Standards and Qualifications for Using Biomass-Derived Solvents

OCT 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biomass Solvent Evolution and Objectives

Biomass-derived solvents have emerged as a sustainable alternative to conventional petroleum-based solvents, marking a significant shift in the chemical industry's approach to environmental responsibility. The evolution of these bio-solvents can be traced back to the early 20th century, but significant research and development only gained momentum in the 1990s as environmental concerns and regulatory pressures intensified. Initially, simple alcohols like bioethanol dominated the biomass solvent landscape, but recent decades have witnessed remarkable diversification into more complex molecules including esters, ethers, and terpenes derived from various biomass feedstocks.

The technological trajectory of biomass solvents has been shaped by advances in biorefinery processes, catalytic conversion techniques, and separation technologies. Particularly noteworthy is the transition from first-generation biomass solvents derived from food crops to second-generation alternatives utilizing agricultural residues and forestry waste, addressing earlier sustainability concerns. Third-generation approaches now explore algae and microbial production systems, representing the cutting edge of the field.

Current research trends indicate growing interest in developing solvent systems with tunable properties, enabling precise customization for specific applications. This represents a paradigm shift from merely substituting conventional solvents to designing bio-based alternatives with superior performance characteristics. The concept of "designer bio-solvents" has emerged as researchers gain deeper understanding of structure-property relationships in biomass-derived molecules.

The primary objective of standardization efforts in this domain is to establish comprehensive frameworks for evaluating the environmental credentials, performance parameters, and safety profiles of biomass-derived solvents. This includes developing metrics for renewable carbon content, biodegradability, toxicity profiles, and life cycle impacts that can be universally applied across different solvent categories and applications.

Technical objectives focus on addressing key challenges including solvent stability, purity specifications, and batch-to-batch consistency—factors critical for industrial adoption. Standardized analytical methods for characterizing biomass solvents represent another crucial goal, as current methods often derive from petroleum-based solvent analysis and may not adequately capture the unique properties of bio-based alternatives.

Market-oriented objectives include creating certification systems that provide clear signals to consumers and industrial users regarding solvent sustainability credentials. This aims to prevent greenwashing while creating market differentiation opportunities for truly sustainable products. Additionally, harmonizing international standards represents a significant goal to prevent regulatory fragmentation that could impede global adoption of these environmentally preferable alternatives.

The technological trajectory of biomass solvents has been shaped by advances in biorefinery processes, catalytic conversion techniques, and separation technologies. Particularly noteworthy is the transition from first-generation biomass solvents derived from food crops to second-generation alternatives utilizing agricultural residues and forestry waste, addressing earlier sustainability concerns. Third-generation approaches now explore algae and microbial production systems, representing the cutting edge of the field.

Current research trends indicate growing interest in developing solvent systems with tunable properties, enabling precise customization for specific applications. This represents a paradigm shift from merely substituting conventional solvents to designing bio-based alternatives with superior performance characteristics. The concept of "designer bio-solvents" has emerged as researchers gain deeper understanding of structure-property relationships in biomass-derived molecules.

The primary objective of standardization efforts in this domain is to establish comprehensive frameworks for evaluating the environmental credentials, performance parameters, and safety profiles of biomass-derived solvents. This includes developing metrics for renewable carbon content, biodegradability, toxicity profiles, and life cycle impacts that can be universally applied across different solvent categories and applications.

Technical objectives focus on addressing key challenges including solvent stability, purity specifications, and batch-to-batch consistency—factors critical for industrial adoption. Standardized analytical methods for characterizing biomass solvents represent another crucial goal, as current methods often derive from petroleum-based solvent analysis and may not adequately capture the unique properties of bio-based alternatives.

Market-oriented objectives include creating certification systems that provide clear signals to consumers and industrial users regarding solvent sustainability credentials. This aims to prevent greenwashing while creating market differentiation opportunities for truly sustainable products. Additionally, harmonizing international standards represents a significant goal to prevent regulatory fragmentation that could impede global adoption of these environmentally preferable alternatives.

Market Analysis for Sustainable Solvent Solutions

The global market for sustainable solvents, particularly those derived from biomass, has experienced significant growth in recent years, driven by increasing environmental regulations and corporate sustainability initiatives. The market value for bio-based solvents reached approximately $6.5 billion in 2022 and is projected to grow at a compound annual growth rate of 7.8% through 2030, potentially reaching $11.2 billion by the end of the forecast period.

Consumer demand for environmentally friendly products has created substantial market pull for sustainable alternatives to conventional petroleum-based solvents. Industries including paints and coatings, pharmaceuticals, cosmetics, and cleaning products are actively seeking biomass-derived solvents to reduce their environmental footprint and comply with increasingly stringent regulations on volatile organic compounds (VOCs).

Regional analysis reveals that Europe currently leads the sustainable solvent market, accounting for roughly 35% of global consumption. This dominance is largely attributed to the European Union's comprehensive regulatory framework, including REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and the European Green Deal. North America follows with approximately 28% market share, while Asia-Pacific represents the fastest-growing region with annual growth rates exceeding 9%.

