Comparative assessment of magnesium-ion battery cost vs sodium-ion battery

SEP 29, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Mg-ion and Na-ion Battery Development Background and Objectives

The evolution of battery technology has been a cornerstone of modern energy storage solutions, with lithium-ion batteries dominating the market for decades. However, concerns regarding lithium's limited global reserves, geographical concentration, and rising costs have prompted researchers and industry stakeholders to explore alternative battery chemistries. Magnesium-ion and sodium-ion batteries have emerged as promising candidates due to their potential cost advantages and resource abundance.

Magnesium-ion battery research began in earnest during the 1990s but gained significant momentum in the early 2000s when researchers recognized magnesium's theoretical advantages: it offers a two-electron transfer capability (compared to lithium's one), possesses high volumetric capacity (3833 mAh/cm³), and benefits from abundant global reserves. The element constitutes approximately 2.4% of the Earth's crust and is widely distributed geographically, reducing supply chain vulnerabilities.

Sodium-ion battery development traces back to the 1970s, concurrent with early lithium-ion research. However, when lithium-ion technology commercialized successfully, sodium research temporarily declined. Interest resurged around 2010 as concerns about lithium sustainability grew. Sodium, constituting approximately 2.6% of the Earth's crust, offers nearly unlimited availability through seawater and mineral deposits, presenting a compelling alternative for large-scale energy storage applications.

The technical objectives for both battery technologies focus on overcoming their respective challenges while capitalizing on their inherent cost advantages. For magnesium-ion batteries, key goals include developing compatible electrolytes that enable reversible magnesium deposition without passivation layer formation, identifying suitable cathode materials that allow rapid Mg²⁺ diffusion, and creating stable electrode-electrolyte interfaces that maintain performance over extended cycling.

Sodium-ion battery development aims to optimize electrode materials that can accommodate the larger sodium ion (compared to lithium), enhance energy density to approach lithium-ion levels, extend cycle life beyond 2000 cycles, and establish manufacturing processes compatible with existing lithium-ion production infrastructure to minimize transition costs.

The overarching objective for both technologies is to achieve cost parity or advantage over lithium-ion batteries while maintaining acceptable performance metrics. Industry projections suggest potential cost reductions of 30-40% for sodium-ion and potentially greater savings for magnesium-ion systems at scale, though the latter faces more significant technical hurdles to commercialization.

Recent technological breakthroughs, including novel electrolyte formulations for magnesium batteries and advanced hard carbon anodes for sodium systems, have accelerated development timelines. Major research institutions and battery manufacturers worldwide have established dedicated programs to advance these technologies, recognizing their strategic importance in the evolving energy storage landscape.

Magnesium-ion battery research began in earnest during the 1990s but gained significant momentum in the early 2000s when researchers recognized magnesium's theoretical advantages: it offers a two-electron transfer capability (compared to lithium's one), possesses high volumetric capacity (3833 mAh/cm³), and benefits from abundant global reserves. The element constitutes approximately 2.4% of the Earth's crust and is widely distributed geographically, reducing supply chain vulnerabilities.

Sodium-ion battery development traces back to the 1970s, concurrent with early lithium-ion research. However, when lithium-ion technology commercialized successfully, sodium research temporarily declined. Interest resurged around 2010 as concerns about lithium sustainability grew. Sodium, constituting approximately 2.6% of the Earth's crust, offers nearly unlimited availability through seawater and mineral deposits, presenting a compelling alternative for large-scale energy storage applications.

The technical objectives for both battery technologies focus on overcoming their respective challenges while capitalizing on their inherent cost advantages. For magnesium-ion batteries, key goals include developing compatible electrolytes that enable reversible magnesium deposition without passivation layer formation, identifying suitable cathode materials that allow rapid Mg²⁺ diffusion, and creating stable electrode-electrolyte interfaces that maintain performance over extended cycling.

Sodium-ion battery development aims to optimize electrode materials that can accommodate the larger sodium ion (compared to lithium), enhance energy density to approach lithium-ion levels, extend cycle life beyond 2000 cycles, and establish manufacturing processes compatible with existing lithium-ion production infrastructure to minimize transition costs.

The overarching objective for both technologies is to achieve cost parity or advantage over lithium-ion batteries while maintaining acceptable performance metrics. Industry projections suggest potential cost reductions of 30-40% for sodium-ion and potentially greater savings for magnesium-ion systems at scale, though the latter faces more significant technical hurdles to commercialization.

Recent technological breakthroughs, including novel electrolyte formulations for magnesium batteries and advanced hard carbon anodes for sodium systems, have accelerated development timelines. Major research institutions and battery manufacturers worldwide have established dedicated programs to advance these technologies, recognizing their strategic importance in the evolving energy storage landscape.

