Cold Plasma Treatment's Role in Reducing Greenhouse Gas Emissions

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Cold Plasma Technology Evolution and Emission Reduction Goals

Cold plasma technology has evolved significantly over the past decades, transitioning from a niche scientific curiosity to a versatile industrial tool with promising environmental applications. Initially developed in the early 20th century for material surface modifications, cold plasma systems have undergone substantial miniaturization and efficiency improvements. The technology operates by creating a partially ionized gas at near-ambient temperatures, enabling chemical reactions that would otherwise require extreme heat, thereby offering energy-efficient alternatives to conventional thermal processes.

The evolution trajectory shows three distinct phases: laboratory experimentation (1950s-1980s), industrial adoption for surface treatment (1980s-2000s), and the current environmental application expansion phase (2000s-present). Recent technological breakthroughs include the development of atmospheric pressure plasma systems, eliminating the need for vacuum chambers and significantly reducing operational costs and complexity.

In the context of greenhouse gas (GHG) emissions reduction, cold plasma technology presents multiple pathways for impact. The primary mechanisms include direct decomposition of GHGs like methane and nitrous oxide, conversion of carbon dioxide into value-added products, and enhancement of catalytic processes for more efficient emission control systems. These applications align with global climate goals established under the Paris Agreement, which aims to limit global warming to well below 2°C above pre-industrial levels.

The technical emission reduction goals for cold plasma applications are multifaceted. Short-term objectives focus on achieving 30-50% conversion efficiency for methane in concentrated streams, such as those from agricultural operations and landfills. Medium-term goals target 60-80% decomposition rates for industrial exhaust gases containing various GHGs, while maintaining energy consumption below 3 kWh per kg of treated gas. Long-term aspirations include developing integrated systems capable of 90%+ reduction efficiency across multiple GHG types simultaneously.

Energy efficiency represents a critical metric in this technological evolution, as the environmental benefit of GHG decomposition must outweigh the carbon footprint of the plasma generation process itself. Current research indicates promising energy return on investment (EROI) ratios of 3:1 to 5:1 for certain applications, with theoretical models suggesting potential improvements to 8:1 through optimization of electrode materials and power supply systems.

The convergence of cold plasma technology with renewable energy sources presents a particularly promising direction, potentially enabling carbon-negative treatment systems that could contribute significantly to global decarbonization efforts while addressing the technical challenges of intermittent renewable energy storage and utilization.

The evolution trajectory shows three distinct phases: laboratory experimentation (1950s-1980s), industrial adoption for surface treatment (1980s-2000s), and the current environmental application expansion phase (2000s-present). Recent technological breakthroughs include the development of atmospheric pressure plasma systems, eliminating the need for vacuum chambers and significantly reducing operational costs and complexity.

In the context of greenhouse gas (GHG) emissions reduction, cold plasma technology presents multiple pathways for impact. The primary mechanisms include direct decomposition of GHGs like methane and nitrous oxide, conversion of carbon dioxide into value-added products, and enhancement of catalytic processes for more efficient emission control systems. These applications align with global climate goals established under the Paris Agreement, which aims to limit global warming to well below 2°C above pre-industrial levels.

The technical emission reduction goals for cold plasma applications are multifaceted. Short-term objectives focus on achieving 30-50% conversion efficiency for methane in concentrated streams, such as those from agricultural operations and landfills. Medium-term goals target 60-80% decomposition rates for industrial exhaust gases containing various GHGs, while maintaining energy consumption below 3 kWh per kg of treated gas. Long-term aspirations include developing integrated systems capable of 90%+ reduction efficiency across multiple GHG types simultaneously.

Energy efficiency represents a critical metric in this technological evolution, as the environmental benefit of GHG decomposition must outweigh the carbon footprint of the plasma generation process itself. Current research indicates promising energy return on investment (EROI) ratios of 3:1 to 5:1 for certain applications, with theoretical models suggesting potential improvements to 8:1 through optimization of electrode materials and power supply systems.

The convergence of cold plasma technology with renewable energy sources presents a particularly promising direction, potentially enabling carbon-negative treatment systems that could contribute significantly to global decarbonization efforts while addressing the technical challenges of intermittent renewable energy storage and utilization.

