Evaluating the Future of Carbon Capture Technologies and Patents

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Evolution and Objectives

Carbon capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications across various industries. The journey began in the 1970s with early experiments in carbon dioxide separation, primarily focused on enhanced oil recovery operations. By the 1990s, growing environmental concerns catalyzed more dedicated research into carbon capture as a climate change mitigation strategy, establishing the foundation for modern carbon capture and storage (CCS) technologies.

The evolution accelerated in the early 2000s with the development of post-combustion, pre-combustion, and oxy-fuel combustion capture methods. These approaches represented the first generation of industrial-scale carbon capture solutions, demonstrating technical feasibility while highlighting significant cost and efficiency challenges. The 2010s witnessed the emergence of second-generation technologies featuring improved solvents, sorbents, and membrane systems that substantially reduced energy penalties and operational costs.

Current technological trajectories point toward third-generation solutions incorporating novel materials such as metal-organic frameworks (MOFs), advanced enzyme-based systems, and direct air capture (DAC) technologies capable of extracting CO2 directly from ambient air. These innovations represent a paradigm shift from traditional point-source capture to more versatile and potentially scalable approaches that could address both industrial emissions and atmospheric carbon dioxide levels.

The primary objectives driving carbon capture technology development include achieving substantial cost reductions to below $50 per ton of CO2 captured, minimizing energy penalties to less than 20% of power plant output, and developing systems capable of capturing at least 90% of carbon emissions from various sources. Additional goals include improving the durability and reliability of capture systems under real-world industrial conditions and developing versatile technologies applicable across diverse emission sources.

Long-term strategic objectives extend beyond mere capture to encompass the entire carbon value chain, including transportation infrastructure, geological storage capacity, and carbon utilization pathways. The ultimate aim is to establish carbon capture as an economically viable climate solution that can be deployed at gigaton scale by 2050, contributing significantly to global net-zero emissions targets while creating new economic opportunities through carbon-negative industries and circular carbon economy principles.

Patent activity in this field has grown exponentially, with innovation clusters forming around solvent chemistry, novel materials, process integration, and utilization technologies, signaling both technological maturity and substantial remaining innovation potential.

The evolution accelerated in the early 2000s with the development of post-combustion, pre-combustion, and oxy-fuel combustion capture methods. These approaches represented the first generation of industrial-scale carbon capture solutions, demonstrating technical feasibility while highlighting significant cost and efficiency challenges. The 2010s witnessed the emergence of second-generation technologies featuring improved solvents, sorbents, and membrane systems that substantially reduced energy penalties and operational costs.

Current technological trajectories point toward third-generation solutions incorporating novel materials such as metal-organic frameworks (MOFs), advanced enzyme-based systems, and direct air capture (DAC) technologies capable of extracting CO2 directly from ambient air. These innovations represent a paradigm shift from traditional point-source capture to more versatile and potentially scalable approaches that could address both industrial emissions and atmospheric carbon dioxide levels.

The primary objectives driving carbon capture technology development include achieving substantial cost reductions to below $50 per ton of CO2 captured, minimizing energy penalties to less than 20% of power plant output, and developing systems capable of capturing at least 90% of carbon emissions from various sources. Additional goals include improving the durability and reliability of capture systems under real-world industrial conditions and developing versatile technologies applicable across diverse emission sources.

Long-term strategic objectives extend beyond mere capture to encompass the entire carbon value chain, including transportation infrastructure, geological storage capacity, and carbon utilization pathways. The ultimate aim is to establish carbon capture as an economically viable climate solution that can be deployed at gigaton scale by 2050, contributing significantly to global net-zero emissions targets while creating new economic opportunities through carbon-negative industries and circular carbon economy principles.

Patent activity in this field has grown exponentially, with innovation clusters forming around solvent chemistry, novel materials, process integration, and utilization technologies, signaling both technological maturity and substantial remaining innovation potential.