Key market segments for biomass-derived solvents include bio-alcohols (ethanol, butanol), bio-glycols, terpenes, and bio-esters. Among these, bio-alcohols currently dominate with approximately 40% market share due to their versatility and established production infrastructure. However, terpenes are experiencing the fastest growth rate, particularly in specialty applications requiring higher performance characteristics.

Price sensitivity remains a significant market factor, with biomass-derived solvents typically commanding a 15-30% premium over their petroleum-based counterparts. This price differential has been gradually narrowing as production scales increase and technologies mature, but still represents a barrier to wider adoption in cost-sensitive applications.

Market penetration varies significantly by industry sector. The cosmetics and personal care industry has achieved the highest adoption rate at approximately 22%, followed by household cleaning products at 18%. Industrial applications in coatings and adhesives show promising growth potential but currently represent lower adoption rates of 12-15% due to more stringent performance requirements and price sensitivity.

Consumer awareness and willingness to pay premiums for sustainable products continue to rise, with recent market surveys indicating that 64% of consumers across major markets express preference for products made with sustainable ingredients, including solvents. This trend is particularly pronounced among younger demographics and in developed economies.

Consumer demand for environmentally friendly products has created substantial market pull for sustainable alternatives to conventional petroleum-based solvents. Industries including paints and coatings, pharmaceuticals, cosmetics, and cleaning products are actively seeking biomass-derived solvents to reduce their environmental footprint and comply with increasingly stringent regulations on volatile organic compounds (VOCs).

Regional analysis reveals that Europe currently leads the sustainable solvent market, accounting for roughly 35% of global consumption. This dominance is largely attributed to the European Union's comprehensive regulatory framework, including REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and the European Green Deal. North America follows with approximately 28% market share, while Asia-Pacific represents the fastest-growing region with annual growth rates exceeding 9%.

Key market segments for biomass-derived solvents include bio-alcohols (ethanol, butanol), bio-glycols, terpenes, and bio-esters. Among these, bio-alcohols currently dominate with approximately 40% market share due to their versatility and established production infrastructure. However, terpenes are experiencing the fastest growth rate, particularly in specialty applications requiring higher performance characteristics.

Price sensitivity remains a significant market factor, with biomass-derived solvents typically commanding a 15-30% premium over their petroleum-based counterparts. This price differential has been gradually narrowing as production scales increase and technologies mature, but still represents a barrier to wider adoption in cost-sensitive applications.

Market penetration varies significantly by industry sector. The cosmetics and personal care industry has achieved the highest adoption rate at approximately 22%, followed by household cleaning products at 18%. Industrial applications in coatings and adhesives show promising growth potential but currently represent lower adoption rates of 12-15% due to more stringent performance requirements and price sensitivity.

Consumer awareness and willingness to pay premiums for sustainable products continue to rise, with recent market surveys indicating that 64% of consumers across major markets express preference for products made with sustainable ingredients, including solvents. This trend is particularly pronounced among younger demographics and in developed economies.

Biomass-Derived Solvents: Status and Barriers

The current landscape of biomass-derived solvents is characterized by significant advancements in research and development, yet widespread industrial adoption faces substantial barriers. These solvents, derived from renewable resources such as agricultural residues, forestry waste, and dedicated energy crops, have gained attention as sustainable alternatives to conventional petroleum-based solvents. However, their implementation is hindered by several critical challenges.

A primary barrier is the lack of standardized quality specifications and performance criteria. Unlike conventional solvents with well-established industry standards, biomass-derived alternatives operate in a regulatory vacuum. This absence of universally accepted standards creates uncertainty regarding solvent purity, stability, and performance consistency across different applications, deterring potential industrial users concerned about quality assurance.

Technical limitations present another significant obstacle. Many biomass-derived solvents exhibit variable composition depending on feedstock source and processing conditions, leading to inconsistent performance. Issues such as thermal stability, moisture sensitivity, and compatibility with existing industrial equipment remain unresolved for several promising bio-solvents, limiting their application scope.

Economic viability represents perhaps the most formidable barrier. Current production processes for biomass-derived solvents typically involve complex multi-step conversions with relatively low yields, resulting in higher production costs compared to petroleum-based alternatives. The price premium, often 1.5-3 times higher than conventional solvents, makes widespread adoption economically challenging without regulatory incentives or carbon pricing mechanisms.

Supply chain constraints further complicate the landscape. The biomass feedstock supply is subject to seasonal variations, geographical limitations, and competition with food production. Additionally, the distributed nature of biomass resources often necessitates decentralized processing facilities, creating logistical challenges for consistent industrial-scale production.

Regulatory frameworks present a mixed picture globally. While some regions have implemented favorable policies promoting bio-based chemicals, others lack clear regulatory pathways for approval and commercialization of novel solvents. The absence of harmonized international standards creates market fragmentation and increases compliance costs for manufacturers targeting global markets.

Knowledge gaps in lifecycle assessment methodologies also impede progress. Comprehensive data on environmental impacts across the entire value chain—from feedstock cultivation to end-of-life disposal—remains incomplete for many biomass-derived solvents, making it difficult to substantiate sustainability claims and secure market differentiation based on environmental performance.

