Carbon Capture Sorbents: A Comparative Market Study

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Technology Evolution and Objectives

Carbon capture technology has evolved significantly since its inception in the 1970s, initially developed for enhanced oil recovery applications. The fundamental concept involves separating carbon dioxide from industrial emissions or directly from the atmosphere to prevent its release into the environment. Early carbon capture systems primarily utilized liquid solvents, particularly amine-based solutions, which remain prevalent in commercial applications today despite their energy-intensive regeneration requirements.

The evolution of carbon capture sorbents has progressed through several distinct phases. First-generation technologies focused on post-combustion capture using liquid amine scrubbing. Second-generation approaches introduced solid sorbents and membrane technologies, offering improved energy efficiency. Current third-generation technologies are exploring novel materials including metal-organic frameworks (MOFs), zeolites, and functionalized porous carbons that demonstrate superior CO2 selectivity and reduced regeneration energy.

Recent technological breakthroughs have significantly improved the economic viability of carbon capture. Advanced materials science has yielded sorbents with higher CO2 adsorption capacities and improved stability across multiple adsorption-desorption cycles. Process engineering innovations have reduced the parasitic energy consumption associated with sorbent regeneration, addressing one of the primary barriers to widespread adoption.

The global objective for carbon capture technology development centers on achieving economic viability at scale. Current cost targets aim to reduce capture costs below $50 per ton of CO2 by 2030, with aspirational goals of $30 per ton by 2035. These targets represent a significant improvement from current costs, which typically range from $60-120 per ton depending on the emission source and capture technology employed.

Technical objectives focus on developing sorbents with specific performance characteristics: high CO2 selectivity in mixed gas environments, rapid adsorption kinetics, minimal regeneration energy requirements, and long-term stability under industrial conditions. Additionally, researchers are pursuing materials that can function effectively across diverse operating environments, from power plants to direct air capture applications.

The trajectory of carbon capture technology is increasingly influenced by policy frameworks and market mechanisms that value carbon reduction. The Paris Agreement and subsequent national commitments have established clear imperatives for decarbonization, while carbon pricing mechanisms in various regions are creating economic incentives for capture technology deployment. These policy drivers, combined with technological advances, are expected to accelerate the commercial adoption of advanced carbon capture sorbents over the next decade.

The evolution of carbon capture sorbents has progressed through several distinct phases. First-generation technologies focused on post-combustion capture using liquid amine scrubbing. Second-generation approaches introduced solid sorbents and membrane technologies, offering improved energy efficiency. Current third-generation technologies are exploring novel materials including metal-organic frameworks (MOFs), zeolites, and functionalized porous carbons that demonstrate superior CO2 selectivity and reduced regeneration energy.

Recent technological breakthroughs have significantly improved the economic viability of carbon capture. Advanced materials science has yielded sorbents with higher CO2 adsorption capacities and improved stability across multiple adsorption-desorption cycles. Process engineering innovations have reduced the parasitic energy consumption associated with sorbent regeneration, addressing one of the primary barriers to widespread adoption.

The global objective for carbon capture technology development centers on achieving economic viability at scale. Current cost targets aim to reduce capture costs below $50 per ton of CO2 by 2030, with aspirational goals of $30 per ton by 2035. These targets represent a significant improvement from current costs, which typically range from $60-120 per ton depending on the emission source and capture technology employed.

Technical objectives focus on developing sorbents with specific performance characteristics: high CO2 selectivity in mixed gas environments, rapid adsorption kinetics, minimal regeneration energy requirements, and long-term stability under industrial conditions. Additionally, researchers are pursuing materials that can function effectively across diverse operating environments, from power plants to direct air capture applications.

The trajectory of carbon capture technology is increasingly influenced by policy frameworks and market mechanisms that value carbon reduction. The Paris Agreement and subsequent national commitments have established clear imperatives for decarbonization, while carbon pricing mechanisms in various regions are creating economic incentives for capture technology deployment. These policy drivers, combined with technological advances, are expected to accelerate the commercial adoption of advanced carbon capture sorbents over the next decade.

