Carbon Capture Technologies Cost-Benefit Analysis

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Evolution and Objectives

Carbon capture technologies have evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications across various industries. The journey began in the 1970s with early experiments in capturing carbon dioxide from industrial flue gases, primarily motivated by enhanced oil recovery rather than climate concerns. By the 1990s, as climate change gained scientific consensus, carbon capture research accelerated, leading to the first large-scale demonstration projects in the early 2000s.

The evolution has progressed through three distinct generations of technology. First-generation systems focused on post-combustion capture using amine-based solvents, characterized by high energy penalties and operational costs. Second-generation technologies expanded to include pre-combustion capture and oxy-fuel combustion, offering improved efficiency but still facing economic challenges. Today's third-generation approaches explore novel materials like metal-organic frameworks, enzymatic systems, and direct air capture, representing significant technological leaps.

The primary objective of carbon capture cost-benefit analysis is to determine the economic viability of these technologies across different applications and scales. This includes quantifying both direct costs (capital expenditure, operational expenses, energy requirements) and indirect benefits (emissions reduction, regulatory compliance, potential revenue streams from carbon utilization). A comprehensive analysis must account for the full lifecycle implications, including environmental impacts beyond CO2 reduction.

Technical objectives focus on reducing the energy penalty associated with capture processes, which currently ranges from 15-30% of a power plant's output. Research aims to bring this below 10% while simultaneously reducing capital costs by at least 30% compared to current benchmarks. Additional goals include improving capture efficiency from the current 85-95% to consistently above 95%, and extending operational lifetimes of capture materials to reduce replacement frequency and associated costs.

Market-oriented objectives include achieving cost parity with carbon pricing mechanisms, currently targeting capture costs below $50/ton CO2 by 2030 and under $30/ton by 2040. The analysis must also consider scalability pathways that allow technologies to progress from demonstration to commercial deployment without prohibitive cost increases.

The ultimate goal extends beyond technical and economic considerations to include social acceptance and policy integration, recognizing that widespread adoption depends not only on cost-effectiveness but also on regulatory frameworks, public perception, and alignment with broader sustainability objectives.

The evolution has progressed through three distinct generations of technology. First-generation systems focused on post-combustion capture using amine-based solvents, characterized by high energy penalties and operational costs. Second-generation technologies expanded to include pre-combustion capture and oxy-fuel combustion, offering improved efficiency but still facing economic challenges. Today's third-generation approaches explore novel materials like metal-organic frameworks, enzymatic systems, and direct air capture, representing significant technological leaps.

The primary objective of carbon capture cost-benefit analysis is to determine the economic viability of these technologies across different applications and scales. This includes quantifying both direct costs (capital expenditure, operational expenses, energy requirements) and indirect benefits (emissions reduction, regulatory compliance, potential revenue streams from carbon utilization). A comprehensive analysis must account for the full lifecycle implications, including environmental impacts beyond CO2 reduction.

Technical objectives focus on reducing the energy penalty associated with capture processes, which currently ranges from 15-30% of a power plant's output. Research aims to bring this below 10% while simultaneously reducing capital costs by at least 30% compared to current benchmarks. Additional goals include improving capture efficiency from the current 85-95% to consistently above 95%, and extending operational lifetimes of capture materials to reduce replacement frequency and associated costs.

Market-oriented objectives include achieving cost parity with carbon pricing mechanisms, currently targeting capture costs below $50/ton CO2 by 2030 and under $30/ton by 2040. The analysis must also consider scalability pathways that allow technologies to progress from demonstration to commercial deployment without prohibitive cost increases.

The ultimate goal extends beyond technical and economic considerations to include social acceptance and policy integration, recognizing that widespread adoption depends not only on cost-effectiveness but also on regulatory frameworks, public perception, and alignment with broader sustainability objectives.

Market Demand for Carbon Capture Solutions

The global market for carbon capture technologies has witnessed significant growth in recent years, driven primarily by increasing environmental concerns and regulatory pressures. As of 2023, the global carbon capture, utilization, and storage (CCUS) market was valued at approximately $7.5 billion, with projections indicating a compound annual growth rate of 19.2% through 2030, potentially reaching $35.9 billion by the end of the decade.

