Carbon Capture Technologies Emerging Market Analysis

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Evolution and Objectives

Carbon capture technologies have evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications across various industries. The journey began in the 1970s with early experiments in carbon dioxide separation for enhanced oil recovery operations. By the 1990s, growing environmental concerns propelled carbon capture research into mainstream scientific discourse, leading to the development of first-generation capture systems primarily focused on post-combustion technologies.

The evolution accelerated in the early 2000s with the emergence of pre-combustion and oxy-fuel combustion approaches, expanding the technological portfolio beyond conventional amine-based solutions. The 2010s marked a pivotal shift toward more energy-efficient and cost-effective methods, including advanced solvents, solid sorbents, and membrane-based separation technologies. Recent years have witnessed groundbreaking innovations in direct air capture (DAC) systems, which represent a paradigm shift by enabling carbon dioxide extraction directly from ambient air rather than point sources.

Current technological trajectories indicate a convergence toward integrated carbon capture, utilization, and storage (CCUS) systems that not only capture carbon but transform it into valuable products or secure it in permanent geological repositories. Biomimetic approaches inspired by natural carbon fixation processes are gaining traction, alongside electrochemical methods that leverage renewable electricity for carbon separation and conversion.

The primary objectives of contemporary carbon capture technology development center on three critical dimensions: economic viability, energy efficiency, and scalability. Economic considerations focus on reducing the capital and operational expenditures to below $100 per ton of CO₂ captured—a threshold widely considered necessary for widespread commercial adoption. Energy efficiency improvements aim to minimize the parasitic energy load that capture systems impose on host facilities, currently ranging from 20-30% of total energy output in many applications.

Scalability objectives address the urgent need to deploy carbon capture technologies at a pace and magnitude commensurate with global climate targets. This includes developing modular systems adaptable to diverse industrial contexts and geographical locations, from power plants to cement factories and steel mills. Additional objectives include enhancing the durability of capture materials to withstand industrial conditions, minimizing environmental side effects, and optimizing integration with existing infrastructure.

Looking forward, the technology roadmap emphasizes achieving negative emissions through bioenergy with carbon capture and storage (BECCS) and direct air capture with storage (DACS), which will be essential to meet the Paris Agreement goals. The ultimate objective remains developing a portfolio of carbon capture solutions that can collectively mitigate billions of tons of CO₂ emissions annually by mid-century, while creating economic opportunities through carbon utilization pathways.

The evolution accelerated in the early 2000s with the emergence of pre-combustion and oxy-fuel combustion approaches, expanding the technological portfolio beyond conventional amine-based solutions. The 2010s marked a pivotal shift toward more energy-efficient and cost-effective methods, including advanced solvents, solid sorbents, and membrane-based separation technologies. Recent years have witnessed groundbreaking innovations in direct air capture (DAC) systems, which represent a paradigm shift by enabling carbon dioxide extraction directly from ambient air rather than point sources.

Current technological trajectories indicate a convergence toward integrated carbon capture, utilization, and storage (CCUS) systems that not only capture carbon but transform it into valuable products or secure it in permanent geological repositories. Biomimetic approaches inspired by natural carbon fixation processes are gaining traction, alongside electrochemical methods that leverage renewable electricity for carbon separation and conversion.

The primary objectives of contemporary carbon capture technology development center on three critical dimensions: economic viability, energy efficiency, and scalability. Economic considerations focus on reducing the capital and operational expenditures to below $100 per ton of CO₂ captured—a threshold widely considered necessary for widespread commercial adoption. Energy efficiency improvements aim to minimize the parasitic energy load that capture systems impose on host facilities, currently ranging from 20-30% of total energy output in many applications.

Scalability objectives address the urgent need to deploy carbon capture technologies at a pace and magnitude commensurate with global climate targets. This includes developing modular systems adaptable to diverse industrial contexts and geographical locations, from power plants to cement factories and steel mills. Additional objectives include enhancing the durability of capture materials to withstand industrial conditions, minimizing environmental side effects, and optimizing integration with existing infrastructure.

