Conductive Adhesives in Power Systems: Application Analysis

OCT 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Power System Conductive Adhesives Background and Objectives

Conductive adhesives have emerged as a critical component in modern power systems, representing a significant advancement in electrical connection technology. The evolution of these materials can be traced back to the mid-20th century, with substantial developments occurring in the 1980s and 1990s as electronics miniaturization demanded more sophisticated interconnection solutions. Initially developed as alternatives to traditional soldering methods, conductive adhesives have progressively evolved from simple epoxy-metal composites to highly engineered materials with specialized electrical, thermal, and mechanical properties.

The technological trajectory of conductive adhesives has been shaped by increasing demands for reliability in power transmission, environmental regulations restricting hazardous materials, and the need for enhanced thermal management in high-power applications. Recent advancements have focused on nanomaterial incorporation, including carbon nanotubes, graphene, and metallic nanoparticles, which have dramatically improved conductivity while maintaining essential adhesive properties.

Market trends indicate a shift toward higher performance requirements in power systems, particularly in renewable energy infrastructure, electric vehicles, and smart grid technologies. These applications demand adhesives capable of withstanding extreme environmental conditions while maintaining consistent electrical performance over extended operational lifetimes. The industry is witnessing a convergence of material science innovations and electrical engineering requirements, creating new opportunities for specialized conductive adhesive formulations.

The primary technical objectives for conductive adhesives in power systems include achieving conductivity levels comparable to or exceeding traditional metallic connections, ensuring long-term reliability under thermal cycling and environmental stressors, and developing formulations compatible with automated manufacturing processes. Additionally, there is significant focus on reducing curing temperatures and times to accommodate temperature-sensitive components and increase production efficiency.

Environmental considerations have become increasingly important, driving research toward lead-free and halogen-free formulations that comply with global regulations such as RoHS and REACH. This regulatory landscape has accelerated innovation in eco-friendly conductive adhesive technologies that maintain performance standards while reducing environmental impact.

The intersection of nanotechnology and polymer science represents the frontier of conductive adhesive development, with research aimed at creating self-healing properties, improved aging resistance, and enhanced thermal conductivity. These advancements are essential for next-generation power systems that require both electrical and thermal management solutions in increasingly compact designs.

As power systems continue to evolve toward higher efficiency and greater integration, conductive adhesives are positioned to play an expanding role in enabling new architectures and functionalities. The technical goals for this field include developing adhesives with tailored properties for specific power applications, from high-voltage transmission to microelectronic power management, while maintaining cost-effectiveness and manufacturing scalability.

The technological trajectory of conductive adhesives has been shaped by increasing demands for reliability in power transmission, environmental regulations restricting hazardous materials, and the need for enhanced thermal management in high-power applications. Recent advancements have focused on nanomaterial incorporation, including carbon nanotubes, graphene, and metallic nanoparticles, which have dramatically improved conductivity while maintaining essential adhesive properties.

Market trends indicate a shift toward higher performance requirements in power systems, particularly in renewable energy infrastructure, electric vehicles, and smart grid technologies. These applications demand adhesives capable of withstanding extreme environmental conditions while maintaining consistent electrical performance over extended operational lifetimes. The industry is witnessing a convergence of material science innovations and electrical engineering requirements, creating new opportunities for specialized conductive adhesive formulations.

The primary technical objectives for conductive adhesives in power systems include achieving conductivity levels comparable to or exceeding traditional metallic connections, ensuring long-term reliability under thermal cycling and environmental stressors, and developing formulations compatible with automated manufacturing processes. Additionally, there is significant focus on reducing curing temperatures and times to accommodate temperature-sensitive components and increase production efficiency.

Environmental considerations have become increasingly important, driving research toward lead-free and halogen-free formulations that comply with global regulations such as RoHS and REACH. This regulatory landscape has accelerated innovation in eco-friendly conductive adhesive technologies that maintain performance standards while reducing environmental impact.