Market Analysis of Carbon Capture Sorbent Demand

The global market for carbon capture sorbents is experiencing significant growth, driven by increasing environmental regulations and corporate sustainability commitments. Current market estimates value the carbon capture technology sector at approximately $2 billion, with sorbent materials representing about 30% of this market. This segment is projected to grow at a compound annual growth rate of 15-20% over the next decade, outpacing many other cleantech sectors.

Demand for carbon capture sorbents varies considerably across regions and industries. North America currently leads market consumption, accounting for roughly 40% of global demand, followed by Europe at 35% and Asia-Pacific at 20%. This regional distribution correlates strongly with regulatory frameworks and carbon pricing mechanisms in these markets. The power generation sector remains the largest end-user, consuming nearly 45% of all carbon capture sorbents, while industrial applications including cement, steel, and chemical manufacturing collectively account for another 40%.

Market segmentation by sorbent type reveals interesting trends. Amine-based sorbents currently dominate with approximately 55% market share due to their established technology readiness level and relatively lower implementation costs. However, metal-organic frameworks (MOFs) are showing the fastest growth rate at 25% annually, driven by their superior CO2 selectivity and capacity. Solid sorbents including activated carbons and zeolites maintain about 20% market share, valued for their stability and regeneration characteristics.

Customer adoption patterns indicate a bifurcated market. Large industrial emitters and utility companies primarily seek proven, scalable solutions with established operational track records, while early adopters and research institutions are more willing to experiment with novel sorbent technologies that promise higher efficiency but carry greater implementation risks. This dynamic creates distinct market entry pathways for different sorbent technologies.

Price sensitivity analysis reveals that cost remains the primary barrier to wider adoption. Current carbon capture costs using commercial sorbents range from $40-100 per ton of CO2 captured, significantly higher than most carbon pricing schemes globally. Market forecasts suggest that reaching the $30 per ton threshold would trigger widespread adoption across multiple industries, creating a potential inflection point for market growth.

Supply chain analysis indicates potential bottlenecks in raw material sourcing for specialized sorbents, particularly those requiring rare earth elements or complex synthesis processes. This presents both a challenge and opportunity for vertical integration strategies among market leaders.

Demand for carbon capture sorbents varies considerably across regions and industries. North America currently leads market consumption, accounting for roughly 40% of global demand, followed by Europe at 35% and Asia-Pacific at 20%. This regional distribution correlates strongly with regulatory frameworks and carbon pricing mechanisms in these markets. The power generation sector remains the largest end-user, consuming nearly 45% of all carbon capture sorbents, while industrial applications including cement, steel, and chemical manufacturing collectively account for another 40%.

Market segmentation by sorbent type reveals interesting trends. Amine-based sorbents currently dominate with approximately 55% market share due to their established technology readiness level and relatively lower implementation costs. However, metal-organic frameworks (MOFs) are showing the fastest growth rate at 25% annually, driven by their superior CO2 selectivity and capacity. Solid sorbents including activated carbons and zeolites maintain about 20% market share, valued for their stability and regeneration characteristics.

Customer adoption patterns indicate a bifurcated market. Large industrial emitters and utility companies primarily seek proven, scalable solutions with established operational track records, while early adopters and research institutions are more willing to experiment with novel sorbent technologies that promise higher efficiency but carry greater implementation risks. This dynamic creates distinct market entry pathways for different sorbent technologies.

Price sensitivity analysis reveals that cost remains the primary barrier to wider adoption. Current carbon capture costs using commercial sorbents range from $40-100 per ton of CO2 captured, significantly higher than most carbon pricing schemes globally. Market forecasts suggest that reaching the $30 per ton threshold would trigger widespread adoption across multiple industries, creating a potential inflection point for market growth.

Supply chain analysis indicates potential bottlenecks in raw material sourcing for specialized sorbents, particularly those requiring rare earth elements or complex synthesis processes. This presents both a challenge and opportunity for vertical integration strategies among market leaders.

Global Sorbent Technology Status and Barriers

Carbon capture sorbent technologies have evolved significantly over the past decade, with varying levels of development across different regions. Currently, the global landscape is dominated by three primary sorbent categories: amine-based solid sorbents, metal-organic frameworks (MOFs), and zeolites. North America and Europe lead in research and commercial deployment, with China rapidly closing the gap through aggressive investment in carbon capture infrastructure.