Looking forward, the technology roadmap emphasizes achieving negative emissions through bioenergy with carbon capture and storage (BECCS) and direct air capture with storage (DACS), which will be essential to meet the Paris Agreement goals. The ultimate objective remains developing a portfolio of carbon capture solutions that can collectively mitigate billions of tons of CO₂ emissions annually by mid-century, while creating economic opportunities through carbon utilization pathways.

Market Demand for Carbon Capture Solutions

The global market for carbon capture technologies is experiencing unprecedented growth, driven by the urgent need to address climate change and meet increasingly stringent emissions targets. Current projections indicate the global carbon capture, utilization, and storage (CCUS) market will reach approximately $7 billion by 2025, with an annual growth rate exceeding 13% through 2030. This acceleration reflects both regulatory pressures and growing corporate commitments to achieve net-zero emissions.

Industrial sectors represent the primary demand source, particularly hard-to-abate industries such as cement production, steel manufacturing, and chemical processing. These sectors contribute nearly 25% of global CO2 emissions yet face significant technical challenges in reducing their carbon footprint through conventional means. The International Energy Agency estimates that CCUS technologies must capture more than 7.6 gigatons of CO2 annually by 2050 to achieve climate neutrality targets, representing a massive scaling opportunity.

Power generation remains another critical market segment, with coal and natural gas plants increasingly exploring retrofit carbon capture solutions. This sector's demand is particularly strong in regions with continued reliance on fossil fuel electricity generation, including parts of Asia, North America, and Europe. Notably, demand patterns show geographic variation, with European markets prioritizing immediate deployment due to carbon pricing mechanisms, while Asian markets focus on technology development for future implementation.

The voluntary carbon market is emerging as a significant demand driver, with corporate net-zero pledges creating willingness to pay premium prices for verified carbon removal. This market segment grew by 164% in 2021 alone and continues to expand as companies seek credible pathways to fulfill climate commitments. Financial institutions are increasingly factoring carbon risk into investment decisions, further stimulating demand for effective capture technologies.

Policy incentives have dramatically altered the economic landscape for carbon capture. The U.S. 45Q tax credit expansion, offering up to $85 per ton for permanent CO2 storage, has transformed project economics. Similarly, the EU Emissions Trading System price exceeding €80 per ton has created viable business models for capture technologies. These mechanisms have effectively established a price floor that supports investment in commercial-scale projects.

Consumer-facing industries are increasingly seeking carbon-neutral products, creating pull-through demand for captured carbon in materials and fuels. This trend is particularly evident in construction materials, synthetic fuels, and consumer packaged goods, where companies can command price premiums for demonstrably low-carbon alternatives. Market research indicates consumers are willing to pay 5-10% more for products with verified carbon reduction credentials.

Industrial sectors represent the primary demand source, particularly hard-to-abate industries such as cement production, steel manufacturing, and chemical processing. These sectors contribute nearly 25% of global CO2 emissions yet face significant technical challenges in reducing their carbon footprint through conventional means. The International Energy Agency estimates that CCUS technologies must capture more than 7.6 gigatons of CO2 annually by 2050 to achieve climate neutrality targets, representing a massive scaling opportunity.

Power generation remains another critical market segment, with coal and natural gas plants increasingly exploring retrofit carbon capture solutions. This sector's demand is particularly strong in regions with continued reliance on fossil fuel electricity generation, including parts of Asia, North America, and Europe. Notably, demand patterns show geographic variation, with European markets prioritizing immediate deployment due to carbon pricing mechanisms, while Asian markets focus on technology development for future implementation.

The voluntary carbon market is emerging as a significant demand driver, with corporate net-zero pledges creating willingness to pay premium prices for verified carbon removal. This market segment grew by 164% in 2021 alone and continues to expand as companies seek credible pathways to fulfill climate commitments. Financial institutions are increasingly factoring carbon risk into investment decisions, further stimulating demand for effective capture technologies.

