Comparative Study of Conductive Adhesives for Flexible Circuits

OCT 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Adhesives Background and Objectives

Conductive adhesives have emerged as a critical technology in the evolution of flexible electronics, representing a significant departure from traditional soldering methods. The development of these materials can be traced back to the 1950s, with initial applications in military and aerospace sectors where reliability under extreme conditions was paramount. Over subsequent decades, conductive adhesives have undergone substantial refinement, transitioning from rudimentary formulations to sophisticated composites engineered for specific performance characteristics.

The technological trajectory of conductive adhesives has been characterized by continuous innovation in both material composition and manufacturing processes. Early iterations primarily utilized silver particles suspended in epoxy matrices, offering limited flexibility and conductivity. Contemporary formulations incorporate diverse conductive fillers including silver, gold, copper, and carbon nanostructures, embedded within polymer systems specifically designed to maintain electrical performance while accommodating mechanical deformation.

Recent advancements have focused on addressing key performance limitations, particularly the trade-off between electrical conductivity and mechanical flexibility. The integration of nanomaterials such as carbon nanotubes, graphene, and metallic nanowires has enabled significant improvements in this regard, facilitating the development of adhesives capable of maintaining stable electrical properties under repeated flexing cycles.

The primary objective of this comparative study is to systematically evaluate the performance characteristics of various conductive adhesive formulations specifically within the context of flexible circuit applications. This includes assessment of electrical conductivity under static and dynamic conditions, adhesion strength to diverse substrate materials, environmental stability, processing requirements, and long-term reliability metrics.

Additionally, this study aims to identify optimal adhesive solutions for specific flexible circuit applications, recognizing that performance requirements vary significantly across use cases ranging from consumer wearables to medical implants to automotive systems. The evaluation framework will incorporate both established industry standards and application-specific testing protocols to ensure comprehensive performance characterization.

A further objective is to forecast technological evolution pathways for conductive adhesives, identifying emerging material systems and processing techniques with potential to address current limitations. This includes evaluation of novel hybrid systems combining traditional adhesives with emerging technologies such as printed electronics and in-situ polymerization approaches.

The ultimate goal is to provide actionable insights for materials selection and process optimization, enabling more effective implementation of conductive adhesives in next-generation flexible electronic systems. This includes development of application-specific selection matrices correlating adhesive properties with performance requirements across diverse use cases.

The technological trajectory of conductive adhesives has been characterized by continuous innovation in both material composition and manufacturing processes. Early iterations primarily utilized silver particles suspended in epoxy matrices, offering limited flexibility and conductivity. Contemporary formulations incorporate diverse conductive fillers including silver, gold, copper, and carbon nanostructures, embedded within polymer systems specifically designed to maintain electrical performance while accommodating mechanical deformation.

Recent advancements have focused on addressing key performance limitations, particularly the trade-off between electrical conductivity and mechanical flexibility. The integration of nanomaterials such as carbon nanotubes, graphene, and metallic nanowires has enabled significant improvements in this regard, facilitating the development of adhesives capable of maintaining stable electrical properties under repeated flexing cycles.

The primary objective of this comparative study is to systematically evaluate the performance characteristics of various conductive adhesive formulations specifically within the context of flexible circuit applications. This includes assessment of electrical conductivity under static and dynamic conditions, adhesion strength to diverse substrate materials, environmental stability, processing requirements, and long-term reliability metrics.

Additionally, this study aims to identify optimal adhesive solutions for specific flexible circuit applications, recognizing that performance requirements vary significantly across use cases ranging from consumer wearables to medical implants to automotive systems. The evaluation framework will incorporate both established industry standards and application-specific testing protocols to ensure comprehensive performance characterization.

A further objective is to forecast technological evolution pathways for conductive adhesives, identifying emerging material systems and processing techniques with potential to address current limitations. This includes evaluation of novel hybrid systems combining traditional adhesives with emerging technologies such as printed electronics and in-situ polymerization approaches.

