What Are the Environmental Impacts of Biomass-Derived Solvent Usage

OCT 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biomass Solvents Background and Objectives

Biomass-derived solvents have emerged as a promising alternative to conventional petroleum-based solvents, driven by increasing environmental concerns and the global push towards sustainable chemistry. The evolution of these bio-solvents traces back to the early 20th century, but significant research acceleration has occurred only in the past two decades, coinciding with heightened awareness of environmental degradation and resource depletion. This technological domain represents a critical intersection of green chemistry principles, circular economy concepts, and industrial sustainability goals.

The development trajectory of biomass-derived solvents has been characterized by three distinct phases: initial discovery and characterization, process optimization, and most recently, commercial-scale implementation. Early research focused primarily on identifying potential biomass feedstocks and basic extraction methodologies, while contemporary efforts have shifted toward enhancing efficiency, reducing production costs, and expanding application versatility across multiple industries.

Current technological trends indicate a growing emphasis on developing solvents from non-food biomass sources, including agricultural waste, forestry residues, and dedicated energy crops. This trend aligns with the broader objective of minimizing competition with food production while maximizing resource utilization efficiency. Additionally, there is increasing interest in designing bio-solvents with tailored properties for specific industrial applications, moving beyond simple drop-in replacements for conventional solvents.

The primary technical objectives in this field encompass several dimensions: first, to develop biomass-derived solvents with performance characteristics matching or exceeding those of petroleum-based counterparts; second, to establish economically viable and environmentally benign production processes; third, to quantify and minimize the full lifecycle environmental impacts of these alternative solvents; and fourth, to create standardized methodologies for environmental impact assessment specific to bio-solvents.

Significant research gaps persist regarding the comprehensive environmental footprint of biomass-derived solvents, particularly concerning land use changes, water consumption patterns, and biodiversity impacts associated with feedstock cultivation. Additionally, the energy intensity of conversion processes and potential emissions during solvent use and disposal require further investigation to ensure that the environmental benefits claimed for these products are scientifically substantiated.

The technological evolution in this domain is increasingly influenced by regulatory frameworks, including chemical registration requirements, volatile organic compound (VOC) emission standards, and emerging extended producer responsibility policies. These regulatory drivers, combined with corporate sustainability commitments, are accelerating innovation and adoption rates across the biomass-derived solvent landscape.

The development trajectory of biomass-derived solvents has been characterized by three distinct phases: initial discovery and characterization, process optimization, and most recently, commercial-scale implementation. Early research focused primarily on identifying potential biomass feedstocks and basic extraction methodologies, while contemporary efforts have shifted toward enhancing efficiency, reducing production costs, and expanding application versatility across multiple industries.

Current technological trends indicate a growing emphasis on developing solvents from non-food biomass sources, including agricultural waste, forestry residues, and dedicated energy crops. This trend aligns with the broader objective of minimizing competition with food production while maximizing resource utilization efficiency. Additionally, there is increasing interest in designing bio-solvents with tailored properties for specific industrial applications, moving beyond simple drop-in replacements for conventional solvents.

The primary technical objectives in this field encompass several dimensions: first, to develop biomass-derived solvents with performance characteristics matching or exceeding those of petroleum-based counterparts; second, to establish economically viable and environmentally benign production processes; third, to quantify and minimize the full lifecycle environmental impacts of these alternative solvents; and fourth, to create standardized methodologies for environmental impact assessment specific to bio-solvents.

Significant research gaps persist regarding the comprehensive environmental footprint of biomass-derived solvents, particularly concerning land use changes, water consumption patterns, and biodiversity impacts associated with feedstock cultivation. Additionally, the energy intensity of conversion processes and potential emissions during solvent use and disposal require further investigation to ensure that the environmental benefits claimed for these products are scientifically substantiated.

The technological evolution in this domain is increasingly influenced by regulatory frameworks, including chemical registration requirements, volatile organic compound (VOC) emission standards, and emerging extended producer responsibility policies. These regulatory drivers, combined with corporate sustainability commitments, are accelerating innovation and adoption rates across the biomass-derived solvent landscape.

Market Demand Analysis for Green Solvents

The global market for green solvents has experienced significant growth in recent years, driven by increasing environmental concerns and regulatory pressures. Biomass-derived solvents represent a crucial segment within this market, offering renewable alternatives to conventional petroleum-based solvents. Current market analysis indicates that the global green solvent market was valued at approximately $4.3 billion in 2022 and is projected to reach $6.8 billion by 2027, growing at a CAGR of 9.6%.

Industrial sectors including pharmaceuticals, cosmetics, paints and coatings, adhesives, and cleaning products are demonstrating heightened demand for biomass-derived solvents. This demand is primarily fueled by stringent environmental regulations limiting volatile organic compound (VOC) emissions and restricting the use of hazardous chemicals in consumer and industrial products. The European Union's REACH regulation and similar frameworks in North America and Asia have created substantial market pull for greener solvent alternatives.

Consumer preferences are also shifting dramatically toward environmentally friendly products, creating additional market pressure for manufacturers to adopt sustainable practices and materials. Market research indicates that 73% of global consumers are willing to pay premium prices for products with proven environmental benefits, directly influencing procurement decisions throughout supply chains.

