Conductive Adhesives in Consumer Electronics: Technical Considerations

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Adhesives Evolution and Objectives

Conductive adhesives have evolved significantly since their inception in the electronics industry in the 1960s. Initially developed as alternatives to traditional soldering methods, these materials have undergone substantial transformation in composition, performance characteristics, and application methodologies. The evolution trajectory has been primarily driven by the miniaturization trend in consumer electronics, increasing environmental regulations, and the demand for more reliable interconnection solutions.

The first generation of conductive adhesives consisted primarily of simple epoxy matrices filled with silver particles. These early formulations offered basic electrical conductivity but suffered from reliability issues, particularly in high-temperature and high-humidity environments. The 1980s marked a significant advancement with the introduction of anisotropic conductive adhesives (ACAs), which provided directional conductivity and enabled finer pitch connections.

By the 1990s, isotropic conductive adhesives (ICAs) gained prominence, offering uniform conductivity in all directions and becoming viable alternatives to lead-based solders. This period coincided with growing environmental concerns about traditional soldering processes, accelerating research into conductive adhesive technologies. The implementation of RoHS (Restriction of Hazardous Substances) directives in the early 2000s further catalyzed the shift toward lead-free interconnection solutions.

The past decade has witnessed remarkable innovations in nano-enhanced conductive adhesives. The incorporation of carbon nanotubes, graphene, and metallic nanoparticles has dramatically improved electrical and thermal conductivity while maintaining or enhancing mechanical properties. These advancements have expanded the application scope of conductive adhesives in flexible electronics, wearable devices, and other emerging consumer electronic products.

The primary objectives of current conductive adhesive development focus on several critical aspects. First, enhancing electrical conductivity to match or exceed that of traditional solders while maintaining processing advantages. Second, improving thermal management capabilities to address the increasing power densities in modern electronic devices. Third, developing formulations with enhanced reliability under extreme conditions, including thermal cycling, mechanical stress, and environmental exposure.

Additionally, research aims to create adhesives with self-healing properties to extend product lifespans and improve long-term reliability. There is also significant interest in developing reworkable conductive adhesives that facilitate repairs and component replacement, addressing a longstanding limitation compared to soldered connections. Finally, efforts are underway to reduce curing temperatures and times, enabling applications with temperature-sensitive components and improving manufacturing throughput.

The first generation of conductive adhesives consisted primarily of simple epoxy matrices filled with silver particles. These early formulations offered basic electrical conductivity but suffered from reliability issues, particularly in high-temperature and high-humidity environments. The 1980s marked a significant advancement with the introduction of anisotropic conductive adhesives (ACAs), which provided directional conductivity and enabled finer pitch connections.

By the 1990s, isotropic conductive adhesives (ICAs) gained prominence, offering uniform conductivity in all directions and becoming viable alternatives to lead-based solders. This period coincided with growing environmental concerns about traditional soldering processes, accelerating research into conductive adhesive technologies. The implementation of RoHS (Restriction of Hazardous Substances) directives in the early 2000s further catalyzed the shift toward lead-free interconnection solutions.

The past decade has witnessed remarkable innovations in nano-enhanced conductive adhesives. The incorporation of carbon nanotubes, graphene, and metallic nanoparticles has dramatically improved electrical and thermal conductivity while maintaining or enhancing mechanical properties. These advancements have expanded the application scope of conductive adhesives in flexible electronics, wearable devices, and other emerging consumer electronic products.

The primary objectives of current conductive adhesive development focus on several critical aspects. First, enhancing electrical conductivity to match or exceed that of traditional solders while maintaining processing advantages. Second, improving thermal management capabilities to address the increasing power densities in modern electronic devices. Third, developing formulations with enhanced reliability under extreme conditions, including thermal cycling, mechanical stress, and environmental exposure.