Market Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing environmental concerns and regulatory pressures to reduce greenhouse gas emissions. Currently valued at approximately $2.1 billion in 2023, the market is projected to reach $7.3 billion by 2030, representing a compound annual growth rate (CAGR) of 19.2%. This robust growth trajectory is supported by substantial government investments, with countries like the United States allocating $12 billion for carbon capture development through the Infrastructure Investment and Jobs Act.

The demand for carbon capture solutions spans multiple sectors, with power generation, cement production, and chemical manufacturing representing the largest market segments. The power generation sector alone accounts for nearly 40% of the current market share, as coal and natural gas plants seek to reduce their carbon footprint while maintaining operational viability. Industrial applications, particularly in hard-to-abate sectors like steel and cement, represent the fastest-growing segment with a projected CAGR of 23.5% through 2030.

Geographically, North America currently leads the market with approximately 35% share, followed by Europe at 30% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to witness the highest growth rate in the coming decade, driven by China's ambitious carbon neutrality goals and increasing industrial adoption in countries like Japan and South Korea.

The market is segmented by technology type, with post-combustion capture currently dominating at 65% market share due to its retrofit compatibility with existing infrastructure. Pre-combustion and oxy-fuel combustion technologies hold smaller but growing segments. Direct air capture (DAC), though currently representing less than 5% of the market, is projected to be the fastest-growing technology segment with potential CAGR exceeding 30% as costs decrease and efficiency improves.

Customer willingness to pay remains a significant market challenge, with current carbon capture costs ranging from $40-120 per ton of CO₂ depending on the technology and application. Market adoption is heavily influenced by carbon pricing mechanisms, with regions implementing carbon taxes or cap-and-trade systems showing accelerated deployment of carbon capture solutions.

The competitive landscape features both established industrial giants and innovative startups. Major players like Mitsubishi Heavy Industries, Fluor Corporation, and Aker Solutions control approximately 45% of the current market, while venture capital investment in carbon capture startups has surged to $1.9 billion in 2022, a 300% increase from 2020 levels, indicating strong market confidence in emerging technologies and solutions.

The demand for carbon capture solutions spans multiple sectors, with power generation, cement production, and chemical manufacturing representing the largest market segments. The power generation sector alone accounts for nearly 40% of the current market share, as coal and natural gas plants seek to reduce their carbon footprint while maintaining operational viability. Industrial applications, particularly in hard-to-abate sectors like steel and cement, represent the fastest-growing segment with a projected CAGR of 23.5% through 2030.

Geographically, North America currently leads the market with approximately 35% share, followed by Europe at 30% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to witness the highest growth rate in the coming decade, driven by China's ambitious carbon neutrality goals and increasing industrial adoption in countries like Japan and South Korea.

The market is segmented by technology type, with post-combustion capture currently dominating at 65% market share due to its retrofit compatibility with existing infrastructure. Pre-combustion and oxy-fuel combustion technologies hold smaller but growing segments. Direct air capture (DAC), though currently representing less than 5% of the market, is projected to be the fastest-growing technology segment with potential CAGR exceeding 30% as costs decrease and efficiency improves.

Customer willingness to pay remains a significant market challenge, with current carbon capture costs ranging from $40-120 per ton of CO₂ depending on the technology and application. Market adoption is heavily influenced by carbon pricing mechanisms, with regions implementing carbon taxes or cap-and-trade systems showing accelerated deployment of carbon capture solutions.

The competitive landscape features both established industrial giants and innovative startups. Major players like Mitsubishi Heavy Industries, Fluor Corporation, and Aker Solutions control approximately 45% of the current market, while venture capital investment in carbon capture startups has surged to $1.9 billion in 2022, a 300% increase from 2020 levels, indicating strong market confidence in emerging technologies and solutions.

Global Carbon Capture Landscape and Barriers

Carbon capture technologies have evolved significantly over the past two decades, with global deployment accelerating in response to climate change imperatives. Currently, there are approximately 35 commercial-scale carbon capture facilities operating worldwide, with the majority concentrated in North America and Europe. These facilities collectively capture about 40 million tonnes of CO2 annually, representing less than 0.1% of global emissions—highlighting the vast gap between current capabilities and climate goals.

