Carbon Capture Technologies in the Context of Global Regulations

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Evolution and Objectives

Carbon capture technologies have evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications in response to growing environmental concerns. The journey began in the 1970s with early experiments in carbon dioxide separation, primarily for enhanced oil recovery rather than climate mitigation. By the 1990s, as climate change gained scientific consensus, carbon capture research accelerated, leading to the first industrial-scale projects in the early 2000s.

The technological evolution has progressed through three distinct generations. First-generation technologies focused on post-combustion capture using amine-based solvents, offering retrofit capabilities but suffering from high energy penalties. Second-generation approaches expanded to pre-combustion and oxy-fuel combustion methods, improving efficiency while reducing costs. Today's third-generation technologies explore novel materials like metal-organic frameworks, enzymatic systems, and direct air capture, representing significant advances in both capture efficiency and economic viability.

Global regulations have played a crucial role in shaping this technological trajectory. The Kyoto Protocol in 1997 established the first international framework acknowledging the need for carbon reduction. Subsequently, the Paris Agreement in 2015 created stronger commitments, spurring investment in carbon capture technologies. Recent regulatory frameworks in the EU, US, and China have further accelerated development through carbon pricing mechanisms, tax incentives, and emissions trading systems.

The primary objective of modern carbon capture technologies is to achieve cost-effective removal of CO₂ from both point sources and ambient air. Current targets aim to reduce capture costs from approximately $40-80 per ton to below $20 per ton by 2030, making widespread deployment economically viable. Technical objectives include improving energy efficiency, as current methods require 15-30% of a power plant's energy output, developing more durable and selective capture materials, and scaling direct air capture technologies.

Long-term objectives extend beyond mere capture to creating integrated carbon management systems that incorporate transportation infrastructure, utilization pathways, and permanent storage solutions. The ultimate goal is developing technologies that can be deployed at gigaton scale annually, necessary to meet the IPCC's recommendation of removing 100-1000 gigatons of CO₂ this century to limit warming to 1.5°C. This ambitious trajectory requires continued innovation across the entire carbon capture value chain, supported by evolving regulatory frameworks that incentivize both development and deployment.

The technological evolution has progressed through three distinct generations. First-generation technologies focused on post-combustion capture using amine-based solvents, offering retrofit capabilities but suffering from high energy penalties. Second-generation approaches expanded to pre-combustion and oxy-fuel combustion methods, improving efficiency while reducing costs. Today's third-generation technologies explore novel materials like metal-organic frameworks, enzymatic systems, and direct air capture, representing significant advances in both capture efficiency and economic viability.

Global regulations have played a crucial role in shaping this technological trajectory. The Kyoto Protocol in 1997 established the first international framework acknowledging the need for carbon reduction. Subsequently, the Paris Agreement in 2015 created stronger commitments, spurring investment in carbon capture technologies. Recent regulatory frameworks in the EU, US, and China have further accelerated development through carbon pricing mechanisms, tax incentives, and emissions trading systems.

The primary objective of modern carbon capture technologies is to achieve cost-effective removal of CO₂ from both point sources and ambient air. Current targets aim to reduce capture costs from approximately $40-80 per ton to below $20 per ton by 2030, making widespread deployment economically viable. Technical objectives include improving energy efficiency, as current methods require 15-30% of a power plant's energy output, developing more durable and selective capture materials, and scaling direct air capture technologies.

Long-term objectives extend beyond mere capture to creating integrated carbon management systems that incorporate transportation infrastructure, utilization pathways, and permanent storage solutions. The ultimate goal is developing technologies that can be deployed at gigaton scale annually, necessary to meet the IPCC's recommendation of removing 100-1000 gigatons of CO₂ this century to limit warming to 1.5°C. This ambitious trajectory requires continued innovation across the entire carbon capture value chain, supported by evolving regulatory frameworks that incentivize both development and deployment.