The intersection of nanotechnology and polymer science represents the frontier of conductive adhesive development, with research aimed at creating self-healing properties, improved aging resistance, and enhanced thermal conductivity. These advancements are essential for next-generation power systems that require both electrical and thermal management solutions in increasingly compact designs.

As power systems continue to evolve toward higher efficiency and greater integration, conductive adhesives are positioned to play an expanding role in enabling new architectures and functionalities. The technical goals for this field include developing adhesives with tailored properties for specific power applications, from high-voltage transmission to microelectronic power management, while maintaining cost-effectiveness and manufacturing scalability.

Market Demand Analysis for Conductive Adhesives

The global market for conductive adhesives in power systems is experiencing robust growth, driven primarily by the increasing adoption of renewable energy sources and the ongoing electrification of transportation. Current market valuations indicate that the conductive adhesives sector specifically for power applications reached approximately 3.2 billion USD in 2022, with projections suggesting a compound annual growth rate of 6.8% through 2028. This growth trajectory is significantly outpacing traditional industrial adhesives, reflecting the specialized nature and increasing demand for these materials.

The automotive sector represents the largest demand driver, accounting for roughly 38% of the market share. This is largely attributed to the exponential growth in electric vehicle production, where conductive adhesives play critical roles in battery assembly, thermal management systems, and power electronics. Major automotive manufacturers are increasingly specifying conductive adhesives in their designs to address weight reduction goals while maintaining electrical and thermal performance requirements.

Renewable energy applications constitute the second-largest market segment at approximately 27%. Solar panel manufacturing particularly relies on conductive adhesives for cell interconnections and junction box attachments, with the global solar capacity additions continuing to set new records annually. Wind power systems similarly utilize these materials for various electrical connections in harsh environmental conditions.

Consumer electronics and industrial power systems collectively represent about 24% of the market, with applications ranging from power supplies to industrial inverters. The remaining market share is distributed across aerospace, medical devices, and emerging applications in smart grid technologies.

Regional analysis reveals Asia-Pacific as the dominant market, controlling nearly 52% of global demand, primarily due to the concentration of electronics manufacturing and renewable energy development in China, Japan, South Korea, and emerging economies like Vietnam and India. North America and Europe follow with approximately 24% and 19% market shares respectively, with particular strength in high-performance applications for automotive and aerospace sectors.

Customer requirements are evolving rapidly, with increasing demands for adhesives that can withstand higher operating temperatures (>200°C), provide enhanced thermal conductivity (>3 W/m·K), and maintain reliability under thermal cycling conditions. Additionally, environmental regulations are driving demand for lead-free and low-VOC formulations, creating new market opportunities for innovative suppliers.

Market research indicates price sensitivity varies significantly by application segment, with consumer electronics manufacturers being most price-conscious, while automotive and aerospace customers prioritize performance and reliability over cost considerations. This segmentation is creating distinct market tiers with different value propositions and competitive dynamics.

The automotive sector represents the largest demand driver, accounting for roughly 38% of the market share. This is largely attributed to the exponential growth in electric vehicle production, where conductive adhesives play critical roles in battery assembly, thermal management systems, and power electronics. Major automotive manufacturers are increasingly specifying conductive adhesives in their designs to address weight reduction goals while maintaining electrical and thermal performance requirements.

Renewable energy applications constitute the second-largest market segment at approximately 27%. Solar panel manufacturing particularly relies on conductive adhesives for cell interconnections and junction box attachments, with the global solar capacity additions continuing to set new records annually. Wind power systems similarly utilize these materials for various electrical connections in harsh environmental conditions.

Consumer electronics and industrial power systems collectively represent about 24% of the market, with applications ranging from power supplies to industrial inverters. The remaining market share is distributed across aerospace, medical devices, and emerging applications in smart grid technologies.