Market Demand for Greenhouse Gas Mitigation Solutions

The global market for greenhouse gas (GHG) mitigation solutions has experienced significant growth in recent years, driven by increasing environmental concerns and regulatory pressures. The Paris Agreement's commitment to limit global warming to well below 2°C above pre-industrial levels has catalyzed substantial investments in emission reduction technologies across various sectors. Current market valuations for carbon capture, utilization, and storage (CCUS) technologies alone exceed $7 billion, with projections indicating a compound annual growth rate of 13.8% through 2030.

Industrial sectors, particularly power generation, manufacturing, and chemical processing, represent the largest potential market for cold plasma treatment technologies. These sectors collectively account for approximately 40% of global greenhouse gas emissions, presenting a substantial addressable market. The steel industry, for instance, produces nearly 7-9% of global CO2 emissions and has shown increasing willingness to adopt innovative abatement technologies to meet stringent emission targets.

Market research indicates that corporate sustainability commitments are driving significant demand for emission reduction solutions. Over 1,500 major corporations worldwide have made net-zero pledges, creating a robust market for technologies that can deliver measurable GHG reductions. This trend is particularly pronounced in developed economies where regulatory frameworks increasingly incorporate carbon pricing mechanisms.

The agricultural sector presents another substantial market opportunity for cold plasma applications in GHG mitigation. Methane emissions from livestock and rice cultivation contribute significantly to global warming, with agriculture responsible for approximately 24% of global GHG emissions. Solutions that can address these non-CO2 greenhouse gases have seen increasing demand, with market growth rates exceeding 15% annually in some regions.

Regional analysis reveals varying market dynamics. The European Union leads in adoption of GHG mitigation technologies, driven by the European Green Deal and ambitious emission reduction targets. North America follows closely, with significant growth potential as climate policies evolve. The Asia-Pacific region represents the fastest-growing market, particularly in China and India, where industrial expansion coincides with increasing environmental regulations.

Economic incentives further bolster market demand, with carbon pricing mechanisms now covering approximately 22% of global emissions. The average carbon price in established markets has risen to meaningful levels that justify investment in abatement technologies. Additionally, government subsidies and green financing initiatives have created favorable market conditions for early adoption of innovative solutions like cold plasma treatment.

Consumer preferences are increasingly influencing corporate decision-making, with 73% of global consumers stating they would change their consumption habits to reduce environmental impact. This translates to growing market demand for products manufactured using low-emission processes, creating additional incentives for industries to invest in GHG mitigation technologies.

Industrial sectors, particularly power generation, manufacturing, and chemical processing, represent the largest potential market for cold plasma treatment technologies. These sectors collectively account for approximately 40% of global greenhouse gas emissions, presenting a substantial addressable market. The steel industry, for instance, produces nearly 7-9% of global CO2 emissions and has shown increasing willingness to adopt innovative abatement technologies to meet stringent emission targets.

Market research indicates that corporate sustainability commitments are driving significant demand for emission reduction solutions. Over 1,500 major corporations worldwide have made net-zero pledges, creating a robust market for technologies that can deliver measurable GHG reductions. This trend is particularly pronounced in developed economies where regulatory frameworks increasingly incorporate carbon pricing mechanisms.

The agricultural sector presents another substantial market opportunity for cold plasma applications in GHG mitigation. Methane emissions from livestock and rice cultivation contribute significantly to global warming, with agriculture responsible for approximately 24% of global GHG emissions. Solutions that can address these non-CO2 greenhouse gases have seen increasing demand, with market growth rates exceeding 15% annually in some regions.

Regional analysis reveals varying market dynamics. The European Union leads in adoption of GHG mitigation technologies, driven by the European Green Deal and ambitious emission reduction targets. North America follows closely, with significant growth potential as climate policies evolve. The Asia-Pacific region represents the fastest-growing market, particularly in China and India, where industrial expansion coincides with increasing environmental regulations.

Economic incentives further bolster market demand, with carbon pricing mechanisms now covering approximately 22% of global emissions. The average carbon price in established markets has risen to meaningful levels that justify investment in abatement technologies. Additionally, government subsidies and green financing initiatives have created favorable market conditions for early adoption of innovative solutions like cold plasma treatment.

