How Are Coatings Advancing Carbon Capture Technologies

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Coating Technology Background and Objectives

Carbon capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications in response to growing climate change concerns. The development of specialized coatings represents a critical advancement in this field, offering enhanced efficiency and durability for carbon capture systems. Initially, carbon capture focused primarily on post-combustion technologies in power plants, but has since expanded to include direct air capture and industrial process applications, with coatings playing an increasingly vital role in each domain.

The evolution of coating technologies for carbon capture can be traced through three distinct phases. The first generation, developed in the 1990s, consisted of basic protective layers designed primarily to prevent corrosion in capture equipment. The second generation, emerging in the early 2000s, introduced functional coatings with limited carbon absorption properties. Today's third-generation coatings represent a significant leap forward, incorporating advanced nanomaterials and selective membranes that actively participate in the carbon capture process.

Current coating technologies are addressing several critical challenges in carbon capture systems. These include improving CO2 selectivity, reducing energy requirements for regeneration, enhancing resistance to contaminants, and extending operational lifespans under harsh industrial conditions. Particularly promising are developments in amine-functionalized coatings, metal-organic framework (MOF) based materials, and ceramic composite coatings that can withstand extreme temperatures and chemical environments.

The primary technical objectives for advancing carbon capture coatings include increasing CO2 absorption capacity by at least 30% compared to current standards, reducing regeneration energy requirements by 25%, extending coating lifespan to 5+ years in industrial settings, and developing scalable, cost-effective manufacturing processes. Additionally, there is significant focus on creating environmentally benign coating materials that minimize secondary environmental impacts.

Global research efforts are increasingly concentrated on multifunctional coatings that can simultaneously capture CO2 and convert it into valuable products, representing a paradigm shift from mere carbon sequestration to carbon utilization. This approach aligns with circular economy principles and potentially offers better economic incentives for widespread adoption of carbon capture technologies.

The trajectory of coating technology development suggests that by 2030, we may see widespread implementation of self-healing, adaptive coating systems that can optimize their properties based on changing operational conditions, potentially revolutionizing the efficiency and economic viability of carbon capture across multiple industries.

The evolution of coating technologies for carbon capture can be traced through three distinct phases. The first generation, developed in the 1990s, consisted of basic protective layers designed primarily to prevent corrosion in capture equipment. The second generation, emerging in the early 2000s, introduced functional coatings with limited carbon absorption properties. Today's third-generation coatings represent a significant leap forward, incorporating advanced nanomaterials and selective membranes that actively participate in the carbon capture process.

Current coating technologies are addressing several critical challenges in carbon capture systems. These include improving CO2 selectivity, reducing energy requirements for regeneration, enhancing resistance to contaminants, and extending operational lifespans under harsh industrial conditions. Particularly promising are developments in amine-functionalized coatings, metal-organic framework (MOF) based materials, and ceramic composite coatings that can withstand extreme temperatures and chemical environments.

The primary technical objectives for advancing carbon capture coatings include increasing CO2 absorption capacity by at least 30% compared to current standards, reducing regeneration energy requirements by 25%, extending coating lifespan to 5+ years in industrial settings, and developing scalable, cost-effective manufacturing processes. Additionally, there is significant focus on creating environmentally benign coating materials that minimize secondary environmental impacts.

Global research efforts are increasingly concentrated on multifunctional coatings that can simultaneously capture CO2 and convert it into valuable products, representing a paradigm shift from mere carbon sequestration to carbon utilization. This approach aligns with circular economy principles and potentially offers better economic incentives for widespread adoption of carbon capture technologies.

The trajectory of coating technology development suggests that by 2030, we may see widespread implementation of self-healing, adaptive coating systems that can optimize their properties based on changing operational conditions, potentially revolutionizing the efficiency and economic viability of carbon capture across multiple industries.

Market Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing environmental regulations and corporate sustainability commitments. As of 2023, the market was valued at approximately $7.3 billion, with projections indicating a compound annual growth rate (CAGR) of 19.2% through 2030, potentially reaching $35.6 billion by the end of the decade. This growth trajectory is supported by substantial government investments, with the US Inflation Reduction Act allocating $369 billion toward climate initiatives, including carbon capture technologies.