The geographical distribution of carbon capture innovation reveals significant disparities. The United States leads with approximately 40% of carbon capture patents, followed by China (15%), Japan (10%), and the European Union (20%). This concentration of intellectual property creates barriers to global technology diffusion, particularly affecting developing nations where carbon-intensive industries are expanding rapidly.

Technical barriers remain substantial across the carbon capture value chain. Post-combustion capture technologies still struggle with energy penalties of 15-30%, significantly reducing plant efficiency. Pre-combustion and oxy-fuel combustion systems face high capital costs and integration challenges with existing infrastructure. Direct air capture (DAC), while promising for addressing distributed emissions, currently costs between $250-600 per tonne of CO2—far above the carbon price in most markets.

Regulatory frameworks present another significant barrier, with inconsistent carbon pricing mechanisms across jurisdictions creating market uncertainty. The global average carbon price remains below $30 per tonne, insufficient to drive widespread adoption of most carbon capture technologies which require $50-100 per tonne to achieve economic viability.

Infrastructure limitations further constrain deployment, with CO2 transportation networks and storage sites underdeveloped in most regions. The total global geological storage capacity is estimated at 8,000-55,000 gigatonnes of CO2, theoretically sufficient for centuries of emissions, yet characterized access points remain limited and unevenly distributed geographically.

Public perception and social acceptance issues create additional barriers, particularly regarding geological storage safety and potential leakage risks. Studies indicate that approximately 30% of the public in developed nations express concerns about carbon storage projects in their communities, necessitating greater transparency and community engagement.

Financial barriers remain perhaps the most significant constraint, with carbon capture projects typically requiring 20-30% higher capital investment than unabated facilities. The current global investment in carbon capture technologies stands at approximately $3 billion annually—less than 5% of what the International Energy Agency estimates is needed to align with Paris Agreement goals.

The geographical distribution of carbon capture innovation reveals significant disparities. The United States leads with approximately 40% of carbon capture patents, followed by China (15%), Japan (10%), and the European Union (20%). This concentration of intellectual property creates barriers to global technology diffusion, particularly affecting developing nations where carbon-intensive industries are expanding rapidly.

Technical barriers remain substantial across the carbon capture value chain. Post-combustion capture technologies still struggle with energy penalties of 15-30%, significantly reducing plant efficiency. Pre-combustion and oxy-fuel combustion systems face high capital costs and integration challenges with existing infrastructure. Direct air capture (DAC), while promising for addressing distributed emissions, currently costs between $250-600 per tonne of CO2—far above the carbon price in most markets.

Regulatory frameworks present another significant barrier, with inconsistent carbon pricing mechanisms across jurisdictions creating market uncertainty. The global average carbon price remains below $30 per tonne, insufficient to drive widespread adoption of most carbon capture technologies which require $50-100 per tonne to achieve economic viability.

Infrastructure limitations further constrain deployment, with CO2 transportation networks and storage sites underdeveloped in most regions. The total global geological storage capacity is estimated at 8,000-55,000 gigatonnes of CO2, theoretically sufficient for centuries of emissions, yet characterized access points remain limited and unevenly distributed geographically.

Public perception and social acceptance issues create additional barriers, particularly regarding geological storage safety and potential leakage risks. Studies indicate that approximately 30% of the public in developed nations express concerns about carbon storage projects in their communities, necessitating greater transparency and community engagement.

Financial barriers remain perhaps the most significant constraint, with carbon capture projects typically requiring 20-30% higher capital investment than unabated facilities. The current global investment in carbon capture technologies stands at approximately $3 billion annually—less than 5% of what the International Energy Agency estimates is needed to align with Paris Agreement goals.

Current Carbon Capture Implementation Approaches

01 Direct Air Capture Technologies

Direct air capture (DAC) technologies involve systems that extract carbon dioxide directly from the atmosphere. These technologies typically use sorbent materials or chemical solutions to selectively capture CO2 from ambient air. After capture, the CO2 can be concentrated and either stored underground or utilized in various applications. DAC systems can be deployed in various locations regardless of emission sources and represent a promising approach for negative emissions.- Direct Air Capture Technologies: Direct air capture (DAC) technologies involve systems that extract carbon dioxide directly from the atmosphere. These technologies typically use sorbent materials or chemical solutions to selectively capture CO2 from ambient air. After capture, the CO2 can be concentrated, compressed, and either stored underground or utilized in various applications. DAC systems can be deployed in various locations regardless of emission sources and offer a solution for addressing historical emissions.