A primary barrier is the lack of standardized quality specifications and performance criteria. Unlike conventional solvents with well-established industry standards, biomass-derived alternatives operate in a regulatory vacuum. This absence of universally accepted standards creates uncertainty regarding solvent purity, stability, and performance consistency across different applications, deterring potential industrial users concerned about quality assurance.

Technical limitations present another significant obstacle. Many biomass-derived solvents exhibit variable composition depending on feedstock source and processing conditions, leading to inconsistent performance. Issues such as thermal stability, moisture sensitivity, and compatibility with existing industrial equipment remain unresolved for several promising bio-solvents, limiting their application scope.

Economic viability represents perhaps the most formidable barrier. Current production processes for biomass-derived solvents typically involve complex multi-step conversions with relatively low yields, resulting in higher production costs compared to petroleum-based alternatives. The price premium, often 1.5-3 times higher than conventional solvents, makes widespread adoption economically challenging without regulatory incentives or carbon pricing mechanisms.

Supply chain constraints further complicate the landscape. The biomass feedstock supply is subject to seasonal variations, geographical limitations, and competition with food production. Additionally, the distributed nature of biomass resources often necessitates decentralized processing facilities, creating logistical challenges for consistent industrial-scale production.

Regulatory frameworks present a mixed picture globally. While some regions have implemented favorable policies promoting bio-based chemicals, others lack clear regulatory pathways for approval and commercialization of novel solvents. The absence of harmonized international standards creates market fragmentation and increases compliance costs for manufacturers targeting global markets.

Knowledge gaps in lifecycle assessment methodologies also impede progress. Comprehensive data on environmental impacts across the entire value chain—from feedstock cultivation to end-of-life disposal—remains incomplete for many biomass-derived solvents, making it difficult to substantiate sustainability claims and secure market differentiation based on environmental performance.

Current Certification Frameworks for Bio-Solvents

01 Production of bio-based solvents from lignocellulosic biomass

Lignocellulosic biomass can be processed to produce environmentally friendly solvents through various conversion methods. These processes typically involve the breakdown of cellulose, hemicellulose, and lignin components to create sustainable solvent alternatives. The resulting bio-based solvents offer reduced environmental impact compared to petroleum-derived counterparts while maintaining similar performance characteristics for industrial applications.- Production of bio-based solvents from lignocellulosic biomass: Lignocellulosic biomass can be processed to produce environmentally friendly solvents through various conversion methods. These processes typically involve the breakdown of cellulose, hemicellulose, and lignin components through hydrolysis, fermentation, or thermochemical treatments. The resulting bio-based solvents offer renewable alternatives to petroleum-derived products with comparable performance characteristics while reducing environmental impact and carbon footprint.

- Biomass-derived solvent systems for industrial applications: Specialized solvent systems derived from biomass sources have been developed for various industrial applications including pulp processing, adhesive formulations, coatings, and cleaning products. These solvent systems often combine multiple bio-based components to achieve specific performance characteristics such as improved dissolution properties, reduced toxicity, and enhanced biodegradability compared to conventional petroleum-based solvents, making them suitable for environmentally conscious industrial processes.

- Fermentation processes for producing bio-solvents: Microbial fermentation represents a significant pathway for converting biomass into valuable solvents. Various microorganisms can transform biomass-derived sugars into solvents such as ethanol, butanol, acetone, and other organic compounds. These fermentation processes can be optimized through strain selection, genetic engineering, and process improvements to enhance yield, selectivity, and efficiency, creating economically viable routes to renewable solvents from agricultural and forestry residues.

- Green chemistry approaches for biomass solvent extraction: Innovative green chemistry approaches have been developed for extracting and processing biomass-derived solvents with minimal environmental impact. These methods include supercritical fluid extraction, microwave-assisted processing, and ionic liquid treatments that can efficiently separate valuable components from biomass while reducing energy consumption and waste generation. Such approaches align with sustainable development principles by minimizing hazardous substances and maximizing resource efficiency in solvent production.

- Novel biomass-derived solvents for specialized applications: Research has yielded novel biomass-derived solvents with unique properties suitable for specialized applications such as pharmaceutical processing, electronics manufacturing, and advanced materials production. These include cyclic carbonates, furan derivatives, and functionalized esters that offer advantages such as high solvating power, low toxicity, and tunable properties. The development of these specialized bio-solvents enables the replacement of problematic conventional solvents in sensitive applications while maintaining or improving performance.

