Regulations and Standards for Conductive Adhesives in Building Technologies

OCT 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Adhesives Regulatory Background and Objectives

Conductive adhesives have emerged as a critical component in modern building technologies, offering innovative solutions for electrical connections, thermal management, and structural bonding. The evolution of these materials can be traced back to the mid-20th century, with significant advancements occurring in the 1980s and 1990s as electronics integration in buildings accelerated. Initially developed for specialized applications in aerospace and defense industries, conductive adhesives have gradually transitioned into mainstream building technologies, driven by increasing demands for energy efficiency, smart building systems, and sustainable construction practices.

The regulatory landscape governing conductive adhesives in building applications has evolved considerably over the past two decades. Early regulations primarily focused on basic safety parameters, while contemporary frameworks address a comprehensive range of considerations including electrical performance, environmental impact, fire safety, and long-term durability. This evolution reflects the growing recognition of conductive adhesives as critical components in building infrastructure rather than merely specialized materials for niche applications.

Current global regulatory frameworks for conductive adhesives vary significantly across regions, with the European Union, North America, and Asia-Pacific each maintaining distinct approaches. The EU's regulatory environment is particularly stringent, with materials governed under multiple directives including the Construction Products Regulation (CPR), Restriction of Hazardous Substances (RoHS), and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH). These regulations establish comprehensive requirements for safety, performance, and environmental compatibility.

The technical objectives for conductive adhesives in building technologies center around several key parameters: electrical conductivity stability under varying environmental conditions, mechanical strength and durability over extended service periods, compatibility with diverse substrate materials, and compliance with increasingly stringent environmental and safety standards. Additionally, there is growing emphasis on developing formulations that maintain performance while reducing or eliminating potentially hazardous components such as certain metal fillers and volatile organic compounds.

Industry stakeholders are increasingly focused on harmonizing standards across international boundaries to facilitate global trade and technology adoption. Organizations such as the International Electrotechnical Commission (IEC), International Organization for Standardization (ISO), and ASTM International have established technical committees dedicated to developing consensus-based standards for conductive adhesives in building applications. These efforts aim to create universally recognized performance metrics, testing methodologies, and classification systems that can be referenced by regulatory bodies worldwide.

The trajectory of regulatory development suggests a continued movement toward performance-based standards rather than prescriptive requirements, allowing for greater innovation while maintaining necessary safety and reliability parameters. This approach recognizes the rapid pace of technological advancement in conductive materials and seeks to avoid regulatory frameworks that might inadvertently constrain beneficial developments in the field.

The regulatory landscape governing conductive adhesives in building applications has evolved considerably over the past two decades. Early regulations primarily focused on basic safety parameters, while contemporary frameworks address a comprehensive range of considerations including electrical performance, environmental impact, fire safety, and long-term durability. This evolution reflects the growing recognition of conductive adhesives as critical components in building infrastructure rather than merely specialized materials for niche applications.

Current global regulatory frameworks for conductive adhesives vary significantly across regions, with the European Union, North America, and Asia-Pacific each maintaining distinct approaches. The EU's regulatory environment is particularly stringent, with materials governed under multiple directives including the Construction Products Regulation (CPR), Restriction of Hazardous Substances (RoHS), and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH). These regulations establish comprehensive requirements for safety, performance, and environmental compatibility.

The technical objectives for conductive adhesives in building technologies center around several key parameters: electrical conductivity stability under varying environmental conditions, mechanical strength and durability over extended service periods, compatibility with diverse substrate materials, and compliance with increasingly stringent environmental and safety standards. Additionally, there is growing emphasis on developing formulations that maintain performance while reducing or eliminating potentially hazardous components such as certain metal fillers and volatile organic compounds.

Industry stakeholders are increasingly focused on harmonizing standards across international boundaries to facilitate global trade and technology adoption. Organizations such as the International Electrotechnical Commission (IEC), International Organization for Standardization (ISO), and ASTM International have established technical committees dedicated to developing consensus-based standards for conductive adhesives in building applications. These efforts aim to create universally recognized performance metrics, testing methodologies, and classification systems that can be referenced by regulatory bodies worldwide.

The trajectory of regulatory development suggests a continued movement toward performance-based standards rather than prescriptive requirements, allowing for greater innovation while maintaining necessary safety and reliability parameters. This approach recognizes the rapid pace of technological advancement in conductive materials and seeks to avoid regulatory frameworks that might inadvertently constrain beneficial developments in the field.