Regional analysis reveals Asia-Pacific as the dominant market, controlling nearly 52% of global demand, primarily due to the concentration of electronics manufacturing and renewable energy development in China, Japan, South Korea, and emerging economies like Vietnam and India. North America and Europe follow with approximately 24% and 19% market shares respectively, with particular strength in high-performance applications for automotive and aerospace sectors.

Customer requirements are evolving rapidly, with increasing demands for adhesives that can withstand higher operating temperatures (>200°C), provide enhanced thermal conductivity (>3 W/m·K), and maintain reliability under thermal cycling conditions. Additionally, environmental regulations are driving demand for lead-free and low-VOC formulations, creating new market opportunities for innovative suppliers.

Market research indicates price sensitivity varies significantly by application segment, with consumer electronics manufacturers being most price-conscious, while automotive and aerospace customers prioritize performance and reliability over cost considerations. This segmentation is creating distinct market tiers with different value propositions and competitive dynamics.

Current Status and Technical Challenges

Conductive adhesives have emerged as a promising alternative to traditional soldering methods in power systems, with global research efforts intensifying over the past decade. Currently, the market is dominated by two primary types: Isotropic Conductive Adhesives (ICAs) and Anisotropic Conductive Adhesives (ACAs), each with distinct application scenarios in power electronics. The technological landscape shows significant advancements in Asian markets, particularly Japan, South Korea, and China, while European and North American institutions focus more on high-reliability applications in aerospace and automotive sectors.

Despite promising developments, conductive adhesives in power systems face several critical technical challenges. The foremost concern is thermal conductivity limitations, as most commercially available adhesives demonstrate heat dissipation capabilities 30-40% lower than traditional solder joints. This creates significant constraints for high-power applications where thermal management is crucial for system reliability and longevity.

Electrical performance stability presents another major hurdle. Current conductive adhesives exhibit conductivity degradation under thermal cycling and high humidity conditions, with resistance increases of up to 200% observed in accelerated aging tests. This instability severely impacts long-term reliability in power conversion applications where consistent electrical performance is essential.

Mechanical strength deficiencies also plague existing solutions. The bond strength of conductive adhesives typically ranges from 15-25 MPa, substantially lower than the 30-45 MPa achieved with traditional soldering methods. This limitation becomes particularly problematic in applications subject to vibration or mechanical stress, such as automotive power systems or industrial equipment.

Manufacturing integration challenges further complicate widespread adoption. Current conductive adhesive technologies require significant modifications to existing production lines, including specialized curing equipment and precise dispensing systems. The curing process itself remains time-intensive, with typical requirements of 30-60 minutes at elevated temperatures, compared to seconds for conventional soldering processes.

Environmental stability represents an ongoing concern, with many formulations showing susceptibility to oxidation and moisture absorption. Research indicates that exposure to 85% relative humidity for 1000 hours can increase joint resistance by up to 300% in some adhesive systems, creating reliability concerns for outdoor power applications or humid environments.

The cost factor remains prohibitive for mass adoption, with high-performance conductive adhesives commanding prices 3-5 times higher than traditional soldering materials. This economic barrier, coupled with the technical limitations, has restricted widespread implementation primarily to niche applications where the benefits of conductive adhesives outweigh their current limitations.

Despite promising developments, conductive adhesives in power systems face several critical technical challenges. The foremost concern is thermal conductivity limitations, as most commercially available adhesives demonstrate heat dissipation capabilities 30-40% lower than traditional solder joints. This creates significant constraints for high-power applications where thermal management is crucial for system reliability and longevity.

Electrical performance stability presents another major hurdle. Current conductive adhesives exhibit conductivity degradation under thermal cycling and high humidity conditions, with resistance increases of up to 200% observed in accelerated aging tests. This instability severely impacts long-term reliability in power conversion applications where consistent electrical performance is essential.