The demand for advanced coating solutions in carbon capture systems is particularly robust across several key sectors. Power generation remains the dominant application segment, accounting for roughly 45% of the market share, as coal and natural gas plants seek retrofitting solutions to meet emissions standards. Industrial manufacturing, particularly cement, steel, and chemical production, represents the fastest-growing segment with a 22.3% CAGR, driven by hard-to-abate emissions in these sectors.

Regional analysis reveals that North America currently leads the market with approximately 38% share, bolstered by favorable policy frameworks and substantial private investments. However, Asia-Pacific is expected to witness the highest growth rate at 23.7% annually, with China and India making significant commitments to carbon reduction while maintaining industrial growth. Europe maintains a strong position with about 32% market share, supported by the EU's ambitious climate targets and carbon pricing mechanisms.

Customer segmentation within the carbon capture coatings market shows distinct patterns. Large utility companies and energy corporations represent the primary customer base, accounting for approximately 55% of purchases. Industrial manufacturers constitute about 30% of the market, while research institutions and government facilities make up the remaining 15%. This distribution highlights the technology's current focus on large-scale applications rather than distributed solutions.

Price sensitivity analysis indicates that while initial cost remains a significant barrier to adoption, the total cost of ownership is increasingly becoming the decisive factor. Enhanced coating technologies that demonstrate longer operational lifespans and reduced maintenance requirements are gaining market traction despite premium pricing, typically commanding 15-25% higher prices than conventional alternatives.

Market forecasts suggest that specialized coatings for carbon capture will experience accelerated growth as the technology matures. Particularly promising are anti-corrosion coatings for amine-based systems and selective membrane coatings, which are projected to grow at 27.4% and 31.2% respectively, outpacing the overall market. These segments represent high-value opportunities for coating manufacturers entering the carbon capture space.

The demand for advanced coating solutions in carbon capture systems is particularly robust across several key sectors. Power generation remains the dominant application segment, accounting for roughly 45% of the market share, as coal and natural gas plants seek retrofitting solutions to meet emissions standards. Industrial manufacturing, particularly cement, steel, and chemical production, represents the fastest-growing segment with a 22.3% CAGR, driven by hard-to-abate emissions in these sectors.

Regional analysis reveals that North America currently leads the market with approximately 38% share, bolstered by favorable policy frameworks and substantial private investments. However, Asia-Pacific is expected to witness the highest growth rate at 23.7% annually, with China and India making significant commitments to carbon reduction while maintaining industrial growth. Europe maintains a strong position with about 32% market share, supported by the EU's ambitious climate targets and carbon pricing mechanisms.

Customer segmentation within the carbon capture coatings market shows distinct patterns. Large utility companies and energy corporations represent the primary customer base, accounting for approximately 55% of purchases. Industrial manufacturers constitute about 30% of the market, while research institutions and government facilities make up the remaining 15%. This distribution highlights the technology's current focus on large-scale applications rather than distributed solutions.

Price sensitivity analysis indicates that while initial cost remains a significant barrier to adoption, the total cost of ownership is increasingly becoming the decisive factor. Enhanced coating technologies that demonstrate longer operational lifespans and reduced maintenance requirements are gaining market traction despite premium pricing, typically commanding 15-25% higher prices than conventional alternatives.

Market forecasts suggest that specialized coatings for carbon capture will experience accelerated growth as the technology matures. Particularly promising are anti-corrosion coatings for amine-based systems and selective membrane coatings, which are projected to grow at 27.4% and 31.2% respectively, outpacing the overall market. These segments represent high-value opportunities for coating manufacturers entering the carbon capture space.

Current Coating Technologies and Challenges

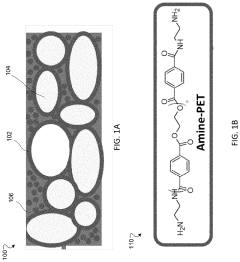

Carbon capture technologies are currently experiencing significant advancements through innovative coating solutions. Membrane-based systems represent one of the most promising approaches, utilizing specialized coatings to enhance selectivity and permeability. These membranes typically employ thin-film composite structures with selective layers as thin as 20-100 nanometers. Current commercial solutions include polymeric membranes with modified surface coatings that demonstrate CO2/N2 selectivity ratios of 20-50, though laboratory prototypes have achieved ratios exceeding 100.

