Exploring Market Dynamics and Carbon Capture Technologies

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Technology Background and Objectives

Carbon capture technologies have evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications in various industrial settings. The journey began in the 1970s with early experiments in carbon dioxide separation, primarily for enhanced oil recovery operations. By the 1990s, growing environmental concerns catalyzed more focused research into carbon capture as a climate change mitigation strategy, establishing the foundation for today's technological landscape.

The current technological ecosystem encompasses three primary capture approaches: post-combustion, pre-combustion, and oxy-fuel combustion systems. Each methodology represents distinct evolutionary paths in addressing the challenge of separating carbon dioxide from industrial processes. Alongside these established methods, emerging direct air capture technologies are expanding the frontier of possibilities, enabling carbon extraction directly from ambient air rather than solely from point sources.

Global research initiatives have accelerated dramatically since 2010, with significant breakthroughs in membrane technology, advanced solvents, and solid sorbents. These innovations have progressively reduced energy penalties and operational costs, historically the most substantial barriers to widespread implementation. The technology readiness levels across various capture methodologies have improved markedly, with several approaches now demonstrating commercial viability in specific applications.

The primary objective of carbon capture technology development centers on achieving economic viability while maximizing capture efficiency. Current targets focus on reducing capture costs below $50 per ton of CO₂ by 2030, representing a critical threshold for widespread commercial adoption. Secondary objectives include minimizing the energy penalty associated with capture processes, currently ranging from 15-30% depending on the technology employed.

Looking forward, the technological trajectory aims toward integration with broader carbon utilization and storage systems, creating comprehensive carbon management solutions. Research priorities are increasingly emphasizing modularity and scalability to accommodate diverse implementation contexts, from power generation facilities to industrial manufacturing and potentially direct atmospheric capture at scale.

The convergence of policy incentives, corporate sustainability commitments, and technological advancement is creating unprecedented momentum in this field. As global decarbonization efforts intensify, carbon capture technologies stand at an inflection point, transitioning from specialized applications to potentially mainstream climate solutions, with significant implications for energy systems, industrial processes, and climate policy frameworks worldwide.

The current technological ecosystem encompasses three primary capture approaches: post-combustion, pre-combustion, and oxy-fuel combustion systems. Each methodology represents distinct evolutionary paths in addressing the challenge of separating carbon dioxide from industrial processes. Alongside these established methods, emerging direct air capture technologies are expanding the frontier of possibilities, enabling carbon extraction directly from ambient air rather than solely from point sources.

Global research initiatives have accelerated dramatically since 2010, with significant breakthroughs in membrane technology, advanced solvents, and solid sorbents. These innovations have progressively reduced energy penalties and operational costs, historically the most substantial barriers to widespread implementation. The technology readiness levels across various capture methodologies have improved markedly, with several approaches now demonstrating commercial viability in specific applications.

The primary objective of carbon capture technology development centers on achieving economic viability while maximizing capture efficiency. Current targets focus on reducing capture costs below $50 per ton of CO₂ by 2030, representing a critical threshold for widespread commercial adoption. Secondary objectives include minimizing the energy penalty associated with capture processes, currently ranging from 15-30% depending on the technology employed.

Looking forward, the technological trajectory aims toward integration with broader carbon utilization and storage systems, creating comprehensive carbon management solutions. Research priorities are increasingly emphasizing modularity and scalability to accommodate diverse implementation contexts, from power generation facilities to industrial manufacturing and potentially direct atmospheric capture at scale.

The convergence of policy incentives, corporate sustainability commitments, and technological advancement is creating unprecedented momentum in this field. As global decarbonization efforts intensify, carbon capture technologies stand at an inflection point, transitioning from specialized applications to potentially mainstream climate solutions, with significant implications for energy systems, industrial processes, and climate policy frameworks worldwide.

Market Analysis for Carbon Capture Solutions

The carbon capture and storage (CCS) market is experiencing significant growth driven by increasing global focus on climate change mitigation strategies. Current market valuations place the global CCS market at approximately $7.1 billion in 2022, with projections indicating potential growth to reach $35.9 billion by 2030, representing a compound annual growth rate (CAGR) of 19.6% during the forecast period.