Mechanical strength deficiencies also plague existing solutions. The bond strength of conductive adhesives typically ranges from 15-25 MPa, substantially lower than the 30-45 MPa achieved with traditional soldering methods. This limitation becomes particularly problematic in applications subject to vibration or mechanical stress, such as automotive power systems or industrial equipment.

Manufacturing integration challenges further complicate widespread adoption. Current conductive adhesive technologies require significant modifications to existing production lines, including specialized curing equipment and precise dispensing systems. The curing process itself remains time-intensive, with typical requirements of 30-60 minutes at elevated temperatures, compared to seconds for conventional soldering processes.

Environmental stability represents an ongoing concern, with many formulations showing susceptibility to oxidation and moisture absorption. Research indicates that exposure to 85% relative humidity for 1000 hours can increase joint resistance by up to 300% in some adhesive systems, creating reliability concerns for outdoor power applications or humid environments.

The cost factor remains prohibitive for mass adoption, with high-performance conductive adhesives commanding prices 3-5 times higher than traditional soldering materials. This economic barrier, coupled with the technical limitations, has restricted widespread implementation primarily to niche applications where the benefits of conductive adhesives outweigh their current limitations.

Current Technical Solutions Overview

01 Conductive fillers in adhesive compositions

Conductive adhesives incorporate various conductive fillers to achieve electrical conductivity. These fillers include metal particles (such as silver, copper, nickel), carbon-based materials (like carbon nanotubes, graphene), and metal-coated particles. The type, size, shape, and concentration of these fillers significantly impact the adhesive's conductivity, mechanical properties, and processing characteristics. Optimizing the filler loading allows for balancing conductivity requirements with adhesion strength and flexibility.- Conductive fillers in adhesive compositions: Conductive adhesives incorporate various conductive fillers to achieve electrical conductivity. These fillers include metal particles (such as silver, gold, copper), carbon-based materials (like carbon nanotubes, graphene), and metal-coated particles. The type, size, shape, and concentration of these fillers significantly impact the conductivity, adhesion strength, and processing characteristics of the adhesive. Optimizing the filler loading is crucial to balance conductivity with mechanical properties.

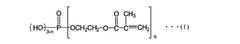

- Polymer matrices for conductive adhesives: The polymer matrix serves as the binding component in conductive adhesives, providing adhesion while allowing electrical conductivity through the embedded conductive fillers. Common polymer matrices include epoxies, silicones, acrylics, and polyurethanes. These polymers can be formulated as thermosetting or thermoplastic systems, each offering different processing and performance characteristics. The selection of polymer matrix affects curing conditions, temperature resistance, flexibility, and compatibility with various substrates.

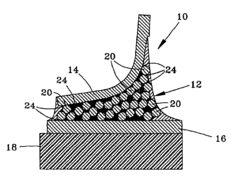

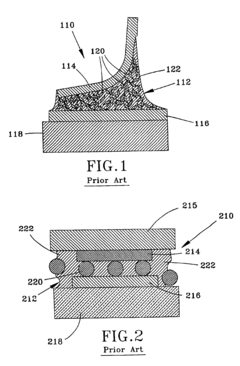

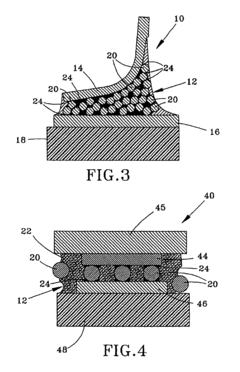

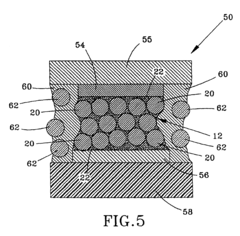

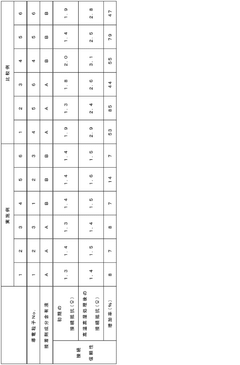

- Anisotropic conductive adhesives: Anisotropic conductive adhesives (ACAs) provide electrical conductivity in a specific direction while maintaining insulation in other directions. These specialized adhesives typically contain conductive particles dispersed in an insulating adhesive matrix. When compressed between electrical contacts, the particles form conductive pathways in the direction of compression only. ACAs are particularly valuable in fine-pitch electronics assembly, display technologies, and flexible circuit connections where directional conductivity is required.