Additionally, research aims to create adhesives with self-healing properties to extend product lifespans and improve long-term reliability. There is also significant interest in developing reworkable conductive adhesives that facilitate repairs and component replacement, addressing a longstanding limitation compared to soldered connections. Finally, efforts are underway to reduce curing temperatures and times, enabling applications with temperature-sensitive components and improving manufacturing throughput.

Market Demand Analysis for Electronics Assembly Solutions

The global market for electronics assembly solutions has witnessed significant growth in recent years, driven by the increasing complexity and miniaturization of consumer electronic devices. The demand for conductive adhesives specifically has surged as manufacturers seek alternatives to traditional soldering methods. Current market analysis indicates that the conductive adhesives market for consumer electronics is expanding at a compound annual growth rate of approximately 6-8%, with particularly strong demand in smartphones, wearables, and flexible electronics segments.

Consumer electronics manufacturers are increasingly prioritizing assembly solutions that can accommodate thinner, lighter, and more flexible device designs. This trend has created substantial market pull for conductive adhesives, which offer advantages in terms of lower processing temperatures and compatibility with heat-sensitive components. Market research reveals that nearly 70% of electronics manufacturers are actively exploring or implementing conductive adhesive solutions to address thermal management challenges in next-generation devices.

The transition toward environmentally sustainable manufacturing processes represents another significant market driver. With regulatory bodies worldwide implementing stricter controls on lead and other hazardous substances, the demand for lead-free assembly solutions has intensified. Conductive adhesives, particularly those formulated without toxic components, are positioned favorably in this regulatory landscape, creating a market segment estimated to reach several billion dollars by 2025.

Regional analysis shows varying adoption rates across global markets. Asia-Pacific dominates the conductive adhesives market, accounting for over 60% of global consumption, primarily due to the concentration of electronics manufacturing in countries like China, Taiwan, and South Korea. North American and European markets show growing interest, particularly in high-reliability applications where traditional soldering presents limitations.

End-user segmentation reveals that smartphone manufacturers represent the largest consumer segment for conductive adhesives, followed by manufacturers of wearable technology and medical electronics. The automotive electronics sector is emerging as a rapidly growing market segment, with increasing integration of electronic components in vehicles driving demand for reliable assembly solutions capable of withstanding harsh operating environments.

Market forecasts indicate that isotropic conductive adhesives currently hold the largest market share, though anisotropic conductive films are experiencing faster growth due to their advantages in fine-pitch applications. Industry surveys suggest that manufacturers are willing to pay premium prices for conductive adhesives that offer enhanced reliability, improved thermal conductivity, and simplified processing requirements.

Consumer electronics manufacturers are increasingly prioritizing assembly solutions that can accommodate thinner, lighter, and more flexible device designs. This trend has created substantial market pull for conductive adhesives, which offer advantages in terms of lower processing temperatures and compatibility with heat-sensitive components. Market research reveals that nearly 70% of electronics manufacturers are actively exploring or implementing conductive adhesive solutions to address thermal management challenges in next-generation devices.

The transition toward environmentally sustainable manufacturing processes represents another significant market driver. With regulatory bodies worldwide implementing stricter controls on lead and other hazardous substances, the demand for lead-free assembly solutions has intensified. Conductive adhesives, particularly those formulated without toxic components, are positioned favorably in this regulatory landscape, creating a market segment estimated to reach several billion dollars by 2025.

Regional analysis shows varying adoption rates across global markets. Asia-Pacific dominates the conductive adhesives market, accounting for over 60% of global consumption, primarily due to the concentration of electronics manufacturing in countries like China, Taiwan, and South Korea. North American and European markets show growing interest, particularly in high-reliability applications where traditional soldering presents limitations.

End-user segmentation reveals that smartphone manufacturers represent the largest consumer segment for conductive adhesives, followed by manufacturers of wearable technology and medical electronics. The automotive electronics sector is emerging as a rapidly growing market segment, with increasing integration of electronic components in vehicles driving demand for reliable assembly solutions capable of withstanding harsh operating environments.

