The Role of Material Innovations in Carbon Capture Technologies

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Materials Background and Objectives

Carbon capture technologies have evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications in response to growing climate change concerns. The historical development began in the 1970s with basic research into carbon dioxide separation methods, primarily for enhanced oil recovery applications. By the 1990s, as climate science advanced, carbon capture research expanded to address emissions from power plants and industrial facilities, marking a shift toward environmental applications.

The technological landscape has progressed through three distinct generations. First-generation technologies focused on post-combustion capture using amine-based solvents, while second-generation approaches expanded to pre-combustion and oxy-fuel combustion methods. Current third-generation technologies are exploring direct air capture and novel material-based solutions that promise higher efficiency and lower energy penalties.

Material innovation represents the cornerstone of advancement in carbon capture technologies. Traditional materials such as monoethanolamine (MEA) and other amine-based solvents have dominated industrial applications but suffer from high regeneration energy requirements and degradation issues. These limitations have driven research toward novel materials including metal-organic frameworks (MOFs), covalent organic frameworks (COFs), zeolites, and advanced membrane materials that offer improved selectivity, capacity, and stability.

The primary technical objectives in this field center on developing materials that can significantly reduce the energy penalty associated with carbon capture, currently estimated at 20-30% for conventional power plants. Specific goals include creating sorbents with CO2 capture capacities exceeding 3 mmol/g, selectivity ratios above 100:1 for CO2 over N2, and regeneration temperatures below 100°C to minimize energy requirements.

Additionally, researchers aim to develop materials that maintain performance over thousands of capture-release cycles, resist degradation from flue gas contaminants, and can be manufactured at scale with environmentally benign processes. Cost reduction represents another critical objective, with targets to decrease capture costs from current levels of $40-80 per ton of CO2 to below $30 per ton to enable widespread commercial deployment.

The convergence of materials science, chemistry, and engineering has created unprecedented opportunities for breakthrough innovations. Computational modeling and high-throughput screening approaches are accelerating material discovery, while advances in nanotechnology enable precise control over material properties at the molecular level, opening new pathways for next-generation carbon capture solutions that could fundamentally transform climate mitigation strategies.

The technological landscape has progressed through three distinct generations. First-generation technologies focused on post-combustion capture using amine-based solvents, while second-generation approaches expanded to pre-combustion and oxy-fuel combustion methods. Current third-generation technologies are exploring direct air capture and novel material-based solutions that promise higher efficiency and lower energy penalties.

Material innovation represents the cornerstone of advancement in carbon capture technologies. Traditional materials such as monoethanolamine (MEA) and other amine-based solvents have dominated industrial applications but suffer from high regeneration energy requirements and degradation issues. These limitations have driven research toward novel materials including metal-organic frameworks (MOFs), covalent organic frameworks (COFs), zeolites, and advanced membrane materials that offer improved selectivity, capacity, and stability.

The primary technical objectives in this field center on developing materials that can significantly reduce the energy penalty associated with carbon capture, currently estimated at 20-30% for conventional power plants. Specific goals include creating sorbents with CO2 capture capacities exceeding 3 mmol/g, selectivity ratios above 100:1 for CO2 over N2, and regeneration temperatures below 100°C to minimize energy requirements.

Additionally, researchers aim to develop materials that maintain performance over thousands of capture-release cycles, resist degradation from flue gas contaminants, and can be manufactured at scale with environmentally benign processes. Cost reduction represents another critical objective, with targets to decrease capture costs from current levels of $40-80 per ton of CO2 to below $30 per ton to enable widespread commercial deployment.

The convergence of materials science, chemistry, and engineering has created unprecedented opportunities for breakthrough innovations. Computational modeling and high-throughput screening approaches are accelerating material discovery, while advances in nanotechnology enable precise control over material properties at the molecular level, opening new pathways for next-generation carbon capture solutions that could fundamentally transform climate mitigation strategies.

Market Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing environmental concerns and regulatory pressures to reduce greenhouse gas emissions. As of 2023, the market size for carbon capture technologies has reached approximately $7 billion, with projections indicating a compound annual growth rate of 19.2% through 2030, potentially reaching $20 billion by the end of the decade.

