How to Adapt Microfluidics for Non-Invasive Diagnostic Tools

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Microfluidics Diagnostic Evolution and Objectives

Microfluidics technology has evolved significantly over the past three decades, transforming from a niche laboratory technique into a powerful platform for diagnostic applications. The journey began in the 1990s with simple microchannels etched into glass or silicon, primarily used for analytical chemistry applications. By the early 2000s, the introduction of soft lithography using polydimethylsiloxane (PDMS) dramatically reduced fabrication costs and complexity, enabling rapid prototyping and accelerating innovation in the field.

The evolution of microfluidics has been driven by its inherent advantages: minimal sample volume requirements, reduced reagent consumption, faster analysis times, and potential for automation and integration. These characteristics make microfluidics particularly attractive for diagnostic applications where sample availability may be limited or where rapid results are critical for clinical decision-making.

Recent technological advances have further expanded the capabilities of microfluidic systems. Paper-based microfluidics has emerged as an ultra-low-cost alternative for resource-limited settings. Digital microfluidics, which manipulates discrete droplets rather than continuous flows, has enabled more complex and programmable assays. Integration with smartphone technology has created portable diagnostic platforms that can be deployed in point-of-care settings.

The current trajectory of microfluidic technology is moving toward non-invasive diagnostic applications, which represents a significant paradigm shift. Traditional diagnostic methods often require invasive procedures such as blood draws or tissue biopsies, causing patient discomfort and sometimes carrying risks of complications. Non-invasive approaches using readily accessible biospecimens like saliva, sweat, tears, or exhaled breath condensate offer compelling alternatives that could revolutionize patient care and monitoring.

The primary objective of adapting microfluidics for non-invasive diagnostics is to develop platforms that can detect and quantify biomarkers from these alternative sample types with sensitivity and specificity comparable to traditional methods. This requires overcoming several technical challenges, including the lower concentration of analytes in non-invasive samples, complex sample matrices, and the need for robust sample preparation integrated within the microfluidic device.

Additional objectives include creating systems that are user-friendly for operation by non-specialists, developing standardized protocols for sample collection and processing, and ensuring reproducibility across different environmental conditions. The ultimate goal is to enable widespread adoption of these technologies in clinical settings, home healthcare, and resource-limited environments, thereby improving access to diagnostic testing and enabling more personalized and timely medical interventions.

The evolution of microfluidics has been driven by its inherent advantages: minimal sample volume requirements, reduced reagent consumption, faster analysis times, and potential for automation and integration. These characteristics make microfluidics particularly attractive for diagnostic applications where sample availability may be limited or where rapid results are critical for clinical decision-making.

Recent technological advances have further expanded the capabilities of microfluidic systems. Paper-based microfluidics has emerged as an ultra-low-cost alternative for resource-limited settings. Digital microfluidics, which manipulates discrete droplets rather than continuous flows, has enabled more complex and programmable assays. Integration with smartphone technology has created portable diagnostic platforms that can be deployed in point-of-care settings.

The current trajectory of microfluidic technology is moving toward non-invasive diagnostic applications, which represents a significant paradigm shift. Traditional diagnostic methods often require invasive procedures such as blood draws or tissue biopsies, causing patient discomfort and sometimes carrying risks of complications. Non-invasive approaches using readily accessible biospecimens like saliva, sweat, tears, or exhaled breath condensate offer compelling alternatives that could revolutionize patient care and monitoring.

The primary objective of adapting microfluidics for non-invasive diagnostics is to develop platforms that can detect and quantify biomarkers from these alternative sample types with sensitivity and specificity comparable to traditional methods. This requires overcoming several technical challenges, including the lower concentration of analytes in non-invasive samples, complex sample matrices, and the need for robust sample preparation integrated within the microfluidic device.