Demand for carbon capture technologies is primarily concentrated in power generation, cement production, steel manufacturing, and chemical processing industries, which collectively account for over 70% of industrial carbon emissions. The oil and gas sector remains a significant adopter, utilizing carbon capture for enhanced oil recovery (EOR) operations while simultaneously addressing emissions concerns.

Geographically, North America currently dominates the market with approximately 45% market share, hosting the majority of operational large-scale CCS facilities. Europe follows with growing investment driven by stringent regulatory frameworks and ambitious climate targets. The Asia-Pacific region, particularly China and Japan, is emerging as the fastest-growing market with substantial government backing for demonstration projects.

Policy incentives have become crucial market drivers, with mechanisms such as the 45Q tax credits in the United States, the EU Emissions Trading System, and various national carbon pricing schemes significantly improving the economic viability of CCS projects. The recent Inflation Reduction Act in the US has further enhanced tax incentives, increasing credits from $50 to $85 per metric ton for sequestered CO₂.

Customer segments are diversifying beyond traditional heavy industry. The emergence of carbon removal as a service has attracted technology companies seeking to achieve net-zero commitments. Additionally, the growing interest in blue hydrogen production (hydrogen produced from natural gas with carbon capture) has created a new demand segment as countries develop hydrogen strategies.

Cost remains the primary market barrier, with current capture costs ranging from $40-120 per ton of CO₂ depending on the source and technology employed. Transportation and storage infrastructure limitations also constrain market growth, with many potential deployment regions lacking the necessary CO₂ pipeline networks and characterized storage sites.

Market forecasts indicate that technological improvements could reduce capture costs by 25-30% within the next five years, potentially expanding the addressable market significantly. The voluntary carbon market's growth also presents opportunities, with premium prices being paid for verified carbon removal credits compared to traditional carbon offsets.

Demand for carbon capture technologies is primarily concentrated in power generation, cement production, steel manufacturing, and chemical processing industries, which collectively account for over 70% of industrial carbon emissions. The oil and gas sector remains a significant adopter, utilizing carbon capture for enhanced oil recovery (EOR) operations while simultaneously addressing emissions concerns.

Geographically, North America currently dominates the market with approximately 45% market share, hosting the majority of operational large-scale CCS facilities. Europe follows with growing investment driven by stringent regulatory frameworks and ambitious climate targets. The Asia-Pacific region, particularly China and Japan, is emerging as the fastest-growing market with substantial government backing for demonstration projects.

Policy incentives have become crucial market drivers, with mechanisms such as the 45Q tax credits in the United States, the EU Emissions Trading System, and various national carbon pricing schemes significantly improving the economic viability of CCS projects. The recent Inflation Reduction Act in the US has further enhanced tax incentives, increasing credits from $50 to $85 per metric ton for sequestered CO₂.

Customer segments are diversifying beyond traditional heavy industry. The emergence of carbon removal as a service has attracted technology companies seeking to achieve net-zero commitments. Additionally, the growing interest in blue hydrogen production (hydrogen produced from natural gas with carbon capture) has created a new demand segment as countries develop hydrogen strategies.

Cost remains the primary market barrier, with current capture costs ranging from $40-120 per ton of CO₂ depending on the source and technology employed. Transportation and storage infrastructure limitations also constrain market growth, with many potential deployment regions lacking the necessary CO₂ pipeline networks and characterized storage sites.

Market forecasts indicate that technological improvements could reduce capture costs by 25-30% within the next five years, potentially expanding the addressable market significantly. The voluntary carbon market's growth also presents opportunities, with premium prices being paid for verified carbon removal credits compared to traditional carbon offsets.

Current Challenges in Carbon Capture Implementation

Despite significant advancements in carbon capture technologies over the past decade, widespread implementation faces substantial barriers across technical, economic, and regulatory dimensions. The current cost structure remains prohibitive, with capture costs ranging from $40-120 per ton of CO2 depending on the source and technology employed. This economic challenge is compounded by the energy penalty—most carbon capture systems require 15-30% additional energy to operate, creating a paradoxical increase in emissions unless powered by renewable sources.