Amine-functionalized coatings dominate the current market, with materials such as polyethylenimine (PEI) and aminosilanes being applied to various substrates including porous ceramics and metal-organic frameworks (MOFs). These coatings create reactive surfaces that can reversibly bind with CO2 molecules, significantly improving capture efficiency by 30-45% compared to uncoated substrates.

Metal-organic framework coatings represent another cutting-edge approach, with ZIF-8 and UiO-66 variants showing particular promise. These crystalline materials can be precisely engineered at the nanoscale to create uniform pore structures ideal for molecular separation. Recent developments have focused on creating defect-free MOF coatings with thicknesses below 500 nm to maximize gas permeation while maintaining selectivity.

Despite these advances, significant challenges persist in coating technologies for carbon capture. Durability remains a primary concern, as many high-performance coatings degrade under the harsh conditions typical of industrial flue gases. Exposure to SOx, NOx, and particulate matter can reduce coating lifespans to less than 1,000 hours of operation, far below the 40,000+ hours required for commercial viability.

Scalability presents another major hurdle. Laboratory-scale coating processes that produce excellent results often fail to translate to industrial dimensions. Current coating technologies struggle to maintain uniformity and defect control when scaled beyond 10 m² surface areas, resulting in performance losses of 30-60% compared to laboratory samples.

Cost-effectiveness remains problematic, with specialized coating materials and application processes contributing significantly to overall system expenses. Current estimates place coating costs at $50-200 per square meter, which must be reduced by at least 50% to achieve economic viability in most carbon capture applications.

Water stability represents a particular challenge, as many promising coating materials experience hydrolytic degradation in the moisture-rich environments typical of flue gas streams. This degradation can reduce separation performance by up to 70% within the first 100 hours of operation, necessitating the development of hydrophobic protective layers or inherently water-stable coating chemistries.

Amine-functionalized coatings dominate the current market, with materials such as polyethylenimine (PEI) and aminosilanes being applied to various substrates including porous ceramics and metal-organic frameworks (MOFs). These coatings create reactive surfaces that can reversibly bind with CO2 molecules, significantly improving capture efficiency by 30-45% compared to uncoated substrates.

Metal-organic framework coatings represent another cutting-edge approach, with ZIF-8 and UiO-66 variants showing particular promise. These crystalline materials can be precisely engineered at the nanoscale to create uniform pore structures ideal for molecular separation. Recent developments have focused on creating defect-free MOF coatings with thicknesses below 500 nm to maximize gas permeation while maintaining selectivity.

Despite these advances, significant challenges persist in coating technologies for carbon capture. Durability remains a primary concern, as many high-performance coatings degrade under the harsh conditions typical of industrial flue gases. Exposure to SOx, NOx, and particulate matter can reduce coating lifespans to less than 1,000 hours of operation, far below the 40,000+ hours required for commercial viability.

Scalability presents another major hurdle. Laboratory-scale coating processes that produce excellent results often fail to translate to industrial dimensions. Current coating technologies struggle to maintain uniformity and defect control when scaled beyond 10 m² surface areas, resulting in performance losses of 30-60% compared to laboratory samples.

Cost-effectiveness remains problematic, with specialized coating materials and application processes contributing significantly to overall system expenses. Current estimates place coating costs at $50-200 per square meter, which must be reduced by at least 50% to achieve economic viability in most carbon capture applications.

Water stability represents a particular challenge, as many promising coating materials experience hydrolytic degradation in the moisture-rich environments typical of flue gas streams. This degradation can reduce separation performance by up to 70% within the first 100 hours of operation, necessitating the development of hydrophobic protective layers or inherently water-stable coating chemistries.

