Biomass-Derived Solvents in the Development of New Materials

OCT 23, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biomass Solvent Evolution and Research Objectives

The evolution of biomass-derived solvents represents a significant paradigm shift in sustainable chemistry, transitioning from petroleum-based solvents to renewable alternatives. This evolution began in the early 2000s with simple bio-alcohols like ethanol and expanded to include more complex structures such as 2-methyltetrahydrofuran, γ-valerolactone, and cyrene. The progression has been driven by increasing environmental concerns, stricter regulations on volatile organic compounds (VOCs), and the growing emphasis on circular economy principles.

Biomass-derived solvents are primarily obtained from agricultural residues, forestry waste, and dedicated energy crops. The conversion processes have evolved from simple fermentation to more sophisticated methods including catalytic conversion, thermochemical processing, and integrated biorefinery approaches. These advancements have significantly improved yield efficiency and reduced production costs, making bio-solvents increasingly competitive with conventional options.

The technical evolution has been marked by several key milestones. The development of selective catalytic systems enabled the efficient conversion of cellulose to platform molecules like levulinic acid and hydroxymethylfurfural (HMF). Innovations in separation technologies facilitated the isolation of high-purity bio-solvents from complex biomass hydrolysates. Recent breakthroughs in enzyme engineering and metabolic pathway optimization have expanded the range of accessible bio-solvent structures.

Current research objectives focus on addressing several critical challenges. First, enhancing the performance characteristics of bio-solvents to match or exceed those of petroleum-derived counterparts, particularly regarding solvation power, stability, and compatibility with existing processes. Second, developing scalable and economically viable production methods that can compete with the established petroleum-based solvent industry. Third, expanding the application scope of bio-solvents in advanced materials synthesis, including polymers, composites, and functional nanomaterials.

The integration of bio-solvents into new materials development represents a particularly promising frontier. Research aims to exploit the unique properties of biomass-derived solvents—such as chirality, biodegradability, and specific functional groups—to create materials with enhanced performance or novel functionalities. This includes the development of bio-based polymers with improved mechanical properties, sustainable composites with reduced environmental footprint, and functional materials for specialized applications in electronics, healthcare, and energy storage.

Long-term objectives include establishing comprehensive structure-property relationships for bio-solvents in materials synthesis, developing predictive models for solvent selection, and creating standardized protocols for evaluating bio-solvent performance across different material applications. The ultimate goal is to transition from petroleum-dependent materials production to fully sustainable, closed-loop systems where biomass-derived solvents play a central role in both processing and end-product functionality.

Biomass-derived solvents are primarily obtained from agricultural residues, forestry waste, and dedicated energy crops. The conversion processes have evolved from simple fermentation to more sophisticated methods including catalytic conversion, thermochemical processing, and integrated biorefinery approaches. These advancements have significantly improved yield efficiency and reduced production costs, making bio-solvents increasingly competitive with conventional options.

The technical evolution has been marked by several key milestones. The development of selective catalytic systems enabled the efficient conversion of cellulose to platform molecules like levulinic acid and hydroxymethylfurfural (HMF). Innovations in separation technologies facilitated the isolation of high-purity bio-solvents from complex biomass hydrolysates. Recent breakthroughs in enzyme engineering and metabolic pathway optimization have expanded the range of accessible bio-solvent structures.

Current research objectives focus on addressing several critical challenges. First, enhancing the performance characteristics of bio-solvents to match or exceed those of petroleum-derived counterparts, particularly regarding solvation power, stability, and compatibility with existing processes. Second, developing scalable and economically viable production methods that can compete with the established petroleum-based solvent industry. Third, expanding the application scope of bio-solvents in advanced materials synthesis, including polymers, composites, and functional nanomaterials.

The integration of bio-solvents into new materials development represents a particularly promising frontier. Research aims to exploit the unique properties of biomass-derived solvents—such as chirality, biodegradability, and specific functional groups—to create materials with enhanced performance or novel functionalities. This includes the development of bio-based polymers with improved mechanical properties, sustainable composites with reduced environmental footprint, and functional materials for specialized applications in electronics, healthcare, and energy storage.

Long-term objectives include establishing comprehensive structure-property relationships for bio-solvents in materials synthesis, developing predictive models for solvent selection, and creating standardized protocols for evaluating bio-solvent performance across different material applications. The ultimate goal is to transition from petroleum-dependent materials production to fully sustainable, closed-loop systems where biomass-derived solvents play a central role in both processing and end-product functionality.

Market Analysis for Bio-based Solvents in Materials Science

The global market for bio-based solvents in materials science has experienced significant growth in recent years, driven by increasing environmental concerns and regulatory pressures to reduce dependence on petroleum-derived chemicals. As of 2023, the market size for bio-based solvents reached approximately $9.3 billion, with projections indicating a compound annual growth rate (CAGR) of 7.8% through 2030, potentially reaching $15.6 billion by the end of the forecast period.

The materials science sector represents one of the largest application areas for bio-based solvents, accounting for roughly 32% of the total market share. This substantial presence is primarily attributed to the growing demand for sustainable materials in industries such as construction, automotive, packaging, and consumer goods.