Global Market Demand for Carbon Capture Solutions

The global market for carbon capture technologies is experiencing unprecedented growth, driven by intensifying climate change concerns and increasingly stringent emissions regulations. Current market valuations place the carbon capture, utilization, and storage (CCUS) sector at approximately $2.5 billion in 2023, with projections indicating expansion to reach $7-10 billion by 2030. This represents a compound annual growth rate exceeding 20%, significantly outpacing many traditional industrial sectors.

Demand patterns show distinct regional variations, with North America currently leading market adoption, accounting for roughly 40% of global carbon capture projects. The European Union follows closely at 30%, while Asia-Pacific regions, particularly China and Japan, are demonstrating the fastest growth trajectories with annual increases of 25-30% in new project investments.

Industrial segmentation reveals that power generation and heavy manufacturing sectors constitute the primary demand drivers, collectively representing over 60% of the market. Cement production, steel manufacturing, and chemical processing industries have emerged as particularly promising application areas due to their inherently carbon-intensive processes and limited alternative decarbonization options.

Financial analyses indicate shifting investment patterns, with venture capital funding for carbon capture startups reaching record levels of $1.9 billion in 2022, triple the amount from just two years prior. This surge in private investment complements government funding initiatives, which have allocated over $20 billion globally toward carbon capture research, development, and deployment programs since 2020.

Consumer and stakeholder pressures are increasingly influencing market dynamics, with 72% of multinational corporations now including carbon reduction strategies in their sustainability commitments. This corporate demand is creating secondary markets for captured carbon utilization in products ranging from construction materials to synthetic fuels.

Regulatory frameworks are proving to be decisive market catalysts, with carbon pricing mechanisms now covering approximately 23% of global emissions. Regions with established carbon markets or taxes demonstrate carbon capture adoption rates nearly three times higher than unregulated markets. The EU's Carbon Border Adjustment Mechanism and similar emerging policies are expected to further accelerate demand by creating economic incentives that improve the cost-competitiveness of carbon capture solutions.

Market forecasts suggest that technological advancements reducing capture costs below $50 per ton would trigger exponential market growth, potentially expanding the addressable market by 300-400% by 2035. This price threshold represents a critical inflection point where carbon capture becomes economically viable across multiple additional industrial sectors without requiring substantial subsidies.

Demand patterns show distinct regional variations, with North America currently leading market adoption, accounting for roughly 40% of global carbon capture projects. The European Union follows closely at 30%, while Asia-Pacific regions, particularly China and Japan, are demonstrating the fastest growth trajectories with annual increases of 25-30% in new project investments.

Industrial segmentation reveals that power generation and heavy manufacturing sectors constitute the primary demand drivers, collectively representing over 60% of the market. Cement production, steel manufacturing, and chemical processing industries have emerged as particularly promising application areas due to their inherently carbon-intensive processes and limited alternative decarbonization options.

Financial analyses indicate shifting investment patterns, with venture capital funding for carbon capture startups reaching record levels of $1.9 billion in 2022, triple the amount from just two years prior. This surge in private investment complements government funding initiatives, which have allocated over $20 billion globally toward carbon capture research, development, and deployment programs since 2020.

Consumer and stakeholder pressures are increasingly influencing market dynamics, with 72% of multinational corporations now including carbon reduction strategies in their sustainability commitments. This corporate demand is creating secondary markets for captured carbon utilization in products ranging from construction materials to synthetic fuels.

Regulatory frameworks are proving to be decisive market catalysts, with carbon pricing mechanisms now covering approximately 23% of global emissions. Regions with established carbon markets or taxes demonstrate carbon capture adoption rates nearly three times higher than unregulated markets. The EU's Carbon Border Adjustment Mechanism and similar emerging policies are expected to further accelerate demand by creating economic incentives that improve the cost-competitiveness of carbon capture solutions.