- Thermal management in conductive adhesives: Conductive adhesives often serve dual purposes of electrical connection and thermal management. Formulations can be designed to enhance thermal conductivity through the incorporation of thermally conductive fillers such as ceramic particles, metal oxides, or specialized carbon materials. These adhesives help dissipate heat from electronic components, preventing overheating and improving device reliability. The balance between electrical conductivity, thermal conductivity, and mechanical properties is critical in these applications.

- Environmental and processing considerations: Modern conductive adhesive formulations address environmental concerns by reducing or eliminating toxic components like lead and harsh solvents. Water-based and solvent-free systems have been developed to comply with environmental regulations. Processing considerations include curing methods (thermal, UV, moisture), pot life, storage stability, and application techniques (dispensing, printing, spraying). Advanced formulations offer improved shelf life, faster curing times, and compatibility with automated manufacturing processes.

02 Polymer matrices for conductive adhesives

The polymer matrix serves as the binding component in conductive adhesives, providing adhesion while supporting the conductive network. Common polymer systems include epoxies, silicones, acrylics, and polyurethanes. Each polymer type offers different advantages in terms of curing mechanisms, temperature resistance, flexibility, and environmental stability. Specialized formulations may incorporate multiple polymer systems to achieve specific performance characteristics such as thermal conductivity alongside electrical conductivity.Expand Specific Solutions03 Application-specific conductive adhesive formulations

Conductive adhesives are formulated for specific applications including electronics assembly, semiconductor packaging, display technologies, and flexible electronics. These specialized formulations address requirements such as fine-pitch bonding, thermal management, flexibility, and compatibility with temperature-sensitive substrates. Anisotropic conductive adhesives (ACAs) provide directional conductivity for high-density interconnections, while pressure-sensitive conductive adhesives offer reworkability for certain applications. The formulation may also include additives to enhance specific properties like thermal stability or moisture resistance.Expand Specific Solutions04 Processing and curing methods for conductive adhesives

The performance of conductive adhesives is significantly influenced by processing and curing methods. Various techniques include thermal curing, UV curing, moisture curing, and hybrid curing systems. The curing process affects the formation of the conductive network, adhesion strength, and reliability. Processing parameters such as temperature profiles, pressure application during bonding, and post-cure treatments are critical for optimizing electrical conductivity and mechanical properties. Advanced processing methods may incorporate sintering of metal particles at relatively low temperatures to enhance conductivity.Expand Specific Solutions05 Novel conductive materials and nanocomposites

Recent innovations in conductive adhesives focus on incorporating novel materials and nanocomposites to enhance performance. These include self-healing conductive systems, stimuli-responsive adhesives, and bio-based conductive materials. Nanostructured additives such as silver nanowires, graphene, and hybrid nanoparticles enable improved conductivity at lower filler loadings. Surface modification of conductive particles improves dispersion and interface properties. These advanced materials address challenges in miniaturization, flexibility, and reliability while potentially reducing dependency on precious metals through more efficient conductive networks.Expand Specific Solutions

Major Industry Players Analysis

The conductive adhesives market in power systems is currently in a growth phase, with increasing adoption driven by sustainability demands and miniaturization trends. The market is projected to expand significantly as power electronics applications proliferate across industries. Technologically, the field shows varying maturity levels, with companies like Henkel, 3M, and DuPont leading innovation through established product portfolios and extensive R&D capabilities. Emerging players such as Electric Hydrogen and Nanotech Energy are introducing novel formulations for specialized applications, while traditional electronics materials companies including Sumitomo Electric, Heraeus, and RESONAC are leveraging their expertise to develop advanced conductive adhesive solutions with enhanced thermal and electrical properties for next-generation power systems.