Market Demand Analysis for Conductive Adhesives in Construction

The global market for conductive adhesives in construction has been experiencing significant growth, driven by the increasing integration of smart building technologies and sustainable construction practices. Current market analysis indicates that the demand for conductive adhesives in building technologies is primarily fueled by the rapid expansion of smart building infrastructure, which requires reliable electrical connections in various structural components.

The construction industry's shift toward energy-efficient buildings has created substantial demand for conductive adhesives that can facilitate the integration of photovoltaic systems, energy management systems, and other green technologies into building envelopes. These adhesives provide crucial electrical conductivity while maintaining structural integrity, making them essential components in modern sustainable construction.

Market research reveals that the Asia-Pacific region currently leads in consumption of conductive adhesives for construction applications, followed by North America and Europe. This regional distribution correlates with the pace of smart building adoption and green building initiatives across these markets. The commercial building sector represents the largest application segment, accounting for a significant portion of the overall market demand.

A notable trend influencing market dynamics is the increasing preference for isotropic conductive adhesives (ICAs) over traditional soldering methods in building technology applications. These adhesives offer advantages such as lower processing temperatures, reduced environmental impact, and compatibility with temperature-sensitive substrates commonly used in modern construction materials.

The regulatory landscape is increasingly shaping market demand patterns. Stringent building codes and safety standards regarding fire resistance, VOC emissions, and electrical safety are driving manufacturers to develop compliant conductive adhesive formulations. This regulatory pressure has created a distinct market segment for high-performance, environmentally friendly conductive adhesives that meet or exceed these standards.

Industry forecasts suggest that the market for conductive adhesives in construction will continue to expand as building automation systems become more prevalent. The integration of Internet of Things (IoT) devices in building management systems is creating new application opportunities, particularly for adhesives that can provide reliable connections in challenging environmental conditions typical in construction settings.

Customer requirements are evolving toward adhesives with enhanced durability, weather resistance, and long-term electrical stability. Construction professionals increasingly demand products that can maintain performance integrity throughout the building's lifecycle while withstanding temperature fluctuations, humidity, and mechanical stress. This has prompted manufacturers to focus on developing specialized formulations tailored specifically for construction applications rather than adapting products designed for electronics or automotive industries.

The construction industry's shift toward energy-efficient buildings has created substantial demand for conductive adhesives that can facilitate the integration of photovoltaic systems, energy management systems, and other green technologies into building envelopes. These adhesives provide crucial electrical conductivity while maintaining structural integrity, making them essential components in modern sustainable construction.

Market research reveals that the Asia-Pacific region currently leads in consumption of conductive adhesives for construction applications, followed by North America and Europe. This regional distribution correlates with the pace of smart building adoption and green building initiatives across these markets. The commercial building sector represents the largest application segment, accounting for a significant portion of the overall market demand.

A notable trend influencing market dynamics is the increasing preference for isotropic conductive adhesives (ICAs) over traditional soldering methods in building technology applications. These adhesives offer advantages such as lower processing temperatures, reduced environmental impact, and compatibility with temperature-sensitive substrates commonly used in modern construction materials.

The regulatory landscape is increasingly shaping market demand patterns. Stringent building codes and safety standards regarding fire resistance, VOC emissions, and electrical safety are driving manufacturers to develop compliant conductive adhesive formulations. This regulatory pressure has created a distinct market segment for high-performance, environmentally friendly conductive adhesives that meet or exceed these standards.

Industry forecasts suggest that the market for conductive adhesives in construction will continue to expand as building automation systems become more prevalent. The integration of Internet of Things (IoT) devices in building management systems is creating new application opportunities, particularly for adhesives that can provide reliable connections in challenging environmental conditions typical in construction settings.

Customer requirements are evolving toward adhesives with enhanced durability, weather resistance, and long-term electrical stability. Construction professionals increasingly demand products that can maintain performance integrity throughout the building's lifecycle while withstanding temperature fluctuations, humidity, and mechanical stress. This has prompted manufacturers to focus on developing specialized formulations tailored specifically for construction applications rather than adapting products designed for electronics or automotive industries.