Regional analysis reveals that Europe currently leads the green solvents market with approximately 38% market share, followed by North America (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years due to rapid industrialization coupled with increasingly stringent environmental regulations in countries like China, Japan, and South Korea.

Among biomass-derived solvents, bio-alcohols (particularly ethanol and butanol) currently dominate the market with a 42% share, followed by d-limonene (18%), methyl soyate (15%), and lactate esters (12%). Emerging categories include cyrene, 2-methyltetrahydrofuran, and various terpene-based solvents, which are gaining traction due to their favorable environmental profiles and performance characteristics.

Price sensitivity remains a significant market barrier, with biomass-derived solvents typically commanding a 15-30% premium over conventional alternatives. However, this gap is narrowing as production scales increase and processing technologies improve. Market forecasts suggest that price parity for several key biomass-derived solvents could be achieved within the next 5-7 years, potentially accelerating market adoption.

Industry partnerships between solvent manufacturers, biomass processors, and end-users are increasingly common, creating integrated value chains that optimize both economic and environmental performance. These collaborative approaches are expected to further drive market growth by addressing technical challenges and reducing implementation barriers across various applications.

Industrial sectors including pharmaceuticals, cosmetics, paints and coatings, adhesives, and cleaning products are demonstrating heightened demand for biomass-derived solvents. This demand is primarily fueled by stringent environmental regulations limiting volatile organic compound (VOC) emissions and restricting the use of hazardous chemicals in consumer and industrial products. The European Union's REACH regulation and similar frameworks in North America and Asia have created substantial market pull for greener solvent alternatives.

Consumer preferences are also shifting dramatically toward environmentally friendly products, creating additional market pressure for manufacturers to adopt sustainable practices and materials. Market research indicates that 73% of global consumers are willing to pay premium prices for products with proven environmental benefits, directly influencing procurement decisions throughout supply chains.

Regional analysis reveals that Europe currently leads the green solvents market with approximately 38% market share, followed by North America (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years due to rapid industrialization coupled with increasingly stringent environmental regulations in countries like China, Japan, and South Korea.

Among biomass-derived solvents, bio-alcohols (particularly ethanol and butanol) currently dominate the market with a 42% share, followed by d-limonene (18%), methyl soyate (15%), and lactate esters (12%). Emerging categories include cyrene, 2-methyltetrahydrofuran, and various terpene-based solvents, which are gaining traction due to their favorable environmental profiles and performance characteristics.

Price sensitivity remains a significant market barrier, with biomass-derived solvents typically commanding a 15-30% premium over conventional alternatives. However, this gap is narrowing as production scales increase and processing technologies improve. Market forecasts suggest that price parity for several key biomass-derived solvents could be achieved within the next 5-7 years, potentially accelerating market adoption.

Industry partnerships between solvent manufacturers, biomass processors, and end-users are increasingly common, creating integrated value chains that optimize both economic and environmental performance. These collaborative approaches are expected to further drive market growth by addressing technical challenges and reducing implementation barriers across various applications.

Current Status and Challenges in Biomass-Derived Solvents

Biomass-derived solvents have gained significant attention as sustainable alternatives to petroleum-based solvents in recent years. Currently, the global market for green solvents is estimated at approximately $4.3 billion and is projected to reach $6.5 billion by 2025, with biomass-derived solvents constituting a substantial portion of this growth. The primary biomass-derived solvents in commercial use include ethanol, methanol, glycerol, 2-methyltetrahydrofuran (2-MeTHF), γ-valerolactone (GVL), and various terpene-based solvents.

Despite promising developments, the widespread adoption of biomass-derived solvents faces several significant challenges. Production scalability remains a critical issue, with many bio-solvents still manufactured at relatively small scales compared to conventional petroleum-based alternatives. This results in higher production costs, typically 2-5 times more expensive than traditional solvents, creating a substantial market entry barrier.

Technical limitations also persist in the synthesis processes for many biomass-derived solvents. Current conversion technologies often require high energy inputs, complex catalytic systems, or multiple reaction steps, reducing overall process efficiency. For instance, the production of 2-MeTHF from lignocellulosic biomass involves multiple conversion steps with yields rarely exceeding 65-70% across the entire process chain.

Performance consistency presents another challenge. The properties of biomass-derived solvents can vary significantly depending on feedstock source and quality, making standardization difficult. This variability affects solvent performance in applications requiring precise specifications, particularly in pharmaceutical and electronics manufacturing.

Geographically, research and development in biomass-derived solvents show distinct patterns. North America and Europe lead in research publications and patent filings, with approximately 65% of all research outputs. However, Asia, particularly China and India, has shown the fastest growth rate in the past five years, increasing research output by over 200%.

Regulatory frameworks present both opportunities and challenges. While environmental regulations increasingly favor green solvents, the approval processes for new solvents in regulated industries like pharmaceuticals and food processing remain lengthy and complex. Complete toxicological and environmental impact assessments are required, which can take 3-5 years to complete.

