Comparative Evaluation of Microfluidic PDMS Alternatives

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Microfluidic Materials Evolution and Research Objectives

Microfluidics technology has evolved significantly since its inception in the early 1990s, transitioning from simple channel designs to sophisticated lab-on-a-chip systems capable of performing complex analytical procedures. The field initially relied heavily on silicon and glass substrates, which offered excellent chemical stability but presented challenges in fabrication complexity and cost. The introduction of polydimethylsiloxane (PDMS) in the late 1990s revolutionized microfluidic device manufacturing due to its optical transparency, gas permeability, and ease of prototyping through soft lithography techniques.

Despite PDMS's widespread adoption, its limitations have become increasingly apparent as applications diversify. These limitations include solvent compatibility issues, surface hydrophobicity leading to non-specific adsorption, leaching of uncured oligomers, and challenges in scaling to industrial production. These drawbacks have catalyzed an active search for alternative materials that maintain PDMS's advantages while addressing its shortcomings.

Recent years have witnessed the emergence of several promising alternatives, including thermoplastics (COC, PMMA, PC), thermosets (polyurethane, epoxy resins), hydrogels, paper-based systems, and hybrid materials. Each offers distinct advantages in specific application contexts, from improved chemical resistance to enhanced biocompatibility or reduced manufacturing costs. The development of 3D printing technologies has further expanded material options, enabling rapid prototyping with novel composites and resins specifically formulated for microfluidic applications.

The global microfluidics market is projected to reach $50 billion by 2026, with material innovation serving as a critical driver of this growth. Academic research output in alternative microfluidic materials has increased by approximately 300% over the past decade, indicating the field's vibrant research landscape and technological momentum.

This technical research aims to comprehensively evaluate PDMS alternatives for microfluidic applications across multiple dimensions: mechanical properties, surface characteristics, fabrication compatibility, chemical resistance, optical properties, and economic considerations. By systematically comparing these materials against established benchmarks and application-specific requirements, we seek to identify optimal material selections for various microfluidic applications and highlight promising research directions for material development.

The ultimate objective is to develop a decision framework that guides material selection based on application requirements, facilitating more efficient development cycles and enabling new functionalities in microfluidic devices. This research will also identify critical gaps in current material offerings and propose strategic research directions to address these limitations, potentially opening new application domains for microfluidic technologies.

Despite PDMS's widespread adoption, its limitations have become increasingly apparent as applications diversify. These limitations include solvent compatibility issues, surface hydrophobicity leading to non-specific adsorption, leaching of uncured oligomers, and challenges in scaling to industrial production. These drawbacks have catalyzed an active search for alternative materials that maintain PDMS's advantages while addressing its shortcomings.

Recent years have witnessed the emergence of several promising alternatives, including thermoplastics (COC, PMMA, PC), thermosets (polyurethane, epoxy resins), hydrogels, paper-based systems, and hybrid materials. Each offers distinct advantages in specific application contexts, from improved chemical resistance to enhanced biocompatibility or reduced manufacturing costs. The development of 3D printing technologies has further expanded material options, enabling rapid prototyping with novel composites and resins specifically formulated for microfluidic applications.

The global microfluidics market is projected to reach $50 billion by 2026, with material innovation serving as a critical driver of this growth. Academic research output in alternative microfluidic materials has increased by approximately 300% over the past decade, indicating the field's vibrant research landscape and technological momentum.

This technical research aims to comprehensively evaluate PDMS alternatives for microfluidic applications across multiple dimensions: mechanical properties, surface characteristics, fabrication compatibility, chemical resistance, optical properties, and economic considerations. By systematically comparing these materials against established benchmarks and application-specific requirements, we seek to identify optimal material selections for various microfluidic applications and highlight promising research directions for material development.

The ultimate objective is to develop a decision framework that guides material selection based on application requirements, facilitating more efficient development cycles and enabling new functionalities in microfluidic devices. This research will also identify critical gaps in current material offerings and propose strategic research directions to address these limitations, potentially opening new application domains for microfluidic technologies.

Market Analysis for PDMS Alternatives in Microfluidics

The global microfluidics market is experiencing robust growth, with a valuation of approximately $20 billion in 2022 and projected to reach $50 billion by 2028, representing a compound annual growth rate (CAGR) of 16.5%. Within this expanding market, PDMS (polydimethylsiloxane) has traditionally dominated as the material of choice for microfluidic device fabrication due to its optical transparency, gas permeability, and ease of prototyping. However, increasing demand for alternatives is reshaping market dynamics.