Policy incentives have dramatically altered the economic landscape for carbon capture. The U.S. 45Q tax credit expansion, offering up to $85 per ton for permanent CO2 storage, has transformed project economics. Similarly, the EU Emissions Trading System price exceeding €80 per ton has created viable business models for capture technologies. These mechanisms have effectively established a price floor that supports investment in commercial-scale projects.

Consumer-facing industries are increasingly seeking carbon-neutral products, creating pull-through demand for captured carbon in materials and fuels. This trend is particularly evident in construction materials, synthetic fuels, and consumer packaged goods, where companies can command price premiums for demonstrably low-carbon alternatives. Market research indicates consumers are willing to pay 5-10% more for products with verified carbon reduction credentials.

Global Carbon Capture Technology Landscape

Carbon capture technologies have evolved significantly over the past three decades, transitioning from theoretical concepts to commercial applications across multiple industries. The global landscape of carbon capture is characterized by three primary technology categories: post-combustion capture, pre-combustion capture, and oxy-fuel combustion systems. Each approach has developed along distinct technological trajectories with varying levels of market penetration and technological maturity.

Post-combustion capture technologies dominate the current market, representing approximately 60% of existing installations worldwide. These systems are primarily deployed in power generation facilities and large industrial operations in North America, Europe, and increasingly in Asia. The technology landscape is geographically concentrated, with the United States, Canada, Norway, and China emerging as innovation hubs with the highest density of research institutions and commercial deployments.

The technological distribution reveals significant regional specialization. North American entities have focused predominantly on solvent-based capture systems and geological storage solutions, while European players have pioneered membrane technology and offshore storage approaches. Asian market participants, particularly in China and Japan, have made substantial advances in solid sorbent technologies and utilization pathways for captured carbon.

Recent technological breakthroughs have accelerated development in direct air capture (DAC) systems, which represent an emerging but rapidly growing segment of the carbon capture landscape. Though currently accounting for less than 5% of total carbon capture capacity, DAC technologies have attracted substantial investment, with pilot projects operational in Switzerland, Canada, and Iceland demonstrating increasing efficiency and declining cost curves.

The global carbon capture technology ecosystem is characterized by significant variation in technological readiness levels (TRLs). While amine-based post-combustion capture systems have reached TRL 9 with full commercial deployment, emerging technologies such as metal-organic frameworks (MOFs) and advanced electrochemical approaches remain at TRL 4-6, with demonstration projects underway but commercial viability still uncertain.

Regulatory frameworks have substantially influenced the geographic distribution of carbon capture technologies. Regions with established carbon pricing mechanisms or tax incentives, such as the European Union's Emissions Trading System and the United States' 45Q tax credits, have fostered more robust technology development ecosystems and higher deployment rates. This regulatory landscape has created distinct technology clusters aligned with policy support mechanisms rather than purely market-driven distribution.

The technology landscape is further shaped by cross-sector collaboration, with notable partnerships between energy companies, industrial manufacturers, and technology developers creating innovation corridors in specific geographic regions. These collaborative networks have accelerated technology transfer and commercialization, particularly evident in the North Sea region and the U.S. Gulf Coast.

Post-combustion capture technologies dominate the current market, representing approximately 60% of existing installations worldwide. These systems are primarily deployed in power generation facilities and large industrial operations in North America, Europe, and increasingly in Asia. The technology landscape is geographically concentrated, with the United States, Canada, Norway, and China emerging as innovation hubs with the highest density of research institutions and commercial deployments.

The technological distribution reveals significant regional specialization. North American entities have focused predominantly on solvent-based capture systems and geological storage solutions, while European players have pioneered membrane technology and offshore storage approaches. Asian market participants, particularly in China and Japan, have made substantial advances in solid sorbent technologies and utilization pathways for captured carbon.