Infrastructure limitations also hinder adoption, as existing industrial processes and equipment are optimized for conventional solvents. Retrofitting or redesigning these systems for biomass-derived alternatives requires significant capital investment and technical expertise, creating inertia against change in established manufacturing sectors.

Despite promising developments, the widespread adoption of biomass-derived solvents faces several significant challenges. Production scalability remains a critical issue, with many bio-solvents still manufactured at relatively small scales compared to conventional petroleum-based alternatives. This results in higher production costs, typically 2-5 times more expensive than traditional solvents, creating a substantial market entry barrier.

Technical limitations also persist in the synthesis processes for many biomass-derived solvents. Current conversion technologies often require high energy inputs, complex catalytic systems, or multiple reaction steps, reducing overall process efficiency. For instance, the production of 2-MeTHF from lignocellulosic biomass involves multiple conversion steps with yields rarely exceeding 65-70% across the entire process chain.

Performance consistency presents another challenge. The properties of biomass-derived solvents can vary significantly depending on feedstock source and quality, making standardization difficult. This variability affects solvent performance in applications requiring precise specifications, particularly in pharmaceutical and electronics manufacturing.

Geographically, research and development in biomass-derived solvents show distinct patterns. North America and Europe lead in research publications and patent filings, with approximately 65% of all research outputs. However, Asia, particularly China and India, has shown the fastest growth rate in the past five years, increasing research output by over 200%.

Regulatory frameworks present both opportunities and challenges. While environmental regulations increasingly favor green solvents, the approval processes for new solvents in regulated industries like pharmaceuticals and food processing remain lengthy and complex. Complete toxicological and environmental impact assessments are required, which can take 3-5 years to complete.

Infrastructure limitations also hinder adoption, as existing industrial processes and equipment are optimized for conventional solvents. Retrofitting or redesigning these systems for biomass-derived alternatives requires significant capital investment and technical expertise, creating inertia against change in established manufacturing sectors.

Current Technical Solutions for Biomass Solvent Production

01 Environmental benefits of biomass-derived solvents

Biomass-derived solvents offer significant environmental advantages over traditional petroleum-based solvents. These bio-based alternatives typically have lower carbon footprints, reduced toxicity, and improved biodegradability. They contribute to reduced greenhouse gas emissions throughout their lifecycle and help minimize environmental pollution. The renewable nature of biomass feedstocks makes these solvents more sustainable and aligned with circular economy principles.- Environmental benefits of biomass-derived solvents: Biomass-derived solvents offer significant environmental advantages compared to traditional petroleum-based solvents. These bio-based alternatives typically have lower carbon footprints, reduced toxicity, and improved biodegradability. They are produced from renewable resources such as agricultural waste, forestry residues, or dedicated energy crops, which helps reduce dependence on fossil fuels and decreases greenhouse gas emissions. The environmental impact assessment of these solvents shows favorable life cycle analysis results when properly implemented in industrial processes.

