, reducing dependence on petroleum resources while supporting circular economy principles. Specific technical goals include enhancing the efficiency of biomass conversion processes, improving the selectivity of target molecules, and developing cost-effective purification methods to ensure commercial viability.

Another critical objective is to standardize the life cycle assessment methodologies for these solvents, providing a robust framework for comparing their environmental performance against conventional alternatives. This includes comprehensive evaluation of factors such as carbon footprint, water usage, land use impact, and biodegradability.

The development of biomass-derived solvents also aims to address the growing market demand for sustainable chemical products, particularly in consumer-facing industries where environmental credentials increasingly influence purchasing decisions. This market-driven objective aligns with broader sustainability goals and regulatory trends toward reduced chemical hazards and emissions.

Looking forward, the field is poised for significant innovation, with emerging research focusing on designer bio-solvents with tailored properties for specific applications, from pharmaceutical manufacturing to advanced materials processing. The ultimate goal remains the establishment of a sustainable, bio-based solvent platform that can comprehensively replace petroleum-derived alternatives while offering new functionalities and performance advantages.

The technological trajectory has been characterized by a steady progression from simple bio-alcohols to more complex and functionally diverse solvents derived from various biomass sources including agricultural residues, forestry waste, and dedicated energy crops. This evolution reflects the growing sophistication in biorefinery processes and the expanding understanding of biomass chemistry.

Current research trends indicate a convergence of green chemistry principles with industrial scalability requirements, focusing on developing solvents that not only minimize environmental impact but also maintain or enhance process efficiency. The integration of advanced catalytic systems and novel separation technologies has been pivotal in overcoming earlier limitations related to purity and performance consistency.

The primary objective in this field is to establish biomass-derived solvents as mainstream alternatives across multiple industries, reducing dependence on petroleum resources while supporting circular economy principles. Specific technical goals include enhancing the efficiency of biomass conversion processes, improving the selectivity of target molecules, and developing cost-effective purification methods to ensure commercial viability.

Another critical objective is to standardize the life cycle assessment methodologies for these solvents, providing a robust framework for comparing their environmental performance against conventional alternatives. This includes comprehensive evaluation of factors such as carbon footprint, water usage, land use impact, and biodegradability.

The development of biomass-derived solvents also aims to address the growing market demand for sustainable chemical products, particularly in consumer-facing industries where environmental credentials increasingly influence purchasing decisions. This market-driven objective aligns with broader sustainability goals and regulatory trends toward reduced chemical hazards and emissions.

Looking forward, the field is poised for significant innovation, with emerging research focusing on designer bio-solvents with tailored properties for specific applications, from pharmaceutical manufacturing to advanced materials processing. The ultimate goal remains the establishment of a sustainable, bio-based solvent platform that can comprehensively replace petroleum-derived alternatives while offering new functionalities and performance advantages.

Market Demand Analysis for Green Solvents

The global market for green solvents has experienced significant growth in recent years, driven primarily by increasing environmental regulations and growing consumer awareness about sustainability. Biomass-derived solvents represent a rapidly expanding segment within this market, with an estimated market value exceeding $6 billion in 2022 and projected to reach $11 billion by 2028, growing at a CAGR of approximately 8.5%.

Industrial sectors including pharmaceuticals, cosmetics, paints and coatings, adhesives, and cleaning products are demonstrating heightened demand for eco-friendly solvent alternatives. The pharmaceutical industry, in particular, has shown strong adoption rates due to stringent regulatory requirements and the need for safer processing methods. Similarly, the personal care and cosmetics industry has embraced biomass-derived solvents to meet consumer preferences for natural and sustainable products.

Regional analysis reveals that Europe currently leads the green solvents market, accounting for approximately 35% of global demand. This dominance stems from the region's strict environmental regulations, particularly REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and various directives limiting VOC emissions. North America follows closely behind with significant market share, while Asia-Pacific represents the fastest-growing regional market with annual growth rates exceeding 10%.

Consumer behavior studies indicate a willingness to pay premium prices for products manufactured using sustainable processes. A recent survey across major markets showed that 68% of consumers consider environmental impact when making purchasing decisions, with 42% willing to pay at least 5% more for products made with green technologies.

Key market drivers include increasingly stringent environmental regulations, corporate sustainability initiatives, and growing consumer demand for eco-friendly products. The implementation of carbon pricing mechanisms in various regions has further accelerated the transition away from petroleum-based solvents. Additionally, volatility in petroleum prices has prompted manufacturers to seek more stable, bio-based alternatives.

Despite positive growth trends, market challenges persist. Price competitiveness remains a significant barrier, with biomass-derived solvents typically commanding 15-30% higher prices than conventional alternatives. Performance consistency across different applications and scaling production to meet growing demand also present challenges for market expansion. However, technological advancements in biorefinery processes and increasing economies of scale are gradually reducing this price gap.