Additional objectives include creating systems that are user-friendly for operation by non-specialists, developing standardized protocols for sample collection and processing, and ensuring reproducibility across different environmental conditions. The ultimate goal is to enable widespread adoption of these technologies in clinical settings, home healthcare, and resource-limited environments, thereby improving access to diagnostic testing and enabling more personalized and timely medical interventions.

Non-Invasive Diagnostic Market Analysis

The non-invasive diagnostic market has experienced substantial growth over the past decade, driven by increasing patient preference for painless testing methods and the rising prevalence of chronic diseases requiring regular monitoring. The global non-invasive diagnostic market was valued at approximately 12 billion USD in 2022 and is projected to reach 20 billion USD by 2028, representing a compound annual growth rate of 8.9%.

Microfluidics-based non-invasive diagnostic tools are gaining significant traction within this market, particularly in areas such as cancer detection, cardiovascular disease monitoring, and infectious disease testing. These applications leverage the ability of microfluidic platforms to detect biomarkers in easily accessible bodily fluids like saliva, sweat, tears, and exhaled breath condensate.

Consumer demand for home-based testing solutions has accelerated following the COVID-19 pandemic, creating new market opportunities for portable microfluidic diagnostic devices. This shift toward decentralized testing is supported by healthcare systems seeking cost-effective alternatives to traditional laboratory diagnostics, with potential savings estimated at 30-40% compared to conventional testing methods.

Regionally, North America dominates the non-invasive diagnostic market with approximately 40% market share, followed by Europe at 30% and Asia-Pacific at 20%. However, the Asia-Pacific region is expected to witness the fastest growth due to improving healthcare infrastructure, increasing healthcare expenditure, and growing awareness about preventive healthcare.

Key market segments include glucose monitoring devices, cardiac monitoring and screening systems, blood analysis devices, and respiratory monitoring devices. The glucose monitoring segment currently holds the largest market share due to the high prevalence of diabetes globally and continuous innovation in non-invasive monitoring technologies.

Reimbursement policies significantly influence market adoption rates, with favorable insurance coverage accelerating uptake in developed markets. Conversely, limited reimbursement in emerging economies remains a constraint despite growing demand. Healthcare providers increasingly recognize the value proposition of non-invasive diagnostics in improving patient compliance and reducing healthcare costs associated with disease complications.

Market research indicates that patients are willing to pay a premium of 15-25% for non-invasive alternatives to traditional diagnostic methods, highlighting significant consumer preference. This willingness to pay creates opportunities for premium positioning of advanced microfluidic diagnostic solutions, particularly those offering improved accuracy and user experience.

Microfluidics-based non-invasive diagnostic tools are gaining significant traction within this market, particularly in areas such as cancer detection, cardiovascular disease monitoring, and infectious disease testing. These applications leverage the ability of microfluidic platforms to detect biomarkers in easily accessible bodily fluids like saliva, sweat, tears, and exhaled breath condensate.

Consumer demand for home-based testing solutions has accelerated following the COVID-19 pandemic, creating new market opportunities for portable microfluidic diagnostic devices. This shift toward decentralized testing is supported by healthcare systems seeking cost-effective alternatives to traditional laboratory diagnostics, with potential savings estimated at 30-40% compared to conventional testing methods.

Regionally, North America dominates the non-invasive diagnostic market with approximately 40% market share, followed by Europe at 30% and Asia-Pacific at 20%. However, the Asia-Pacific region is expected to witness the fastest growth due to improving healthcare infrastructure, increasing healthcare expenditure, and growing awareness about preventive healthcare.

Key market segments include glucose monitoring devices, cardiac monitoring and screening systems, blood analysis devices, and respiratory monitoring devices. The glucose monitoring segment currently holds the largest market share due to the high prevalence of diabetes globally and continuous innovation in non-invasive monitoring technologies.

Reimbursement policies significantly influence market adoption rates, with favorable insurance coverage accelerating uptake in developed markets. Conversely, limited reimbursement in emerging economies remains a constraint despite growing demand. Healthcare providers increasingly recognize the value proposition of non-invasive diagnostics in improving patient compliance and reducing healthcare costs associated with disease complications.