Geographically, North America currently dominates the carbon capture market, accounting for roughly 40% of global installations, followed by Europe at 30% and Asia-Pacific at 20%. This distribution reflects both regulatory environments and industrial concentration in these regions. The United States, Canada, Norway, and the United Kingdom have emerged as key markets due to their favorable policy frameworks and substantial investment in carbon capture infrastructure.

Demand for carbon capture solutions spans multiple sectors, with power generation, oil and gas, cement production, and chemical manufacturing representing the primary market segments. The power generation sector alone constitutes approximately 45% of the current market demand, as coal and natural gas plants seek solutions to reduce their carbon footprint while maintaining operational viability.

Material innovations are significantly influencing market dynamics by addressing key economic barriers. Traditional carbon capture technologies have been hampered by high costs, with capture expenses ranging from $40-100 per ton of CO2. Advanced materials are driving these costs downward, with some next-generation sorbents and membranes demonstrating potential to reduce capture costs to $25-30 per ton, substantially improving commercial viability.

Customer segments can be categorized into three primary groups: large industrial emitters seeking compliance solutions, energy companies pursuing enhanced oil recovery applications, and environmental service providers developing carbon utilization pathways. Each segment presents distinct requirements and price sensitivities, with industrial emitters particularly focused on operational efficiency and minimal energy penalties.

Market adoption is currently in the early mainstream phase, with approximately 40 large-scale carbon capture facilities operational globally and over 100 in various stages of development. The inflection point for widespread adoption appears to be approaching as material innovations reduce costs and carbon pricing mechanisms become more prevalent across major economies.

Competition in this market features established industrial gas companies like Air Liquide and Linde, specialized carbon capture technology providers such as Carbon Engineering and Climeworks, and recent entrants from materials science backgrounds bringing novel capture solutions. This competitive landscape is driving rapid innovation cycles, particularly in materials development for more efficient capture processes.

Geographically, North America currently dominates the carbon capture market, accounting for roughly 40% of global installations, followed by Europe at 30% and Asia-Pacific at 20%. This distribution reflects both regulatory environments and industrial concentration in these regions. The United States, Canada, Norway, and the United Kingdom have emerged as key markets due to their favorable policy frameworks and substantial investment in carbon capture infrastructure.

Demand for carbon capture solutions spans multiple sectors, with power generation, oil and gas, cement production, and chemical manufacturing representing the primary market segments. The power generation sector alone constitutes approximately 45% of the current market demand, as coal and natural gas plants seek solutions to reduce their carbon footprint while maintaining operational viability.

Material innovations are significantly influencing market dynamics by addressing key economic barriers. Traditional carbon capture technologies have been hampered by high costs, with capture expenses ranging from $40-100 per ton of CO2. Advanced materials are driving these costs downward, with some next-generation sorbents and membranes demonstrating potential to reduce capture costs to $25-30 per ton, substantially improving commercial viability.

Customer segments can be categorized into three primary groups: large industrial emitters seeking compliance solutions, energy companies pursuing enhanced oil recovery applications, and environmental service providers developing carbon utilization pathways. Each segment presents distinct requirements and price sensitivities, with industrial emitters particularly focused on operational efficiency and minimal energy penalties.

Market adoption is currently in the early mainstream phase, with approximately 40 large-scale carbon capture facilities operational globally and over 100 in various stages of development. The inflection point for widespread adoption appears to be approaching as material innovations reduce costs and carbon pricing mechanisms become more prevalent across major economies.

Competition in this market features established industrial gas companies like Air Liquide and Linde, specialized carbon capture technology providers such as Carbon Engineering and Climeworks, and recent entrants from materials science backgrounds bringing novel capture solutions. This competitive landscape is driving rapid innovation cycles, particularly in materials development for more efficient capture processes.