Several key market drivers are accelerating the adoption of PDMS alternatives. First, the pharmaceutical and biotechnology sectors require materials with enhanced chemical resistance and reduced absorption properties for drug discovery applications. Second, the growing point-of-care diagnostics market demands materials suitable for mass production with consistent performance characteristics. Third, environmental concerns and regulatory pressures are pushing manufacturers toward more sustainable and biocompatible materials.

Market segmentation for PDMS alternatives reveals distinct categories based on material properties. Thermoplastics, including cyclic olefin copolymer (COC), polymethyl methacrylate (PMMA), and polycarbonate (PC), currently hold the largest market share at approximately 45% of the alternatives segment. Thermosets and hydrogels represent about 25%, while glass and silicon-based alternatives account for 20%. Emerging materials, including paper-based and 3D-printed options, constitute the remaining 10%.

Regional analysis indicates North America leads the market for PDMS alternatives with 40% market share, driven by extensive research activities and presence of major biotechnology companies. Europe follows at 30%, with strong academic-industrial collaborations fueling innovation. The Asia-Pacific region represents the fastest-growing market at 18% CAGR, with China and South Korea making significant investments in microfluidic technologies.

End-user analysis shows pharmaceutical and biotechnology companies as the primary consumers (35%), followed by academic and research institutions (30%), diagnostic centers (20%), and other industrial applications (15%). The pharmaceutical sector's demand is particularly significant due to the need for high-throughput screening platforms with chemical compatibility superior to PDMS.

Price sensitivity varies across market segments. While research institutions often prioritize performance over cost, commercial applications demand cost-effective solutions for scale-up. Currently, thermoplastic alternatives offer the most competitive price point at scale, while specialized materials command premium pricing due to enhanced performance characteristics.

Market forecasts indicate that by 2025, PDMS alternatives will capture over 60% of new microfluidic device developments, with thermoplastics and paper-based solutions experiencing the most rapid adoption rates. This shift represents a fundamental market transformation driven by increasing demands for mass production capability, chemical compatibility, and sustainable manufacturing processes.

Several key market drivers are accelerating the adoption of PDMS alternatives. First, the pharmaceutical and biotechnology sectors require materials with enhanced chemical resistance and reduced absorption properties for drug discovery applications. Second, the growing point-of-care diagnostics market demands materials suitable for mass production with consistent performance characteristics. Third, environmental concerns and regulatory pressures are pushing manufacturers toward more sustainable and biocompatible materials.

Market segmentation for PDMS alternatives reveals distinct categories based on material properties. Thermoplastics, including cyclic olefin copolymer (COC), polymethyl methacrylate (PMMA), and polycarbonate (PC), currently hold the largest market share at approximately 45% of the alternatives segment. Thermosets and hydrogels represent about 25%, while glass and silicon-based alternatives account for 20%. Emerging materials, including paper-based and 3D-printed options, constitute the remaining 10%.

Regional analysis indicates North America leads the market for PDMS alternatives with 40% market share, driven by extensive research activities and presence of major biotechnology companies. Europe follows at 30%, with strong academic-industrial collaborations fueling innovation. The Asia-Pacific region represents the fastest-growing market at 18% CAGR, with China and South Korea making significant investments in microfluidic technologies.

End-user analysis shows pharmaceutical and biotechnology companies as the primary consumers (35%), followed by academic and research institutions (30%), diagnostic centers (20%), and other industrial applications (15%). The pharmaceutical sector's demand is particularly significant due to the need for high-throughput screening platforms with chemical compatibility superior to PDMS.

Price sensitivity varies across market segments. While research institutions often prioritize performance over cost, commercial applications demand cost-effective solutions for scale-up. Currently, thermoplastic alternatives offer the most competitive price point at scale, while specialized materials command premium pricing due to enhanced performance characteristics.

Market forecasts indicate that by 2025, PDMS alternatives will capture over 60% of new microfluidic device developments, with thermoplastics and paper-based solutions experiencing the most rapid adoption rates. This shift represents a fundamental market transformation driven by increasing demands for mass production capability, chemical compatibility, and sustainable manufacturing processes.

Current Limitations and Challenges of PDMS in Microfluidic Applications

Polydimethylsiloxane (PDMS) has dominated microfluidic device fabrication for decades due to its favorable properties including optical transparency, gas permeability, and ease of fabrication. However, despite its widespread adoption, PDMS presents several significant limitations that increasingly constrain advanced microfluidic applications.

