What Market Forces Are Shaping Carbon Capture Technology Adoption

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Technology Evolution and Objectives

Carbon capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications across various industries. The evolution began in the 1970s with early experiments in enhanced oil recovery, where carbon dioxide was injected into oil fields to improve extraction rates. This inadvertently became one of the first commercial applications of carbon capture, though environmental benefits were secondary to economic considerations at that time.

By the 1990s, growing awareness of climate change catalyzed more focused research into carbon capture specifically for emissions reduction. The first dedicated carbon capture and storage (CCS) project was launched in 1996 at the Sleipner gas field in Norway, marking a pivotal moment in the technology's development trajectory. This project demonstrated the feasibility of large-scale geological storage of CO2 and set important precedents for regulatory frameworks.

The 2000s witnessed significant technological diversification, with three main capture approaches emerging: post-combustion capture (removing CO2 from flue gases), pre-combustion capture (converting fuel into hydrogen and CO2 before combustion), and oxy-fuel combustion (burning fuel in pure oxygen). Each pathway offered distinct advantages for different industrial applications, broadening the potential implementation scenarios.

Recent technological innovations have focused on improving efficiency and reducing costs, which have historically been major barriers to widespread adoption. Advanced solvents and sorbents with lower regeneration energy requirements, membrane-based separation technologies, and direct air capture (DAC) systems represent the cutting edge of current development efforts. DAC in particular represents a paradigm shift, as it can address distributed and historical emissions rather than just point sources.

The primary objectives driving carbon capture technology development today include achieving substantial cost reductions to make implementation economically viable without heavy subsidies, improving energy efficiency to reduce the parasitic load that capture systems place on power plants, and scaling up to industrial levels that can meaningfully impact global emissions. There is also growing emphasis on developing end-to-end solutions that address not just capture but also transportation, utilization, and permanent storage of captured carbon.

Looking forward, the technology evolution is increasingly focused on carbon utilization pathways that can create value from captured CO2, potentially transforming it from a waste product into a valuable resource for manufacturing processes, building materials, or synthetic fuels. This represents a crucial shift in the conceptualization of carbon capture from purely an emissions reduction strategy to a potential component of a circular carbon economy.

By the 1990s, growing awareness of climate change catalyzed more focused research into carbon capture specifically for emissions reduction. The first dedicated carbon capture and storage (CCS) project was launched in 1996 at the Sleipner gas field in Norway, marking a pivotal moment in the technology's development trajectory. This project demonstrated the feasibility of large-scale geological storage of CO2 and set important precedents for regulatory frameworks.

The 2000s witnessed significant technological diversification, with three main capture approaches emerging: post-combustion capture (removing CO2 from flue gases), pre-combustion capture (converting fuel into hydrogen and CO2 before combustion), and oxy-fuel combustion (burning fuel in pure oxygen). Each pathway offered distinct advantages for different industrial applications, broadening the potential implementation scenarios.

Recent technological innovations have focused on improving efficiency and reducing costs, which have historically been major barriers to widespread adoption. Advanced solvents and sorbents with lower regeneration energy requirements, membrane-based separation technologies, and direct air capture (DAC) systems represent the cutting edge of current development efforts. DAC in particular represents a paradigm shift, as it can address distributed and historical emissions rather than just point sources.

The primary objectives driving carbon capture technology development today include achieving substantial cost reductions to make implementation economically viable without heavy subsidies, improving energy efficiency to reduce the parasitic load that capture systems place on power plants, and scaling up to industrial levels that can meaningfully impact global emissions. There is also growing emphasis on developing end-to-end solutions that address not just capture but also transportation, utilization, and permanent storage of captured carbon.

Looking forward, the technology evolution is increasingly focused on carbon utilization pathways that can create value from captured CO2, potentially transforming it from a waste product into a valuable resource for manufacturing processes, building materials, or synthetic fuels. This represents a crucial shift in the conceptualization of carbon capture from purely an emissions reduction strategy to a potential component of a circular carbon economy.