Current State and Challenges in Carbon Capture Materials

Carbon capture technologies have seen significant advancements in recent years, yet material limitations remain a critical bottleneck in their widespread implementation. Current carbon capture materials can be categorized into several major types: amine-based sorbents, metal-organic frameworks (MOFs), zeolites, and membrane materials. Each presents unique advantages and distinct challenges that researchers worldwide are actively addressing.

Amine-based materials, particularly those using monoethanolamine (MEA), represent the most commercially mature technology. However, these materials suffer from high regeneration energy requirements (3.5-4.0 GJ/tCO2), corrosion issues, and degradation over multiple capture-release cycles. The energy penalty associated with regeneration significantly impacts the economic viability of large-scale deployment.

Metal-organic frameworks have emerged as promising alternatives due to their exceptional CO2 selectivity and tunable pore structures. Recent innovations in MOFs have achieved theoretical CO2 uptake capacities exceeding 40 wt%, substantially higher than conventional materials. Nevertheless, challenges persist in their hydrothermal stability, manufacturing scalability, and production costs, which currently exceed $100/kg for high-performance variants.

Zeolites offer excellent thermal stability and relatively low production costs but demonstrate limited CO2 selectivity in humid conditions—a significant drawback for flue gas applications where water vapor is invariably present. Research efforts are focused on hydrophobic zeolite modifications to overcome this limitation.

Membrane-based capture technologies present another frontier, with polymeric and mixed-matrix membranes showing promise for continuous operation systems. However, the permeability-selectivity trade-off remains a fundamental challenge, with most high-performance membranes struggling to maintain both properties simultaneously.

Geographically, material innovation in carbon capture technologies shows distinct patterns. North America and Europe lead in amine-based research and commercialization, while East Asian research institutions, particularly in China and Japan, have made significant contributions to MOF development. This regional specialization has created collaborative opportunities but also competitive tensions in intellectual property development.

The economic barriers to material advancement cannot be overstated. Current materials contribute to capture costs ranging from $40-100 per ton of CO2, significantly higher than the carbon price in most markets. This cost gap represents perhaps the most formidable challenge to widespread adoption.

Technical challenges also include material durability under industrial conditions, with most advanced materials showing performance degradation after 500-1000 capture-release cycles—far below the thousands of cycles required for economical operation. Additionally, the scalability of laboratory-developed materials to industrial quantities remains problematic, with many promising materials facing synthesis barriers when production volumes increase.

Amine-based materials, particularly those using monoethanolamine (MEA), represent the most commercially mature technology. However, these materials suffer from high regeneration energy requirements (3.5-4.0 GJ/tCO2), corrosion issues, and degradation over multiple capture-release cycles. The energy penalty associated with regeneration significantly impacts the economic viability of large-scale deployment.

Metal-organic frameworks have emerged as promising alternatives due to their exceptional CO2 selectivity and tunable pore structures. Recent innovations in MOFs have achieved theoretical CO2 uptake capacities exceeding 40 wt%, substantially higher than conventional materials. Nevertheless, challenges persist in their hydrothermal stability, manufacturing scalability, and production costs, which currently exceed $100/kg for high-performance variants.

Zeolites offer excellent thermal stability and relatively low production costs but demonstrate limited CO2 selectivity in humid conditions—a significant drawback for flue gas applications where water vapor is invariably present. Research efforts are focused on hydrophobic zeolite modifications to overcome this limitation.

Membrane-based capture technologies present another frontier, with polymeric and mixed-matrix membranes showing promise for continuous operation systems. However, the permeability-selectivity trade-off remains a fundamental challenge, with most high-performance membranes struggling to maintain both properties simultaneously.

Geographically, material innovation in carbon capture technologies shows distinct patterns. North America and Europe lead in amine-based research and commercialization, while East Asian research institutions, particularly in China and Japan, have made significant contributions to MOF development. This regional specialization has created collaborative opportunities but also competitive tensions in intellectual property development.

The economic barriers to material advancement cannot be overstated. Current materials contribute to capture costs ranging from $40-100 per ton of CO2, significantly higher than the carbon price in most markets. This cost gap represents perhaps the most formidable challenge to widespread adoption.

