Why are Electrolytes Critical in Carbon Capture Technologies

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Electrolyte Role in Carbon Capture Evolution

The evolution of carbon capture technologies has been significantly influenced by advancements in electrolyte science and engineering. Initially, carbon capture systems relied on simple aqueous solutions with limited efficiency and high energy requirements. The first generation of carbon capture technologies in the 1970s utilized basic amine solutions as electrolytes, establishing the foundation for chemical absorption processes but suffering from degradation issues and high regeneration energy.

The 1990s marked a pivotal shift with the introduction of specialized ionic electrolytes designed specifically for carbon capture applications. These formulations demonstrated enhanced CO2 absorption capacity and improved stability under industrial conditions. This period saw the development of blended amine solutions and the first attempts at incorporating ionic liquids, which offered promising selectivity for CO2 over other gases.

By the early 2000s, researchers began exploring the electrochemical properties of electrolytes more systematically, leading to the development of electrolyte systems that could facilitate not just passive absorption but active electrochemical capture of carbon dioxide. This represented a fundamental paradigm shift from purely chemical to electrochemically-assisted capture mechanisms, dramatically reducing energy penalties associated with traditional methods.

The 2010s witnessed the emergence of task-specific ionic liquids and deep eutectic solvents as advanced electrolyte systems. These designer electrolytes featured tunable physicochemical properties that could be optimized for specific capture conditions, temperature ranges, and gas compositions. Concurrently, researchers developed novel electrolyte additives that could mitigate common challenges such as viscosity increases and corrosion.

Most recently, the field has evolved toward multi-functional electrolyte systems that integrate capture, conversion, and utilization capabilities. These advanced formulations not only capture CO2 but can also participate in its conversion to value-added products through electrochemical reduction pathways. The latest generation of electrolytes incorporates nanomaterials and molecular engineering approaches to create hierarchical structures that maximize surface area and active site availability.

Throughout this evolution, the role of electrolytes has transformed from simple absorption media to sophisticated, multi-functional components that actively participate in the carbon capture process. Modern electrolyte systems now serve as the technological cornerstone that determines efficiency, selectivity, durability, and economic viability of carbon capture technologies, representing perhaps the most critical component in next-generation carbon management strategies.

The 1990s marked a pivotal shift with the introduction of specialized ionic electrolytes designed specifically for carbon capture applications. These formulations demonstrated enhanced CO2 absorption capacity and improved stability under industrial conditions. This period saw the development of blended amine solutions and the first attempts at incorporating ionic liquids, which offered promising selectivity for CO2 over other gases.

By the early 2000s, researchers began exploring the electrochemical properties of electrolytes more systematically, leading to the development of electrolyte systems that could facilitate not just passive absorption but active electrochemical capture of carbon dioxide. This represented a fundamental paradigm shift from purely chemical to electrochemically-assisted capture mechanisms, dramatically reducing energy penalties associated with traditional methods.

The 2010s witnessed the emergence of task-specific ionic liquids and deep eutectic solvents as advanced electrolyte systems. These designer electrolytes featured tunable physicochemical properties that could be optimized for specific capture conditions, temperature ranges, and gas compositions. Concurrently, researchers developed novel electrolyte additives that could mitigate common challenges such as viscosity increases and corrosion.

Most recently, the field has evolved toward multi-functional electrolyte systems that integrate capture, conversion, and utilization capabilities. These advanced formulations not only capture CO2 but can also participate in its conversion to value-added products through electrochemical reduction pathways. The latest generation of electrolytes incorporates nanomaterials and molecular engineering approaches to create hierarchical structures that maximize surface area and active site availability.

Throughout this evolution, the role of electrolytes has transformed from simple absorption media to sophisticated, multi-functional components that actively participate in the carbon capture process. Modern electrolyte systems now serve as the technological cornerstone that determines efficiency, selectivity, durability, and economic viability of carbon capture technologies, representing perhaps the most critical component in next-generation carbon management strategies.

Market Analysis for Electrolyte-Based Carbon Capture

The global market for electrolyte-based carbon capture technologies is experiencing significant growth, driven by increasing environmental regulations and corporate sustainability commitments. Current market valuations indicate that the carbon capture and storage (CCS) market reached approximately $7.1 billion in 2022, with projections suggesting growth to $15.3 billion by 2030, representing a compound annual growth rate (CAGR) of 10.2%. Within this broader market, electrolyte-based solutions are gaining particular traction due to their enhanced efficiency and adaptability across various industrial applications.