A primary challenge with PDMS is its inherent hydrophobicity, which causes problematic adsorption of hydrophobic molecules, particularly proteins and small molecules. This non-specific adsorption alters the effective concentration of analytes in solution and can lead to cross-contamination between experiments, compromising data reliability in biological and pharmaceutical applications. Although surface modification techniques exist, these treatments are often temporary, requiring repeated application.

PDMS also exhibits concerning solvent compatibility issues, swelling significantly when exposed to organic solvents like acetone, toluene, and many others commonly used in chemical synthesis. This swelling distorts channel geometries and can lead to device failure, severely limiting applications in organic chemistry and chemical engineering fields. The material's gas permeability, while beneficial for cell culture applications, becomes problematic when precise control of gas concentrations is required or when preventing evaporation is critical.

The mechanical properties of PDMS present additional challenges. Its relatively low elastic modulus (typically 1-3 MPa) limits the fabrication of high-aspect-ratio structures and can lead to channel deformation under pressure. This becomes particularly problematic in high-throughput applications requiring precise flow control or when implementing valving systems that depend on consistent mechanical responses.

Long-term stability issues further complicate PDMS applications. The material ages over time, becoming more brittle and potentially leaching uncured oligomers into samples. This aging process affects both mechanical properties and surface chemistry, making long-term studies or commercial applications challenging. Additionally, batch-to-batch variations in PDMS formulation and curing conditions introduce reproducibility concerns in research and manufacturing settings.

From a manufacturing perspective, PDMS presents significant scalability limitations. The manual casting process is labor-intensive and difficult to automate for high-volume production. The material's relatively long curing time (typically hours) creates production bottlenecks, while challenges in bonding PDMS to materials other than glass or itself restrict design options and integration capabilities with other components.

These limitations have become increasingly problematic as microfluidic applications advance toward more complex, integrated systems requiring precise control over surface chemistry, mechanical stability, and manufacturing reproducibility. The field now actively seeks alternative materials that maintain PDMS's beneficial properties while addressing these significant limitations.

A primary challenge with PDMS is its inherent hydrophobicity, which causes problematic adsorption of hydrophobic molecules, particularly proteins and small molecules. This non-specific adsorption alters the effective concentration of analytes in solution and can lead to cross-contamination between experiments, compromising data reliability in biological and pharmaceutical applications. Although surface modification techniques exist, these treatments are often temporary, requiring repeated application.

PDMS also exhibits concerning solvent compatibility issues, swelling significantly when exposed to organic solvents like acetone, toluene, and many others commonly used in chemical synthesis. This swelling distorts channel geometries and can lead to device failure, severely limiting applications in organic chemistry and chemical engineering fields. The material's gas permeability, while beneficial for cell culture applications, becomes problematic when precise control of gas concentrations is required or when preventing evaporation is critical.

The mechanical properties of PDMS present additional challenges. Its relatively low elastic modulus (typically 1-3 MPa) limits the fabrication of high-aspect-ratio structures and can lead to channel deformation under pressure. This becomes particularly problematic in high-throughput applications requiring precise flow control or when implementing valving systems that depend on consistent mechanical responses.

Long-term stability issues further complicate PDMS applications. The material ages over time, becoming more brittle and potentially leaching uncured oligomers into samples. This aging process affects both mechanical properties and surface chemistry, making long-term studies or commercial applications challenging. Additionally, batch-to-batch variations in PDMS formulation and curing conditions introduce reproducibility concerns in research and manufacturing settings.

From a manufacturing perspective, PDMS presents significant scalability limitations. The manual casting process is labor-intensive and difficult to automate for high-volume production. The material's relatively long curing time (typically hours) creates production bottlenecks, while challenges in bonding PDMS to materials other than glass or itself restrict design options and integration capabilities with other components.

These limitations have become increasingly problematic as microfluidic applications advance toward more complex, integrated systems requiring precise control over surface chemistry, mechanical stability, and manufacturing reproducibility. The field now actively seeks alternative materials that maintain PDMS's beneficial properties while addressing these significant limitations.