02 Fermentation processes for biomass-derived solvent production

Microbial fermentation represents a key pathway for converting biomass into valuable solvents. These bioprocesses utilize specialized microorganisms to transform biomass sugars into solvents such as ethanol, butanol, and acetone. Advanced fermentation techniques have been developed to improve yields, reduce byproducts, and enhance the economic viability of biomass-derived solvent production through optimized biocatalytic pathways.Expand Specific Solutions03 Green chemistry applications of biomass-derived solvents

Biomass-derived solvents serve as sustainable alternatives in green chemistry applications across multiple industries. These bio-based solvents can replace conventional petroleum-derived solvents in processes such as extraction, cleaning, coating, and chemical synthesis. Their biodegradability, low toxicity, and renewable nature make them particularly valuable for environmentally conscious manufacturing processes and consumer products.Expand Specific Solutions04 Novel biomass-derived solvent formulations and compositions

Innovative formulations combining biomass-derived solvents with other components have been developed to enhance performance characteristics. These specialized compositions may include co-solvents, additives, or modified biomass derivatives designed to optimize properties such as solvency power, volatility, stability, and compatibility with specific applications. Such formulations enable biomass-derived solvents to effectively compete with or outperform conventional petroleum-based alternatives.Expand Specific Solutions05 Catalytic conversion technologies for biomass-to-solvent processes

Advanced catalytic systems play a crucial role in efficiently converting biomass feedstocks into high-quality solvents. These technologies employ specialized catalysts to facilitate selective chemical transformations under optimized reaction conditions. Catalytic approaches can improve yields, reduce energy requirements, and enable the production of specific solvent molecules from diverse biomass sources, contributing to more economical and sustainable manufacturing processes.Expand Specific Solutions

Industry Leaders in Biomass Solvent Production

The biomass-derived solvents market is in a growth phase, with increasing demand driven by sustainability initiatives and regulatory pressures to reduce dependence on petroleum-based chemicals. The global market is projected to reach significant scale as industries seek greener alternatives. Technologically, the field shows varying maturity levels across different applications. Leading players like DuPont, Virent, and Renmatix have established commercial-scale production capabilities, while companies such as GTI Energy and Battelle Memorial Institute contribute significant R&D advancements. Chevron and POET Research represent traditional energy companies pivoting toward bio-based solutions. The competitive landscape features a mix of specialized biotech firms (Xyleco, SweetWater Energy), chemical giants (Teijin, Sandoz), and research institutions (Council of Scientific & Industrial Research), indicating a diversifying ecosystem with increasing cross-sector collaboration.

Virent, Inc.

Technical Solution: Virent has developed BioForming® technology that converts plant-based sugars into a range of drop-in hydrocarbon products including bio-based solvents. Their patented catalytic process transforms biomass-derived oxygenates to produce solvents that are chemically identical to petroleum-based counterparts. The company has established comprehensive standards for their BioForm® solvents, including purity specifications (>99.5%), water content limits (<0.1%), and specific gravity parameters. Virent's approach includes rigorous quality control protocols with batch testing for contaminants and performance characteristics. Their solvents meet ASTM International standards for renewable chemicals and have received certification under various eco-labeling programs including USDA BioPreferred® designation[1][3]. The company has also developed lifecycle assessment methodologies to quantify the environmental benefits of their bio-solvents compared to conventional alternatives.

Strengths: Produces drop-in replacements chemically identical to petroleum-based solvents, eliminating compatibility issues. Their products have established third-party certifications and meet existing industry standards. Weaknesses: The catalytic process requires significant energy input and specialized equipment, potentially limiting scalability and increasing production costs compared to conventional solvent manufacturing.

Renmatix, Inc.

Technical Solution: Renmatix has pioneered the Plantrose® Process, a water-based technology that uses supercritical hydrolysis to convert biomass into cellulosic sugars and lignin, which serve as building blocks for bio-based solvents. Their proprietary process operates at high temperatures (>374°C) and pressures (>221 bar) where water acts as both solvent and catalyst, breaking down biomass without requiring acids, enzymes, or other chemicals. For biomass-derived solvents, Renmatix has developed the Celltice™ platform that produces bio-derived alternatives to petroleum-based solvents. The company has established internal quality standards for their bio-solvents including specifications for purity (>98%), pH range (5.5-7.0), and maximum allowable contaminant levels. Their products comply with REACH regulations and have received USDA Certified Biobased Product labeling[2]. Renmatix has also collaborated with industry partners to develop application-specific standards for their bio-solvents in cosmetics, personal care, and industrial applications.

Strengths: Their water-based process eliminates the need for harsh chemicals and produces minimal waste streams, offering environmental advantages. The technology can process multiple biomass feedstocks, providing flexibility in raw material sourcing. Weaknesses: The high-pressure, high-temperature process requires significant energy input and specialized equipment, potentially limiting widespread adoption. The technology is relatively new to commercial scale, which may present challenges in consistent quality control across large production volumes.