Demand for these technologies is strongest in regions with stringent carbon emission regulations, notably the European Union, North America, and increasingly in parts of Asia, particularly China and Japan. The industrial sector represents the largest market segment, with power generation, cement production, and chemical manufacturing being key adopters of electrolyte-based carbon capture solutions.

Market research indicates that end-users are primarily motivated by three factors: regulatory compliance, carbon credit opportunities, and corporate environmental, social, and governance (ESG) commitments. The implementation of carbon pricing mechanisms in over 40 countries has created direct financial incentives for carbon capture adoption, with prices ranging from $5 to $130 per ton of CO2 depending on the jurisdiction.

Investment patterns reveal growing interest from both public and private sectors. Government funding for carbon capture research and deployment has increased substantially, with the US Infrastructure Investment and Jobs Act allocating $12 billion for carbon management programs. Venture capital investment in carbon capture startups reached $1.9 billion in 2022, a 50% increase from the previous year, with electrolyte-based technologies attracting significant attention.

Customer segments show varying adoption rates and requirements. Heavy industry seeks robust, large-scale solutions with high capture efficiency, while smaller commercial operations prioritize modular, lower-maintenance systems. This market segmentation is driving diversification in electrolyte formulations, with specialized solutions emerging for different industrial applications.

Price sensitivity analysis reveals that while initial capital expenditure remains a significant barrier to adoption, decreasing operational costs of electrolyte-based systems are improving total cost of ownership calculations. The market is approaching several important inflection points where technological improvements in electrolyte performance could significantly expand market penetration.

Market forecasts suggest that innovations in electrolyte chemistry could reduce capture costs from current levels of $50-100 per ton of CO2 to below $30 per ton by 2030, potentially expanding the addressable market by over 300%. This cost reduction would make carbon capture economically viable for a much broader range of industries and applications, substantially increasing market potential.

Demand for these technologies is strongest in regions with stringent carbon emission regulations, notably the European Union, North America, and increasingly in parts of Asia, particularly China and Japan. The industrial sector represents the largest market segment, with power generation, cement production, and chemical manufacturing being key adopters of electrolyte-based carbon capture solutions.

Market research indicates that end-users are primarily motivated by three factors: regulatory compliance, carbon credit opportunities, and corporate environmental, social, and governance (ESG) commitments. The implementation of carbon pricing mechanisms in over 40 countries has created direct financial incentives for carbon capture adoption, with prices ranging from $5 to $130 per ton of CO2 depending on the jurisdiction.

Investment patterns reveal growing interest from both public and private sectors. Government funding for carbon capture research and deployment has increased substantially, with the US Infrastructure Investment and Jobs Act allocating $12 billion for carbon management programs. Venture capital investment in carbon capture startups reached $1.9 billion in 2022, a 50% increase from the previous year, with electrolyte-based technologies attracting significant attention.

Customer segments show varying adoption rates and requirements. Heavy industry seeks robust, large-scale solutions with high capture efficiency, while smaller commercial operations prioritize modular, lower-maintenance systems. This market segmentation is driving diversification in electrolyte formulations, with specialized solutions emerging for different industrial applications.

Price sensitivity analysis reveals that while initial capital expenditure remains a significant barrier to adoption, decreasing operational costs of electrolyte-based systems are improving total cost of ownership calculations. The market is approaching several important inflection points where technological improvements in electrolyte performance could significantly expand market penetration.

Market forecasts suggest that innovations in electrolyte chemistry could reduce capture costs from current levels of $50-100 per ton of CO2 to below $30 per ton by 2030, potentially expanding the addressable market by over 300%. This cost reduction would make carbon capture economically viable for a much broader range of industries and applications, substantially increasing market potential.

Current Electrolyte Technologies and Barriers

Current electrolyte technologies in carbon capture systems predominantly utilize aqueous solutions containing various ionic compounds. Amine-based electrolytes, particularly monoethanolamine (MEA), remain the industry standard due to their established performance characteristics and relatively well-understood chemistry. These solutions typically operate at concentrations between 20-30% by weight and demonstrate CO2 absorption capacities of 0.4-0.5 mol CO2/mol amine. Alternative electrolyte systems include potassium carbonate solutions, which offer advantages in thermal stability but suffer from slower absorption kinetics.