Market forecasts suggest that technological advancements reducing capture costs below $50 per ton would trigger exponential market growth, potentially expanding the addressable market by 300-400% by 2035. This price threshold represents a critical inflection point where carbon capture becomes economically viable across multiple additional industrial sectors without requiring substantial subsidies.

Current Carbon Capture Technologies and Barriers

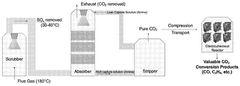

Carbon capture technologies have evolved significantly over the past decades, with three primary approaches currently dominating the field: post-combustion capture, pre-combustion capture, and oxy-fuel combustion. Post-combustion technology, the most widely deployed method, involves separating CO2 from flue gases after fossil fuel combustion using chemical solvents like monoethanolamine (MEA). Pre-combustion capture converts fuel into a mixture of hydrogen and CO2 before combustion, while oxy-fuel combustion uses pure oxygen instead of air for combustion, resulting in exhaust gases composed primarily of CO2 and water vapor.

Direct air capture (DAC) represents an emerging technology that extracts CO2 directly from ambient air rather than point sources. Companies like Carbon Engineering and Climeworks have developed commercial DAC systems, though they currently operate at relatively small scales and high costs compared to point-source capture methods.

Significant technical barriers impede widespread adoption of carbon capture technologies. Cost remains the foremost challenge, with current capture processes adding approximately $40-120 per ton of CO2 captured, making many applications economically unfeasible without substantial policy support. Energy penalties constitute another major barrier, as carbon capture systems typically consume 15-30% of a power plant's energy output, substantially reducing efficiency and increasing operational costs.

Infrastructure limitations present additional challenges, particularly regarding CO2 transportation and storage. The global pipeline network for CO2 remains underdeveloped, and geological storage capacity, while theoretically abundant, requires extensive site characterization and monitoring to ensure safety and permanence. Public acceptance issues further complicate deployment, with concerns about leakage risks and long-term storage security.

Scale-up challenges persist across all carbon capture technologies. Most successful demonstrations operate at scales significantly smaller than would be required for meaningful climate impact. The chemical processes involved in carbon capture face diminishing returns when scaled up, requiring innovative engineering solutions to maintain efficiency at industrial scales.

Regulatory uncertainty compounds these technical barriers. Inconsistent carbon pricing mechanisms, evolving emissions standards, and unclear liability frameworks for long-term storage create investment risks that deter capital allocation to carbon capture projects. The absence of harmonized international standards further fragments the market, impeding technology transfer and global deployment.

Material limitations also constrain advancement, with current solvents and sorbents suffering from degradation, corrosion issues, and high regeneration energy requirements. Research into novel materials, including metal-organic frameworks and advanced membranes, shows promise but remains largely at laboratory scale.

Direct air capture (DAC) represents an emerging technology that extracts CO2 directly from ambient air rather than point sources. Companies like Carbon Engineering and Climeworks have developed commercial DAC systems, though they currently operate at relatively small scales and high costs compared to point-source capture methods.

Significant technical barriers impede widespread adoption of carbon capture technologies. Cost remains the foremost challenge, with current capture processes adding approximately $40-120 per ton of CO2 captured, making many applications economically unfeasible without substantial policy support. Energy penalties constitute another major barrier, as carbon capture systems typically consume 15-30% of a power plant's energy output, substantially reducing efficiency and increasing operational costs.

Infrastructure limitations present additional challenges, particularly regarding CO2 transportation and storage. The global pipeline network for CO2 remains underdeveloped, and geological storage capacity, while theoretically abundant, requires extensive site characterization and monitoring to ensure safety and permanence. Public acceptance issues further complicate deployment, with concerns about leakage risks and long-term storage security.

Scale-up challenges persist across all carbon capture technologies. Most successful demonstrations operate at scales significantly smaller than would be required for meaningful climate impact. The chemical processes involved in carbon capture face diminishing returns when scaled up, requiring innovative engineering solutions to maintain efficiency at industrial scales.