Market Demand Analysis for Post-Lithium Battery Technologies

The global energy storage market is witnessing a significant shift away from traditional lithium-ion batteries due to concerns about lithium supply constraints, geopolitical tensions affecting supply chains, and environmental impacts of lithium extraction. This transition has created substantial market opportunities for post-lithium battery technologies, particularly magnesium-ion and sodium-ion batteries, which are emerging as promising alternatives.

Market research indicates that the global battery market is projected to reach $240 billion by 2027, with post-lithium technologies expected to capture an increasing share. Sodium-ion batteries are gaining particular traction, with market forecasts suggesting they could represent 5% of the stationary storage market by 2025 and potentially 20% by 2030, driven by their cost advantages and resource abundance.

The demand for magnesium-ion batteries remains more speculative but shows promise in specialized applications. While currently occupying a smaller market segment, industry analysts project that magnesium-ion technology could establish significant presence in niche markets requiring high energy density solutions by 2028, particularly in portable electronics and specialized industrial applications.

Key market drivers for these post-lithium technologies include the electric vehicle sector, which is actively seeking cost-effective alternatives to reduce dependency on lithium supply chains. The stationary energy storage sector represents another substantial market opportunity, with grid-scale storage installations increasing by 62% in 2022 alone, creating demand for lower-cost battery solutions.

Regional analysis reveals varying adoption patterns, with Asian markets—particularly China—leading in sodium-ion battery development and commercialization. European markets show strong interest driven by sustainability regulations and circular economy initiatives, while North American markets are increasingly investing in post-lithium technologies to reduce dependency on foreign battery supply chains.

Consumer electronics manufacturers are also exploring these alternative battery technologies to address consumer demands for longer-lasting, safer, and more environmentally friendly power sources. This sector could provide an early adoption pathway for both sodium and magnesium-ion technologies, allowing for technology refinement before scaling to larger applications.

The industrial sector presents additional demand opportunities, particularly for applications requiring batteries with enhanced safety profiles and operational stability in challenging environments. Both sodium and magnesium-ion technologies offer potential advantages in these contexts, with sodium-ion batteries already being tested in industrial equipment and magnesium-ion systems showing promise for specialized industrial applications requiring high energy density.

Market research indicates that the global battery market is projected to reach $240 billion by 2027, with post-lithium technologies expected to capture an increasing share. Sodium-ion batteries are gaining particular traction, with market forecasts suggesting they could represent 5% of the stationary storage market by 2025 and potentially 20% by 2030, driven by their cost advantages and resource abundance.

The demand for magnesium-ion batteries remains more speculative but shows promise in specialized applications. While currently occupying a smaller market segment, industry analysts project that magnesium-ion technology could establish significant presence in niche markets requiring high energy density solutions by 2028, particularly in portable electronics and specialized industrial applications.

Key market drivers for these post-lithium technologies include the electric vehicle sector, which is actively seeking cost-effective alternatives to reduce dependency on lithium supply chains. The stationary energy storage sector represents another substantial market opportunity, with grid-scale storage installations increasing by 62% in 2022 alone, creating demand for lower-cost battery solutions.

Regional analysis reveals varying adoption patterns, with Asian markets—particularly China—leading in sodium-ion battery development and commercialization. European markets show strong interest driven by sustainability regulations and circular economy initiatives, while North American markets are increasingly investing in post-lithium technologies to reduce dependency on foreign battery supply chains.

Consumer electronics manufacturers are also exploring these alternative battery technologies to address consumer demands for longer-lasting, safer, and more environmentally friendly power sources. This sector could provide an early adoption pathway for both sodium and magnesium-ion technologies, allowing for technology refinement before scaling to larger applications.

The industrial sector presents additional demand opportunities, particularly for applications requiring batteries with enhanced safety profiles and operational stability in challenging environments. Both sodium and magnesium-ion technologies offer potential advantages in these contexts, with sodium-ion batteries already being tested in industrial equipment and magnesium-ion systems showing promise for specialized industrial applications requiring high energy density.

Current Technical Status and Cost Challenges of Mg-ion vs Na-ion Batteries

Magnesium-ion (Mg-ion) and sodium-ion (Na-ion) batteries represent promising alternatives to conventional lithium-ion technology, each with distinct cost profiles and technical maturity levels. Currently, Na-ion batteries have achieved greater commercial readiness, with several companies including CATL, Faradion, and HiNa Battery Technology demonstrating pilot production capabilities. In contrast, Mg-ion batteries remain predominantly at the laboratory research stage, with significant fundamental challenges still to be overcome.