Recent technological breakthroughs have accelerated development in direct air capture (DAC) systems, which represent an emerging but rapidly growing segment of the carbon capture landscape. Though currently accounting for less than 5% of total carbon capture capacity, DAC technologies have attracted substantial investment, with pilot projects operational in Switzerland, Canada, and Iceland demonstrating increasing efficiency and declining cost curves.

The global carbon capture technology ecosystem is characterized by significant variation in technological readiness levels (TRLs). While amine-based post-combustion capture systems have reached TRL 9 with full commercial deployment, emerging technologies such as metal-organic frameworks (MOFs) and advanced electrochemical approaches remain at TRL 4-6, with demonstration projects underway but commercial viability still uncertain.

Regulatory frameworks have substantially influenced the geographic distribution of carbon capture technologies. Regions with established carbon pricing mechanisms or tax incentives, such as the European Union's Emissions Trading System and the United States' 45Q tax credits, have fostered more robust technology development ecosystems and higher deployment rates. This regulatory landscape has created distinct technology clusters aligned with policy support mechanisms rather than purely market-driven distribution.

The technology landscape is further shaped by cross-sector collaboration, with notable partnerships between energy companies, industrial manufacturers, and technology developers creating innovation corridors in specific geographic regions. These collaborative networks have accelerated technology transfer and commercialization, particularly evident in the North Sea region and the U.S. Gulf Coast.

Current Carbon Capture Implementation Methods

01 Direct Air Capture Technologies

Direct Air Capture (DAC) technologies involve systems that extract carbon dioxide directly from the atmosphere. These systems typically use sorbent materials or chemical solutions that selectively capture CO2 from ambient air. After capture, the CO2 can be concentrated, compressed, and either stored underground or utilized in various applications. DAC technologies are particularly valuable for addressing emissions from distributed sources and can help achieve negative emissions when combined with permanent storage solutions.- Direct Air Capture Technologies: Direct air capture (DAC) technologies involve systems that extract carbon dioxide directly from the atmosphere. These systems typically use sorbent materials or chemical solutions to selectively capture CO2 from ambient air. After capture, the CO2 can be concentrated and either stored underground or utilized in various applications. DAC technologies are particularly valuable for addressing emissions from distributed sources that are difficult to capture at the point of emission.

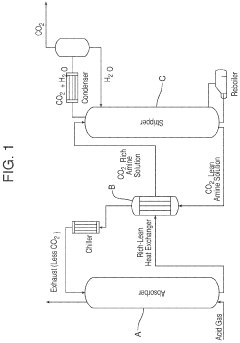

- Post-Combustion Carbon Capture: Post-combustion carbon capture technologies focus on removing CO2 from flue gases after the combustion process in power plants and industrial facilities. These systems typically employ chemical solvents, membranes, or solid sorbents to separate CO2 from other exhaust gases. The captured CO2 can then be compressed and transported for storage or utilization. This approach allows for retrofitting existing facilities without major modifications to the primary industrial process.

- Biological Carbon Sequestration Methods: Biological carbon sequestration leverages natural processes to capture and store carbon dioxide. These methods include enhanced forestry practices, algae-based capture systems, and agricultural techniques that increase soil carbon content. Engineered biological systems can also be developed to accelerate carbon fixation rates beyond natural levels. These approaches often provide co-benefits such as improved soil health, increased biodiversity, and enhanced ecosystem services while removing CO2 from the atmosphere.

- Carbon Mineralization and Enhanced Weathering: Carbon mineralization technologies accelerate natural weathering processes to convert CO2 into stable carbonate minerals. These approaches involve exposing CO2 to reactive materials such as certain types of rocks or industrial waste products that contain calcium or magnesium. The resulting chemical reactions permanently sequester carbon in solid mineral form. Enhanced weathering can be implemented in various settings, from spreading crushed minerals on agricultural lands to engineered reactors that optimize the carbonation process.