Market research indicates that patients are willing to pay a premium of 15-25% for non-invasive alternatives to traditional diagnostic methods, highlighting significant consumer preference. This willingness to pay creates opportunities for premium positioning of advanced microfluidic diagnostic solutions, particularly those offering improved accuracy and user experience.

Microfluidic Technology Barriers and Global Development

Despite significant advancements in microfluidic technologies for non-invasive diagnostics, several technological barriers continue to impede widespread implementation. Material compatibility remains a primary challenge, as biocompatible materials must simultaneously satisfy mechanical requirements, optical transparency needs, and resistance to chemical reagents while maintaining low manufacturing costs. The integration of these competing material properties often results in compromises that limit device performance.

Fabrication scalability presents another significant hurdle. While academic prototypes demonstrate impressive capabilities, transitioning to high-volume manufacturing while maintaining precision and reproducibility proves difficult. Traditional microfabrication techniques like photolithography offer high precision but remain costly and time-consuming for mass production, while injection molding and embossing techniques struggle with the micro-scale features required for advanced diagnostic applications.

System integration complexity further complicates development, as microfluidic diagnostic tools require seamless integration of multiple components—pumps, valves, sensors, and readout systems—into compact, user-friendly packages. The miniaturization of these components while maintaining reliability and performance creates substantial engineering challenges, particularly for point-of-care applications where robustness is paramount.

Globally, microfluidic technology development exhibits distinct regional characteristics. North America, particularly the United States, leads in innovation with strong academic-industry partnerships and substantial venture capital investment. The region emphasizes breakthrough technologies for precision medicine and personalized diagnostics, supported by robust intellectual property frameworks.

Europe demonstrates strength in standardization and regulatory frameworks, with countries like Germany, Switzerland, and the Netherlands focusing on high-precision manufacturing and quality assurance. European development typically prioritizes sustainable materials and manufacturing processes, reflecting regional environmental priorities.

The Asia-Pacific region, led by China, Japan, and South Korea, has emerged as the fastest-growing market for microfluidic technologies. These countries leverage manufacturing expertise and cost advantages to rapidly scale production, with particular focus on affordable diagnostic solutions for resource-limited settings. China's government-backed initiatives have accelerated development in recent years, narrowing the innovation gap with Western counterparts.

Emerging economies in South America and Africa are increasingly adopting microfluidic technologies, primarily focusing on adapting existing platforms to address local healthcare challenges rather than fundamental innovation. These regions benefit from international collaborations that facilitate technology transfer while adapting solutions to local infrastructure limitations and disease profiles.

Fabrication scalability presents another significant hurdle. While academic prototypes demonstrate impressive capabilities, transitioning to high-volume manufacturing while maintaining precision and reproducibility proves difficult. Traditional microfabrication techniques like photolithography offer high precision but remain costly and time-consuming for mass production, while injection molding and embossing techniques struggle with the micro-scale features required for advanced diagnostic applications.

System integration complexity further complicates development, as microfluidic diagnostic tools require seamless integration of multiple components—pumps, valves, sensors, and readout systems—into compact, user-friendly packages. The miniaturization of these components while maintaining reliability and performance creates substantial engineering challenges, particularly for point-of-care applications where robustness is paramount.

Globally, microfluidic technology development exhibits distinct regional characteristics. North America, particularly the United States, leads in innovation with strong academic-industry partnerships and substantial venture capital investment. The region emphasizes breakthrough technologies for precision medicine and personalized diagnostics, supported by robust intellectual property frameworks.

Europe demonstrates strength in standardization and regulatory frameworks, with countries like Germany, Switzerland, and the Netherlands focusing on high-precision manufacturing and quality assurance. European development typically prioritizes sustainable materials and manufacturing processes, reflecting regional environmental priorities.