The raw material cost advantage represents a key economic driver for both technologies. Sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, with global reserves estimated at 300 billion tons compared to lithium's 21 million tons. This abundance translates to sodium carbonate costing roughly $300-500 per ton versus lithium carbonate at $15,000-20,000 per ton (as of 2023). Similarly, magnesium offers cost benefits with greater abundance than lithium and current prices around $2,500-3,500 per ton for magnesium metal.

Manufacturing infrastructure presents divergent challenges for these technologies. Na-ion batteries benefit from compatibility with existing lithium-ion production lines, requiring only minimal modifications estimated at 10-15% of total equipment costs. This compatibility significantly reduces capital expenditure for manufacturers transitioning to sodium technology. Conversely, Mg-ion battery production would require substantial new manufacturing processes and equipment due to different electrolyte requirements and electrode fabrication methods.

Technical limitations currently impact the cost-effectiveness of both technologies. Na-ion batteries face energy density constraints (90-160 Wh/kg versus 250-300 Wh/kg for commercial lithium-ion), necessitating larger battery packs for equivalent performance. This limitation increases indirect costs related to packaging, thermal management, and vehicle integration. Mg-ion batteries theoretically offer higher energy densities but suffer from electrolyte compatibility issues, slow diffusion kinetics, and cathode material challenges that have prevented practical demonstrations of their theoretical advantages.

Cell component costs reveal further distinctions. Na-ion batteries utilize aluminum rather than copper for anodes, reducing material costs by approximately 10-15% per cell. However, current cathode materials for Na-ion batteries (primarily layered oxides and Prussian blue analogs) remain relatively expensive due to limited production scale. For Mg-ion batteries, the potential elimination of separator components could reduce costs, but specialized electrolytes currently require expensive, high-purity chemicals that offset these savings.

Lifecycle economics also factor into the comparative assessment. Na-ion batteries demonstrate promising cycle life (2,000-4,000 cycles) and enhanced safety profiles that reduce battery management system requirements. Mg-ion technology theoretically offers even longer lifespans due to reduced dendrite formation issues, but practical demonstrations remain limited by electrolyte stability challenges.

The raw material cost advantage represents a key economic driver for both technologies. Sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, with global reserves estimated at 300 billion tons compared to lithium's 21 million tons. This abundance translates to sodium carbonate costing roughly $300-500 per ton versus lithium carbonate at $15,000-20,000 per ton (as of 2023). Similarly, magnesium offers cost benefits with greater abundance than lithium and current prices around $2,500-3,500 per ton for magnesium metal.

Manufacturing infrastructure presents divergent challenges for these technologies. Na-ion batteries benefit from compatibility with existing lithium-ion production lines, requiring only minimal modifications estimated at 10-15% of total equipment costs. This compatibility significantly reduces capital expenditure for manufacturers transitioning to sodium technology. Conversely, Mg-ion battery production would require substantial new manufacturing processes and equipment due to different electrolyte requirements and electrode fabrication methods.

Technical limitations currently impact the cost-effectiveness of both technologies. Na-ion batteries face energy density constraints (90-160 Wh/kg versus 250-300 Wh/kg for commercial lithium-ion), necessitating larger battery packs for equivalent performance. This limitation increases indirect costs related to packaging, thermal management, and vehicle integration. Mg-ion batteries theoretically offer higher energy densities but suffer from electrolyte compatibility issues, slow diffusion kinetics, and cathode material challenges that have prevented practical demonstrations of their theoretical advantages.

Cell component costs reveal further distinctions. Na-ion batteries utilize aluminum rather than copper for anodes, reducing material costs by approximately 10-15% per cell. However, current cathode materials for Na-ion batteries (primarily layered oxides and Prussian blue analogs) remain relatively expensive due to limited production scale. For Mg-ion batteries, the potential elimination of separator components could reduce costs, but specialized electrolytes currently require expensive, high-purity chemicals that offset these savings.

Lifecycle economics also factor into the comparative assessment. Na-ion batteries demonstrate promising cycle life (2,000-4,000 cycles) and enhanced safety profiles that reduce battery management system requirements. Mg-ion technology theoretically offers even longer lifespans due to reduced dendrite formation issues, but practical demonstrations remain limited by electrolyte stability challenges.