Market forecasts indicate that isotropic conductive adhesives currently hold the largest market share, though anisotropic conductive films are experiencing faster growth due to their advantages in fine-pitch applications. Industry surveys suggest that manufacturers are willing to pay premium prices for conductive adhesives that offer enhanced reliability, improved thermal conductivity, and simplified processing requirements.

Technical Challenges in Conductive Adhesive Implementation

Despite significant advancements in conductive adhesive technology, several technical challenges persist that limit their widespread implementation in consumer electronics. The primary challenge remains achieving consistent electrical conductivity while maintaining mechanical strength. Current conductive adhesives often exhibit higher electrical resistance compared to traditional soldering methods, resulting in performance degradation, especially in high-frequency applications. This resistance variability increases with environmental exposure and aging, creating reliability concerns for long-term product deployment.

Moisture sensitivity presents another significant hurdle, as many conductive adhesives absorb environmental moisture, leading to conductivity fluctuations and potential delamination. This is particularly problematic in portable consumer electronics that frequently experience varying humidity conditions. The hygroscopic nature of polymer matrices in these adhesives necessitates additional protective measures that add complexity to manufacturing processes.

Thermal management challenges also plague conductive adhesive implementation. The thermal conductivity of most commercially available conductive adhesives remains substantially lower than traditional solder connections, creating potential hotspots in densely packed electronic assemblies. This limitation becomes increasingly critical as consumer devices continue to shrink while processing requirements escalate, generating more heat in confined spaces.

Manufacturing integration presents additional complications. Conductive adhesives typically require precise dispensing equipment and controlled curing environments that differ significantly from established soldering infrastructure. The curing process itself introduces thermal stress that can affect sensitive components, while incomplete curing leads to unreliable connections. Furthermore, the shelf life of many conductive adhesive formulations is relatively short, creating inventory management challenges.

Compatibility issues with surface finishes and component metallization further complicate implementation. Certain surface treatments and metal combinations can inhibit proper adhesion or accelerate degradation of electrical properties. This necessitates extensive compatibility testing across the diverse materials found in modern consumer electronics.

Cost considerations remain a significant barrier to widespread adoption. While raw material costs for some conductive adhesives have decreased, the specialized equipment, process modifications, and quality control measures required for implementation often outweigh the material savings. Additionally, rework and repair processes for conductive adhesive joints are generally more complex and less standardized than those for traditional solder connections, increasing lifecycle maintenance costs.

Addressing these technical challenges requires interdisciplinary approaches combining polymer science, nanomaterial engineering, and electronics manufacturing expertise. Recent research focusing on hybrid systems that combine the benefits of traditional soldering with conductive adhesives shows promise but requires further development before commercial viability.

Moisture sensitivity presents another significant hurdle, as many conductive adhesives absorb environmental moisture, leading to conductivity fluctuations and potential delamination. This is particularly problematic in portable consumer electronics that frequently experience varying humidity conditions. The hygroscopic nature of polymer matrices in these adhesives necessitates additional protective measures that add complexity to manufacturing processes.

Thermal management challenges also plague conductive adhesive implementation. The thermal conductivity of most commercially available conductive adhesives remains substantially lower than traditional solder connections, creating potential hotspots in densely packed electronic assemblies. This limitation becomes increasingly critical as consumer devices continue to shrink while processing requirements escalate, generating more heat in confined spaces.

Manufacturing integration presents additional complications. Conductive adhesives typically require precise dispensing equipment and controlled curing environments that differ significantly from established soldering infrastructure. The curing process itself introduces thermal stress that can affect sensitive components, while incomplete curing leads to unreliable connections. Furthermore, the shelf life of many conductive adhesive formulations is relatively short, creating inventory management challenges.

Compatibility issues with surface finishes and component metallization further complicate implementation. Certain surface treatments and metal combinations can inhibit proper adhesion or accelerate degradation of electrical properties. This necessitates extensive compatibility testing across the diverse materials found in modern consumer electronics.

