Regulatory and Patent Considerations for Conductive Adhesives

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Adhesives Technology Background and Objectives

Conductive adhesives have emerged as a critical technology in modern electronics manufacturing, offering alternatives to traditional soldering methods. The evolution of this technology can be traced back to the 1950s when basic electrically conductive adhesives were first developed for specialized applications. Over subsequent decades, significant advancements have occurred in formulation chemistry, particle technology, and application methodologies, transforming conductive adhesives from niche solutions to mainstream interconnection materials.

The technological trajectory of conductive adhesives has been largely driven by environmental regulations and performance requirements in electronics. The global transition away from lead-based solders, accelerated by the European Union's Restriction of Hazardous Substances (RoHS) directive implemented in 2006, created substantial momentum for conductive adhesive development. This regulatory push coincided with the miniaturization trend in electronics, creating dual drivers for advancement in this field.

Conductive adhesives are primarily categorized into isotropic conductive adhesives (ICAs) and anisotropic conductive adhesives (ACAs), each serving distinct application needs. ICAs conduct electricity in all directions and typically contain 25-30% metal fillers by volume, while ACAs conduct primarily in one direction and contain lower filler concentrations. This technological differentiation has enabled specialized solutions for varying interconnection requirements.

The current technological objectives in conductive adhesive development focus on several key areas: enhancing electrical conductivity while maintaining mechanical flexibility, improving thermal stability for high-temperature applications, developing environmentally sustainable formulations, and ensuring compatibility with increasingly miniaturized electronic components. Additionally, there is growing interest in developing conductive adhesives with self-healing properties and improved aging characteristics to extend product lifecycles.

Patent activity in conductive adhesives has shown consistent growth, with significant concentration in Asia, particularly Japan, South Korea, and China. Major electronics manufacturers and specialty chemical companies hold substantial intellectual property portfolios in this space. The patent landscape reveals increasing focus on nanomaterial incorporation, particularly silver nanowires, carbon nanotubes, and graphene derivatives, to achieve superior conductivity at lower filler loadings.

The regulatory framework governing conductive adhesives continues to evolve, with increasing attention to environmental impact, recyclability, and end-of-life considerations. Future development trajectories will likely be shaped by both technological innovation and regulatory requirements, particularly those related to electronic waste management and circular economy principles.

The technological trajectory of conductive adhesives has been largely driven by environmental regulations and performance requirements in electronics. The global transition away from lead-based solders, accelerated by the European Union's Restriction of Hazardous Substances (RoHS) directive implemented in 2006, created substantial momentum for conductive adhesive development. This regulatory push coincided with the miniaturization trend in electronics, creating dual drivers for advancement in this field.

Conductive adhesives are primarily categorized into isotropic conductive adhesives (ICAs) and anisotropic conductive adhesives (ACAs), each serving distinct application needs. ICAs conduct electricity in all directions and typically contain 25-30% metal fillers by volume, while ACAs conduct primarily in one direction and contain lower filler concentrations. This technological differentiation has enabled specialized solutions for varying interconnection requirements.

The current technological objectives in conductive adhesive development focus on several key areas: enhancing electrical conductivity while maintaining mechanical flexibility, improving thermal stability for high-temperature applications, developing environmentally sustainable formulations, and ensuring compatibility with increasingly miniaturized electronic components. Additionally, there is growing interest in developing conductive adhesives with self-healing properties and improved aging characteristics to extend product lifecycles.

Patent activity in conductive adhesives has shown consistent growth, with significant concentration in Asia, particularly Japan, South Korea, and China. Major electronics manufacturers and specialty chemical companies hold substantial intellectual property portfolios in this space. The patent landscape reveals increasing focus on nanomaterial incorporation, particularly silver nanowires, carbon nanotubes, and graphene derivatives, to achieve superior conductivity at lower filler loadings.

The regulatory framework governing conductive adhesives continues to evolve, with increasing attention to environmental impact, recyclability, and end-of-life considerations. Future development trajectories will likely be shaped by both technological innovation and regulatory requirements, particularly those related to electronic waste management and circular economy principles.