The ultimate goal is to provide actionable insights for materials selection and process optimization, enabling more effective implementation of conductive adhesives in next-generation flexible electronic systems. This includes development of application-specific selection matrices correlating adhesive properties with performance requirements across diverse use cases.

Market Analysis for Flexible Circuit Applications

The flexible circuit market has experienced substantial growth over the past decade, driven primarily by the increasing demand for miniaturization and lightweight electronic components across various industries. The global flexible circuit market was valued at approximately 12.7 billion USD in 2022 and is projected to reach 18.5 billion USD by 2027, growing at a CAGR of 7.8%. This growth trajectory is particularly significant for conductive adhesive applications, which represent a critical component in flexible circuit manufacturing.

Consumer electronics remains the dominant application sector, accounting for nearly 40% of the total market share. Smartphones, wearable devices, and tablets are the primary drivers within this segment, with manufacturers continuously seeking thinner, more flexible, and reliable connection solutions. The automotive industry follows as the second-largest application area, representing about 22% of the market, with increasing integration of electronics in modern vehicles demanding flexible circuit solutions that can withstand harsh environmental conditions.

Medical device applications have shown the fastest growth rate at approximately 9.3% annually, as the healthcare sector increasingly adopts flexible electronics for implantable devices, patient monitoring systems, and diagnostic equipment. The aerospace and defense sectors, though smaller in market share (approximately 8%), demand high-performance conductive adhesives that can withstand extreme conditions and offer exceptional reliability.

Geographically, Asia-Pacific dominates the market with over 60% share, primarily due to the concentration of electronics manufacturing in countries like China, Japan, South Korea, and Taiwan. North America and Europe follow with approximately 20% and 15% market shares respectively, with their focus primarily on high-value applications in medical, aerospace, and advanced automotive systems.

The market dynamics are increasingly influenced by sustainability concerns, with growing demand for environmentally friendly conductive adhesives that reduce or eliminate toxic components while maintaining performance characteristics. This trend is particularly strong in European markets where regulatory pressures regarding hazardous materials are most stringent.

Price sensitivity varies significantly across application segments. While consumer electronics manufacturers prioritize cost-effectiveness alongside performance, medical and aerospace applications emphasize reliability and durability over price considerations. This market segmentation creates diverse opportunities for conductive adhesive manufacturers to develop specialized products for different application requirements.

Supply chain resilience has emerged as a critical factor following recent global disruptions, with manufacturers increasingly seeking diversified sourcing strategies for conductive adhesive components. This trend has accelerated the development of alternative formulations that reduce dependency on scarce or geographically concentrated raw materials.

Consumer electronics remains the dominant application sector, accounting for nearly 40% of the total market share. Smartphones, wearable devices, and tablets are the primary drivers within this segment, with manufacturers continuously seeking thinner, more flexible, and reliable connection solutions. The automotive industry follows as the second-largest application area, representing about 22% of the market, with increasing integration of electronics in modern vehicles demanding flexible circuit solutions that can withstand harsh environmental conditions.

Medical device applications have shown the fastest growth rate at approximately 9.3% annually, as the healthcare sector increasingly adopts flexible electronics for implantable devices, patient monitoring systems, and diagnostic equipment. The aerospace and defense sectors, though smaller in market share (approximately 8%), demand high-performance conductive adhesives that can withstand extreme conditions and offer exceptional reliability.

Geographically, Asia-Pacific dominates the market with over 60% share, primarily due to the concentration of electronics manufacturing in countries like China, Japan, South Korea, and Taiwan. North America and Europe follow with approximately 20% and 15% market shares respectively, with their focus primarily on high-value applications in medical, aerospace, and advanced automotive systems.

The market dynamics are increasingly influenced by sustainability concerns, with growing demand for environmentally friendly conductive adhesives that reduce or eliminate toxic components while maintaining performance characteristics. This trend is particularly strong in European markets where regulatory pressures regarding hazardous materials are most stringent.