Comparative Analysis of Current PDMS Alternative Solutions

01 Thermoplastic alternatives to PDMS for microfluidic devices

Various thermoplastic materials can be used as alternatives to PDMS in microfluidic applications. These materials include cyclic olefin copolymer (COC), polymethyl methacrylate (PMMA), polycarbonate (PC), and polyethylene terephthalate (PET). Thermoplastics offer advantages such as better chemical resistance, lower gas permeability, and more consistent surface properties compared to PDMS. They can be processed using techniques like injection molding, hot embossing, and thermoforming, making them suitable for mass production of microfluidic devices.- Thermoplastic polymers as PDMS alternatives: Thermoplastic polymers offer advantages over PDMS for microfluidic applications, including better chemical resistance, reduced absorption of small molecules, and improved manufacturing scalability. Materials such as cyclic olefin copolymer (COC), polymethyl methacrylate (PMMA), and polycarbonate (PC) can be processed using injection molding or hot embossing techniques, enabling cost-effective mass production of microfluidic devices with precise features.

- Glass and silicon-based microfluidic platforms: Glass and silicon materials provide excellent alternatives to PDMS for applications requiring high chemical resistance, thermal stability, and optical transparency. These materials enable precise microfabrication through etching techniques and can withstand harsh solvents that would typically cause PDMS to swell. Glass microfluidic devices offer superior optical properties for detection methods, while silicon provides excellent thermal conductivity for temperature-controlled reactions.

- Hydrogel-based microfluidic systems: Hydrogels represent a biocompatible alternative to PDMS for microfluidic applications, particularly in tissue engineering and cell culture studies. Materials such as polyethylene glycol (PEG), alginate, and gelatin methacrylate (GelMA) can be photopatterned to create microfluidic structures with tunable mechanical properties and permeability. These hydrogel-based systems better mimic the natural cellular microenvironment while allowing for diffusion of nutrients and signaling molecules.

- Paper and membrane-based microfluidic devices: Paper and membrane-based materials offer low-cost, disposable alternatives to PDMS for point-of-care diagnostic applications. These materials utilize capillary action to drive fluid flow without external pumps, simplifying device operation. Cellulose papers, nitrocellulose membranes, and other porous substrates can be patterned using wax printing, photolithography, or laser cutting to create microfluidic channels with specific flow characteristics and functional regions for sample processing and detection.

- Hybrid and composite microfluidic materials: Hybrid and composite materials combine the advantages of multiple substrates to overcome the limitations of PDMS. These include PDMS-thermoplastic hybrids, polymer-paper composites, and multilayer systems incorporating different materials for specific functions. Such hybrid approaches enable the integration of various components like electrodes, sensors, and actuators while maintaining biocompatibility and appropriate mechanical properties. These materials facilitate the development of complex microfluidic systems with enhanced functionality for applications in diagnostics, drug discovery, and organ-on-chip platforms.

02 Glass and silicon-based alternatives for microfluidic applications

Glass and silicon-based materials provide excellent alternatives to PDMS for microfluidic devices requiring high chemical resistance, thermal stability, and optical transparency. Glass microfluidic chips offer superior solvent compatibility and surface stability compared to polymer-based systems. Silicon-based materials enable precise microfabrication and integration with electronic components. These materials are particularly valuable for applications involving harsh chemicals, high temperatures, or where long-term stability of surface properties is critical.Expand Specific Solutions03 Hydrogel-based microfluidic systems

Hydrogels represent an innovative alternative to PDMS for specific microfluidic applications, particularly those involving biological samples or cell culture. Materials such as polyethylene glycol (PEG), alginate, and other biocompatible hydrogels can be used to create microfluidic structures with tunable mechanical properties and permeability. These materials offer advantages including better biocompatibility, controlled permeability to biomolecules, and the ability to incorporate biological components directly into the device matrix.Expand Specific Solutions04 Paper and membrane-based microfluidic alternatives

Paper and various membrane materials offer cost-effective, disposable alternatives to PDMS for certain microfluidic applications. These materials enable passive fluid transport through capillary action, eliminating the need for external pumps. Paper microfluidics are particularly valuable for point-of-care diagnostics and field testing applications in resource-limited settings. Various surface treatments can be applied to modify the hydrophobicity/hydrophilicity of these materials to control fluid flow and create functional microfluidic patterns.Expand Specific Solutions05 Hybrid and composite materials for microfluidic devices