Despite technological advances, several critical barriers impede widespread adoption. Cost remains the foremost challenge, with current sorbent materials requiring significant capital investment for synthesis and regeneration processes. Most commercially available sorbents demonstrate regeneration energy requirements of 2.5-4.0 GJ/tonne CO₂, substantially higher than the theoretical minimum of 1.8 GJ/tonne CO₂, creating economic inefficiencies in large-scale implementation.

Durability presents another significant obstacle, as many promising sorbents exhibit performance degradation after multiple adsorption-desorption cycles. Laboratory studies indicate that amine-based sorbents typically lose 15-30% capacity after 100 cycles, while MOFs often suffer from structural instability in humid conditions or in the presence of SOx and NOx contaminants. This degradation necessitates frequent replacement, further increasing operational costs.

Scalability challenges persist throughout the industry. While laboratory-scale synthesis of advanced sorbents shows promising CO₂ capture capacities (often exceeding 3 mmol/g), translating these materials to industrial production volumes introduces quality inconsistencies and cost escalations. The gap between theoretical performance and practical application remains substantial, with only a handful of technologies successfully demonstrated beyond pilot scale.

Regulatory frameworks and carbon pricing mechanisms vary significantly across regions, creating market uncertainties that discourage investment. The European Union's Emissions Trading System provides the most developed carbon market, valuing CO₂ at €80-90/tonne, while many developing economies lack comparable incentives, resulting in geographically fragmented technology deployment.

Technical integration with existing industrial infrastructure presents additional complications. Retrofitting carbon capture systems to power plants or industrial facilities requires customized engineering solutions that accommodate space constraints, energy availability, and process compatibility. Current sorbent technologies often demand significant modifications to host facilities, limiting their appeal to operators of aging infrastructure.

Recent technological breakthroughs in composite sorbents and process intensification show promise for overcoming these barriers, but require further development before achieving commercial viability. The industry consensus suggests that a 30-40% reduction in capture costs is necessary to enable widespread adoption beyond regions with strong regulatory mandates.

Despite technological advances, several critical barriers impede widespread adoption. Cost remains the foremost challenge, with current sorbent materials requiring significant capital investment for synthesis and regeneration processes. Most commercially available sorbents demonstrate regeneration energy requirements of 2.5-4.0 GJ/tonne CO₂, substantially higher than the theoretical minimum of 1.8 GJ/tonne CO₂, creating economic inefficiencies in large-scale implementation.

Durability presents another significant obstacle, as many promising sorbents exhibit performance degradation after multiple adsorption-desorption cycles. Laboratory studies indicate that amine-based sorbents typically lose 15-30% capacity after 100 cycles, while MOFs often suffer from structural instability in humid conditions or in the presence of SOx and NOx contaminants. This degradation necessitates frequent replacement, further increasing operational costs.

Scalability challenges persist throughout the industry. While laboratory-scale synthesis of advanced sorbents shows promising CO₂ capture capacities (often exceeding 3 mmol/g), translating these materials to industrial production volumes introduces quality inconsistencies and cost escalations. The gap between theoretical performance and practical application remains substantial, with only a handful of technologies successfully demonstrated beyond pilot scale.

Regulatory frameworks and carbon pricing mechanisms vary significantly across regions, creating market uncertainties that discourage investment. The European Union's Emissions Trading System provides the most developed carbon market, valuing CO₂ at €80-90/tonne, while many developing economies lack comparable incentives, resulting in geographically fragmented technology deployment.

Technical integration with existing industrial infrastructure presents additional complications. Retrofitting carbon capture systems to power plants or industrial facilities requires customized engineering solutions that accommodate space constraints, energy availability, and process compatibility. Current sorbent technologies often demand significant modifications to host facilities, limiting their appeal to operators of aging infrastructure.

Recent technological breakthroughs in composite sorbents and process intensification show promise for overcoming these barriers, but require further development before achieving commercial viability. The industry consensus suggests that a 30-40% reduction in capture costs is necessary to enable widespread adoption beyond regions with strong regulatory mandates.

