How Emerging Technologies are Transforming Carbon Capture

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Technology Evolution and Objectives

Carbon capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications in various industrial settings. The journey began in the 1970s with early experiments in capturing carbon dioxide from power plant emissions, primarily using amine-based chemical absorption processes. These initial efforts were largely driven by enhanced oil recovery applications rather than climate concerns.

By the 1990s, as climate change awareness grew, carbon capture research expanded substantially, with the first commercial-scale projects emerging in the early 2000s. The Sleipner project in Norway, launched in 1996, marked a significant milestone as the first industrial-scale CO2 storage project, demonstrating the feasibility of geological sequestration.

The evolution of carbon capture technologies has followed three distinct generations. First-generation technologies focused on post-combustion capture using solvent-based approaches. Second-generation technologies expanded to include pre-combustion capture and oxy-fuel combustion methods, offering improved efficiency. Today's emerging third-generation technologies represent a paradigm shift, incorporating novel materials like metal-organic frameworks (MOFs), advanced membranes, and direct air capture systems.

The primary objective of modern carbon capture innovation is to dramatically reduce the energy penalty and cost associated with capture processes. Current technologies typically require 20-30% of a power plant's energy output, making widespread adoption economically challenging. Emerging technologies aim to reduce this energy requirement to below 10% while decreasing capture costs from the current $40-80 per ton of CO2 to under $30 per ton.

Another critical objective is scaling carbon capture solutions to meet global climate targets. The International Energy Agency estimates that carbon capture must reach 5.6 gigatons annually by 2050 to limit global warming to 1.5°C. Current capacity stands at approximately 40 megatons, highlighting the enormous scaling challenge ahead.

Technological objectives also include developing versatile solutions applicable across diverse emission sources. While power generation remains important, hard-to-abate sectors like cement, steel, and chemical manufacturing require tailored approaches. Emerging technologies are increasingly designed with cross-sector applicability in mind.

The ultimate goal extends beyond mere capture to creating circular carbon economies where captured CO2 becomes a valuable feedstock for fuels, chemicals, building materials, and other products. This transformation from waste to resource represents the frontier of carbon capture technology evolution, potentially creating economic drivers for widespread adoption while addressing climate imperatives.

By the 1990s, as climate change awareness grew, carbon capture research expanded substantially, with the first commercial-scale projects emerging in the early 2000s. The Sleipner project in Norway, launched in 1996, marked a significant milestone as the first industrial-scale CO2 storage project, demonstrating the feasibility of geological sequestration.

The evolution of carbon capture technologies has followed three distinct generations. First-generation technologies focused on post-combustion capture using solvent-based approaches. Second-generation technologies expanded to include pre-combustion capture and oxy-fuel combustion methods, offering improved efficiency. Today's emerging third-generation technologies represent a paradigm shift, incorporating novel materials like metal-organic frameworks (MOFs), advanced membranes, and direct air capture systems.

The primary objective of modern carbon capture innovation is to dramatically reduce the energy penalty and cost associated with capture processes. Current technologies typically require 20-30% of a power plant's energy output, making widespread adoption economically challenging. Emerging technologies aim to reduce this energy requirement to below 10% while decreasing capture costs from the current $40-80 per ton of CO2 to under $30 per ton.

Another critical objective is scaling carbon capture solutions to meet global climate targets. The International Energy Agency estimates that carbon capture must reach 5.6 gigatons annually by 2050 to limit global warming to 1.5°C. Current capacity stands at approximately 40 megatons, highlighting the enormous scaling challenge ahead.

Technological objectives also include developing versatile solutions applicable across diverse emission sources. While power generation remains important, hard-to-abate sectors like cement, steel, and chemical manufacturing require tailored approaches. Emerging technologies are increasingly designed with cross-sector applicability in mind.

The ultimate goal extends beyond mere capture to creating circular carbon economies where captured CO2 becomes a valuable feedstock for fuels, chemicals, building materials, and other products. This transformation from waste to resource represents the frontier of carbon capture technology evolution, potentially creating economic drivers for widespread adoption while addressing climate imperatives.