Current Cost Structure Analysis of Mg-ion vs Na-ion Batteries

01 Cost comparison between magnesium-ion and sodium-ion batteries

Magnesium-ion and sodium-ion batteries offer cost advantages over traditional lithium-ion batteries due to the abundance and lower cost of raw materials. Sodium is approximately 1000 times more abundant than lithium in the Earth's crust, while magnesium is the eighth most abundant element. This abundance translates to lower material costs, making these battery technologies economically attractive alternatives. Cost analyses show potential for significant reduction in production expenses, particularly for large-scale energy storage applications.- Cost advantages of sodium-ion batteries over lithium-ion batteries: Sodium-ion batteries offer significant cost advantages compared to traditional lithium-ion batteries due to the abundance and lower cost of sodium resources. The raw materials for sodium-ion batteries are more widely available and less expensive, making them an economically viable alternative for large-scale energy storage applications. These batteries can achieve comparable energy density at a fraction of the cost, particularly beneficial for stationary storage systems where weight is less critical.

- Manufacturing cost reduction strategies for magnesium-ion batteries: Various approaches have been developed to reduce the manufacturing costs of magnesium-ion batteries, including simplified production processes, use of less expensive electrode materials, and optimization of electrolyte formulations. These strategies focus on maintaining performance while reducing dependency on rare or expensive components. Innovations in cathode materials and cell design have enabled more cost-effective production methods without sacrificing energy density or cycle life, making magnesium-ion technology more commercially viable.

- Economic analysis of battery lifecycle costs: Comprehensive economic analyses of magnesium-ion and sodium-ion batteries consider not only initial manufacturing costs but also lifecycle expenses including operation, maintenance, and end-of-life recycling. These analyses demonstrate that while initial production costs may be higher for some advanced battery technologies, the total cost of ownership can be lower due to longer cycle life, improved safety features, and reduced maintenance requirements. The recyclability of materials also contributes to better economic performance over the complete battery lifecycle.

- Raw material supply chain impacts on battery costs: The supply chain for raw materials significantly impacts the overall cost structure of both magnesium-ion and sodium-ion batteries. Sodium-ion batteries benefit from more geographically distributed and politically stable supply sources compared to lithium, reducing price volatility and supply risks. For magnesium-ion batteries, the abundance of magnesium in the earth's crust provides potential cost advantages, though processing technologies require further development to fully realize these benefits. Strategic sourcing and vertical integration in manufacturing can further reduce costs for both battery types.

- Scaling effects on production economics: The economics of both magnesium-ion and sodium-ion battery production are significantly influenced by manufacturing scale. As production volumes increase, economies of scale lead to substantial cost reductions through more efficient use of equipment, bulk purchasing of materials, and process optimization. Research indicates that sodium-ion batteries may achieve cost parity with lead-acid batteries at commercial scale, while magnesium-ion batteries could eventually compete with lithium-ion batteries on cost as manufacturing techniques mature and production volumes increase.

02 Manufacturing cost reduction strategies

Various manufacturing approaches have been developed to reduce the production costs of magnesium-ion and sodium-ion batteries. These include simplified electrode preparation processes, use of water-based electrode slurries instead of organic solvents, and streamlined assembly techniques. Additionally, the ability to use aluminum current collectors for both electrodes in sodium-ion batteries (unlike lithium-ion batteries which require copper for the anode) represents a significant cost advantage. These manufacturing innovations contribute to making these alternative battery technologies more economically competitive.Expand Specific Solutions03 Electrode material cost optimization

Research has focused on developing low-cost electrode materials for magnesium-ion and sodium-ion batteries. For sodium-ion batteries, hard carbon derived from biomass waste, Prussian blue analogs, and sodium-containing layered oxides have emerged as cost-effective alternatives to traditional materials. For magnesium-ion batteries, various cathode materials including chalcogenides and oxide-based compounds have been investigated to balance performance with cost. These material innovations help reduce the overall battery cost while maintaining acceptable performance metrics.Expand Specific Solutions04 Electrolyte cost considerations

Electrolyte formulations significantly impact the overall cost of magnesium-ion and sodium-ion batteries. For sodium-ion batteries, conventional sodium salts in carbonate-based solvents offer a cost-effective solution. Magnesium-ion batteries face challenges with electrolytes due to compatibility issues with magnesium metal anodes, but progress has been made in developing less expensive and more stable formulations. Research indicates that optimized electrolyte compositions can reduce costs while improving battery performance and cycle life.Expand Specific Solutions05 Lifecycle cost analysis and commercial viability

Lifecycle cost analyses of magnesium-ion and sodium-ion batteries demonstrate their economic advantages beyond initial manufacturing costs. These analyses consider factors such as cycle life, energy density, safety, and recycling potential. While sodium-ion batteries are closer to commercial deployment with several companies already producing them at scale, magnesium-ion batteries remain primarily in the research phase. The total cost of ownership for sodium-ion batteries is becoming increasingly competitive with lithium-ion batteries, particularly for stationary storage applications where energy density is less critical than cost.Expand Specific Solutions