Current Sorbent Solutions Comparison

01 Metal-organic frameworks (MOFs) for carbon capture

Metal-organic frameworks are advanced porous materials with high surface area that can be tailored for selective CO2 adsorption. These crystalline structures consist of metal ions coordinated to organic ligands, creating a framework with tunable pore sizes and functionalities. MOFs demonstrate exceptional CO2 capture capacity under various conditions and can be modified with specific functional groups to enhance selectivity and adsorption efficiency. Their regeneration typically requires less energy compared to traditional sorbents, making them promising candidates for industrial carbon capture applications.- Metal-organic frameworks (MOFs) for carbon capture: Metal-organic frameworks are advanced porous materials with high surface area that can effectively capture carbon dioxide. These crystalline structures consist of metal ions coordinated with organic ligands, creating a framework with tunable pore sizes and functionalities. MOFs can be designed with specific binding sites for CO2, allowing for selective adsorption even in the presence of other gases. Their high adsorption capacity and regeneration capabilities make them promising candidates for industrial carbon capture applications.

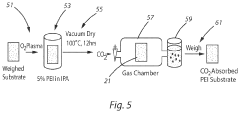

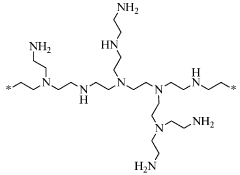

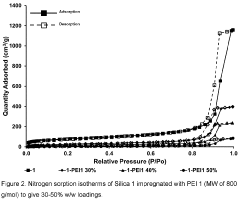

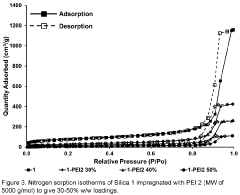

- Amine-functionalized sorbents for CO2 capture: Amine-functionalized materials represent a significant class of carbon capture sorbents that utilize the chemical reaction between amines and CO2 to form carbamates or bicarbonates. These sorbents can be created by incorporating amine groups onto various supports such as silica, polymers, or porous carbon. The amine functionality provides high selectivity for CO2 over other gases and can operate effectively at lower temperatures compared to traditional capture methods. These materials offer advantages including high CO2 adsorption capacity, good stability over multiple adsorption-desorption cycles, and the ability to capture CO2 even at low concentrations.

- Zeolite-based carbon capture materials: Zeolites are crystalline aluminosilicate materials with well-defined pore structures that can be utilized for carbon dioxide capture. These materials function through physical adsorption mechanisms, where CO2 molecules are trapped within the pores and cavities of the zeolite structure. The adsorption properties can be tailored by modifying the silicon-to-aluminum ratio, introducing metal cations, or post-synthetic functionalization. Zeolites offer advantages including high thermal stability, resistance to harsh conditions, and relatively low cost for large-scale applications. Their regeneration typically requires less energy compared to chemical sorbents.

- Carbon-based sorbents for CO2 capture: Carbon-based materials, including activated carbon, carbon nanotubes, graphene, and porous carbon frameworks, serve as effective sorbents for carbon dioxide capture. These materials can be derived from various sources including biomass, polymers, or industrial waste, making them potentially sustainable options. Their effectiveness stems from high surface area, tunable pore structure, and the ability to be functionalized with various chemical groups to enhance CO2 selectivity. Carbon-based sorbents typically demonstrate good mechanical stability, chemical resistance, and can be regenerated multiple times without significant performance degradation. Additionally, their relatively low cost of production makes them attractive for large-scale carbon capture applications.

- Novel composite and hybrid sorbent materials: Composite and hybrid sorbent materials combine different types of materials to create synergistic effects for enhanced carbon capture performance. These may include combinations of organic and inorganic components, polymer-inorganic hybrids, or multi-functional composites. By integrating the advantages of different materials, these sorbents can achieve improved CO2 selectivity, higher adsorption capacity, better mechanical stability, and enhanced regeneration properties. Examples include polymer-supported amines, MOF-polymer composites, and hierarchical porous materials with multiple functionalities. These hybrid approaches often address limitations of single-component sorbents and can be tailored for specific operating conditions in carbon capture applications.