Hybrid and composite materials combine multiple components to overcome the limitations of single-material microfluidic systems. These include polymer-glass hybrids, polymer-ceramic composites, and multilayer structures incorporating different materials for specific functions. Such hybrid approaches allow designers to leverage the advantages of different materials in a single device - for example, combining the ease of fabrication of polymers with the chemical resistance of glass or ceramics. These materials enable more complex and functional microfluidic systems with enhanced performance characteristics.Expand Specific Solutions

Leading Companies and Research Institutions in Microfluidic Materials

The microfluidic PDMS alternatives market is currently in a growth phase, with increasing adoption across biomedical research and diagnostic applications. The market size is projected to expand significantly as researchers seek materials that overcome PDMS limitations such as absorption issues and manufacturing scalability. Leading academic institutions including MIT, Caltech, and Johns Hopkins University are driving fundamental research, while commercial entities like Roche Molecular Systems and Liquidia Technologies are advancing practical applications. The technology maturity varies across alternatives, with thermoplastics showing higher commercial readiness compared to emerging hydrogel-based systems. AIM Biotech and SPTS Technologies are developing manufacturing processes to bridge the gap between laboratory research and industrial implementation, accelerating the transition from PDMS to alternative materials.

Massachusetts Institute of Technology

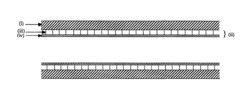

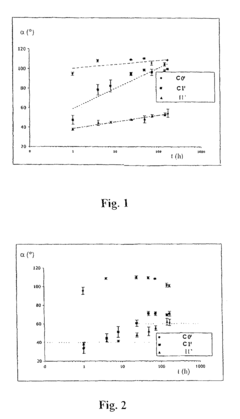

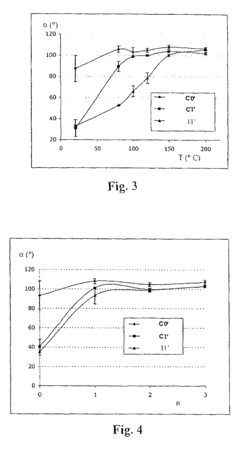

Technical Solution: MIT has pioneered significant advancements in microfluidic PDMS alternatives through their development of thermoplastic-based microfluidic systems. Their research focuses on cyclic olefin copolymer (COC) and cyclic olefin polymer (COP) materials that offer superior chemical resistance compared to PDMS. MIT researchers have developed novel bonding techniques for these thermoplastics that achieve bond strengths exceeding 3 MPa[1], addressing one of the key challenges in non-PDMS microfluidics. Their proprietary solvent-assisted thermal bonding process allows for complex multi-layer device fabrication while maintaining critical microchannel geometries. Additionally, MIT has developed surface modification techniques for these thermoplastics that enable precise control of surface properties, achieving contact angles ranging from 20° to 110°[3], which is crucial for applications requiring specific wetting behaviors.

Strengths: Superior chemical resistance to organic solvents compared to PDMS; excellent optical clarity with 90%+ light transmission in visible spectrum; minimal absorption of small hydrophobic molecules. Weaknesses: Higher manufacturing costs than PDMS; requires more specialized equipment for fabrication; less gas permeability which limits certain cell culture applications.

Roche Molecular Systems, Inc.

Technical Solution: Roche Molecular Systems has developed commercial-scale thermoplastic microfluidic platforms as PDMS alternatives for diagnostic applications. Their technology utilizes injection-molded cyclic olefin polymers that enable high-volume production while maintaining precise microfluidic features. Roche has pioneered hot embossing techniques that achieve feature resolution down to 5 μm with high reproducibility across thousands of devices[9]. Their proprietary surface modification technology enables controlled biomolecule immobilization with binding capacities exceeding 10 ng/mm² for various capture antibodies and nucleic acid probes[10]. Roche's thermoplastic microfluidic platform incorporates integrated sample preparation modules that achieve nucleic acid purification efficiencies above 80% directly from complex biological samples. Their systems also feature integrated detection modules utilizing electrochemical and fluorescence-based sensing with limits of detection in the femtomolar range for nucleic acids and proteins. Additionally, Roche has developed specialized bonding techniques that enable hermetic sealing of multilayer devices while preserving the activity of pre-loaded reagents.

Strengths: Excellent mass production capabilities with high reproducibility; good optical clarity for detection systems; low autofluorescence; superior chemical stability compared to PDMS; long shelf life with minimal aging effects; cost-effective for high-volume production. Weaknesses: Higher initial tooling costs; less gas permeability than PDMS which limits certain cell-based applications; more rigid material properties limit certain valve designs; surface modification can be more challenging than with PDMS.