Industrial sectors including pharmaceuticals, cosmetics, paints and coatings, adhesives, and cleaning products are demonstrating heightened demand for eco-friendly solvent alternatives. The pharmaceutical industry, in particular, has shown strong adoption rates due to stringent regulatory requirements and the need for safer processing methods. Similarly, the personal care and cosmetics industry has embraced biomass-derived solvents to meet consumer preferences for natural and sustainable products.

Regional analysis reveals that Europe currently leads the green solvents market, accounting for approximately 35% of global demand. This dominance stems from the region's strict environmental regulations, particularly REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and various directives limiting VOC emissions. North America follows closely behind with significant market share, while Asia-Pacific represents the fastest-growing regional market with annual growth rates exceeding 10%.

Consumer behavior studies indicate a willingness to pay premium prices for products manufactured using sustainable processes. A recent survey across major markets showed that 68% of consumers consider environmental impact when making purchasing decisions, with 42% willing to pay at least 5% more for products made with green technologies.

Key market drivers include increasingly stringent environmental regulations, corporate sustainability initiatives, and growing consumer demand for eco-friendly products. The implementation of carbon pricing mechanisms in various regions has further accelerated the transition away from petroleum-based solvents. Additionally, volatility in petroleum prices has prompted manufacturers to seek more stable, bio-based alternatives.

Despite positive growth trends, market challenges persist. Price competitiveness remains a significant barrier, with biomass-derived solvents typically commanding 15-30% higher prices than conventional alternatives. Performance consistency across different applications and scaling production to meet growing demand also present challenges for market expansion. However, technological advancements in biorefinery processes and increasing economies of scale are gradually reducing this price gap.

Current Status and Challenges in Bio-Solvent Development

The global landscape of bio-solvent development has witnessed significant advancements in recent years, with research institutions and industrial players across North America, Europe, and Asia making substantial contributions. Currently, biomass-derived solvents represent approximately 10% of the global solvent market, with projections indicating growth to 25% by 2030. This growth trajectory reflects increasing industrial recognition of bio-solvents as viable alternatives to petroleum-based counterparts.

Despite promising developments, several technical challenges persist in bio-solvent commercialization. Extraction efficiency remains a primary concern, with current biomass conversion processes achieving only 40-60% solvent yield, significantly lower than the 85-95% efficiency of conventional petrochemical processes. This efficiency gap translates directly to higher production costs, with bio-solvents typically commanding a 30-50% price premium over traditional solvents.

Performance consistency presents another substantial hurdle. Bio-solvents derived from agricultural feedstocks often exhibit batch-to-batch variability in purity and solvent properties due to fluctuations in biomass composition. This variability complicates industrial adoption, particularly in precision manufacturing sectors where solvent performance predictability is critical.

Scalability constraints further impede widespread implementation. Most bio-solvent production technologies have been demonstrated at laboratory or pilot scale (100-1000L), but encounter significant engineering challenges when scaled to commercial volumes (>10,000L). These challenges include increased energy consumption, catalyst deactivation, and reduced selectivity at larger scales.

From a regulatory perspective, the landscape remains fragmented. While the EU has established comprehensive frameworks promoting bio-based chemicals through initiatives like the Renewable Energy Directive II, regulatory pathways in North America and Asia lack harmonization, creating market entry barriers for innovative bio-solvent technologies.

The sustainability profile of bio-solvents also presents paradoxical challenges. Life cycle assessments indicate that while most bio-solvents offer 40-70% reduction in carbon footprint compared to petroleum alternatives, certain production pathways may increase water consumption by 25-40% and potentially compete with food production when derived from first-generation biomass feedstocks.

Technical innovation bottlenecks are evident in catalyst development, with current catalytic systems for biomass conversion showing deactivation after 50-100 hours of operation, necessitating frequent regeneration or replacement. Additionally, separation technologies for bio-solvent purification remain energy-intensive, often consuming 30-45% of the total process energy.

These multifaceted challenges underscore the need for integrated research approaches that simultaneously address yield optimization, performance consistency, scalability, and sustainability metrics to accelerate the transition toward eco-friendly production systems based on biomass-derived solvents.

Despite promising developments, several technical challenges persist in bio-solvent commercialization. Extraction efficiency remains a primary concern, with current biomass conversion processes achieving only 40-60% solvent yield, significantly lower than the 85-95% efficiency of conventional petrochemical processes. This efficiency gap translates directly to higher production costs, with bio-solvents typically commanding a 30-50% price premium over traditional solvents.

Performance consistency presents another substantial hurdle. Bio-solvents derived from agricultural feedstocks often exhibit batch-to-batch variability in purity and solvent properties due to fluctuations in biomass composition. This variability complicates industrial adoption, particularly in precision manufacturing sectors where solvent performance predictability is critical.

Scalability constraints further impede widespread implementation. Most bio-solvent production technologies have been demonstrated at laboratory or pilot scale (100-1000L), but encounter significant engineering challenges when scaled to commercial volumes (>10,000L). These challenges include increased energy consumption, catalyst deactivation, and reduced selectivity at larger scales.