Regulatory uncertainty compounds these technical barriers. Inconsistent carbon pricing mechanisms, evolving emissions standards, and unclear liability frameworks for long-term storage create investment risks that deter capital allocation to carbon capture projects. The absence of harmonized international standards further fragments the market, impeding technology transfer and global deployment.

Material limitations also constrain advancement, with current solvents and sorbents suffering from degradation, corrosion issues, and high regeneration energy requirements. Research into novel materials, including metal-organic frameworks and advanced membranes, shows promise but remains largely at laboratory scale.

Mainstream Carbon Capture Implementation Approaches

01 Direct Air Capture Technologies

Direct air capture (DAC) technologies involve systems that extract carbon dioxide directly from the atmosphere. These technologies typically use sorbent materials or chemical solutions to selectively capture CO2 from ambient air. After capture, the CO2 can be concentrated and either stored underground or utilized in various applications. DAC systems can be deployed in various locations regardless of emission sources and represent a promising approach for negative emissions.- Direct Air Capture Technologies: Direct Air Capture (DAC) technologies involve systems that extract carbon dioxide directly from the atmosphere. These systems typically use sorbent materials or chemical solutions to selectively capture CO2 from ambient air. After capture, the CO2 can be concentrated, compressed, and either stored underground or utilized in various applications. DAC technologies are particularly valuable for addressing emissions from distributed sources that are difficult to capture at the point of emission.

- Post-Combustion Carbon Capture: Post-combustion carbon capture technologies focus on removing CO2 from flue gases after the combustion process in power plants and industrial facilities. These systems typically employ chemical solvents, solid sorbents, or membrane technologies to separate CO2 from other exhaust gases. The captured CO2 is then compressed and prepared for transport and storage. This approach allows for retrofitting existing facilities without major modifications to the primary combustion process.

- Biological Carbon Sequestration Methods: Biological carbon sequestration leverages natural processes to capture and store carbon dioxide. These methods include enhanced forestry practices, algae-based capture systems, and agricultural techniques that increase carbon storage in soil. Engineered biological systems can also be developed to accelerate natural carbon fixation processes. These approaches often provide co-benefits such as improved soil health, increased biodiversity, and enhanced ecosystem services while removing CO2 from the atmosphere.

- Carbon Mineralization and Enhanced Weathering: Carbon mineralization technologies accelerate natural weathering processes to convert CO2 into stable carbonate minerals. These approaches include enhanced weathering of silicate rocks, accelerated carbonation of industrial waste materials, and in-situ mineralization in suitable geological formations. The resulting carbonate minerals provide permanent and secure carbon storage. These technologies can be applied to various waste streams and natural materials, offering pathways for large-scale carbon sequestration with minimal energy requirements.

- Carbon Capture Utilization and Storage (CCUS) Systems: CCUS systems integrate carbon capture with utilization and storage components to create comprehensive solutions for managing captured CO2. These systems include technologies for converting captured CO2 into valuable products such as building materials, fuels, and chemicals, as well as methods for secure geological storage. CCUS approaches aim to create economic value from captured carbon while ensuring long-term climate benefits. These integrated systems often incorporate monitoring technologies to verify the permanence of carbon storage.

02 Post-Combustion Carbon Capture

Post-combustion carbon capture technologies focus on removing CO2 from flue gases after the combustion process in power plants and industrial facilities. These systems typically employ chemical absorption using amine-based solvents or other capture media to selectively remove CO2 from exhaust streams. The captured carbon dioxide can then be compressed and transported for storage or utilization. This approach allows retrofitting existing facilities without major modifications to the primary process.Expand Specific Solutions03 Biological Carbon Sequestration Methods