Technical challenges also include material durability under industrial conditions, with most advanced materials showing performance degradation after 500-1000 capture-release cycles—far below the thousands of cycles required for economical operation. Additionally, the scalability of laboratory-developed materials to industrial quantities remains problematic, with many promising materials facing synthesis barriers when production volumes increase.

Current Material Solutions for Carbon Capture

01 Metal-Organic Frameworks (MOFs) for Carbon Capture

Metal-Organic Frameworks represent a significant advancement in carbon capture materials due to their highly porous structure and customizable properties. These crystalline compounds consist of metal ions coordinated to organic ligands, creating three-dimensional structures with exceptional surface area for CO2 adsorption. MOFs can be tailored for selective carbon capture by modifying their pore size, functional groups, and metal centers, allowing for efficient separation of CO2 from other gases in industrial emissions.- Metal-Organic Frameworks (MOFs) for Carbon Capture: Metal-Organic Frameworks represent a significant advancement in carbon capture materials due to their highly porous structure and customizable chemistry. These crystalline compounds consist of metal ions coordinated to organic ligands, creating three-dimensional structures with exceptional surface area and tunable pore sizes. MOFs can be designed to selectively adsorb CO2 from various gas mixtures, including post-combustion flue gases, with high capacity and efficiency. Recent innovations focus on improving MOF stability under humid conditions and reducing manufacturing costs for industrial-scale applications.

- Novel Amine-Based Sorbents and Solutions: Advanced amine-based materials represent an evolution of traditional carbon capture technologies. These innovations include solid amine sorbents, where amine functional groups are grafted onto high-surface-area supports, and enhanced amine solutions with modified chemistries. These materials offer improved CO2 absorption capacity, faster kinetics, and reduced regeneration energy compared to conventional amine scrubbing. Recent developments focus on addressing degradation issues, minimizing volatile emissions, and creating formulations that resist oxidative degradation during the capture-regeneration cycle.

- Biomimetic and Enzyme-Inspired Carbon Capture Materials: Biomimetic approaches to carbon capture draw inspiration from natural CO2-processing systems like the enzyme carbonic anhydrase. These materials mimic the active sites of enzymes that efficiently convert CO2 to bicarbonate in biological systems. Synthetic catalysts and engineered proteins are being developed to replicate this functionality under industrial conditions. These bio-inspired materials can operate at ambient temperatures with lower energy requirements than conventional technologies. Research focuses on improving stability in harsh industrial environments and scaling up production for commercial applications.

- Advanced Membrane Technologies for CO2 Separation: Innovative membrane materials are being developed specifically for carbon capture applications. These include mixed matrix membranes that combine polymers with inorganic fillers, facilitated transport membranes containing CO2-reactive carriers, and thermally rearranged polymers with enhanced gas selectivity. These next-generation membranes offer improved CO2/N2 selectivity, higher permeability, and better resistance to contaminants in flue gas. Current research focuses on developing membranes that maintain performance over extended periods and can be manufactured at scale for industrial deployment.

- Carbon-Based Adsorbents and Composites: Advanced carbon-based materials, including functionalized activated carbons, graphene derivatives, and carbon nanotubes, are being engineered for enhanced CO2 capture. These materials leverage high surface area and tunable surface chemistry to selectively adsorb carbon dioxide. Recent innovations include hierarchical porous structures that optimize diffusion kinetics and composite materials that combine carbon substrates with metal oxides or amines. These adsorbents offer advantages including low regeneration energy, stability across multiple cycles, and potential for manufacturing from sustainable or waste carbon sources.