Industrial sectors represent the largest demand segment for carbon capture solutions, particularly power generation, cement production, steel manufacturing, and chemical processing. These industries collectively account for over 70% of global carbon emissions from industrial processes, creating substantial market potential for targeted carbon capture implementations. The power generation sector alone constitutes nearly 40% of the current market demand, as coal and natural gas plants seek compliance with increasingly stringent emission regulations.

Regional analysis reveals varying levels of market maturity and demand patterns. North America leads the market with approximately 35% share, driven by favorable tax incentives like the 45Q tax credit in the United States, which offers up to $85 per metric ton for permanent CO2 storage. The European market follows closely at 30%, bolstered by the EU Emissions Trading System and the European Green Deal's ambitious climate targets. The Asia-Pacific region, while currently representing about 25% of the market, is expected to demonstrate the fastest growth rate of 22.3% annually through 2030.

From an end-user perspective, demand segmentation shows distinct patterns. Large-scale industrial applications currently dominate with 65% market share, while direct air capture (DAC) technologies, though representing only 8% of current demand, are projected to grow at 27% annually as costs decrease and technological efficiency improves. The remaining market share is distributed among various applications including enhanced oil recovery operations and small to medium-scale industrial implementations.

Economic factors significantly influence market demand dynamics. The current average cost of carbon capture ranges from $40-120 per ton of CO2 depending on the technology and application, with post-combustion capture for power plants averaging $58-78 per ton. This cost structure creates a bifurcated market demand: regions with carbon prices or taxes exceeding $50 per ton demonstrate robust demand growth, while areas lacking such mechanisms show limited adoption despite technological availability.

Customer willingness to pay remains heavily influenced by regulatory frameworks rather than voluntary action. Survey data indicates that only 23% of industrial operators would implement carbon capture solutions without regulatory requirements or financial incentives, highlighting the critical role of policy in market development.

Industrial sectors represent the largest demand segment for carbon capture solutions, particularly power generation, cement production, steel manufacturing, and chemical processing. These industries collectively account for over 70% of global carbon emissions from industrial processes, creating substantial market potential for targeted carbon capture implementations. The power generation sector alone constitutes nearly 40% of the current market demand, as coal and natural gas plants seek compliance with increasingly stringent emission regulations.

Regional analysis reveals varying levels of market maturity and demand patterns. North America leads the market with approximately 35% share, driven by favorable tax incentives like the 45Q tax credit in the United States, which offers up to $85 per metric ton for permanent CO2 storage. The European market follows closely at 30%, bolstered by the EU Emissions Trading System and the European Green Deal's ambitious climate targets. The Asia-Pacific region, while currently representing about 25% of the market, is expected to demonstrate the fastest growth rate of 22.3% annually through 2030.

From an end-user perspective, demand segmentation shows distinct patterns. Large-scale industrial applications currently dominate with 65% market share, while direct air capture (DAC) technologies, though representing only 8% of current demand, are projected to grow at 27% annually as costs decrease and technological efficiency improves. The remaining market share is distributed among various applications including enhanced oil recovery operations and small to medium-scale industrial implementations.

Economic factors significantly influence market demand dynamics. The current average cost of carbon capture ranges from $40-120 per ton of CO2 depending on the technology and application, with post-combustion capture for power plants averaging $58-78 per ton. This cost structure creates a bifurcated market demand: regions with carbon prices or taxes exceeding $50 per ton demonstrate robust demand growth, while areas lacking such mechanisms show limited adoption despite technological availability.

Customer willingness to pay remains heavily influenced by regulatory frameworks rather than voluntary action. Survey data indicates that only 23% of industrial operators would implement carbon capture solutions without regulatory requirements or financial incentives, highlighting the critical role of policy in market development.

Technical Barriers in Carbon Capture Implementation

Despite significant advancements in carbon capture technologies, several critical technical barriers continue to impede widespread implementation. The energy penalty associated with carbon capture remains one of the most significant challenges, with current technologies requiring approximately 20-30% of a power plant's energy output for operation. This substantial energy requirement directly impacts the economic viability of these systems and contributes to higher operational costs.