Price sensitivity varies significantly across application segments. While consumer electronics manufacturers prioritize cost-effectiveness alongside performance, medical and aerospace applications emphasize reliability and durability over price considerations. This market segmentation creates diverse opportunities for conductive adhesive manufacturers to develop specialized products for different application requirements.

Supply chain resilience has emerged as a critical factor following recent global disruptions, with manufacturers increasingly seeking diversified sourcing strategies for conductive adhesive components. This trend has accelerated the development of alternative formulations that reduce dependency on scarce or geographically concentrated raw materials.

Current Limitations and Technical Challenges

Despite significant advancements in conductive adhesive technology for flexible circuits, several critical limitations and technical challenges persist that hinder widespread adoption and optimal performance. Traditional conductive adhesives often struggle with maintaining consistent electrical conductivity across repeated bending and flexing cycles, leading to performance degradation over time. This reliability issue becomes particularly pronounced in applications requiring extreme flexibility or those subjected to continuous mechanical stress.

Thermal stability represents another major challenge, as many conductive adhesives exhibit significant changes in electrical properties when exposed to temperature fluctuations. The coefficient of thermal expansion mismatch between adhesives and substrate materials can induce internal stresses, potentially causing delamination or cracking during thermal cycling. This limitation severely restricts the operating temperature range of flexible circuits in demanding environments.

Environmental resistance poses substantial concerns, particularly regarding humidity and chemical exposure. Current conductive adhesives often demonstrate inadequate moisture barrier properties, allowing water vapor penetration that can compromise electrical connections. Chemical compatibility issues with certain substrates and processing chemicals further complicate manufacturing integration and long-term reliability.

Processing challenges remain significant barriers to industrial scalability. Many high-performance conductive adhesives require specialized curing conditions, including elevated temperatures or controlled atmospheres that may damage heat-sensitive flexible substrates. The balance between cure temperature, cure time, and resulting electrical performance represents a complex optimization problem that limits manufacturing throughput.

Contact resistance at interfaces between conductive adhesives and circuit components frequently exceeds that of traditional soldering methods, creating performance bottlenecks in high-frequency applications. This issue is compounded by inconsistent particle distribution within adhesive matrices, leading to unpredictable electrical pathways and potential hot spots.

Cost considerations continue to impede broader market penetration, as high-performance conductive adhesives typically incorporate expensive materials such as silver, gold, or specialized conductive fillers. The trade-off between cost and performance remains a significant challenge for manufacturers seeking economically viable solutions for mass production.

Standardization gaps further complicate the landscape, with limited industry-wide testing protocols and performance metrics specifically designed for flexible circuit applications. This absence of standardized evaluation methods makes comparative assessment difficult and slows technology adoption across different market segments.

Thermal stability represents another major challenge, as many conductive adhesives exhibit significant changes in electrical properties when exposed to temperature fluctuations. The coefficient of thermal expansion mismatch between adhesives and substrate materials can induce internal stresses, potentially causing delamination or cracking during thermal cycling. This limitation severely restricts the operating temperature range of flexible circuits in demanding environments.

Environmental resistance poses substantial concerns, particularly regarding humidity and chemical exposure. Current conductive adhesives often demonstrate inadequate moisture barrier properties, allowing water vapor penetration that can compromise electrical connections. Chemical compatibility issues with certain substrates and processing chemicals further complicate manufacturing integration and long-term reliability.

Processing challenges remain significant barriers to industrial scalability. Many high-performance conductive adhesives require specialized curing conditions, including elevated temperatures or controlled atmospheres that may damage heat-sensitive flexible substrates. The balance between cure temperature, cure time, and resulting electrical performance represents a complex optimization problem that limits manufacturing throughput.

Contact resistance at interfaces between conductive adhesives and circuit components frequently exceeds that of traditional soldering methods, creating performance bottlenecks in high-frequency applications. This issue is compounded by inconsistent particle distribution within adhesive matrices, leading to unpredictable electrical pathways and potential hot spots.