02 Novel Adsorbent Materials and Composites

Advanced adsorbent materials and composites are being developed to enhance carbon capture efficiency. These include modified zeolites, activated carbons, and hybrid materials that combine the advantages of different adsorbents. These materials feature high selectivity for CO2, improved adsorption capacity, and enhanced stability under various operating conditions. Some innovations focus on reducing the energy required for regeneration while maintaining capture performance across multiple cycles.Expand Specific Solutions03 Membrane-Based Carbon Capture Technologies

Innovative membrane materials are revolutionizing carbon capture through selective gas separation. These membranes utilize polymeric, inorganic, or mixed matrix compositions with precisely engineered pore structures to allow CO2 to permeate while blocking other gases. Recent advancements focus on improving membrane permeability and selectivity while enhancing mechanical strength and thermal stability for industrial applications. These materials offer advantages in terms of energy efficiency and operational simplicity compared to traditional capture methods.Expand Specific Solutions04 Enzymatic and Biologically-Inspired Carbon Capture Materials

Biologically-inspired approaches to carbon capture utilize enzymes, biomimetic catalysts, and bio-derived materials to selectively capture CO2. These systems mimic natural carbon fixation processes found in organisms, offering high selectivity and efficiency under mild conditions. Innovations include immobilized carbonic anhydrase enzymes, engineered microorganisms, and biomimetic polymers that can operate at ambient temperatures and pressures, potentially reducing the energy requirements for carbon capture compared to conventional methods.Expand Specific Solutions05 Direct Air Capture Materials and Sorbents

Materials specifically designed for direct air capture (DAC) of CO2 from ambient air represent a growing area of innovation. These specialized sorbents must function effectively at the very low CO2 concentrations found in atmospheric air. Recent developments include novel amine-functionalized materials, alkali metal-based sorbents, and advanced porous structures with high surface area. These materials are engineered to minimize energy requirements for regeneration while maximizing CO2 selectivity and capacity under ambient conditions.Expand Specific Solutions

Leading Organizations in Carbon Capture Material Development

The carbon capture technology market is currently in a growth phase, with increasing investments and research activities. The global market size is projected to expand significantly, driven by climate change concerns and regulatory pressures. Technologically, the field shows varying maturity levels across different capture methods. Leading players include major energy corporations like Saudi Aramco, CNPC, and PETRONAS, who are leveraging their industrial infrastructure for large-scale implementation. Academic institutions such as MIT, Columbia University, and KAUST are pioneering material innovations, while specialized companies like Climeworks and CocoonCarbon are commercializing novel capture technologies. The competitive landscape reflects a collaborative ecosystem where material innovations from research institutions are increasingly being adopted by industry players to enhance capture efficiency and reduce costs.

China Petroleum & Chemical Corp.

Technical Solution: Sinopec has developed a comprehensive portfolio of carbon capture materials tailored for high-volume industrial applications. Their proprietary amine-modified mesoporous silica adsorbents demonstrate CO2 capture capacity exceeding 4 mmol/g with significantly reduced regeneration energy requirements compared to conventional liquid amines. Sinopec's material innovations include specialized zeolite formulations with optimized pore structures that enhance CO2 selectivity while maintaining performance in the presence of contaminants like SOx and NOx. Their dual-phase ceramic-carbonate membranes operate at elevated temperatures (500-900°C), enabling integration with industrial processes for improved energy efficiency. Sinopec has successfully scaled these materials for commercial deployment at their Qilu Petrochemical facility, which captures over 1 million tons of CO2 annually for utilization in food-grade CO2 production and enhanced oil recovery. Recent advancements include composite materials that combine physical and chemical adsorption mechanisms to optimize performance across varying CO2 concentrations and operating conditions[9][10].

Strengths: Extensive industrial implementation experience validates material performance at scale; integrated approach addressing capture, utilization and storage applications; strong manufacturing capabilities enable cost-effective material production. Weaknesses: Some materials optimized for specific industrial conditions with limited flexibility; heavy focus on materials compatible with existing infrastructure rather than breakthrough technologies; regeneration energy requirements still higher than theoretical minimums despite improvements.

Climeworks AG

Technical Solution: Climeworks has pioneered Direct Air Capture (DAC) technology using innovative amine-functionalized filter materials that selectively bind CO2 from ambient air. Their modular collectors feature specialized sorbent materials arranged in filter structures that capture CO2 when air passes through them. The process involves a two-step temperature-vacuum swing adsorption cycle where the filters first capture CO2 at ambient conditions, then release concentrated CO2 when heated to 80-100°C in vacuum conditions. Climeworks' latest material innovations include enhanced sorbent stability that maintains capture efficiency over thousands of cycles and improved material architectures that optimize airflow while maximizing contact surface area. Their Orca plant in Iceland demonstrates these advancements at commercial scale, with captured CO2 being permanently mineralized in basaltic rock formations through partnership with Carbfix[1][3].