Ionic liquids represent an emerging class of electrolytes with promising properties for carbon capture applications. These non-volatile, thermally stable compounds can be tailored through molecular design to optimize CO2 selectivity and capacity. Task-specific ionic liquids incorporating amine functionalities have demonstrated absorption capacities approaching 0.5-0.7 mol CO2/mol ionic liquid under ambient conditions, with significantly reduced regeneration energy requirements compared to conventional amine systems.

Deep eutectic solvents (DES) constitute another innovative electrolyte category, formed through the complexation of hydrogen bond donors with quaternary ammonium salts. These systems offer tunable physicochemical properties and can achieve CO2 solubilities of 0.2-0.3 mol/mol at moderate pressures, while maintaining lower viscosities than many ionic liquids.

Despite these advances, significant barriers impede widespread implementation of advanced electrolyte technologies. Viscosity management presents a persistent challenge, particularly for ionic liquids and DES systems, where values often exceed 100 cP at operating temperatures, severely limiting mass transfer rates and increasing pumping energy requirements. This high viscosity necessitates specialized equipment design and can reduce overall process efficiency by 15-25%.

Stability issues also plague current electrolyte systems. Amine-based solutions suffer from oxidative and thermal degradation, with annual makeup rates typically reaching 1-2 kg/tonne CO2 captured. This degradation generates potentially hazardous byproducts and increases operational costs. Similarly, many advanced electrolytes demonstrate promising initial performance but experience capacity losses of 5-15% after multiple absorption-desorption cycles.

Cost factors represent perhaps the most significant barrier to commercial deployment. While conventional amine systems cost approximately $1-3/kg, specialized ionic liquids may exceed $50-100/kg, rendering them economically unviable for large-scale applications despite their superior technical performance. Manufacturing scalability remains limited for many advanced electrolytes, with current production capabilities typically restricted to laboratory or pilot scales.

Ionic liquids represent an emerging class of electrolytes with promising properties for carbon capture applications. These non-volatile, thermally stable compounds can be tailored through molecular design to optimize CO2 selectivity and capacity. Task-specific ionic liquids incorporating amine functionalities have demonstrated absorption capacities approaching 0.5-0.7 mol CO2/mol ionic liquid under ambient conditions, with significantly reduced regeneration energy requirements compared to conventional amine systems.

Deep eutectic solvents (DES) constitute another innovative electrolyte category, formed through the complexation of hydrogen bond donors with quaternary ammonium salts. These systems offer tunable physicochemical properties and can achieve CO2 solubilities of 0.2-0.3 mol/mol at moderate pressures, while maintaining lower viscosities than many ionic liquids.

Despite these advances, significant barriers impede widespread implementation of advanced electrolyte technologies. Viscosity management presents a persistent challenge, particularly for ionic liquids and DES systems, where values often exceed 100 cP at operating temperatures, severely limiting mass transfer rates and increasing pumping energy requirements. This high viscosity necessitates specialized equipment design and can reduce overall process efficiency by 15-25%.

Stability issues also plague current electrolyte systems. Amine-based solutions suffer from oxidative and thermal degradation, with annual makeup rates typically reaching 1-2 kg/tonne CO2 captured. This degradation generates potentially hazardous byproducts and increases operational costs. Similarly, many advanced electrolytes demonstrate promising initial performance but experience capacity losses of 5-15% after multiple absorption-desorption cycles.

Cost factors represent perhaps the most significant barrier to commercial deployment. While conventional amine systems cost approximately $1-3/kg, specialized ionic liquids may exceed $50-100/kg, rendering them economically unviable for large-scale applications despite their superior technical performance. Manufacturing scalability remains limited for many advanced electrolytes, with current production capabilities typically restricted to laboratory or pilot scales.