Cost considerations continue to impede broader market penetration, as high-performance conductive adhesives typically incorporate expensive materials such as silver, gold, or specialized conductive fillers. The trade-off between cost and performance remains a significant challenge for manufacturers seeking economically viable solutions for mass production.

Standardization gaps further complicate the landscape, with limited industry-wide testing protocols and performance metrics specifically designed for flexible circuit applications. This absence of standardized evaluation methods makes comparative assessment difficult and slows technology adoption across different market segments.

Comparative Analysis of Existing Adhesive Solutions

01 Conductive fillers in adhesive compositions

Conductive adhesives incorporate various conductive fillers to achieve electrical conductivity. These fillers include metal particles (such as silver, copper, nickel), carbon-based materials (like carbon nanotubes, graphene), and metal-coated particles. The type, size, shape, and concentration of these fillers significantly impact the adhesive's conductivity, mechanical properties, and processing characteristics. Optimizing the filler loading allows for balancing conductivity requirements with adhesion strength and flexibility.- Metal-filled conductive adhesives: Metal-filled conductive adhesives incorporate metallic particles such as silver, gold, copper, or nickel to create electrical conductivity. These particles form conductive pathways when the adhesive is cured. The concentration and type of metal filler significantly affect the conductivity level, with silver typically providing the highest conductivity. These adhesives are widely used in electronics assembly, particularly for applications requiring both mechanical bonding and electrical connectivity.

- Carbon-based conductive adhesives: Carbon-based conductive adhesives utilize carbon materials such as graphite, carbon black, carbon nanotubes, or graphene as conductive fillers. These materials provide moderate conductivity at lower cost compared to metal fillers. Carbon nanotubes and graphene offer excellent electrical properties while requiring lower loading levels. These adhesives are particularly useful in applications where moderate conductivity is sufficient and cost considerations are important, such as EMI shielding, static dissipation, and certain sensor applications.

- Anisotropic conductive adhesives: Anisotropic conductive adhesives (ACAs) provide electrical conductivity in one direction while maintaining insulation in others. They typically contain conductive particles dispersed in an insulating adhesive matrix. When compressed between electrical contacts, the particles form conductive paths in the z-direction while remaining isolated in the x-y plane. This technology is particularly valuable for fine-pitch electronics connections, display technologies, and flexible circuit applications where directional conductivity is required.

- Thermally conductive adhesives: Thermally conductive adhesives are designed to transfer heat while providing adhesion between components. These formulations typically contain thermally conductive fillers such as aluminum oxide, boron nitride, or metal particles in a polymer matrix. They are essential in electronics packaging for heat dissipation from components to heat sinks or substrates. The thermal conductivity can be tailored by adjusting filler type, size, and concentration, while maintaining appropriate viscosity for application and adequate adhesion strength after curing.

- Environmentally friendly conductive adhesives: Environmentally friendly conductive adhesives address health and environmental concerns by eliminating or reducing hazardous materials like lead and certain solvents. These formulations often use bio-based resins, water-based systems, or low-VOC components while maintaining electrical performance. Some incorporate novel conductive fillers like silver-coated copper or functionalized carbon materials to reduce precious metal content. These adhesives are increasingly important for compliance with global regulations like RoHS and REACH while meeting performance requirements for electronics manufacturing.

02 Polymer matrices for conductive adhesives

The polymer matrix serves as the binding component in conductive adhesives, providing adhesion while supporting the conductive network. Common polymer systems include epoxies, silicones, acrylics, and polyurethanes. Each polymer type offers different characteristics in terms of curing mechanisms, temperature resistance, flexibility, and environmental stability. Advanced formulations may incorporate hybrid polymer systems or specialized additives to enhance specific properties such as thermal conductivity, flexibility, or adhesion to challenging substrates.Expand Specific Solutions03 Anisotropic conductive adhesives