Strengths: Modular, scalable design allows flexible deployment; advanced sorbent materials achieve high selectivity for CO2; integration with geothermal energy provides renewable heat source for regeneration. Weaknesses: Current materials require significant energy for regeneration; higher material production costs compared to traditional carbon capture approaches; sorbent degradation over multiple cycles remains a challenge despite improvements.

Key Innovations in Carbon Capture Material Science

Synthesis process for solid carbon capture materials

PatentWO2021096958A1

Innovation

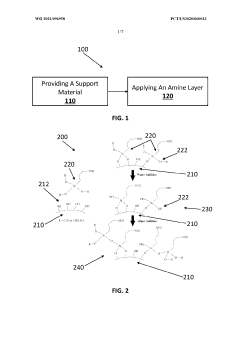

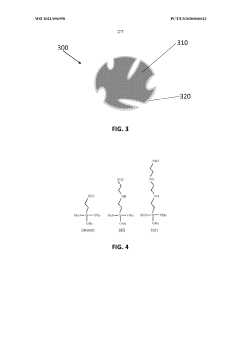

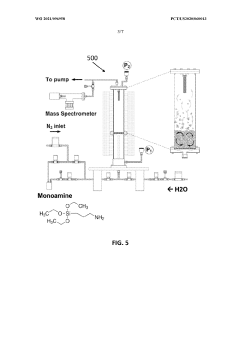

- The use of molecular layer deposition (MLD) to create amine-functionalized solid CO2 sorbents, which allows for precise angstrom-level thickness control and covalent anchoring of amine layers on a wide range of substrate materials, including nano-powders, enhancing surface area functionalization and maintaining active sites during regeneration without specialized substrates or costly preparation.

Systems and methods for carbon capture

PatentInactiveUS20220203297A1

Innovation

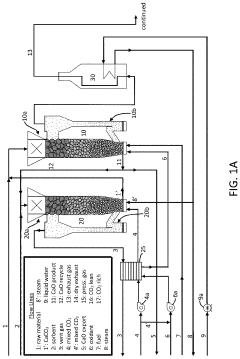

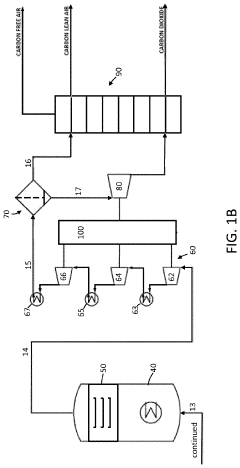

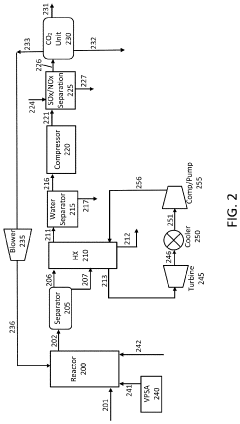

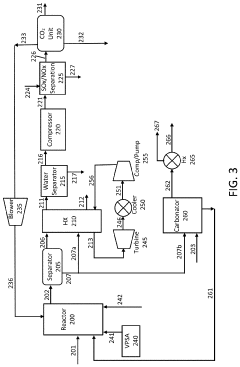

- A system and method for capturing CO2 during calcination processes, integrating carbon capture with cement, steel, and power production, utilizing a reactor, separator, heat exchange unit, and CO2 separation unit, including oxygen provision and membrane separation, to produce 'carbon dioxide-free' industrial products and integrate with power plants for efficient CO2 utilization.

Environmental Impact Assessment of Carbon Capture Materials

The environmental impact assessment of carbon capture materials is a critical component in evaluating the sustainability of carbon capture technologies. Traditional carbon capture methods often present significant environmental trade-offs that must be carefully considered against their climate benefits.