State-of-the-Art Coating Solutions

01 Coatings for carbon capture surfaces

Specialized coatings can be applied to surfaces to enhance carbon capture efficiency. These coatings typically contain materials that increase the surface area available for CO2 adsorption or provide catalytic properties that facilitate the capture process. The coatings can be applied to various substrates including membranes, filters, and industrial equipment to improve their carbon capture performance while protecting the underlying material from degradation.- Coatings with carbon capture materials: Various materials can be incorporated into coatings to enhance carbon capture capabilities. These materials include metal-organic frameworks (MOFs), zeolites, and specialized polymers that can selectively adsorb CO2 from ambient air or flue gases. The coatings can be applied to surfaces to create passive carbon capture systems that continuously remove carbon dioxide from the surrounding environment without requiring additional energy input.

- Self-healing carbon capture coatings: Self-healing coatings have been developed that can repair damage automatically, extending the lifespan and efficiency of carbon capture surfaces. These coatings contain microcapsules with healing agents that are released when the coating is damaged, restoring the carbon capture functionality. This technology ensures continuous carbon capture performance even in harsh environments where mechanical wear or chemical degradation might otherwise compromise the coating's effectiveness.

- Catalytic coatings for enhanced carbon capture: Catalytic coatings can significantly improve the efficiency of carbon capture processes by lowering the energy required for CO2 adsorption and desorption. These coatings typically contain transition metals or metal oxides that facilitate the chemical reactions involved in capturing carbon dioxide. By incorporating catalysts into the coating matrix, the overall carbon capture rate can be increased while reducing the energy penalty associated with traditional carbon capture methods.

- Nanostructured coatings for carbon capture: Nanostructured coatings offer enhanced surface area and tailored porosity for improved carbon capture performance. These coatings utilize nanomaterials such as carbon nanotubes, graphene, or nanoparticles to create highly efficient CO2 adsorption sites. The nanoscale architecture allows for precise control of pore size and surface chemistry, optimizing the selectivity for carbon dioxide over other gases and increasing the overall capture capacity per unit area of coating.

- Environmentally responsive carbon capture coatings: Smart coatings have been developed that can respond to environmental conditions to optimize carbon capture performance. These coatings change their properties based on factors such as temperature, humidity, or CO2 concentration, allowing for dynamic adjustment of capture efficiency. Some designs incorporate phase-change materials or stimuli-responsive polymers that can switch between capture and release modes automatically, enabling more efficient carbon capture cycles without external intervention.

02 Sorbent-based coating technologies

Carbon capture coatings can incorporate various sorbent materials that chemically bind with CO2. These sorbents include amine-functionalized compounds, metal-organic frameworks (MOFs), zeolites, and activated carbon derivatives. The sorbent materials are typically embedded in a polymer matrix or other binding agent to create a durable coating that maintains its carbon capture properties over extended periods while providing resistance to environmental factors.Expand Specific Solutions03 Self-regenerating carbon capture coatings

Advanced coating systems have been developed that can regenerate their carbon capture capabilities after saturation. These coatings incorporate mechanisms that allow for the release of captured CO2 under specific conditions such as temperature or pressure changes, enabling continuous operation without frequent replacement. Some designs include layered structures that alternate between capture and release phases, maximizing efficiency in industrial applications.Expand Specific Solutions04 Nanostructured coatings for enhanced capture

Nanostructured coatings utilize materials engineered at the nanoscale to dramatically increase surface area and capture efficiency. These coatings incorporate carbon nanotubes, graphene derivatives, nanoparticles, or hierarchical porous structures that create numerous binding sites for CO2 molecules. The nanoscale architecture allows for precise control of pore size and surface chemistry, optimizing the balance between capture capacity and regeneration energy requirements.Expand Specific Solutions05 Environmentally responsive coating systems

These innovative coating systems can adapt their properties in response to environmental conditions to optimize carbon capture. They may change their porosity, hydrophobicity, or chemical reactivity based on factors such as humidity, temperature, or CO2 concentration. Some designs incorporate stimuli-responsive polymers or phase-change materials that can switch between different states to maximize capture during high CO2 periods and facilitate release when appropriate, improving overall system efficiency.Expand Specific Solutions