Infrastructure limitations present another significant obstacle. The global CO2 transport and storage network remains underdeveloped, with insufficient pipeline capacity and limited geological characterization of potential storage sites. Current estimates suggest only 40 million tons of CO2 storage capacity is operational worldwide, representing less than 0.1% of annual global emissions.

Technical challenges persist across the carbon capture value chain. Post-combustion capture technologies struggle with low CO2 concentrations in flue gases (typically 3-15%), requiring energy-intensive separation processes. Pre-combustion and oxy-fuel combustion alternatives offer higher efficiency but demand substantial modifications to existing facilities, limiting retrofit applications.

Regulatory frameworks remain fragmented and inconsistent across jurisdictions. Uncertainty regarding long-term liability for stored CO2, monitoring requirements, and permitting processes creates investment hesitation. Only 40 countries currently have explicit carbon pricing mechanisms, and even these vary dramatically in scope and price signals ($1-137 per ton CO2).

Public perception and social acceptance issues further complicate deployment. Communities near proposed storage sites often express concerns about leakage risks, induced seismicity, and environmental justice implications. The NIMBY (Not In My Back Yard) phenomenon has delayed or derailed several major carbon capture projects in Europe and North America.

Scale-up challenges represent a critical implementation barrier. Most successful carbon capture installations operate at demonstration scale (capturing thousands rather than millions of tons annually). The technology readiness level (TRL) varies significantly across capture methods, with direct air capture particularly lagging at TRL 6-7 compared to post-combustion technologies at TRL 8-9.

Material limitations affect system durability and performance. Current amine-based solvents degrade over time, requiring replacement and creating waste management challenges. Alternative materials like metal-organic frameworks show promise but remain costly and unproven at commercial scale.

Addressing these interconnected challenges requires coordinated action across technology development, policy frameworks, and market mechanisms to create viable pathways for carbon capture implementation at climate-relevant scales.

Infrastructure limitations present another significant obstacle. The global CO2 transport and storage network remains underdeveloped, with insufficient pipeline capacity and limited geological characterization of potential storage sites. Current estimates suggest only 40 million tons of CO2 storage capacity is operational worldwide, representing less than 0.1% of annual global emissions.

Technical challenges persist across the carbon capture value chain. Post-combustion capture technologies struggle with low CO2 concentrations in flue gases (typically 3-15%), requiring energy-intensive separation processes. Pre-combustion and oxy-fuel combustion alternatives offer higher efficiency but demand substantial modifications to existing facilities, limiting retrofit applications.

Regulatory frameworks remain fragmented and inconsistent across jurisdictions. Uncertainty regarding long-term liability for stored CO2, monitoring requirements, and permitting processes creates investment hesitation. Only 40 countries currently have explicit carbon pricing mechanisms, and even these vary dramatically in scope and price signals ($1-137 per ton CO2).

Public perception and social acceptance issues further complicate deployment. Communities near proposed storage sites often express concerns about leakage risks, induced seismicity, and environmental justice implications. The NIMBY (Not In My Back Yard) phenomenon has delayed or derailed several major carbon capture projects in Europe and North America.

Scale-up challenges represent a critical implementation barrier. Most successful carbon capture installations operate at demonstration scale (capturing thousands rather than millions of tons annually). The technology readiness level (TRL) varies significantly across capture methods, with direct air capture particularly lagging at TRL 6-7 compared to post-combustion technologies at TRL 8-9.

Material limitations affect system durability and performance. Current amine-based solvents degrade over time, requiring replacement and creating waste management challenges. Alternative materials like metal-organic frameworks show promise but remain costly and unproven at commercial scale.

Addressing these interconnected challenges requires coordinated action across technology development, policy frameworks, and market mechanisms to create viable pathways for carbon capture implementation at climate-relevant scales.