Global Market Demand Analysis for Carbon Capture

The global carbon capture market is experiencing unprecedented growth driven by increasing climate change concerns and stringent emission regulations worldwide. Current market valuations place the global carbon capture, utilization, and storage (CCUS) market at approximately $2.5 billion in 2022, with projections indicating expansion to reach $7.0 billion by 2030, representing a compound annual growth rate (CAGR) of 13.8%. This robust growth trajectory reflects the urgent need for decarbonization technologies across multiple industrial sectors.

Regional analysis reveals significant variations in market demand patterns. North America currently leads the market with the largest share, accounting for roughly 40% of global carbon capture deployments, primarily due to established enhanced oil recovery (EOR) operations and favorable tax incentives like the 45Q tax credit in the United States. Europe follows closely with approximately 30% market share, driven by ambitious climate targets under the European Green Deal and carbon pricing mechanisms through the EU Emissions Trading System (EU ETS).

The Asia-Pacific region represents the fastest-growing market for carbon capture technologies, with China, Japan, and Australia making substantial investments in demonstration projects and research initiatives. Middle Eastern countries are increasingly exploring carbon capture as a means to reduce emissions while maintaining their position in global energy markets.

Sector-specific demand analysis indicates that power generation and industrial processes (particularly cement, steel, and chemical manufacturing) constitute the primary application areas, collectively accounting for over 70% of the total addressable market. The blue hydrogen production sector is emerging as a significant growth driver, with demand expected to increase by 25% annually through 2030 as countries pursue hydrogen-based energy transitions.

Market demand is further segmented by technology type, with post-combustion capture currently dominating with approximately 65% market share due to its retrofit compatibility with existing infrastructure. Pre-combustion and oxy-fuel combustion technologies are gaining traction in new facility designs, while direct air capture (DAC) represents a small but rapidly growing segment with projected annual growth rates exceeding 30%.

Economic factors significantly influence adoption patterns, with carbon pricing mechanisms being the primary market driver. Regions with carbon prices exceeding $50-60 per ton consistently demonstrate higher technology deployment rates. Additional market forces include corporate net-zero commitments, investor pressure for ESG compliance, and consumer demand for low-carbon products, collectively creating a favorable environment for accelerated carbon capture technology adoption across global markets.

Regional analysis reveals significant variations in market demand patterns. North America currently leads the market with the largest share, accounting for roughly 40% of global carbon capture deployments, primarily due to established enhanced oil recovery (EOR) operations and favorable tax incentives like the 45Q tax credit in the United States. Europe follows closely with approximately 30% market share, driven by ambitious climate targets under the European Green Deal and carbon pricing mechanisms through the EU Emissions Trading System (EU ETS).

The Asia-Pacific region represents the fastest-growing market for carbon capture technologies, with China, Japan, and Australia making substantial investments in demonstration projects and research initiatives. Middle Eastern countries are increasingly exploring carbon capture as a means to reduce emissions while maintaining their position in global energy markets.

Sector-specific demand analysis indicates that power generation and industrial processes (particularly cement, steel, and chemical manufacturing) constitute the primary application areas, collectively accounting for over 70% of the total addressable market. The blue hydrogen production sector is emerging as a significant growth driver, with demand expected to increase by 25% annually through 2030 as countries pursue hydrogen-based energy transitions.

Market demand is further segmented by technology type, with post-combustion capture currently dominating with approximately 65% market share due to its retrofit compatibility with existing infrastructure. Pre-combustion and oxy-fuel combustion technologies are gaining traction in new facility designs, while direct air capture (DAC) represents a small but rapidly growing segment with projected annual growth rates exceeding 30%.

Economic factors significantly influence adoption patterns, with carbon pricing mechanisms being the primary market driver. Regions with carbon prices exceeding $50-60 per ton consistently demonstrate higher technology deployment rates. Additional market forces include corporate net-zero commitments, investor pressure for ESG compliance, and consumer demand for low-carbon products, collectively creating a favorable environment for accelerated carbon capture technology adoption across global markets.