The Asia-Pacific region, led by China, Japan, and South Korea, has emerged as the fastest-growing market for microfluidic technologies. These countries leverage manufacturing expertise and cost advantages to rapidly scale production, with particular focus on affordable diagnostic solutions for resource-limited settings. China's government-backed initiatives have accelerated development in recent years, narrowing the innovation gap with Western counterparts.

Emerging economies in South America and Africa are increasingly adopting microfluidic technologies, primarily focusing on adapting existing platforms to address local healthcare challenges rather than fundamental innovation. These regions benefit from international collaborations that facilitate technology transfer while adapting solutions to local infrastructure limitations and disease profiles.

Current Microfluidic Solutions for Non-Invasive Testing

01 Microfluidic devices for non-invasive diagnostics

Microfluidic technologies enable non-invasive diagnostic methods by allowing the analysis of small sample volumes from easily accessible bodily fluids. These devices integrate various components for sample preparation, processing, and detection, eliminating the need for invasive procedures. The miniaturized systems can detect biomarkers, cells, or pathogens with high sensitivity and specificity, providing rapid results while minimizing patient discomfort.- Microfluidic devices for non-invasive diagnostics: Microfluidic technologies enable non-invasive diagnostic methods by analyzing small volumes of easily accessible biological samples such as saliva, sweat, or tears. These devices incorporate channels, chambers, and sensors at the microscale to detect biomarkers without requiring blood draws or tissue sampling. The integration of microfluidics with biosensors allows for rapid, point-of-care testing with minimal patient discomfort.

- Lab-on-a-chip systems for continuous health monitoring: Lab-on-a-chip systems utilize microfluidic technology to enable continuous, non-invasive health monitoring. These miniaturized platforms integrate sample collection, preparation, and analysis functions into a single device. By monitoring biomarkers in fluids like sweat or interstitial fluid, these systems can track health parameters in real-time without breaking the skin barrier, providing valuable data for managing chronic conditions and preventive healthcare.

- Optical sensing in microfluidic platforms: Optical sensing techniques integrated with microfluidic platforms enable non-invasive detection and analysis of biological samples. These systems use light-based methods such as fluorescence, absorbance, or Raman spectroscopy to detect analytes without physical contact with internal tissues. The combination of optical sensing with microfluidics allows for high-sensitivity detection in extremely small sample volumes, making it ideal for non-invasive diagnostic applications.

- Wearable microfluidic sensors: Wearable microfluidic sensors provide non-invasive monitoring of physiological parameters through analysis of body fluids like sweat or interstitial fluid. These flexible, skin-mounted devices incorporate microchannels and sensing elements that can collect and analyze biomarkers continuously. The integration of microfluidics into wearable formats enables real-time health monitoring without the need for invasive procedures, improving patient comfort and compliance.

- Microfluidic sample preparation for non-invasive testing: Microfluidic technologies enable sophisticated sample preparation techniques for non-invasive testing applications. These systems can process minute volumes of easily accessible biological samples through operations such as filtration, concentration, and purification. By efficiently preparing samples at the microscale, these technologies enhance the sensitivity and specificity of non-invasive diagnostic tests, allowing for detection of low-abundance biomarkers without requiring invasive collection methods.

02 Non-invasive monitoring systems using microfluidic sensors

Microfluidic sensors can be integrated into wearable or portable devices for continuous non-invasive monitoring of physiological parameters. These systems utilize microchannels to collect and analyze bodily fluids such as sweat, tears, or interstitial fluid, providing real-time health data without breaking the skin barrier. The technology enables long-term monitoring of chronic conditions, medication effectiveness, or general wellness metrics through sophisticated fluid handling and sensing mechanisms.Expand Specific Solutions03 Lab-on-a-chip systems for point-of-care testing