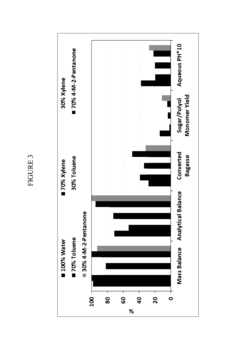

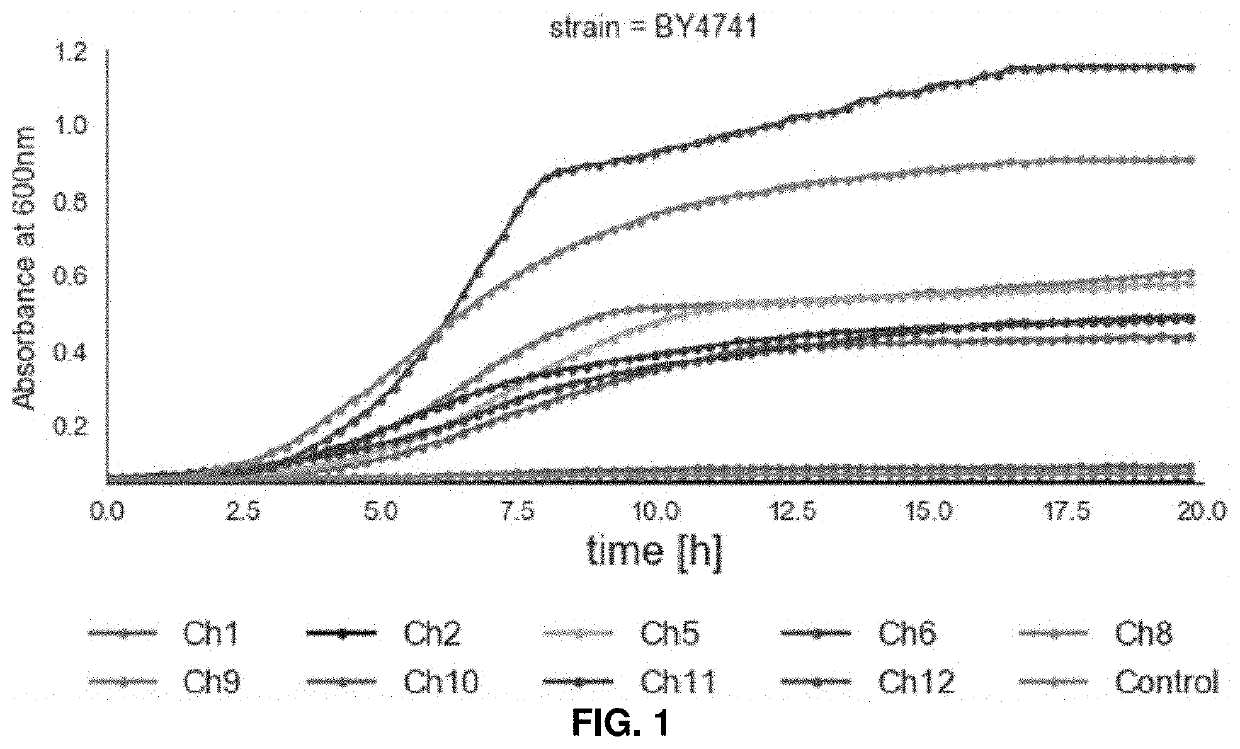

- Production methods and sustainability considerations: Various production methods for biomass-derived solvents focus on sustainability throughout the manufacturing process. These include enzymatic conversion, fermentation, thermochemical processes, and catalytic transformations of biomass feedstocks. The environmental impact of these production methods varies based on energy consumption, water usage, land use changes, and waste generation. Sustainable production practices aim to minimize resource consumption, utilize waste streams effectively, and optimize process efficiency to ensure that the environmental benefits of bio-based solvents are not offset by their production impacts.

- Comparative environmental impact analysis: Comparative studies between biomass-derived and conventional solvents reveal important differences in environmental impacts. These analyses typically consider factors such as ecotoxicity, human health effects, ozone depletion potential, and global warming potential. While biomass-derived solvents generally show reduced environmental impacts in many categories, certain production pathways may have trade-offs, such as increased land and water use. Life cycle assessments provide comprehensive evaluations of these solvents from raw material extraction through production, use, and disposal phases, helping to identify the most environmentally favorable options.

- Industrial applications and waste reduction: Biomass-derived solvents find applications across various industries including pharmaceuticals, cosmetics, cleaning products, paints, and coatings. Their implementation in industrial processes can lead to significant waste reduction and pollution prevention. These solvents often enable more efficient extraction processes, reduce processing steps, and minimize hazardous waste generation. Additionally, many biomass-derived solvents can be recovered and reused, further reducing their environmental footprint. The transition to these greener alternatives supports circular economy principles and helps industries meet increasingly stringent environmental regulations.

- Economic and policy considerations for environmental impact: The economic viability and policy frameworks surrounding biomass-derived solvents significantly influence their environmental impact. Cost considerations, market incentives, and regulatory requirements all affect adoption rates and implementation practices. Environmental policies promoting renewable resources, carbon pricing mechanisms, and chemical regulations can drive the development and use of more sustainable solvents. Economic analyses that incorporate externalities such as environmental damage costs provide a more complete picture of the true cost comparison between bio-based and conventional solvents, often revealing long-term economic advantages for biomass-derived alternatives despite potentially higher initial production costs.

02 Production methods and feedstock considerations

Various production methods are employed to convert biomass into solvents, including fermentation, chemical conversion, and thermochemical processes. The environmental impact varies significantly based on the feedstock selection (agricultural residues, forestry waste, dedicated energy crops) and processing technology. Sustainable sourcing of biomass feedstocks is crucial to prevent land-use conflicts, biodiversity loss, and ensure the overall environmental benefit of the derived solvents.Expand Specific Solutions03 Life cycle assessment of biomass-derived solvents

Life cycle assessments (LCA) of biomass-derived solvents evaluate their environmental impacts from raw material extraction through production, use, and disposal. These assessments consider multiple environmental indicators including global warming potential, eutrophication, acidification, and resource depletion. LCA studies generally show that biomass-derived solvents have lower environmental impacts compared to conventional solvents, though results vary depending on production pathways and system boundaries.Expand Specific Solutions04 Industrial applications and performance characteristics

Biomass-derived solvents find applications across various industries including pharmaceuticals, cosmetics, cleaning products, and industrial processes. Their performance characteristics, such as solvation power, volatility, and stability, determine their suitability for specific applications and their potential to replace conventional solvents. The environmental impact is influenced by how these solvents perform in real-world applications, including their efficiency, required quantities, and potential for recovery and reuse.Expand Specific Solutions05 Regulatory frameworks and sustainability certification

Regulatory frameworks and sustainability certification schemes play a crucial role in ensuring the environmental benefits of biomass-derived solvents. These include standards for sustainable biomass sourcing, production process efficiency, and end-of-life management. Certification systems help verify environmental claims and provide transparency throughout the supply chain. Evolving regulations around volatile organic compounds (VOCs), toxicity, and carbon footprints continue to drive the development and adoption of more environmentally friendly biomass-derived solvents.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The environmental impacts of biomass-derived solvent usage market is currently in a growth phase, with increasing adoption driven by sustainability concerns. The global market is expanding rapidly, estimated to reach several billion dollars by 2025 as industries seek alternatives to petroleum-based solvents. Technologically, the field shows varying maturity levels across different applications. Leading companies like BASF Corp. and Air Liquide SA have established commercial-scale production, while research institutions such as Texas A&M University and École Polytechnique Fédérale de Lausanne are advancing fundamental innovations. Specialized firms including Virent, Inc., Teysha Technologies, and Advanced BioCatalytics are developing novel bio-solvent technologies with reduced environmental footprints. Government entities and regulatory bodies are increasingly supporting this transition through policy frameworks and research funding.