Henkel AG & Co. KGaA

Technical Solution: Henkel has developed advanced silver-filled epoxy-based conductive adhesives specifically engineered for power systems applications. Their LOCTITE ABLESTIK SSA series features proprietary filler technology that achieves conductivity levels approaching those of soldered connections while maintaining flexibility under thermal cycling. The company's latest formulations incorporate nano-silver particles that enable sintering at temperatures as low as 175°C, creating metallurgical-like interfaces with exceptional current-carrying capacity. Henkel's adhesives employ unique cross-linking chemistry that resists degradation in high-humidity environments while maintaining stable electrical performance. Their power electronics solutions include specialized die-attach materials that offer thermal conductivity exceeding 45 W/m·K while providing electrical conductivity suitable for high-current applications in electric vehicle power converters and renewable energy systems.

Strengths: Superior electrical conductivity approaching solder performance; excellent thermal stability up to 200°C; strong adhesion to diverse substrates including ceramics and metals; environmentally friendly lead-free composition. Weaknesses: Higher cost compared to traditional soldering; requires precise application equipment; some formulations have limited shelf life; performance may degrade under extreme temperature cycling.

3M Innovative Properties Co.

Technical Solution: 3M has pioneered anisotropic conductive adhesives (ACAs) specifically designed for power electronics applications. Their proprietary technology incorporates precisely aligned conductive particles in a polymer matrix, enabling directional electrical conductivity while maintaining insulation in other planes. 3M's power system adhesives feature thermally conductive fillers that simultaneously manage heat dissipation while establishing reliable electrical connections. Their latest generation products utilize hybrid silver-coated ceramic particles that resist electromigration under high current loads. The company's formulations incorporate stress-relieving additives that accommodate the coefficient of thermal expansion mismatch between different power system components, particularly in applications joining silicon carbide or gallium nitride semiconductors to substrates. 3M's adhesives maintain performance integrity even after 1000+ thermal cycles from -40°C to +150°C, making them suitable for demanding automotive and industrial power applications.

Strengths: Excellent directional conductivity with Z-axis precision; superior thermal cycling resistance; compatible with automated dispensing systems; environmentally compliant formulations. Weaknesses: Higher initial cost compared to traditional joining methods; requires specialized application expertise; some formulations have limited rework capability; performance may be affected by extreme humidity conditions.

Key Patents and Technical Literature Review

Conductive adhesive material with metallurgically-bonded conductive particles

PatentInactiveUS6802446B2

Innovation

- A conductive adhesive material with fusible particles and a polymer matrix containing a fluxing component that reduces metal oxides, allowing the particles to form metallurgical bonds when heated, providing superior electrical continuity and structural integrity.

Conductive adhesive, method for producing circuit connection structure, and circuit connection structure

PatentWO2021230212A1

Innovation

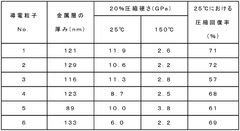

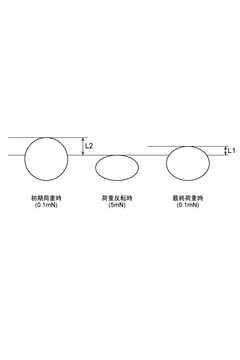

- A conductive adhesive with conductive particles having specific compression hardness and recovery rates, combined with a thermosetting or photocurable adhesive composition, is used for thermocompression bonding to connect circuit electrodes, ensuring low resistance and reliability even with titanium-coated electrodes.