02 Amine-functionalized sorbents

Amine-functionalized materials represent a significant class of carbon capture sorbents that operate through chemical adsorption mechanisms. These sorbents incorporate various amine groups onto support materials such as silica, polymers, or porous substrates to create reactive sites for CO2 binding. The amine groups form carbamates or bicarbonates when reacting with CO2, enabling high selectivity even at low CO2 concentrations. These materials can be designed with different amine types (primary, secondary, tertiary) and loadings to optimize capture performance under specific operating conditions while maintaining stability through multiple adsorption-desorption cycles.Expand Specific Solutions03 Novel composite and hybrid sorbent materials

Composite and hybrid sorbent materials combine multiple components to achieve enhanced carbon capture performance beyond what individual materials can offer. These innovative formulations typically integrate complementary capture mechanisms, such as physical adsorption components with chemical binding sites. By engineering these multi-functional materials, researchers have developed sorbents with improved CO2 selectivity, capacity, and stability under various operating conditions. The synergistic effects between components can also address common challenges like moisture sensitivity, thermal stability, and mechanical strength, making these hybrid materials particularly promising for real-world carbon capture applications.Expand Specific Solutions04 Regeneration and cycling stability improvements

Advancements in sorbent regeneration techniques and cycling stability are critical for practical carbon capture applications. These innovations focus on reducing the energy requirements for sorbent regeneration while maintaining capture performance over numerous adsorption-desorption cycles. Key approaches include developing materials with optimized binding energies, incorporating stabilizing additives to prevent degradation, and engineering sorbent structures that resist physical breakdown during temperature or pressure swings. Novel regeneration methods using alternative energy inputs such as microwave, electrical, or solar heating have also been developed to improve the overall energy efficiency of carbon capture processes.Expand Specific Solutions05 Biomass-derived and sustainable carbon capture sorbents

Sustainable carbon capture sorbents derived from biomass and other renewable resources represent an environmentally friendly approach to CO2 removal. These materials utilize agricultural waste, forestry byproducts, or other biological sources as precursors for creating effective carbon capture media. Through various activation and functionalization processes, these renewable feedstocks can be transformed into high-performance adsorbents with significant CO2 capture capacity. The inherent chemical composition of biomass often provides beneficial functional groups that can be enhanced for selective CO2 adsorption. These sustainable sorbents offer the dual benefits of carbon capture capability and reduced environmental footprint compared to conventional synthetic materials.Expand Specific Solutions

Leading Companies in Carbon Capture Sorbent Market

Carbon capture sorbents market is currently in the growth phase, characterized by increasing investments and technological advancements. The global market size is projected to expand significantly, driven by stringent emission regulations and net-zero commitments. Regarding technological maturity, established players like ExxonMobil, BASF, and Siemens Energy lead with commercial-scale solutions, while Climeworks represents breakthrough direct air capture technology. Chinese entities (Sinopec, China Petroleum University) are rapidly advancing indigenous technologies. Academic institutions (MIT, Rice University, Imperial College) contribute fundamental research, while industrial collaborations between companies like IBM and Rolls-Royce accelerate practical applications. The competitive landscape features both traditional energy companies pivoting toward carbon capture and specialized startups developing novel sorbent materials, creating a dynamic ecosystem of innovation across various technological readiness levels.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced solid sorbent technologies for carbon capture focusing on zeolite-based molecular sieves and metal-organic frameworks (MOFs). Their proprietary zeolite sorbents feature tailored pore structures and surface chemistry modifications that enhance CO2 selectivity and capacity. Sinopec has implemented these technologies at their Qilu Petrochemical facility, capturing over 1 million tons of CO2 annually. Their approach includes a pressure/temperature swing adsorption system that allows for efficient sorbent regeneration while minimizing energy penalties. Sinopec's MOF-based sorbents demonstrate CO2 uptake capacities of 4-6 mmol/g under flue gas conditions with selectivity ratios exceeding 25:1 for CO2 over N2. The company has also developed hybrid sorbent systems that combine the advantages of physical adsorption and chemical absorption mechanisms, allowing operation across broader temperature ranges (20-120°C) and pressure conditions.