Current Technological Landscape and Barriers

Carbon capture technology currently exists in various stages of development and deployment across the global landscape. The most mature technologies include post-combustion capture, pre-combustion capture, and oxy-fuel combustion systems. Post-combustion technologies, particularly those using amine-based solvents, represent the most widely deployed commercial solutions, with approximately 65% of existing large-scale carbon capture facilities utilizing these methods. However, these established technologies face significant efficiency limitations, typically capturing only 85-95% of emissions while imposing energy penalties of 20-30% on host facilities.

The geographical distribution of carbon capture technology development shows concentration in North America, Europe, and parts of Asia, particularly China and Japan. The United States leads with the highest number of operational large-scale facilities (approximately 12), followed by Canada and Norway. This distribution largely correlates with regions having both strong policy support and geological formations suitable for carbon storage.

Despite progress, several critical technical barriers impede widespread adoption. Energy requirements for capture processes remain prohibitively high, with current technologies consuming between 0.7-1.2 GJ of energy per ton of CO2 captured. This energy penalty significantly impacts the economic viability of projects, particularly in energy-intensive industries with thin profit margins.

Cost factors present another substantial barrier, with current capture costs ranging from $40-120 per ton of CO2 depending on the source and technology employed. Transportation and storage infrastructure adds an additional $10-30 per ton. These economics remain challenging without strong carbon pricing or regulatory frameworks in most markets.

Scale-up challenges persist as technologies move from demonstration to commercial deployment. Many promising technologies that perform well in laboratory settings encounter unforeseen complications when scaled to industrial levels, including issues with material degradation, process stability, and integration with existing industrial systems.

Material limitations also constrain advancement, particularly for next-generation capture technologies. Novel sorbents and membranes often suffer from stability issues under real-world industrial conditions, with performance degradation occurring after repeated capture-release cycles. Additionally, the environmental impact of some capture materials raises sustainability concerns.

Infrastructure gaps represent another significant barrier, as comprehensive CO2 transportation networks and storage facilities remain underdeveloped in most regions. The capital-intensive nature of this infrastructure creates a "chicken-and-egg" problem that slows deployment across industrial clusters.

The geographical distribution of carbon capture technology development shows concentration in North America, Europe, and parts of Asia, particularly China and Japan. The United States leads with the highest number of operational large-scale facilities (approximately 12), followed by Canada and Norway. This distribution largely correlates with regions having both strong policy support and geological formations suitable for carbon storage.

Despite progress, several critical technical barriers impede widespread adoption. Energy requirements for capture processes remain prohibitively high, with current technologies consuming between 0.7-1.2 GJ of energy per ton of CO2 captured. This energy penalty significantly impacts the economic viability of projects, particularly in energy-intensive industries with thin profit margins.

Cost factors present another substantial barrier, with current capture costs ranging from $40-120 per ton of CO2 depending on the source and technology employed. Transportation and storage infrastructure adds an additional $10-30 per ton. These economics remain challenging without strong carbon pricing or regulatory frameworks in most markets.

Scale-up challenges persist as technologies move from demonstration to commercial deployment. Many promising technologies that perform well in laboratory settings encounter unforeseen complications when scaled to industrial levels, including issues with material degradation, process stability, and integration with existing industrial systems.

Material limitations also constrain advancement, particularly for next-generation capture technologies. Novel sorbents and membranes often suffer from stability issues under real-world industrial conditions, with performance degradation occurring after repeated capture-release cycles. Additionally, the environmental impact of some capture materials raises sustainability concerns.

Infrastructure gaps represent another significant barrier, as comprehensive CO2 transportation networks and storage facilities remain underdeveloped in most regions. The capital-intensive nature of this infrastructure creates a "chicken-and-egg" problem that slows deployment across industrial clusters.