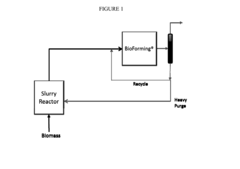

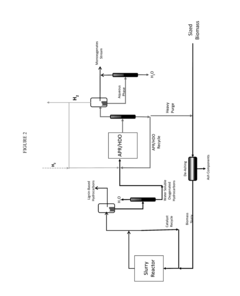

UOP LLC

Technical Solution: UOP LLC, a Honeywell company, has developed innovative biomass-derived solvent technologies focusing on green chemistry principles. Their BioForming® process converts plant sugars into hydrocarbon molecules that can replace petroleum-based solvents. This technology utilizes catalytic processes to transform biomass feedstocks into high-performance solvents with reduced environmental footprints. UOP's approach includes life cycle assessment methodologies to quantify environmental benefits, showing up to 65% reduction in greenhouse gas emissions compared to conventional petroleum-derived solvents[1]. Their integrated biorefinery concept enables the production of multiple value-added products from a single biomass source, maximizing resource efficiency while minimizing waste generation. UOP has also developed specialized catalysts that operate at lower temperatures, reducing energy requirements and associated environmental impacts during solvent production processes.

Strengths: Established infrastructure and expertise in refining processes allows for efficient scaling of biomass solvent technologies. Their integrated biorefinery approach maximizes resource utilization. Weaknesses: Higher initial capital costs compared to conventional solvent production methods, and potential feedstock supply chain challenges that could impact consistent production.

Virent, Inc.

Technical Solution: Virent has pioneered the BioForming® platform technology that converts plant-based sugars into a range of hydrocarbon products identical to those made from petroleum, including solvents. Their patented catalytic process transforms biomass-derived feedstocks into drop-in replacement solvents with significantly reduced environmental impacts. Life cycle analyses of Virent's bio-solvents demonstrate up to 70% reduction in greenhouse gas emissions compared to conventional alternatives[2]. The company's aqueous phase reforming technology operates at moderate temperatures and pressures, reducing energy consumption during production. Virent's bio-solvents maintain performance characteristics identical to petroleum-derived counterparts while offering improved biodegradability and reduced toxicity profiles. Their process can utilize a variety of feedstocks including agricultural residues and dedicated energy crops, providing flexibility and reducing competition with food resources.

Strengths: Production of true "drop-in" replacement solvents that require no infrastructure changes for end-users, and flexibility in feedstock selection reduces supply risks and environmental impacts. Weaknesses: Process complexity requires specialized equipment and expertise, and feedstock pretreatment steps can add to production costs and environmental footprint if not optimized.

Critical Patents and Innovations in Bio-Solvent Technology

Solvolysis of biomass using solvent from a bioreforming process

PatentActiveUS20170058370A1

Innovation

- A method involving catalytically reacting water and a water-soluble oxygenated hydrocarbon with hydrogen in the presence of a deoxygenation catalyst to produce a biomass processing solvent, which is then used to deconstruct biomass at specific temperatures and pressures to produce a biomass hydrolysate containing soluble derivatives and carbohydrates.