From a regulatory perspective, the landscape remains fragmented. While the EU has established comprehensive frameworks promoting bio-based chemicals through initiatives like the Renewable Energy Directive II, regulatory pathways in North America and Asia lack harmonization, creating market entry barriers for innovative bio-solvent technologies.

The sustainability profile of bio-solvents also presents paradoxical challenges. Life cycle assessments indicate that while most bio-solvents offer 40-70% reduction in carbon footprint compared to petroleum alternatives, certain production pathways may increase water consumption by 25-40% and potentially compete with food production when derived from first-generation biomass feedstocks.

Technical innovation bottlenecks are evident in catalyst development, with current catalytic systems for biomass conversion showing deactivation after 50-100 hours of operation, necessitating frequent regeneration or replacement. Additionally, separation technologies for bio-solvent purification remain energy-intensive, often consuming 30-45% of the total process energy.

These multifaceted challenges underscore the need for integrated research approaches that simultaneously address yield optimization, performance consistency, scalability, and sustainability metrics to accelerate the transition toward eco-friendly production systems based on biomass-derived solvents.

Current Biomass-Derived Solvent Solutions and Applications

01 Bio-based solvents from agricultural waste

Solvents derived from agricultural waste materials offer sustainable alternatives to petroleum-based products. These eco-friendly solvents utilize renewable resources such as crop residues, food processing byproducts, and other biomass waste streams. The conversion processes typically involve fermentation, extraction, or chemical transformation to produce solvents with properties comparable to conventional options but with significantly reduced environmental impact and carbon footprint.- Biomass-derived solvents from agricultural waste: Solvents derived from agricultural waste materials offer sustainable alternatives to petroleum-based products. These eco-friendly solvents utilize renewable resources such as crop residues, food processing byproducts, and other agricultural waste streams. The conversion processes typically involve fermentation, extraction, or chemical transformation to produce green solvents with properties comparable to conventional options but with significantly reduced environmental impact and carbon footprint.

- Lignocellulosic biomass conversion to eco-friendly solvents: Lignocellulosic materials from forestry residues, wood chips, and plant fibers can be converted into environmentally friendly solvents through various processing methods. These techniques include hydrolysis, depolymerization, and catalytic conversion to break down complex biomass structures into simpler solvent molecules. The resulting bio-based solvents offer biodegradability, low toxicity, and reduced greenhouse gas emissions compared to traditional petroleum-derived alternatives, making them suitable for industrial applications with minimal environmental impact.

- Bio-derived solvent formulations for industrial applications: Specialized formulations of biomass-derived solvents have been developed for specific industrial applications including coatings, adhesives, cleaning products, and pharmaceutical processing. These formulations combine different bio-based solvents to achieve desired properties such as appropriate volatility, solvation power, and viscosity. The eco-friendly solvent systems can directly replace conventional toxic solvents in many manufacturing processes while maintaining performance standards and reducing environmental and health hazards.

- Production methods for biomass-derived green solvents: Innovative production methods have been developed to efficiently convert biomass into eco-friendly solvents at commercial scale. These processes include catalytic conversion, microwave-assisted extraction, supercritical fluid technology, and enzymatic transformations. Advanced reactor designs and process intensification techniques help optimize yield and purity while minimizing energy consumption and waste generation. These methods enable cost-effective production of bio-based solvents that can compete economically with conventional petroleum-derived alternatives.

- Applications of biomass-derived solvents in green chemistry: Biomass-derived solvents play a crucial role in green chemistry initiatives by enabling more sustainable chemical processes and reactions. These eco-friendly solvents facilitate reactions under milder conditions, improve selectivity, and reduce hazardous waste generation. They are particularly valuable in pharmaceutical synthesis, polymer production, and extraction processes where environmental impact is a concern. The integration of these bio-based solvents into chemical manufacturing helps industries meet increasingly stringent environmental regulations while supporting circular economy principles.

02 Lignocellulosic biomass conversion technologies

Advanced technologies for converting lignocellulosic biomass into eco-friendly solvents involve breaking down complex plant structures into simpler compounds. These processes include enzymatic hydrolysis, thermochemical conversion, and catalytic transformations that can produce various green solvents such as ethanol, butanol, and other oxygenated compounds. The resulting bio-based solvents offer comparable performance to traditional solvents while being biodegradable and derived from renewable resources.Expand Specific Solutions03 Biomass-derived solvent formulations for industrial applications

Specialized formulations of biomass-derived solvents have been developed for various industrial applications including coatings, adhesives, cleaning products, and extraction processes. These formulations combine different bio-based solvents to achieve specific performance characteristics such as volatility, solvency power, and compatibility with various substrates. The eco-friendly nature of these formulations makes them particularly valuable in industries seeking to reduce environmental impact and meet sustainability goals.Expand Specific Solutions04 Green extraction processes using biomass-derived solvents