- Post-Combustion Carbon Capture: Post-combustion carbon capture technologies focus on removing CO2 from flue gases after the combustion process in power plants and industrial facilities. These systems typically employ chemical absorption using amine-based solvents or other advanced materials that selectively bind with CO2. The captured carbon dioxide is then separated, compressed, and prepared for transportation and storage. This approach allows retrofitting existing power plants and industrial facilities without major modifications to the original combustion process.

- Biological Carbon Sequestration Methods: Biological carbon sequestration leverages natural processes to capture and store carbon dioxide. These methods include enhanced forestry management, agricultural practices that increase soil carbon content, algae-based capture systems, and engineered biological systems. Microorganisms and plants are utilized to absorb CO2 through photosynthesis or other metabolic processes. These approaches often provide co-benefits such as improved soil health, increased biodiversity, and enhanced ecosystem services while capturing carbon at relatively lower costs compared to some technological solutions.

- Carbon Mineralization and Geological Storage: Carbon mineralization involves converting CO2 into stable carbonate minerals through reaction with metal oxides found in certain rock types. This process can occur naturally but is accelerated in engineered systems. Geological storage involves injecting captured CO2 into deep underground formations such as depleted oil and gas reservoirs, unminable coal seams, or saline aquifers where it can be trapped for long periods. These approaches offer permanent storage solutions for captured carbon dioxide, preventing its release back into the atmosphere.

- Carbon Utilization and Conversion Technologies: Carbon utilization technologies convert captured CO2 into valuable products rather than simply storing it. These processes transform carbon dioxide into fuels, chemicals, building materials, and other commercial products. Methods include catalytic conversion, electrochemical reduction, thermochemical processes, and biological conversion pathways. By creating economic value from captured carbon, these technologies help offset the costs of carbon capture while reducing the carbon footprint of conventional product manufacturing processes.

02 Post-Combustion Carbon Capture

Post-combustion carbon capture technologies focus on removing CO2 from flue gases after the combustion process in power plants and industrial facilities. These systems typically employ chemical absorption using amine-based solvents or other capture media to selectively remove CO2 from exhaust streams. The captured CO2 is then separated, compressed, and prepared for transport and storage. This approach allows retrofitting existing facilities without major modifications to the primary energy production process.Expand Specific Solutions03 Carbon Utilization and Conversion

Carbon utilization technologies focus on converting captured CO2 into valuable products rather than simply storing it. These processes transform CO2 into fuels, chemicals, building materials, or other commercial products. Methods include catalytic conversion, electrochemical reduction, mineralization, and biological conversion using microorganisms. By creating economic value from captured carbon, these technologies aim to improve the financial viability of carbon capture while reducing net emissions through carbon recycling.Expand Specific Solutions04 Biological Carbon Sequestration

Biological carbon sequestration leverages natural processes to capture and store carbon dioxide. These approaches include enhanced forestry management, agricultural practices that increase soil carbon content, algae cultivation systems, and engineered biological systems. Microorganisms and plants are utilized to absorb CO2 through photosynthesis or other metabolic processes. These methods often provide co-benefits such as improved soil health, increased biodiversity, and enhanced ecosystem services while capturing carbon at relatively low costs.Expand Specific Solutions05 Novel Materials and Processes for Carbon Capture

