Conductive Adhesives: Manufacturing Challenges and Solutions

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Adhesives Background and Development Goals

Conductive adhesives have emerged as a critical technology in modern electronics manufacturing, offering alternatives to traditional soldering methods. The evolution of these materials can be traced back to the 1960s when the first electrically conductive adhesives (ECAs) were developed primarily for specialized military and aerospace applications. Initially limited by performance constraints, these early formulations laid the groundwork for subsequent innovations that have transformed the industry.

The development trajectory of conductive adhesives has been significantly influenced by environmental regulations, particularly the Restriction of Hazardous Substances (RoHS) directive implemented in 2006, which restricted the use of lead in electronics. This regulatory shift accelerated research into lead-free joining technologies, positioning conductive adhesives as a viable alternative to traditional soldering methods.

Modern conductive adhesives typically fall into two main categories: isotropically conductive adhesives (ICAs) and anisotropically conductive adhesives (ACAs). ICAs conduct electricity in all directions and are commonly used in die attach applications, while ACAs conduct primarily in one direction and find applications in fine-pitch interconnections. The market has also seen the emergence of non-epoxy based formulations, including silicone and polyimide matrices, expanding the application range of these materials.

The current technical landscape is characterized by ongoing efforts to enhance conductivity while maintaining mechanical reliability. Nanomaterials, particularly silver nanoparticles and carbon nanotubes, have been incorporated to improve electrical performance without compromising other properties. These advancements have enabled conductive adhesives to address increasingly complex assembly challenges in miniaturized electronic devices.

The primary development goals for conductive adhesives center on overcoming several persistent limitations. These include improving electrical conductivity to match or exceed that of traditional solder joints, enhancing thermal conductivity for better heat dissipation, and increasing mechanical strength and durability under thermal cycling conditions. Additionally, there is a strong focus on reducing curing temperatures and times to accommodate temperature-sensitive components and increase manufacturing throughput.

Looking forward, the industry aims to develop formulations that maintain stable performance in harsh environments, particularly high-temperature and high-humidity conditions. There is also significant interest in creating reworkable conductive adhesives that allow for component replacement without damaging the underlying substrate, addressing a key limitation compared to traditional soldering methods. The ultimate goal remains creating versatile, high-performance adhesives that can serve as drop-in replacements for conventional soldering across a broader range of applications.

The development trajectory of conductive adhesives has been significantly influenced by environmental regulations, particularly the Restriction of Hazardous Substances (RoHS) directive implemented in 2006, which restricted the use of lead in electronics. This regulatory shift accelerated research into lead-free joining technologies, positioning conductive adhesives as a viable alternative to traditional soldering methods.

Modern conductive adhesives typically fall into two main categories: isotropically conductive adhesives (ICAs) and anisotropically conductive adhesives (ACAs). ICAs conduct electricity in all directions and are commonly used in die attach applications, while ACAs conduct primarily in one direction and find applications in fine-pitch interconnections. The market has also seen the emergence of non-epoxy based formulations, including silicone and polyimide matrices, expanding the application range of these materials.

The current technical landscape is characterized by ongoing efforts to enhance conductivity while maintaining mechanical reliability. Nanomaterials, particularly silver nanoparticles and carbon nanotubes, have been incorporated to improve electrical performance without compromising other properties. These advancements have enabled conductive adhesives to address increasingly complex assembly challenges in miniaturized electronic devices.

The primary development goals for conductive adhesives center on overcoming several persistent limitations. These include improving electrical conductivity to match or exceed that of traditional solder joints, enhancing thermal conductivity for better heat dissipation, and increasing mechanical strength and durability under thermal cycling conditions. Additionally, there is a strong focus on reducing curing temperatures and times to accommodate temperature-sensitive components and increase manufacturing throughput.

Looking forward, the industry aims to develop formulations that maintain stable performance in harsh environments, particularly high-temperature and high-humidity conditions. There is also significant interest in creating reworkable conductive adhesives that allow for component replacement without damaging the underlying substrate, addressing a key limitation compared to traditional soldering methods. The ultimate goal remains creating versatile, high-performance adhesives that can serve as drop-in replacements for conventional soldering across a broader range of applications.

Market Demand Analysis for Conductive Adhesives

The global market for conductive adhesives has witnessed substantial growth in recent years, driven primarily by the expanding electronics industry and the increasing demand for miniaturized electronic components. The market value reached approximately $3.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% through 2028, potentially reaching $5.4 billion by the end of the forecast period.