Cost considerations remain a significant barrier to widespread adoption. While raw material costs for some conductive adhesives have decreased, the specialized equipment, process modifications, and quality control measures required for implementation often outweigh the material savings. Additionally, rework and repair processes for conductive adhesive joints are generally more complex and less standardized than those for traditional solder connections, increasing lifecycle maintenance costs.

Addressing these technical challenges requires interdisciplinary approaches combining polymer science, nanomaterial engineering, and electronics manufacturing expertise. Recent research focusing on hybrid systems that combine the benefits of traditional soldering with conductive adhesives shows promise but requires further development before commercial viability.

Current Conductive Adhesive Formulations and Applications

01 Conductive adhesives with metal fillers

Conductive adhesives incorporating metal fillers such as silver, copper, or gold particles provide electrical conductivity while maintaining adhesive properties. These metal-filled adhesives create conductive pathways through the adhesive matrix, allowing for electrical connections between components. The size, shape, and concentration of metal particles can be optimized to achieve desired conductivity levels while maintaining proper adhesion strength and flexibility.- Metal-filled conductive adhesives: Metal-filled conductive adhesives incorporate metallic particles such as silver, gold, or copper into adhesive matrices to create electrical conductivity. These formulations typically use epoxy, silicone, or acrylic bases with precisely controlled metal filler concentrations to achieve optimal conductivity while maintaining adhesive properties. The size, shape, and distribution of metal particles significantly impact the conductivity and mechanical strength of the final product. These adhesives are widely used in electronics assembly, particularly for applications requiring both electrical connections and structural bonding.

- Carbon-based conductive adhesives: Carbon-based conductive adhesives utilize carbon materials such as graphene, carbon nanotubes, or carbon black as conductive fillers. These materials offer advantages including lower cost compared to precious metals, lighter weight, and resistance to oxidation. Carbon-based fillers can be incorporated into various polymer matrices to create flexible, durable adhesives with tunable conductivity. These formulations are particularly valuable in applications requiring flexibility, thermal management, or where metal migration concerns exist. The unique structure of carbon nanomaterials allows for electrical conductivity at lower filler loadings than traditional conductive particles.

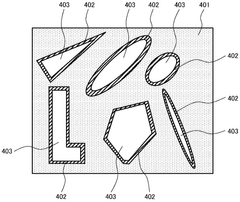

- Anisotropic conductive adhesives: Anisotropic conductive adhesives (ACAs) provide electrical conductivity in a specific direction while maintaining insulation in others. These specialized formulations typically contain conductive particles suspended in an insulating adhesive matrix. When compressed between electrical contacts, the particles form conductive pathways in the z-direction while remaining electrically isolated in the x and y directions. This unique property makes ACAs ideal for high-density interconnections in display technologies, flexible electronics, and fine-pitch components where preventing short circuits between adjacent connections is critical.

- Thermally conductive adhesives: Thermally conductive adhesives are designed to transfer heat while providing bonding functionality. These formulations incorporate thermally conductive fillers such as aluminum oxide, boron nitride, or aluminum nitride into adhesive bases. The adhesives create thermal pathways that help dissipate heat from electronic components, preventing overheating and improving device reliability. Advanced formulations balance thermal conductivity with other properties like electrical insulation, flexibility, and bond strength. These materials are crucial in modern electronics where thermal management is essential for performance and longevity.

- Environmentally friendly conductive adhesives: Environmentally friendly conductive adhesives address sustainability concerns by eliminating toxic components like lead while maintaining electrical performance. These formulations use bio-based polymers, water-based systems, or recyclable materials as alternatives to traditional solvent-based adhesives. Some incorporate novel conductive fillers derived from renewable resources or utilize manufacturing processes with reduced environmental impact. These green alternatives meet increasingly stringent environmental regulations while providing the conductivity needed for electronic applications. Research in this area focuses on achieving performance comparable to conventional conductive adhesives while reducing ecological footprint.