Market Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing environmental concerns and regulatory pressures. As of 2023, the market size has reached approximately $7 billion, with projections indicating expansion to $20 billion by 2030, representing a compound annual growth rate (CAGR) of over 16%. This growth trajectory is supported by substantial government investments, with the United States allocating $12 billion for carbon capture development through the Infrastructure Investment and Jobs Act, and the European Union committing €10 billion through various climate initiatives.

Market segmentation reveals distinct sectors within carbon capture solutions. Post-combustion capture currently dominates with 65% market share, while pre-combustion and oxy-fuel combustion technologies account for 25% and 10% respectively. From an application perspective, power generation represents the largest segment at 40%, followed by industrial processes (30%), natural gas processing (20%), and other applications (10%).

Regional analysis shows North America leading the market with 35% share, driven by favorable policies and substantial private investments. Europe follows closely at 30%, with the Asia-Pacific region showing the fastest growth rate at 22% annually, primarily led by China and Japan's aggressive decarbonization strategies.

Customer demand patterns indicate a shift from purely compliance-driven adoption to strategic implementation as part of broader ESG (Environmental, Social, and Governance) initiatives. Large industrial emitters, particularly in cement, steel, and chemical manufacturing, represent the most significant customer segment, accounting for approximately 55% of market demand.

Pricing models for carbon capture solutions vary widely, with current costs ranging from $40-$120 per ton of CO₂ captured. However, emerging technologies are demonstrating potential to reduce these costs to $25-$30 per ton within the next decade, which would significantly expand market adoption beyond regulatory compliance.

Market barriers include high capital expenditure requirements, uncertain regulatory frameworks in developing markets, and infrastructure limitations for carbon transport and storage. Despite these challenges, venture capital funding for carbon capture startups has increased by 300% since 2019, indicating strong investor confidence in the sector's growth potential.

The competitive landscape features established industrial gas companies like Air Liquide and Linde, specialized carbon capture firms such as Carbon Engineering and Climeworks, and recent entrants from adjacent technology sectors. Market consolidation is expected as technologies mature, with strategic partnerships between technology providers and large industrial emitters becoming increasingly common.

Market segmentation reveals distinct sectors within carbon capture solutions. Post-combustion capture currently dominates with 65% market share, while pre-combustion and oxy-fuel combustion technologies account for 25% and 10% respectively. From an application perspective, power generation represents the largest segment at 40%, followed by industrial processes (30%), natural gas processing (20%), and other applications (10%).

Regional analysis shows North America leading the market with 35% share, driven by favorable policies and substantial private investments. Europe follows closely at 30%, with the Asia-Pacific region showing the fastest growth rate at 22% annually, primarily led by China and Japan's aggressive decarbonization strategies.

Customer demand patterns indicate a shift from purely compliance-driven adoption to strategic implementation as part of broader ESG (Environmental, Social, and Governance) initiatives. Large industrial emitters, particularly in cement, steel, and chemical manufacturing, represent the most significant customer segment, accounting for approximately 55% of market demand.

Pricing models for carbon capture solutions vary widely, with current costs ranging from $40-$120 per ton of CO₂ captured. However, emerging technologies are demonstrating potential to reduce these costs to $25-$30 per ton within the next decade, which would significantly expand market adoption beyond regulatory compliance.

Market barriers include high capital expenditure requirements, uncertain regulatory frameworks in developing markets, and infrastructure limitations for carbon transport and storage. Despite these challenges, venture capital funding for carbon capture startups has increased by 300% since 2019, indicating strong investor confidence in the sector's growth potential.

The competitive landscape features established industrial gas companies like Air Liquide and Linde, specialized carbon capture firms such as Carbon Engineering and Climeworks, and recent entrants from adjacent technology sectors. Market consolidation is expected as technologies mature, with strategic partnerships between technology providers and large industrial emitters becoming increasingly common.