- Carbon Capture Utilization and Storage (CCUS) Systems: CCUS systems integrate capture technologies with methods for utilizing or permanently storing captured CO2. Utilization pathways include conversion to fuels, chemicals, building materials, or use in enhanced oil recovery. Storage options primarily focus on geological sequestration in deep saline formations, depleted oil and gas reservoirs, or unminable coal seams. These integrated systems address both the capture challenge and the equally important question of what to do with the captured carbon, creating potential economic value from what would otherwise be a waste product.

02 Post-Combustion Carbon Capture

Post-combustion carbon capture technologies focus on removing CO2 from flue gases after the combustion process in power plants and industrial facilities. These systems typically employ chemical absorption using amine-based solvents, membrane separation, or adsorption processes. The captured CO2 is then separated, compressed, and prepared for transport and storage. This approach allows for retrofitting existing power plants and industrial facilities without major modifications to the core combustion process.Expand Specific Solutions03 Carbon Storage and Sequestration Methods

Carbon storage and sequestration methods involve the permanent or long-term containment of captured CO2 to prevent its release into the atmosphere. These methods include geological storage in depleted oil and gas reservoirs, deep saline formations, and unminable coal seams. Enhanced techniques involve mineralizing CO2 into stable carbonate minerals through reactions with certain rock types. Ocean sequestration and enhanced weathering are also being explored as potential storage solutions, though with careful consideration of environmental impacts.Expand Specific Solutions04 Carbon Utilization Technologies

Carbon utilization technologies convert captured CO2 into valuable products rather than simply storing it. These approaches include converting CO2 into fuels, chemicals, building materials, and polymers. Specific applications include enhanced oil recovery, production of synthetic fuels through catalytic processes, creation of carbonates for construction materials, and incorporation into polymers and plastics. These technologies aim to create economic value from captured carbon while reducing net emissions.Expand Specific Solutions05 Biogenic Carbon Capture Systems

Biogenic carbon capture systems leverage natural biological processes to remove CO2 from the atmosphere. These include technologies such as bioenergy with carbon capture and storage (BECCS), which combines biomass energy production with carbon capture; enhanced agricultural practices that increase soil carbon sequestration; afforestation and reforestation projects; and the cultivation of algae and microorganisms that efficiently absorb CO2. These systems often provide co-benefits such as improved soil health, biodiversity, and sustainable biomass production.Expand Specific Solutions

Key Industry Players and Competitive Analysis

Carbon capture technologies are emerging as a critical solution for climate change mitigation, with the market currently in its early growth phase. The global carbon capture market is projected to reach $7-10 billion by 2025, expanding at a CAGR of approximately 20%. Technologically, the field is advancing rapidly but remains in mid-maturity, with significant R&D investments from both public and private sectors. Key players include established energy corporations like Sinopec and China Resources Power, alongside specialized technology developers such as NuScale Power and C-TECH. Academic institutions including Arizona State University, Nanyang Technological University, and Zhejiang University are driving fundamental research, while national laboratories like Lawrence Livermore National Security provide critical infrastructure for technology validation. This competitive landscape reflects a diverse ecosystem of stakeholders working to commercialize and scale carbon capture solutions.

China Petroleum & Chemical Corp.

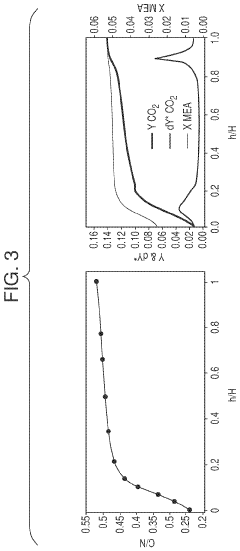

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed an innovative carbon capture technology suite focused on integrated CCUS (Carbon Capture, Utilization and Storage) solutions. Their approach combines pre-combustion, post-combustion, and oxy-fuel combustion technologies tailored to different industrial applications. Sinopec's flagship Qilu-Shengli CCUS project captures over 1 million tons of CO2 annually from petrochemical operations, which is then transported via pipeline for enhanced oil recovery. Their technology employs advanced amine-based solvents with improved absorption rates and reduced energy penalties, achieving capture efficiency of approximately 90% while reducing regeneration energy requirements by up to 30% compared to conventional MEA systems. Sinopec has also pioneered membrane separation technology with specialized polymer materials that demonstrate high CO2 selectivity under industrial conditions.