Key Patents and Research in Biomass Solvent Technology

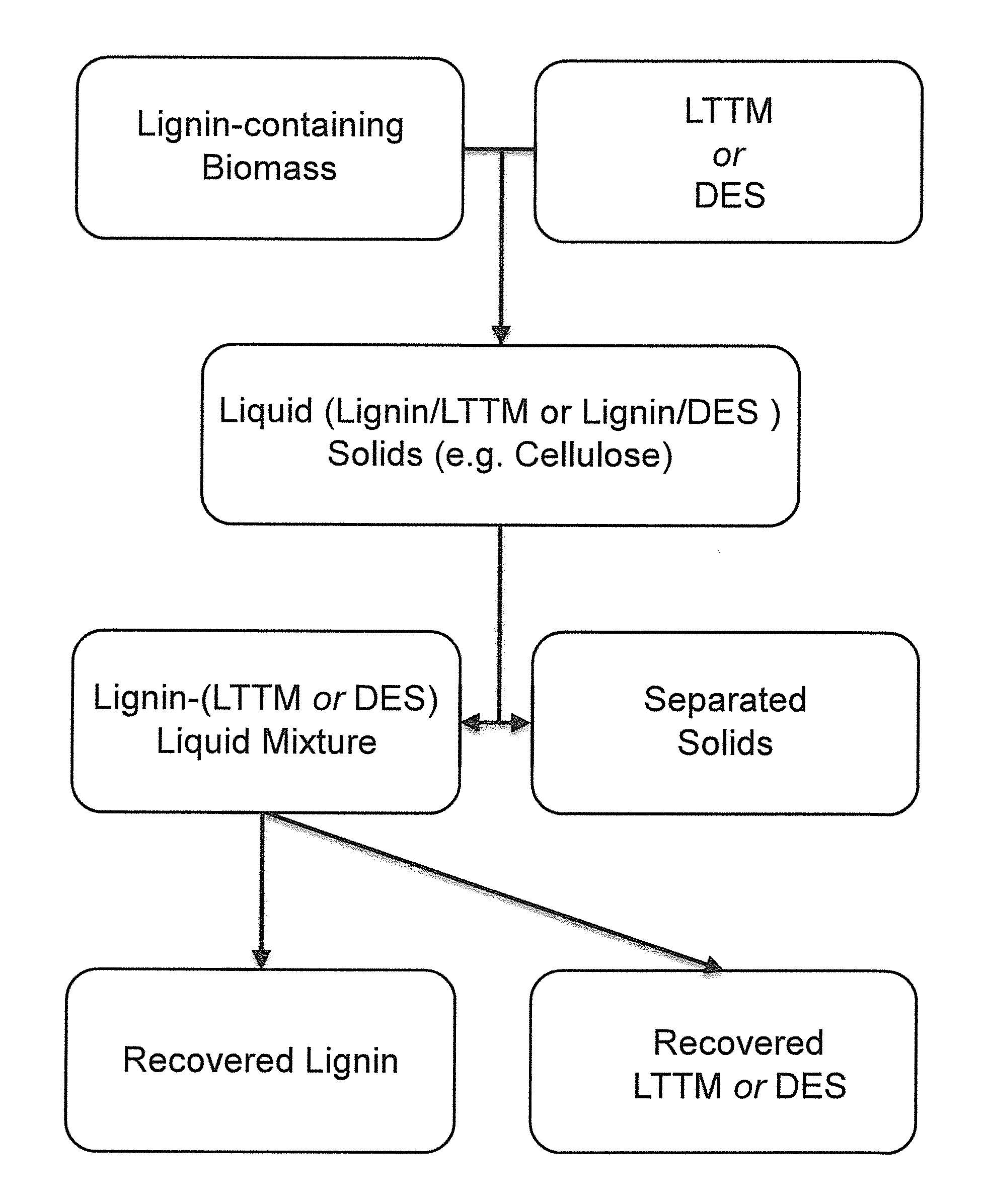

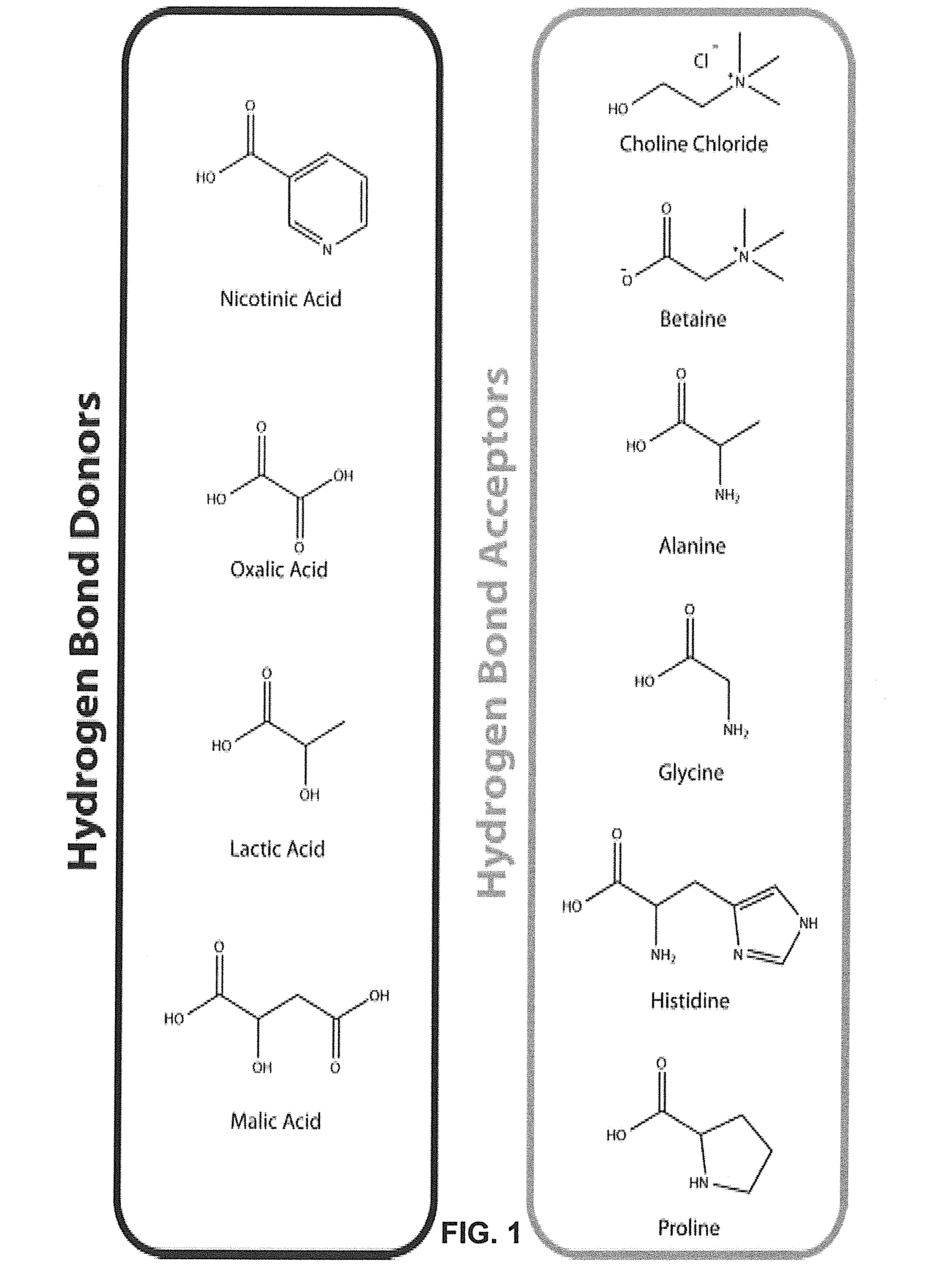

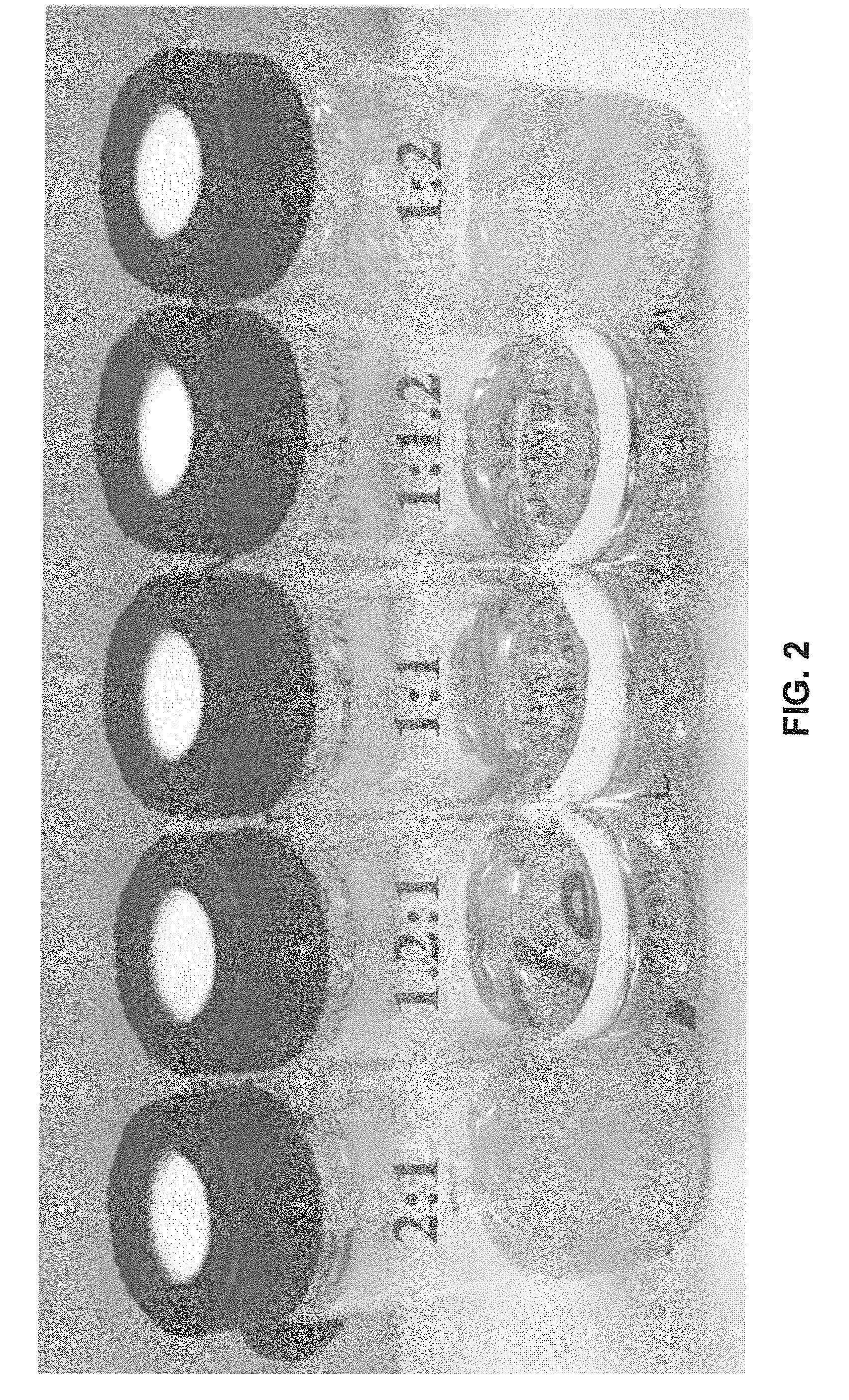

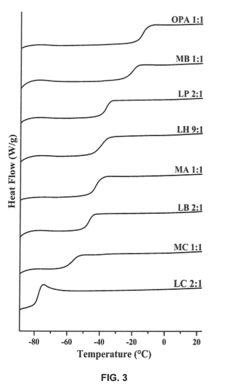

Pretreatment of Lignocellulosic Biomass and Recovery of Substituents using Natural Deep Eutectic Solvents/Compound Mixtures with Low Transition Temperatures

PatentInactiveUS20150094459A1

Innovation

- Development of low transition temperature mixtures (LTTMs) composed of renewable components, which selectively dissolve lignin from lignin-containing biomass at mild conditions, allowing for energy-efficient separation of lignin from cellulose without degradation, and enable recovery of high-quality lignin and cellulose.

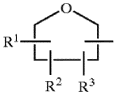

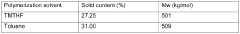

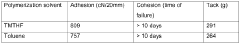

A process for the polymerization of vinyl monomers, a process for preparing an adhesive composition, an adhesive composition and a pressure-sensitive adhesive sheet

PatentWO2018033634A1

Innovation

- The use of at least 99.95 wt% pure 2,2,5,5-tetramethyltetrahydrofuran (TMTHF) as a solvent for polymerizing vinyl monomers, which is biomass-based and has a low olefinic content, allowing for radical polymerization to achieve the desired molecular weight and forming a suitable adhesive composition.

Regulatory Compliance for Bio-Based Chemical Products

The regulatory landscape for bio-based chemical products, particularly biomass-derived solvents, is complex and evolving rapidly as governments worldwide implement policies to promote sustainable alternatives to petroleum-based chemicals. Compliance with these regulations requires manufacturers to navigate multiple frameworks across different jurisdictions, each with specific requirements for registration, safety assessment, and environmental impact evaluation.