Global Carbon Capture Landscape and Barriers

Carbon capture technologies have evolved significantly over the past decades, with global deployment currently reaching approximately 40 megatons of CO2 captured annually. However, this represents less than 0.1% of global emissions, highlighting the substantial gap between current implementation and climate mitigation needs. The landscape is characterized by uneven development, with North America and Europe leading in both research and deployment, while emerging economies like China and India are rapidly scaling up their carbon capture initiatives to balance industrial growth with emissions reduction commitments.

The current global carbon capture infrastructure faces several critical barriers that impede widespread adoption. Technical challenges remain prominent, particularly in capture efficiency and energy requirements. Most commercial systems operate at 85-95% capture efficiency but consume 15-30% of a power plant's energy output, creating a significant energy penalty. Cost factors present another substantial obstacle, with current capture costs ranging from $40-120 per ton of CO2 depending on the source and technology, making economic viability difficult without strong policy support.

Regulatory frameworks vary dramatically across regions, creating an inconsistent landscape for technology developers and investors. While countries like Norway and Canada have established comprehensive carbon pricing and storage regulations, many nations lack clear legal frameworks for CO2 transport and storage liability, creating uncertainty for project developers. This regulatory patchwork significantly slows cross-border technology transfer and standardization efforts.

Infrastructure limitations further constrain expansion, as CO2 transport networks remain underdeveloped in most regions. The global CO2 pipeline network spans approximately 8,000 kilometers, predominantly in North America, leaving other regions with insufficient transport capacity. Additionally, geological storage capacity assessment remains incomplete in many regions, creating uncertainty about long-term storage potential.

Public perception and social acceptance represent increasingly important barriers, with community resistance to storage sites emerging as a significant project risk factor. Studies indicate that approximately 30-40% of proposed carbon capture projects face delays or cancellations due to public opposition, highlighting the need for improved stakeholder engagement strategies.

The financing gap remains perhaps the most pressing barrier, with current investment levels at approximately $3-4 billion annually, far below the estimated $50-100 billion required by 2030 to align with climate goals. Traditional financing mechanisms struggle with the long development timelines and uncertain revenue streams characteristic of carbon capture projects, necessitating innovative financing approaches and stronger policy support mechanisms.

The current global carbon capture infrastructure faces several critical barriers that impede widespread adoption. Technical challenges remain prominent, particularly in capture efficiency and energy requirements. Most commercial systems operate at 85-95% capture efficiency but consume 15-30% of a power plant's energy output, creating a significant energy penalty. Cost factors present another substantial obstacle, with current capture costs ranging from $40-120 per ton of CO2 depending on the source and technology, making economic viability difficult without strong policy support.

Regulatory frameworks vary dramatically across regions, creating an inconsistent landscape for technology developers and investors. While countries like Norway and Canada have established comprehensive carbon pricing and storage regulations, many nations lack clear legal frameworks for CO2 transport and storage liability, creating uncertainty for project developers. This regulatory patchwork significantly slows cross-border technology transfer and standardization efforts.

Infrastructure limitations further constrain expansion, as CO2 transport networks remain underdeveloped in most regions. The global CO2 pipeline network spans approximately 8,000 kilometers, predominantly in North America, leaving other regions with insufficient transport capacity. Additionally, geological storage capacity assessment remains incomplete in many regions, creating uncertainty about long-term storage potential.

Public perception and social acceptance represent increasingly important barriers, with community resistance to storage sites emerging as a significant project risk factor. Studies indicate that approximately 30-40% of proposed carbon capture projects face delays or cancellations due to public opposition, highlighting the need for improved stakeholder engagement strategies.

The financing gap remains perhaps the most pressing barrier, with current investment levels at approximately $3-4 billion annually, far below the estimated $50-100 billion required by 2030 to align with climate goals. Traditional financing mechanisms struggle with the long development timelines and uncertain revenue streams characteristic of carbon capture projects, necessitating innovative financing approaches and stronger policy support mechanisms.