Market Demand Analysis for Conductive Adhesives

The global market for conductive adhesives has been experiencing robust growth, driven primarily by the expanding electronics industry and the increasing demand for miniaturized electronic devices. The market size was valued at approximately 3.4 billion USD in 2022 and is projected to reach 5.7 billion USD by 2028, representing a compound annual growth rate (CAGR) of 8.9% during the forecast period.

The electronics industry remains the largest consumer of conductive adhesives, accounting for over 65% of the total market share. Within this sector, the demand is particularly strong in consumer electronics, automotive electronics, and telecommunications. The trend toward smaller, lighter, and more powerful electronic devices has significantly boosted the need for conductive adhesives as alternatives to traditional soldering methods.

Automotive electronics represents one of the fastest-growing application segments, with a growth rate exceeding 10% annually. This surge is attributed to the increasing integration of electronic components in vehicles, especially in electric and hybrid vehicles where thermal management and electrical conductivity are critical factors.

The healthcare sector is emerging as a promising market for conductive adhesives, particularly in medical devices and wearable health monitoring systems. The market in this segment is expected to grow at a CAGR of 9.5% through 2028, driven by innovations in biocompatible conductive adhesives that can be safely used in direct contact with human skin.

Geographically, Asia-Pacific dominates the market with approximately 45% share, led by manufacturing powerhouses like China, Japan, South Korea, and Taiwan. North America and Europe follow with market shares of 25% and 20% respectively, with significant demand coming from advanced electronics manufacturing and automotive industries.

Environmental regulations are increasingly influencing market dynamics, with growing demand for lead-free and environmentally friendly conductive adhesives. This trend is particularly pronounced in Europe and North America, where stringent environmental regulations are driving the adoption of eco-friendly alternatives.

The market is also witnessing a shift toward silver-filled conductive adhesives due to their superior conductivity properties, despite their higher cost compared to other variants. However, cost considerations remain a significant factor influencing market adoption, especially in price-sensitive applications and regions.

Industry analysts predict that the development of new conductive adhesive formulations with enhanced properties such as improved conductivity, better adhesion, and increased reliability will further expand the market potential, particularly in emerging applications like flexible electronics, printed electronics, and Internet of Things (IoT) devices.

The electronics industry remains the largest consumer of conductive adhesives, accounting for over 65% of the total market share. Within this sector, the demand is particularly strong in consumer electronics, automotive electronics, and telecommunications. The trend toward smaller, lighter, and more powerful electronic devices has significantly boosted the need for conductive adhesives as alternatives to traditional soldering methods.

Automotive electronics represents one of the fastest-growing application segments, with a growth rate exceeding 10% annually. This surge is attributed to the increasing integration of electronic components in vehicles, especially in electric and hybrid vehicles where thermal management and electrical conductivity are critical factors.

The healthcare sector is emerging as a promising market for conductive adhesives, particularly in medical devices and wearable health monitoring systems. The market in this segment is expected to grow at a CAGR of 9.5% through 2028, driven by innovations in biocompatible conductive adhesives that can be safely used in direct contact with human skin.

Geographically, Asia-Pacific dominates the market with approximately 45% share, led by manufacturing powerhouses like China, Japan, South Korea, and Taiwan. North America and Europe follow with market shares of 25% and 20% respectively, with significant demand coming from advanced electronics manufacturing and automotive industries.

Environmental regulations are increasingly influencing market dynamics, with growing demand for lead-free and environmentally friendly conductive adhesives. This trend is particularly pronounced in Europe and North America, where stringent environmental regulations are driving the adoption of eco-friendly alternatives.

The market is also witnessing a shift toward silver-filled conductive adhesives due to their superior conductivity properties, despite their higher cost compared to other variants. However, cost considerations remain a significant factor influencing market adoption, especially in price-sensitive applications and regions.

Industry analysts predict that the development of new conductive adhesive formulations with enhanced properties such as improved conductivity, better adhesion, and increased reliability will further expand the market potential, particularly in emerging applications like flexible electronics, printed electronics, and Internet of Things (IoT) devices.

Global Technical Status and Challenges in Conductive Adhesives

The global landscape of conductive adhesives technology presents a complex picture of advancement and challenges. Currently, the market is dominated by silver-filled epoxy adhesives, which have established themselves as the industry standard due to their excellent conductivity and reliability. However, these traditional solutions face significant limitations including high cost, potential silver migration issues, and environmental concerns related to heavy metal content.