Regional analysis reveals that Europe currently leads the market with approximately 38% share, followed by North America (29%) and Asia-Pacific (24%). Europe's dominance stems from stringent environmental regulations, particularly the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which has accelerated the transition toward bio-based alternatives. However, the Asia-Pacific region is expected to witness the fastest growth rate of 9.2% annually, driven by rapid industrialization and increasing environmental awareness in countries like China, Japan, and South Korea.

From an end-user perspective, the construction industry represents the largest consumer of bio-based solvents in materials development, followed by automotive and packaging industries. The construction sector's preference is largely due to the increasing adoption of green building standards and certifications such as LEED (Leadership in Energy and Environmental Design).

Price sensitivity remains a significant market challenge, with bio-based solvents typically commanding a 15-30% premium over their petroleum-based counterparts. However, this price gap has been narrowing due to technological advancements in production processes and economies of scale. The volatility of raw material prices, particularly agricultural feedstocks, continues to impact market stability and growth potential.

Consumer awareness and preference for environmentally friendly products have become key market drivers. According to recent surveys, approximately 67% of consumers express willingness to pay premium prices for products developed using sustainable materials and processes, including those utilizing bio-based solvents.

The competitive landscape features both established chemical companies pivoting toward bio-based offerings and innovative startups specializing exclusively in biomass-derived solutions. Strategic partnerships between solvent manufacturers and material developers have become increasingly common, creating integrated value chains that enhance market competitiveness and product innovation capabilities.

The materials science sector represents one of the largest application areas for bio-based solvents, accounting for roughly 32% of the total market share. This substantial presence is primarily attributed to the growing demand for sustainable materials in industries such as construction, automotive, packaging, and consumer goods.

Regional analysis reveals that Europe currently leads the market with approximately 38% share, followed by North America (29%) and Asia-Pacific (24%). Europe's dominance stems from stringent environmental regulations, particularly the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which has accelerated the transition toward bio-based alternatives. However, the Asia-Pacific region is expected to witness the fastest growth rate of 9.2% annually, driven by rapid industrialization and increasing environmental awareness in countries like China, Japan, and South Korea.

From an end-user perspective, the construction industry represents the largest consumer of bio-based solvents in materials development, followed by automotive and packaging industries. The construction sector's preference is largely due to the increasing adoption of green building standards and certifications such as LEED (Leadership in Energy and Environmental Design).

Price sensitivity remains a significant market challenge, with bio-based solvents typically commanding a 15-30% premium over their petroleum-based counterparts. However, this price gap has been narrowing due to technological advancements in production processes and economies of scale. The volatility of raw material prices, particularly agricultural feedstocks, continues to impact market stability and growth potential.

Consumer awareness and preference for environmentally friendly products have become key market drivers. According to recent surveys, approximately 67% of consumers express willingness to pay premium prices for products developed using sustainable materials and processes, including those utilizing bio-based solvents.

The competitive landscape features both established chemical companies pivoting toward bio-based offerings and innovative startups specializing exclusively in biomass-derived solutions. Strategic partnerships between solvent manufacturers and material developers have become increasingly common, creating integrated value chains that enhance market competitiveness and product innovation capabilities.

Current Landscape and Technical Barriers in Biomass-Derived Solvents

The global landscape of biomass-derived solvents has witnessed significant growth in recent years, driven by increasing environmental concerns and the push towards sustainable chemistry. Currently, the market is dominated by bio-alcohols (ethanol, butanol), esters (ethyl acetate, methyl lactate), and terpenes (d-limonene), with emerging categories including cyrene, 2-methyltetrahydrofuran, and gamma-valerolactone gaining traction in specialized applications.

Geographically, Europe leads in both research and commercial adoption, with countries like Germany, Netherlands, and Denmark hosting major production facilities and research centers. North America follows closely, particularly in bio-ethanol production, while Asia-Pacific represents the fastest-growing region, with significant investments in countries like China and India focusing on agricultural waste valorization.

Despite promising advancements, several technical barriers impede widespread adoption of biomass-derived solvents in material development. Foremost among these is production scalability - most novel bio-solvents remain confined to laboratory or pilot scales, with prohibitive costs compared to petroleum-based alternatives. Current production methods often require complex multi-step processes, resulting in low yields and high energy consumption.

Inconsistent quality presents another significant challenge. Biomass feedstocks exhibit natural variability in composition depending on geographical origin, harvest season, and processing methods. This variability translates to fluctuations in solvent properties, creating obstacles for industries requiring precise specifications for material synthesis.

Performance limitations also restrict application scope. Many bio-solvents demonstrate lower solvation power compared to conventional solvents, particularly for non-polar polymers and resins critical in advanced material development. Additionally, stability issues including thermal degradation, oxidative sensitivity, and moisture absorption complicate their integration into existing material processing systems.

Regulatory hurdles further complicate the landscape. While bio-derived status offers environmental advantages, comprehensive toxicological and environmental impact data remain incomplete for many novel bio-solvents, delaying regulatory approvals necessary for commercial applications in sensitive sectors like pharmaceuticals, food packaging, and medical devices.

Infrastructure constraints represent a final significant barrier. The existing chemical industry infrastructure is optimized for petroleum-based solvents, with storage, transportation, and processing equipment often incompatible with the chemical properties of bio-alternatives. Retrofitting or developing new infrastructure requires substantial capital investment, creating a chicken-and-egg problem where market demand cannot grow without infrastructure, while infrastructure investment awaits market growth.