Carbon capture materials, including amine-based sorbents, metal-organic frameworks (MOFs), and zeolites, each generate distinct environmental footprints throughout their lifecycle. Manufacturing processes for advanced MOFs, for instance, frequently require energy-intensive synthesis conditions and specialized solvents that may contribute to various forms of pollution if not properly managed.

Water consumption represents another significant environmental concern, particularly for aqueous amine systems that require substantial cooling water during regeneration cycles. Recent material innovations have focused on developing water-efficient alternatives, with solid sorbents demonstrating up to 70% reduction in water requirements compared to conventional liquid amine systems.

Land use impacts vary considerably across different carbon capture material applications. Direct air capture installations utilizing novel materials may require significant land area, with current estimates suggesting approximately 1-2 km² per million tons of CO₂ captured annually. This spatial requirement necessitates careful site selection to minimize ecosystem disruption and potential conflicts with agricultural or conservation priorities.

The toxicological profiles of emerging carbon capture materials present evolving environmental health considerations. While traditional amine solutions pose known respiratory and aquatic toxicity risks, newer materials such as bio-inspired metal-organic frameworks demonstrate promising reductions in ecotoxicity. However, comprehensive long-term environmental fate studies remain limited for many novel materials.

Energy penalties associated with material regeneration constitute a significant environmental factor. The regeneration energy requirements for first-generation materials often reached 3-4 GJ/ton CO₂, potentially offsetting climate benefits through increased fossil fuel consumption. Recent innovations in phase-change materials and low-temperature sorbents have demonstrated regeneration energy reductions of up to 40%, substantially improving net environmental performance.

Waste management challenges emerge particularly at end-of-life stages for carbon capture materials. Spent sorbents may contain accumulated contaminants requiring specialized disposal protocols. Emerging circular economy approaches focus on material recovery and regeneration, with pilot programs demonstrating up to 85% recovery rates for precious metal components in advanced sorbent structures.

Carbon capture materials, including amine-based sorbents, metal-organic frameworks (MOFs), and zeolites, each generate distinct environmental footprints throughout their lifecycle. Manufacturing processes for advanced MOFs, for instance, frequently require energy-intensive synthesis conditions and specialized solvents that may contribute to various forms of pollution if not properly managed.

Water consumption represents another significant environmental concern, particularly for aqueous amine systems that require substantial cooling water during regeneration cycles. Recent material innovations have focused on developing water-efficient alternatives, with solid sorbents demonstrating up to 70% reduction in water requirements compared to conventional liquid amine systems.

Land use impacts vary considerably across different carbon capture material applications. Direct air capture installations utilizing novel materials may require significant land area, with current estimates suggesting approximately 1-2 km² per million tons of CO₂ captured annually. This spatial requirement necessitates careful site selection to minimize ecosystem disruption and potential conflicts with agricultural or conservation priorities.

The toxicological profiles of emerging carbon capture materials present evolving environmental health considerations. While traditional amine solutions pose known respiratory and aquatic toxicity risks, newer materials such as bio-inspired metal-organic frameworks demonstrate promising reductions in ecotoxicity. However, comprehensive long-term environmental fate studies remain limited for many novel materials.

Energy penalties associated with material regeneration constitute a significant environmental factor. The regeneration energy requirements for first-generation materials often reached 3-4 GJ/ton CO₂, potentially offsetting climate benefits through increased fossil fuel consumption. Recent innovations in phase-change materials and low-temperature sorbents have demonstrated regeneration energy reductions of up to 40%, substantially improving net environmental performance.

Waste management challenges emerge particularly at end-of-life stages for carbon capture materials. Spent sorbents may contain accumulated contaminants requiring specialized disposal protocols. Emerging circular economy approaches focus on material recovery and regeneration, with pilot programs demonstrating up to 85% recovery rates for precious metal components in advanced sorbent structures.