Environmental Impact and Sustainability Considerations

The environmental impact of conductive adhesives in power systems represents a critical consideration as industries increasingly prioritize sustainability. Traditional soldering methods often utilize lead-based materials that pose significant environmental hazards throughout their lifecycle. Conductive adhesives, particularly those formulated with silver, copper, or carbon fillers, offer substantially reduced environmental footprints compared to conventional soldering technologies. These adhesives typically require lower curing temperatures, resulting in decreased energy consumption during manufacturing processes and consequently lower carbon emissions.

The elimination of lead and other heavy metals in conductive adhesive formulations addresses a major environmental concern. Lead-free alternatives significantly reduce the risk of soil and water contamination, mitigating potential harm to ecosystems and human health. Furthermore, many conductive adhesives are designed with reduced volatile organic compound (VOC) content, minimizing air pollution during application and curing phases.

End-of-life considerations also favor conductive adhesives in power system applications. The recyclability of components joined with conductive adhesives typically exceeds that of traditionally soldered assemblies. This characteristic facilitates more efficient material recovery processes, supporting circular economy principles and reducing waste destined for landfills. Additionally, the disassembly of components bonded with certain conductive adhesive formulations can be achieved through specific thermal or chemical processes, enabling more effective component reuse and material reclamation.

Regulatory frameworks worldwide increasingly emphasize environmental compliance, with directives such as RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) imposing stringent requirements on electronic manufacturing. Conductive adhesives align well with these evolving regulations, positioning them as forward-compatible solutions for sustainable power system development.

Life cycle assessment (LCA) studies comparing conductive adhesives to traditional soldering methods consistently demonstrate reduced environmental impact across multiple categories, including global warming potential, resource depletion, and ecotoxicity. However, challenges remain regarding the environmental implications of nanomaterials sometimes incorporated into advanced conductive adhesive formulations, necessitating ongoing research into their long-term environmental behavior and potential remediation strategies.

The sustainability profile of conductive adhesives continues to improve through innovations in bio-based polymer matrices and environmentally benign fillers. Research into renewable source materials for conductive adhesives represents a promising frontier, with potential to further enhance their environmental credentials while maintaining or improving technical performance in power system applications.

The elimination of lead and other heavy metals in conductive adhesive formulations addresses a major environmental concern. Lead-free alternatives significantly reduce the risk of soil and water contamination, mitigating potential harm to ecosystems and human health. Furthermore, many conductive adhesives are designed with reduced volatile organic compound (VOC) content, minimizing air pollution during application and curing phases.

End-of-life considerations also favor conductive adhesives in power system applications. The recyclability of components joined with conductive adhesives typically exceeds that of traditionally soldered assemblies. This characteristic facilitates more efficient material recovery processes, supporting circular economy principles and reducing waste destined for landfills. Additionally, the disassembly of components bonded with certain conductive adhesive formulations can be achieved through specific thermal or chemical processes, enabling more effective component reuse and material reclamation.

Regulatory frameworks worldwide increasingly emphasize environmental compliance, with directives such as RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) imposing stringent requirements on electronic manufacturing. Conductive adhesives align well with these evolving regulations, positioning them as forward-compatible solutions for sustainable power system development.

Life cycle assessment (LCA) studies comparing conductive adhesives to traditional soldering methods consistently demonstrate reduced environmental impact across multiple categories, including global warming potential, resource depletion, and ecotoxicity. However, challenges remain regarding the environmental implications of nanomaterials sometimes incorporated into advanced conductive adhesive formulations, necessitating ongoing research into their long-term environmental behavior and potential remediation strategies.

The sustainability profile of conductive adhesives continues to improve through innovations in bio-based polymer matrices and environmentally benign fillers. Research into renewable source materials for conductive adhesives represents a promising frontier, with potential to further enhance their environmental credentials while maintaining or improving technical performance in power system applications.

Reliability and Performance Testing Standards

The reliability and performance testing of conductive adhesives in power systems follows standardized protocols that ensure consistent evaluation across different applications and environments. These standards are crucial for validating the long-term stability and operational capabilities of adhesive-based connections in power electronic assemblies.