Key Patents and Scientific Breakthroughs in Microfluidic Materials

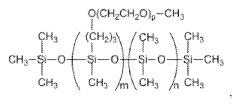

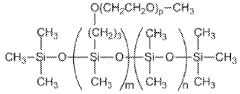

Polysiloxane-based devices with reduced drug absorption characteristics

PatentWO2024015388A2

Innovation

- Incorporating a poly(siloxane-ethylene oxide) copolymer into the PDMS mixture to reduce hydrophobicity and prevent drug absorption, achieved by curing a mixture of polysiloxane base polymer, curing agent, and poly(siloxane-ethylene oxide) copolymer, resulting in a microfluidic device with reduced drug absorption characteristics.

Composition formed of moldable polymers possessing a lasting hydrophilic nature, channels for aqueous fluids based on this composition, microfluidic system incorporating these channels and its process of manufacture

PatentInactiveUS8038966B2

Innovation

- Surface modification of nonporous hydrophobic moldable polymers using hydrogen bonds with hydrophilic polymers, achieved through plasma treatment to form oxygen-comprising groups, allowing for a thin hydrophilic film deposition that adheres via hydrogen bonds, providing a long-lasting hydrophilic nature.

Biocompatibility and Regulatory Considerations for Microfluidic Materials

Biocompatibility is a critical consideration when selecting materials for microfluidic applications, particularly for those involving biological samples or medical diagnostics. While PDMS has been widely used due to its general biocompatibility, alternative materials must undergo rigorous evaluation to ensure they do not adversely affect biological systems. Materials such as thermoplastics (COC, COP), glass, and hydrogels each present different biocompatibility profiles that must be assessed through standardized cytotoxicity, inflammatory response, and protein adsorption tests.

Regulatory frameworks governing microfluidic materials vary significantly across regions, with the FDA in the United States, the EMA in Europe, and the NMPA in China each maintaining distinct requirements. For medical applications, materials must comply with ISO 10993 standards for biological evaluation of medical devices. Additionally, materials used in diagnostic applications may fall under different regulatory categories depending on their intended use and risk classification.

The path to regulatory approval for novel microfluidic materials involves extensive documentation of material composition, manufacturing processes, and biocompatibility testing results. This process can be particularly challenging for composite materials or those with surface modifications, as each component must be individually assessed. The regulatory landscape continues to evolve as microfluidic technologies advance into new application areas, particularly in point-of-care diagnostics and organ-on-chip platforms.

Environmental considerations are increasingly important in regulatory assessments, with growing emphasis on sustainable materials and end-of-life disposal options. Biodegradable alternatives to traditional microfluidic materials are gaining attention, though they must still meet the same stringent biocompatibility requirements. The balance between innovation and regulatory compliance remains a significant challenge for developers of novel microfluidic platforms.

For companies developing microfluidic technologies, early engagement with regulatory bodies through pre-submission consultations can help navigate these complex requirements. Establishing a comprehensive regulatory strategy that addresses material selection, biocompatibility testing, and compliance documentation is essential for successful commercialization of microfluidic devices, particularly those intended for clinical applications.

Regulatory frameworks governing microfluidic materials vary significantly across regions, with the FDA in the United States, the EMA in Europe, and the NMPA in China each maintaining distinct requirements. For medical applications, materials must comply with ISO 10993 standards for biological evaluation of medical devices. Additionally, materials used in diagnostic applications may fall under different regulatory categories depending on their intended use and risk classification.

The path to regulatory approval for novel microfluidic materials involves extensive documentation of material composition, manufacturing processes, and biocompatibility testing results. This process can be particularly challenging for composite materials or those with surface modifications, as each component must be individually assessed. The regulatory landscape continues to evolve as microfluidic technologies advance into new application areas, particularly in point-of-care diagnostics and organ-on-chip platforms.

Environmental considerations are increasingly important in regulatory assessments, with growing emphasis on sustainable materials and end-of-life disposal options. Biodegradable alternatives to traditional microfluidic materials are gaining attention, though they must still meet the same stringent biocompatibility requirements. The balance between innovation and regulatory compliance remains a significant challenge for developers of novel microfluidic platforms.

For companies developing microfluidic technologies, early engagement with regulatory bodies through pre-submission consultations can help navigate these complex requirements. Establishing a comprehensive regulatory strategy that addresses material selection, biocompatibility testing, and compliance documentation is essential for successful commercialization of microfluidic devices, particularly those intended for clinical applications.