Biomass-derived solvents enable environmentally friendly extraction processes for obtaining valuable compounds from natural materials. These green extraction methods utilize solvents such as ethyl lactate, γ-valerolactone, and other bio-based alternatives to replace toxic petroleum-derived solvents. The processes demonstrate high efficiency in extracting bioactive compounds, essential oils, and other valuable substances while minimizing environmental impact and reducing health risks associated with conventional solvent use.Expand Specific Solutions05 Biodegradable solvent systems with enhanced performance

Advanced biodegradable solvent systems derived from biomass sources have been engineered to provide enhanced performance characteristics. These systems incorporate modified bio-based solvents with improved stability, solvency power, and application-specific properties. Through careful molecular design and formulation, these eco-friendly solvents achieve performance levels that match or exceed conventional petroleum-based solvents while maintaining biodegradability and low toxicity profiles, making them suitable for environmentally sensitive applications.Expand Specific Solutions

Leading Companies and Research Institutions in Bio-Solvents

The biomass-derived solvents market is in a growth phase, driven by increasing demand for eco-friendly production alternatives. With an estimated market size of $8-10 billion and projected annual growth of 5-7%, this sector represents a significant opportunity in green chemistry. Technology maturity varies across players: established chemical giants like BASF, Air Liquide, and China Petroleum & Chemical Corp have commercialized solutions, while innovative companies such as Virent, Furanix Technologies, and Teysha Technologies are advancing novel conversion technologies. Academic institutions including Dartmouth College, South China University of Technology, and École Polytechnique Fédérale de Lausanne are contributing fundamental research. The competitive landscape features collaboration between industry and academia, with UOP LLC and Archer-Daniels-Midland leveraging agricultural feedstocks for industrial-scale production of sustainable solvents.

UOP LLC

Technical Solution: UOP LLC (a Honeywell company) has developed the Ecofining™ process, which has been adapted to produce bio-derived solvents from renewable feedstocks. This technology utilizes hydroprocessing techniques originally developed for biofuel production to create high-quality, bio-based solvents. The process begins with various biomass-derived oils (including vegetable oils, waste cooking oils, and animal fats) that undergo catalytic hydrogenation and isomerization. UOP's proprietary catalysts and process conditions allow selective conversion of these feedstocks into specific solvent molecules with tailored properties. The technology is particularly notable for its ability to remove oxygen, nitrogen, and sulfur impurities, resulting in ultra-pure solvents that meet or exceed the performance of conventional petroleum-derived alternatives. UOP has also developed integrated heat recovery systems that significantly reduce the energy footprint of the production process. The company has successfully demonstrated this technology at commercial scale through partnerships with major chemical producers and has documented substantial reductions in greenhouse gas emissions compared to conventional solvent production pathways[1][6].

Strengths: UOP's technology leverages existing refinery infrastructure and expertise, facilitating easier adoption and scale-up. Their process produces solvents with exceptional purity and consistent performance characteristics. Weaknesses: The process requires significant hydrogen input, which may limit sustainability benefits if the hydrogen is derived from fossil sources rather than renewable pathways.

Virent, Inc.

Technical Solution: Virent has pioneered the BioForming® process, a groundbreaking technology that converts plant-based sugars into a range of drop-in biochemicals and biofuels, including bio-based solvents. Their patented catalytic process combines aqueous phase reforming (APR) with conventional catalytic processing to produce solvents chemically identical to petroleum-derived counterparts. The technology first converts biomass-derived oxygenated compounds to a mixture of chemical intermediates through the APR process, which operates at moderate temperatures and pressures. These intermediates then undergo further catalytic processing to produce specific solvents like paraxylene, benzene, and toluene. Virent's process is particularly notable for its flexibility in feedstock utilization, capable of processing conventional sugars, cellulosic biomass, and even waste agricultural residues. The company has demonstrated commercial viability through partnerships with major corporations and has scaled its technology to demonstration plant level[2][5].

Strengths: Virent's technology produces true "drop-in" solvents that are molecularly identical to petroleum-based versions, eliminating compatibility issues. Their process offers exceptional feedstock flexibility and high carbon efficiency. Weaknesses: The multi-step catalytic process requires precise control conditions and specialized catalysts that may increase production costs compared to conventional methods.