Consumer preferences are increasingly influencing corporate decision-making, with 73% of global consumers stating they would change their consumption habits to reduce environmental impact. This translates to growing market demand for products manufactured using low-emission processes, creating additional incentives for industries to invest in GHG mitigation technologies.

Current State and Challenges of Cold Plasma Treatment

Cold plasma treatment technology for greenhouse gas (GHG) reduction has advanced significantly in recent years, with implementations across various industrial sectors. Currently, non-thermal plasma systems are being deployed in power plants, chemical manufacturing facilities, and waste management operations to treat exhaust gases containing methane, carbon dioxide, and nitrogen oxides. Laboratory-scale demonstrations have shown conversion efficiencies of 60-85% for methane and 40-70% for carbon dioxide under optimized conditions, representing substantial progress from earlier systems that achieved only 20-30% conversion rates.

Despite these advancements, several critical challenges impede widespread adoption. Energy efficiency remains a primary concern, as current plasma systems require 4-8 kWh of electricity per kilogram of GHG processed, making the technology economically viable only in specific applications. The energy return on investment must improve by at least 30-40% to compete with alternative abatement technologies in most industrial settings.

Scalability presents another significant hurdle. While laboratory and pilot systems effectively process gas volumes of 1-10 m³/hour, industrial applications often require treatment capacities of 1,000-10,000 m³/hour. Current reactor designs face challenges in maintaining plasma stability and uniform treatment at these larger scales, with performance typically degrading by 15-25% when scaled up.

Catalyst integration with plasma systems shows promise but introduces complexity. Hybrid plasma-catalytic systems demonstrate enhanced conversion rates and selectivity toward valuable by-products, but catalyst deactivation occurs rapidly in industrial environments. Most catalysts require replacement or regeneration after 200-500 operating hours, compared to the 5,000+ hours needed for economic viability.

Geographically, research leadership in cold plasma GHG treatment is concentrated in specific regions. European institutions, particularly in Germany, the Netherlands, and Belgium, lead in fundamental research and pilot demonstrations. China has rapidly expanded its research capacity, focusing on coal power plant applications. The United States maintains strength in plasma physics fundamentals but lags in industrial implementation compared to East Asia and Europe.

Regulatory frameworks significantly impact technology adoption patterns. The European Union's carbon pricing mechanisms have accelerated industrial interest, while more fragmented approaches in North America have resulted in isolated implementation. Japan and South Korea have established specialized funding programs specifically targeting plasma-based environmental technologies, creating regional centers of expertise.

Material limitations further constrain system durability. Electrode degradation under continuous operation remains problematic, with most systems requiring maintenance after 1,000-2,000 operating hours. High-temperature plasma zones create material stress that current engineering solutions have only partially addressed.

Despite these advancements, several critical challenges impede widespread adoption. Energy efficiency remains a primary concern, as current plasma systems require 4-8 kWh of electricity per kilogram of GHG processed, making the technology economically viable only in specific applications. The energy return on investment must improve by at least 30-40% to compete with alternative abatement technologies in most industrial settings.

Scalability presents another significant hurdle. While laboratory and pilot systems effectively process gas volumes of 1-10 m³/hour, industrial applications often require treatment capacities of 1,000-10,000 m³/hour. Current reactor designs face challenges in maintaining plasma stability and uniform treatment at these larger scales, with performance typically degrading by 15-25% when scaled up.

Catalyst integration with plasma systems shows promise but introduces complexity. Hybrid plasma-catalytic systems demonstrate enhanced conversion rates and selectivity toward valuable by-products, but catalyst deactivation occurs rapidly in industrial environments. Most catalysts require replacement or regeneration after 200-500 operating hours, compared to the 5,000+ hours needed for economic viability.

Geographically, research leadership in cold plasma GHG treatment is concentrated in specific regions. European institutions, particularly in Germany, the Netherlands, and Belgium, lead in fundamental research and pilot demonstrations. China has rapidly expanded its research capacity, focusing on coal power plant applications. The United States maintains strength in plasma physics fundamentals but lags in industrial implementation compared to East Asia and Europe.

Regulatory frameworks significantly impact technology adoption patterns. The European Union's carbon pricing mechanisms have accelerated industrial interest, while more fragmented approaches in North America have resulted in isolated implementation. Japan and South Korea have established specialized funding programs specifically targeting plasma-based environmental technologies, creating regional centers of expertise.