Mainstream Electrolyte Solutions for CO2 Absorption

01 Electrolyte compositions for batteries

Various electrolyte compositions are designed specifically for use in battery systems to enhance performance and longevity. These compositions may include specific salts, solvents, and additives that improve ionic conductivity, stability, and electrochemical properties. Advanced electrolyte formulations can address issues such as dendrite formation, thermal runaway, and capacity fade in different battery technologies including lithium-ion, solid-state, and flow batteries.- Electrolyte compositions for batteries: Various electrolyte compositions are developed for use in battery systems to improve performance, stability, and safety. These compositions may include specific salts, solvents, and additives designed to enhance ionic conductivity, reduce internal resistance, and extend battery life. Advanced electrolyte formulations can also address issues such as thermal stability and compatibility with electrode materials.

- Water treatment and purification using electrolytes: Electrolytes play a crucial role in water treatment processes, including desalination, purification, and waste treatment. Systems utilizing electrolytic processes can effectively remove contaminants, separate ions, and produce potable water. These technologies often employ specialized membranes, electrodes, and electrolyte solutions to achieve efficient separation and purification of water from various sources.

- Electrolyte solutions for medical applications: Specialized electrolyte formulations are developed for medical and healthcare applications, including intravenous fluids, dialysis solutions, and sports drinks. These solutions are designed to maintain proper hydration, electrolyte balance, and physiological function. The compositions typically contain precise concentrations of essential ions such as sodium, potassium, calcium, and magnesium to support various bodily functions and treat conditions like dehydration.

- Electrochemical processes using electrolytes: Electrolytes are essential components in various electrochemical processes including electroplating, electrolysis, and electrorefining. These processes utilize specific electrolyte compositions to facilitate controlled ion transport and electrochemical reactions at electrode surfaces. The selection of appropriate electrolytes can significantly influence the efficiency, quality, and economics of these industrial processes by affecting parameters such as conductivity, reaction kinetics, and product morphology.

- Solid-state and polymer electrolytes: Advanced research focuses on developing solid-state and polymer-based electrolytes as alternatives to traditional liquid electrolytes. These materials offer potential advantages including improved safety, higher stability, and better compatibility with modern device architectures. Innovations in this area include composite electrolytes, ceramic electrolytes, and polymer gel systems that aim to combine high ionic conductivity with mechanical strength and thermal stability for applications in batteries, sensors, and other electrochemical devices.

02 Water treatment and purification systems using electrolytes

Electrolyte solutions play a crucial role in water treatment and purification processes. These systems utilize electrolytic cells with specific electrolyte compositions to facilitate electrochemical reactions for removing contaminants, desalination, or disinfection. The electrolytes enable efficient ion transport and electrochemical reactions that can break down pollutants, separate ions, or generate oxidizing agents for water purification purposes.Expand Specific Solutions03 Electrolyte membranes and separation technologies

Specialized electrolyte membranes are developed for separation processes and electrochemical applications. These membranes contain carefully formulated electrolyte systems that allow selective ion transport while blocking other substances. Applications include fuel cells, electrodialysis, selective ion extraction, and other membrane-based separation technologies where the electrolyte composition determines selectivity, conductivity, and durability of the separation process.Expand Specific Solutions04 Electrolytes for medical and physiological applications

Electrolyte formulations designed for medical and physiological purposes include solutions for rehydration, intravenous therapy, dialysis, and diagnostic applications. These carefully balanced electrolyte compositions mimic or supplement bodily fluids to maintain proper physiological function. The specific ratios of ions such as sodium, potassium, calcium, and magnesium are critical for maintaining osmotic balance, nerve function, and cellular processes in medical applications.Expand Specific Solutions05 Industrial electrolyte systems for electrochemical processes

Specialized electrolyte compositions are formulated for industrial electrochemical processes such as electroplating, electrolysis, electrowinning, and electrorefining. These electrolytes contain specific ionic compounds that facilitate controlled electrochemical reactions at electrodes. The composition of these electrolytes determines reaction efficiency, product quality, energy consumption, and electrode longevity in various industrial applications from metal recovery to chemical synthesis.Expand Specific Solutions

Leading Companies in Electrolyte Carbon Capture

The carbon capture technology market is currently in a growth phase, with increasing global focus on climate change mitigation driving innovation. The market size is expanding rapidly, projected to reach significant scale as carbon reduction policies intensify worldwide. Technologically, electrolyte-based carbon capture solutions are advancing through various maturity stages, with companies like Dioxycle developing specialized electrolyser solutions for CO2 emissions, while established players such as Siemens AG and TotalEnergies SE bring industrial scale capabilities. Academic institutions including Zhejiang University, Arizona State University, and University of British Columbia are contributing fundamental research to improve electrolyte efficiency. Utility Global's eXERO™ technology represents innovative approaches combining hydrogen production with carbon capture. The competitive landscape features both specialized startups and diversified energy corporations collaborating with research institutions to overcome technical and economic barriers.