Key Technological Innovations in Bio-Solvent Production

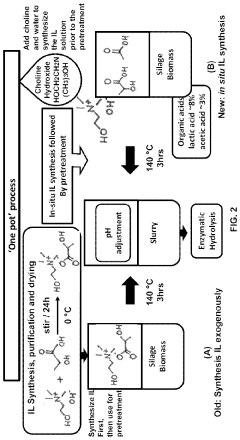

Use of renewable deep eutectic solvents in a one-pot process for a biomass

PatentInactiveUS20200216863A1

Innovation

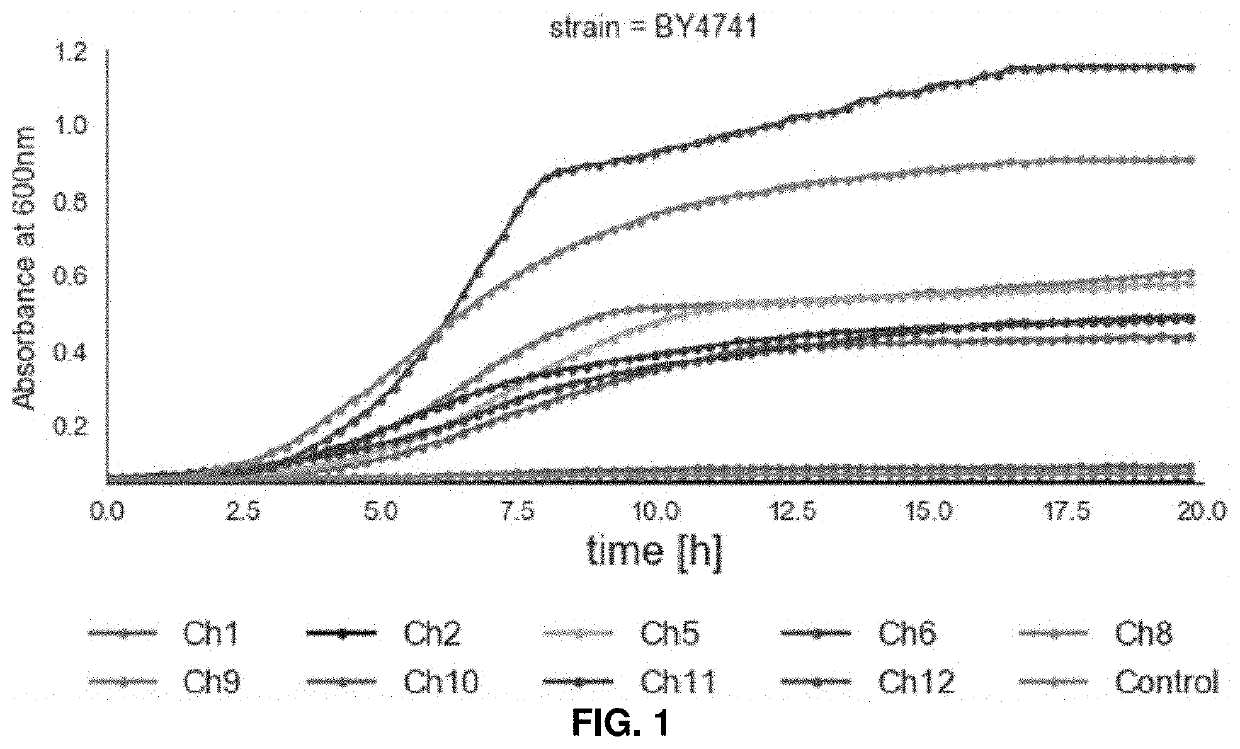

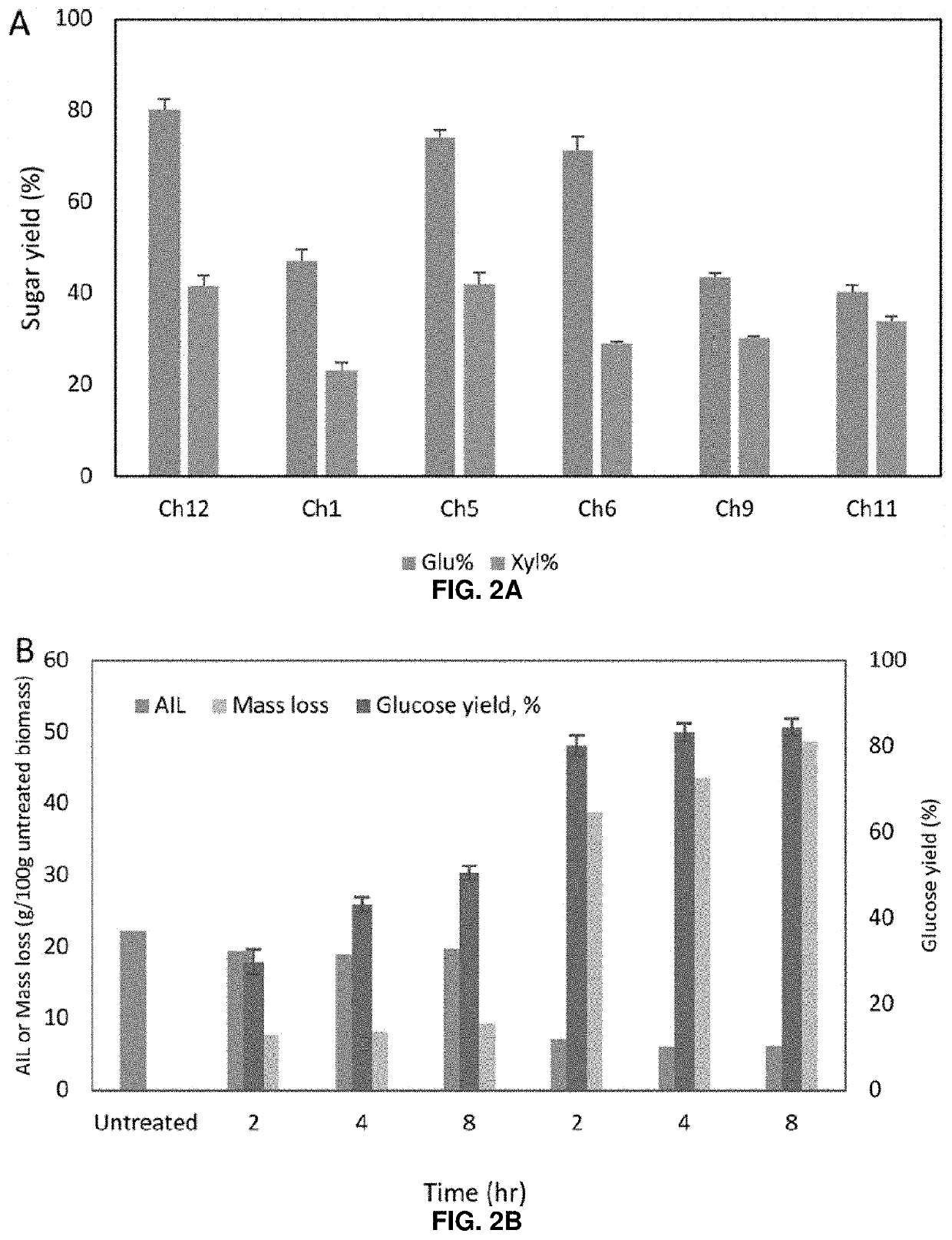

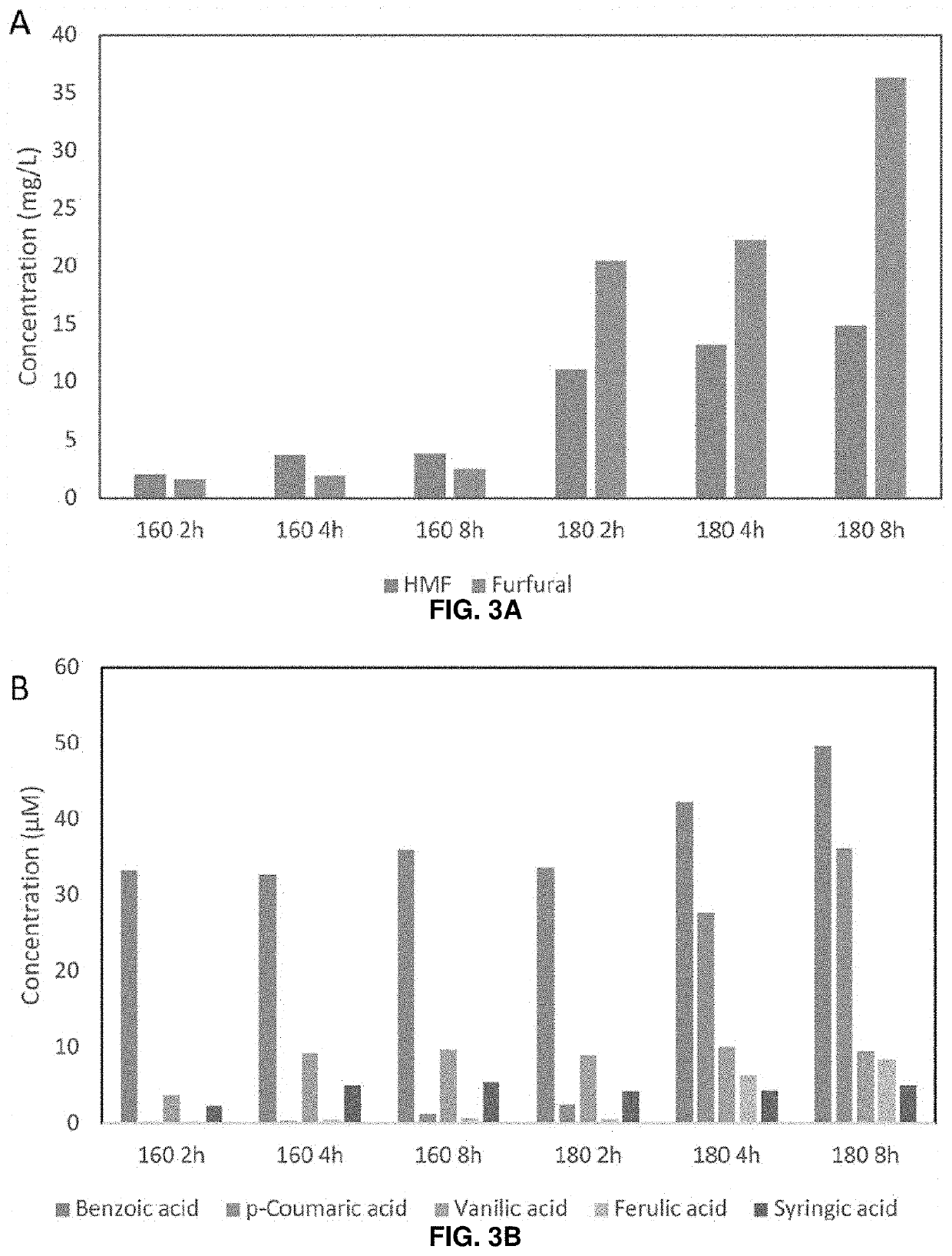

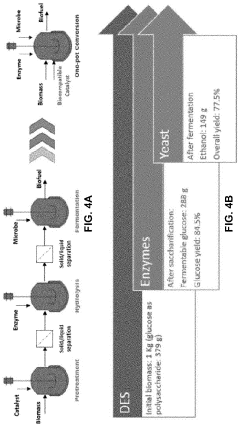

- The use of biocompatible deep eutectic solvents (DESs), specifically choline chloride and glycerol mixtures, for a one-pot biomass pretreatment, saccharification, and fermentation process that eliminates the need for pH adjustments, water dilution, and solid-liquid separations, allowing for continuous operation and compatibility with enzymes and microbes.

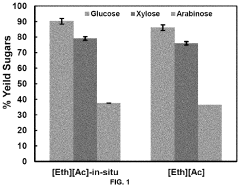

Use of in-situ ionic liquid (IL) and deep eutectic solvent (DES) synthesis using chemically synthesized or biomass-derived ions in the pretreatment of biomass

PatentActiveUS20210363696A1

Innovation

- The method involves synthesizing ionic liquids and deep eutectic solvents in-situ during biomass pretreatment by adding their individual components directly to the pretreatment vessel with the biomass, utilizing endogenous organic acids present in the biomass to form the solvents, thereby eliminating the need for pre-synthesis and reducing costs.

Life Cycle Assessment and Environmental Impact Analysis

Life Cycle Assessment (LCA) studies of biomass-derived solvents reveal significant environmental advantages compared to conventional petroleum-based alternatives. These assessments typically evaluate environmental impacts across multiple categories including global warming potential, ozone depletion, acidification, eutrophication, and human toxicity. Research indicates that solvents derived from renewable biomass sources can reduce greenhouse gas emissions by 40-70% compared to their fossil-based counterparts, depending on feedstock selection and processing methods.