Anisotropic conductive adhesives (ACAs) provide electrical conductivity in a specific direction while maintaining insulation in other directions. These specialized adhesives typically contain conductive particles dispersed in an insulating adhesive matrix. When compressed between electrical contacts, the particles form conductive pathways in the z-direction while remaining isolated from each other in the x-y plane. ACAs are particularly valuable in fine-pitch electronics assembly, display technologies, and flexible circuit connections where directional conductivity is required.Expand Specific Solutions04 Thermal management in conductive adhesives

Conductive adhesives often serve dual purposes of electrical connection and thermal management. Formulations may incorporate thermally conductive fillers such as ceramic particles, metal oxides, or specialized carbon materials to enhance heat dissipation. The thermal conductivity of these adhesives is critical in high-power electronics applications where heat management directly impacts device reliability and performance. Advanced formulations balance electrical conductivity, thermal conductivity, and mechanical properties to meet demanding application requirements.Expand Specific Solutions05 Processing and curing technologies

The processing and curing methods for conductive adhesives significantly impact their final properties and application performance. Various curing mechanisms include thermal curing, UV curing, moisture curing, and room-temperature curing systems. The curing process affects the formation of the conductive network, adhesion strength, and reliability. Advanced processing techniques may involve controlled pressure application during curing, specialized dispensing methods, or multi-stage curing profiles to optimize both electrical performance and mechanical properties.Expand Specific Solutions

Leading Manufacturers and Competitive Landscape

The conductive adhesives market for flexible circuits is currently in a growth phase, with increasing demand driven by the expanding flexible electronics sector. Market size is projected to reach significant levels as applications in wearables, automotive, and medical devices proliferate. Technologically, the field shows varying maturity levels across different adhesive types. Industry leaders like Henkel, 3M, and RESONAC have established strong positions with advanced formulations offering superior conductivity and flexibility. Emerging players such as PragmatIC Semiconductor, Nanotech Energy, and Beijing Dream Ink are introducing innovative approaches, particularly in graphene-based and printable conductive materials. Academic institutions like Northwestern University and Osaka University are contributing fundamental research, while specialized manufacturers like Gwent Electronic Materials focus on niche applications, collectively advancing the field toward higher performance and reliability.

3M Innovative Properties Co.

Technical Solution: 3M has developed advanced electrically conductive adhesives (ECAs) specifically designed for flexible circuit applications. Their technology incorporates anisotropic conductive films (ACFs) and anisotropic conductive adhesives (ACAs) that provide electrical conductivity in the z-axis while maintaining insulation in the x-y plane. These materials utilize precisely dispersed conductive particles (typically gold-coated polymer spheres or nickel particles) in a polymer matrix that, when compressed between contact pads, create electrical pathways[1]. 3M's proprietary formulations include thermoplastic and thermoset variants with different activation temperatures (ranging from 120°C to 180°C) to accommodate various substrate materials. Their latest generation of ECAs incorporates nano-scale metal particles that enable finer pitch connections (down to 40μm) while maintaining reliable conductivity across temperature cycling and humidity exposure[2]. The company has also developed stretchable conductive adhesives that maintain electrical performance at up to 100% elongation, specifically targeting wearable electronics applications.

Strengths: Superior environmental stability with resistance to temperature cycling (-40°C to 125°C) and humidity; excellent adhesion to multiple substrate types including polyimide, PET, and glass; precise particle distribution enabling fine-pitch applications. Weaknesses: Higher cost compared to traditional soldering methods; some formulations require specialized application equipment; potential for increased contact resistance over time in harsh environments.

Henkel AG & Co. KGaA

Technical Solution: Henkel has pioneered a comprehensive range of conductive adhesives for flexible circuits under their LOCTITE brand. Their technology portfolio includes both isotropic conductive adhesives (ICAs) and anisotropic conductive adhesives (ACAs) formulated specifically for flexible circuit applications. Henkel's silver-filled epoxy systems provide excellent electrical conductivity (volume resistivity as low as 1×10^-4 Ω·cm) while maintaining flexibility through specialized polymer matrices[3]. Their LOCTITE ABLESTIK ECAs incorporate proprietary filler technology that prevents silver migration—a common failure mode in conductive adhesives—while maintaining stable resistance values through thermal cycling and high humidity conditions. For ultra-flexible applications, Henkel has developed stretchable conductive adhesives that incorporate silver-coated copper particles in a modified silicone matrix, allowing for repeated bending and flexing without performance degradation[4]. Their latest innovations include hybrid formulations that combine the benefits of both pressure-sensitive adhesives and thermosetting systems, enabling low-temperature processing (as low as 80°C) for heat-sensitive substrates while providing excellent mechanical and electrical stability.