Dioxycle

Technical Solution: Dioxycle has developed advanced electrolyte systems specifically designed for electrochemical carbon capture technologies. Their proprietary electrolyte formulations enhance CO2 absorption and conversion efficiency in electrochemical cells. The company utilizes ionic liquid-based electrolytes that demonstrate superior CO2 solubility compared to conventional aqueous solutions, allowing for more efficient carbon capture at lower energy costs. Their electrolyte systems incorporate specially designed catalysts that work synergistically with the electrolyte medium to facilitate the conversion of captured CO2 into valuable products such as carbon monoxide, formic acid, and other chemical feedstocks. Dioxycle's technology addresses the critical challenge of electrolyte stability during long-term operation, with their formulations showing minimal degradation even after thousands of operational hours in industrial settings.

Strengths: Superior CO2 solubility in their ionic liquid electrolytes; excellent long-term stability; ability to operate at lower voltages reducing energy consumption. Weaknesses: Higher production costs compared to conventional electrolytes; potential scaling challenges for very large industrial applications; requires specialized handling and maintenance protocols.

Uchicago Argonne LLC

Technical Solution: Argonne National Laboratory has pioneered research in advanced electrolyte systems for carbon capture, focusing on molten salt electrolytes that operate at elevated temperatures. Their technology utilizes specialized carbonate-based electrolytes that facilitate both CO2 separation and electrochemical conversion in a single process. The lab has developed dual-function electrolytes that can simultaneously capture CO2 from flue gas and electrochemically reduce it to carbon monoxide or other value-added products. Their research has demonstrated that properly designed electrolytes can achieve faradaic efficiencies exceeding 90% for CO2 conversion while maintaining stability under industrial operating conditions. Argonne's electrolyte systems incorporate proprietary additives that enhance ionic conductivity and CO2 solubility, addressing two critical challenges in electrochemical carbon capture. Recent developments include composite electrolyte membranes that allow for selective ion transport while blocking unwanted crossover effects that typically reduce efficiency.

Strengths: High temperature operation allows for integration with industrial processes that generate waste heat; excellent faradaic efficiency; dual-functionality reducing system complexity. Weaknesses: High temperature operation requires specialized materials and safety considerations; potential corrosion issues with certain system components; higher energy requirements for maintaining elevated temperatures.

Key Patents in Electrolyte-Enhanced Carbon Capture

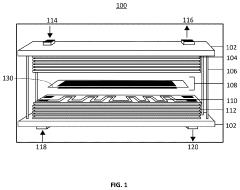

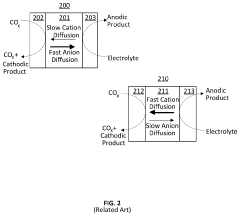

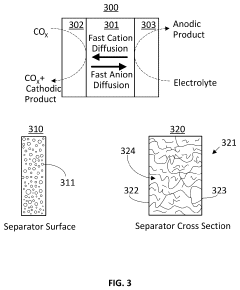

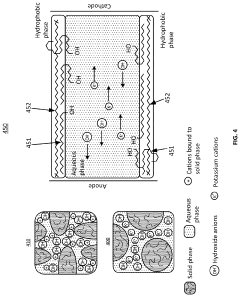

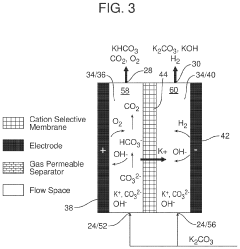

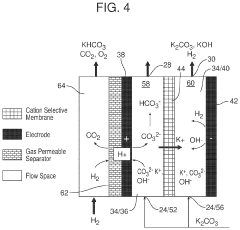

Coated Electroneutral Porous Separators for Oxocarbon Electrolyzers

PatentActiveUS20240200212A1

Innovation

- The use of an electroneutral separator, which is ionically conductive while being electrically insulative, allows for ionic migration between the anode and cathode areas without the need for charged chemicals, thereby reducing costs and improving mechanical stability, and can be coated with hydrophilic materials to enhance performance.