IEC 60068 series provides the foundation for environmental testing of electronic components, including those bonded with conductive adhesives. Specifically, IEC 60068-2-14 (thermal cycling) and IEC 60068-2-78 (steady-state humidity) are frequently applied to assess the durability of conductive adhesive joints under varying conditions typical in power systems.

ASTM D4496 and ASTM F84 standards focus on measuring the electrical resistivity of conductive materials, offering methodologies to quantify the electrical performance of adhesives before and after environmental exposure. These measurements are critical indicators of connection quality in power applications where minimal resistance is essential.

For mechanical reliability assessment, standards such as ASTM D1002 (lap shear strength) and ASTM D3163 (adhesive bonds in shear by tension loading) provide protocols to evaluate the structural integrity of conductive adhesive joints under mechanical stress. These tests are particularly relevant for power systems subject to vibration or thermal expansion stresses.

Thermal performance testing follows guidelines from ASTM E1530 for thermal conductivity measurement and JEDEC JESD22-A105 for power cycling reliability. These standards help determine how effectively conductive adhesives transfer heat in high-power applications, a critical factor in preventing thermal runaway conditions.

Accelerated aging protocols, including ASTM F1980 and IEC 60068-2-2, simulate extended service conditions to predict long-term performance. These tests typically involve exposure to elevated temperatures, humidity, and electrical loads simultaneously to accelerate degradation mechanisms.

Industry-specific standards also exist, such as IPC-6012 for rigid printed boards and UL 746 for polymeric materials in electrical equipment. These standards incorporate specialized testing requirements relevant to power system applications, including flammability ratings and electrical breakdown thresholds.

Recent developments in testing standards have begun to address the unique characteristics of nanomaterial-enhanced conductive adhesives, with modified protocols that account for their distinctive failure modes and performance parameters. These emerging standards are particularly relevant as power systems increasingly incorporate advanced materials to meet higher performance demands.

IEC 60068 series provides the foundation for environmental testing of electronic components, including those bonded with conductive adhesives. Specifically, IEC 60068-2-14 (thermal cycling) and IEC 60068-2-78 (steady-state humidity) are frequently applied to assess the durability of conductive adhesive joints under varying conditions typical in power systems.

ASTM D4496 and ASTM F84 standards focus on measuring the electrical resistivity of conductive materials, offering methodologies to quantify the electrical performance of adhesives before and after environmental exposure. These measurements are critical indicators of connection quality in power applications where minimal resistance is essential.

For mechanical reliability assessment, standards such as ASTM D1002 (lap shear strength) and ASTM D3163 (adhesive bonds in shear by tension loading) provide protocols to evaluate the structural integrity of conductive adhesive joints under mechanical stress. These tests are particularly relevant for power systems subject to vibration or thermal expansion stresses.

Thermal performance testing follows guidelines from ASTM E1530 for thermal conductivity measurement and JEDEC JESD22-A105 for power cycling reliability. These standards help determine how effectively conductive adhesives transfer heat in high-power applications, a critical factor in preventing thermal runaway conditions.

Accelerated aging protocols, including ASTM F1980 and IEC 60068-2-2, simulate extended service conditions to predict long-term performance. These tests typically involve exposure to elevated temperatures, humidity, and electrical loads simultaneously to accelerate degradation mechanisms.

Industry-specific standards also exist, such as IPC-6012 for rigid printed boards and UL 746 for polymeric materials in electrical equipment. These standards incorporate specialized testing requirements relevant to power system applications, including flammability ratings and electrical breakdown thresholds.

Recent developments in testing standards have begun to address the unique characteristics of nanomaterial-enhanced conductive adhesives, with modified protocols that account for their distinctive failure modes and performance parameters. These emerging standards are particularly relevant as power systems increasingly incorporate advanced materials to meet higher performance demands.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!