The electronics sector remains the dominant consumer of conductive adhesives, accounting for over 65% of the total market share. Within this sector, consumer electronics, particularly smartphones, tablets, and wearable devices, represent the largest application segment. The trend toward smaller, lighter, and more powerful electronic devices has significantly boosted the demand for conductive adhesives as alternatives to traditional soldering methods.

Automotive electronics has emerged as the fastest-growing application segment, with a growth rate exceeding 8% annually. This surge is attributed to the increasing integration of electronic components in vehicles and the rapid expansion of the electric vehicle (EV) market. Modern vehicles contain numerous electronic control units, sensors, and displays, all requiring reliable interconnection solutions that can withstand harsh operating conditions.

The healthcare sector presents another promising market for conductive adhesives, particularly in medical devices and wearable health monitors. The market in this segment is growing at approximately 7.5% annually, driven by innovations in patient monitoring systems and implantable medical devices.

Regionally, Asia-Pacific dominates the conductive adhesives market, accounting for approximately 45% of global consumption. This dominance is primarily due to the concentration of electronics manufacturing facilities in countries like China, Japan, South Korea, and Taiwan. North America and Europe follow with market shares of approximately 25% and 20% respectively.

Customer requirements are increasingly focused on performance characteristics such as thermal conductivity, electrical conductivity, adhesion strength, and environmental resistance. Additionally, there is growing demand for eco-friendly formulations with reduced volatile organic compound (VOC) content and lead-free compositions, driven by stringent environmental regulations in major markets.

Price sensitivity varies significantly across application segments. While consumer electronics manufacturers are highly price-sensitive due to competitive pressures, automotive and aerospace applications place greater emphasis on reliability and performance, allowing for premium pricing for high-performance conductive adhesives.

The market is also witnessing increased demand for specialized conductive adhesives designed for emerging technologies such as flexible electronics, printed electronics, and 5G infrastructure. These applications require adhesives with specific performance characteristics, creating new market niches and opportunities for product differentiation.

The electronics sector remains the dominant consumer of conductive adhesives, accounting for over 65% of the total market share. Within this sector, consumer electronics, particularly smartphones, tablets, and wearable devices, represent the largest application segment. The trend toward smaller, lighter, and more powerful electronic devices has significantly boosted the demand for conductive adhesives as alternatives to traditional soldering methods.

Automotive electronics has emerged as the fastest-growing application segment, with a growth rate exceeding 8% annually. This surge is attributed to the increasing integration of electronic components in vehicles and the rapid expansion of the electric vehicle (EV) market. Modern vehicles contain numerous electronic control units, sensors, and displays, all requiring reliable interconnection solutions that can withstand harsh operating conditions.

The healthcare sector presents another promising market for conductive adhesives, particularly in medical devices and wearable health monitors. The market in this segment is growing at approximately 7.5% annually, driven by innovations in patient monitoring systems and implantable medical devices.

Regionally, Asia-Pacific dominates the conductive adhesives market, accounting for approximately 45% of global consumption. This dominance is primarily due to the concentration of electronics manufacturing facilities in countries like China, Japan, South Korea, and Taiwan. North America and Europe follow with market shares of approximately 25% and 20% respectively.

Customer requirements are increasingly focused on performance characteristics such as thermal conductivity, electrical conductivity, adhesion strength, and environmental resistance. Additionally, there is growing demand for eco-friendly formulations with reduced volatile organic compound (VOC) content and lead-free compositions, driven by stringent environmental regulations in major markets.

Price sensitivity varies significantly across application segments. While consumer electronics manufacturers are highly price-sensitive due to competitive pressures, automotive and aerospace applications place greater emphasis on reliability and performance, allowing for premium pricing for high-performance conductive adhesives.

The market is also witnessing increased demand for specialized conductive adhesives designed for emerging technologies such as flexible electronics, printed electronics, and 5G infrastructure. These applications require adhesives with specific performance characteristics, creating new market niches and opportunities for product differentiation.

Technical Challenges in Conductive Adhesive Manufacturing

Conductive adhesives face significant manufacturing challenges that impact their performance, reliability, and commercial viability. The primary technical hurdle involves achieving consistent electrical conductivity while maintaining strong mechanical adhesion. This dual functionality requirement creates inherent tensions in material design and processing parameters that manufacturers must carefully balance.