In Asia, particularly in Japan, China, and South Korea, there has been substantial progress in developing nano-particle enhanced conductive adhesives that offer improved performance at lower filler loadings. These regions lead in manufacturing scale and cost optimization, with China emerging as the largest producer of conductive adhesives globally.

European research institutions and companies have focused on environmentally friendly alternatives, pioneering lead-free and halogen-free formulations that comply with RoHS and REACH regulations. The European approach emphasizes sustainability alongside performance, with notable advancements in bio-based conductive adhesives.

North American entities, particularly in the United States, maintain technological leadership in high-performance specialty applications, with significant innovations in anisotropic conductive adhesives (ACAs) for microelectronics and aerospace applications. The region excels in developing solutions for extreme operating conditions.

The primary technical challenges currently facing the conductive adhesives field include achieving stable electrical conductivity under thermal cycling and high humidity conditions. Many existing formulations suffer from performance degradation over time, limiting their application in mission-critical systems requiring long-term reliability.

Another significant hurdle is the trade-off between conductivity and mechanical properties. Higher filler loadings improve electrical performance but often compromise adhesion strength, flexibility, and impact resistance. This balance remains difficult to optimize across diverse application requirements.

Manufacturing scalability presents additional challenges, particularly for newer formulations incorporating nanomaterials. Consistent dispersion of conductive particles, prevention of agglomeration, and maintaining batch-to-batch consistency remain problematic for mass production scenarios.

The integration of conductive adhesives with emerging substrate materials, such as flexible electronics and 3D-printed components, introduces compatibility issues that require novel approaches. Current adhesives often fail to maintain performance when applied to non-traditional surfaces or when subjected to repeated flexing.

Regulatory compliance varies significantly across regions, creating a fragmented landscape of technical requirements that manufacturers must navigate. This regulatory complexity has slowed global adoption and standardization of advanced conductive adhesive technologies.

In Asia, particularly in Japan, China, and South Korea, there has been substantial progress in developing nano-particle enhanced conductive adhesives that offer improved performance at lower filler loadings. These regions lead in manufacturing scale and cost optimization, with China emerging as the largest producer of conductive adhesives globally.

European research institutions and companies have focused on environmentally friendly alternatives, pioneering lead-free and halogen-free formulations that comply with RoHS and REACH regulations. The European approach emphasizes sustainability alongside performance, with notable advancements in bio-based conductive adhesives.

North American entities, particularly in the United States, maintain technological leadership in high-performance specialty applications, with significant innovations in anisotropic conductive adhesives (ACAs) for microelectronics and aerospace applications. The region excels in developing solutions for extreme operating conditions.

The primary technical challenges currently facing the conductive adhesives field include achieving stable electrical conductivity under thermal cycling and high humidity conditions. Many existing formulations suffer from performance degradation over time, limiting their application in mission-critical systems requiring long-term reliability.

Another significant hurdle is the trade-off between conductivity and mechanical properties. Higher filler loadings improve electrical performance but often compromise adhesion strength, flexibility, and impact resistance. This balance remains difficult to optimize across diverse application requirements.

Manufacturing scalability presents additional challenges, particularly for newer formulations incorporating nanomaterials. Consistent dispersion of conductive particles, prevention of agglomeration, and maintaining batch-to-batch consistency remain problematic for mass production scenarios.

The integration of conductive adhesives with emerging substrate materials, such as flexible electronics and 3D-printed components, introduces compatibility issues that require novel approaches. Current adhesives often fail to maintain performance when applied to non-traditional surfaces or when subjected to repeated flexing.

Regulatory compliance varies significantly across regions, creating a fragmented landscape of technical requirements that manufacturers must navigate. This regulatory complexity has slowed global adoption and standardization of advanced conductive adhesive technologies.