Strengths: Extensive industrial implementation experience across the entire CCUS value chain; proprietary solvent formulations with reduced energy penalties; vertical integration capabilities from capture to utilization. Weaknesses: Technologies primarily optimized for petroleum and chemical industry applications; relatively high capital expenditure requirements; some solutions remain dependent on geographical proximity to suitable storage or utilization sites.

Research Triangle Institute

Technical Solution: Research Triangle Institute (RTI) has developed a comprehensive suite of carbon capture technologies focused on cost-effective solutions for both point-source and direct air capture applications. Their flagship technology is a non-aqueous solvent-based system that demonstrates superior CO2 absorption capacity and significantly reduced energy requirements for regeneration. RTI's proprietary solvents achieve capture rates exceeding 95% while reducing regeneration energy by approximately 40% compared to conventional amine systems. Their advanced process design incorporates novel contactor configurations that maximize mass transfer efficiency while minimizing pressure drop, resulting in overall energy savings of 25-30%. RTI has also pioneered solid sorbent technologies using functionalized porous materials with tailored surface chemistry, achieving CO2 working capacities of 2-3 mmol/g under realistic operating conditions. Their modular capture system design enables flexible deployment across diverse industrial settings, from power plants to cement facilities, with demonstrated scale-up from laboratory to pilot-scale operations capturing several tons of CO2 per day. RTI's technology portfolio also includes advanced process control systems that optimize capture performance under variable operating conditions.

Strengths: Versatile technology applicable across multiple industries; demonstrated scale-up from laboratory to pilot scale; significantly reduced energy requirements; modular design enabling flexible deployment. Weaknesses: Full commercial-scale implementation still in progress; performance in real-world industrial environments with contaminants requires further validation; economic competitiveness dependent on carbon pricing or incentives.

Breakthrough Patents in Carbon Capture Technology

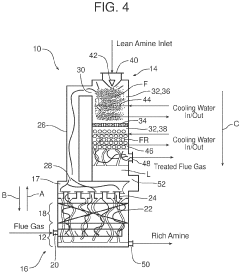

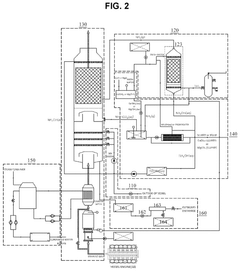

Compact absorption column for CO<sub>2 </sub>capture

PatentActiveUS11819799B2

Innovation

- A compact CO2 absorber design incorporating a co-current first or fog subsection, a co-current second or froth subsection, and a counter-current packed section, which reduces diffusivity resistance and increases the specific surface area for enhanced CO2 mass transfer, thereby minimizing equipment size and pressure drop while achieving better temperature control and absorption efficiency.

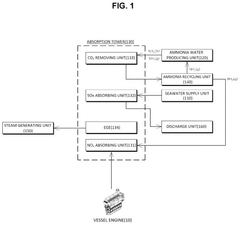

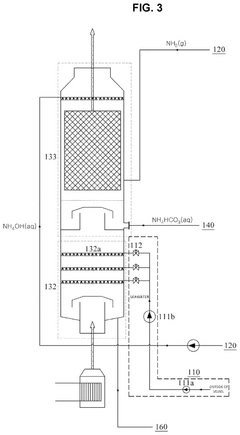

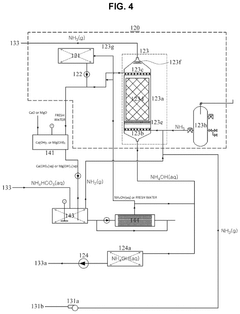

Apparatus for reducing greenhouse gas emission in vessel and vessel including the same

PatentActiveUS12123336B2

Innovation

- An apparatus that includes a seawater supply unit, an ammonia water producing unit, and an ammonia recycling unit, which reacts exhaust gas with seawater and ammonia water to convert CO2 into NH4HCO3, using Ca(OH)2 or Mg(OH)2 to recycle ammonia, thereby increasing CO2 removal efficiency and reducing costs by only consuming NH3 and these hydroxides during CO2 removal.