02 Carbon-based conductive adhesives

Carbon-based materials such as carbon nanotubes, graphene, and carbon black are incorporated into adhesive formulations to create electrically conductive adhesives. These carbon-based fillers provide conductivity with lower weight and often better corrosion resistance compared to metal fillers. The carbon structures create conductive networks throughout the adhesive matrix, enabling electrical connections while maintaining flexibility and adhesion properties required for various electronic applications.Expand Specific Solutions03 Thermally conductive adhesives

Adhesives formulated with thermally conductive fillers such as ceramic particles, metal oxides, or boron nitride provide both adhesion and heat dissipation capabilities. These adhesives are designed to transfer heat away from electronic components while maintaining electrical insulation properties. The thermal conductivity can be adjusted by varying the type, size, and concentration of fillers, making these adhesives suitable for applications where heat management is critical.Expand Specific Solutions04 Anisotropic conductive adhesives

Anisotropic conductive adhesives (ACAs) provide electrical conductivity in one direction while maintaining insulation in other directions. These specialized adhesives typically contain conductive particles suspended in an insulating adhesive matrix. When compressed between components, the particles form conductive pathways in the z-direction while remaining electrically isolated from each other in the x-y plane. This technology enables high-density interconnections in electronic assemblies without the risk of short circuits.Expand Specific Solutions05 Environmentally friendly conductive adhesives

Eco-friendly conductive adhesives are formulated to reduce environmental impact while maintaining electrical conductivity. These adhesives may use bio-based resins, avoid toxic solvents, or incorporate sustainable conductive fillers. Some formulations eliminate lead and other hazardous substances to comply with environmental regulations such as RoHS. These green alternatives provide similar electrical performance to conventional conductive adhesives while reducing ecological footprint and improving workplace safety.Expand Specific Solutions

Leading Manufacturers and Industry Competition Landscape

The conductive adhesives market in consumer electronics is currently in a growth phase, with increasing demand driven by miniaturization trends and sustainability requirements. The market is projected to expand significantly as electronics become more compact and complex. Technologically, the field shows varying maturity levels, with established players like Henkel AG, 3M Innovative Properties, and Sumitomo Electric leading innovation through extensive R&D investments. These companies have developed specialized formulations addressing thermal conductivity, flexibility, and reliability challenges. Emerging competitors such as TactoTek, RESONAC, and Nitto Denko are advancing novel applications in flexible electronics and IoT devices. The competitive landscape features both chemical conglomerates diversifying their adhesive portfolios and specialized manufacturers focusing on high-performance niche solutions for next-generation consumer electronics.

Henkel AG & Co. KGaA

Technical Solution: Henkel has developed advanced electrically conductive adhesives (ECAs) specifically designed for consumer electronics applications. Their LOCTITE brand conductive adhesives utilize silver-filled epoxy technology that provides excellent electrical conductivity while maintaining strong mechanical bonds. These adhesives feature fine-pitch capability for high-density interconnects with particle sizes typically below 20 microns, enabling reliable connections in miniaturized devices. Henkel's formulations offer controlled rheology for precision dispensing and screen printing, with viscosities tailored between 15,000-50,000 cPs depending on application requirements. Their latest generation products incorporate nano-silver technology that achieves conductivity levels approaching 10^-4 ohm·cm while reducing silver content by up to 30% compared to conventional formulations[1]. Additionally, Henkel has developed reworkable conductive adhesives with cure temperatures as low as 80°C for temperature-sensitive components, making them suitable for flexible electronics and displays.

Strengths: Superior electrical conductivity approaching solder performance; excellent reliability under thermal cycling (withstanding -40°C to 125°C for 1000+ cycles); environmentally friendly lead-free composition; and compatibility with temperature-sensitive substrates. Weaknesses: Higher cost compared to traditional soldering; longer processing time due to cure requirements; and potential for silver migration under high humidity conditions requiring specialized encapsulation.