Current Standards and Technical Challenges

The global landscape for conductive adhesive standards in building technologies reveals significant regional variations. In North America, UL 746C and ASTM D5363 provide comprehensive frameworks for electrical adhesives, while the IPC-A-610 standard specifically addresses requirements for electronic assemblies. The European Union has established more stringent environmental regulations through RoHS and REACH directives, which significantly impact conductive adhesive formulations by restricting hazardous substances like lead and certain solvents.

In Asia, particularly Japan and China, standards such as JIS Z 3284 and GB/T 29863 have been developed to address the unique environmental conditions of the region, including higher humidity and temperature fluctuations that can affect adhesive performance. These regional differences create compliance challenges for global manufacturers who must navigate multiple regulatory frameworks.

Technical challenges in conductive adhesive standardization primarily revolve around five key areas. First, conductivity stability presents a significant hurdle as many conductive adhesives experience performance degradation over time, particularly under thermal cycling and humidity exposure. Current standards inadequately address long-term reliability metrics, with testing protocols typically limited to 1000-hour evaluations despite building applications requiring decades of performance.

Second, adhesion strength requirements vary dramatically across building technology applications, from structural elements requiring high shear strength to flexible electronics demanding elasticity. The absence of application-specific standards forces manufacturers to over-engineer solutions, increasing costs unnecessarily.

Third, environmental resistance testing protocols remain inconsistent across regions. While some standards mandate UV exposure testing, others focus on humidity resistance or chemical compatibility, creating a fragmented approach to environmental durability assessment.

Fourth, thermal management considerations are inadequately addressed in current standards. As building technologies increasingly incorporate power electronics and IoT devices, heat dissipation capabilities of conductive adhesives become critical, yet standardized testing methodologies for thermal conductivity in real-world applications are lacking.

Finally, sustainability requirements are emerging as a major challenge. New regulations increasingly demand lower VOC content and recyclability features, but standardized methods to evaluate these parameters while maintaining electrical performance are still under development. The EU's Construction Products Regulation (CPR) is leading this shift with its emphasis on lifecycle assessment, creating pressure for global harmonization of sustainability metrics in conductive adhesive standards.

In Asia, particularly Japan and China, standards such as JIS Z 3284 and GB/T 29863 have been developed to address the unique environmental conditions of the region, including higher humidity and temperature fluctuations that can affect adhesive performance. These regional differences create compliance challenges for global manufacturers who must navigate multiple regulatory frameworks.

Technical challenges in conductive adhesive standardization primarily revolve around five key areas. First, conductivity stability presents a significant hurdle as many conductive adhesives experience performance degradation over time, particularly under thermal cycling and humidity exposure. Current standards inadequately address long-term reliability metrics, with testing protocols typically limited to 1000-hour evaluations despite building applications requiring decades of performance.

Second, adhesion strength requirements vary dramatically across building technology applications, from structural elements requiring high shear strength to flexible electronics demanding elasticity. The absence of application-specific standards forces manufacturers to over-engineer solutions, increasing costs unnecessarily.

Third, environmental resistance testing protocols remain inconsistent across regions. While some standards mandate UV exposure testing, others focus on humidity resistance or chemical compatibility, creating a fragmented approach to environmental durability assessment.

Fourth, thermal management considerations are inadequately addressed in current standards. As building technologies increasingly incorporate power electronics and IoT devices, heat dissipation capabilities of conductive adhesives become critical, yet standardized testing methodologies for thermal conductivity in real-world applications are lacking.

Finally, sustainability requirements are emerging as a major challenge. New regulations increasingly demand lower VOC content and recyclability features, but standardized methods to evaluate these parameters while maintaining electrical performance are still under development. The EU's Construction Products Regulation (CPR) is leading this shift with its emphasis on lifecycle assessment, creating pressure for global harmonization of sustainability metrics in conductive adhesive standards.

Current Compliance Solutions and Methodologies

01 Metal-filled conductive adhesives

Metal-filled conductive adhesives incorporate metallic particles such as silver, gold, copper, or nickel to create electrical conductivity. These adhesives typically consist of a polymer matrix loaded with conductive metal fillers that form conductive pathways when cured. The concentration and distribution of metal particles directly affect the conductivity level. These adhesives are widely used in electronics assembly, semiconductor packaging, and circuit board manufacturing where electrical connections need to be established without traditional soldering.- Conductive fillers in adhesive compositions: Conductive adhesives incorporate various conductive fillers to achieve electrical conductivity. These fillers include metal particles (such as silver, copper, nickel), carbon-based materials (like carbon nanotubes, graphene), and metal-coated particles. The type, size, shape, and concentration of these fillers significantly impact the adhesive's conductivity, viscosity, and bonding strength. Optimizing the filler loading allows for balancing electrical performance with mechanical properties.