Mainstream Carbon Capture Implementation Approaches

01 Direct Air Capture Technologies

Direct air capture (DAC) technologies involve systems that extract carbon dioxide directly from the atmosphere. These technologies use various sorbents and chemical processes to capture CO2 from ambient air, which can then be stored underground or utilized in industrial processes. DAC systems are being developed as standalone facilities or integrated with existing industrial infrastructure to enhance carbon capture efficiency and reduce implementation costs.- Direct Air Capture Technologies: Direct air capture (DAC) technologies involve systems that extract carbon dioxide directly from the atmosphere. These technologies use various sorbents and chemical processes to capture CO2 from ambient air, which can then be stored or utilized. DAC systems are being developed as a key component in carbon management strategies, offering flexibility in deployment locations and the ability to address emissions from distributed sources.

- Carbon Capture in Industrial Processes: Carbon capture technologies integrated into industrial processes focus on capturing CO2 emissions at the source, particularly in high-emission industries such as power generation, cement production, and steel manufacturing. These technologies include post-combustion capture, pre-combustion capture, and oxy-fuel combustion systems that can be retrofitted to existing facilities or incorporated into new plant designs to significantly reduce carbon emissions.

- Economic Incentives and Carbon Markets: Economic frameworks and market mechanisms are being developed to incentivize the adoption of carbon capture technologies. These include carbon pricing systems, tax credits, subsidies, and trading platforms that create financial value for captured carbon. Such economic instruments help offset the high costs of carbon capture implementation and create sustainable business models for technology deployment.

- Carbon Utilization and Conversion: Technologies that focus on converting captured carbon dioxide into valuable products represent an important pathway for carbon capture adoption. These include processes for converting CO2 into fuels, chemicals, building materials, and other commercial products. Carbon utilization creates economic value from captured carbon, potentially offsetting capture costs and creating circular carbon economies.

- Digital Monitoring and Verification Systems: Digital technologies and systems for monitoring, reporting, and verifying carbon capture performance are essential for technology adoption. These include IoT sensors, blockchain-based tracking systems, and AI-powered analytics platforms that provide transparent accounting of captured carbon. Such systems build trust in carbon capture initiatives, support regulatory compliance, and enable participation in carbon markets.

02 Carbon Capture in Industrial Applications

Carbon capture technologies are being integrated into industrial processes, particularly in high-emission sectors such as power generation, cement production, and steel manufacturing. These systems capture CO2 emissions at the source before they enter the atmosphere. The technologies include post-combustion capture, pre-combustion capture, and oxy-fuel combustion methods, which can be tailored to specific industrial applications to maximize capture efficiency while minimizing operational disruptions.Expand Specific Solutions03 Economic Incentives and Carbon Markets

Economic frameworks and carbon markets are being developed to incentivize the adoption of carbon capture technologies. These include carbon pricing mechanisms, tax credits, subsidies, and trading systems that create financial value for captured carbon. Such economic instruments help offset the high costs associated with implementing carbon capture technologies and encourage businesses to invest in emission reduction strategies.Expand Specific Solutions04 Utilization of Captured Carbon

Carbon capture and utilization (CCU) approaches focus on converting captured CO2 into valuable products rather than simply storing it. These technologies transform CO2 into fuels, chemicals, building materials, and other commercial products. CCU creates economic value from captured carbon, potentially making carbon capture more financially viable while reducing the need for geological storage and providing alternatives to fossil-based products.Expand Specific Solutions05 Digital Monitoring and Optimization Systems

Digital technologies are being deployed to enhance the efficiency and effectiveness of carbon capture systems. These include AI-driven optimization algorithms, IoT sensors for real-time monitoring, blockchain for carbon credit verification, and digital twins for system modeling. Such technologies improve operational performance, reduce energy requirements, verify carbon removal claims, and support decision-making for carbon capture deployment and management.Expand Specific Solutions