Policy Framework and Incentives for Carbon Capture Implementation

The global policy landscape for carbon capture technologies has evolved significantly over the past decade, with governments increasingly recognizing the critical role these technologies play in meeting climate goals. Carbon pricing mechanisms, including carbon taxes and cap-and-trade systems, have emerged as primary policy instruments driving carbon capture implementation. The European Union's Emissions Trading System (EU ETS) represents one of the most mature carbon markets, while similar schemes in Canada, China, and various U.S. states demonstrate growing international commitment to pricing carbon emissions.

Tax incentives have proven particularly effective in accelerating carbon capture deployment. The U.S. Section 45Q tax credit, enhanced in 2018, provides up to $50 per metric ton of CO2 permanently sequestered, creating a substantial financial incentive for industrial adoption. Similarly, Norway's carbon tax on offshore petroleum activities has driven the development of the Sleipner and Snøhvit carbon capture projects, demonstrating how targeted fiscal policies can stimulate technological implementation.

Direct government funding programs have catalyzed material innovations in carbon capture technologies. The U.S. Department of Energy's Carbon Capture Program has invested over $1 billion in research and development, while the EU Innovation Fund allocates substantial resources to breakthrough technologies. These initiatives have been instrumental in advancing novel materials for carbon capture, including metal-organic frameworks (MOFs), advanced amines, and membrane technologies.

Regulatory frameworks also play a crucial role in facilitating carbon capture implementation. Clear permitting processes for CO2 storage, liability frameworks, and monitoring requirements provide certainty for investors and operators. Countries like Australia, Canada, and the UK have established comprehensive regulatory regimes specifically addressing carbon capture and storage activities, creating enabling environments for technology deployment.

International cooperation mechanisms further enhance the policy landscape. The Clean Development Mechanism under the Kyoto Protocol and emerging Article 6 mechanisms under the Paris Agreement provide frameworks for cross-border collaboration. Organizations such as the Carbon Sequestration Leadership Forum and the International CCS Knowledge Centre facilitate knowledge sharing and best practices exchange, accelerating global adoption of advanced carbon capture materials and technologies.

Looking forward, policy integration across energy, industrial, and climate domains will be essential for maximizing the impact of material innovations in carbon capture. Harmonized standards for carbon accounting, technology performance metrics, and life-cycle assessments will create more predictable market conditions for technology developers and investors, driving continued innovation in this critical climate solution space.

Tax incentives have proven particularly effective in accelerating carbon capture deployment. The U.S. Section 45Q tax credit, enhanced in 2018, provides up to $50 per metric ton of CO2 permanently sequestered, creating a substantial financial incentive for industrial adoption. Similarly, Norway's carbon tax on offshore petroleum activities has driven the development of the Sleipner and Snøhvit carbon capture projects, demonstrating how targeted fiscal policies can stimulate technological implementation.

Direct government funding programs have catalyzed material innovations in carbon capture technologies. The U.S. Department of Energy's Carbon Capture Program has invested over $1 billion in research and development, while the EU Innovation Fund allocates substantial resources to breakthrough technologies. These initiatives have been instrumental in advancing novel materials for carbon capture, including metal-organic frameworks (MOFs), advanced amines, and membrane technologies.

Regulatory frameworks also play a crucial role in facilitating carbon capture implementation. Clear permitting processes for CO2 storage, liability frameworks, and monitoring requirements provide certainty for investors and operators. Countries like Australia, Canada, and the UK have established comprehensive regulatory regimes specifically addressing carbon capture and storage activities, creating enabling environments for technology deployment.

International cooperation mechanisms further enhance the policy landscape. The Clean Development Mechanism under the Kyoto Protocol and emerging Article 6 mechanisms under the Paris Agreement provide frameworks for cross-border collaboration. Organizations such as the Carbon Sequestration Leadership Forum and the International CCS Knowledge Centre facilitate knowledge sharing and best practices exchange, accelerating global adoption of advanced carbon capture materials and technologies.

Looking forward, policy integration across energy, industrial, and climate domains will be essential for maximizing the impact of material innovations in carbon capture. Harmonized standards for carbon accounting, technology performance metrics, and life-cycle assessments will create more predictable market conditions for technology developers and investors, driving continued innovation in this critical climate solution space.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!