In the United States, the Environmental Protection Agency (EPA) regulates bio-based solvents primarily through the Toxic Substances Control Act (TSCA), which requires manufacturers to submit premanufacture notices for new chemical substances. Additionally, the USDA BioPreferred Program establishes minimum bio-based content standards for various product categories, including solvents, and provides certification for qualifying products.

The European Union has implemented the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation, which applies equally to bio-based and conventional chemicals. Manufacturers must register substances produced or imported in quantities over one ton per year and provide comprehensive safety data. The EU has also established the EN 16785 standard specifically for bio-based products, which verifies bio-based content claims.

Certification schemes play a crucial role in market acceptance of biomass-derived solvents. Third-party certifications such as ISCC PLUS (International Sustainability & Carbon Certification) and RSB (Roundtable on Sustainable Biomaterials) verify sustainability claims throughout the supply chain. These certifications assess factors including greenhouse gas emissions reduction, sustainable sourcing practices, and social responsibility.

Life Cycle Assessment (LCA) requirements are increasingly becoming mandatory in regulatory frameworks. Manufacturers must demonstrate that their bio-based solvents offer genuine environmental benefits compared to conventional alternatives across their entire life cycle, from raw material extraction to end-of-life disposal. ISO 14040 and 14044 standards provide the methodology for conducting these assessments.