Material limitations present another major obstacle. Existing sorbents and solvents used in carbon capture processes often suffer from degradation issues, limited CO2 selectivity, and insufficient durability under industrial conditions. For instance, amine-based solvents, while effective at capturing CO2, are prone to oxidative degradation and require significant energy for regeneration, creating a technical bottleneck that researchers are actively working to overcome.

Scale-up challenges further complicate implementation efforts. Laboratory-proven technologies frequently encounter unforeseen difficulties when scaled to industrial levels, including uneven flow distribution, pressure drop issues, and heat management complications. These engineering challenges can significantly reduce capture efficiency and increase costs when systems are deployed at commercial scale.

Integration with existing infrastructure represents another substantial barrier. Retrofitting carbon capture systems to existing power plants and industrial facilities requires complex engineering solutions to address space constraints, compatibility issues, and operational disruptions. The technical complexity of these retrofits often leads to higher implementation costs and extended installation timeframes.

Process optimization remains inadequate across many carbon capture technologies. Current systems frequently lack sophisticated control mechanisms and real-time monitoring capabilities necessary for maintaining optimal performance under varying operational conditions. This limitation results in sub-optimal capture rates and increased operational expenses.

Transportation infrastructure for captured CO2 presents additional technical challenges. Pipeline networks require specialized materials and monitoring systems to safely transport compressed CO2, while ensuring minimal leakage. The technical specifications for these transportation systems must account for the unique properties of dense-phase CO2, including its corrosive potential under certain conditions.

Storage verification and monitoring technologies are still evolving, creating uncertainty around long-term sequestration effectiveness. Current monitoring systems have limitations in accurately tracking CO2 plume migration and detecting potential leakage pathways in geological formations, raising technical concerns about storage permanence and environmental safety.

Material limitations present another major obstacle. Existing sorbents and solvents used in carbon capture processes often suffer from degradation issues, limited CO2 selectivity, and insufficient durability under industrial conditions. For instance, amine-based solvents, while effective at capturing CO2, are prone to oxidative degradation and require significant energy for regeneration, creating a technical bottleneck that researchers are actively working to overcome.

Scale-up challenges further complicate implementation efforts. Laboratory-proven technologies frequently encounter unforeseen difficulties when scaled to industrial levels, including uneven flow distribution, pressure drop issues, and heat management complications. These engineering challenges can significantly reduce capture efficiency and increase costs when systems are deployed at commercial scale.

Integration with existing infrastructure represents another substantial barrier. Retrofitting carbon capture systems to existing power plants and industrial facilities requires complex engineering solutions to address space constraints, compatibility issues, and operational disruptions. The technical complexity of these retrofits often leads to higher implementation costs and extended installation timeframes.

Process optimization remains inadequate across many carbon capture technologies. Current systems frequently lack sophisticated control mechanisms and real-time monitoring capabilities necessary for maintaining optimal performance under varying operational conditions. This limitation results in sub-optimal capture rates and increased operational expenses.

Transportation infrastructure for captured CO2 presents additional technical challenges. Pipeline networks require specialized materials and monitoring systems to safely transport compressed CO2, while ensuring minimal leakage. The technical specifications for these transportation systems must account for the unique properties of dense-phase CO2, including its corrosive potential under certain conditions.

Storage verification and monitoring technologies are still evolving, creating uncertainty around long-term sequestration effectiveness. Current monitoring systems have limitations in accurately tracking CO2 plume migration and detecting potential leakage pathways in geological formations, raising technical concerns about storage permanence and environmental safety.

Current Carbon Capture Methodologies

01 Direct Air Capture (DAC) Cost-Benefit Analysis

Direct Air Capture technologies extract CO2 directly from the atmosphere, offering flexibility in installation locations. The cost-benefit analysis shows initial high capital expenditure but potential long-term economic benefits through carbon credits and environmental impact reduction. Recent innovations have focused on reducing energy requirements and operational costs, making DAC increasingly viable as part of comprehensive carbon management strategies.- Direct Air Capture (DAC) Technologies: Direct Air Capture technologies extract CO2 directly from the atmosphere using chemical processes. These systems can be deployed anywhere and offer flexibility in implementation. While they provide high purity carbon capture, they typically have higher operational costs compared to point-source capture methods. The cost-benefit analysis shows potential for improvement through technological advancements and economies of scale, with current costs ranging from $250-600 per ton of CO2 captured.