Lab-on-a-chip systems incorporate microfluidic technology to perform complex laboratory procedures in a single, compact device suitable for point-of-care settings. These systems enable non-invasive or minimally invasive testing by processing small sample volumes collected through non-invasive means. The integration of sample preparation, reagent mixing, and detection mechanisms allows for rapid analysis without specialized laboratory equipment, making healthcare more accessible while reducing the need for invasive sampling procedures.Expand Specific Solutions04 Optical detection methods in microfluidic platforms

Optical detection methods integrated with microfluidic platforms enable non-invasive analysis of biological samples. These systems utilize techniques such as fluorescence, absorbance, or Raman spectroscopy to detect biomarkers without direct tissue sampling. The combination of microfluidic sample handling with optical sensing allows for highly sensitive detection of analytes in easily accessible bodily fluids, providing non-invasive alternatives to traditional diagnostic methods that require tissue extraction or blood draws.Expand Specific Solutions05 Microfluidic devices for drug delivery and therapeutic applications

Microfluidic technologies enable non-invasive or minimally invasive drug delivery systems that can administer therapeutic agents through alternative routes. These devices utilize precise fluid control to deliver medications through transdermal, mucosal, or other non-invasive pathways. The microfluidic platforms can be designed to respond to physiological conditions, providing controlled release of drugs without the need for injections or surgical implantation, thereby improving patient compliance and reducing complications associated with invasive delivery methods.Expand Specific Solutions

Leading Companies in Non-Invasive Microfluidic Diagnostics

The microfluidics-based non-invasive diagnostic tools market is currently in a growth phase, with increasing adoption across healthcare sectors. The global market size is projected to expand significantly, driven by rising demand for point-of-care testing and personalized medicine. Technologically, the field shows varying maturity levels, with companies like Abbott Diagnostics Scarborough and Roche Diagnostics leading with established platforms, while newer entrants such as Dianax and BOE Health Technology are developing innovative approaches. Academic institutions including Vanderbilt University and Shenzhen University are contributing fundamental research, while commercial players like Revvity Health Sciences and Wondfo Biotech are scaling applications. The competitive landscape features both healthcare giants and specialized startups, with recent collaborations between technology companies and medical device manufacturers accelerating development of integrated microfluidic diagnostic solutions.

Abbott Diagnostics Scarborough, Inc.

Technical Solution: Abbott has pioneered microfluidic technology for non-invasive diagnostics through their i-STAT system and FreeStyle Libre continuous glucose monitoring platform. Their approach integrates electrochemical sensors with microfluidic channels to analyze small volumes of interstitial fluid or saliva. Abbott's technology employs microfabrication techniques to create networks of channels with dimensions in the micrometer range, allowing for precise fluid handling and analysis. Their platforms utilize capillary action and controlled surface chemistry to facilitate passive fluid movement, eliminating the need for external pumps in many applications. Abbott has developed specialized surface treatments to prevent biofouling and protein adsorption, critical for accurate results with biological samples. Their microfluidic cartridges incorporate multiple reaction chambers and detection zones, enabling multiplexed testing from a single sample input.

Strengths: Extensive commercial experience with proven reliability in field conditions; sophisticated manufacturing capabilities ensuring consistent quality; strong distribution network for global accessibility. Weaknesses: Some systems require proprietary readers limiting deployment flexibility; relatively higher per-test costs compared to traditional laboratory methods; limited customization options for end users.

Guangzhou Wondfo Biotech Co., Ltd.

Technical Solution: Wondfo has developed cost-effective microfluidic platforms for non-invasive diagnostics, particularly focusing on lateral flow immunoassays enhanced with microfluidic channels. Their technology utilizes paper-based microfluidics with patterned hydrophobic barriers to create defined flow paths for biological samples like saliva and urine. Wondfo's approach incorporates capillary-driven flow with precisely controlled channel dimensions to achieve consistent sample delivery to detection zones without external instrumentation. Their platforms feature integrated sample preparation components including filtration membranes and conjugate release pads that are critical for processing complex biological matrices. Wondfo has pioneered the use of nanoparticle-enhanced colorimetric detection within microfluidic channels, improving sensitivity for detecting low-abundance biomarkers in non-invasive samples. Their systems employ multiplexed detection zones within a single microfluidic device, allowing simultaneous testing for multiple analytes from a single sample input. Wondfo's technology includes smartphone-based readout capabilities, enabling quantitative analysis of test results in resource-limited settings.