- Polymer matrices for conductive adhesives: The polymer matrix serves as the binding component in conductive adhesives, providing adhesion while suspending conductive fillers. Common matrices include epoxies, silicones, acrylics, and polyurethanes, each offering different properties such as flexibility, thermal stability, and curing mechanisms. The selection of polymer matrix affects the adhesive's processing parameters, environmental resistance, and long-term reliability. Advanced formulations may incorporate hybrid polymer systems to achieve specific performance characteristics.

- Anisotropic conductive adhesives: Anisotropic conductive adhesives (ACAs) provide electrical conductivity in one direction while maintaining insulation in others. These specialized adhesives contain conductive particles dispersed in an insulating adhesive matrix, creating electrical pathways only when compressed between contact points. ACAs are particularly valuable in fine-pitch electronics assembly, display technologies, and flexible circuit connections where directional conductivity is required. Their design allows for simultaneous electrical connection and mechanical bonding without the risk of short circuits.

- Thermal management in conductive adhesives: Conductive adhesives often serve dual purposes of electrical connection and thermal management. Formulations may incorporate thermally conductive fillers like aluminum oxide, boron nitride, or metal particles to enhance heat dissipation. The thermal conductivity of these adhesives is critical in high-power electronics applications where heat buildup can affect performance and reliability. Advanced designs balance electrical conductivity, thermal conductivity, and mechanical properties to meet the demands of modern electronic devices.

- Environmental and processing considerations: Modern conductive adhesive formulations address environmental concerns by reducing or eliminating toxic components like lead and harsh solvents. Processing parameters such as curing temperature, time, and pressure significantly impact the final performance of conductive adhesives. Innovations include room-temperature curing systems, reworkable adhesives, and formulations with extended pot life. Storage stability, application methods, and compatibility with automated assembly processes are also important considerations in developing commercially viable conductive adhesive systems.

02 Carbon-based conductive adhesives

Carbon-based conductive adhesives utilize carbon materials such as graphene, carbon nanotubes, or carbon black as conductive fillers. These materials provide electrical conductivity while often being lighter and less expensive than metal-filled alternatives. Carbon-based adhesives offer advantages including flexibility, thermal stability, and corrosion resistance. They are particularly useful in applications requiring moderate conductivity combined with mechanical flexibility, such as flexible electronics, EMI shielding, and certain sensor applications.Expand Specific Solutions03 Anisotropic conductive adhesives

Anisotropic conductive adhesives (ACAs) provide electrical conductivity in one direction while maintaining insulation in others. These specialized adhesives contain conductive particles suspended in an insulating adhesive matrix. When compressed between electrical contacts, the particles form conductive paths only in the direction of compression. This unique property makes them ideal for fine-pitch connections in display technologies, flexible circuit bonding, and chip-on-glass or chip-on-flex applications where selective conductivity is required.Expand Specific Solutions04 Thermally conductive adhesives

Thermally conductive adhesives are designed to transfer heat while providing bonding strength. These adhesives incorporate thermally conductive fillers such as ceramic particles, metal oxides, or boron nitride in a polymer matrix. They serve dual functions by creating mechanical bonds while efficiently dissipating heat from electronic components. These materials are crucial in thermal management applications including LED assembly, power electronics, heat sink attachment, and other scenarios where heat dissipation is critical for device performance and reliability.Expand Specific Solutions05 Environmentally friendly conductive adhesives

Environmentally friendly conductive adhesives are formulated to reduce or eliminate hazardous substances while maintaining electrical performance. These adhesives often replace lead-based solders or adhesives containing volatile organic compounds with more sustainable alternatives. Innovations include water-based formulations, bio-derived polymers, and reduced-silver content systems. These eco-friendly options address growing regulatory requirements and sustainability concerns in electronics manufacturing while providing comparable electrical and mechanical performance to conventional conductive adhesives.Expand Specific Solutions