Use of renewable deep eutectic solvents in a one-pot process for a biomass

PatentInactiveUS20200216863A1

Innovation

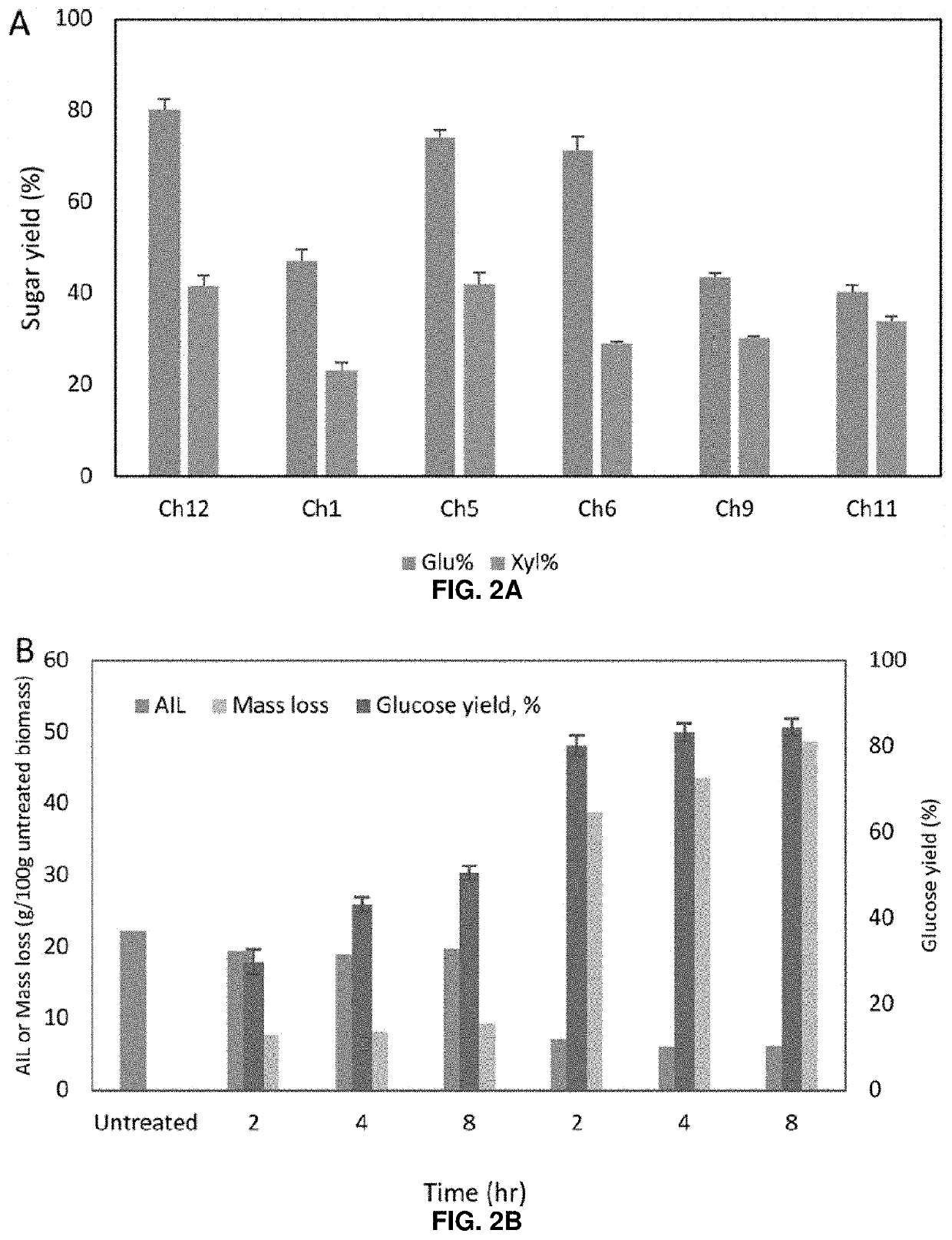

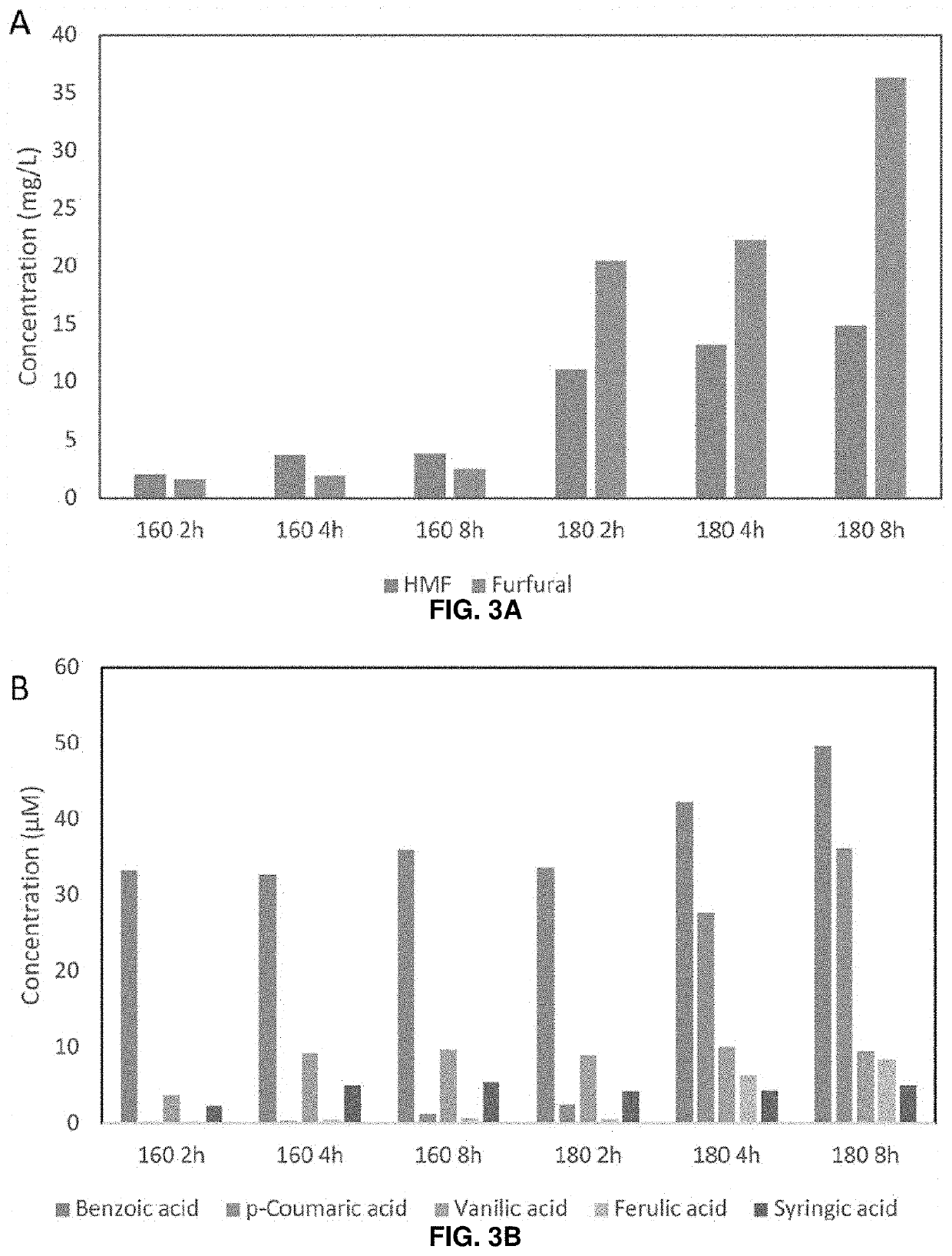

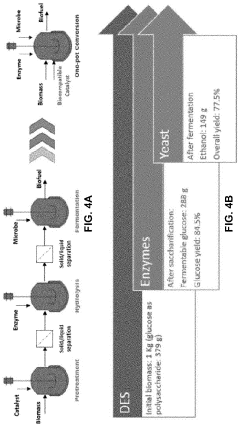

- The use of biocompatible deep eutectic solvents (DESs), specifically choline chloride and glycerol mixtures, for a one-pot biomass pretreatment, saccharification, and fermentation process that eliminates the need for pH adjustments, water dilution, and solid-liquid separations, allowing for continuous operation and compatibility with enzymes and microbes.

Life Cycle Assessment of Biomass-Derived Solvents

Life Cycle Assessment (LCA) provides a comprehensive framework for evaluating the environmental impacts of biomass-derived solvents throughout their entire lifecycle. This methodology examines impacts from raw material extraction through production, use, and final disposal or recycling. For biomass-derived solvents, LCA typically begins with biomass cultivation, considering factors such as land use change, agricultural inputs, water consumption, and biodiversity impacts.

The production phase analysis includes biomass harvesting, transportation, pretreatment, and conversion processes. Energy requirements, chemical inputs, water usage, and waste generation during solvent manufacturing represent critical assessment points. Studies indicate that production processes for bio-solvents like ethyl lactate and 2-methyltetrahydrofuran often demonstrate lower greenhouse gas emissions compared to petroleum-based alternatives, though results vary significantly based on feedstock selection and processing technologies.

Use phase assessment examines solvent performance characteristics, including volatility, toxicity, and efficiency in intended applications. Many biomass-derived solvents demonstrate reduced human and environmental toxicity during application, contributing to their favorable environmental profile. However, some bio-solvents may require higher application volumes to achieve equivalent performance, potentially offsetting certain environmental benefits.

End-of-life considerations include biodegradability, potential for recovery and recycling, and ultimate environmental fate. Most biomass-derived solvents exhibit enhanced biodegradability compared to conventional alternatives, reducing persistent environmental contamination risks. However, proper waste management infrastructure remains essential to realize these benefits.