Strengths: Large-scale industrial implementation experience; integration with existing petrochemical infrastructure; comprehensive sorbent manufacturing capabilities; ability to utilize captured CO2 in enhanced oil recovery operations. Weaknesses: Technologies primarily focused on point-source capture rather than direct air capture; relatively high regeneration energy requirements; potential durability issues with some advanced MOF materials in industrial conditions.

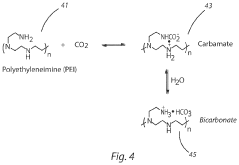

Climeworks AG

Technical Solution: Climeworks has developed a Direct Air Capture (DAC) technology using solid sorbent filters that selectively capture CO2 from ambient air. Their modular collectors use a two-step process where air flows through the filter material that binds CO2, followed by heating the filter to around 100°C to release concentrated CO2 for storage or utilization. Climeworks' technology employs amine-functionalized sorbents on porous filters that can be regenerated thousands of times. Their commercial plants, including Orca in Iceland (4,000 tons CO2/year capacity) and the upcoming Mammoth facility (36,000 tons CO2/year), demonstrate scalable implementation. The captured CO2 is injected underground where it mineralizes and turns to stone through natural processes, providing permanent storage. Climeworks has achieved significant cost reductions, bringing DAC costs from $600-1000 per ton initially to projections of $250-300 per ton at scale.

Strengths: Modular design allows for flexible deployment and scaling; integration with renewable energy sources; permanent storage solution through mineralization; proven commercial implementation. Weaknesses: Still relatively high cost per ton of CO2 captured compared to point-source capture; energy-intensive regeneration process; limited capture capacity compared to global emissions.

Key Patents and Research in Sorbent Technologies

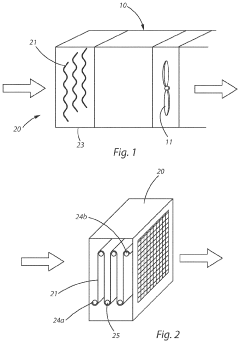

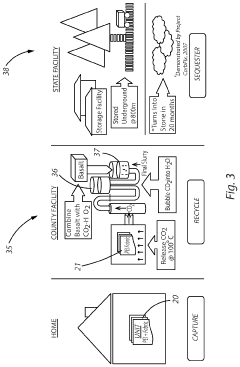

Carbon capture apparatus, method, and capture element

PatentPendingUS20230372861A1

Innovation

- A carbon capture apparatus using a treated fabric substrate with a high surface area, coated with a carbon sequestering agent like polyethyleneimine, which absorbs CO2 from ambient air and can be reused after desorption, facilitating indoor CO2 capture and subsequent sequestration or industrial use.

Sorbents for carbon dioxide capture

PatentWO2024133317A1

Innovation

- A sorbent comprising polyalkyleneimine or alkoxylated polyalkyleneimine loaded onto an inorganic solid support with a water content greater than 2 wt%, allowing for aqueous solvent use and reducing the need for organic solvents, which enhances CO2 absorption rates and oxidative stability.

Policy Frameworks Influencing Carbon Capture Markets

Policy frameworks across the globe have emerged as critical drivers shaping the trajectory of carbon capture markets. The Paris Agreement of 2015 represents a watershed moment, establishing international consensus on climate action and catalyzing national policies supportive of carbon capture technologies. This agreement has prompted numerous countries to incorporate carbon capture into their Nationally Determined Contributions (NDCs), creating a foundation for market development.

In the United States, the 45Q tax credit has transformed the economic landscape for carbon capture projects. Recent enhancements through the Inflation Reduction Act of 2022 have increased credit values to $85 per metric ton for geological sequestration and $60 per ton for utilization or enhanced oil recovery, significantly improving project economics. This policy mechanism has been instrumental in mobilizing private investment toward commercial-scale carbon capture initiatives.