Current Carbon Capture Methodologies

01 Direct Air Capture (DAC) Technologies

Direct Air Capture technologies involve systems that extract carbon dioxide directly from the atmosphere. These technologies typically use sorbents or solvents to selectively capture CO2 from ambient air, which can then be concentrated and stored or utilized. DAC systems can be deployed in various locations regardless of emission sources and represent a promising approach for negative emissions to address historical CO2 emissions.- Direct Air Capture (DAC) Technologies: Direct Air Capture technologies involve systems that extract carbon dioxide directly from the atmosphere. These technologies typically use sorbent materials or chemical processes to selectively capture CO2 from ambient air. After capture, the CO2 can be concentrated and either stored underground or transformed into useful products. DAC systems are being developed as scalable solutions that can be deployed in various locations regardless of emission sources.

- Carbon Capture and Utilization (CCU): Carbon Capture and Utilization focuses on transforming captured CO2 into valuable products rather than simply storing it. These technologies convert carbon dioxide into fuels, chemicals, building materials, and other commercial products. CCU approaches include catalytic conversion, electrochemical reduction, biological conversion using microorganisms, and mineralization processes. By creating economic value from captured carbon, these technologies aim to create sustainable carbon cycles and provide financial incentives for carbon capture.

- Biological Carbon Sequestration Systems: Biological carbon sequestration leverages natural processes to capture and store carbon dioxide. These technologies include enhanced forest management, algae cultivation systems, biochar production, and engineered microorganisms designed to accelerate carbon fixation. Biological approaches often offer co-benefits such as improved soil health, increased biodiversity, and sustainable biomass production. These systems can be integrated with other carbon capture technologies to create hybrid solutions with improved efficiency.

- Industrial Point-Source Carbon Capture: Industrial point-source carbon capture technologies focus on capturing CO2 emissions directly from industrial facilities and power plants before they enter the atmosphere. These systems typically employ absorption, adsorption, membrane separation, or cryogenic processes to separate CO2 from flue gases. Recent innovations include advanced solvents with lower energy requirements, novel membrane materials with higher selectivity, and process optimizations that reduce the overall cost of capture. These technologies are particularly important for hard-to-abate sectors like cement, steel, and chemical production.

- Carbon Transformation and Storage Infrastructure: Carbon transformation and storage infrastructure encompasses the systems needed to transport, process, and permanently store captured carbon dioxide. This includes pipeline networks, compression facilities, injection wells, monitoring systems, and geological storage sites. Recent innovations focus on reducing infrastructure costs, improving monitoring technologies, enhancing storage security, and developing regulatory frameworks. These infrastructure systems are essential for scaling carbon capture technologies and ensuring the permanent removal of CO2 from the atmosphere.

02 Carbon Capture and Utilization (CCU)

Carbon Capture and Utilization technologies focus on transforming captured CO2 into valuable products rather than simply storing it. These processes convert carbon dioxide into fuels, chemicals, building materials, and other commercial products. CCU approaches include catalytic conversion, electrochemical reduction, mineralization, and biological conversion methods that create economic value while reducing net carbon emissions.Expand Specific Solutions03 Enhanced Biological Carbon Sequestration

Enhanced biological carbon sequestration leverages natural processes to increase carbon uptake and storage in ecosystems. These technologies include advanced forestry management, biochar production, enhanced weathering, ocean fertilization, and agricultural practices that increase soil carbon content. By enhancing natural carbon sinks, these approaches offer scalable and potentially cost-effective methods for atmospheric carbon removal.Expand Specific Solutions04 Industrial Carbon Capture Systems

Industrial carbon capture systems are designed to capture CO2 emissions from large point sources such as power plants, cement factories, and steel mills. These technologies include post-combustion capture, pre-combustion capture, and oxy-fuel combustion systems. Advanced sorbents, membranes, and cryogenic separation methods are being developed to increase efficiency and reduce the energy penalty associated with carbon capture in industrial settings.Expand Specific Solutions05 Carbon Storage and Transformation Infrastructure

Carbon storage and transformation infrastructure encompasses the systems needed to transport, store, and monitor captured CO2. This includes pipeline networks, geological storage facilities, monitoring technologies, and regulatory frameworks. Advanced approaches involve mineral carbonation for permanent storage, integration with renewable energy systems, and development of carbon hubs that connect multiple capture sources with storage or utilization facilities to achieve economies of scale.Expand Specific Solutions