Labeling regulations present another compliance challenge. The EU Ecolabel, Nordic Swan, and Blue Angel are examples of eco-labeling schemes with specific criteria for solvents. These labels require verification of environmental performance claims and may restrict certain hazardous substances, regardless of whether they are bio-based or petroleum-derived.

Emerging regulations are focusing on sustainable feedstock sourcing. The Renewable Energy Directive II (RED II) in Europe establishes sustainability criteria for biomass used in various applications, including chemical production. Companies must demonstrate that their biomass feedstocks do not contribute to deforestation or land-use change and meet minimum greenhouse gas savings thresholds.

In the United States, the Environmental Protection Agency (EPA) regulates bio-based solvents primarily through the Toxic Substances Control Act (TSCA), which requires manufacturers to submit premanufacture notices for new chemical substances. Additionally, the USDA BioPreferred Program establishes minimum bio-based content standards for various product categories, including solvents, and provides certification for qualifying products.

The European Union has implemented the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation, which applies equally to bio-based and conventional chemicals. Manufacturers must register substances produced or imported in quantities over one ton per year and provide comprehensive safety data. The EU has also established the EN 16785 standard specifically for bio-based products, which verifies bio-based content claims.

Certification schemes play a crucial role in market acceptance of biomass-derived solvents. Third-party certifications such as ISCC PLUS (International Sustainability & Carbon Certification) and RSB (Roundtable on Sustainable Biomaterials) verify sustainability claims throughout the supply chain. These certifications assess factors including greenhouse gas emissions reduction, sustainable sourcing practices, and social responsibility.