Biological carbon sequestration leverages natural processes to capture and store carbon dioxide. These methods include enhanced forestry practices, algae-based systems, and agricultural techniques that increase carbon content in soil. Engineered biological systems can be designed to accelerate natural carbon fixation rates through photosynthesis. These approaches often provide co-benefits such as improved soil health, increased biodiversity, and enhanced ecosystem services while removing CO2 from the atmosphere.Expand Specific Solutions04 Mineral Carbonation and Enhanced Weathering

Mineral carbonation technologies accelerate natural weathering processes to convert CO2 into stable carbonate minerals. These processes involve reactions between carbon dioxide and calcium or magnesium-rich materials such as basalt, olivine, or industrial waste products like steel slag. The resulting carbonates provide permanent and secure carbon storage. Enhanced weathering techniques can be applied to agricultural lands, mine tailings, or coastal areas to increase carbon sequestration while potentially improving soil quality or neutralizing acidity.Expand Specific Solutions05 Carbon Capture Utilization and Storage (CCUS) Systems

CCUS systems integrate carbon capture with utilization pathways and long-term storage solutions. These comprehensive approaches capture CO2 from industrial processes or power generation and either convert it into valuable products or securely store it in geological formations. Utilization pathways include conversion to fuels, chemicals, building materials, or enhanced oil recovery. Storage options focus on injecting captured CO2 into deep geological formations such as depleted oil and gas reservoirs or saline aquifers for permanent sequestration.Expand Specific Solutions

Leading Companies and Research Institutions in Carbon Capture

Carbon capture technologies are evolving rapidly within a complex global regulatory landscape. The market is in an early growth phase, with increasing momentum driven by climate policies and corporate sustainability commitments. Current global market size is estimated at $7-10 billion, projected to reach $50+ billion by 2030. Technology maturity varies significantly across capture methods, with post-combustion technologies being most commercially advanced. Key industry players demonstrate diverse approaches: oil majors (Saudi Aramco, Shell, Phillips 66) leverage existing infrastructure; chemical companies (Sinopec, Mitsubishi Gas Chemical) focus on process integration; while academic institutions (MIT, Columbia, Caltech) drive fundamental innovation. Emerging companies like Pi Green Innovations and e-Novia are introducing disruptive solutions, though scale remains challenging. The competitive landscape is characterized by strategic partnerships between established energy companies and technology developers to overcome technical and economic barriers.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a comprehensive carbon capture, utilization, and storage (CCUS) technology portfolio. Their flagship project at the Qilu Petrochemical complex captures over 1 million tons of CO2 annually from hydrogen production units using advanced amine-based absorption technology[1]. Sinopec has also pioneered integration of carbon capture with enhanced oil recovery (EOR), particularly in the Shengli Oilfield CCUS project, where captured CO2 is transported via pipeline and injected into depleted oil reservoirs. Their technology includes proprietary solvent formulations that reduce regeneration energy requirements by approximately 15% compared to conventional MEA systems[3]. Sinopec has further developed membrane-based separation technologies for pre-combustion capture and is exploring direct air capture (DAC) methods to align with China's carbon neutrality goals by 2060[5].

Strengths: Extensive integration with existing petrochemical infrastructure; proven large-scale implementation; cost efficiency through EOR revenue generation; strong government backing through China's climate commitments. Weaknesses: Heavy reliance on EOR for economic viability; technology primarily optimized for high-concentration CO2 streams; limited experience with post-combustion capture from power plants compared to industrial applications.

Saudi Arabian Oil Co.

Technical Solution: Saudi Aramco has developed a multi-faceted carbon capture technology approach centered on both reducing emissions from operations and developing commercial-scale carbon capture solutions. Their flagship technology is the Converge® polyols system, which converts captured CO2 into high-value polymers and materials using proprietary catalysts[2]. Aramco has also implemented mobile carbon capture units that can be deployed at various emission points across their operations, capturing up to 45 tons of CO2 daily per unit[4]. Their Hawiyah NGL carbon capture facility represents one of the world's largest industrial carbon capture deployments, sequestering approximately 800,000 tons of CO2 annually. Aramco is pioneering direct CO2 conversion technologies that transform captured carbon into valuable chemicals and fuels without intermediate processing steps[6]. Their research includes novel non-aqueous solvents that reduce the energy penalty of traditional capture methods by up to 30%[8].