Key Industrial Players in Mg-ion and Na-ion Battery Development

The magnesium-ion vs sodium-ion battery cost comparison reveals an evolving competitive landscape in the early commercialization stage. While the global market remains relatively small, it's growing rapidly as companies seek alternatives to lithium-ion batteries. Sodium-ion technology demonstrates higher technical maturity, with companies like Faradion Ltd. and Shenzhen Zhenhua New Materials achieving commercial production. Magnesium-ion technology, though promising for higher energy density, remains primarily in research phases with organizations like Toyota, KIST, and Central South University leading development. The competitive advantage currently favors sodium-ion batteries due to lower material costs and established manufacturing processes, though magnesium-ion technology could gain ground as research advances at institutions like Kyoto University and Nankai University.

Faradion Ltd.

Technical Solution: Faradion has pioneered sodium-ion battery technology as a cost-effective alternative to lithium-ion batteries. Their proprietary Na-ion technology utilizes abundant and low-cost sodium resources, eliminating the need for costly lithium, cobalt, and copper. Faradion's cells employ a layered oxide cathode (Na₂/₃Fe₁/₃Mn₂/₃O₂) and hard carbon anode architecture, delivering energy densities of 140-160 Wh/kg at the cell level. Their economic analysis demonstrates a 20-30% cost reduction compared to LFP lithium-ion batteries, with raw material costs approximately 30% lower. The company's manufacturing approach leverages existing lithium-ion production infrastructure, requiring minimal capital investment for conversion. This technology has been validated through multiple commercial-scale pilot productions and extensive cycle life testing showing 1,500+ cycles at 80% capacity retention.

Strengths: Utilizes abundant, globally available sodium resources; compatible with existing Li-ion manufacturing equipment; significantly lower raw material costs; operates effectively across wider temperature ranges than Li-ion. Weaknesses: Lower energy density compared to premium Li-ion chemistries; technology still scaling to mass production; limited commercial deployment history compared to established battery technologies.

Chinese Academy of Sciences Institute of Physics

Technical Solution: The Chinese Academy of Sciences Institute of Physics has developed advanced research on both magnesium-ion and sodium-ion battery technologies with particular focus on comparative cost structures. Their magnesium-ion battery research centers on novel Chevrel phase Mo₆S₈ cathodes and magnesium metal anodes, achieving energy densities of 100-120 Wh/kg in laboratory settings. Their economic modeling indicates that Mg-ion batteries could potentially achieve 15-25% cost reduction compared to Li-ion batteries due to the abundance of magnesium resources (2.3% of earth's crust vs. 0.0065% for lithium). However, their research highlights significant challenges with Mg-ion electrolytes, which currently require expensive and complex chloride-based formulations. For sodium-ion batteries, the Institute has pioneered layered oxide cathodes and hard carbon anodes, demonstrating energy densities of 120-150 Wh/kg with raw material costs approximately 40-50% lower than comparable lithium-ion cells.

Strengths: Comprehensive comparative analysis between multiple battery chemistries; strong fundamental research capabilities; access to advanced characterization techniques; established relationships with Chinese battery manufacturers for technology transfer. Weaknesses: Research remains primarily academic with limited commercial-scale validation; magnesium-ion technology faces significant electrolyte challenges that increase system complexity and cost; current energy densities for both technologies remain below commercial lithium-ion batteries.

Critical Patents and Research Breakthroughs in Cost Reduction

Sodium-ion battery pack

PatentPendingUS20240234796A1

Innovation

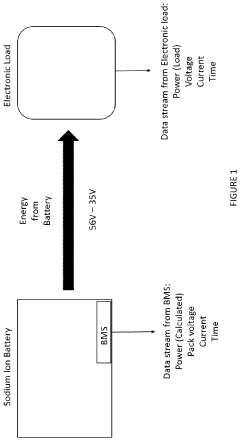

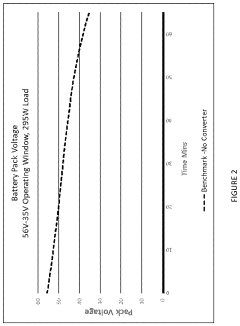

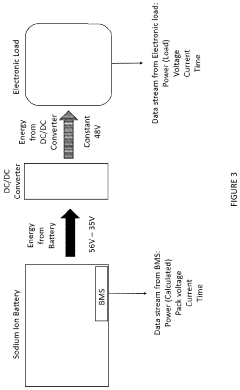

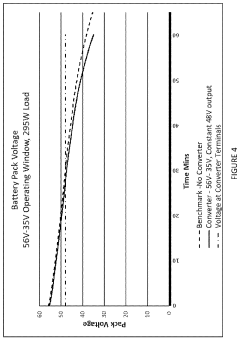

- A sodium-ion battery pack incorporating multiple sodium-ion cells with voltage converters, particularly DC/DC converters, to expand the operational voltage range and align the output voltage with electronic components, enabling efficient energy access and utilization even at low voltages.