Current Technical Solutions for Conductive Adhesives

01 Conductive fillers in adhesive compositions

Conductive adhesives incorporate various conductive fillers to achieve electrical conductivity. These fillers include metallic particles (such as silver, copper, nickel), carbon-based materials (like carbon nanotubes, graphene), and other conductive materials that create electrical pathways through the adhesive matrix. The type, size, shape, and concentration of these fillers significantly impact the conductivity, adhesion strength, and processing characteristics of the final adhesive.- Conductive fillers in adhesive compositions: Conductive adhesives incorporate various conductive fillers to achieve electrical conductivity. These fillers include metal particles (such as silver, gold, copper), carbon-based materials (like carbon nanotubes, graphene), and metal-coated particles. The type, size, shape, and concentration of these fillers significantly impact the adhesive's conductivity, mechanical properties, and processing characteristics. Optimizing the filler loading allows for balancing conductivity requirements with adhesion strength and flexibility.

- Polymer matrices for conductive adhesives: The polymer matrix serves as the binding component in conductive adhesives, providing adhesion while supporting the conductive network. Common polymer systems include epoxies, silicones, acrylics, and polyurethanes, each offering different properties regarding curing mechanisms, temperature resistance, and flexibility. Advanced formulations may incorporate hybrid polymer systems or specialized additives to enhance specific properties such as thermal stability, moisture resistance, or mechanical strength while maintaining electrical conductivity.

- Anisotropic conductive adhesives: Anisotropic conductive adhesives (ACAs) provide electrical conductivity in a specific direction while maintaining insulation in other directions. These specialized adhesives typically contain conductive particles dispersed in an insulating adhesive matrix. When compressed between electrical contacts, the particles form conductive pathways in the z-direction while remaining isolated laterally. ACAs are particularly valuable in fine-pitch electronics assembly, display technologies, and flexible circuit connections where directional conductivity is required.

- Thermal management in conductive adhesives: Conductive adhesives often serve dual purposes of electrical connection and thermal management. Formulations may incorporate thermally conductive fillers such as aluminum oxide, boron nitride, or metal particles to enhance heat dissipation. These adhesives are critical in power electronics, LED applications, and other heat-generating devices where efficient thermal transfer is essential for reliability and performance. The balance between electrical conductivity, thermal conductivity, and mechanical properties is carefully engineered based on application requirements.

- Application methods and curing technologies: Conductive adhesives employ various application and curing technologies to optimize performance and manufacturing efficiency. Application methods include screen printing, dispensing, stencil printing, and jet printing, each suited to different assembly requirements. Curing technologies range from thermal curing to UV-initiated systems, microwave curing, and room-temperature curing formulations. Advanced systems may incorporate dual-cure mechanisms or snap-cure properties to accommodate complex assembly processes while ensuring complete polymerization and optimal electrical performance.

02 Polymer matrices for conductive adhesives

The polymer matrix serves as the binding component in conductive adhesives, providing adhesion while suspending conductive fillers. Various polymer types are used, including epoxies, silicones, acrylics, and polyurethanes, each offering different properties such as flexibility, thermal stability, and curing mechanisms. The selection of polymer matrix affects not only the mechanical properties but also how the conductive fillers disperse and connect within the adhesive, ultimately influencing conductivity and reliability.Expand Specific Solutions03 Application-specific conductive adhesive formulations

Conductive adhesives are formulated specifically for different applications such as electronics assembly, semiconductor packaging, EMI/RFI shielding, and thermal management. These specialized formulations consider factors like operating temperature, mechanical stress, environmental exposure, and electrical performance requirements. For instance, adhesives for flexible electronics require different properties than those used for rigid circuit boards or high-temperature applications.Expand Specific Solutions04 Processing and curing methods

The processing and curing methods for conductive adhesives significantly impact their performance. Various approaches include thermal curing, UV curing, pressure-assisted curing, and room-temperature curing systems. The curing process affects how conductive particles align and connect, influencing the final electrical conductivity. Processing parameters such as temperature profiles, pressure application, and curing time must be optimized to achieve desired conductivity while maintaining adhesion strength and reliability.Expand Specific Solutions05 Innovations in anisotropic conductive adhesives

Anisotropic conductive adhesives (ACAs) provide electrical conductivity in specific directions while maintaining insulation in others. These specialized adhesives typically contain conductive particles in concentrations below the percolation threshold, which become conductive only when compressed between electrical contacts. Recent innovations include nano-scale conductive particles, hybrid organic-inorganic compositions, and self-aligning particles that improve connection reliability while reducing pitch requirements for high-density interconnections.Expand Specific Solutions