Strengths: Exceptional financial resources for technology scaling; integration of carbon capture with existing oil and gas infrastructure; advanced materials science capabilities; strong focus on creating value-added products from captured carbon. Weaknesses: Heavy focus on technologies that extend fossil fuel use rather than replacement; limited transparency on full lifecycle emissions accounting; geographic concentration of projects primarily in Saudi Arabia limiting global regulatory experience.

Key Patents and Innovations in Carbon Sequestration

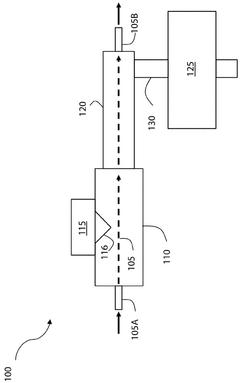

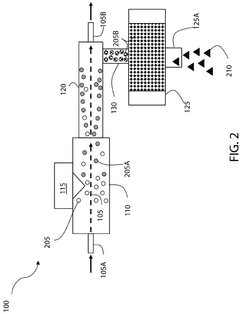

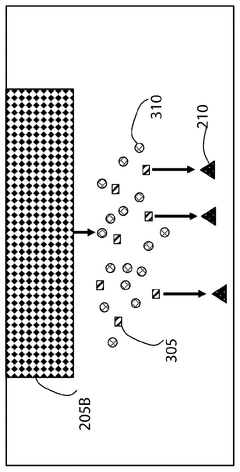

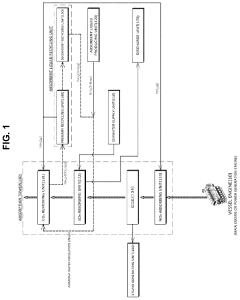

Systems, articles, and methods related to capture and/or conversion of gases including carbon dioxide

PatentWO2025160138A1

Innovation

- An integrated system that combines carbon dioxide capture and conversion, using a gas flow pathway with an absorption zone, electrostatic separation, and a conversion apparatus to convert gaseous carbon dioxide into valuable products like carbon monoxide and ethanol, utilizing a liquid mist to enhance capture efficiency and reduce the need for compression and transportation.

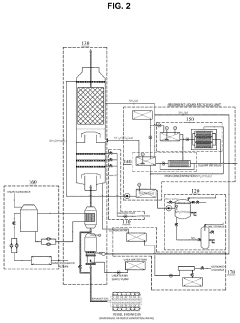

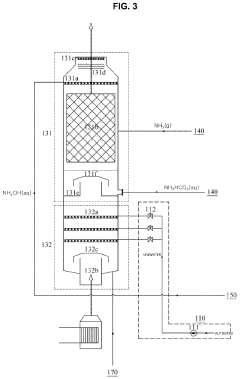

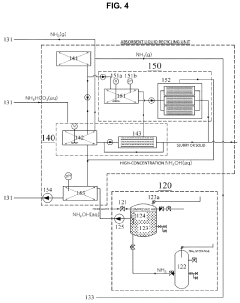

Apparatus for reducing greenhouse gas emission in vessel and vessel including the same

PatentPendingUS20230372867A1

Innovation

- An apparatus with a seawater supply unit, absorbent liquid producing unit, and a multi-stage absorbent liquid recycling unit that recycles aqueous ammonium salt solutions using divalent metal hydroxides to maintain ammonia water concentration, coupled with exhaust gas cooling via heat exchange, preventing concentration decreases and enhancing recovery rates.