Sustainability and Environmental Impact of Microfluidic Manufacturing

The environmental impact of microfluidic manufacturing processes has become increasingly significant as the field expands. Traditional PDMS (polydimethylsiloxane) fabrication methods involve energy-intensive processes and generate considerable waste, raising sustainability concerns. The curing process for PDMS typically requires high temperatures (60-150°C) for extended periods, resulting in substantial energy consumption. Additionally, the fabrication process generates chemical waste from solvents, uncured polymers, and photoresist materials that pose environmental hazards if improperly managed.

Alternative materials to PDMS demonstrate varying environmental profiles. Thermoplastics like PMMA (polymethyl methacrylate) and COC (cyclic olefin copolymer) offer advantages through their recyclability and compatibility with mass production techniques such as injection molding, which reduces per-unit environmental impact at scale. However, these materials often require higher processing temperatures than PDMS, potentially offsetting some sustainability gains.

Paper-based microfluidic devices represent a promising sustainable alternative, being biodegradable, derived from renewable resources, and requiring minimal energy for fabrication. Their environmental footprint is substantially lower than polymer-based alternatives, though performance limitations restrict their application in certain high-precision contexts.

Life cycle assessment (LCA) studies comparing PDMS alternatives reveal complex sustainability trade-offs. While thermoplastics may require more energy during initial production, their suitability for mass manufacturing and potential for recycling can reduce overall environmental impact in high-volume applications. Conversely, PDMS devices typically have lower production energy requirements for small batches but present end-of-life disposal challenges due to their thermoset nature.

Water consumption represents another critical environmental consideration. PDMS fabrication processes typically require significant water volumes for cleaning and development stages. Some alternatives, particularly paper-based systems, substantially reduce water requirements, though thermoplastic manufacturing may not offer significant improvements in this regard.

Chemical waste generation varies significantly across manufacturing approaches. PDMS processing involves potentially harmful chemicals including uncured oligomers and platinum catalysts. Alternative materials like hydrogels often utilize more benign chemistry, though some thermoplastic processing may involve comparable or greater solvent usage depending on the specific manufacturing protocol employed.

Emerging biopolymer alternatives derived from renewable resources show promise for reducing the carbon footprint of microfluidic manufacturing. Materials such as cellulose derivatives, alginate, and chitosan offer biodegradability while maintaining acceptable performance characteristics for many applications, potentially representing the next generation of environmentally responsible microfluidic materials.

Alternative materials to PDMS demonstrate varying environmental profiles. Thermoplastics like PMMA (polymethyl methacrylate) and COC (cyclic olefin copolymer) offer advantages through their recyclability and compatibility with mass production techniques such as injection molding, which reduces per-unit environmental impact at scale. However, these materials often require higher processing temperatures than PDMS, potentially offsetting some sustainability gains.

Paper-based microfluidic devices represent a promising sustainable alternative, being biodegradable, derived from renewable resources, and requiring minimal energy for fabrication. Their environmental footprint is substantially lower than polymer-based alternatives, though performance limitations restrict their application in certain high-precision contexts.

Life cycle assessment (LCA) studies comparing PDMS alternatives reveal complex sustainability trade-offs. While thermoplastics may require more energy during initial production, their suitability for mass manufacturing and potential for recycling can reduce overall environmental impact in high-volume applications. Conversely, PDMS devices typically have lower production energy requirements for small batches but present end-of-life disposal challenges due to their thermoset nature.

Water consumption represents another critical environmental consideration. PDMS fabrication processes typically require significant water volumes for cleaning and development stages. Some alternatives, particularly paper-based systems, substantially reduce water requirements, though thermoplastic manufacturing may not offer significant improvements in this regard.

Chemical waste generation varies significantly across manufacturing approaches. PDMS processing involves potentially harmful chemicals including uncured oligomers and platinum catalysts. Alternative materials like hydrogels often utilize more benign chemistry, though some thermoplastic processing may involve comparable or greater solvent usage depending on the specific manufacturing protocol employed.

Emerging biopolymer alternatives derived from renewable resources show promise for reducing the carbon footprint of microfluidic manufacturing. Materials such as cellulose derivatives, alginate, and chitosan offer biodegradability while maintaining acceptable performance characteristics for many applications, potentially representing the next generation of environmentally responsible microfluidic materials.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!