The European Union's regulatory approach centers on the Emissions Trading System (ETS), which establishes a carbon price through a cap-and-trade mechanism. The EU Innovation Fund further complements this by providing substantial financial support for demonstration projects. Additionally, the Carbon Border Adjustment Mechanism (CBAM) aims to prevent carbon leakage by imposing carbon-equivalent tariffs on imports, potentially creating global ripple effects for carbon capture adoption.

China's policy framework has evolved from its initial focus on pilot ETS programs to the world's largest national carbon market launched in 2021. The 14th Five-Year Plan explicitly prioritizes carbon capture technologies, allocating significant research funding and setting ambitious deployment targets. These policy signals have accelerated domestic technology development and created market opportunities for sorbent manufacturers.

Developing economies are increasingly implementing supportive frameworks, often with international financial assistance. The Clean Development Mechanism (CDM) and its successor mechanisms under Article 6 of the Paris Agreement provide pathways for cross-border investment in carbon capture projects, though implementation challenges remain.

Industry standards and certification schemes are emerging as important market enablers. The International Organization for Standardization (ISO) has developed standards for quantification and verification of CO₂ capture performance, while initiatives like the Carbon Capture Coalition advocate for technology-neutral performance standards rather than prescriptive regulations, allowing innovation in sorbent technologies to flourish.

The interplay between these policy frameworks creates a complex but increasingly supportive environment for carbon capture sorbent markets, with regional variations in approach creating diverse market opportunities for different sorbent technologies based on their performance characteristics and cost profiles.

In the United States, the 45Q tax credit has transformed the economic landscape for carbon capture projects. Recent enhancements through the Inflation Reduction Act of 2022 have increased credit values to $85 per metric ton for geological sequestration and $60 per ton for utilization or enhanced oil recovery, significantly improving project economics. This policy mechanism has been instrumental in mobilizing private investment toward commercial-scale carbon capture initiatives.

The European Union's regulatory approach centers on the Emissions Trading System (ETS), which establishes a carbon price through a cap-and-trade mechanism. The EU Innovation Fund further complements this by providing substantial financial support for demonstration projects. Additionally, the Carbon Border Adjustment Mechanism (CBAM) aims to prevent carbon leakage by imposing carbon-equivalent tariffs on imports, potentially creating global ripple effects for carbon capture adoption.

China's policy framework has evolved from its initial focus on pilot ETS programs to the world's largest national carbon market launched in 2021. The 14th Five-Year Plan explicitly prioritizes carbon capture technologies, allocating significant research funding and setting ambitious deployment targets. These policy signals have accelerated domestic technology development and created market opportunities for sorbent manufacturers.

Developing economies are increasingly implementing supportive frameworks, often with international financial assistance. The Clean Development Mechanism (CDM) and its successor mechanisms under Article 6 of the Paris Agreement provide pathways for cross-border investment in carbon capture projects, though implementation challenges remain.

Industry standards and certification schemes are emerging as important market enablers. The International Organization for Standardization (ISO) has developed standards for quantification and verification of CO₂ capture performance, while initiatives like the Carbon Capture Coalition advocate for technology-neutral performance standards rather than prescriptive regulations, allowing innovation in sorbent technologies to flourish.

The interplay between these policy frameworks creates a complex but increasingly supportive environment for carbon capture sorbent markets, with regional variations in approach creating diverse market opportunities for different sorbent technologies based on their performance characteristics and cost profiles.

Cost-Benefit Analysis of Competing Sorbent Technologies

The economic viability of carbon capture technologies hinges significantly on the cost-effectiveness of sorbent materials. Amine-based sorbents, while demonstrating high CO2 selectivity, incur substantial operational costs due to their energy-intensive regeneration processes, typically requiring temperatures of 100-120°C. These regeneration costs can represent up to 70% of the total operational expenditure in carbon capture systems, making them less economically attractive despite their technical efficiency.

Metal-Organic Frameworks (MOFs) present a more balanced cost-benefit profile. Although their synthesis costs remain higher than traditional sorbents ($200-500/kg compared to $50-100/kg for amines), their superior adsorption capacity (up to 1.5 mmol/g) and lower regeneration energy requirements (1.5-2.5 GJ/tCO2) yield better long-term economics. Market analysis indicates that MOFs could reduce capture costs to $40-60/tCO2, representing a 20-30% improvement over first-generation technologies.