Key Industry Players and Manufacturers

The conductive adhesives market in building technologies is currently in a growth phase, with increasing adoption driven by sustainability regulations and energy efficiency standards. The market size is expanding due to the rising demand for smart buildings and green construction practices. Technologically, the field is maturing with companies like Henkel AG, 3M Innovative Properties, and PPG Industries leading innovation in high-performance conductive adhesives. Specialized players such as Daejoo Electronic Materials and CEMEDINE are advancing formulations for specific building applications, while larger corporations like Apple and Illinois Tool Works are integrating these technologies into broader building systems. The regulatory landscape is evolving with stricter electrical safety standards and environmental compliance requirements, pushing manufacturers toward developing more sustainable and efficient adhesive solutions.

3M Innovative Properties Co.

Technical Solution: 3M has developed advanced conductive adhesive technologies specifically designed for building applications that comply with international standards like IEC 61215/61730 and UL 94. Their proprietary formulations incorporate nano-silver particles in polymer matrices to achieve optimal conductivity while maintaining structural integrity. The company's VHB™ Architectural Panel Tape system includes conductive variants that meet AAMA 711 requirements for building envelope applications, providing both electrical connectivity and weather resistance. 3M's conductive adhesives feature controlled impedance characteristics and are formulated to maintain performance across temperature ranges from -40°C to +90°C as required by building codes. Their solutions incorporate flame retardants that comply with ASTM E84 and EN 13501 fire safety standards, making them suitable for both interior and exterior building applications where electrical conductivity is required.

Strengths: Superior adhesion strength across diverse building substrates; excellent aging resistance with 20+ year durability testing; comprehensive regulatory compliance across global markets. Weaknesses: Higher cost compared to conventional adhesives; requires specialized application techniques; limited repairability once cured.

Henkel AG & Co. KGaA

Technical Solution: Henkel has pioneered electrically conductive adhesives (ECAs) for building technology applications that meet stringent European Construction Products Regulation (CPR) requirements. Their LOCTITE ABLESTIK ECAs incorporate silver-filled epoxy systems specifically engineered to provide reliable electrical connections while maintaining structural integrity in building environments. Henkel's formulations comply with RoHS and REACH regulations, containing no restricted substances that would limit their use in sustainable building designs. Their conductive adhesives have been tested according to EN 1366-3 for maintaining fire resistance in penetration seals and EN 13501 for reaction to fire classification. Henkel's products feature controlled resistivity values (typically 10^-4 to 10^-6 Ω·cm) that remain stable through thermal cycling tests according to IEC 61215, ensuring long-term performance in building integrated electronics and smart building systems. Their adhesives also meet UL 746C requirements for polymeric materials in building applications, with documented performance in accelerated weathering tests simulating 20+ years of service life.

Strengths: Comprehensive global regulatory compliance portfolio; excellent thermal stability across building operational temperature ranges; formulations specifically designed for EMI shielding in smart buildings. Weaknesses: Requires careful surface preparation for optimal performance; higher initial cost compared to non-conductive alternatives; limited pot life after mixing for two-component systems.

Critical Technical Specifications and Testing Protocols

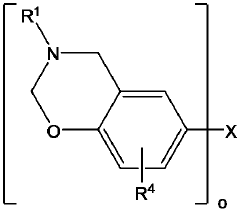

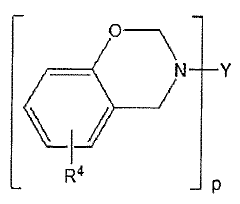

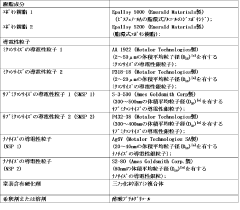

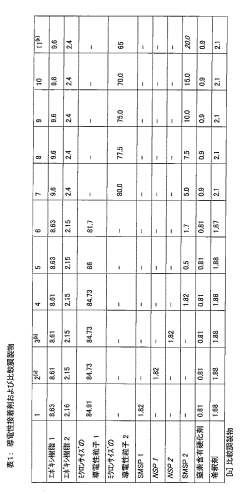

conductive adhesive

PatentActiveJP2013541611A

Innovation

- A conductive adhesive formulation using micron-sized and submicron-sized conductive particles, combined with specific resin components, that can be cured at low temperatures and low viscosities, forming stable electrical connections with low contact resistance.