These technical barriers collectively create a complex innovation landscape where promising laboratory discoveries struggle to achieve commercial viability in material development applications.

Geographically, Europe leads in both research and commercial adoption, with countries like Germany, Netherlands, and Denmark hosting major production facilities and research centers. North America follows closely, particularly in bio-ethanol production, while Asia-Pacific represents the fastest-growing region, with significant investments in countries like China and India focusing on agricultural waste valorization.

Despite promising advancements, several technical barriers impede widespread adoption of biomass-derived solvents in material development. Foremost among these is production scalability - most novel bio-solvents remain confined to laboratory or pilot scales, with prohibitive costs compared to petroleum-based alternatives. Current production methods often require complex multi-step processes, resulting in low yields and high energy consumption.

Inconsistent quality presents another significant challenge. Biomass feedstocks exhibit natural variability in composition depending on geographical origin, harvest season, and processing methods. This variability translates to fluctuations in solvent properties, creating obstacles for industries requiring precise specifications for material synthesis.

Performance limitations also restrict application scope. Many bio-solvents demonstrate lower solvation power compared to conventional solvents, particularly for non-polar polymers and resins critical in advanced material development. Additionally, stability issues including thermal degradation, oxidative sensitivity, and moisture absorption complicate their integration into existing material processing systems.

Regulatory hurdles further complicate the landscape. While bio-derived status offers environmental advantages, comprehensive toxicological and environmental impact data remain incomplete for many novel bio-solvents, delaying regulatory approvals necessary for commercial applications in sensitive sectors like pharmaceuticals, food packaging, and medical devices.

Infrastructure constraints represent a final significant barrier. The existing chemical industry infrastructure is optimized for petroleum-based solvents, with storage, transportation, and processing equipment often incompatible with the chemical properties of bio-alternatives. Retrofitting or developing new infrastructure requires substantial capital investment, creating a chicken-and-egg problem where market demand cannot grow without infrastructure, while infrastructure investment awaits market growth.

These technical barriers collectively create a complex innovation landscape where promising laboratory discoveries struggle to achieve commercial viability in material development applications.

Contemporary Approaches for Biomass Solvent Implementation

01 Production of biomass-derived solvents from lignocellulosic materials

Processes for converting lignocellulosic biomass into renewable solvents through various conversion methods including fermentation, hydrolysis, and catalytic processes. These methods enable the transformation of plant-based materials such as agricultural residues, wood chips, and dedicated energy crops into environmentally friendly solvents that can replace petroleum-based alternatives. The resulting bio-solvents offer comparable performance characteristics while reducing carbon footprint and dependence on fossil resources.- Production of biomass-derived solvents from lignocellulosic materials: Processes for converting lignocellulosic biomass into renewable solvents through various conversion pathways including fermentation, hydrolysis, and catalytic reactions. These methods typically involve breaking down cellulose and hemicellulose components into sugars, which are then further processed into solvent compounds. The resulting bio-based solvents offer environmentally friendly alternatives to petroleum-derived solvents with comparable performance characteristics.

- Gamma-valerolactone (GVL) as a biomass-derived solvent: Gamma-valerolactone (GVL) is produced from biomass sources and serves as a sustainable solvent with applications in various industries. GVL can be synthesized from levulinic acid, which is derived from cellulosic materials. It exhibits favorable properties including low volatility, low toxicity, high boiling point, and good solubility characteristics. GVL can replace traditional petroleum-based solvents in processes such as biomass conversion, chemical synthesis, and pharmaceutical manufacturing.

- Biomass-derived solvents for pulp and paper processing: Biomass-derived solvents can be utilized in pulp and paper processing as environmentally friendly alternatives to conventional chemical solvents. These bio-based solvents facilitate the separation of lignin from cellulose fibers, improving the efficiency of pulping processes while reducing environmental impact. The technology enables more sustainable paper production methods with reduced chemical waste and energy consumption compared to traditional pulping techniques.

- Biofuel production using biomass-derived solvents: Biomass-derived solvents play a crucial role in biofuel production processes by facilitating the extraction and conversion of biomass components into liquid fuels. These solvents help in the pretreatment of biomass, dissolution of cellulose, and extraction of valuable compounds. The use of bio-based solvents in biofuel production creates a more sustainable process chain, reducing the carbon footprint of the resulting fuels and contributing to circular bioeconomy principles.

- Novel biomass-derived solvent formulations and applications: Innovative formulations of biomass-derived solvents with enhanced properties for specific industrial applications. These formulations may include solvent mixtures, additives, or modified biomass-derived compounds designed to improve performance in areas such as cleaning, degreasing, coating, adhesives, and pharmaceutical processing. The novel formulations aim to replace conventional petroleum-based solvents while offering comparable or superior technical performance with improved environmental and safety profiles.