Strengths: Highly cost-effective manufacturing enabling affordable testing; simplified user interfaces requiring minimal training; robust performance in challenging environmental conditions. Weaknesses: Generally lower analytical sensitivity compared to more sophisticated platforms; limited automation capabilities; fewer multiplexing options than high-end systems.

Key Patents in Non-Invasive Microfluidic Diagnostics

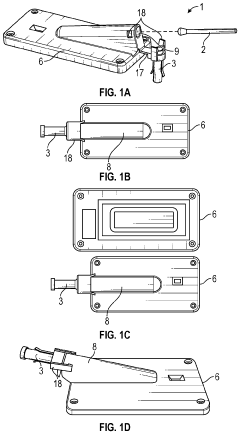

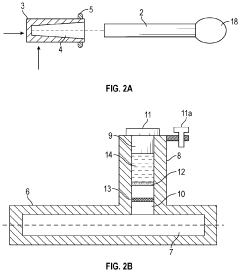

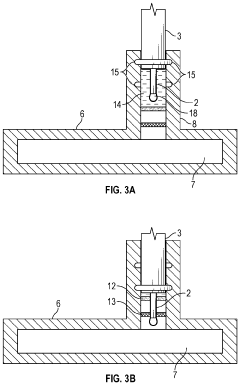

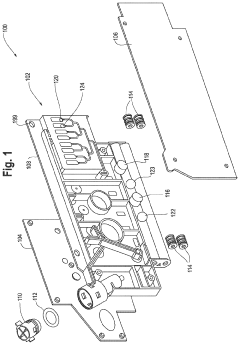

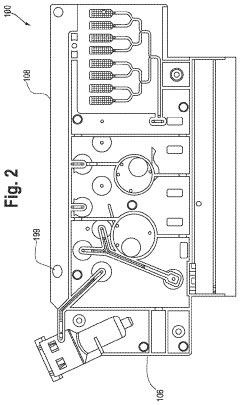

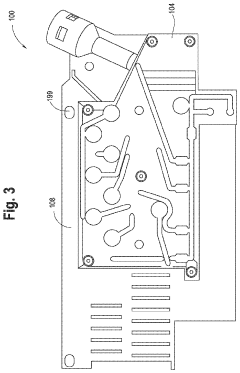

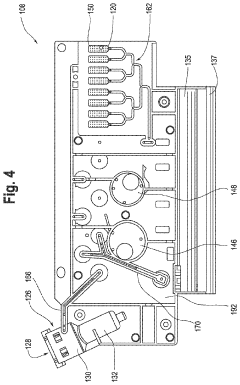

Device for allowing pressurization of fluid in a microfluidic diagnostic device

PatentPendingUS20240238784A1

Innovation

- A microfluidic diagnostic device that uses a pressurized sample introduction system with a membrane that perforates under pressure, allowing efficient flow of biological samples into a microfluidic testing device, optionally with a filter to regulate flow and improve accuracy.

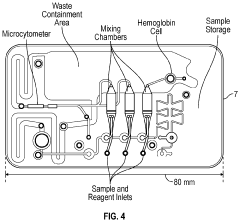

Microfluidic devices and related methods

PatentActiveUS11872554B2

Innovation

- A microfluidic device with a cartridge assembly and elastomer layer that includes a series of fluidly coupled ports, channels, chambers, and valves, featuring on-board pumps and reaction chambers for precise fluid management, acoustic mixing, and a waste reservoir to buffer air pressure, enabling rapid and accurate detection of nucleic acids within a closed system.