Policy and Regulatory Framework

The global policy landscape for carbon capture technologies has evolved significantly over the past decade, with major economies implementing varied regulatory frameworks to incentivize adoption. The United States has established the 45Q tax credit, which provides up to $85 per metric ton of CO2 permanently sequestered, creating a substantial financial incentive for carbon capture projects. This policy has been enhanced through the Inflation Reduction Act of 2022, which extended and increased these credits, potentially mobilizing billions in private investment.

In the European Union, the regulatory approach centers on the EU Emissions Trading System (EU ETS), complemented by the Innovation Fund which allocates resources specifically for carbon capture projects. The EU's Carbon Border Adjustment Mechanism further strengthens these measures by addressing carbon leakage concerns and creating a more level playing field for industries implementing carbon capture solutions.

Asian economies have developed distinct regulatory approaches. China has incorporated carbon capture into its national climate strategy with pilot carbon markets in key industrial regions, while Japan offers substantial subsidies for early-stage carbon capture projects through its Green Innovation Fund. These varied approaches reflect different industrial priorities and energy system characteristics across regions.

International agreements, particularly the Paris Agreement, have created a foundation for carbon capture policy development by establishing emissions reduction targets that indirectly drive investment in these technologies. The agreement's Article 6 mechanisms potentially enable cross-border cooperation on carbon capture projects through internationally transferred mitigation outcomes.

Regulatory challenges persist despite these frameworks. Many jurisdictions lack clear permitting processes for CO2 transport and storage infrastructure, creating project delays and uncertainty. Liability frameworks for long-term CO2 storage remain underdeveloped in most regions, presenting significant barriers to private investment. Additionally, the absence of standardized monitoring, reporting, and verification protocols across jurisdictions complicates international carbon capture projects and carbon credit trading.

Future policy development is trending toward technology-neutral carbon pricing mechanisms, harmonized international standards for carbon accounting, and dedicated regulatory frameworks for emerging carbon capture technologies like direct air capture. These evolving frameworks will likely determine which carbon capture technologies achieve commercial scale and where deployment accelerates most rapidly in the coming decade.

In the European Union, the regulatory approach centers on the EU Emissions Trading System (EU ETS), complemented by the Innovation Fund which allocates resources specifically for carbon capture projects. The EU's Carbon Border Adjustment Mechanism further strengthens these measures by addressing carbon leakage concerns and creating a more level playing field for industries implementing carbon capture solutions.

Asian economies have developed distinct regulatory approaches. China has incorporated carbon capture into its national climate strategy with pilot carbon markets in key industrial regions, while Japan offers substantial subsidies for early-stage carbon capture projects through its Green Innovation Fund. These varied approaches reflect different industrial priorities and energy system characteristics across regions.

International agreements, particularly the Paris Agreement, have created a foundation for carbon capture policy development by establishing emissions reduction targets that indirectly drive investment in these technologies. The agreement's Article 6 mechanisms potentially enable cross-border cooperation on carbon capture projects through internationally transferred mitigation outcomes.

Regulatory challenges persist despite these frameworks. Many jurisdictions lack clear permitting processes for CO2 transport and storage infrastructure, creating project delays and uncertainty. Liability frameworks for long-term CO2 storage remain underdeveloped in most regions, presenting significant barriers to private investment. Additionally, the absence of standardized monitoring, reporting, and verification protocols across jurisdictions complicates international carbon capture projects and carbon credit trading.

Future policy development is trending toward technology-neutral carbon pricing mechanisms, harmonized international standards for carbon accounting, and dedicated regulatory frameworks for emerging carbon capture technologies like direct air capture. These evolving frameworks will likely determine which carbon capture technologies achieve commercial scale and where deployment accelerates most rapidly in the coming decade.