02 Green solvents derived from biomass for industrial applications

Development of sustainable solvents from biomass feedstocks specifically designed for industrial applications including cleaning, degreasing, coating, and extraction processes. These bio-based solvents provide environmentally friendly alternatives to traditional petroleum-derived solvents, offering reduced toxicity, improved biodegradability, and lower environmental impact. Applications span across multiple industries including manufacturing, electronics, pharmaceuticals, and consumer products where solvent performance and sustainability are both critical requirements.Expand Specific Solutions03 Biomass-derived solvents for polymer processing and formulations

Utilization of biomass-derived solvents in polymer processing, formulation, and application systems. These bio-solvents serve as sustainable alternatives in polymer dissolution, coating formulations, adhesive systems, and composite material production. The solvents enable effective processing of both bio-based and conventional polymers while reducing environmental impact. Research demonstrates compatibility with various polymer types and processing methods, allowing for drop-in replacement of traditional solvents in existing manufacturing processes.Expand Specific Solutions04 Extraction and purification techniques using biomass-derived solvents

Methods for using biomass-derived solvents in extraction and purification processes across various industries including pharmaceuticals, food processing, and natural product isolation. These green solvents offer selective extraction capabilities for valuable compounds while maintaining product quality and purity. The techniques leverage the unique properties of bio-solvents such as tunable polarity, low toxicity, and biodegradability to create more sustainable separation processes compared to conventional solvent-based methods.Expand Specific Solutions05 Catalytic conversion processes for biomass to solvent production

Advanced catalytic processes designed specifically for converting biomass feedstocks into high-quality solvents. These processes employ novel catalysts and reaction conditions to transform biomass components into targeted solvent molecules with desired properties. The catalytic approaches enable selective conversion pathways, improved yields, and energy-efficient production methods compared to traditional biomass processing techniques. The resulting solvents meet industrial specifications while being derived from renewable resources.Expand Specific Solutions

Industry Leaders and Competitive Dynamics in Biomass Solvent Market

Biomass-derived solvents for new materials development is currently in a growth phase, with the market expanding rapidly due to increasing sustainability demands. The global market is projected to reach significant scale as industries seek greener alternatives to petroleum-based solvents. Technologically, the field shows varying maturity levels across applications. Leading players include Shell Oil Co. and Clariant International AG, who have established commercial production capabilities, while UOP LLC and Dow Global Technologies LLC focus on process optimization. Research institutions like Dalian Institute of Chemical Physics and Chinese Academy of Science are advancing fundamental innovations. DuPont and Mitsubishi Hitachi Power Systems are developing application-specific solutions, creating a competitive landscape balanced between established chemical companies and emerging specialized players.

Dalian Institute of Chemical Physics of CAS

Technical Solution: Dalian Institute has developed innovative biomass-derived solvent systems focusing on the conversion of lignocellulosic biomass into valuable platform chemicals. Their technology utilizes γ-valerolactone (GVL) as a sustainable solvent for fractionation of lignocellulosic biomass, achieving high yields of cellulose (>90%) and lignin (>85%) under mild conditions. The institute has pioneered a one-pot catalytic system where GVL acts both as solvent and reaction medium for the production of furfural and 5-hydroxymethylfurfural (HMF) from biomass carbohydrates. Their recent advances include the development of biphasic systems combining GVL with water to enhance separation efficiency and product yields. Additionally, they've engineered recyclable catalyst systems specifically designed to work in biomass-derived solvent environments, allowing for multiple reuse cycles without significant activity loss[1][3].

Strengths: Exceptional selectivity in biomass fractionation processes, high product yields under relatively mild conditions, and excellent solvent recyclability (>95% recovery). Weaknesses: Energy-intensive solvent recovery processes, potential catalyst deactivation issues in the presence of biomass impurities, and relatively high production costs compared to petroleum-based alternatives.

Clariant International AG

Technical Solution: Clariant has developed the sunliquid® technology platform utilizing biomass-derived solvents for sustainable material production. This technology employs energy-efficient enzymatic hydrolysis processes with bio-catalysts that convert agricultural residues into cellulosic sugars. These sugars serve as building blocks for various bio-based chemicals and materials. Their proprietary process uses biomass-derived organic solvents for lignin extraction, achieving separation efficiencies of over 95% while maintaining the structural integrity of cellulose components. Clariant has also pioneered integrated biorefinery concepts where biomass-derived solvents like 2-methyltetrahydrofuran (2-MeTHF) and γ-valerolactone are both produced from and used within the same process system, creating a circular production model. The company has successfully scaled this technology to commercial production levels, with their first full-scale plant in Romania processing approximately 250,000 tons of straw annually to produce cellulosic ethanol and other bio-based materials[2][5].

Strengths: Highly efficient integrated biorefinery approach with excellent solvent recyclability, reduced carbon footprint (up to 95% CO2 reduction compared to fossil alternatives), and commercial-scale implementation proven. Weaknesses: High initial capital investment requirements, dependence on consistent biomass feedstock quality, and sensitivity to market fluctuations in agricultural residue availability and pricing.

Key Patents and Scientific Breakthroughs in Biomass Solvent Technology

Use of metal salts and deep eutectic solvents in a process to solubilize a biomass

PatentActiveUS20210317481A1

Innovation

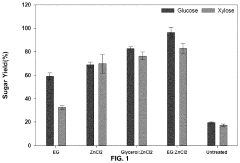

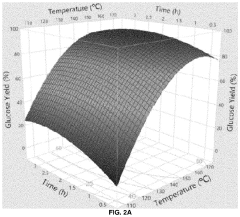

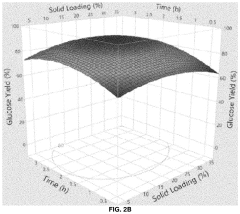

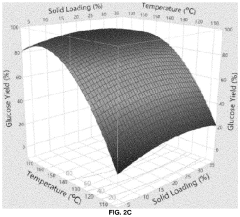

- The use of metal-based deep eutectic solvents (mDES) that solubilize biomass, optionally with enzymes or microbes, to facilitate selective lignin depolymerization and biofuel production, with specific compositions like zinc chloride and glycerol or ethylene glycol, enabling controlled cleavage of aryl ether linkages and aiding in DES recycle and product recovery.