The environmental footprint of biomass-derived solvents is heavily influenced by feedstock cultivation practices. Agricultural residues and waste biomass generally offer superior environmental performance by avoiding the land use changes and intensive farming practices associated with dedicated energy crops. Studies demonstrate that solvents produced from agricultural waste streams can achieve carbon footprint reductions of up to 85% when optimal processing technologies are employed.

Processing efficiency represents a critical factor in the overall environmental profile of bio-based solvents. Advanced biorefinery concepts implementing energy integration and solvent recovery systems have demonstrated substantial improvements in life cycle impacts. Recent technological innovations have reduced energy requirements for biomass-derived solvent production by approximately 30% over the past decade, further enhancing their environmental credentials.

Water consumption and land use impacts require careful consideration when evaluating biomass-derived solvents. While these solvents generally outperform petroleum-based alternatives in carbon metrics, they may present trade-offs in water usage depending on feedstock selection and regional growing conditions. Comprehensive impact assessments indicate that drought-resistant feedstocks and water-efficient processing technologies can mitigate these concerns.

End-of-life considerations significantly influence the overall environmental profile of biomass-derived solvents. Their biodegradability characteristics typically result in reduced persistence in the environment compared to conventional solvents. Toxicity assessments demonstrate that many biomass-derived solvents exhibit lower ecotoxicity and human health impacts, with some showing 50-90% reductions in aquatic toxicity metrics.

Sensitivity analyses within LCA studies highlight the importance of regional factors in determining environmental performance. Electricity grid composition, transportation distances, and local agricultural practices can substantially alter impact profiles. This underscores the need for regionally-specific assessments when evaluating the implementation of biomass-derived solvents in industrial processes.

The environmental footprint of biomass-derived solvents is heavily influenced by feedstock cultivation practices. Agricultural residues and waste biomass generally offer superior environmental performance by avoiding the land use changes and intensive farming practices associated with dedicated energy crops. Studies demonstrate that solvents produced from agricultural waste streams can achieve carbon footprint reductions of up to 85% when optimal processing technologies are employed.

Processing efficiency represents a critical factor in the overall environmental profile of bio-based solvents. Advanced biorefinery concepts implementing energy integration and solvent recovery systems have demonstrated substantial improvements in life cycle impacts. Recent technological innovations have reduced energy requirements for biomass-derived solvent production by approximately 30% over the past decade, further enhancing their environmental credentials.