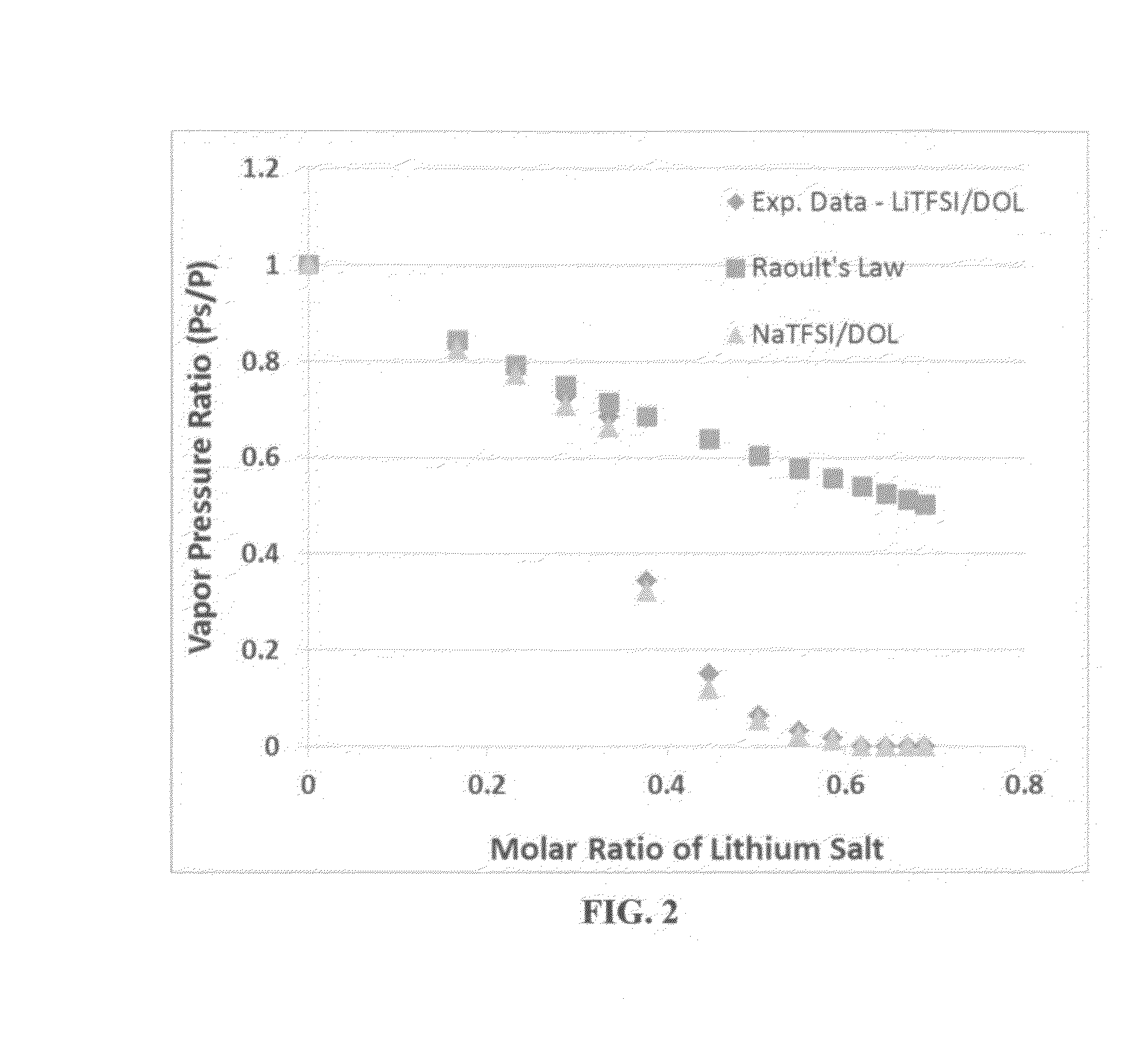

Non-flammable quasi-solid electrolyte and non-lithium alkali metal or alkali-ion secondary batteries containing same

PatentActiveUS20150064574A1

Innovation

- A non-flammable quasi-solid electrolyte is developed with a high concentration of alkali metal salts dissolved in organic solvents, exceeding previous limits, which suppresses flammability and enhances ion conductivity, preventing dendrite growth and improving cycle life.