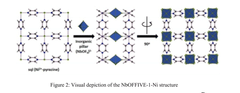

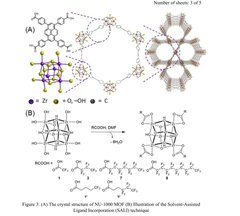

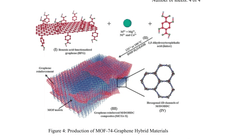

Advanced materials and innovative processes are being developed to improve the efficiency and reduce the costs of carbon capture. These include metal-organic frameworks (MOFs), specialized membranes, ionic liquids, and other engineered sorbents with high selectivity for CO2. Novel process designs incorporate temperature or pressure swing adsorption, membrane separation, or hybrid systems that combine multiple capture mechanisms. These technologies aim to overcome the energy penalties and high costs associated with conventional carbon capture methods.Expand Specific Solutions

Leading Carbon Capture Industry Stakeholders

The carbon capture technology market is currently in a growth phase, with increasing global focus on emissions reduction driving innovation. The market size is projected to expand significantly, reaching approximately $7-10 billion by 2030. Technologically, the field shows varying maturity levels across different capture methods. Industry leaders include energy giants like Saudi Aramco, ExxonMobil, and China Petroleum & Chemical Corp. (Sinopec), who are leveraging their infrastructure advantages. Academic institutions such as MIT and Arizona State University are pioneering next-generation technologies, while specialized firms like 8 Rivers Capital are developing innovative solutions like the Allam-Fetvedt Cycle. International players including Schlumberger and TotalEnergies are advancing cross-border implementation, creating a competitive landscape balanced between established energy companies and emerging technology providers.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed an integrated carbon capture, utilization, and storage (CCUS) technology system focusing on post-combustion capture using advanced amine-based solvents. Their approach includes a proprietary solvent formulation that reduces regeneration energy by approximately 30% compared to conventional MEA solutions. Sinopec has implemented this technology at their Qilu Petrochemical facility, capturing over 1 million tons of CO2 annually and transporting it via pipeline to nearby oil fields for enhanced oil recovery (EOR). Their system incorporates multi-stage absorption columns with optimized packing materials that improve mass transfer efficiency and reduce pressure drop. Additionally, Sinopec has developed heat integration techniques that recover waste heat from various process streams, significantly improving the overall energy efficiency of the capture process. The company has also pioneered membrane-assisted solvent absorption technology that combines the advantages of membrane separation and chemical absorption.

Strengths: Extensive industrial implementation experience with proven large-scale projects; vertical integration capabilities from capture to utilization; proprietary solvent formulations with reduced energy penalties. Weaknesses: Technologies primarily focused on high-concentration CO2 sources from industrial processes rather than direct air capture; relatively high capital costs for initial infrastructure development; continued reliance on fossil fuel production as the end use for captured carbon.

ExxonMobil Technology & Engineering Co.

Technical Solution: ExxonMobil has developed a comprehensive carbon capture portfolio centered around their proprietary Controlled Freeze Zone™ (CFZ) technology and advanced carbonate fuel cell systems. The CFZ technology enables single-step separation of CO2 and other impurities from natural gas through a controlled freezing process, achieving separation efficiencies exceeding 90% while consuming approximately 30% less energy than conventional amine scrubbing methods. Their carbonate fuel cell approach simultaneously generates electricity while concentrating and capturing CO2, addressing the energy penalty issue that plagues traditional capture methods. ExxonMobil has also pioneered advanced metal-organic framework (MOF) materials with tailored pore structures that can selectively adsorb CO2 at lower energy costs. Their integrated approach includes novel process configurations that optimize pressure swing adsorption cycles, reducing parasitic energy loads by up to 25% compared to first-generation systems. ExxonMobil's CCS technology roadmap includes direct air capture research focusing on novel sorbent materials that can function effectively at atmospheric CO2 concentrations.

Strengths: Diverse technology portfolio spanning multiple capture approaches; significant R&D resources and testing capabilities; integration with existing oil and gas infrastructure for storage and utilization. Weaknesses: Technologies still heavily oriented toward supporting continued fossil fuel production through enhanced oil recovery; limited commercial-scale direct air capture deployment; higher costs compared to point-source capture technologies.