Existing Carbon Capture Methodologies

01 Chemical absorption methods for carbon capture

Chemical absorption is a widely used method for carbon capture that involves the use of solvents to absorb CO2 from flue gases. These processes typically use amine-based solvents or other chemical compounds that selectively bind with carbon dioxide. The CO2-rich solution is then heated to release the captured carbon dioxide, which can be compressed and stored. This technology is particularly effective for post-combustion capture from power plants and industrial facilities.- Chemical absorption methods for carbon capture: Chemical absorption is a widely used method for carbon capture that involves the use of solvents to absorb CO2 from flue gases. These processes typically use amine-based solvents that chemically react with CO2, allowing for its separation from other gases. The captured CO2 can then be released through heating, and the regenerated solvent can be reused. This technology is particularly effective for post-combustion capture from power plants and industrial facilities.

- Direct air capture (DAC) technologies: Direct air capture technologies are designed to extract CO2 directly from the atmosphere rather than from point sources. These systems typically use sorbents or solvents that selectively capture CO2 from ambient air. Once captured, the CO2 can be released through heating or pressure changes, allowing for its subsequent storage or utilization. DAC technologies are particularly valuable for addressing historical emissions and achieving negative emissions goals.

- Membrane-based carbon capture systems: Membrane-based carbon capture systems utilize selective membranes that allow CO2 to pass through while blocking other gases. These membranes can be made from various materials including polymers, ceramics, or hybrid materials, each offering different selectivity and permeability characteristics. Membrane technology offers advantages such as lower energy requirements, compact design, and continuous operation capability, making it suitable for both industrial applications and mobile carbon capture units.

- Biological carbon capture methods: Biological carbon capture methods leverage natural biological processes to capture and sequester CO2. These approaches include engineered microalgae systems, bacterial carbon fixation, and enhanced forest management. Microalgae can capture CO2 through photosynthesis at rates much higher than terrestrial plants, while certain bacteria can convert CO2 into valuable compounds. These biological systems can be integrated with industrial processes to capture emissions directly from flue gases or can be deployed as standalone carbon capture solutions.

- Mineralization and geological storage techniques: Mineralization involves converting captured CO2 into stable mineral carbonates through reaction with metal oxides, providing permanent storage solutions. This can occur naturally or be accelerated through engineered processes. Geological storage techniques involve injecting captured CO2 into suitable underground formations such as depleted oil and gas reservoirs, deep saline aquifers, or unminable coal seams. These methods offer long-term sequestration potential with minimal risk of CO2 re-entering the atmosphere, addressing concerns about the permanence of carbon storage.

02 Direct air capture (DAC) technologies

Direct air capture technologies extract CO2 directly from the atmosphere rather than from point sources like power plants. These systems use various sorbents or solutions that selectively capture carbon dioxide from ambient air. After capture, the CO2 is released through heating or other processes, then compressed for storage or utilization. DAC is particularly valuable for addressing distributed emissions and potentially achieving negative emissions by removing historical CO2 from the atmosphere.Expand Specific Solutions03 Biological carbon sequestration methods

Biological carbon sequestration leverages natural processes to capture and store carbon dioxide. These approaches include enhanced forestry management, algae-based capture systems, and engineered microorganisms designed to absorb CO2 efficiently. Some technologies combine biological processes with engineered systems to enhance carbon uptake rates. These methods are often considered more environmentally friendly and can provide co-benefits such as ecosystem restoration or biomass production.Expand Specific Solutions04 Mineral carbonation and enhanced weathering

Mineral carbonation technologies convert CO2 into stable carbonate minerals through reactions with calcium or magnesium-rich materials. This process mimics and accelerates natural weathering processes that sequester carbon over geological timescales. These technologies can utilize industrial waste materials like steel slag or mine tailings as feedstock, providing both carbon sequestration and waste management benefits. The resulting carbonate minerals are environmentally benign and can potentially be used in construction materials.Expand Specific Solutions05 Novel carbon capture and utilization systems