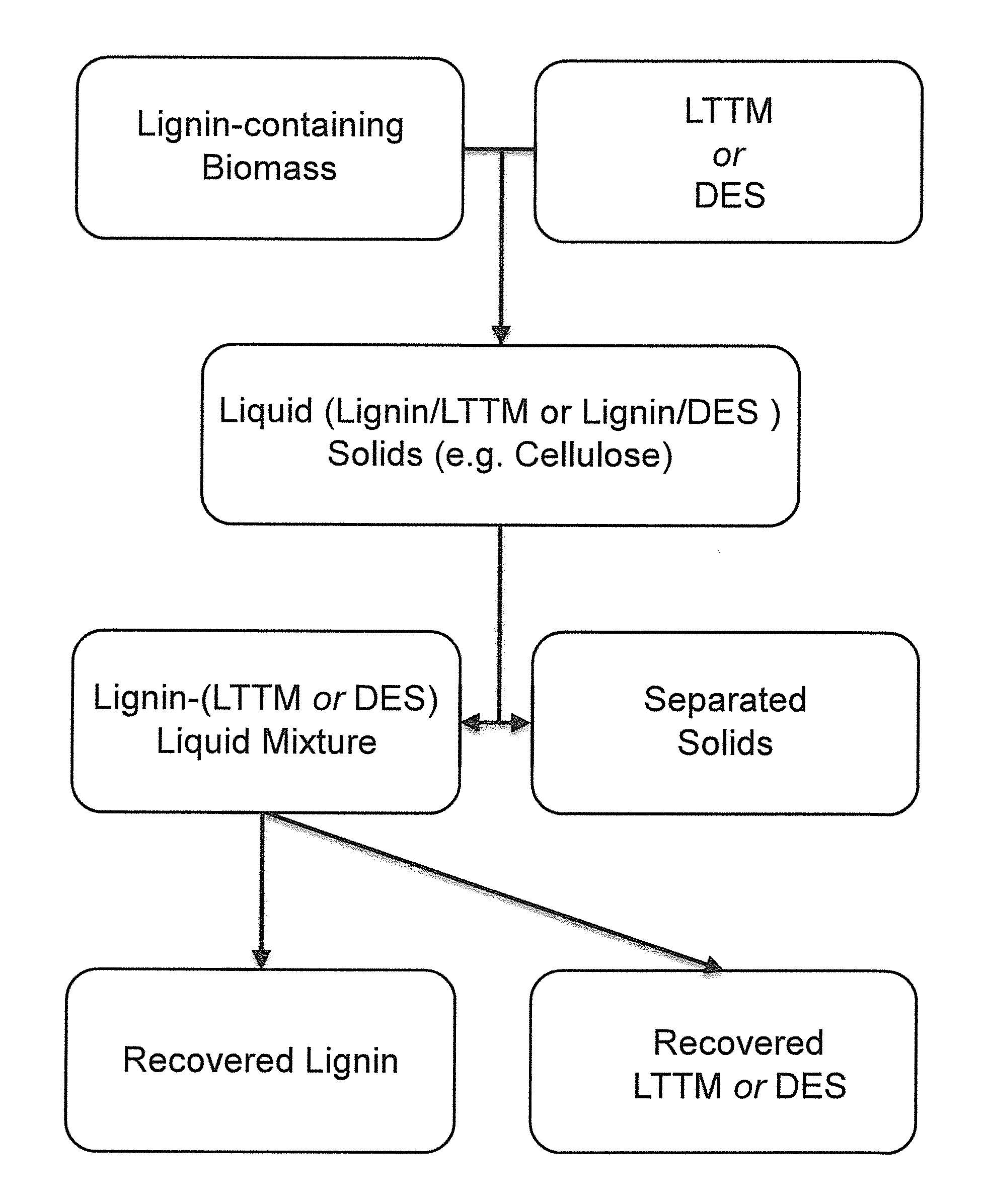

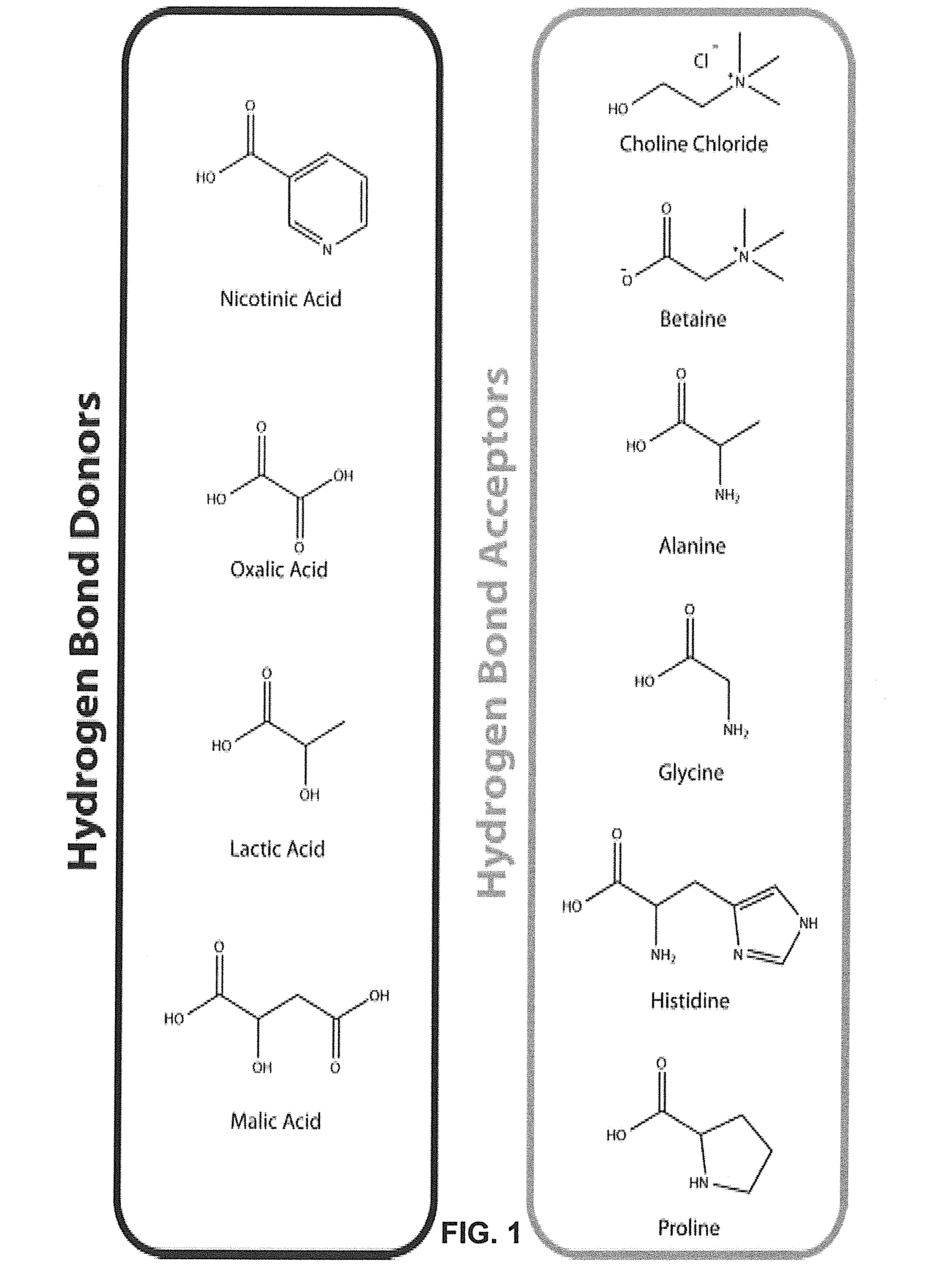

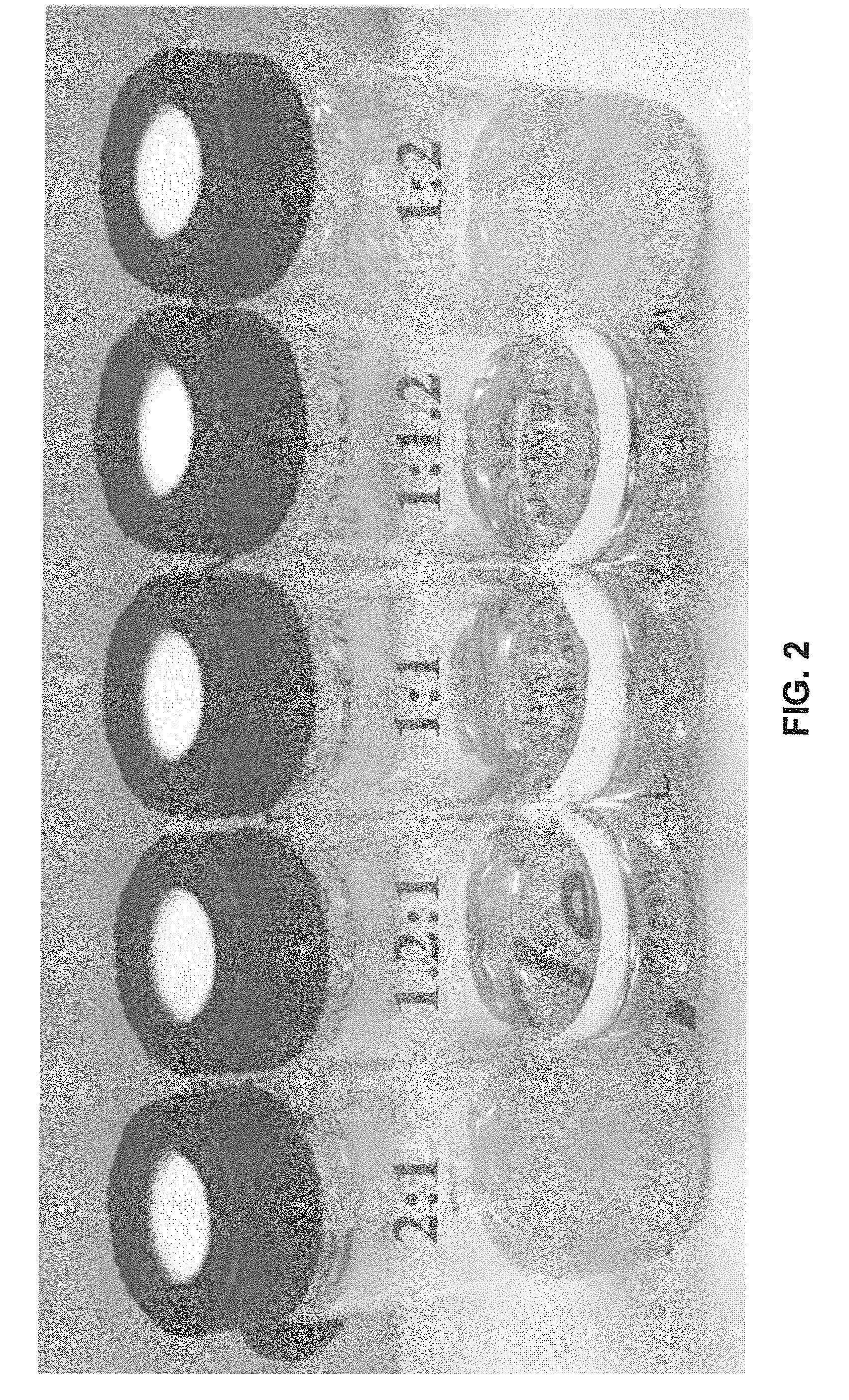

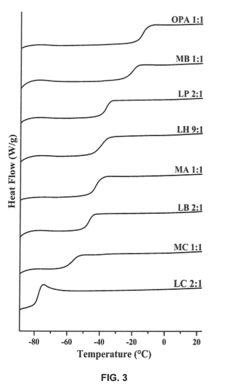

Pretreatment of Lignocellulosic Biomass and Recovery of Substituents using Natural Deep Eutectic Solvents/Compound Mixtures with Low Transition Temperatures

PatentInactiveUS20150094459A1

Innovation

- Development of low transition temperature mixtures (LTTMs) composed of renewable components, which selectively dissolve lignin from lignin-containing biomass at mild conditions, allowing for energy-efficient separation of lignin from cellulose without degradation, and enable recovery of high-quality lignin and cellulose.

Sustainability Metrics and Life Cycle Assessment

The sustainability assessment of biomass-derived solvents represents a critical component in evaluating their true environmental impact and potential for sustainable material development. Life Cycle Assessment (LCA) provides a comprehensive framework for quantifying environmental impacts across the entire value chain, from raw material extraction to end-of-life disposal.

When examining biomass-derived solvents, key sustainability metrics include greenhouse gas emissions, energy consumption, water usage, land use change, and biodiversity impacts. These metrics must be evaluated against conventional petroleum-based solvents to determine the actual environmental benefits. Research indicates that while biomass-derived solvents generally show reduced carbon footprints, their sustainability advantages can be compromised by intensive agricultural practices or inefficient processing methods.