Raw Material Supply Chain Assessment for Mg and Na Battery Production

The global supply chain for battery raw materials represents a critical factor in determining the economic viability of emerging battery technologies. For magnesium-ion batteries, the supply chain presents distinct advantages compared to lithium-ion batteries but differs significantly from sodium-ion batteries in several key aspects.

Magnesium is abundantly available in the Earth's crust (2.1% by mass) and seawater, making it the eighth most abundant element. Its widespread geographical distribution reduces geopolitical supply risks that currently plague lithium supply chains. Major magnesium producers include China (approximately 87% of global production), Russia, Israel, and the United States. However, the current magnesium supply chain is primarily oriented toward metallurgical applications rather than battery-grade materials, necessitating new refining processes for battery applications.

Sodium resources are even more abundant and widely distributed globally, with virtually unlimited reserves in seawater (approximately 1.1% by mass) and substantial deposits as rock salt (NaCl) across numerous countries. Major producers include China, the United States, India, Germany, and Australia. The established chlor-alkali industry already processes significant quantities of sodium compounds, providing potential infrastructure advantages for scaling sodium battery production.

From a processing perspective, magnesium extraction currently relies heavily on energy-intensive methods, particularly in China where coal-powered thermal reduction processes dominate production. This results in a significant carbon footprint for magnesium production (approximately 25-30 kg CO2 per kg Mg). Alternative, more environmentally friendly extraction methods are under development but not yet commercially viable at scale.

Sodium compound processing benefits from established industrial processes with optimized energy efficiency. The extraction and purification of battery-grade sodium salts generally requires less energy and generates fewer emissions than comparable lithium processes, with estimates suggesting 18-22 kg CO2 per kg of battery-grade sodium compounds.

Supply chain resilience analysis indicates that sodium-ion battery production faces fewer bottlenecks than magnesium-ion batteries. The sodium supply chain leverages existing industrial infrastructure, while magnesium battery production requires development of new purification and processing capabilities specifically designed for electrochemical applications rather than structural metals.

Price volatility represents another critical factor. Magnesium prices have shown significant fluctuations, particularly during 2021-2022 when Chinese production restrictions caused prices to spike from approximately $2,500/ton to over $10,000/ton before stabilizing. Sodium compounds demonstrate considerably more price stability due to diverse supply sources and established production capacity, typically maintaining prices within 10-15% ranges annually.

Magnesium is abundantly available in the Earth's crust (2.1% by mass) and seawater, making it the eighth most abundant element. Its widespread geographical distribution reduces geopolitical supply risks that currently plague lithium supply chains. Major magnesium producers include China (approximately 87% of global production), Russia, Israel, and the United States. However, the current magnesium supply chain is primarily oriented toward metallurgical applications rather than battery-grade materials, necessitating new refining processes for battery applications.

Sodium resources are even more abundant and widely distributed globally, with virtually unlimited reserves in seawater (approximately 1.1% by mass) and substantial deposits as rock salt (NaCl) across numerous countries. Major producers include China, the United States, India, Germany, and Australia. The established chlor-alkali industry already processes significant quantities of sodium compounds, providing potential infrastructure advantages for scaling sodium battery production.

From a processing perspective, magnesium extraction currently relies heavily on energy-intensive methods, particularly in China where coal-powered thermal reduction processes dominate production. This results in a significant carbon footprint for magnesium production (approximately 25-30 kg CO2 per kg Mg). Alternative, more environmentally friendly extraction methods are under development but not yet commercially viable at scale.

Sodium compound processing benefits from established industrial processes with optimized energy efficiency. The extraction and purification of battery-grade sodium salts generally requires less energy and generates fewer emissions than comparable lithium processes, with estimates suggesting 18-22 kg CO2 per kg of battery-grade sodium compounds.

Supply chain resilience analysis indicates that sodium-ion battery production faces fewer bottlenecks than magnesium-ion batteries. The sodium supply chain leverages existing industrial infrastructure, while magnesium battery production requires development of new purification and processing capabilities specifically designed for electrochemical applications rather than structural metals.