Innovative carbon capture and utilization systems focus on capturing CO2 and converting it into valuable products rather than simply storing it. These technologies include electrochemical reduction of CO2 to fuels or chemicals, catalytic conversion processes, and integrated systems that combine capture with immediate utilization. Some approaches incorporate renewable energy sources to power the conversion processes, creating carbon-neutral or negative-emission value chains. These systems aim to create economic incentives for carbon capture by producing marketable products.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The carbon capture technology market is currently in a growth phase, with increasing global focus on decarbonization driving market expansion. The sector is expected to reach significant scale as climate policies tighten worldwide, though technology maturity varies across capture methods. Leading players include established energy giants like Saudi Aramco and Sinopec, who leverage their industrial infrastructure for large-scale implementation, alongside specialized innovators such as Carbon Upcycling Technologies and 8 Rivers Capital developing next-generation solutions. Academic-industry partnerships involving institutions like Dalian University of Technology and Johns Hopkins University are accelerating technological advancement. The competitive landscape features both traditional energy companies pivoting toward sustainability and pure-play carbon capture startups, with differentiation occurring through efficiency improvements, cost reduction, and novel carbon utilization pathways.

China Petroleum & Chemical Corp.

Technical Solution: Sinopec has developed comprehensive carbon capture, utilization, and storage (CCUS) technologies focusing on large-scale implementation. Their flagship Qilu-Shengli CCUS project captures over 1 million tons of CO2 annually from petrochemical operations and injects it into oil reservoirs for enhanced oil recovery. The company employs advanced amine-based absorption systems with proprietary solvents that reduce energy penalties by approximately 15% compared to conventional MEA systems. Sinopec has also pioneered integration of carbon capture with hydrogen production facilities, creating blue hydrogen with significantly reduced carbon footprint. Their technology roadmap includes membrane-based capture systems currently in pilot phase that promise 30% lower operational costs than conventional methods.

Strengths: Extensive infrastructure integration capabilities, proven large-scale implementation, and proprietary solvent technology with reduced energy requirements. Weaknesses: Heavy reliance on enhanced oil recovery as utilization pathway, potentially limiting application in non-oil producing regions, and relatively high capital expenditure requirements for implementation.

Saudi Arabian Oil Co.

Technical Solution: Saudi Aramco has developed a multi-faceted carbon capture strategy centered on both reducing emissions from operations and creating economic value from captured carbon. Their technology portfolio includes advanced post-combustion capture systems deployed at their Hawiyah NGL facility, capturing approximately 500,000 tons of CO2 annually. Aramco's proprietary carbon capture technology employs specialized catalysts and advanced separation techniques that reduce energy consumption by up to 25% compared to first-generation systems. The company has pioneered mobile carbon capture units for deployment at remote facilities and is developing direct air capture technologies through their SABIC subsidiary. Their carbon utilization pathway focuses on converting CO2 to polymers, construction materials, and enhanced oil recovery applications, creating a circular carbon economy model.

Strengths: Substantial financial resources for technology development, integrated value chain from capture to utilization, and advanced catalyst technology. Weaknesses: Heavy focus on applications supporting continued fossil fuel production rather than permanent sequestration, and limited deployment outside petroleum sector applications.

Critical Patents and Innovations in Carbon Capture

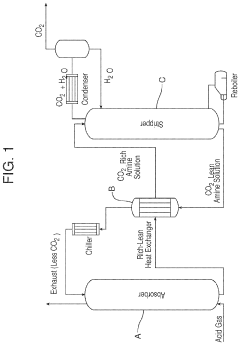

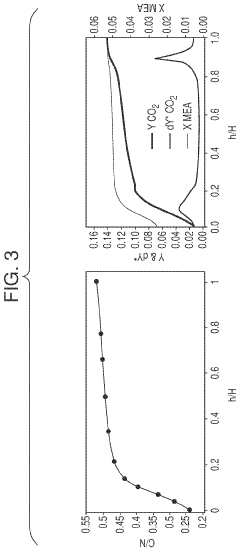

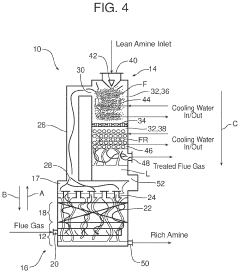

Compact absorption column for co2 capture

PatentActiveUS20210236985A1

Innovation

- A compact CO2 absorber design incorporating a co-current first or fog subsection, a co-current second or froth subsection, and a counter-current packed section, reducing diffusivity resistance and increasing specific surface area, thereby enhancing CO2 mass transfer and minimizing pressure drop.