Strengths: Wide processing window with both low and high-temperature curing options; excellent adhesion to difficult substrates including polyimide and PET; formulations available with extended pot life for manufacturing flexibility; demonstrated reliability in automotive and consumer electronics applications. Weaknesses: Some formulations show higher initial resistance compared to solder connections; potential for silver migration in high-humidity environments without proper encapsulation; limited shelf life for single-component systems.

Key Patents and Technical Innovations

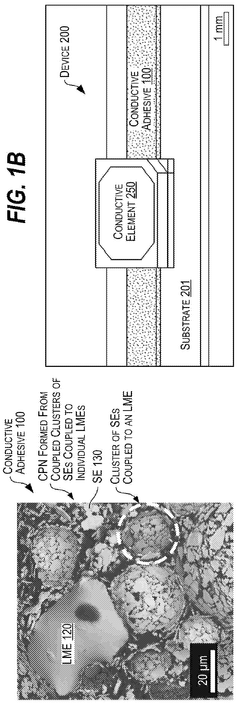

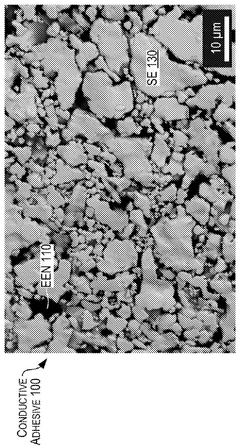

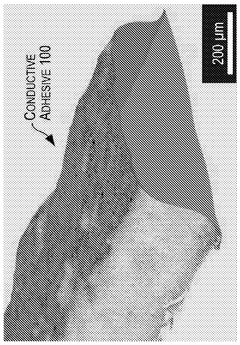

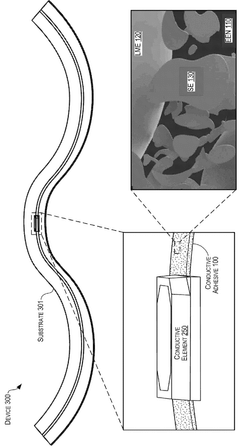

A flexible and highly electrically conductive liquid metal adhesive for hybrid electronics

PatentWO2025165398A2

Innovation

- A conductive adhesive comprising a multiphase soft composite of an elastomeric epoxy network with liquid metal droplets and silver flakes forms a conductive percolated network, allowing for robust integration of rigid components onto flexible substrates without sintering or high-temperature processing.

Conductive adhesive comprising conductive polymer and adhesive film

PatentWO2015115781A1

Innovation

- A conductive adhesive comprising a combination of metal powder, conductive polymer, and polymer binder, where the conductive polymer enhances adhesiveness and conductivity by providing a path for charge flow with lower resistance, balancing the trade-off between adhesiveness and conductivity.

Environmental Impact and Sustainability Factors

The environmental impact of conductive adhesives in flexible circuits represents a critical consideration as electronics manufacturing faces increasing sustainability pressures. Traditional soldering methods utilizing lead-based materials have long been associated with significant environmental hazards, including soil contamination, water pollution, and potential health risks to humans and wildlife. Conductive adhesives, particularly those designed for flexible circuit applications, offer promising alternatives with potentially reduced environmental footprints.

When examining the lifecycle assessment of conductive adhesives, several key factors emerge. Silver-filled epoxy adhesives, while effective conductors, raise sustainability concerns due to silver mining's environmental impact, including habitat destruction, water usage, and energy consumption. However, these adhesives typically require lower curing temperatures than traditional soldering methods, resulting in reduced energy consumption during manufacturing processes and associated carbon emissions.