Major Industry Players and Competitive Landscape

The conductive adhesives market is currently in a growth phase, driven by increasing demand in electronics, automotive, and renewable energy sectors. The global market size is estimated to exceed $3 billion, with projected annual growth of 8-10% through 2028. Technologically, the field is maturing but still evolving, with major players focusing on regulatory compliance and intellectual property protection. Leading companies like 3M, Henkel, and Dow are dominating patent portfolios, while Asian manufacturers including Shin-Etsu, Nitto Denko, and Samsung Display are rapidly expanding their IP presence. Japanese firms particularly hold significant patents in specialized applications. The regulatory landscape is complex, with companies navigating environmental regulations (RoHS, REACH) while protecting innovations through strategic patenting across multiple jurisdictions.

3M Innovative Properties Co.

Technical Solution: 3M has developed a comprehensive approach to conductive adhesives focusing on regulatory compliance and patent protection. Their technology involves electrically conductive adhesive compositions comprising a curable adhesive component and electrically conductive particles. These adhesives are designed to meet stringent environmental regulations including RoHS and REACH compliance by eliminating lead and other restricted substances[1]. 3M's patent portfolio covers various formulations including anisotropic conductive films (ACFs) and isotropic conductive adhesives (ICAs) with specific attention to thermal management properties. Their regulatory strategy includes obtaining UL certification for flame retardancy and electrical safety while maintaining compliance with FDA regulations for applications in medical devices[3]. The company has also developed specialized testing protocols to verify electromagnetic compatibility (EMC) and electromagnetic interference (EMI) shielding properties of their conductive adhesives, ensuring they meet international standards like IEC 61000.

Strengths: Extensive patent portfolio covering multiple conductive adhesive technologies; strong regulatory compliance framework across global markets; established testing and certification processes. Weaknesses: Higher cost compared to traditional soldering methods; some formulations may have limited high-temperature performance; potential challenges with long-term reliability in extreme environments.

Henkel AG & Co. KGaA

Technical Solution: Henkel has pioneered a dual-approach strategy for conductive adhesives focusing on both regulatory compliance and intellectual property protection. Their LOCTITE® conductive adhesive technology incorporates silver, gold, or carbon fillers in epoxy, silicone, or acrylic matrices, carefully formulated to comply with global electronics manufacturing regulations[2]. Henkel's patent strategy covers both composition and application methods, with particular focus on anisotropic conductive adhesives for fine-pitch electronics. Their regulatory approach includes comprehensive documentation for REACH and RoHS compliance, with specific attention to the exemption status of certain conductive fillers under these frameworks. Henkel has developed specialized testing protocols to verify electrical performance while maintaining compliance with IPC standards for electronics assembly. Their patent portfolio includes innovations in reworkable conductive adhesives that allow for component replacement while maintaining environmental compliance[5]. Additionally, Henkel has established a global regulatory affairs team that monitors changing international regulations to ensure continued compliance across different markets.

Strengths: Comprehensive patent portfolio covering both materials and application methods; strong global regulatory compliance team; established position in electronics manufacturing supply chains. Weaknesses: Higher cost structure compared to traditional interconnect methods; some formulations have limited shelf life; potential challenges with thermal cycling reliability in automotive applications.

Key Patents and Technical Literature Analysis

Electrically Conductive Adhesives

PatentInactiveUS20120177930A1

Innovation

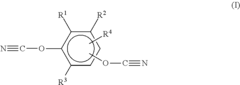

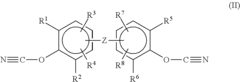

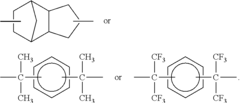

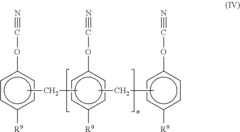

- A composite adhesive comprising cyanate ester and epoxy resin components, a nitrogen-containing curative, and a low melting point metal filler, which forms an electrically conductive bond between substrates, curing within 0.1 seconds to 100 minutes at 50°C to 220°C, offering high adhesion, stable electrical contact resistance, and high electrical conductivity.