Regulatory Framework and Policy Incentives

The global regulatory landscape for carbon capture technologies has evolved significantly over the past decade, creating a complex framework that both drives and constrains market development. At the international level, the Paris Agreement has established a foundation for national climate policies, with many signatories incorporating carbon capture, utilization, and storage (CCUS) into their Nationally Determined Contributions (NDCs). This international framework provides the overarching context within which regional and national regulations operate.

In the United States, the 45Q tax credit has emerged as a cornerstone policy, offering up to $50 per metric ton of CO2 permanently sequestered and $35 per ton for CO2 used in enhanced oil recovery or other utilization pathways. The 2022 Inflation Reduction Act further expanded these incentives, increasing credit values and lowering capture thresholds, making projects more economically viable across various industrial sectors.

The European Union has implemented the EU Emissions Trading System (ETS) as its primary carbon pricing mechanism, complemented by the Innovation Fund which allocates substantial resources to breakthrough technologies including carbon capture. Additionally, the EU Taxonomy for Sustainable Activities now recognizes certain CCUS applications as environmentally sustainable investments, facilitating access to green finance.

China has incorporated carbon capture into its 14th Five-Year Plan and launched the world's largest carbon market in 2021, though specific CCUS incentives remain in development. Meanwhile, Canada has implemented both carbon pricing and tax incentives, with provincial programs offering additional support tailored to regional industrial profiles.

Beyond direct financial incentives, regulatory frameworks increasingly address liability concerns for long-term CO2 storage, permitting processes for capture facilities and transport infrastructure, and monitoring requirements. These elements are critical for investor confidence but vary significantly across jurisdictions, creating regulatory uncertainty that can impede project development.

Policy stability represents a significant challenge, as carbon capture projects typically require decades-long investment horizons. Countries with consistent, technology-neutral climate policies have demonstrated greater success in attracting private investment to the sector. The interaction between carbon pricing mechanisms and direct subsidies also creates complex market signals that influence technology deployment patterns.

Recent policy innovations include carbon border adjustment mechanisms, procurement preferences for low-carbon products, and sectoral agreements targeting hard-to-abate industries. These complementary approaches are increasingly recognized as necessary components of a comprehensive policy framework that can drive carbon capture deployment at the scale required for meaningful climate impact.

In the United States, the 45Q tax credit has emerged as a cornerstone policy, offering up to $50 per metric ton of CO2 permanently sequestered and $35 per ton for CO2 used in enhanced oil recovery or other utilization pathways. The 2022 Inflation Reduction Act further expanded these incentives, increasing credit values and lowering capture thresholds, making projects more economically viable across various industrial sectors.

The European Union has implemented the EU Emissions Trading System (ETS) as its primary carbon pricing mechanism, complemented by the Innovation Fund which allocates substantial resources to breakthrough technologies including carbon capture. Additionally, the EU Taxonomy for Sustainable Activities now recognizes certain CCUS applications as environmentally sustainable investments, facilitating access to green finance.

China has incorporated carbon capture into its 14th Five-Year Plan and launched the world's largest carbon market in 2021, though specific CCUS incentives remain in development. Meanwhile, Canada has implemented both carbon pricing and tax incentives, with provincial programs offering additional support tailored to regional industrial profiles.

Beyond direct financial incentives, regulatory frameworks increasingly address liability concerns for long-term CO2 storage, permitting processes for capture facilities and transport infrastructure, and monitoring requirements. These elements are critical for investor confidence but vary significantly across jurisdictions, creating regulatory uncertainty that can impede project development.

Policy stability represents a significant challenge, as carbon capture projects typically require decades-long investment horizons. Countries with consistent, technology-neutral climate policies have demonstrated greater success in attracting private investment to the sector. The interaction between carbon pricing mechanisms and direct subsidies also creates complex market signals that influence technology deployment patterns.