Isotropic conductive adhesives (ICAs) generally demonstrate better environmental performance than anisotropic conductive adhesives (ACAs) due to their simpler formulations and manufacturing processes. The carbon footprint differential becomes particularly significant when considering large-scale production scenarios for flexible electronics applications.

Recent innovations in bio-based conductive adhesives represent a promising development in sustainability efforts. These formulations incorporate renewable resources such as modified cellulose, lignin derivatives, and plant-based resins as partial replacements for petroleum-based polymers. Early studies indicate these bio-based alternatives can reduce environmental impact by 15-30% compared to conventional conductive adhesives while maintaining acceptable electrical performance for many flexible circuit applications.

End-of-life considerations reveal additional sustainability dimensions. Conductive adhesives generally facilitate easier disassembly and component recovery compared to soldered connections, potentially enhancing recyclability of flexible electronic devices. However, the composite nature of these adhesives—combining polymers with metallic fillers—presents recycling challenges that require specialized separation processes.

Regulatory frameworks increasingly influence material selection in electronics manufacturing. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations worldwide have accelerated the transition away from lead-based solders toward conductive adhesives. Future regulatory trends suggest stricter requirements regarding recyclability, carbon footprint, and overall environmental impact of electronic components, potentially favoring continued innovation in sustainable conductive adhesive formulations.

Manufacturing process optimization offers additional sustainability opportunities. Low-temperature curing adhesives reduce energy requirements, while precision dispensing technologies minimize material waste. Advanced curing methods utilizing UV light or microwave energy can further reduce the environmental impact of conductive adhesive applications in flexible circuit production.

When examining the lifecycle assessment of conductive adhesives, several key factors emerge. Silver-filled epoxy adhesives, while effective conductors, raise sustainability concerns due to silver mining's environmental impact, including habitat destruction, water usage, and energy consumption. However, these adhesives typically require lower curing temperatures than traditional soldering methods, resulting in reduced energy consumption during manufacturing processes and associated carbon emissions.

Isotropic conductive adhesives (ICAs) generally demonstrate better environmental performance than anisotropic conductive adhesives (ACAs) due to their simpler formulations and manufacturing processes. The carbon footprint differential becomes particularly significant when considering large-scale production scenarios for flexible electronics applications.

Recent innovations in bio-based conductive adhesives represent a promising development in sustainability efforts. These formulations incorporate renewable resources such as modified cellulose, lignin derivatives, and plant-based resins as partial replacements for petroleum-based polymers. Early studies indicate these bio-based alternatives can reduce environmental impact by 15-30% compared to conventional conductive adhesives while maintaining acceptable electrical performance for many flexible circuit applications.

End-of-life considerations reveal additional sustainability dimensions. Conductive adhesives generally facilitate easier disassembly and component recovery compared to soldered connections, potentially enhancing recyclability of flexible electronic devices. However, the composite nature of these adhesives—combining polymers with metallic fillers—presents recycling challenges that require specialized separation processes.

Regulatory frameworks increasingly influence material selection in electronics manufacturing. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations worldwide have accelerated the transition away from lead-based solders toward conductive adhesives. Future regulatory trends suggest stricter requirements regarding recyclability, carbon footprint, and overall environmental impact of electronic components, potentially favoring continued innovation in sustainable conductive adhesive formulations.

Manufacturing process optimization offers additional sustainability opportunities. Low-temperature curing adhesives reduce energy requirements, while precision dispensing technologies minimize material waste. Advanced curing methods utilizing UV light or microwave energy can further reduce the environmental impact of conductive adhesive applications in flexible circuit production.

Reliability Testing Methodologies and Standards

Reliability testing is a critical component in evaluating conductive adhesives for flexible circuit applications. The industry has established several standardized methodologies to assess the performance and durability of these materials under various environmental and mechanical stresses. The IPC-TM-650 test methods, particularly sections 2.4.9 and 2.6.3, provide comprehensive guidelines for testing adhesion strength and electrical conductivity retention after environmental exposure.