Price volatility represents another critical factor. Magnesium prices have shown significant fluctuations, particularly during 2021-2022 when Chinese production restrictions caused prices to spike from approximately $2,500/ton to over $10,000/ton before stabilizing. Sodium compounds demonstrate considerably more price stability due to diverse supply sources and established production capacity, typically maintaining prices within 10-15% ranges annually.

Environmental Impact and Sustainability Comparison

The environmental footprint of battery technologies has become a critical factor in their adoption for sustainable energy solutions. When comparing magnesium-ion and sodium-ion batteries from an environmental perspective, several key differences emerge that significantly impact their sustainability profiles.

Raw material extraction for magnesium-ion batteries generally presents lower environmental concerns compared to sodium-ion batteries. Magnesium is the eighth most abundant element in Earth's crust (2.1% by mass), and its extraction typically involves less invasive mining processes than those required for lithium. Sodium, while even more abundant (2.6% in Earth's crust), often requires energy-intensive extraction methods when sourced from brine pools.

Manufacturing processes for both battery types differ in their environmental impact. Magnesium-ion battery production typically requires higher processing temperatures, resulting in greater energy consumption during manufacturing. Conversely, sodium-ion batteries can be produced using existing lithium-ion manufacturing infrastructure with minimal modifications, potentially reducing the carbon footprint associated with establishing new production facilities.

Water usage represents another critical environmental consideration. Magnesium extraction from seawater can be water-intensive but generally less impactful than the extensive water requirements for sodium extraction from salt flats, which can disrupt local ecosystems and deplete water resources in often arid regions.

End-of-life management and recyclability favor sodium-ion batteries in current assessments. The simpler chemistry of sodium-ion batteries facilitates more straightforward recycling processes, with recovery rates potentially reaching 90-95% for key materials. Magnesium-ion batteries present more complex recycling challenges due to their varied electrolyte compositions and electrode materials.

Carbon emissions across the lifecycle show notable differences between these technologies. While magnesium-ion batteries may have higher manufacturing emissions due to energy-intensive production processes, their potentially longer cycle life could offset this initial carbon investment. Sodium-ion batteries generally demonstrate lower production-phase emissions but may require more frequent replacement depending on application demands.

Toxicity profiles also differ significantly. Magnesium compounds used in batteries are generally non-toxic and pose minimal environmental hazards if properly managed. Sodium-ion batteries similarly use non-toxic materials, representing a substantial improvement over lithium-ion technologies that often incorporate cobalt and other potentially harmful elements.

Land use impacts for both technologies are considerably lower than conventional lithium-ion batteries, particularly those requiring cobalt and nickel, which often involve extensive habitat disruption through mining operations in ecologically sensitive areas.

Raw material extraction for magnesium-ion batteries generally presents lower environmental concerns compared to sodium-ion batteries. Magnesium is the eighth most abundant element in Earth's crust (2.1% by mass), and its extraction typically involves less invasive mining processes than those required for lithium. Sodium, while even more abundant (2.6% in Earth's crust), often requires energy-intensive extraction methods when sourced from brine pools.

Manufacturing processes for both battery types differ in their environmental impact. Magnesium-ion battery production typically requires higher processing temperatures, resulting in greater energy consumption during manufacturing. Conversely, sodium-ion batteries can be produced using existing lithium-ion manufacturing infrastructure with minimal modifications, potentially reducing the carbon footprint associated with establishing new production facilities.

Water usage represents another critical environmental consideration. Magnesium extraction from seawater can be water-intensive but generally less impactful than the extensive water requirements for sodium extraction from salt flats, which can disrupt local ecosystems and deplete water resources in often arid regions.

End-of-life management and recyclability favor sodium-ion batteries in current assessments. The simpler chemistry of sodium-ion batteries facilitates more straightforward recycling processes, with recovery rates potentially reaching 90-95% for key materials. Magnesium-ion batteries present more complex recycling challenges due to their varied electrolyte compositions and electrode materials.

Carbon emissions across the lifecycle show notable differences between these technologies. While magnesium-ion batteries may have higher manufacturing emissions due to energy-intensive production processes, their potentially longer cycle life could offset this initial carbon investment. Sodium-ion batteries generally demonstrate lower production-phase emissions but may require more frequent replacement depending on application demands.

Toxicity profiles also differ significantly. Magnesium compounds used in batteries are generally non-toxic and pose minimal environmental hazards if properly managed. Sodium-ion batteries similarly use non-toxic materials, representing a substantial improvement over lithium-ion technologies that often incorporate cobalt and other potentially harmful elements.

Land use impacts for both technologies are considerably lower than conventional lithium-ion batteries, particularly those requiring cobalt and nickel, which often involve extensive habitat disruption through mining operations in ecologically sensitive areas.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!