Regulatory Pathways for Microfluidic Diagnostic Devices

The regulatory landscape for microfluidic diagnostic devices presents a complex framework that manufacturers must navigate to bring their innovations to market. In the United States, the Food and Drug Administration (FDA) classifies most microfluidic diagnostic tools as in vitro diagnostic devices (IVDs), categorizing them into Class I, II, or III based on their intended use and risk profile. Non-invasive diagnostic applications typically fall under Class II, requiring a 510(k) premarket notification unless they represent novel technologies that may necessitate the more rigorous Premarket Approval (PMA) pathway.

The European Union has implemented the In Vitro Diagnostic Regulation (IVDR 2017/746), which replaced the previous directive (IVDD) with full application in May 2022. This regulation introduces a new risk-based classification system and strengthens requirements for clinical evidence, particularly for novel diagnostic approaches. Microfluidic devices for non-invasive diagnostics must demonstrate both analytical and clinical performance under these regulations.

In Asia, Japan's Pharmaceuticals and Medical Devices Agency (PMDA) and China's National Medical Products Administration (NMPA) have established their own regulatory frameworks. Japan follows a classification system similar to the FDA but with unique requirements for foreign manufacturers, while China has recently reformed its approval process to accelerate innovative medical technologies, including microfluidic diagnostics.

Regulatory considerations specific to microfluidic technology include validation of fluid dynamics, material biocompatibility, and manufacturing consistency. For non-invasive applications, additional validation may be required to demonstrate correlation between the measured biomarkers and the clinical condition being diagnosed, especially when traditional invasive methods serve as the gold standard.

The Clinical Laboratory Improvement Amendments (CLIA) in the US adds another layer of regulation for laboratory-developed tests using microfluidic platforms. Tests categorized as high complexity require specialized laboratory certification, potentially limiting point-of-care applications unless they can achieve CLIA-waived status.

Emerging regulatory pathways include the FDA's Breakthrough Devices Program and similar accelerated review processes in other regions, which can expedite approval for microfluidic diagnostics addressing unmet medical needs. Additionally, international harmonization efforts through the International Medical Device Regulators Forum (IMDRF) are working to standardize requirements across major markets, potentially simplifying the global commercialization process for innovative microfluidic diagnostic technologies.

The European Union has implemented the In Vitro Diagnostic Regulation (IVDR 2017/746), which replaced the previous directive (IVDD) with full application in May 2022. This regulation introduces a new risk-based classification system and strengthens requirements for clinical evidence, particularly for novel diagnostic approaches. Microfluidic devices for non-invasive diagnostics must demonstrate both analytical and clinical performance under these regulations.

In Asia, Japan's Pharmaceuticals and Medical Devices Agency (PMDA) and China's National Medical Products Administration (NMPA) have established their own regulatory frameworks. Japan follows a classification system similar to the FDA but with unique requirements for foreign manufacturers, while China has recently reformed its approval process to accelerate innovative medical technologies, including microfluidic diagnostics.

Regulatory considerations specific to microfluidic technology include validation of fluid dynamics, material biocompatibility, and manufacturing consistency. For non-invasive applications, additional validation may be required to demonstrate correlation between the measured biomarkers and the clinical condition being diagnosed, especially when traditional invasive methods serve as the gold standard.

The Clinical Laboratory Improvement Amendments (CLIA) in the US adds another layer of regulation for laboratory-developed tests using microfluidic platforms. Tests categorized as high complexity require specialized laboratory certification, potentially limiting point-of-care applications unless they can achieve CLIA-waived status.

Emerging regulatory pathways include the FDA's Breakthrough Devices Program and similar accelerated review processes in other regions, which can expedite approval for microfluidic diagnostics addressing unmet medical needs. Additionally, international harmonization efforts through the International Medical Device Regulators Forum (IMDRF) are working to standardize requirements across major markets, potentially simplifying the global commercialization process for innovative microfluidic diagnostic technologies.