Key Carbon Capture Patents and Innovations

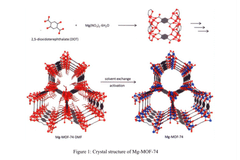

Advanced carbon capture technologies using metal-organic frameworks

PatentPendingIN202441037277A

Innovation

- The development of Metal-Organic Frameworks (MOFs) with tailored compositions, amine-functionalization, and solvent confinement strategies enhances CO2 adsorption capacity, stability, and selectivity, facilitating chemical bonding of CO2 molecules and reducing reactivation energy.

Gaseous co 2 capture systems for improving capture performace, and methods of use thereof

PatentWO2023056011A1

Innovation

- The development of gaseous CO2 capture systems that include a plurality of CO2 sources connected through a common capture constraining element, such as a shared CO2 capture liquid or mineralization system, to improve capture performance metrics like efficiency and cost-effectiveness, and utilize protocols like absorption, adsorption, and membrane transport.

Regulatory Framework and Policy Incentives

The global regulatory landscape for carbon capture technologies has evolved significantly over the past decade, creating a complex framework that both drives and constrains innovation. The Paris Agreement of 2015 marked a pivotal moment, establishing international commitments to reduce carbon emissions and implicitly promoting carbon capture as a viable mitigation strategy. This agreement has catalyzed numerous national policies aimed at accelerating the deployment of carbon capture technologies.

In the United States, the 45Q tax credit has emerged as a cornerstone policy, offering up to $50 per metric ton of CO2 permanently sequestered. This financial incentive has stimulated substantial private investment in carbon capture projects, particularly in the power generation and industrial sectors. The 2021 Infrastructure Investment and Jobs Act further allocated $12 billion specifically for carbon capture development, signaling strong federal commitment to this technology pathway.

The European Union has implemented the Emissions Trading System (ETS), which creates a market-based approach to carbon reduction. By placing a price on carbon emissions, the ETS indirectly incentivizes carbon capture deployment. Additionally, the EU Innovation Fund provides direct financial support for demonstration projects, addressing the high capital costs that often impede commercial-scale implementation.

Regulatory frameworks in Asia present a more varied landscape. China's national carbon market, launched in 2021, represents the world's largest emissions trading system by volume. Japan has established the "Beyond Zero" initiative, which includes substantial funding for carbon capture technologies as part of its strategy to achieve carbon neutrality by 2050.

Policy incentives have increasingly shifted from research and development support to deployment-focused mechanisms. This transition reflects growing recognition that carbon capture technologies have matured sufficiently for commercial application, but require financial support to overcome market barriers. Performance-based incentives, which reward actual carbon reduction rather than merely installed capacity, have gained prominence in recent policy designs.

Patent protection within this regulatory environment presents unique challenges. The cross-border nature of climate change mitigation demands consideration of international patent harmonization, while the public interest in rapid technology diffusion creates tension with traditional intellectual property protections. Several jurisdictions have explored expedited patent examination for climate technologies, including carbon capture innovations, to accelerate market entry.

In the United States, the 45Q tax credit has emerged as a cornerstone policy, offering up to $50 per metric ton of CO2 permanently sequestered. This financial incentive has stimulated substantial private investment in carbon capture projects, particularly in the power generation and industrial sectors. The 2021 Infrastructure Investment and Jobs Act further allocated $12 billion specifically for carbon capture development, signaling strong federal commitment to this technology pathway.

The European Union has implemented the Emissions Trading System (ETS), which creates a market-based approach to carbon reduction. By placing a price on carbon emissions, the ETS indirectly incentivizes carbon capture deployment. Additionally, the EU Innovation Fund provides direct financial support for demonstration projects, addressing the high capital costs that often impede commercial-scale implementation.

Regulatory frameworks in Asia present a more varied landscape. China's national carbon market, launched in 2021, represents the world's largest emissions trading system by volume. Japan has established the "Beyond Zero" initiative, which includes substantial funding for carbon capture technologies as part of its strategy to achieve carbon neutrality by 2050.

Policy incentives have increasingly shifted from research and development support to deployment-focused mechanisms. This transition reflects growing recognition that carbon capture technologies have matured sufficiently for commercial application, but require financial support to overcome market barriers. Performance-based incentives, which reward actual carbon reduction rather than merely installed capacity, have gained prominence in recent policy designs.