The dispersion of conductive fillers represents a critical manufacturing challenge. Achieving uniform distribution of metallic particles (typically silver, copper, or nickel) throughout the polymer matrix requires sophisticated mixing technologies. Inadequate dispersion leads to conductivity variations, potential hot spots, and unreliable electrical performance. Advanced mixing equipment utilizing ultrasonic or high-shear technologies can improve dispersion but adds complexity and cost to manufacturing processes.

Viscosity control presents another significant challenge during production. Conductive adhesives must maintain appropriate flow characteristics for application methods ranging from screen printing to dispensing. The addition of conductive fillers inherently increases viscosity, often requiring careful formulation adjustments with rheology modifiers. These adjustments must not compromise electrical performance or curing properties, creating a complex optimization problem.

Curing processes introduce additional manufacturing complexities. Temperature profiles must be precisely controlled to ensure complete polymerization without damaging temperature-sensitive components. Incomplete curing leads to poor mechanical strength and reliability issues, while excessive temperatures can cause polymer degradation or filler oxidation. The development of low-temperature curing systems remains an active research area but often involves trade-offs with cure speed and final properties.

Shelf life stability represents a significant manufacturing and logistics challenge. Conductive adhesives typically require refrigerated storage and have limited working life after preparation. Premature curing, filler sedimentation, or solvent evaporation can render materials unusable. Manufacturers must implement strict inventory control systems and often face yield losses due to expired materials.

Environmental and health considerations increasingly impact manufacturing processes. Traditional conductive adhesives often contain volatile organic compounds (VOCs) and potentially hazardous materials. Regulatory pressures are driving the development of water-based and solvent-free alternatives, though these typically face performance limitations compared to conventional systems.

Scale-up from laboratory to production volumes introduces additional challenges in maintaining consistent quality. Process parameters that work effectively at small scales may not translate directly to industrial production. Manufacturers must develop robust quality control protocols and in-line testing methodologies to ensure batch-to-batch consistency in electrical and mechanical properties.

The dispersion of conductive fillers represents a critical manufacturing challenge. Achieving uniform distribution of metallic particles (typically silver, copper, or nickel) throughout the polymer matrix requires sophisticated mixing technologies. Inadequate dispersion leads to conductivity variations, potential hot spots, and unreliable electrical performance. Advanced mixing equipment utilizing ultrasonic or high-shear technologies can improve dispersion but adds complexity and cost to manufacturing processes.

Viscosity control presents another significant challenge during production. Conductive adhesives must maintain appropriate flow characteristics for application methods ranging from screen printing to dispensing. The addition of conductive fillers inherently increases viscosity, often requiring careful formulation adjustments with rheology modifiers. These adjustments must not compromise electrical performance or curing properties, creating a complex optimization problem.

Curing processes introduce additional manufacturing complexities. Temperature profiles must be precisely controlled to ensure complete polymerization without damaging temperature-sensitive components. Incomplete curing leads to poor mechanical strength and reliability issues, while excessive temperatures can cause polymer degradation or filler oxidation. The development of low-temperature curing systems remains an active research area but often involves trade-offs with cure speed and final properties.

Shelf life stability represents a significant manufacturing and logistics challenge. Conductive adhesives typically require refrigerated storage and have limited working life after preparation. Premature curing, filler sedimentation, or solvent evaporation can render materials unusable. Manufacturers must implement strict inventory control systems and often face yield losses due to expired materials.

Environmental and health considerations increasingly impact manufacturing processes. Traditional conductive adhesives often contain volatile organic compounds (VOCs) and potentially hazardous materials. Regulatory pressures are driving the development of water-based and solvent-free alternatives, though these typically face performance limitations compared to conventional systems.

Scale-up from laboratory to production volumes introduces additional challenges in maintaining consistent quality. Process parameters that work effectively at small scales may not translate directly to industrial production. Manufacturers must develop robust quality control protocols and in-line testing methodologies to ensure batch-to-batch consistency in electrical and mechanical properties.