Clinical Validation Strategies for New Diagnostic Technologies

Clinical validation represents a critical phase in the development pathway for microfluidic-based non-invasive diagnostic tools. Establishing robust validation strategies requires a systematic approach that addresses both analytical and clinical performance metrics. The validation process typically begins with preliminary analytical validation in controlled laboratory settings, followed by clinical validation studies involving target patient populations.

For microfluidic diagnostic technologies, validation protocols must first establish analytical performance characteristics including sensitivity, specificity, precision, accuracy, and limits of detection. These parameters should be evaluated across different operating conditions to ensure reliability in real-world clinical environments. Particular attention must be paid to sample preparation protocols, as non-invasive samples (saliva, tears, sweat) often contain lower biomarker concentrations than traditional invasive samples.

Clinical validation studies for microfluidic diagnostics should follow a phased approach. Initial feasibility studies with small patient cohorts help identify potential issues before proceeding to larger validation trials. These studies should include diverse patient populations that represent the intended use case, including variations in age, gender, ethnicity, and comorbidities to ensure broad applicability of results.

Comparative studies against current gold standard diagnostic methods are essential for establishing clinical utility. For microfluidic non-invasive diagnostics, this often means demonstrating comparable or superior performance to existing invasive techniques. Statistical analysis plans should be developed a priori, with appropriate sample sizes calculated to achieve sufficient statistical power.

Regulatory considerations must be integrated into validation strategies from the outset. Different regulatory pathways (FDA, CE marking, etc.) have specific validation requirements that influence study design. For novel microfluidic technologies, early engagement with regulatory bodies through pre-submission meetings can provide valuable guidance on validation expectations.

Real-world performance evaluation represents an increasingly important component of clinical validation. This includes usability testing with intended operators, assessment of environmental factors affecting performance, and evaluation in point-of-care settings. For microfluidic devices intended for home use, validation should include studies with lay users to confirm ease of use and result interpretation.

Long-term stability testing and shelf-life determination are particularly important for microfluidic devices, as reagent stability and channel integrity can degrade over time. Accelerated aging studies combined with real-time stability testing provide comprehensive data on expected performance throughout the product lifecycle.

For microfluidic diagnostic technologies, validation protocols must first establish analytical performance characteristics including sensitivity, specificity, precision, accuracy, and limits of detection. These parameters should be evaluated across different operating conditions to ensure reliability in real-world clinical environments. Particular attention must be paid to sample preparation protocols, as non-invasive samples (saliva, tears, sweat) often contain lower biomarker concentrations than traditional invasive samples.

Clinical validation studies for microfluidic diagnostics should follow a phased approach. Initial feasibility studies with small patient cohorts help identify potential issues before proceeding to larger validation trials. These studies should include diverse patient populations that represent the intended use case, including variations in age, gender, ethnicity, and comorbidities to ensure broad applicability of results.

Comparative studies against current gold standard diagnostic methods are essential for establishing clinical utility. For microfluidic non-invasive diagnostics, this often means demonstrating comparable or superior performance to existing invasive techniques. Statistical analysis plans should be developed a priori, with appropriate sample sizes calculated to achieve sufficient statistical power.

Regulatory considerations must be integrated into validation strategies from the outset. Different regulatory pathways (FDA, CE marking, etc.) have specific validation requirements that influence study design. For novel microfluidic technologies, early engagement with regulatory bodies through pre-submission meetings can provide valuable guidance on validation expectations.

Real-world performance evaluation represents an increasingly important component of clinical validation. This includes usability testing with intended operators, assessment of environmental factors affecting performance, and evaluation in point-of-care settings. For microfluidic devices intended for home use, validation should include studies with lay users to confirm ease of use and result interpretation.

Long-term stability testing and shelf-life determination are particularly important for microfluidic devices, as reagent stability and channel integrity can degrade over time. Accelerated aging studies combined with real-time stability testing provide comprehensive data on expected performance throughout the product lifecycle.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!