- Point-Source Carbon Capture Systems: These technologies capture CO2 directly from industrial emissions sources such as power plants and manufacturing facilities. They typically use absorption, adsorption, or membrane separation techniques. The cost-benefit analysis shows these systems are more economically viable than DAC in the short term, with capture costs ranging from $40-120 per ton of CO2. However, they require significant infrastructure modifications and are limited to locations with concentrated emission sources.

- Biological Carbon Sequestration Methods: Biological approaches use natural processes like afforestation, reforestation, and enhanced agricultural practices to capture carbon. These methods offer additional environmental benefits including improved biodiversity and soil health. The cost-benefit analysis shows these are among the most cost-effective options at $5-50 per ton of CO2 sequestered, though they face challenges related to land availability, permanence of storage, and verification of carbon removal.

- Carbon Utilization and Conversion Technologies: These technologies convert captured CO2 into valuable products such as building materials, fuels, and chemicals. The cost-benefit analysis shows potential for creating economic value from captured carbon, offsetting capture costs. While currently limited by market size and energy requirements, these approaches offer pathways to create circular carbon economies. The economic viability varies widely depending on the end product, with some applications already commercially viable while others require further development.

- Economic Modeling and Policy Frameworks: Economic models and policy frameworks are essential for evaluating the cost-benefit ratio of carbon capture technologies. These include carbon pricing mechanisms, tax incentives, and regulatory frameworks that influence adoption rates. Analysis shows that supportive policies significantly improve the economic viability of carbon capture projects. Models indicate that costs will decrease over time with technological learning, economies of scale, and increased deployment, potentially reaching $100-150 per ton for DAC by 2050.

02 Carbon Capture and Storage (CCS) Economic Viability

Carbon Capture and Storage systems capture CO2 from point sources like power plants and industrial facilities before storing it underground. The economic assessment reveals that while implementation costs remain significant, regulatory incentives and carbon pricing mechanisms are improving the cost-benefit ratio. The technology offers substantial emissions reduction potential for hard-to-abate sectors, with recent developments focusing on reducing capture costs and improving storage safety.Expand Specific Solutions03 Bioenergy with Carbon Capture (BECCS) Financial Models

BECCS combines biomass energy production with carbon capture, potentially achieving negative emissions. Financial modeling shows that while upfront costs are high, the dual benefits of energy production and carbon removal create unique economic opportunities. The cost-effectiveness depends on biomass supply chains, energy market prices, and carbon credit values. Recent innovations focus on optimizing the entire process from biomass cultivation to carbon storage to improve overall economic returns.Expand Specific Solutions04 Carbon Utilization Pathways and Value Creation

Carbon utilization technologies convert captured CO2 into valuable products like building materials, fuels, and chemicals. The cost-benefit analysis indicates that creating marketable products from captured carbon can offset capture costs and generate additional revenue streams. The economic viability varies by end product, with high-value applications showing better returns. Recent developments focus on catalysts and processes that reduce energy requirements and improve conversion efficiency to enhance overall economic performance.Expand Specific Solutions05 Policy Frameworks and Carbon Market Mechanisms

Policy frameworks and carbon market mechanisms significantly impact the cost-benefit analysis of carbon capture technologies. Carbon pricing, tax incentives, subsidies, and regulatory requirements can transform economically challenging projects into viable investments. The analysis shows that stable, long-term policy support is crucial for attracting investment in carbon capture technologies. Recent developments in international carbon markets and national climate policies are creating more favorable economic conditions for carbon capture implementation.Expand Specific Solutions