Current Manufacturing Solutions and Methodologies

01 Filler Material Challenges

Manufacturing conductive adhesives faces challenges related to filler materials. The selection, dispersion, and concentration of conductive fillers such as silver, copper, or carbon particles significantly impact the electrical conductivity and mechanical properties of the adhesive. Achieving uniform dispersion without agglomeration while maintaining proper viscosity for application presents technical difficulties. Additionally, balancing filler loading to achieve optimal conductivity without compromising adhesion strength remains a critical manufacturing challenge.- Filler Material Selection and Distribution: The selection and distribution of conductive fillers in adhesives present significant manufacturing challenges. Achieving uniform dispersion of metallic particles, carbon nanotubes, or other conductive materials throughout the adhesive matrix is critical for consistent electrical performance. Improper distribution can lead to conductivity variations, hot spots, or complete failure of electrical pathways. Manufacturing processes must carefully control mixing parameters to prevent agglomeration while maintaining the desired viscosity for application.

- Thermal Management During Curing: Controlling the thermal profile during the curing process of conductive adhesives presents significant manufacturing challenges. The curing temperature and time must be precisely managed to ensure proper cross-linking of the polymer matrix while avoiding thermal damage to sensitive components. Uneven heating can cause stress within the adhesive layer, leading to delamination or cracking. Additionally, thermal expansion mismatches between the adhesive and substrates must be considered to prevent reliability issues in the final product.

- Environmental Stability and Reliability: Manufacturing conductive adhesives with long-term environmental stability presents significant challenges. Formulations must resist degradation from humidity, temperature cycling, and oxidation while maintaining electrical conductivity. The interface between the adhesive and substrate must remain stable over time to prevent delamination or increased contact resistance. Achieving this reliability requires careful selection of base polymers, stabilizers, and conductive fillers, along with specialized manufacturing processes that ensure consistent quality and performance in various operating environments.

- Viscosity Control and Application Methods: Maintaining optimal viscosity during manufacturing and application of conductive adhesives presents significant challenges. The adhesive must be fluid enough for precise dispensing but viscous enough to maintain position without flowing or sagging. Manufacturing processes must account for thixotropic behavior, where viscosity changes under shear stress during application. Additionally, the development of application methods suitable for different assembly processes, such as screen printing, stenciling, or automated dispensing, requires specialized formulations with tailored rheological properties to ensure consistent bond line thickness and coverage.

- Scale-up and Quality Control Challenges: Scaling up production from laboratory to industrial volumes presents significant manufacturing challenges for conductive adhesives. Maintaining consistent electrical and mechanical properties across large batches requires robust quality control processes and specialized testing methods. Manufacturing equipment must be designed to handle potentially abrasive conductive fillers without excessive wear. Additionally, shelf-life stability must be carefully monitored, as conductive adhesives can experience settling of particles or premature curing during storage, which affects their performance and application characteristics.

02 Curing Process Optimization

The curing process for conductive adhesives presents significant manufacturing challenges. Achieving complete polymerization while maintaining conductive pathways requires precise temperature control and timing. Incomplete curing leads to poor mechanical strength and reliability issues, while excessive curing can cause brittleness or degradation of conductive properties. Developing curing processes that work effectively across different substrate materials and geometries while minimizing thermal stress remains a complex manufacturing challenge.Expand Specific Solutions03 Environmental Stability Issues

Conductive adhesives face manufacturing challenges related to environmental stability. Ensuring consistent performance across varying humidity, temperature, and environmental conditions requires specialized formulations. Moisture absorption can significantly degrade conductivity and adhesion properties over time. Manufacturing processes must address potential oxidation of metallic fillers and implement proper storage protocols. Creating adhesives that maintain their conductive properties and mechanical integrity throughout their service life under various environmental conditions remains technically challenging.Expand Specific Solutions04 Interface and Contact Resistance

A significant manufacturing challenge for conductive adhesives involves managing interface and contact resistance. Creating reliable electrical connections between the adhesive and different substrate materials requires specialized surface preparation techniques. Manufacturing processes must address potential oxidation layers, contamination, and surface energy differences that can increase contact resistance. Developing adhesives that maintain low contact resistance over time, despite thermal cycling and mechanical stress, presents ongoing technical difficulties in the manufacturing process.Expand Specific Solutions05 Scale-up and Production Consistency