3M Innovative Properties Co.

Technical Solution: 3M has pioneered anisotropic conductive adhesives (ACAs) and films (ACFs) specifically engineered for consumer electronics applications. Their technology utilizes precisely dispersed conductive particles (typically gold-coated polymer spheres or nickel particles) suspended in a polymer matrix that conducts electricity only in the z-direction when compressed. This unique property prevents short circuits between adjacent connections, making it ideal for high-density applications with fine pitch requirements down to 40μm. 3M's latest generation ACFs incorporate thermoset epoxy systems with cure temperatures optimized between 170-200°C and cure times as short as 3-5 seconds under appropriate pressure conditions (typically 3-5 MPa)[2]. The company has also developed specialized formulations with enhanced thermal stability that maintain reliable connections through 1000+ hours of 85°C/85% relative humidity testing. For flexible electronics applications, 3M offers stretchable conductive adhesives that maintain conductivity under deformation, with some formulations capable of withstanding up to 30% elongation while maintaining electrical performance.

Strengths: Excellent fine-pitch capability for ultra-high-density interconnections; eliminates the need for flux cleaning processes; provides both electrical connection and mechanical bonding in a single step; and offers good compatibility with temperature-sensitive substrates like flexible displays. Weaknesses: Requires specialized bonding equipment with precise temperature and pressure control; higher initial investment compared to traditional soldering processes; and potential for increased contact resistance over time in harsh environmental conditions.

Key Patents and Innovations in Conductive Adhesive Materials

Conductive adhesive and electronic control device using same

PatentWO2024219134A1

Innovation

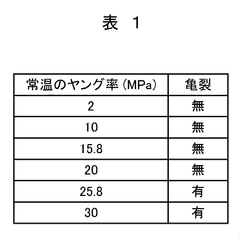

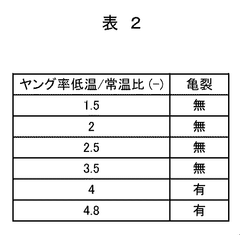

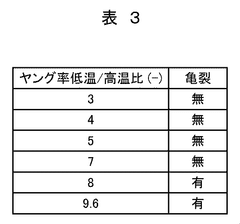

- A conductive adhesive comprising a silicone resin with conductive carbonaceous particles coated in a metal layer, specifically with a Young's modulus of 0.1 to 25.0 MPa, which suppresses cracking due to temperature changes, ensuring long-term electromagnetic shielding efficacy.

conductive adhesive

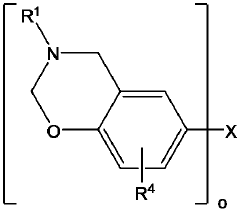

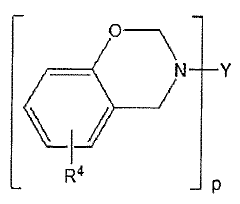

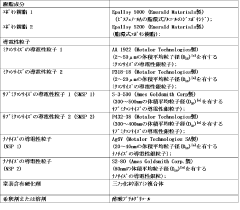

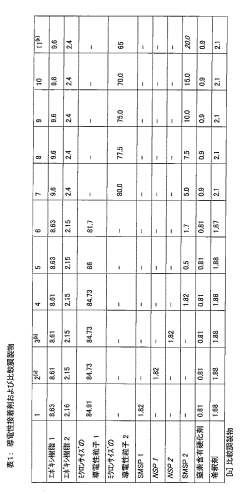

PatentActiveJP2013541611A

Innovation

- A conductive adhesive formulation using micron-sized and submicron-sized conductive particles, combined with specific resin components, that can be cured at low temperatures and low viscosities, forming stable electrical connections with low contact resistance.