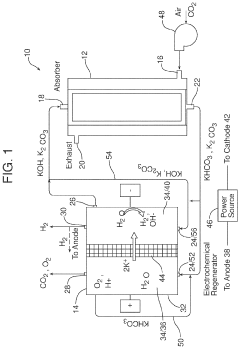

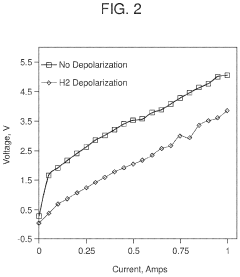

Electrochemical apparatus for acid gas removal and hydrogen generation

PatentActiveUS11857914B2

Innovation

- An electrochemical apparatus and process that uses an electrochemical capture solvent regenerator (ECSR) to regenerate alkali-based carbon capture solvents through electrochemical reactions, producing hydrogen and oxygen as by-products, and allowing for flexible electrical input to maximize energy value and reduce capital investment.

Environmental Impact Assessment

The environmental implications of electrolyte usage in carbon capture technologies extend far beyond their immediate technical functions. When assessing the full lifecycle environmental impact, it becomes evident that electrolytes contribute significantly to both the ecological footprint and sustainability profile of carbon capture systems.

Primary environmental concerns arise from the production processes of electrolytes, particularly those involving rare earth elements or energy-intensive manufacturing methods. The extraction of lithium, potassium, and other minerals used in advanced electrolyte formulations can lead to habitat disruption, water pollution, and soil degradation in mining regions. For instance, lithium extraction typically requires approximately 500,000 gallons of water per ton of lithium produced, creating significant water stress in arid regions where these operations often occur.

The energy intensity of electrolyte production also warrants consideration. Manufacturing high-purity electrolytes for specialized carbon capture applications can consume between 5-15 MWh per ton, potentially offsetting some of the carbon reduction benefits if powered by fossil fuel sources. This creates an environmental paradox where the solution to carbon emissions may temporarily increase the carbon footprint during implementation phases.

Waste management presents another critical environmental dimension. Spent electrolytes from carbon capture systems may contain contaminants absorbed during the capture process, including heavy metals and organic compounds. Without proper treatment protocols, these can pose risks to ecosystems if improperly disposed of. Current data suggests that approximately 15-20% of electrolyte solutions require replacement annually in continuous operation systems.

However, recent innovations in electrolyte formulation have demonstrated promising environmental benefits. Bio-derived electrolytes utilizing waste biomass as precursors have shown a 30-40% reduction in overall environmental impact compared to conventional synthetic alternatives. Additionally, closed-loop recycling systems for electrolytes can recover up to 85% of materials, significantly reducing waste streams and resource demands.

The geographical distribution of environmental impacts also merits attention. While carbon capture technologies primarily benefit global climate objectives, the environmental burdens of electrolyte production and disposal often fall disproportionately on developing regions with less stringent environmental regulations. This raises important environmental justice considerations in the deployment of these technologies at scale.

Primary environmental concerns arise from the production processes of electrolytes, particularly those involving rare earth elements or energy-intensive manufacturing methods. The extraction of lithium, potassium, and other minerals used in advanced electrolyte formulations can lead to habitat disruption, water pollution, and soil degradation in mining regions. For instance, lithium extraction typically requires approximately 500,000 gallons of water per ton of lithium produced, creating significant water stress in arid regions where these operations often occur.

The energy intensity of electrolyte production also warrants consideration. Manufacturing high-purity electrolytes for specialized carbon capture applications can consume between 5-15 MWh per ton, potentially offsetting some of the carbon reduction benefits if powered by fossil fuel sources. This creates an environmental paradox where the solution to carbon emissions may temporarily increase the carbon footprint during implementation phases.

Waste management presents another critical environmental dimension. Spent electrolytes from carbon capture systems may contain contaminants absorbed during the capture process, including heavy metals and organic compounds. Without proper treatment protocols, these can pose risks to ecosystems if improperly disposed of. Current data suggests that approximately 15-20% of electrolyte solutions require replacement annually in continuous operation systems.