Leading Carbon Capture Industry Players

The carbon capture technology market is currently in a growth phase, with increasing investments and research activities. The global market size is projected to expand significantly due to rising environmental concerns and regulatory pressures. Technologically, the field shows varying maturity levels across different capture methods. Leading players include established energy corporations like China National Petroleum Corporation and CHN Energy Investment Group, which are leveraging their industrial infrastructure for large-scale implementation. Research institutions such as Huaneng Clean Energy Research Institute, University of Kentucky Research Foundation, and Korea Research Institute of Chemical Technology are advancing fundamental technologies. Companies like Calix Ltd. and Saipem SpA are developing innovative commercial solutions, while academic institutions including Peking University and Zhejiang University contribute through fundamental research and talent development, creating a competitive landscape balanced between industrial applications and technological innovation.

Huaneng Clean Energy Research Institute

Technical Solution: Huaneng Clean Energy Research Institute has developed a comprehensive carbon capture technology portfolio with significant cost optimization. Their flagship post-combustion capture system at Shidongkou Power Plant demonstrates 120,000 tons CO2 annual capture capacity with energy consumption reduced to 2.8-3.2 GJ/ton CO2, representing a 30% cost reduction compared to first-generation technologies. The institute employs a proprietary amine-based solvent formulation that resists degradation and requires less regeneration energy. Their integrated techno-economic assessment framework evaluates the entire carbon capture value chain, incorporating capital expenditure, operational costs, and potential revenue streams from carbon utilization. Recent innovations include a modular design approach that reduces installation costs by 15-20% and enables scalable implementation across different plant sizes.

Strengths: Proven large-scale implementation experience with demonstrated cost reductions; proprietary solvent technology with lower energy penalties; comprehensive techno-economic modeling capabilities. Weaknesses: Technology still faces challenges in retrofit applications to existing plants; economic viability remains dependent on carbon pricing or incentive mechanisms.

Saipem SpA

Technical Solution: Saipem SpA has developed an innovative CO2 Solutions by Saipem (CSS) technology platform that utilizes a biocatalyst (carbonic anhydrase enzyme) to significantly enhance carbon capture efficiency while reducing energy requirements. Their proprietary process operates at lower temperatures (35-40°C) compared to conventional amine-based systems (120-150°C), resulting in energy consumption reductions of approximately 30-40%. The company's cost-benefit analysis demonstrates CAPEX reductions of 25% and OPEX savings of 35% compared to traditional MEA-based capture systems. Saipem's technology is particularly effective for industrial applications with moderate CO2 concentrations (5-15%) and has been validated through multiple demonstration projects, including a 30 tonnes/day facility in Canada. Their integrated approach includes comprehensive lifecycle assessment methodologies that account for both direct operational costs and indirect environmental impacts across the entire carbon capture and utilization/storage chain.

Strengths: Enzyme-based technology offers significant energy and cost advantages; proven at demonstration scale with validated performance data; applicable across multiple industrial sectors beyond power generation. Weaknesses: Enzyme stability and longevity remain challenges in certain industrial environments; technology still scaling to full commercial implementation; requires specific operating conditions for optimal performance.

Key Patents in Carbon Capture Technologies

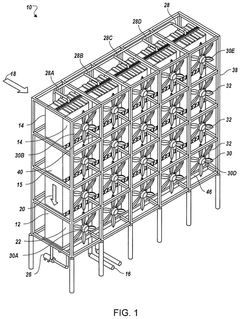

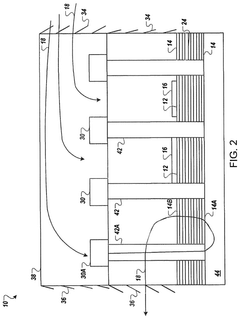

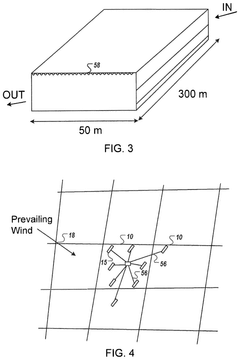

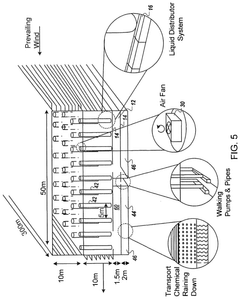

Carbon Dioxide Capture Method and Facility

PatentPendingUS20250153095A1

Innovation

- The use of a carbon dioxide capture facility with a slab-shaped packing structure that allows wind to flow through, combined with intermittent pulsed flow of a high molarity carbon dioxide absorbent liquid, enhances CO2 capture efficiency while reducing energy consumption and capital costs.