Zeolites offer perhaps the most favorable immediate cost-benefit ratio, with established manufacturing processes resulting in lower production costs ($30-80/kg) and reasonable adsorption capacities (0.8-1.2 mmol/g). Their widespread industrial availability further reduces implementation barriers, though their performance in humid conditions remains suboptimal, potentially increasing operational costs in real-world applications.

Emerging carbon-based sorbents, particularly activated carbon and carbon nanotubes, demonstrate promising economics when lifecycle costs are considered. Despite moderate initial costs ($100-300/kg), their exceptional durability (maintaining >90% capacity after 1000+ cycles) significantly reduces replacement frequency and associated expenses. Market projections suggest these materials could achieve capture costs below $50/tCO2 by 2025 as manufacturing scales increase.

Alkaline earth metal oxides represent the most economical option for high-temperature applications, with calcium oxide (CaO) derived from limestone costing merely $10-20/kg. However, their rapid performance degradation necessitates frequent replacement, offsetting initial cost advantages. Recent innovations in stabilization techniques have extended their useful life by 300%, potentially transforming their cost-benefit equation.

When evaluating total system economics, integration costs vary significantly across sorbent technologies. Amine systems require corrosion-resistant equipment, adding 15-25% to capital expenditures. Conversely, solid sorbents like zeolites and MOFs can utilize simpler containment systems, though they often demand more sophisticated pressure-swing or temperature-swing adsorption equipment.

Market sensitivity analysis reveals that sorbent selection becomes increasingly critical as carbon pricing mechanisms mature globally. At carbon prices below $30/tCO2, only the most economical sorbents remain viable. However, as prices rise toward projected 2030 levels ($50-80/tCO2), more advanced materials with higher capture efficiencies become economically justified despite higher initial costs.

Metal-Organic Frameworks (MOFs) present a more balanced cost-benefit profile. Although their synthesis costs remain higher than traditional sorbents ($200-500/kg compared to $50-100/kg for amines), their superior adsorption capacity (up to 1.5 mmol/g) and lower regeneration energy requirements (1.5-2.5 GJ/tCO2) yield better long-term economics. Market analysis indicates that MOFs could reduce capture costs to $40-60/tCO2, representing a 20-30% improvement over first-generation technologies.

Zeolites offer perhaps the most favorable immediate cost-benefit ratio, with established manufacturing processes resulting in lower production costs ($30-80/kg) and reasonable adsorption capacities (0.8-1.2 mmol/g). Their widespread industrial availability further reduces implementation barriers, though their performance in humid conditions remains suboptimal, potentially increasing operational costs in real-world applications.

Emerging carbon-based sorbents, particularly activated carbon and carbon nanotubes, demonstrate promising economics when lifecycle costs are considered. Despite moderate initial costs ($100-300/kg), their exceptional durability (maintaining >90% capacity after 1000+ cycles) significantly reduces replacement frequency and associated expenses. Market projections suggest these materials could achieve capture costs below $50/tCO2 by 2025 as manufacturing scales increase.

Alkaline earth metal oxides represent the most economical option for high-temperature applications, with calcium oxide (CaO) derived from limestone costing merely $10-20/kg. However, their rapid performance degradation necessitates frequent replacement, offsetting initial cost advantages. Recent innovations in stabilization techniques have extended their useful life by 300%, potentially transforming their cost-benefit equation.

When evaluating total system economics, integration costs vary significantly across sorbent technologies. Amine systems require corrosion-resistant equipment, adding 15-25% to capital expenditures. Conversely, solid sorbents like zeolites and MOFs can utilize simpler containment systems, though they often demand more sophisticated pressure-swing or temperature-swing adsorption equipment.

Market sensitivity analysis reveals that sorbent selection becomes increasingly critical as carbon pricing mechanisms mature globally. At carbon prices below $30/tCO2, only the most economical sorbents remain viable. However, as prices rise toward projected 2030 levels ($50-80/tCO2), more advanced materials with higher capture efficiencies become economically justified despite higher initial costs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!