Material limitations further constrain system durability. Electrode degradation under continuous operation remains problematic, with most systems requiring maintenance after 1,000-2,000 operating hours. High-temperature plasma zones create material stress that current engineering solutions have only partially addressed.

Current Cold Plasma Solutions for GHG Reduction

01 Cold plasma technology for greenhouse gas reduction

Cold plasma technology can be utilized to reduce greenhouse gas emissions by breaking down harmful gases into less harmful components. This non-thermal plasma treatment operates at ambient temperatures and can effectively decompose gases like methane, carbon dioxide, and nitrous oxide through ionization processes. The technology is particularly valuable for treating industrial emissions before they are released into the atmosphere, offering an energy-efficient approach to mitigating climate change impacts.- Cold plasma technology for greenhouse gas reduction: Cold plasma technology can be utilized to reduce greenhouse gas emissions by breaking down harmful gases into less harmful components. This non-thermal plasma treatment operates at ambient temperatures and can effectively decompose gases like methane, carbon dioxide, and nitrous oxide through ionization processes. The technology is particularly valuable for treating industrial emissions and can be integrated into existing emission control systems.

- Plasma-assisted catalytic conversion systems: Combining cold plasma with catalysts enhances the efficiency of greenhouse gas conversion. These hybrid systems use plasma to activate catalytic surfaces, lowering the energy requirements for chemical reactions that transform greenhouse gases into valuable products or less harmful substances. The synergistic effect between plasma and catalysts improves conversion rates and selectivity while operating at lower temperatures than traditional catalytic methods.

- Monitoring and control systems for plasma-based emission treatment: Advanced monitoring and control systems are essential for optimizing cold plasma treatment of greenhouse gases. These systems utilize sensors and data analytics to adjust plasma parameters in real-time based on emission composition and flow rates. Intelligent control algorithms can maximize treatment efficiency while minimizing energy consumption, ensuring optimal performance across varying operational conditions.

- Energy-efficient plasma generation for environmental applications: Energy efficiency is crucial for the practical application of cold plasma in greenhouse gas treatment. Innovative power supply designs, pulsed plasma techniques, and optimized electrode configurations can significantly reduce the energy consumption of plasma systems. These advancements make cold plasma treatment more economically viable for large-scale implementation in industrial settings where greenhouse gas emissions are substantial.

- Integration of plasma technology in carbon capture and utilization: Cold plasma systems can be integrated into carbon capture and utilization frameworks to not only reduce greenhouse gas emissions but also convert them into valuable products. This approach combines plasma treatment with subsequent processing steps to transform captured carbon dioxide and other greenhouse gases into fuels, chemicals, or materials. The integration provides both environmental benefits and potential economic returns through the production of marketable compounds.

02 Plasma-based carbon capture and utilization systems

Plasma treatment systems can be integrated with carbon capture technologies to not only reduce greenhouse gas emissions but also convert captured carbon into valuable products. These systems use plasma reactors to transform carbon dioxide and other greenhouse gases into useful chemicals or fuels through plasma-catalytic processes. This approach provides dual benefits of emissions reduction and resource recovery, making it economically attractive for industrial applications.Expand Specific Solutions03 Monitoring and control systems for plasma-based emission treatment

Advanced monitoring and control systems are essential for optimizing cold plasma treatment of greenhouse gas emissions. These systems incorporate sensors, data analytics, and automated control mechanisms to ensure efficient operation of plasma reactors. Real-time monitoring allows for adjustments to plasma parameters based on emission composition and flow rates, maximizing treatment effectiveness while minimizing energy consumption. These intelligent systems can be integrated with existing industrial emission control infrastructure.Expand Specific Solutions04 Agricultural applications of cold plasma for emissions management

Cold plasma technology can be applied in agricultural settings to manage greenhouse gas emissions from livestock operations and crop production. Plasma systems can treat methane from animal waste, reduce ammonia emissions, and process agricultural residues in ways that minimize their climate impact. These applications help the agricultural sector reduce its carbon footprint while potentially improving soil health and crop yields through plasma-treated inputs.Expand Specific Solutions05 Economic and environmental impact assessment of plasma emission treatment