Patent

Innovation

- Integration of economic modeling with carbon capture technology assessment to provide comprehensive cost-benefit analysis across the entire carbon capture lifecycle.

- Standardized methodology for comparing diverse carbon capture technologies using normalized metrics that account for both direct costs and externalities.

- Dynamic assessment framework that adapts to changing market conditions, policy environments, and technological advancements in real-time.

Economic Viability Assessment

The economic viability of carbon capture technologies remains a critical factor determining their widespread adoption. Current cost estimates for carbon capture range from $40 to $120 per ton of CO2 captured, with significant variations based on technology type, implementation scale, and source of emissions. Direct air capture (DAC) technologies typically represent the higher end of this spectrum, while post-combustion capture from concentrated industrial sources offers more favorable economics.

Capital expenditure requirements present a substantial barrier to entry, with large-scale carbon capture facilities requiring investments of $500 million to over $1 billion. These high upfront costs necessitate long-term financial planning and often require public-private partnerships or government incentives to achieve financial feasibility.

Operational expenses further impact economic viability, with energy consumption representing 30-60% of ongoing costs. Most carbon capture systems impose a significant energy penalty, reducing overall efficiency of power plants or industrial facilities by 15-30%. This parasitic energy load directly affects the cost-benefit equation and must be factored into comprehensive economic assessments.

Revenue streams for captured carbon remain limited but are expanding. Enhanced oil recovery (EOR) currently provides the most established commercial pathway, valuing CO2 at $20-45 per ton depending on oil prices. Emerging markets for carbon utilization in building materials, synthetic fuels, and chemical feedstocks show promise but lack sufficient scale to drive widespread economic viability.

Policy mechanisms significantly influence the cost-benefit analysis. Carbon pricing schemes, tax credits like the U.S. 45Q, and regulatory frameworks create economic incentives that can transform marginally viable projects into attractive investments. The recent increase of the 45Q tax credit to $85 per ton for stored CO2 has notably improved project economics in the United States.

Break-even analysis indicates most carbon capture projects require a carbon price or equivalent incentive of $50-80 per ton to achieve financial viability without additional revenue streams. This threshold has important implications for policy design and investment decisions. Economies of scale offer pathways to cost reduction, with modeling suggesting that doubling deployment capacity could reduce costs by 10-15% through learning effects and supply chain optimization.

Capital expenditure requirements present a substantial barrier to entry, with large-scale carbon capture facilities requiring investments of $500 million to over $1 billion. These high upfront costs necessitate long-term financial planning and often require public-private partnerships or government incentives to achieve financial feasibility.

Operational expenses further impact economic viability, with energy consumption representing 30-60% of ongoing costs. Most carbon capture systems impose a significant energy penalty, reducing overall efficiency of power plants or industrial facilities by 15-30%. This parasitic energy load directly affects the cost-benefit equation and must be factored into comprehensive economic assessments.

Revenue streams for captured carbon remain limited but are expanding. Enhanced oil recovery (EOR) currently provides the most established commercial pathway, valuing CO2 at $20-45 per ton depending on oil prices. Emerging markets for carbon utilization in building materials, synthetic fuels, and chemical feedstocks show promise but lack sufficient scale to drive widespread economic viability.

Policy mechanisms significantly influence the cost-benefit analysis. Carbon pricing schemes, tax credits like the U.S. 45Q, and regulatory frameworks create economic incentives that can transform marginally viable projects into attractive investments. The recent increase of the 45Q tax credit to $85 per ton for stored CO2 has notably improved project economics in the United States.

Break-even analysis indicates most carbon capture projects require a carbon price or equivalent incentive of $50-80 per ton to achieve financial viability without additional revenue streams. This threshold has important implications for policy design and investment decisions. Economies of scale offer pathways to cost reduction, with modeling suggesting that doubling deployment capacity could reduce costs by 10-15% through learning effects and supply chain optimization.