Industry Leaders and Competitive Dynamics

The carbon capture technology market is currently in a growth phase, with increasing adoption driven by climate change concerns and regulatory pressures. The global market size is projected to expand significantly, reaching approximately $7-10 billion by 2030. Technologically, the field shows varying maturity levels across different capture methods. Leading players include established energy corporations like Sinopec and BASF developing industrial-scale solutions, research institutions such as Columbia University and Zhejiang University advancing fundamental technologies, and innovative startups like Carboncapture Inc. and Daphne Technology introducing disruptive approaches. The competitive landscape features collaboration between traditional energy companies and specialized technology providers, with increasing investment in both post-combustion capture for existing infrastructure and direct air capture technologies for future deployment.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a comprehensive carbon capture technology portfolio focusing on post-combustion capture using advanced amine-based solvents. Their approach includes proprietary solvent formulations that reduce regeneration energy by approximately 30% compared to conventional MEA systems. Sinopec has implemented large-scale CCUS projects across their refineries and petrochemical facilities, with their Qilu-Shengli CCUS project capturing over 1 million tons of CO2 annually for enhanced oil recovery operations. The company has also pioneered integration of carbon capture with existing industrial processes, developing heat integration systems that recover waste heat from industrial operations to power carbon capture processes, reducing the overall energy penalty by up to 25%. Sinopec's technology roadmap includes membrane-based capture systems currently in pilot testing phase that show potential for 40% lower operational costs in specific applications.

Strengths: Extensive industrial implementation experience; vertical integration capabilities from capture to utilization; strong domestic supply chain for equipment manufacturing. Weaknesses: Technologies primarily optimized for their own industrial facilities; relatively higher implementation costs compared to Western competitors; limited international deployment experience outside Asia.

Saipem SpA

Technical Solution: Saipem has developed the CO2 Solutions by Saipem (CSS) technology, an enzymatic carbon capture process that utilizes carbonic anhydrase enzyme as a biocatalyst to dramatically accelerate CO2 absorption rates. This proprietary technology operates at lower temperatures (around 40°C versus 120°C for conventional amine systems) and uses non-toxic, biodegradable solvents resistant to oxygen degradation. The system demonstrates energy consumption reductions of approximately 30-40% compared to conventional amine processes, with regeneration energy requirements as low as 2.5 GJ/tonne of CO2. Saipem has successfully demonstrated this technology at commercial scale with their 30-tonne-per-day unit at the Resolute Forest Products pulp mill in Canada, proving its effectiveness in industrial environments. The company has further enhanced the technology with advanced process integration techniques that allow for efficient heat recovery and utilization of low-grade waste heat, making it particularly suitable for integration with existing industrial facilities.

Strengths: Significantly lower energy requirements than conventional technologies; environmentally benign solvents with minimal degradation; ability to handle flue gases with high oxygen content without solvent degradation. Weaknesses: Enzyme management adds complexity to operations; limited track record at very large scales (>100,000 tonnes/year); higher upfront catalyst costs compared to conventional systems.

Key Patents and Technical Innovations

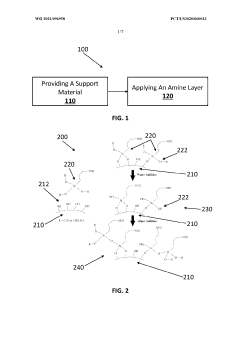

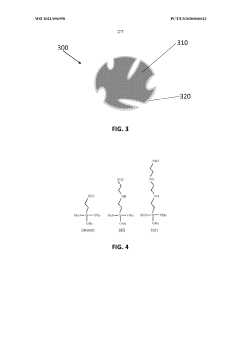

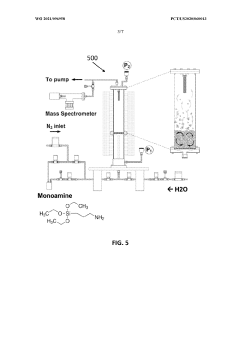

Synthesis process for solid carbon capture materials

PatentWO2021096958A1

Innovation

- The use of molecular layer deposition (MLD) to create amine-functionalized solid CO2 sorbents, which allows for precise angstrom-level thickness control and covalent anchoring of amine layers on a wide range of substrate materials, including nano-powders, enhancing surface area functionalization and maintaining active sites during regeneration without specialized substrates or costly preparation.