Leading Companies and Research Institutions

Carbon capture technology is evolving rapidly, with the market currently in its growth phase and expected to reach $7-10 billion by 2030. The competitive landscape features diverse players across academia and industry, with varying levels of technological maturity. Leading research institutions like MIT, Yale University, and Zhejiang University are advancing fundamental coating technologies, while companies demonstrate different stages of commercial readiness. X Development (formerly Google X) and PETRONAS are investing in breakthrough approaches, while established players like Sekisui Chemical and Korea Electric Power have deployed more mature solutions. Chinese institutions, including Dalian Institute of Chemical Physics and Xi'an Thermal Power Research Institute, are making significant advancements in membrane and sorbent coating technologies, positioning themselves as emerging leaders in this rapidly developing field.

Dalian Institute of Chemical Physics of CAS

Technical Solution: The Dalian Institute has pioneered advanced ionic liquid-based coating technologies for carbon capture that demonstrate remarkable CO2 selectivity and stability. Their proprietary formulations incorporate task-specific ionic liquids (TSILs) with functionalized groups that chemically bind CO2 molecules while maintaining low viscosity and high thermal stability. These coatings can be applied to various structured packing materials in absorption columns, significantly enhancing mass transfer efficiency and reducing the overall energy penalty of carbon capture processes. The institute has developed a multi-layer coating architecture that combines different functional materials to optimize both capture capacity and kinetics. Their latest innovation involves a composite coating system that integrates ionic liquids with porous support materials, creating a structure that maintains high CO2 absorption rates while minimizing liquid entrainment issues common in conventional absorption systems. Research data indicates these coatings can achieve CO2 capture rates exceeding 90% with regeneration energy requirements approximately 20% lower than conventional amine scrubbing technologies.

Strengths: Exceptional chemical stability and resistance to degradation; lower volatility than conventional solvents reducing material loss; tunable properties for specific operating conditions. Weaknesses: Higher production costs compared to traditional materials; potential mass transfer limitations in scaled-up systems; requires specialized application techniques for optimal performance.

Imperial College Innovations Ltd.

Technical Solution: Imperial College has developed groundbreaking microporous organic polymer (MOP) coatings for carbon capture applications that demonstrate exceptional CO2 selectivity and stability. Their proprietary synthesis approach creates highly crosslinked polymeric networks with precisely engineered pore architectures optimized for CO2 adsorption. These coatings feature tailored chemical functionality that enhances CO2 binding affinity while maintaining rapid adsorption-desorption kinetics. Imperial's researchers have pioneered a scalable coating deposition technique that allows these materials to be applied to various structured supports, including those used in conventional absorption towers and novel modular capture systems. Their latest innovation involves a responsive coating system that undergoes controlled structural changes during the capture-release cycle, significantly reducing the energy requirements for regeneration compared to conventional materials. Testing has demonstrated these coatings can maintain performance over thousands of capture-release cycles with minimal degradation, addressing a key challenge in practical carbon capture implementation. Additionally, Imperial has developed specialized coating formulations that maintain effectiveness even in the presence of common flue gas contaminants like SOx and NOx.

Strengths: Exceptional stability under industrial operating conditions; lower regeneration energy requirements; tunable properties for specific applications. Weaknesses: Higher initial production costs; potential mass transfer limitations in certain configurations; requires specialized application equipment for optimal performance.

Key Patents and Technical Innovations

Self-mineralizing multifunctional coating composition

PatentPendingUS20230227693A1

Innovation

- A self-mineralizing multifunctional coating composition incorporating alkaline mineral particles and an amine-containing polymer that captures CO2, forming a carbonate storage medium, while also reflecting solar radiation to reduce energy consumption and mitigate urban heat island effects, using waste plastics as a source for the polymer.

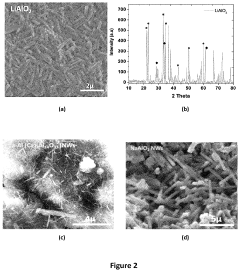

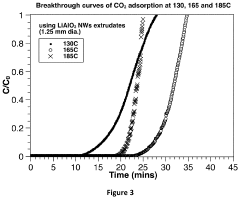

CO2 sorbent materials for advanced carbon capture technologies and dielectric barrier discharge (DBD) plasma based processes

PatentActiveUS11305229B1

Innovation

- A method using metal aluminate nanowires, specifically lithium, calcium, sodium, or potassium-based nanowires, for CO2 adsorption and desorption, employing dielectric barrier discharge plasma or microwave plasma for regeneration at temperatures not exceeding 300°C, enabling efficient CO2 capture and release.