Environmental Impact and Sustainability Considerations

The environmental impact of conductive adhesives in consumer electronics represents a critical consideration as the industry moves toward more sustainable manufacturing practices. Traditional soldering methods using lead-based materials have long been associated with significant environmental hazards, including soil and water contamination, as well as health risks to workers and consumers. Conductive adhesives, particularly those based on environmentally friendly formulations, offer a promising alternative with reduced ecological footprint.

Recent life cycle assessments reveal that electrically conductive adhesives (ECAs) can reduce energy consumption during the assembly process by up to 70% compared to conventional soldering techniques. This energy reduction stems from lower curing temperatures, typically ranging from 80°C to 150°C, versus the 220°C to 250°C required for lead-free solders. The decreased thermal requirements translate directly into reduced carbon emissions throughout the manufacturing process.

Material composition of conductive adhesives presents both challenges and opportunities for sustainability. Silver-based ECAs, while effective conductors, rely on precious metal mining with associated environmental degradation. However, emerging research into carbon-based alternatives, including graphene and carbon nanotubes, promises to reduce dependence on rare metals while maintaining performance standards. These carbon-based materials offer potentially lower environmental impact during both production and end-of-life phases.

End-of-life considerations for electronic devices containing conductive adhesives require particular attention. Unlike traditional soldered connections, many ECAs can be formulated to enable easier disassembly and component recovery, facilitating more effective recycling processes. This characteristic aligns with circular economy principles and extended producer responsibility frameworks increasingly adopted by regulatory bodies worldwide.

Regulatory landscapes are evolving rapidly in response to environmental concerns. The European Union's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives have accelerated the transition away from lead-based solders. Conductive adhesives that comply with these regulations while maintaining performance standards position manufacturers advantageously in global markets with stringent environmental requirements.

Water usage and contamination represent additional environmental factors in the conductive adhesive manufacturing process. Water-based conductive adhesive formulations are emerging as alternatives to solvent-based systems, reducing volatile organic compound (VOC) emissions and associated air quality impacts. These formulations typically require 40-60% less water during production compared to conventional manufacturing processes.

Recent life cycle assessments reveal that electrically conductive adhesives (ECAs) can reduce energy consumption during the assembly process by up to 70% compared to conventional soldering techniques. This energy reduction stems from lower curing temperatures, typically ranging from 80°C to 150°C, versus the 220°C to 250°C required for lead-free solders. The decreased thermal requirements translate directly into reduced carbon emissions throughout the manufacturing process.

Material composition of conductive adhesives presents both challenges and opportunities for sustainability. Silver-based ECAs, while effective conductors, rely on precious metal mining with associated environmental degradation. However, emerging research into carbon-based alternatives, including graphene and carbon nanotubes, promises to reduce dependence on rare metals while maintaining performance standards. These carbon-based materials offer potentially lower environmental impact during both production and end-of-life phases.

End-of-life considerations for electronic devices containing conductive adhesives require particular attention. Unlike traditional soldered connections, many ECAs can be formulated to enable easier disassembly and component recovery, facilitating more effective recycling processes. This characteristic aligns with circular economy principles and extended producer responsibility frameworks increasingly adopted by regulatory bodies worldwide.

Regulatory landscapes are evolving rapidly in response to environmental concerns. The European Union's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives have accelerated the transition away from lead-based solders. Conductive adhesives that comply with these regulations while maintaining performance standards position manufacturers advantageously in global markets with stringent environmental requirements.

Water usage and contamination represent additional environmental factors in the conductive adhesive manufacturing process. Water-based conductive adhesive formulations are emerging as alternatives to solvent-based systems, reducing volatile organic compound (VOC) emissions and associated air quality impacts. These formulations typically require 40-60% less water during production compared to conventional manufacturing processes.

Reliability Testing and Quality Assurance Methodologies

Reliability testing and quality assurance methodologies for conductive adhesives in consumer electronics require comprehensive approaches to ensure long-term performance under various operating conditions. Standard testing protocols typically include thermal cycling tests, which subject adhesive bonds to repeated temperature fluctuations between -40°C and 125°C to evaluate thermal expansion coefficient compatibility and bond integrity over time.