Leading Organizations in Carbon Capture Innovation

The carbon capture technology landscape is evolving rapidly, currently transitioning from early development to commercial scaling phase. The global carbon capture market, valued at approximately $7 billion, is projected to grow significantly as climate policies tighten. Technology maturity varies across players, with companies like Carboncapture Inc. and NuScale Power leading in direct air capture innovations, while established energy giants such as Saudi Aramco and Sinopec focus on industrial carbon capture integration. Academic institutions including Yale University, KAIST, and King Fahd University contribute fundamental research breakthroughs. The competitive landscape features collaboration between private enterprises, research institutions, and government entities, with increasing cross-sector partnerships accelerating technology commercialization and deployment across diverse carbon capture pathways.

Carboncapture, Inc.

Technical Solution: Carboncapture has developed a modular direct air capture (DAC) technology that uses solid sorbents to extract CO2 directly from the atmosphere. Their system employs specialized zeolites that can adsorb CO2 at ambient conditions and release it when heated. The company's approach features stackable, shipping container-sized modules that can be deployed at various scales and locations. Their proprietary temperature swing adsorption process allows for efficient carbon capture with lower energy requirements compared to liquid solvent systems. Carboncapture has also implemented a carbon removal credit system, allowing businesses to purchase carbon removal services to offset their emissions. Their Project Bison in Wyoming aims to remove 5 million tons of CO2 annually by 2030, making it one of the largest DAC projects globally.

Strengths: Modular design allows for scalable deployment and reduced capital costs; solid sorbents require less energy than liquid systems; can be powered by renewable energy sources. Weaknesses: Still requires significant energy for the temperature swing process; zeolite production has its own carbon footprint; technology remains relatively expensive compared to point-source capture methods.

The Trustees of Columbia University in The City of New York

Technical Solution: Columbia University has developed several cutting-edge carbon capture technologies through its Lenfest Center for Sustainable Energy and Earth Institute. Their most notable innovation is a "moisture-swing" sorbent technology that captures CO2 from ambient air using the natural humidity cycle. This passive system requires minimal energy input as it relies on humidity changes to drive the capture and release of carbon dioxide. Columbia researchers have also pioneered artificial photosynthesis systems that use novel catalysts to convert captured CO2 directly into valuable products such as methanol and formic acid. Their work extends to advanced materials science, developing specialized metal-organic frameworks (MOFs) with record-breaking CO2 selectivity and capacity. The university has also created computational models for optimizing carbon capture networks across urban environments, identifying the most efficient placement of capture technologies to maximize carbon removal while minimizing costs. Their latest research focuses on electrochemical capture systems that can operate using intermittent renewable energy sources.

Strengths: Highly innovative approaches that move beyond conventional technologies; passive systems require significantly less energy; strong focus on direct air capture rather than just point sources; integration of capture with utilization pathways. Weaknesses: Many technologies remain at laboratory or small pilot scale; commercialization pathways less defined than industrial players; some approaches face challenges with material durability and long-term stability.

Breakthrough Patents in Carbon Capture Technologies

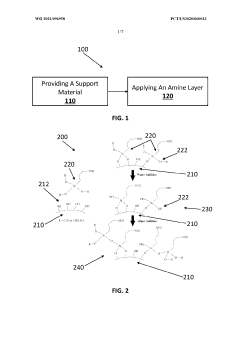

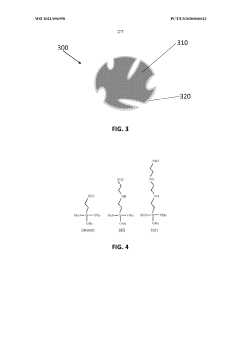

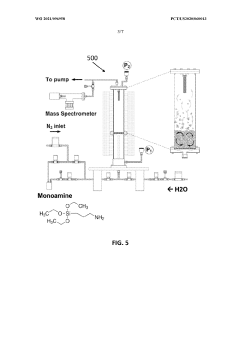

Synthesis process for solid carbon capture materials

PatentWO2021096958A1

Innovation

- The use of molecular layer deposition (MLD) to create amine-functionalized solid CO2 sorbents, which allows for precise angstrom-level thickness control and covalent anchoring of amine layers on a wide range of substrate materials, including nano-powders, enhancing surface area functionalization and maintaining active sites during regeneration without specialized substrates or costly preparation.