Comparative LCA studies between biomass-derived and conventional solvents reveal complex tradeoff patterns. While bio-solvents typically demonstrate advantages in global warming potential, fossil resource depletion, and toxicity categories, they may show increased impacts in land use, eutrophication, and water consumption categories. These tradeoffs necessitate careful consideration of application-specific priorities and regional environmental sensitivities.

Methodological challenges in bio-solvent LCA include allocation procedures for multi-output systems, accounting for temporal carbon dynamics, and addressing data gaps in emerging production pathways. Standardization efforts are ongoing to improve consistency and comparability across studies, with organizations like the International Organization for Standardization (ISO) providing frameworks for biobased product assessment.

The production phase analysis includes biomass harvesting, transportation, pretreatment, and conversion processes. Energy requirements, chemical inputs, water usage, and waste generation during solvent manufacturing represent critical assessment points. Studies indicate that production processes for bio-solvents like ethyl lactate and 2-methyltetrahydrofuran often demonstrate lower greenhouse gas emissions compared to petroleum-based alternatives, though results vary significantly based on feedstock selection and processing technologies.

Use phase assessment examines solvent performance characteristics, including volatility, toxicity, and efficiency in intended applications. Many biomass-derived solvents demonstrate reduced human and environmental toxicity during application, contributing to their favorable environmental profile. However, some bio-solvents may require higher application volumes to achieve equivalent performance, potentially offsetting certain environmental benefits.

End-of-life considerations include biodegradability, potential for recovery and recycling, and ultimate environmental fate. Most biomass-derived solvents exhibit enhanced biodegradability compared to conventional alternatives, reducing persistent environmental contamination risks. However, proper waste management infrastructure remains essential to realize these benefits.