Policy Frameworks and Incentives

Policy frameworks and incentives play a pivotal role in determining the economic viability and widespread adoption of carbon capture technologies. Currently, the global landscape of carbon capture policy support varies significantly across regions, with some jurisdictions implementing robust incentive structures while others lag behind in creating supportive regulatory environments.

The United States has emerged as a leader through its 45Q tax credit system, which provides up to $85 per metric ton of CO2 permanently sequestered and $60 per ton for CO2 utilized in enhanced oil recovery or other applications. This financial mechanism has catalyzed numerous commercial-scale projects, particularly in industrial sectors with concentrated CO2 streams. The Inflation Reduction Act of 2022 further strengthened these incentives, extending eligibility and increasing credit values.

In the European Union, the Emissions Trading System (ETS) serves as the primary market-based mechanism driving carbon capture investments. By placing a price on carbon emissions, the ETS creates economic incentives for emitters to adopt capture technologies. Complementary programs like the Innovation Fund provide direct financial support for demonstration projects, addressing the high capital costs that often impede deployment.

Direct government subsidies represent another critical policy tool, particularly for early-stage technologies that have not yet achieved commercial viability. Countries including Norway, Canada, and Australia have established dedicated funding programs that cover portions of both capital and operational expenditures for carbon capture facilities, effectively reducing investment risks for private sector participants.

Regulatory frameworks also significantly impact deployment rates. Carbon intensity standards, clean fuel standards, and emissions performance requirements create compliance pathways that can make carbon capture economically attractive even in the absence of direct subsidies. These performance-based approaches offer flexibility in implementation while driving technological innovation.

Public procurement policies represent an emerging incentive mechanism, with governments increasingly specifying low-carbon materials in infrastructure projects. This creates premium markets for products manufactured using carbon capture technologies, such as low-carbon cement and steel, providing revenue certainty for early adopters.

International cooperation frameworks, including carbon border adjustment mechanisms and technology transfer initiatives, are becoming increasingly important as countries seek to harmonize carbon pricing and prevent carbon leakage. These cross-border policies help create consistent market signals that support long-term investment decisions in carbon capture infrastructure.

The United States has emerged as a leader through its 45Q tax credit system, which provides up to $85 per metric ton of CO2 permanently sequestered and $60 per ton for CO2 utilized in enhanced oil recovery or other applications. This financial mechanism has catalyzed numerous commercial-scale projects, particularly in industrial sectors with concentrated CO2 streams. The Inflation Reduction Act of 2022 further strengthened these incentives, extending eligibility and increasing credit values.

In the European Union, the Emissions Trading System (ETS) serves as the primary market-based mechanism driving carbon capture investments. By placing a price on carbon emissions, the ETS creates economic incentives for emitters to adopt capture technologies. Complementary programs like the Innovation Fund provide direct financial support for demonstration projects, addressing the high capital costs that often impede deployment.

Direct government subsidies represent another critical policy tool, particularly for early-stage technologies that have not yet achieved commercial viability. Countries including Norway, Canada, and Australia have established dedicated funding programs that cover portions of both capital and operational expenditures for carbon capture facilities, effectively reducing investment risks for private sector participants.

Regulatory frameworks also significantly impact deployment rates. Carbon intensity standards, clean fuel standards, and emissions performance requirements create compliance pathways that can make carbon capture economically attractive even in the absence of direct subsidies. These performance-based approaches offer flexibility in implementation while driving technological innovation.

Public procurement policies represent an emerging incentive mechanism, with governments increasingly specifying low-carbon materials in infrastructure projects. This creates premium markets for products manufactured using carbon capture technologies, such as low-carbon cement and steel, providing revenue certainty for early adopters.

International cooperation frameworks, including carbon border adjustment mechanisms and technology transfer initiatives, are becoming increasingly important as countries seek to harmonize carbon pricing and prevent carbon leakage. These cross-border policies help create consistent market signals that support long-term investment decisions in carbon capture infrastructure.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!