However, recent innovations in electrolyte formulation have demonstrated promising environmental benefits. Bio-derived electrolytes utilizing waste biomass as precursors have shown a 30-40% reduction in overall environmental impact compared to conventional synthetic alternatives. Additionally, closed-loop recycling systems for electrolytes can recover up to 85% of materials, significantly reducing waste streams and resource demands.

The geographical distribution of environmental impacts also merits attention. While carbon capture technologies primarily benefit global climate objectives, the environmental burdens of electrolyte production and disposal often fall disproportionately on developing regions with less stringent environmental regulations. This raises important environmental justice considerations in the deployment of these technologies at scale.

Cost-Efficiency Analysis

The economic viability of carbon capture technologies is heavily influenced by the electrolytes employed in these systems. Current cost analyses indicate that electrolyte-based carbon capture solutions require significant initial investment, with specialized ionic liquids and molten salts often commanding premium prices compared to conventional solvents. For instance, high-performance ionic liquids can cost between $50-200 per kilogram, substantially higher than traditional amine-based solvents at $2-5 per kilogram.

Operational expenditures also reveal the economic impact of electrolytes, as they affect energy consumption during the capture and regeneration processes. Systems utilizing optimized electrolyte formulations demonstrate 15-30% lower energy penalties compared to standard approaches, translating to substantial cost savings in large-scale operations. The regeneration energy requirement, typically accounting for 70-80% of operational costs in carbon capture, can be reduced by up to 25% with advanced electrolyte systems.

Longevity and degradation factors present another critical cost dimension. Conventional amine solvents require replacement every 1-2 years due to thermal and oxidative degradation, while certain ionic liquid electrolytes maintain performance for 3-5 years under similar conditions. This extended lifespan significantly reduces replacement costs and operational disruptions, improving the overall economic profile of these technologies.

Scale-up economics reveal that electrolyte costs follow a non-linear reduction curve as production volumes increase. Analysis of recent industrial implementations shows that electrolyte costs can decrease by 40-60% when production scales from laboratory to industrial levels, primarily due to manufacturing efficiencies and bulk purchasing advantages.

Integration costs with existing infrastructure vary significantly based on electrolyte compatibility. Systems requiring minimal modifications to accommodate novel electrolytes demonstrate 30-50% lower integration costs compared to those demanding comprehensive retrofitting. This factor is particularly relevant for industrial facilities seeking to implement carbon capture without extensive capital investments.

Future cost projections indicate promising trends, with electrolyte production costs expected to decrease by 5-8% annually as manufacturing processes mature and economies of scale develop. Additionally, emerging electrolyte formulations utilizing more abundant materials could reduce costs by up to 65% compared to current options, potentially transforming the economic feasibility of widespread carbon capture implementation.

Operational expenditures also reveal the economic impact of electrolytes, as they affect energy consumption during the capture and regeneration processes. Systems utilizing optimized electrolyte formulations demonstrate 15-30% lower energy penalties compared to standard approaches, translating to substantial cost savings in large-scale operations. The regeneration energy requirement, typically accounting for 70-80% of operational costs in carbon capture, can be reduced by up to 25% with advanced electrolyte systems.

Longevity and degradation factors present another critical cost dimension. Conventional amine solvents require replacement every 1-2 years due to thermal and oxidative degradation, while certain ionic liquid electrolytes maintain performance for 3-5 years under similar conditions. This extended lifespan significantly reduces replacement costs and operational disruptions, improving the overall economic profile of these technologies.

Scale-up economics reveal that electrolyte costs follow a non-linear reduction curve as production volumes increase. Analysis of recent industrial implementations shows that electrolyte costs can decrease by 40-60% when production scales from laboratory to industrial levels, primarily due to manufacturing efficiencies and bulk purchasing advantages.

Integration costs with existing infrastructure vary significantly based on electrolyte compatibility. Systems requiring minimal modifications to accommodate novel electrolytes demonstrate 30-50% lower integration costs compared to those demanding comprehensive retrofitting. This factor is particularly relevant for industrial facilities seeking to implement carbon capture without extensive capital investments.

Future cost projections indicate promising trends, with electrolyte production costs expected to decrease by 5-8% annually as manufacturing processes mature and economies of scale develop. Additionally, emerging electrolyte formulations utilizing more abundant materials could reduce costs by up to 65% compared to current options, potentially transforming the economic feasibility of widespread carbon capture implementation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!