International Regulatory Framework for Carbon Emissions

The global landscape of carbon emissions regulation has evolved significantly over the past three decades, creating a complex framework that shapes carbon capture technology development and implementation. The 1992 United Nations Framework Convention on Climate Change (UNFCCC) established the foundation for international climate action, followed by the 1997 Kyoto Protocol which introduced binding emission reduction targets for developed nations and market mechanisms like emissions trading.

The 2015 Paris Agreement marked a watershed moment, with 196 countries committing to limit global warming to well below 2°C above pre-industrial levels. This agreement introduced Nationally Determined Contributions (NDCs), requiring countries to establish their own emission reduction targets and report progress regularly. The Paris Agreement has catalyzed significant regulatory developments worldwide, with many nations incorporating carbon capture requirements into their climate strategies.

Regional regulatory frameworks have emerged with varying approaches. The European Union's Emissions Trading System (EU ETS), established in 2005, remains the world's largest carbon market and has recently strengthened its provisions for carbon capture technologies. The EU's 2019 Innovation Fund specifically allocates resources for carbon capture projects, while the European Green Deal aims for carbon neutrality by 2050.

In North America, regulatory approaches differ significantly between countries and states. The United States has implemented tax incentives through Section 45Q, offering credits for carbon oxide sequestration, while Canada has established both carbon pricing mechanisms and the Clean Fuel Standard. China, the world's largest emitter, has launched its national emissions trading scheme in 2021, gradually incorporating carbon capture considerations into its regulatory framework.

Developing nations face unique regulatory challenges, often balancing economic development with emission reduction goals. International support mechanisms like the Green Climate Fund aim to assist these countries in implementing carbon capture technologies while addressing their specific circumstances.

Industry-specific regulations have also emerged, with sectors like power generation, cement, and steel facing increasingly stringent carbon emission standards. These sector-specific approaches often include provisions for carbon capture implementation as a compliance pathway, creating targeted incentives for technology adoption in high-emission industries.

The regulatory landscape continues to evolve rapidly, with increasing focus on standardization of measurement, reporting, and verification protocols for carbon capture. International organizations like the International Organization for Standardization (ISO) are developing global standards for carbon capture technologies, aiming to harmonize approaches across jurisdictions and facilitate technology transfer and implementation worldwide.

The 2015 Paris Agreement marked a watershed moment, with 196 countries committing to limit global warming to well below 2°C above pre-industrial levels. This agreement introduced Nationally Determined Contributions (NDCs), requiring countries to establish their own emission reduction targets and report progress regularly. The Paris Agreement has catalyzed significant regulatory developments worldwide, with many nations incorporating carbon capture requirements into their climate strategies.

Regional regulatory frameworks have emerged with varying approaches. The European Union's Emissions Trading System (EU ETS), established in 2005, remains the world's largest carbon market and has recently strengthened its provisions for carbon capture technologies. The EU's 2019 Innovation Fund specifically allocates resources for carbon capture projects, while the European Green Deal aims for carbon neutrality by 2050.

In North America, regulatory approaches differ significantly between countries and states. The United States has implemented tax incentives through Section 45Q, offering credits for carbon oxide sequestration, while Canada has established both carbon pricing mechanisms and the Clean Fuel Standard. China, the world's largest emitter, has launched its national emissions trading scheme in 2021, gradually incorporating carbon capture considerations into its regulatory framework.

Developing nations face unique regulatory challenges, often balancing economic development with emission reduction goals. International support mechanisms like the Green Climate Fund aim to assist these countries in implementing carbon capture technologies while addressing their specific circumstances.

Industry-specific regulations have also emerged, with sectors like power generation, cement, and steel facing increasingly stringent carbon emission standards. These sector-specific approaches often include provisions for carbon capture implementation as a compliance pathway, creating targeted incentives for technology adoption in high-emission industries.