Temperature cycling tests (JEDEC JESD22-A104) represent one of the most widely implemented reliability assessments, typically subjecting samples to cycles between -40°C and 125°C for 500-1000 cycles. This test effectively simulates the thermal expansion mismatch stresses that occur in real-world applications. For flexible circuits specifically, the test parameters may be modified to reflect the unique operating conditions of wearable electronics or automotive flexible interconnects.

Humidity testing follows standards such as JEDEC JESD22-A101, exposing conductive adhesive joints to 85°C/85% RH conditions for periods ranging from 168 to 1000 hours. This methodology is particularly relevant for evaluating silver-filled epoxy adhesives, which can exhibit significant performance degradation in high-humidity environments due to silver migration phenomena.

Mechanical reliability testing includes bend testing (ASTM D4338), peel strength (ASTM D903), and vibration testing (MIL-STD-810G). For flexible circuit applications, dynamic bend testing is especially important, with samples typically subjected to 10,000+ cycles of bending at specified radii. The IEC 60068-2-21 standard provides guidelines for testing the mechanical robustness of electrical connections.

Accelerated aging tests combine multiple stressors to predict long-term reliability. The Highly Accelerated Stress Test (HAST) exposes samples to elevated temperature, humidity, and bias voltage simultaneously. For automotive applications, additional tests including salt spray exposure (ASTM B117) and fluid resistance (ISO 16750-5) are commonly implemented.

Electrical performance degradation is monitored throughout these tests, with resistance measurements taken at regular intervals. The IPC-9701 standard provides guidelines for interpreting reliability data and establishing acceptance criteria. For flexible circuits, a maximum resistance increase of 20% is typically considered acceptable after reliability testing, though this threshold varies by application.

Recent developments in reliability testing include the implementation of in-situ monitoring techniques that allow for continuous measurement during environmental exposure, providing more detailed insights into failure mechanisms and degradation kinetics of conductive adhesives in flexible circuit applications.

Temperature cycling tests (JEDEC JESD22-A104) represent one of the most widely implemented reliability assessments, typically subjecting samples to cycles between -40°C and 125°C for 500-1000 cycles. This test effectively simulates the thermal expansion mismatch stresses that occur in real-world applications. For flexible circuits specifically, the test parameters may be modified to reflect the unique operating conditions of wearable electronics or automotive flexible interconnects.

Humidity testing follows standards such as JEDEC JESD22-A101, exposing conductive adhesive joints to 85°C/85% RH conditions for periods ranging from 168 to 1000 hours. This methodology is particularly relevant for evaluating silver-filled epoxy adhesives, which can exhibit significant performance degradation in high-humidity environments due to silver migration phenomena.

Mechanical reliability testing includes bend testing (ASTM D4338), peel strength (ASTM D903), and vibration testing (MIL-STD-810G). For flexible circuit applications, dynamic bend testing is especially important, with samples typically subjected to 10,000+ cycles of bending at specified radii. The IEC 60068-2-21 standard provides guidelines for testing the mechanical robustness of electrical connections.

Accelerated aging tests combine multiple stressors to predict long-term reliability. The Highly Accelerated Stress Test (HAST) exposes samples to elevated temperature, humidity, and bias voltage simultaneously. For automotive applications, additional tests including salt spray exposure (ASTM B117) and fluid resistance (ISO 16750-5) are commonly implemented.

Electrical performance degradation is monitored throughout these tests, with resistance measurements taken at regular intervals. The IPC-9701 standard provides guidelines for interpreting reliability data and establishing acceptance criteria. For flexible circuits, a maximum resistance increase of 20% is typically considered acceptable after reliability testing, though this threshold varies by application.

Recent developments in reliability testing include the implementation of in-situ monitoring techniques that allow for continuous measurement during environmental exposure, providing more detailed insights into failure mechanisms and degradation kinetics of conductive adhesives in flexible circuit applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!