Conductive adhesive, anisotropic conductive film, connected structure, and manufacturing method of connected structure

PatentInactiveKR1020230057466A

Innovation

- A conductive adhesive containing thermosetting binder, solder particles with a 50 to 80 wt% Sn and 20 to 50 wt% Bi, and dicarboxylic acid, used in an anisotropic conductive film with specific particle diameter and thickness ratios, allows for solder particles to be effectively moved between electrodes without mechanical load, ensuring good solder wettability, conductivity, and insulation.

Environmental Impact and Sustainability Considerations

The environmental impact of conductive adhesives in building technologies represents a critical consideration as the construction industry increasingly adopts sustainable practices. Traditional conductive bonding methods often rely on lead-based solders and other environmentally harmful materials that pose significant ecological risks throughout their lifecycle. Conductive adhesives offer a promising alternative, potentially reducing toxic waste and environmental contamination when properly formulated and applied.

Life cycle assessment (LCA) studies indicate that many conductive adhesives demonstrate lower carbon footprints compared to conventional soldering techniques. This advantage stems primarily from lower processing temperatures, which translate to reduced energy consumption during application. Additionally, certain formulations eliminate the need for harmful flux cleaning agents that contribute to water pollution and ozone depletion.

The composition of conductive adhesives presents both challenges and opportunities for sustainability. Silver-based conductive adhesives, while effective, raise concerns regarding resource depletion and mining impacts. However, emerging research into carbon-based alternatives, including graphene and carbon nanotubes, offers potentially more sustainable options with reduced environmental footprints. These materials may provide comparable conductivity while minimizing dependence on precious metals.

End-of-life considerations for buildings incorporating conductive adhesives remain an evolving regulatory area. Current waste electrical and electronic equipment (WEEE) directives and Restriction of Hazardous Substances (RoHS) regulations increasingly influence formulation requirements. The recyclability of components joined with conductive adhesives varies significantly based on adhesive chemistry, with thermoplastic-based systems generally offering better recyclability than thermosetting alternatives.

Water consumption and pollution represent additional environmental factors in conductive adhesive manufacturing and application. Water-based formulations generally demonstrate lower volatile organic compound (VOC) emissions compared to solvent-based alternatives, aligning with green building certification requirements such as LEED and BREEAM. However, manufacturing processes for conductive fillers often involve significant water usage and potential contamination risks.

Recent regulatory trends indicate increasing emphasis on circular economy principles, pushing manufacturers toward developing conductive adhesives designed for disassembly and material recovery. This shift necessitates innovations in reversible bonding technologies and improved material identification systems to facilitate future recycling efforts. Several leading manufacturers have begun implementing take-back programs for construction materials containing electronic components joined with conductive adhesives.

Life cycle assessment (LCA) studies indicate that many conductive adhesives demonstrate lower carbon footprints compared to conventional soldering techniques. This advantage stems primarily from lower processing temperatures, which translate to reduced energy consumption during application. Additionally, certain formulations eliminate the need for harmful flux cleaning agents that contribute to water pollution and ozone depletion.

The composition of conductive adhesives presents both challenges and opportunities for sustainability. Silver-based conductive adhesives, while effective, raise concerns regarding resource depletion and mining impacts. However, emerging research into carbon-based alternatives, including graphene and carbon nanotubes, offers potentially more sustainable options with reduced environmental footprints. These materials may provide comparable conductivity while minimizing dependence on precious metals.

End-of-life considerations for buildings incorporating conductive adhesives remain an evolving regulatory area. Current waste electrical and electronic equipment (WEEE) directives and Restriction of Hazardous Substances (RoHS) regulations increasingly influence formulation requirements. The recyclability of components joined with conductive adhesives varies significantly based on adhesive chemistry, with thermoplastic-based systems generally offering better recyclability than thermosetting alternatives.

Water consumption and pollution represent additional environmental factors in conductive adhesive manufacturing and application. Water-based formulations generally demonstrate lower volatile organic compound (VOC) emissions compared to solvent-based alternatives, aligning with green building certification requirements such as LEED and BREEAM. However, manufacturing processes for conductive fillers often involve significant water usage and potential contamination risks.