The regulatory landscape continues to evolve rapidly, with increasing focus on standardization of measurement, reporting, and verification protocols for carbon capture. International organizations like the International Organization for Standardization (ISO) are developing global standards for carbon capture technologies, aiming to harmonize approaches across jurisdictions and facilitate technology transfer and implementation worldwide.

Economic Viability and Funding Mechanisms

The economic viability of carbon capture technologies remains a critical challenge despite their technical advancement. Current cost estimates for carbon capture range from $40 to $120 per ton of CO2, depending on the technology and implementation context. This cost structure presents significant barriers to widespread adoption, particularly in developing economies where capital constraints are more pronounced.

Financial mechanisms supporting carbon capture deployment have evolved substantially in recent years. Carbon pricing schemes, including emissions trading systems and carbon taxes implemented in over 40 jurisdictions globally, provide essential market signals. The EU Emissions Trading System, for instance, has seen carbon prices reach €80 per ton, creating economic incentives for capture technologies in high-emission industries.

Public funding initiatives have emerged as crucial catalysts for early-stage deployment. The US Department of Energy's Carbon Capture Program has allocated over $3 billion toward research and demonstration projects, while the EU Innovation Fund dedicates significant resources to large-scale carbon capture implementations. These public investments help bridge the "valley of death" between laboratory development and commercial viability.

Private sector financing models are increasingly sophisticated, with project finance structures allowing risk distribution among multiple stakeholders. Green bonds specifically targeting carbon capture projects have grown exponentially, with issuances exceeding $15 billion in 2022. Additionally, venture capital investment in carbon capture startups reached $1.9 billion in 2021, reflecting growing investor confidence.

Tax incentives represent another vital funding mechanism. The US 45Q tax credit, offering up to $85 per ton for permanent CO2 storage, has catalyzed numerous commercial projects. Similar incentive structures are emerging in Canada, Norway, and the United Kingdom, creating predictable revenue streams that improve project bankability.

Long-term economic sustainability will likely require hybrid funding approaches combining regulatory mandates, market mechanisms, and strategic public investments. The development of carbon removal markets, where companies purchase verified carbon removals to meet net-zero commitments, represents a promising pathway toward self-sustaining economics. However, policy certainty remains essential for attracting the estimated $1 trillion in capital required for carbon capture deployment at climate-relevant scales by 2050.

Financial mechanisms supporting carbon capture deployment have evolved substantially in recent years. Carbon pricing schemes, including emissions trading systems and carbon taxes implemented in over 40 jurisdictions globally, provide essential market signals. The EU Emissions Trading System, for instance, has seen carbon prices reach €80 per ton, creating economic incentives for capture technologies in high-emission industries.

Public funding initiatives have emerged as crucial catalysts for early-stage deployment. The US Department of Energy's Carbon Capture Program has allocated over $3 billion toward research and demonstration projects, while the EU Innovation Fund dedicates significant resources to large-scale carbon capture implementations. These public investments help bridge the "valley of death" between laboratory development and commercial viability.

Private sector financing models are increasingly sophisticated, with project finance structures allowing risk distribution among multiple stakeholders. Green bonds specifically targeting carbon capture projects have grown exponentially, with issuances exceeding $15 billion in 2022. Additionally, venture capital investment in carbon capture startups reached $1.9 billion in 2021, reflecting growing investor confidence.

Tax incentives represent another vital funding mechanism. The US 45Q tax credit, offering up to $85 per ton for permanent CO2 storage, has catalyzed numerous commercial projects. Similar incentive structures are emerging in Canada, Norway, and the United Kingdom, creating predictable revenue streams that improve project bankability.

Long-term economic sustainability will likely require hybrid funding approaches combining regulatory mandates, market mechanisms, and strategic public investments. The development of carbon removal markets, where companies purchase verified carbon removals to meet net-zero commitments, represents a promising pathway toward self-sustaining economics. However, policy certainty remains essential for attracting the estimated $1 trillion in capital required for carbon capture deployment at climate-relevant scales by 2050.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!