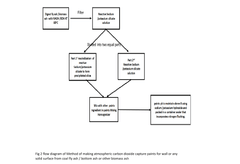

Method of making atmospheric carbon dioxide capture paints for wall or any solid surface from coal fly ash / bottom ash or other biomass ash

PatentPendingIN202321036002A

Innovation

- Development of paints from coal fly ash or biomass ash containing reactive sodium/potassium silicate that react with atmospheric CO2 at normal temperatures and pressures, reducing energy consumption and waste, using a process involving heating ash with sodium/potassium hydroxide, filtration, and mixing with additives to form a paint that captures CO2 through a thermodynamically favorable reaction.

Policy and Regulatory Framework Influence

The policy and regulatory landscape significantly influences the trajectory of carbon capture technology adoption across global markets. Carbon pricing mechanisms, including carbon taxes and cap-and-trade systems, have emerged as primary drivers for investment in carbon capture technologies. The European Union's Emissions Trading System (ETS) has established a benchmark, creating financial incentives for industries to reduce emissions or face increasing costs. Similarly, Canada's federal carbon pricing framework has accelerated interest in carbon capture solutions among heavy emitters.

Tax incentives represent another powerful regulatory tool shaping market dynamics. The United States' 45Q tax credit, enhanced under the Inflation Reduction Act of 2022, provides up to $85 per metric ton of CO2 permanently sequestered, dramatically improving project economics for carbon capture initiatives. This policy shift has catalyzed numerous project announcements across industrial sectors previously hesitant to adopt such technologies.

Direct government funding programs further accelerate technology deployment. The EU Innovation Fund, allocating €10 billion for low-carbon technologies between 2020-2030, has prioritized carbon capture projects. Similarly, the UK's £1 billion Carbon Capture and Storage Infrastructure Fund demonstrates how targeted public investment can de-risk early commercial deployments and attract private capital.

Regulatory standards and mandates create market certainty essential for long-term investment. California's Low Carbon Fuel Standard (LCFS) has established a compliance market that rewards carbon intensity reductions, creating demand for carbon capture technologies in fuel production. Meanwhile, Norway's offshore CO2 storage regulations have provided a clear legal framework for sequestration activities, addressing liability concerns that previously hindered project development.

International agreements, particularly the Paris Climate Accord, have established the policy foundation for national carbon reduction strategies. Countries' Nationally Determined Contributions (NDCs) increasingly recognize carbon capture as necessary for meeting climate targets, especially in hard-to-abate sectors like cement and steel production. This recognition translates into supportive policy environments across multiple jurisdictions.

The interplay between these policy instruments creates complex market signals. Regions with complementary policies—combining carbon pricing, tax incentives, and direct funding—have seen the most robust carbon capture technology adoption. However, regulatory uncertainty and policy discontinuity remain significant barriers, as evidenced by project cancellations following shifts in government support programs in countries like the UK and Australia.

Tax incentives represent another powerful regulatory tool shaping market dynamics. The United States' 45Q tax credit, enhanced under the Inflation Reduction Act of 2022, provides up to $85 per metric ton of CO2 permanently sequestered, dramatically improving project economics for carbon capture initiatives. This policy shift has catalyzed numerous project announcements across industrial sectors previously hesitant to adopt such technologies.

Direct government funding programs further accelerate technology deployment. The EU Innovation Fund, allocating €10 billion for low-carbon technologies between 2020-2030, has prioritized carbon capture projects. Similarly, the UK's £1 billion Carbon Capture and Storage Infrastructure Fund demonstrates how targeted public investment can de-risk early commercial deployments and attract private capital.

Regulatory standards and mandates create market certainty essential for long-term investment. California's Low Carbon Fuel Standard (LCFS) has established a compliance market that rewards carbon intensity reductions, creating demand for carbon capture technologies in fuel production. Meanwhile, Norway's offshore CO2 storage regulations have provided a clear legal framework for sequestration activities, addressing liability concerns that previously hindered project development.

International agreements, particularly the Paris Climate Accord, have established the policy foundation for national carbon reduction strategies. Countries' Nationally Determined Contributions (NDCs) increasingly recognize carbon capture as necessary for meeting climate targets, especially in hard-to-abate sectors like cement and steel production. This recognition translates into supportive policy environments across multiple jurisdictions.