Recent regulatory trends indicate increasing emphasis on circular economy principles, pushing manufacturers toward developing conductive adhesives designed for disassembly and material recovery. This shift necessitates innovations in reversible bonding technologies and improved material identification systems to facilitate future recycling efforts. Several leading manufacturers have begun implementing take-back programs for construction materials containing electronic components joined with conductive adhesives.

International Harmonization of Building Safety Codes

The global construction industry faces significant challenges in adopting conductive adhesive technologies due to fragmented regulatory frameworks across different countries and regions. International harmonization of building safety codes represents a critical step toward facilitating wider implementation of these innovative materials. Currently, major building code organizations including the International Code Council (ICC), European Committee for Standardization (CEN), and International Organization for Standardization (ISO) are working toward establishing unified standards for conductive adhesives in construction applications.

Efforts to harmonize these regulations have accelerated in recent years, with the establishment of the Global Building Codes Alliance in 2021, which specifically addresses emerging technologies like conductive adhesives. This alliance has created working groups focused on developing performance-based criteria rather than prescriptive requirements, allowing for greater innovation while maintaining safety standards. The International Electrotechnical Commission (IEC) has also joined these efforts, contributing expertise on electrical safety considerations specific to conductive materials.

Key progress has been made in standardizing testing methodologies for conductive adhesives across jurisdictions. The development of ISO/TS 21376, which establishes uniform testing protocols for electrical conductivity, thermal stability, and adhesion strength under various environmental conditions, represents a significant milestone. This technical specification has been adopted by 37 countries as of 2023, creating a common language for evaluating these materials regardless of geographic location.

Regulatory convergence faces several persistent challenges, including varying climate considerations that affect material performance requirements. Northern European countries emphasize freeze-thaw durability, while regions with high humidity require different performance parameters. Additionally, electrical safety thresholds differ substantially between North American and Asian regulatory frameworks, complicating harmonization efforts.

The economic implications of regulatory harmonization are substantial. A 2022 World Economic Forum study estimated that unified building codes for conductive materials could reduce compliance costs by 23% and accelerate market entry for new products by an average of 14 months. This harmonization would particularly benefit small and medium enterprises developing innovative conductive adhesive solutions by reducing the burden of multiple certification processes.

Looking forward, the Building Technology Roadmap Initiative, supported by G20 nations, has established a five-year timeline (2023-2028) for achieving substantial harmonization of conductive adhesive standards. This initiative prioritizes creating unified classification systems, performance metrics, and safety parameters that can be adopted globally while allowing for regional adaptations where necessary due to specific environmental or structural requirements.

Efforts to harmonize these regulations have accelerated in recent years, with the establishment of the Global Building Codes Alliance in 2021, which specifically addresses emerging technologies like conductive adhesives. This alliance has created working groups focused on developing performance-based criteria rather than prescriptive requirements, allowing for greater innovation while maintaining safety standards. The International Electrotechnical Commission (IEC) has also joined these efforts, contributing expertise on electrical safety considerations specific to conductive materials.

Key progress has been made in standardizing testing methodologies for conductive adhesives across jurisdictions. The development of ISO/TS 21376, which establishes uniform testing protocols for electrical conductivity, thermal stability, and adhesion strength under various environmental conditions, represents a significant milestone. This technical specification has been adopted by 37 countries as of 2023, creating a common language for evaluating these materials regardless of geographic location.

Regulatory convergence faces several persistent challenges, including varying climate considerations that affect material performance requirements. Northern European countries emphasize freeze-thaw durability, while regions with high humidity require different performance parameters. Additionally, electrical safety thresholds differ substantially between North American and Asian regulatory frameworks, complicating harmonization efforts.

The economic implications of regulatory harmonization are substantial. A 2022 World Economic Forum study estimated that unified building codes for conductive materials could reduce compliance costs by 23% and accelerate market entry for new products by an average of 14 months. This harmonization would particularly benefit small and medium enterprises developing innovative conductive adhesive solutions by reducing the burden of multiple certification processes.

Looking forward, the Building Technology Roadmap Initiative, supported by G20 nations, has established a five-year timeline (2023-2028) for achieving substantial harmonization of conductive adhesive standards. This initiative prioritizes creating unified classification systems, performance metrics, and safety parameters that can be adopted globally while allowing for regional adaptations where necessary due to specific environmental or structural requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!