Comparative LCA studies between biomass-derived and conventional solvents reveal complex tradeoff patterns. While bio-solvents typically demonstrate advantages in global warming potential, fossil resource depletion, and toxicity categories, they may show increased impacts in land use, eutrophication, and water consumption categories. These tradeoffs necessitate careful consideration of application-specific priorities and regional environmental sensitivities.

Methodological challenges in bio-solvent LCA include allocation procedures for multi-output systems, accounting for temporal carbon dynamics, and addressing data gaps in emerging production pathways. Standardization efforts are ongoing to improve consistency and comparability across studies, with organizations like the International Organization for Standardization (ISO) providing frameworks for biobased product assessment.

Regulatory Framework and Compliance Standards

The regulatory landscape governing biomass-derived solvents is complex and evolving rapidly as governments worldwide implement stricter environmental protection measures. At the international level, the Paris Agreement and United Nations Sustainable Development Goals provide overarching frameworks that indirectly influence solvent regulations through carbon reduction targets and sustainable production initiatives. These global commitments have catalyzed the development of more specific regulatory mechanisms at regional and national levels.

In the European Union, the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation serves as the cornerstone for chemical management, requiring comprehensive safety assessments for biomass-derived solvents before market entry. Complementing REACH, the EU's Renewable Energy Directive II (RED II) establishes sustainability criteria for bio-based products, including solvents, mandating life cycle assessments to verify genuine environmental benefits compared to petroleum-based alternatives.

The United States regulatory approach differs significantly, with the Toxic Substances Control Act (TSCA) and the Environmental Protection Agency's Significant New Use Rules (SNURs) governing novel biomass-derived solvents. Additionally, California's Safer Consumer Products regulations have emerged as influential state-level standards that often drive national compliance practices for environmentally preferable solvents.

Voluntary certification systems have gained prominence as market differentiators and compliance tools. The USDA BioPreferred program and EU Ecolabel provide certification frameworks specifically addressing bio-based content and environmental performance. These schemes establish standardized testing methodologies for verifying renewable carbon content, biodegradability, and reduced environmental footprint of biomass-derived solvents.

Industry-specific compliance standards further complicate the regulatory landscape. Pharmaceutical manufacturing follows Good Manufacturing Practices (GMP) guidelines, which increasingly incorporate green chemistry principles when evaluating solvent selection. Similarly, the food and cosmetics industries must adhere to strict purity and safety standards for bio-based solvents used in their products, as outlined in FDA regulations and the EU Cosmetic Products Regulation.

Emerging regulatory trends indicate a shift toward harmonized international standards for biomass-derived solvents. The International Organization for Standardization (ISO) has developed several standards specifically addressing bio-based products, including ISO 16620 for bio-based carbon content determination. These standards facilitate global trade while ensuring consistent environmental performance metrics across jurisdictions.

Companies utilizing biomass-derived solvents must navigate this complex regulatory environment through comprehensive compliance strategies. This typically involves maintaining detailed documentation of solvent origins, production methods, and environmental impact assessments to satisfy increasingly stringent reporting requirements across multiple jurisdictions.

In the European Union, the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation serves as the cornerstone for chemical management, requiring comprehensive safety assessments for biomass-derived solvents before market entry. Complementing REACH, the EU's Renewable Energy Directive II (RED II) establishes sustainability criteria for bio-based products, including solvents, mandating life cycle assessments to verify genuine environmental benefits compared to petroleum-based alternatives.

The United States regulatory approach differs significantly, with the Toxic Substances Control Act (TSCA) and the Environmental Protection Agency's Significant New Use Rules (SNURs) governing novel biomass-derived solvents. Additionally, California's Safer Consumer Products regulations have emerged as influential state-level standards that often drive national compliance practices for environmentally preferable solvents.

Voluntary certification systems have gained prominence as market differentiators and compliance tools. The USDA BioPreferred program and EU Ecolabel provide certification frameworks specifically addressing bio-based content and environmental performance. These schemes establish standardized testing methodologies for verifying renewable carbon content, biodegradability, and reduced environmental footprint of biomass-derived solvents.

Industry-specific compliance standards further complicate the regulatory landscape. Pharmaceutical manufacturing follows Good Manufacturing Practices (GMP) guidelines, which increasingly incorporate green chemistry principles when evaluating solvent selection. Similarly, the food and cosmetics industries must adhere to strict purity and safety standards for bio-based solvents used in their products, as outlined in FDA regulations and the EU Cosmetic Products Regulation.

Emerging regulatory trends indicate a shift toward harmonized international standards for biomass-derived solvents. The International Organization for Standardization (ISO) has developed several standards specifically addressing bio-based products, including ISO 16620 for bio-based carbon content determination. These standards facilitate global trade while ensuring consistent environmental performance metrics across jurisdictions.

Companies utilizing biomass-derived solvents must navigate this complex regulatory environment through comprehensive compliance strategies. This typically involves maintaining detailed documentation of solvent origins, production methods, and environmental impact assessments to satisfy increasingly stringent reporting requirements across multiple jurisdictions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!