Humidity resistance testing is equally critical, with samples exposed to environments of 85% relative humidity at 85°C for periods ranging from 500 to 1000 hours. This test reveals potential degradation mechanisms related to moisture ingress and corrosion susceptibility, particularly important for devices used in humid climates or wearable technology.

Mechanical stress testing evaluates the adhesive's ability to withstand physical forces through methods such as shear strength testing, pull testing, and drop impact analysis. These tests simulate real-world handling conditions and provide quantitative data on bond strength under various mechanical stresses.

Accelerated aging methodologies are employed to predict long-term reliability within compressed timeframes. These tests often combine multiple stressors—heat, humidity, and electrical bias—to accelerate potential failure mechanisms. The industry standard JEDEC qualification protocols provide structured frameworks for these evaluations.

Electrical performance stability testing measures changes in conductivity over time and under environmental stressors. Parameters monitored include contact resistance, volume resistivity, and current-carrying capacity under thermal loading. For high-frequency applications, impedance stability and signal integrity testing become essential quality metrics.

Statistical process control (SPC) methodologies are increasingly implemented in manufacturing environments to ensure consistent adhesive application. Key process variables monitored include viscosity, cure time, dispensing accuracy, and bond line thickness. Advanced manufacturers employ in-line optical inspection systems and automated electrical testing to verify proper adhesive placement and functionality.

Failure analysis techniques form a critical component of quality assurance programs. When failures occur, techniques such as cross-sectional analysis, scanning electron microscopy, and energy-dispersive X-ray spectroscopy help identify root causes, whether they stem from material defects, process inconsistencies, or design incompatibilities.

Industry certification standards, including IPC-A-610 for electronic assemblies and MIL-STD-883 for microelectronic devices, provide benchmarks for reliability requirements. Consumer electronics manufacturers typically develop customized testing protocols that exceed these standards to differentiate their products in competitive markets.

Humidity resistance testing is equally critical, with samples exposed to environments of 85% relative humidity at 85°C for periods ranging from 500 to 1000 hours. This test reveals potential degradation mechanisms related to moisture ingress and corrosion susceptibility, particularly important for devices used in humid climates or wearable technology.

Mechanical stress testing evaluates the adhesive's ability to withstand physical forces through methods such as shear strength testing, pull testing, and drop impact analysis. These tests simulate real-world handling conditions and provide quantitative data on bond strength under various mechanical stresses.

Accelerated aging methodologies are employed to predict long-term reliability within compressed timeframes. These tests often combine multiple stressors—heat, humidity, and electrical bias—to accelerate potential failure mechanisms. The industry standard JEDEC qualification protocols provide structured frameworks for these evaluations.

Electrical performance stability testing measures changes in conductivity over time and under environmental stressors. Parameters monitored include contact resistance, volume resistivity, and current-carrying capacity under thermal loading. For high-frequency applications, impedance stability and signal integrity testing become essential quality metrics.

Statistical process control (SPC) methodologies are increasingly implemented in manufacturing environments to ensure consistent adhesive application. Key process variables monitored include viscosity, cure time, dispensing accuracy, and bond line thickness. Advanced manufacturers employ in-line optical inspection systems and automated electrical testing to verify proper adhesive placement and functionality.

Failure analysis techniques form a critical component of quality assurance programs. When failures occur, techniques such as cross-sectional analysis, scanning electron microscopy, and energy-dispersive X-ray spectroscopy help identify root causes, whether they stem from material defects, process inconsistencies, or design incompatibilities.

Industry certification standards, including IPC-A-610 for electronic assemblies and MIL-STD-883 for microelectronic devices, provide benchmarks for reliability requirements. Consumer electronics manufacturers typically develop customized testing protocols that exceed these standards to differentiate their products in competitive markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!