The interplay between these policy instruments creates complex market signals. Regions with complementary policies—combining carbon pricing, tax incentives, and direct funding—have seen the most robust carbon capture technology adoption. However, regulatory uncertainty and policy discontinuity remain significant barriers, as evidenced by project cancellations following shifts in government support programs in countries like the UK and Australia.

Economic Viability and Cost Reduction Pathways

The economic viability of carbon capture technologies remains a critical barrier to widespread adoption. Currently, the cost of capturing one ton of CO2 ranges from $40-120 for industrial applications and $60-150 for direct air capture, making these technologies prohibitively expensive without significant policy support or carbon pricing mechanisms. These high costs stem primarily from energy requirements, equipment capital expenditures, and operational expenses associated with the capture, transportation, and storage processes.

Market analysis indicates several promising cost reduction pathways emerging. Economies of scale represent the most immediate opportunity, with projections suggesting that increasing facility size could reduce unit costs by 30-40% over the next decade. The learning curve effect is also significant, with each doubling of cumulative installed capacity historically delivering 10-15% cost reductions across similar environmental technologies.

Technological innovation continues to drive efficiency improvements in both capture processes and materials. Advanced solvents and sorbents with higher CO2 selectivity and lower regeneration energy requirements could potentially reduce operational costs by 25-35%. Membrane-based systems are showing particular promise, with recent breakthroughs potentially reducing energy penalties by up to 50% compared to first-generation technologies.

Integration with existing industrial processes offers another avenue for improving economic viability. By capturing CO2 at high-concentration sources and utilizing waste heat from industrial operations, companies can significantly reduce the marginal cost of capture. This approach has demonstrated cost reductions of 15-30% in pilot projects across cement, steel, and chemical manufacturing sectors.

The utilization of captured carbon in commercial products represents an emerging value stream that could offset capture costs. The market for CO2-derived products—including building materials, synthetic fuels, and chemicals—is projected to reach $5.9 billion by 2026, growing at a CAGR of 30%. However, these markets remain nascent and cannot yet absorb the volumes needed for climate-relevant deployment.

Policy mechanisms increasingly play a decisive role in economic viability. Carbon pricing, tax credits (such as the expanded 45Q credit in the United States), and regulatory frameworks are creating financial incentives that effectively reduce the cost gap. Analysis suggests that sustained policy support providing $50-75 per ton of CO2 would make carbon capture economically viable across multiple industrial sectors within this decade.

Market analysis indicates several promising cost reduction pathways emerging. Economies of scale represent the most immediate opportunity, with projections suggesting that increasing facility size could reduce unit costs by 30-40% over the next decade. The learning curve effect is also significant, with each doubling of cumulative installed capacity historically delivering 10-15% cost reductions across similar environmental technologies.

Technological innovation continues to drive efficiency improvements in both capture processes and materials. Advanced solvents and sorbents with higher CO2 selectivity and lower regeneration energy requirements could potentially reduce operational costs by 25-35%. Membrane-based systems are showing particular promise, with recent breakthroughs potentially reducing energy penalties by up to 50% compared to first-generation technologies.

Integration with existing industrial processes offers another avenue for improving economic viability. By capturing CO2 at high-concentration sources and utilizing waste heat from industrial operations, companies can significantly reduce the marginal cost of capture. This approach has demonstrated cost reductions of 15-30% in pilot projects across cement, steel, and chemical manufacturing sectors.

The utilization of captured carbon in commercial products represents an emerging value stream that could offset capture costs. The market for CO2-derived products—including building materials, synthetic fuels, and chemicals—is projected to reach $5.9 billion by 2026, growing at a CAGR of 30%. However, these markets remain nascent and cannot yet absorb the volumes needed for climate-relevant deployment.

Policy mechanisms increasingly play a decisive role in economic viability. Carbon pricing, tax credits (such as the expanded 45Q credit in the United States), and regulatory frameworks are creating financial incentives that effectively reduce the cost gap. Analysis suggests that sustained policy support providing $50-75 per ton of CO2 would make carbon capture economically viable across multiple industrial sectors within this decade.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!