The carbon intensity of biomass-derived solvents varies significantly based on feedstock selection and processing technology. For instance, solvents derived from agricultural residues typically demonstrate better sustainability profiles than those requiring dedicated crop cultivation. Studies show that solvents produced from waste biomass can achieve carbon emission reductions of 50-80% compared to their fossil-based counterparts.

Water footprint analysis reveals complex trade-offs in biomass solvent production. While bio-based processes often consume more water than petrochemical routes, they typically generate less toxic wastewater. Quantitative water impact assessments must therefore consider both consumption volumes and contamination potential to provide meaningful sustainability comparisons.

Standardization of sustainability metrics remains challenging due to methodological variations in LCA approaches. The ISO 14040/14044 frameworks provide general guidance, but sector-specific methodologies for biomass-derived solvents are still evolving. This lack of standardization complicates direct comparisons between different studies and solvent options.

Social sustainability dimensions, including impacts on food security, rural development, and labor conditions, are increasingly recognized as essential components of comprehensive sustainability assessments. The development of socio-economic indicators alongside environmental metrics enables more holistic evaluation of biomass-derived solvent sustainability.

Recent advancements in consequential LCA methodologies have improved our understanding of market-mediated effects, such as indirect land use change, which can significantly influence the overall sustainability profile of biomass-derived solvents. These sophisticated assessment approaches help identify potential unintended consequences of scaling up bio-based solvent production.

When examining biomass-derived solvents, key sustainability metrics include greenhouse gas emissions, energy consumption, water usage, land use change, and biodiversity impacts. These metrics must be evaluated against conventional petroleum-based solvents to determine the actual environmental benefits. Research indicates that while biomass-derived solvents generally show reduced carbon footprints, their sustainability advantages can be compromised by intensive agricultural practices or inefficient processing methods.

The carbon intensity of biomass-derived solvents varies significantly based on feedstock selection and processing technology. For instance, solvents derived from agricultural residues typically demonstrate better sustainability profiles than those requiring dedicated crop cultivation. Studies show that solvents produced from waste biomass can achieve carbon emission reductions of 50-80% compared to their fossil-based counterparts.

Water footprint analysis reveals complex trade-offs in biomass solvent production. While bio-based processes often consume more water than petrochemical routes, they typically generate less toxic wastewater. Quantitative water impact assessments must therefore consider both consumption volumes and contamination potential to provide meaningful sustainability comparisons.