Conductive adhesive and LED substrate using the same

PatentInactiveUS20110140162A1

Innovation

- A conductive adhesive comprising a conductive filler with a metal powder of 2-30 μm average particle size and ultrafine metal particles of 100 nm or less, which increases packing density and forms a metallic bond at low sintering temperatures, along with a binder resin and solvent, optimizing the content of each component to achieve balanced properties.

Regulatory Framework and Compliance Requirements

The regulatory landscape for conductive adhesives spans multiple domains including environmental protection, worker safety, and industry-specific standards. In the United States, the Environmental Protection Agency (EPA) regulates many conductive adhesive components under the Toxic Substances Control Act (TSCA), particularly those containing heavy metals or volatile organic compounds (VOCs). The Occupational Safety and Health Administration (OSHA) establishes workplace exposure limits for potentially hazardous ingredients commonly found in these formulations, such as silver particles and epoxy resins.

European regulations present more stringent requirements through the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) and Restriction of Hazardous Substances (RoHS) directives. These frameworks significantly impact conductive adhesive formulations by restricting certain substances and requiring comprehensive documentation of chemical properties and safety profiles. Manufacturers must ensure their products contain less than 0.1% by weight of restricted substances including lead, mercury, and hexavalent chromium.

In the electronics industry, compliance with IPC standards is paramount, particularly IPC-4101 for base materials and IPC-A-610 for acceptability of electronic assemblies. These standards define performance requirements for conductive adhesives used in circuit assembly, including electrical conductivity parameters, thermal stability metrics, and mechanical strength specifications.

Medical device applications face additional regulatory hurdles through FDA requirements in the US and Medical Device Regulation (MDR) in Europe. These frameworks demand biocompatibility testing according to ISO 10993 standards and comprehensive documentation of material properties when conductive adhesives are used in medical devices.

Automotive applications must adhere to industry-specific standards such as IATF 16949 quality management systems and various OEM specifications. These standards often include requirements for thermal cycling resistance, vibration tolerance, and long-term reliability under harsh environmental conditions.

Emerging global harmonization efforts are attempting to standardize regulatory approaches across regions, with initiatives like the Globally Harmonized System of Classification and Labeling of Chemicals (GHS) providing consistent hazard communication frameworks. This trend is gradually reducing regulatory fragmentation, though significant regional differences persist.

Compliance documentation requirements have grown increasingly complex, with manufacturers now expected to maintain comprehensive technical files including safety data sheets (SDS), technical data sheets (TDS), declarations of conformity, and in some cases, full material disclosure (FMD) documentation. These requirements create substantial administrative burdens but are essential for market access across global supply chains.

European regulations present more stringent requirements through the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) and Restriction of Hazardous Substances (RoHS) directives. These frameworks significantly impact conductive adhesive formulations by restricting certain substances and requiring comprehensive documentation of chemical properties and safety profiles. Manufacturers must ensure their products contain less than 0.1% by weight of restricted substances including lead, mercury, and hexavalent chromium.

In the electronics industry, compliance with IPC standards is paramount, particularly IPC-4101 for base materials and IPC-A-610 for acceptability of electronic assemblies. These standards define performance requirements for conductive adhesives used in circuit assembly, including electrical conductivity parameters, thermal stability metrics, and mechanical strength specifications.

Medical device applications face additional regulatory hurdles through FDA requirements in the US and Medical Device Regulation (MDR) in Europe. These frameworks demand biocompatibility testing according to ISO 10993 standards and comprehensive documentation of material properties when conductive adhesives are used in medical devices.

Automotive applications must adhere to industry-specific standards such as IATF 16949 quality management systems and various OEM specifications. These standards often include requirements for thermal cycling resistance, vibration tolerance, and long-term reliability under harsh environmental conditions.

Emerging global harmonization efforts are attempting to standardize regulatory approaches across regions, with initiatives like the Globally Harmonized System of Classification and Labeling of Chemicals (GHS) providing consistent hazard communication frameworks. This trend is gradually reducing regulatory fragmentation, though significant regional differences persist.