Assessment frameworks have been developed to evaluate the economic viability and environmental benefits of implementing cold plasma systems for greenhouse gas reduction. These methodologies consider factors such as installation costs, operational expenses, emission reduction efficiency, and potential carbon credits. Life cycle assessments help quantify the net environmental impact of plasma treatment technologies compared to conventional approaches, supporting decision-making for industrial adoption and policy development.Expand Specific Solutions

Key Industry Players in Cold Plasma Emission Treatment

Cold plasma treatment for greenhouse gas reduction is in an early growth phase, with market size expanding due to increasing environmental regulations. The technology is moderately mature but advancing rapidly, with key players demonstrating varying levels of expertise. Research institutions like Beijing University of Technology, Dalian University of Technology, and Zhejiang University are driving fundamental innovations, while commercial entities including US Medical Innovations, Plasmology4, and Air Liquide are developing practical applications. Sinopec and China Petroleum & Chemical Corp. are exploring industrial-scale implementations. Fraunhofer-Gesellschaft and Tokyo Electron provide technological infrastructure, while companies like CINOGY GmbH and Jiangsu Tianying focus on specialized plasma solutions for environmental applications. The competitive landscape shows a healthy mix of academic research, established industrial players, and specialized technology providers.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced cold plasma treatment systems specifically designed for reducing greenhouse gas emissions in petroleum refining processes. Their technology utilizes non-thermal plasma reactors that can effectively decompose methane and other volatile organic compounds (VOCs) at relatively low temperatures (80-120°C). The system employs dielectric barrier discharge (DBD) plasma generators that create high-energy electrons while maintaining near-ambient gas temperatures. These electrons trigger chemical reactions that convert greenhouse gases like methane (CH4) into less harmful compounds or valuable products such as hydrogen and carbon black. Sinopec's implementation includes multi-stage plasma reactors with specialized catalysts that enhance conversion efficiency by up to 85% for methane and 92% for other VOCs. The technology has been successfully deployed at several refineries, demonstrating 30-40% reduction in greenhouse gas emissions from targeted processes while consuming significantly less energy than thermal treatment alternatives.

Strengths: The technology operates at near-ambient temperatures, requiring significantly less energy than thermal alternatives. Integration with existing refinery infrastructure is relatively straightforward, and the process can simultaneously address multiple pollutants. Weaknesses: The technology requires specialized high-voltage power supplies and faces challenges with electrode fouling in high-particulate environments. Scalability to handle very large gas volumes remains a technical challenge.

Tokyo Electron Ltd.

Technical Solution: Tokyo Electron Ltd. has pioneered an innovative cold plasma treatment system called "PlasmaGreen" specifically designed for semiconductor manufacturing facilities to reduce perfluorocarbon (PFC) emissions, which have global warming potentials thousands of times greater than CO2. Their technology employs a unique dual-frequency capacitively coupled plasma (CCP) system that operates at temperatures below 150°C while achieving decomposition rates exceeding 99% for CF4, SF6, and other fluorinated compounds. The system utilizes a proprietary electrode configuration that enhances plasma density while maintaining low gas temperatures, coupled with specialized catalysts that promote the conversion of these stable molecules into less harmful byproducts. Tokyo Electron's approach includes real-time monitoring and adaptive control systems that optimize plasma parameters based on gas composition, ensuring maximum abatement efficiency while minimizing energy consumption. Field tests at semiconductor fabrication facilities have demonstrated that the technology can reduce greenhouse gas emissions by approximately 95-99% compared to unabated processes, while consuming 30-40% less energy than thermal abatement alternatives.

Strengths: Extremely high destruction efficiency for potent greenhouse gases like PFCs and SF6 (>99%). The system integrates seamlessly with semiconductor manufacturing equipment and features advanced monitoring capabilities. Weaknesses: The technology requires specialized maintenance expertise and periodic replacement of catalyst materials. Initial capital costs are relatively high compared to simpler abatement technologies, though lifetime operational costs are competitive.