Policy Frameworks Influencing Carbon Capture Adoption

The global policy landscape for carbon capture technologies has evolved significantly over the past decade, creating a complex framework that both enables and constrains technological adoption. National and international climate agreements, particularly the Paris Agreement, have established emissions reduction targets that indirectly promote carbon capture as a viable mitigation strategy. These frameworks typically operate through three primary mechanisms: direct subsidies, tax incentives, and regulatory requirements.

In the United States, the 45Q tax credit has emerged as a cornerstone policy, offering up to $50 per metric ton of CO2 permanently sequestered. The Inflation Reduction Act of 2022 further expanded these incentives, increasing credit values and lowering capture thresholds for qualification. Similarly, the EU's Innovation Fund allocates substantial resources to carbon capture projects, while the European Emissions Trading System (ETS) creates market-based incentives through carbon pricing mechanisms.

Regional variations in policy approaches significantly impact technology deployment patterns. Nordic countries have implemented carbon taxes exceeding $100 per ton, creating strong economic cases for capture technologies. In contrast, emerging economies like China and India have focused on pilot projects and technology demonstration rather than broad market mechanisms, reflecting their different development priorities and industrial structures.

Regulatory frameworks addressing liability and monitoring requirements for geological storage sites represent another critical policy dimension. These frameworks must balance rigorous safety standards with practical implementation considerations to avoid creating insurmountable barriers to project development. The EU's CCS Directive and similar frameworks in Canada and Australia provide models for comprehensive regulatory approaches.

Policy stability remains a significant challenge, as carbon capture projects typically require decades-long investment horizons. Historical policy reversals in several jurisdictions have undermined investor confidence, highlighting the need for durable, cross-partisan policy frameworks. Recent trends toward embedding carbon capture in broader industrial policy and economic transformation narratives may help address this challenge.

Cross-border policy coordination presents both opportunities and challenges. Carbon border adjustment mechanisms being developed in several jurisdictions could create additional incentives for carbon capture adoption, while international technology transfer initiatives aim to accelerate deployment in developing economies. However, divergent national approaches to intellectual property protection and technology standards continue to complicate global deployment efforts.

In the United States, the 45Q tax credit has emerged as a cornerstone policy, offering up to $50 per metric ton of CO2 permanently sequestered. The Inflation Reduction Act of 2022 further expanded these incentives, increasing credit values and lowering capture thresholds for qualification. Similarly, the EU's Innovation Fund allocates substantial resources to carbon capture projects, while the European Emissions Trading System (ETS) creates market-based incentives through carbon pricing mechanisms.

Regional variations in policy approaches significantly impact technology deployment patterns. Nordic countries have implemented carbon taxes exceeding $100 per ton, creating strong economic cases for capture technologies. In contrast, emerging economies like China and India have focused on pilot projects and technology demonstration rather than broad market mechanisms, reflecting their different development priorities and industrial structures.

Regulatory frameworks addressing liability and monitoring requirements for geological storage sites represent another critical policy dimension. These frameworks must balance rigorous safety standards with practical implementation considerations to avoid creating insurmountable barriers to project development. The EU's CCS Directive and similar frameworks in Canada and Australia provide models for comprehensive regulatory approaches.

Policy stability remains a significant challenge, as carbon capture projects typically require decades-long investment horizons. Historical policy reversals in several jurisdictions have undermined investor confidence, highlighting the need for durable, cross-partisan policy frameworks. Recent trends toward embedding carbon capture in broader industrial policy and economic transformation narratives may help address this challenge.

Cross-border policy coordination presents both opportunities and challenges. Carbon border adjustment mechanisms being developed in several jurisdictions could create additional incentives for carbon capture adoption, while international technology transfer initiatives aim to accelerate deployment in developing economies. However, divergent national approaches to intellectual property protection and technology standards continue to complicate global deployment efforts.