Scaling up conductive adhesive production from laboratory to industrial scale presents significant manufacturing challenges. Maintaining consistent electrical and mechanical properties across production batches requires precise control of mixing processes, filler dispersion, and curing parameters. Variations in raw materials and processing conditions can lead to inconsistent performance. Implementing quality control measures that effectively evaluate conductivity, adhesion strength, and reliability while maintaining production efficiency remains a complex manufacturing challenge.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The conductive adhesives market is currently in a growth phase, with increasing demand driven by electronics miniaturization and sustainable manufacturing trends. The global market size is projected to reach approximately $4 billion by 2027, expanding at a CAGR of 6-8%. Technologically, the field shows varying maturity levels, with industry leaders like Henkel AG, 3M Innovative Properties, and Shin-Etsu Chemical offering advanced solutions for high-reliability applications. Mid-tier players such as Namics Corp. and Dexerials Corp. are focusing on specialized applications, while emerging companies like Guangzhou Fangbang Electronics are developing cost-effective alternatives. The competitive landscape is characterized by continuous innovation in addressing key manufacturing challenges including thermal conductivity, adhesion strength, and processing compatibility.

Henkel AG & Co. KGaA

Technical Solution: Henkel has developed advanced isotropic conductive adhesives (ICAs) and anisotropic conductive adhesives (ACAs) that address key manufacturing challenges in electronics assembly. Their LOCTITE ABLESTIK ICA solutions incorporate nano-silver particles with proprietary surface treatments to achieve high conductivity at lower processing temperatures (150-175°C compared to traditional 220°C soldering). Henkel's ACAs feature precisely engineered conductive particles with uniform size distribution (typically 3-5μm) suspended in a polymer matrix that enables directional conductivity when compressed. Their manufacturing process includes patented dispersion technology that prevents particle agglomeration, maintaining consistent electrical performance across production batches. Henkel has also pioneered reworkable conductive adhesives with thermally reversible polymer systems that allow component removal and replacement without damaging substrates, addressing a major limitation of traditional conductive adhesives.

Strengths: Superior thermal stability with degradation temperatures exceeding 300°C; excellent reliability under thermal cycling (-40°C to 150°C for 1000+ cycles); compatibility with flexible substrates enabling applications in flexible electronics. Weaknesses: Higher cost compared to traditional soldering; longer curing times (30-60 minutes) impacting production throughput; potential for silver migration in high-humidity environments requiring additional protective measures.

3M Innovative Properties Co.

Technical Solution: 3M has developed a comprehensive suite of conductive adhesive solutions addressing manufacturing challenges through their Electrically Conductive Adhesive Transfer Tapes (ECATTs) and Anisotropic Conductive Films (ACFs). Their proprietary manufacturing process incorporates uniformly dispersed conductive particles (typically nickel, gold-coated nickel, or silver) in acrylic or silicone adhesive matrices. 3M's Z-axis conductive adhesives achieve directional conductivity through precisely controlled particle size distribution (3-10μm) and concentration (5-10% by volume), enabling fine-pitch connections down to 50μm. Their manufacturing innovation includes a patented dual-stage curing system that allows initial positioning followed by permanent bonding, addressing alignment challenges in high-density applications. 3M has also developed specialized formulations with controlled flow characteristics to prevent bleeding and contamination during assembly processes, maintaining consistent electrical performance across production runs.

Strengths: Excellent environmental resistance with stable performance after 1000+ hours at 85°C/85% relative humidity; compatibility with multiple substrate materials including flexible circuits; room temperature bonding options reducing thermal stress on components. Weaknesses: Higher initial investment in specialized application equipment; potential for increased contact resistance over time in harsh environments; limited current-carrying capacity compared to traditional soldering methods.

Critical Patents and Technical Innovations

Electroconductive adhesive

PatentWO2020175056A1

Innovation

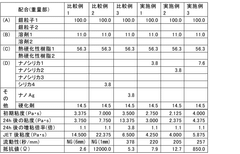

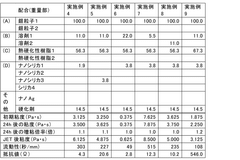

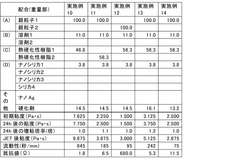

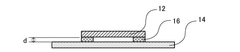

- A conductive adhesive with high fluidity and conductivity is developed, comprising conductive particles, a solvent, thermosetting resin, and silica particles with an average size of 1 to 50 nm, allowing for jet dispensing and simultaneous grounding and fixing of components.