Standardization of sustainability metrics remains challenging due to methodological variations in LCA approaches. The ISO 14040/14044 frameworks provide general guidance, but sector-specific methodologies for biomass-derived solvents are still evolving. This lack of standardization complicates direct comparisons between different studies and solvent options.

Social sustainability dimensions, including impacts on food security, rural development, and labor conditions, are increasingly recognized as essential components of comprehensive sustainability assessments. The development of socio-economic indicators alongside environmental metrics enables more holistic evaluation of biomass-derived solvent sustainability.

Recent advancements in consequential LCA methodologies have improved our understanding of market-mediated effects, such as indirect land use change, which can significantly influence the overall sustainability profile of biomass-derived solvents. These sophisticated assessment approaches help identify potential unintended consequences of scaling up bio-based solvent production.

Regulatory Framework and Green Chemistry Compliance

The regulatory landscape governing biomass-derived solvents has evolved significantly in response to growing environmental concerns and sustainability imperatives. In the European Union, the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation provides a comprehensive framework that increasingly favors bio-based alternatives over petroleum-derived solvents. Similarly, the United States EPA has established the Significant New Alternatives Policy (SNAP) program, which evaluates and regulates substitutes for ozone-depleting substances, creating opportunities for biomass-derived solvents.

Green Chemistry principles, particularly those established by Anastas and Warner, have become fundamental guidelines in the development of biomass-derived solvents. These principles emphasize waste prevention, atom economy, less hazardous chemical syntheses, and the use of renewable feedstocks—all attributes that biomass-derived solvents can potentially fulfill. The solvent selection guides developed by pharmaceutical companies like GSK, Pfizer, and Sanofi have further institutionalized these principles, categorizing solvents based on their environmental impact and sustainability profiles.

Certification schemes play a crucial role in market acceptance of new materials developed using biomass-derived solvents. Programs such as the USDA BioPreferred program and the EU Ecolabel provide verification mechanisms that can enhance consumer confidence and market penetration. These certifications often require life cycle assessments (LCAs) that quantify environmental impacts across the entire value chain, from biomass cultivation to end-of-life disposal.

Regulatory compliance challenges remain significant barriers to wider adoption. The variability in biomass feedstocks can lead to inconsistent solvent properties, potentially complicating regulatory approval processes. Additionally, the regulatory framework for novel biomass-derived solvents often lags behind innovation, creating uncertainty for manufacturers and investors. Cross-border regulatory differences further complicate global commercialization efforts.

Industry-specific regulations present both challenges and opportunities. In pharmaceutical manufacturing, ICH (International Council for Harmonisation) guidelines on residual solvents have established strict limits on solvent residues in medicinal products. Biomass-derived solvents must demonstrate compliance with these standards to gain acceptance in pharmaceutical applications. Similarly, in food packaging applications, regulations such as EU 10/2011 and FDA CFR Title 21 govern material safety, requiring extensive migration studies for new solvent-derived materials.

Future regulatory trends indicate a progressive tightening of environmental standards, likely accelerating the transition toward greener alternatives. Extended Producer Responsibility (EPR) schemes are expanding globally, potentially creating additional incentives for materials developed with sustainable solvents. Carbon pricing mechanisms and border carbon adjustments may further enhance the competitive position of biomass-derived solvents relative to their fossil-based counterparts.

Green Chemistry principles, particularly those established by Anastas and Warner, have become fundamental guidelines in the development of biomass-derived solvents. These principles emphasize waste prevention, atom economy, less hazardous chemical syntheses, and the use of renewable feedstocks—all attributes that biomass-derived solvents can potentially fulfill. The solvent selection guides developed by pharmaceutical companies like GSK, Pfizer, and Sanofi have further institutionalized these principles, categorizing solvents based on their environmental impact and sustainability profiles.

Certification schemes play a crucial role in market acceptance of new materials developed using biomass-derived solvents. Programs such as the USDA BioPreferred program and the EU Ecolabel provide verification mechanisms that can enhance consumer confidence and market penetration. These certifications often require life cycle assessments (LCAs) that quantify environmental impacts across the entire value chain, from biomass cultivation to end-of-life disposal.

Regulatory compliance challenges remain significant barriers to wider adoption. The variability in biomass feedstocks can lead to inconsistent solvent properties, potentially complicating regulatory approval processes. Additionally, the regulatory framework for novel biomass-derived solvents often lags behind innovation, creating uncertainty for manufacturers and investors. Cross-border regulatory differences further complicate global commercialization efforts.

Industry-specific regulations present both challenges and opportunities. In pharmaceutical manufacturing, ICH (International Council for Harmonisation) guidelines on residual solvents have established strict limits on solvent residues in medicinal products. Biomass-derived solvents must demonstrate compliance with these standards to gain acceptance in pharmaceutical applications. Similarly, in food packaging applications, regulations such as EU 10/2011 and FDA CFR Title 21 govern material safety, requiring extensive migration studies for new solvent-derived materials.

Future regulatory trends indicate a progressive tightening of environmental standards, likely accelerating the transition toward greener alternatives. Extended Producer Responsibility (EPR) schemes are expanding globally, potentially creating additional incentives for materials developed with sustainable solvents. Carbon pricing mechanisms and border carbon adjustments may further enhance the competitive position of biomass-derived solvents relative to their fossil-based counterparts.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!