Life Cycle Assessment (LCA) requirements are increasingly becoming mandatory in regulatory frameworks. Manufacturers must demonstrate that their bio-based solvents offer genuine environmental benefits compared to conventional alternatives across their entire life cycle, from raw material extraction to end-of-life disposal. ISO 14040 and 14044 standards provide the methodology for conducting these assessments.

Labeling regulations present another compliance challenge. The EU Ecolabel, Nordic Swan, and Blue Angel are examples of eco-labeling schemes with specific criteria for solvents. These labels require verification of environmental performance claims and may restrict certain hazardous substances, regardless of whether they are bio-based or petroleum-derived.

Emerging regulations are focusing on sustainable feedstock sourcing. The Renewable Energy Directive II (RED II) in Europe establishes sustainability criteria for biomass used in various applications, including chemical production. Companies must demonstrate that their biomass feedstocks do not contribute to deforestation or land-use change and meet minimum greenhouse gas savings thresholds.

Life Cycle Assessment of Biomass-Derived Solvents

Life Cycle Assessment (LCA) of biomass-derived solvents provides a comprehensive evaluation framework for understanding the environmental impacts associated with these alternative chemicals throughout their entire life cycle. This assessment methodology examines impacts from raw material extraction through production, use, and final disposal or recycling, offering crucial insights for sustainable development decisions.

The LCA process for biomass-derived solvents typically follows four main phases: goal and scope definition, inventory analysis, impact assessment, and interpretation. Each phase contributes essential data points that help quantify environmental benefits compared to conventional petroleum-based solvents. The assessment boundaries must clearly define whether the analysis follows a cradle-to-gate, cradle-to-grave, or cradle-to-cradle approach.

Key environmental impact categories evaluated in biomass solvent LCAs include global warming potential, acidification potential, eutrophication potential, ozone depletion potential, and resource depletion. These metrics provide a multi-dimensional view of environmental performance rather than focusing solely on carbon footprint. Recent studies have demonstrated that many biomass-derived solvents show significant reductions in greenhouse gas emissions compared to their petroleum-based counterparts.

Methodological challenges in conducting LCAs for biomass solvents include allocation procedures for co-products, accounting for land-use changes, and addressing temporal aspects of carbon sequestration. The choice of functional unit significantly influences results, with options including volume-based, mass-based, or functionality-based units depending on the specific application context.

Data quality represents another critical consideration, as agricultural practices, regional electricity grids, and processing technologies can dramatically alter the environmental profile of biomass-derived solvents. Sensitivity analyses are therefore essential to identify which parameters most significantly influence overall environmental performance.

Standardization efforts for biomass solvent LCAs have been advancing through organizations like ISO (International Organization for Standardization) and ASTM International. These standards help ensure consistency and comparability across different studies and products. The development of Product Category Rules (PCRs) specifically for bio-based chemicals has further enhanced the reliability of environmental product declarations.

Recent technological innovations in biomass processing have improved the life cycle performance of these solvents, particularly through more efficient extraction methods, reduced energy requirements, and closed-loop production systems. These advancements have narrowed the economic gap between conventional and biomass-derived solvents while simultaneously enhancing their environmental credentials.

The LCA process for biomass-derived solvents typically follows four main phases: goal and scope definition, inventory analysis, impact assessment, and interpretation. Each phase contributes essential data points that help quantify environmental benefits compared to conventional petroleum-based solvents. The assessment boundaries must clearly define whether the analysis follows a cradle-to-gate, cradle-to-grave, or cradle-to-cradle approach.

Key environmental impact categories evaluated in biomass solvent LCAs include global warming potential, acidification potential, eutrophication potential, ozone depletion potential, and resource depletion. These metrics provide a multi-dimensional view of environmental performance rather than focusing solely on carbon footprint. Recent studies have demonstrated that many biomass-derived solvents show significant reductions in greenhouse gas emissions compared to their petroleum-based counterparts.

Methodological challenges in conducting LCAs for biomass solvents include allocation procedures for co-products, accounting for land-use changes, and addressing temporal aspects of carbon sequestration. The choice of functional unit significantly influences results, with options including volume-based, mass-based, or functionality-based units depending on the specific application context.

Data quality represents another critical consideration, as agricultural practices, regional electricity grids, and processing technologies can dramatically alter the environmental profile of biomass-derived solvents. Sensitivity analyses are therefore essential to identify which parameters most significantly influence overall environmental performance.

Standardization efforts for biomass solvent LCAs have been advancing through organizations like ISO (International Organization for Standardization) and ASTM International. These standards help ensure consistency and comparability across different studies and products. The development of Product Category Rules (PCRs) specifically for bio-based chemicals has further enhanced the reliability of environmental product declarations.

Recent technological innovations in biomass processing have improved the life cycle performance of these solvents, particularly through more efficient extraction methods, reduced energy requirements, and closed-loop production systems. These advancements have narrowed the economic gap between conventional and biomass-derived solvents while simultaneously enhancing their environmental credentials.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!