Economic Viability Assessment

The economic viability of carbon capture technologies remains a critical factor determining their widespread adoption in global markets. Current cost structures present significant challenges, with capture costs ranging from $40-120 per ton of CO2 depending on the source and technology employed. Post-combustion capture from power plants typically incurs higher costs compared to industrial processes with concentrated CO2 streams, such as natural gas processing or ammonia production.

Transportation and storage expenses add approximately $10-20 per ton, creating a total cost burden that exceeds current carbon prices in most markets. This economic gap represents the primary barrier to commercial deployment at scale, as few industries can justify the investment without substantial policy support or market incentives.

Recent technological advancements have demonstrated promising cost reduction trajectories. Second-generation capture technologies utilizing advanced solvents, solid sorbents, and membrane systems have shown potential to reduce energy penalties by 30-40% compared to conventional amine-based systems. These improvements translate to approximately 20-25% lower overall capture costs when factoring in capital expenditure reductions.

The economic equation is further complicated by regional variations in energy prices, regulatory frameworks, and available infrastructure. Markets with established CO2 pipeline networks and suitable geological storage formations (North America, parts of Europe) present more favorable economics than regions requiring new infrastructure development. Similarly, regions with high natural gas prices face steeper challenges in managing the energy penalty associated with capture processes.

Revenue opportunities beyond carbon pricing are emerging as potential economic enablers. Enhanced oil recovery (EOR) operations can generate $20-40 per ton of CO2 value, while emerging markets for CO2 utilization in building materials, chemicals, and synthetic fuels could potentially create higher-value pathways. However, these markets remain nascent and cannot yet absorb the volumes required for meaningful climate impact.

Financial modeling indicates that carbon prices of $50-100 per ton would be necessary to drive widespread adoption across most industrial sectors without additional incentives. Current carbon markets fall significantly below this threshold in most regions, with the EU ETS reaching approximately €30-40 per ton and most other markets trading at lower levels. This gap underscores the need for complementary policy mechanisms such as tax credits, direct subsidies, or regulatory mandates to bridge the economic viability gap during the technology's critical scaling phase.

Transportation and storage expenses add approximately $10-20 per ton, creating a total cost burden that exceeds current carbon prices in most markets. This economic gap represents the primary barrier to commercial deployment at scale, as few industries can justify the investment without substantial policy support or market incentives.

Recent technological advancements have demonstrated promising cost reduction trajectories. Second-generation capture technologies utilizing advanced solvents, solid sorbents, and membrane systems have shown potential to reduce energy penalties by 30-40% compared to conventional amine-based systems. These improvements translate to approximately 20-25% lower overall capture costs when factoring in capital expenditure reductions.

The economic equation is further complicated by regional variations in energy prices, regulatory frameworks, and available infrastructure. Markets with established CO2 pipeline networks and suitable geological storage formations (North America, parts of Europe) present more favorable economics than regions requiring new infrastructure development. Similarly, regions with high natural gas prices face steeper challenges in managing the energy penalty associated with capture processes.

Revenue opportunities beyond carbon pricing are emerging as potential economic enablers. Enhanced oil recovery (EOR) operations can generate $20-40 per ton of CO2 value, while emerging markets for CO2 utilization in building materials, chemicals, and synthetic fuels could potentially create higher-value pathways. However, these markets remain nascent and cannot yet absorb the volumes required for meaningful climate impact.

Financial modeling indicates that carbon prices of $50-100 per ton would be necessary to drive widespread adoption across most industrial sectors without additional incentives. Current carbon markets fall significantly below this threshold in most regions, with the EU ETS reaching approximately €30-40 per ton and most other markets trading at lower levels. This gap underscores the need for complementary policy mechanisms such as tax credits, direct subsidies, or regulatory mandates to bridge the economic viability gap during the technology's critical scaling phase.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!