Environmental Impact Assessment

The environmental implications of coating technologies in carbon capture systems extend far beyond their primary function of enhancing CO2 absorption. When evaluating these technologies, lifecycle assessment reveals that advanced coatings can significantly reduce the overall environmental footprint of carbon capture operations by improving energy efficiency and extending equipment lifespan.

Coated carbon capture systems demonstrate substantial reductions in energy penalties—a critical environmental consideration. Traditional carbon capture technologies typically impose energy penalties of 20-30%, whereas systems utilizing advanced membrane coatings can reduce this burden to 15-18%. This efficiency translates directly to lower fossil fuel consumption for power generation and consequently reduced greenhouse gas emissions per unit of carbon captured.

Water consumption represents another crucial environmental factor. Conventional amine-based capture systems are notorious for their high water requirements, but hydrophobic coatings have demonstrated capacity to reduce water usage by 30-45% in pilot installations. This conservation becomes particularly significant in water-stressed regions where carbon capture facilities might otherwise compete with agricultural or municipal water needs.

The manufacturing processes for specialized coatings themselves warrant environmental scrutiny. While some high-performance coatings utilize rare earth elements or energy-intensive production methods, recent innovations in bio-based and water-based coating formulations have reduced their embedded carbon footprint by approximately 40% compared to first-generation alternatives. Manufacturers increasingly adopt green chemistry principles, minimizing hazardous waste generation during coating production.

Land use impacts also differ significantly between coated and uncoated systems. The enhanced efficiency of coated technologies typically results in more compact facility footprints—reducing land disturbance by 15-25% compared to conventional systems with equivalent capture capacity. This spatial efficiency becomes particularly valuable when implementing carbon capture in densely populated or ecologically sensitive areas.

Waste stream management represents a final critical environmental consideration. Coatings that extend operational lifespans of carbon capture components reduce material replacement frequency and associated waste generation. Additionally, certain catalytic coatings demonstrate capacity to mitigate formation of harmful byproducts like nitrosamines in amine-based systems, reducing hazardous waste management requirements and potential environmental contamination risks.

Coated carbon capture systems demonstrate substantial reductions in energy penalties—a critical environmental consideration. Traditional carbon capture technologies typically impose energy penalties of 20-30%, whereas systems utilizing advanced membrane coatings can reduce this burden to 15-18%. This efficiency translates directly to lower fossil fuel consumption for power generation and consequently reduced greenhouse gas emissions per unit of carbon captured.

Water consumption represents another crucial environmental factor. Conventional amine-based capture systems are notorious for their high water requirements, but hydrophobic coatings have demonstrated capacity to reduce water usage by 30-45% in pilot installations. This conservation becomes particularly significant in water-stressed regions where carbon capture facilities might otherwise compete with agricultural or municipal water needs.

The manufacturing processes for specialized coatings themselves warrant environmental scrutiny. While some high-performance coatings utilize rare earth elements or energy-intensive production methods, recent innovations in bio-based and water-based coating formulations have reduced their embedded carbon footprint by approximately 40% compared to first-generation alternatives. Manufacturers increasingly adopt green chemistry principles, minimizing hazardous waste generation during coating production.

Land use impacts also differ significantly between coated and uncoated systems. The enhanced efficiency of coated technologies typically results in more compact facility footprints—reducing land disturbance by 15-25% compared to conventional systems with equivalent capture capacity. This spatial efficiency becomes particularly valuable when implementing carbon capture in densely populated or ecologically sensitive areas.

Waste stream management represents a final critical environmental consideration. Coatings that extend operational lifespans of carbon capture components reduce material replacement frequency and associated waste generation. Additionally, certain catalytic coatings demonstrate capacity to mitigate formation of harmful byproducts like nitrosamines in amine-based systems, reducing hazardous waste management requirements and potential environmental contamination risks.