Core Patents and Research in Cold Plasma Emission Control

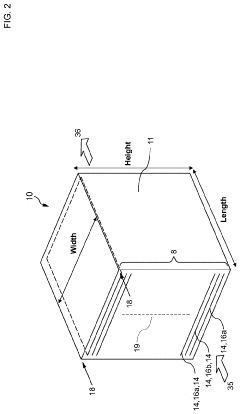

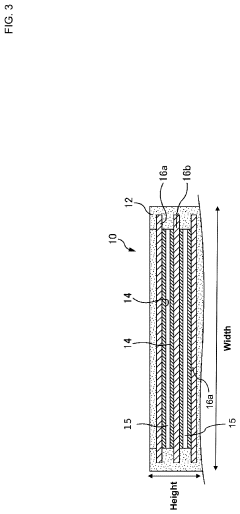

Methods and apparatus for generating atmospheric pressure, low temperature plasma with changing parameters

PatentWO2024192184A1

Innovation

- A plasma generator with a dielectric-barrier discharge configuration, using high frequency power supply to control AC voltage and frequency, and dielectric layers to stabilize the plasma generation, allowing for the production of stable cold plasma with adjustable parameters to optimize reactive species generation.

Methods and apparatus for generating atmospheric pressure, low temperature plasma

PatentPendingUS20240066161A1

Innovation

- A plasma generator system using dielectric-barrier discharge (DBD) with adjustable AC voltage and frequency to produce atmospheric pressure, low-temperature plasma, where electrodes are separated by dielectric layers to control ionization and generate stable cold plasma, effectively creating a matrix for air purification and sterilization.

Environmental Policy Impact on Cold Plasma Adoption

Environmental policies across the globe are increasingly recognizing cold plasma technology as a viable solution for greenhouse gas (GHG) emission reduction. The Paris Agreement and subsequent national climate commitments have created a regulatory framework that indirectly supports innovative emission reduction technologies. Cold plasma treatment, with its ability to convert methane and other GHGs into less harmful compounds, aligns perfectly with these policy objectives.

In the European Union, the European Green Deal has established ambitious targets for carbon neutrality by 2050, creating significant incentives for industries to adopt technologies like cold plasma. The EU's Emission Trading System (ETS) puts a price on carbon emissions, making investment in emission reduction technologies economically attractive. Several member states have introduced additional subsidies and tax benefits for companies implementing innovative GHG reduction solutions.

The United States has seen a shift toward supportive policies at both federal and state levels. The Inflation Reduction Act of 2022 includes substantial funding for clean energy technologies, with specific provisions that could benefit cold plasma adoption. California's stringent emission standards have particularly driven interest in plasma technologies for industrial applications, creating a model that other states are beginning to follow.

In Asia, China's 14th Five-Year Plan emphasizes green development and emission reduction, creating a massive potential market for cold plasma technology. Japan and South Korea have similarly introduced policies supporting technological solutions for climate change mitigation, including research grants specifically targeting plasma applications for environmental remediation.

Policy challenges remain significant barriers to widespread adoption. Regulatory frameworks often lag behind technological innovation, creating uncertainty for potential adopters. The lack of standardized protocols for measuring and verifying emission reductions achieved through cold plasma treatment complicates compliance certification and access to carbon markets.

Financial incentives vary dramatically between jurisdictions, creating uneven adoption patterns globally. While some regions offer substantial subsidies, grants, and tax incentives for emission reduction technologies, others provide minimal support, slowing market penetration in these areas. International coordination of environmental policies would significantly accelerate cold plasma adoption by creating more consistent market signals and investment opportunities.

In the European Union, the European Green Deal has established ambitious targets for carbon neutrality by 2050, creating significant incentives for industries to adopt technologies like cold plasma. The EU's Emission Trading System (ETS) puts a price on carbon emissions, making investment in emission reduction technologies economically attractive. Several member states have introduced additional subsidies and tax benefits for companies implementing innovative GHG reduction solutions.

The United States has seen a shift toward supportive policies at both federal and state levels. The Inflation Reduction Act of 2022 includes substantial funding for clean energy technologies, with specific provisions that could benefit cold plasma adoption. California's stringent emission standards have particularly driven interest in plasma technologies for industrial applications, creating a model that other states are beginning to follow.

In Asia, China's 14th Five-Year Plan emphasizes green development and emission reduction, creating a massive potential market for cold plasma technology. Japan and South Korea have similarly introduced policies supporting technological solutions for climate change mitigation, including research grants specifically targeting plasma applications for environmental remediation.