Patent protection within this regulatory environment presents unique challenges. The cross-border nature of climate change mitigation demands consideration of international patent harmonization, while the public interest in rapid technology diffusion creates tension with traditional intellectual property protections. Several jurisdictions have explored expedited patent examination for climate technologies, including carbon capture innovations, to accelerate market entry.

Economic Viability and Commercialization Pathways

The economic viability of carbon capture technologies remains a critical factor determining their widespread adoption. Current cost estimates for carbon capture range from $40 to $120 per ton of CO2, depending on the technology and implementation context. This cost structure presents significant challenges for commercialization without supportive policy frameworks or carbon pricing mechanisms.

Market analysis indicates that the global carbon capture market is projected to grow from approximately $2 billion in 2021 to over $7 billion by 2030, representing a compound annual growth rate of about 13.8%. This growth trajectory is primarily driven by increasing regulatory pressures, corporate sustainability commitments, and technological advancements reducing operational costs.

Several commercialization pathways are emerging as viable routes to market. The enhanced oil recovery (EOR) sector currently represents the most established commercial application, where captured carbon is utilized to extract additional oil from depleted wells. This creates a revenue stream that partially offsets capture costs, though it raises questions about net climate benefits.

Direct industrial utilization presents another promising pathway, with captured CO2 being incorporated into building materials, chemicals, and synthetic fuels. These applications could potentially create higher-value markets for captured carbon, improving the overall economics of deployment.

Public-private partnerships have proven essential for early commercial-scale projects. Government initiatives like the U.S. Department of Energy's Carbon Capture Program and the EU Innovation Fund have provided critical capital for demonstration projects that would otherwise struggle to secure private financing due to technology risks and uncertain returns.

Tax incentives, such as the U.S. 45Q tax credit offering up to $50 per ton for sequestered CO2, are significantly improving project economics. Similar mechanisms in Canada, Norway, and the UK are creating regional hubs where carbon capture technologies can achieve commercial viability ahead of broader market adoption.

The development of carbon markets and pricing mechanisms represents perhaps the most important long-term driver for commercialization. As carbon prices increase—whether through compliance markets or voluntary mechanisms—the economic case for carbon capture strengthens proportionally. Analysis suggests that stable carbon prices above $75-100 per ton would make most carbon capture applications economically self-sustaining without additional subsidies.

Market analysis indicates that the global carbon capture market is projected to grow from approximately $2 billion in 2021 to over $7 billion by 2030, representing a compound annual growth rate of about 13.8%. This growth trajectory is primarily driven by increasing regulatory pressures, corporate sustainability commitments, and technological advancements reducing operational costs.

Several commercialization pathways are emerging as viable routes to market. The enhanced oil recovery (EOR) sector currently represents the most established commercial application, where captured carbon is utilized to extract additional oil from depleted wells. This creates a revenue stream that partially offsets capture costs, though it raises questions about net climate benefits.

Direct industrial utilization presents another promising pathway, with captured CO2 being incorporated into building materials, chemicals, and synthetic fuels. These applications could potentially create higher-value markets for captured carbon, improving the overall economics of deployment.

Public-private partnerships have proven essential for early commercial-scale projects. Government initiatives like the U.S. Department of Energy's Carbon Capture Program and the EU Innovation Fund have provided critical capital for demonstration projects that would otherwise struggle to secure private financing due to technology risks and uncertain returns.

Tax incentives, such as the U.S. 45Q tax credit offering up to $50 per ton for sequestered CO2, are significantly improving project economics. Similar mechanisms in Canada, Norway, and the UK are creating regional hubs where carbon capture technologies can achieve commercial viability ahead of broader market adoption.

The development of carbon markets and pricing mechanisms represents perhaps the most important long-term driver for commercialization. As carbon prices increase—whether through compliance markets or voluntary mechanisms—the economic case for carbon capture strengthens proportionally. Analysis suggests that stable carbon prices above $75-100 per ton would make most carbon capture applications economically self-sustaining without additional subsidies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!