Compliance documentation requirements have grown increasingly complex, with manufacturers now expected to maintain comprehensive technical files including safety data sheets (SDS), technical data sheets (TDS), declarations of conformity, and in some cases, full material disclosure (FMD) documentation. These requirements create substantial administrative burdens but are essential for market access across global supply chains.

Intellectual Property Strategy and Patent Portfolio Management

Effective intellectual property (IP) management is crucial for companies developing conductive adhesive technologies. A comprehensive IP strategy should begin with a thorough landscape analysis to identify existing patents, white spaces, and potential infringement risks in the conductive adhesives field. This analysis reveals that major players like Henkel, 3M, and Dow Chemical hold significant patent portfolios covering formulations, manufacturing processes, and application methods.

For organizations seeking to innovate in this space, strategic patent filing approaches are essential. Geographic considerations should guide filing decisions, with priority given to markets with high manufacturing volumes (China, South Korea, Japan) and significant R&D activities (US, Germany). Companies should balance broad claims covering fundamental formulation principles with narrower claims addressing specific performance characteristics such as thermal conductivity, electrical resistance, and environmental stability.

Freedom-to-operate (FTO) analyses must be conducted regularly to navigate the complex patent landscape. This is particularly important for conductive adhesives, where overlapping claims between electronic materials, polymer chemistry, and manufacturing methods create potential infringement risks. Establishing a systematic approach to monitoring competitor patent activities can provide early warning of emerging threats and opportunities.

Strategic licensing and partnership arrangements offer valuable pathways for accessing protected technologies. Cross-licensing agreements with complementary technology holders can expand product capabilities while reducing litigation risks. For startups and smaller enterprises, strategic partnerships with established players may provide access to foundational patents while contributing specialized innovations.

Trade secret protection represents an alternative or complementary approach to patenting, particularly for manufacturing processes and formulation details that are difficult to reverse-engineer. Companies should implement robust internal protocols to maintain confidentiality while carefully evaluating which innovations to patent versus protect as trade secrets.

Defensive publication strategies can be employed for incremental innovations that may not warrant full patent protection but should be prevented from being patented by competitors. This approach creates prior art that blocks others from obtaining patents while preserving the company's freedom to operate.

Finally, a well-structured patent portfolio should align with product development roadmaps, ensuring protection extends to next-generation conductive adhesive technologies while maintaining coverage for current commercial products. Regular portfolio reviews should assess patent strength, commercial relevance, and maintenance fee justification to optimize resource allocation.

For organizations seeking to innovate in this space, strategic patent filing approaches are essential. Geographic considerations should guide filing decisions, with priority given to markets with high manufacturing volumes (China, South Korea, Japan) and significant R&D activities (US, Germany). Companies should balance broad claims covering fundamental formulation principles with narrower claims addressing specific performance characteristics such as thermal conductivity, electrical resistance, and environmental stability.

Freedom-to-operate (FTO) analyses must be conducted regularly to navigate the complex patent landscape. This is particularly important for conductive adhesives, where overlapping claims between electronic materials, polymer chemistry, and manufacturing methods create potential infringement risks. Establishing a systematic approach to monitoring competitor patent activities can provide early warning of emerging threats and opportunities.

Strategic licensing and partnership arrangements offer valuable pathways for accessing protected technologies. Cross-licensing agreements with complementary technology holders can expand product capabilities while reducing litigation risks. For startups and smaller enterprises, strategic partnerships with established players may provide access to foundational patents while contributing specialized innovations.

Trade secret protection represents an alternative or complementary approach to patenting, particularly for manufacturing processes and formulation details that are difficult to reverse-engineer. Companies should implement robust internal protocols to maintain confidentiality while carefully evaluating which innovations to patent versus protect as trade secrets.

Defensive publication strategies can be employed for incremental innovations that may not warrant full patent protection but should be prevented from being patented by competitors. This approach creates prior art that blocks others from obtaining patents while preserving the company's freedom to operate.

Finally, a well-structured patent portfolio should align with product development roadmaps, ensuring protection extends to next-generation conductive adhesive technologies while maintaining coverage for current commercial products. Regular portfolio reviews should assess patent strength, commercial relevance, and maintenance fee justification to optimize resource allocation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!