Policy challenges remain significant barriers to widespread adoption. Regulatory frameworks often lag behind technological innovation, creating uncertainty for potential adopters. The lack of standardized protocols for measuring and verifying emission reductions achieved through cold plasma treatment complicates compliance certification and access to carbon markets.

Financial incentives vary dramatically between jurisdictions, creating uneven adoption patterns globally. While some regions offer substantial subsidies, grants, and tax incentives for emission reduction technologies, others provide minimal support, slowing market penetration in these areas. International coordination of environmental policies would significantly accelerate cold plasma adoption by creating more consistent market signals and investment opportunities.

Cost-Benefit Analysis of Cold Plasma Implementation

Implementing cold plasma technology for greenhouse gas reduction requires careful economic analysis to determine its viability across different sectors. Initial capital expenditure for cold plasma systems varies significantly based on scale and application, ranging from $50,000 for small-scale agricultural implementations to over $2 million for industrial-scale facilities. These systems typically require specialized equipment including plasma generators, gas handling systems, and monitoring infrastructure.

Operational costs present a more nuanced picture. Energy consumption remains the primary ongoing expense, with modern cold plasma systems requiring 0.3-0.8 kWh per cubic meter of treated gas. However, this represents a 30% improvement over previous generation technologies. Maintenance costs average 5-8% of initial capital investment annually, primarily for electrode replacement and control system calibration.

The economic benefits manifest through multiple channels. Direct emission reduction benefits can be quantified through carbon credit markets, with current values ranging from $25-85 per ton of CO2 equivalent depending on jurisdiction. For methane-intensive operations like livestock farming, the financial returns can be substantial, with potential annual savings of $15,000-60,000 for medium-sized operations.

Secondary benefits include improved regulatory compliance, reducing potential fines and penalties that average $10,000-100,000 per violation in most developed economies. Additionally, companies implementing greenhouse gas reduction technologies increasingly report premium pricing opportunities, with consumer willingness to pay 5-15% more for products with verified lower carbon footprints.

Return on investment timelines vary significantly by sector. Agricultural implementations typically achieve breakeven within 3-5 years, while industrial applications may see returns in 2-4 years due to larger emission volumes and efficiency gains. The most favorable economics appear in natural gas processing and landfill operations, where ROI periods can be as short as 18 months when accounting for all benefits.

Sensitivity analysis reveals that economic viability is most dependent on energy costs, carbon pricing, and regulatory frameworks. A 20% increase in electricity costs extends payback periods by approximately 15%, while a similar increase in carbon credit values can reduce payback periods by up to 25%. This underscores the importance of policy stability for investment decisions in this technology.

Operational costs present a more nuanced picture. Energy consumption remains the primary ongoing expense, with modern cold plasma systems requiring 0.3-0.8 kWh per cubic meter of treated gas. However, this represents a 30% improvement over previous generation technologies. Maintenance costs average 5-8% of initial capital investment annually, primarily for electrode replacement and control system calibration.

The economic benefits manifest through multiple channels. Direct emission reduction benefits can be quantified through carbon credit markets, with current values ranging from $25-85 per ton of CO2 equivalent depending on jurisdiction. For methane-intensive operations like livestock farming, the financial returns can be substantial, with potential annual savings of $15,000-60,000 for medium-sized operations.

Secondary benefits include improved regulatory compliance, reducing potential fines and penalties that average $10,000-100,000 per violation in most developed economies. Additionally, companies implementing greenhouse gas reduction technologies increasingly report premium pricing opportunities, with consumer willingness to pay 5-15% more for products with verified lower carbon footprints.

Return on investment timelines vary significantly by sector. Agricultural implementations typically achieve breakeven within 3-5 years, while industrial applications may see returns in 2-4 years due to larger emission volumes and efficiency gains. The most favorable economics appear in natural gas processing and landfill operations, where ROI periods can be as short as 18 months when accounting for all benefits.

Sensitivity analysis reveals that economic viability is most dependent on energy costs, carbon pricing, and regulatory frameworks. A 20% increase in electricity costs extends payback periods by approximately 15%, while a similar increase in carbon credit values can reduce payback periods by up to 25%. This underscores the importance of policy stability for investment decisions in this technology.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!