Economic Viability of Emerging Carbon Capture Solutions

The economic viability of carbon capture technologies has been a significant barrier to widespread adoption. Traditional carbon capture methods have typically cost between $40-100 per ton of CO2 captured, making them prohibitively expensive for commercial implementation without substantial subsidies or carbon pricing mechanisms. However, emerging technologies are dramatically altering this economic equation.

Recent innovations in solvent-based capture systems have reduced energy penalties by up to 30%, translating to operational cost reductions of approximately 25%. These improvements come from novel amine formulations and process optimizations that minimize the energy required for solvent regeneration. Additionally, membrane-based systems have seen manufacturing cost reductions of nearly 40% over the past five years, with performance improvements that allow for more efficient separation at lower pressure differentials.

Direct air capture (DAC) technologies, while still more expensive than point-source capture, have demonstrated promising cost reduction trajectories. Current costs range from $250-600 per ton, but projections based on learning curves and economies of scale suggest potential costs below $100 per ton by 2035 if deployment accelerates. Companies like Carbon Engineering and Climeworks have secured significant investment to scale their technologies, with each new facility demonstrating improved economics.

The integration of carbon capture with utilization pathways creates additional revenue streams that improve overall economics. Enhanced oil recovery has historically been the primary utilization pathway, valued at $20-40 per ton of CO2. However, emerging applications in concrete curing, synthetic fuels, and polymers offer potentially higher-value markets, with some applications valuing captured carbon at over $100 per ton.

Policy support mechanisms have evolved significantly, with carbon pricing schemes expanding globally and specific incentives for carbon capture deployment increasing. The U.S. 45Q tax credit now offers up to $85 per ton for permanent storage and $60 per ton for utilization, fundamentally altering project economics. Similar mechanisms are emerging in the EU, UK, Canada, and parts of Asia, creating a more favorable investment landscape.

Financial innovation is also contributing to improved economic viability. New business models including carbon capture as a service, risk-sharing arrangements between technology providers and operators, and specialized project finance vehicles are reducing capital barriers. Additionally, corporate commitments to carbon neutrality are creating voluntary markets for negative emissions, providing price support above regulatory minimums.

Recent innovations in solvent-based capture systems have reduced energy penalties by up to 30%, translating to operational cost reductions of approximately 25%. These improvements come from novel amine formulations and process optimizations that minimize the energy required for solvent regeneration. Additionally, membrane-based systems have seen manufacturing cost reductions of nearly 40% over the past five years, with performance improvements that allow for more efficient separation at lower pressure differentials.

Direct air capture (DAC) technologies, while still more expensive than point-source capture, have demonstrated promising cost reduction trajectories. Current costs range from $250-600 per ton, but projections based on learning curves and economies of scale suggest potential costs below $100 per ton by 2035 if deployment accelerates. Companies like Carbon Engineering and Climeworks have secured significant investment to scale their technologies, with each new facility demonstrating improved economics.

The integration of carbon capture with utilization pathways creates additional revenue streams that improve overall economics. Enhanced oil recovery has historically been the primary utilization pathway, valued at $20-40 per ton of CO2. However, emerging applications in concrete curing, synthetic fuels, and polymers offer potentially higher-value markets, with some applications valuing captured carbon at over $100 per ton.

Policy support mechanisms have evolved significantly, with carbon pricing schemes expanding globally and specific incentives for carbon capture deployment increasing. The U.S. 45Q tax credit now offers up to $85 per ton for permanent storage and $60 per ton for utilization, fundamentally altering project economics. Similar mechanisms are emerging in the EU, UK, Canada, and parts of Asia, creating a more favorable investment landscape.

Financial innovation is also contributing to improved economic viability. New business models including carbon capture as a service, risk-sharing arrangements between technology providers and operators, and specialized project finance vehicles are reducing capital barriers. Additionally, corporate commitments to carbon neutrality are creating voluntary markets for negative emissions, providing price support above regulatory minimums.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!