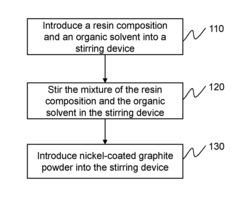

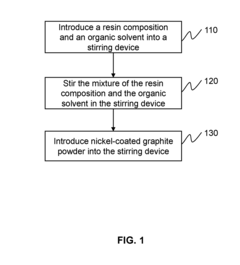

Single-component low hardness conductive adhesive and methods of manufacture and use thereof

PatentActiveUS20180022969A1

Innovation

- A single-component conductive adhesive with a resin composition, organic solvent, and nickel-coated graphite powder, formulated with specific weight ratios and manufacturing processes to achieve low hardness and enhanced electromagnetic shielding capabilities.

Environmental and Sustainability Considerations

The environmental impact of conductive adhesives has become increasingly significant as industries strive for more sustainable manufacturing processes. Traditional soldering methods often involve lead-based materials that pose serious environmental and health hazards. Conductive adhesives, particularly those that are lead-free, represent a more environmentally friendly alternative, aligning with global initiatives to reduce hazardous substances in electronic products, such as the European Union's Restriction of Hazardous Substances (RoHS) directive.

However, the environmental benefits of conductive adhesives extend beyond the elimination of lead. Many formulations are designed to cure at lower temperatures compared to traditional soldering processes, resulting in reduced energy consumption during manufacturing. This energy efficiency translates to lower carbon emissions and operational costs, making conductive adhesives an attractive option for companies committed to reducing their carbon footprint.

The recyclability of electronic components joined with conductive adhesives presents both opportunities and challenges. On one hand, certain conductive adhesive formulations facilitate easier disassembly and recovery of valuable materials at end-of-life. On the other hand, some adhesives may complicate recycling processes due to the difficulty in separating bonded components or the introduction of new material combinations that existing recycling infrastructure is not equipped to handle.

Life cycle assessment (LCA) studies comparing conductive adhesives to traditional soldering methods have yielded mixed results, with outcomes heavily dependent on specific formulations and application scenarios. While conductive adhesives generally show advantages in terms of toxicity and energy consumption during manufacturing, some formulations may introduce new environmental concerns through the use of nanomaterials or specialized additives with unknown long-term environmental impacts.

Recent innovations in bio-based conductive adhesives represent a promising frontier for sustainability. Research into adhesives derived from renewable resources such as plant-based polymers and naturally occurring conductive materials is gaining momentum. These bio-based alternatives aim to reduce dependence on petroleum-derived components while maintaining or enhancing performance characteristics.

Regulatory frameworks worldwide are increasingly emphasizing the importance of sustainable electronics manufacturing. Companies developing and implementing conductive adhesive solutions must navigate evolving compliance requirements while also considering voluntary sustainability certifications that may provide market advantages. This regulatory landscape is driving continuous improvement in formulation and application techniques to minimize environmental impact throughout the product lifecycle.

However, the environmental benefits of conductive adhesives extend beyond the elimination of lead. Many formulations are designed to cure at lower temperatures compared to traditional soldering processes, resulting in reduced energy consumption during manufacturing. This energy efficiency translates to lower carbon emissions and operational costs, making conductive adhesives an attractive option for companies committed to reducing their carbon footprint.

The recyclability of electronic components joined with conductive adhesives presents both opportunities and challenges. On one hand, certain conductive adhesive formulations facilitate easier disassembly and recovery of valuable materials at end-of-life. On the other hand, some adhesives may complicate recycling processes due to the difficulty in separating bonded components or the introduction of new material combinations that existing recycling infrastructure is not equipped to handle.

Life cycle assessment (LCA) studies comparing conductive adhesives to traditional soldering methods have yielded mixed results, with outcomes heavily dependent on specific formulations and application scenarios. While conductive adhesives generally show advantages in terms of toxicity and energy consumption during manufacturing, some formulations may introduce new environmental concerns through the use of nanomaterials or specialized additives with unknown long-term environmental impacts.

Recent innovations in bio-based conductive adhesives represent a promising frontier for sustainability. Research into adhesives derived from renewable resources such as plant-based polymers and naturally occurring conductive materials is gaining momentum. These bio-based alternatives aim to reduce dependence on petroleum-derived components while maintaining or enhancing performance characteristics.