Recent policy innovations include carbon border adjustment mechanisms, procurement preferences for low-carbon products, and sectoral agreements targeting hard-to-abate industries. These complementary approaches are increasingly recognized as necessary components of a comprehensive policy framework that can drive carbon capture deployment at the scale required for meaningful climate impact.

Economic Viability and ROI Analysis

The economic viability of carbon capture technologies represents a critical factor in their widespread adoption and implementation. Current cost structures for most carbon capture solutions range from $40 to $120 per ton of CO2 captured, with significant variations based on technology maturity, deployment scale, and regional economic factors. These costs encompass capital expenditures for equipment installation, operational expenses including energy consumption, and maintenance requirements throughout the system lifecycle.

Return on investment (ROI) calculations for carbon capture projects must account for multiple revenue streams beyond direct carbon pricing. These include enhanced oil recovery applications, carbon credit markets, tax incentives, and potential premium pricing for low-carbon products. Analysis indicates that without supportive policy frameworks, most carbon capture projects struggle to achieve positive ROI within conventional investment timeframes of 5-7 years.

Sensitivity analysis reveals that energy costs typically constitute 30-40% of operational expenses for carbon capture facilities, making energy efficiency improvements a key driver for economic viability. Projects utilizing waste heat or renewable energy sources demonstrate 15-25% better financial performance compared to those relying on conventional energy sources.

Scale economies significantly impact financial feasibility, with industrial-scale implementations (capturing >100,000 tons CO2 annually) showing 30-50% lower per-ton costs compared to smaller pilot projects. This creates a challenging "valley of death" for mid-scale deployments seeking to transition from demonstration to commercial viability.

Policy support mechanisms, including carbon pricing, tax credits, and direct subsidies, dramatically alter ROI projections. Markets with carbon prices exceeding $50 per ton or equivalent incentives show substantially improved business cases, with potential payback periods reduced to 8-12 years compared to 15+ years in unsupported markets.

Emerging business models, such as Carbon Capture as a Service (CCaaS), are creating new financing structures that reduce capital barriers and distribute risks more effectively across the value chain. These models show promise for accelerating adoption by converting large upfront investments into manageable operational expenses, potentially improving ROI metrics by 20-30% for end users.

Long-term economic modeling suggests that continued technological improvements and manufacturing scale could reduce carbon capture costs by 25-40% over the next decade, potentially bringing break-even points within reach of market-based mechanisms without requiring permanent subsidization.

Return on investment (ROI) calculations for carbon capture projects must account for multiple revenue streams beyond direct carbon pricing. These include enhanced oil recovery applications, carbon credit markets, tax incentives, and potential premium pricing for low-carbon products. Analysis indicates that without supportive policy frameworks, most carbon capture projects struggle to achieve positive ROI within conventional investment timeframes of 5-7 years.

Sensitivity analysis reveals that energy costs typically constitute 30-40% of operational expenses for carbon capture facilities, making energy efficiency improvements a key driver for economic viability. Projects utilizing waste heat or renewable energy sources demonstrate 15-25% better financial performance compared to those relying on conventional energy sources.

Scale economies significantly impact financial feasibility, with industrial-scale implementations (capturing >100,000 tons CO2 annually) showing 30-50% lower per-ton costs compared to smaller pilot projects. This creates a challenging "valley of death" for mid-scale deployments seeking to transition from demonstration to commercial viability.

Policy support mechanisms, including carbon pricing, tax credits, and direct subsidies, dramatically alter ROI projections. Markets with carbon prices exceeding $50 per ton or equivalent incentives show substantially improved business cases, with potential payback periods reduced to 8-12 years compared to 15+ years in unsupported markets.

Emerging business models, such as Carbon Capture as a Service (CCaaS), are creating new financing structures that reduce capital barriers and distribute risks more effectively across the value chain. These models show promise for accelerating adoption by converting large upfront investments into manageable operational expenses, potentially improving ROI metrics by 20-30% for end users.

Long-term economic modeling suggests that continued technological improvements and manufacturing scale could reduce carbon capture costs by 25-40% over the next decade, potentially bringing break-even points within reach of market-based mechanisms without requiring permanent subsidization.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!