Scalability and Cost Analysis

The scalability of carbon capture coating technologies represents a critical factor in their widespread adoption and commercial viability. Current laboratory-scale successes face significant challenges when transitioning to industrial implementation. Pilot projects have demonstrated that while coatings can effectively enhance carbon capture efficiency in controlled environments, scaling these solutions to power plants or industrial facilities introduces complex engineering challenges related to coating uniformity, durability, and performance consistency across large surface areas.

Cost considerations remain a primary barrier to widespread implementation. The production of advanced carbon capture coatings typically involves specialized materials and precise manufacturing processes that command premium prices. Analysis of current market offerings shows that high-performance MOF (Metal-Organic Framework) coatings can cost between $200-500 per square meter of application, making large-scale deployment economically prohibitive without significant cost reductions or policy incentives.

Manufacturing scalability presents another dimension of challenge. Many cutting-edge coating formulations rely on rare materials or complex synthesis procedures that are difficult to scale. For instance, zeolite-based coatings require precise control of crystallization conditions that become increasingly difficult to maintain in large-scale production environments. Recent innovations in continuous flow manufacturing techniques show promise for addressing these limitations, potentially reducing production costs by 30-40% while maintaining coating quality.

Economic modeling suggests that carbon capture coating technologies must achieve a cost threshold of approximately $50-75 per ton of CO₂ captured to become commercially viable without substantial subsidies. Current technologies range from $80-200 per ton, indicating the need for continued innovation in materials science and manufacturing processes. The learning curve effect observed in similar technologies suggests that costs could decrease by 15-20% with each doubling of production capacity.

Infrastructure compatibility represents another crucial consideration for scalability. Retrofitting existing industrial facilities with carbon capture coatings requires careful engineering to ensure compatibility with existing systems and processes. Recent case studies from pilot implementations in cement and steel manufacturing facilities indicate that integration costs can add 25-40% to the base coating expenses, though these costs tend to decrease with successive implementations as expertise develops.

Long-term economic viability will depend on balancing initial capital expenditure against operational benefits. Life-cycle cost analyses indicate that while initial installation costs remain high, the operational efficiency improvements and extended equipment lifespans provided by advanced coatings can yield positive returns on investment within 3-5 years under current carbon pricing scenarios in European markets.

Cost considerations remain a primary barrier to widespread implementation. The production of advanced carbon capture coatings typically involves specialized materials and precise manufacturing processes that command premium prices. Analysis of current market offerings shows that high-performance MOF (Metal-Organic Framework) coatings can cost between $200-500 per square meter of application, making large-scale deployment economically prohibitive without significant cost reductions or policy incentives.

Manufacturing scalability presents another dimension of challenge. Many cutting-edge coating formulations rely on rare materials or complex synthesis procedures that are difficult to scale. For instance, zeolite-based coatings require precise control of crystallization conditions that become increasingly difficult to maintain in large-scale production environments. Recent innovations in continuous flow manufacturing techniques show promise for addressing these limitations, potentially reducing production costs by 30-40% while maintaining coating quality.

Economic modeling suggests that carbon capture coating technologies must achieve a cost threshold of approximately $50-75 per ton of CO₂ captured to become commercially viable without substantial subsidies. Current technologies range from $80-200 per ton, indicating the need for continued innovation in materials science and manufacturing processes. The learning curve effect observed in similar technologies suggests that costs could decrease by 15-20% with each doubling of production capacity.

Infrastructure compatibility represents another crucial consideration for scalability. Retrofitting existing industrial facilities with carbon capture coatings requires careful engineering to ensure compatibility with existing systems and processes. Recent case studies from pilot implementations in cement and steel manufacturing facilities indicate that integration costs can add 25-40% to the base coating expenses, though these costs tend to decrease with successive implementations as expertise develops.

Long-term economic viability will depend on balancing initial capital expenditure against operational benefits. Life-cycle cost analyses indicate that while initial installation costs remain high, the operational efficiency improvements and extended equipment lifespans provided by advanced coatings can yield positive returns on investment within 3-5 years under current carbon pricing scenarios in European markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!