Regulatory frameworks worldwide are increasingly emphasizing the importance of sustainable electronics manufacturing. Companies developing and implementing conductive adhesive solutions must navigate evolving compliance requirements while also considering voluntary sustainability certifications that may provide market advantages. This regulatory landscape is driving continuous improvement in formulation and application techniques to minimize environmental impact throughout the product lifecycle.

Quality Control and Reliability Testing Methods

Quality control and reliability testing represent critical components in the manufacturing process of conductive adhesives, directly impacting product performance and longevity. The industry has developed comprehensive methodologies to ensure consistent quality across production batches and reliable performance under various environmental conditions.

Standard testing protocols for conductive adhesives typically include electrical conductivity measurements, which must be performed at multiple stages of the manufacturing process. These measurements often utilize four-point probe techniques to accurately determine volume resistivity and surface resistance properties. Variations in these values beyond established thresholds can indicate contamination or improper curing conditions.

Adhesion strength testing constitutes another fundamental quality control measure, commonly conducted through lap shear, peel strength, and die shear tests. These mechanical evaluations ensure that the conductive adhesive maintains proper bonding under thermal and mechanical stress conditions. Advanced manufacturers implement automated pull testing systems that provide quantitative data on bond integrity while minimizing human error in measurement.

Environmental reliability testing exposes conductive adhesive samples to accelerated aging conditions, including temperature cycling (-65°C to +150°C), high temperature/high humidity storage (85°C/85% RH), and thermal shock testing. These procedures identify potential failure mechanisms before field deployment. Modern testing facilities employ computer-controlled environmental chambers that can simulate years of operational conditions within weeks.

Non-destructive evaluation techniques have gained prominence in quality control workflows. These include acoustic microscopy, X-ray inspection, and infrared thermography, which can detect voids, delamination, and inconsistent filler distribution without compromising the sample. The integration of machine vision systems with artificial intelligence algorithms has significantly enhanced defect detection capabilities in production environments.

Statistical process control (SPC) methodologies are increasingly applied to conductive adhesive manufacturing, with control charts monitoring critical parameters such as viscosity, thixotropic index, and pot life. Advanced manufacturers implement real-time monitoring systems that can detect process drift before it impacts product quality, enabling proactive intervention rather than reactive quality control.

Reliability prediction models have evolved to incorporate accelerated life testing data, allowing manufacturers to estimate product lifespans under various operating conditions. These models typically consider factors such as thermal cycling, mechanical vibration, and humidity exposure to calculate mean time to failure (MTTF) metrics that inform warranty policies and maintenance schedules.

Standard testing protocols for conductive adhesives typically include electrical conductivity measurements, which must be performed at multiple stages of the manufacturing process. These measurements often utilize four-point probe techniques to accurately determine volume resistivity and surface resistance properties. Variations in these values beyond established thresholds can indicate contamination or improper curing conditions.

Adhesion strength testing constitutes another fundamental quality control measure, commonly conducted through lap shear, peel strength, and die shear tests. These mechanical evaluations ensure that the conductive adhesive maintains proper bonding under thermal and mechanical stress conditions. Advanced manufacturers implement automated pull testing systems that provide quantitative data on bond integrity while minimizing human error in measurement.

Environmental reliability testing exposes conductive adhesive samples to accelerated aging conditions, including temperature cycling (-65°C to +150°C), high temperature/high humidity storage (85°C/85% RH), and thermal shock testing. These procedures identify potential failure mechanisms before field deployment. Modern testing facilities employ computer-controlled environmental chambers that can simulate years of operational conditions within weeks.

Non-destructive evaluation techniques have gained prominence in quality control workflows. These include acoustic microscopy, X-ray inspection, and infrared thermography, which can detect voids, delamination, and inconsistent filler distribution without compromising the sample. The integration of machine vision systems with artificial intelligence algorithms has significantly enhanced defect detection capabilities in production environments.

Statistical process control (SPC) methodologies are increasingly applied to conductive adhesive manufacturing, with control charts monitoring critical parameters such as viscosity, thixotropic index, and pot life. Advanced manufacturers implement real-time monitoring systems that can detect process drift before it impacts product quality, enabling proactive intervention rather than reactive quality control.

Reliability prediction models have evolved to incorporate accelerated life testing data, allowing manufacturers to estimate product lifespans under various operating conditions. These models typically consider factors such as thermal cycling, mechanical vibration, and humidity exposure to calculate mean time to failure (MTTF) metrics that inform warranty policies and maintenance schedules.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!