Water consumption and land use impacts require careful consideration when evaluating biomass-derived solvents. While these solvents generally outperform petroleum-based alternatives in carbon metrics, they may present trade-offs in water usage depending on feedstock selection and regional growing conditions. Comprehensive impact assessments indicate that drought-resistant feedstocks and water-efficient processing technologies can mitigate these concerns.

End-of-life considerations significantly influence the overall environmental profile of biomass-derived solvents. Their biodegradability characteristics typically result in reduced persistence in the environment compared to conventional solvents. Toxicity assessments demonstrate that many biomass-derived solvents exhibit lower ecotoxicity and human health impacts, with some showing 50-90% reductions in aquatic toxicity metrics.

Sensitivity analyses within LCA studies highlight the importance of regional factors in determining environmental performance. Electricity grid composition, transportation distances, and local agricultural practices can substantially alter impact profiles. This underscores the need for regionally-specific assessments when evaluating the implementation of biomass-derived solvents in industrial processes.

Regulatory Framework and Sustainability Certification Standards

The regulatory landscape for biomass-derived solvents is evolving rapidly as governments worldwide implement stricter environmental policies. In the European Union, the Renewable Energy Directive (RED II) establishes sustainability criteria for biofuels and bio-based products, including solvents derived from biomass. This directive requires a minimum 65% greenhouse gas emission reduction compared to fossil-based alternatives and prohibits raw materials from land with high biodiversity or carbon stock. Similarly, the U.S. Environmental Protection Agency's Significant New Alternatives Policy (SNAP) program evaluates and regulates substitutes for ozone-depleting substances, providing a pathway for biomass-derived solvents to gain regulatory approval.

International sustainability certification standards play a crucial role in validating the environmental claims of biomass-derived solvents. The International Sustainability and Carbon Certification (ISCC) system offers a robust framework for assessing the sustainability of biomass feedstocks and their derivatives. This certification verifies compliance with environmental, social, and economic sustainability criteria throughout the supply chain. Similarly, the Roundtable on Sustainable Biomaterials (RSB) provides a comprehensive certification system that addresses 12 principles, including greenhouse gas emissions, conservation, soil health, and social responsibility.

Industry-specific standards are also emerging to address the unique challenges of solvent applications. The ASTM International has developed standards for bio-based solvents, including ASTM D6866, which determines the biobased content using radiocarbon analysis. This standard enables manufacturers to verify and communicate the renewable content of their products accurately. The European Committee for Standardization (CEN) has established similar standards under the EN 16785 series for bio-based products.

Compliance with these regulatory frameworks and certification standards offers significant market advantages. Many government procurement policies now favor certified sustainable products, creating substantial market opportunities for biomass-derived solvents. For instance, the U.S. BioPreferred Program mandates federal agencies to purchase bio-based products when available, while the EU Green Public Procurement (GPP) criteria encourage the selection of environmentally friendly alternatives.

Looking forward, regulatory frameworks are expected to become more stringent, with increased focus on full lifecycle assessment and circular economy principles. The development of harmonized global standards will likely reduce compliance complexity and facilitate international trade of biomass-derived solvents. Companies investing in regulatory compliance and sustainability certification now will gain competitive advantages as markets increasingly demand environmentally responsible solutions.

International sustainability certification standards play a crucial role in validating the environmental claims of biomass-derived solvents. The International Sustainability and Carbon Certification (ISCC) system offers a robust framework for assessing the sustainability of biomass feedstocks and their derivatives. This certification verifies compliance with environmental, social, and economic sustainability criteria throughout the supply chain. Similarly, the Roundtable on Sustainable Biomaterials (RSB) provides a comprehensive certification system that addresses 12 principles, including greenhouse gas emissions, conservation, soil health, and social responsibility.

Industry-specific standards are also emerging to address the unique challenges of solvent applications. The ASTM International has developed standards for bio-based solvents, including ASTM D6866, which determines the biobased content using radiocarbon analysis. This standard enables manufacturers to verify and communicate the renewable content of their products accurately. The European Committee for Standardization (CEN) has established similar standards under the EN 16785 series for bio-based products.

Compliance with these regulatory frameworks and certification standards offers significant market advantages. Many government procurement policies now favor certified sustainable products, creating substantial market opportunities for biomass-derived solvents. For instance, the U.S. BioPreferred Program mandates federal agencies to purchase bio-based products when available, while the EU Green Public Procurement (GPP) criteria encourage the selection of environmentally friendly alternatives.

Looking forward, regulatory frameworks are expected to become more stringent, with increased focus on full lifecycle assessment and circular economy principles. The development of harmonized global standards will likely reduce compliance complexity and facilitate international trade of biomass-derived solvents. Companies investing in regulatory compliance and sustainability certification now will gain competitive advantages as markets increasingly demand environmentally responsible solutions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!