Conductive Adhesives' Contribution to Sustainable Technology Solutions

OCT 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Adhesives Background and Sustainability Goals

Conductive adhesives have emerged as a pivotal technology in the electronics manufacturing landscape over the past three decades. Initially developed as alternatives to traditional soldering methods, these specialized materials combine electrical conductivity with adhesive properties, creating versatile solutions for component assembly and interconnection. The evolution of conductive adhesives has been driven by increasing demands for miniaturization in electronics, higher performance requirements, and growing environmental concerns regarding traditional joining technologies.

The technological trajectory of conductive adhesives has progressed from simple epoxy-silver composites to sophisticated formulations incorporating nanomaterials, specialized polymers, and engineered fillers. This progression reflects the industry's continuous pursuit of enhanced electrical performance, mechanical reliability, and processing compatibility. Recent advancements have focused on developing adhesives with improved thermal management capabilities, reduced curing temperatures, and enhanced durability under extreme operating conditions.

Environmental considerations have become increasingly central to conductive adhesive development. Traditional soldering processes rely heavily on lead-based alloys and high-temperature processing, contributing significantly to electronic manufacturing's environmental footprint. The transition toward lead-free electronics, mandated by regulations such as RoHS (Restriction of Hazardous Substances), has accelerated interest in conductive adhesives as sustainable alternatives.

The sustainability goals for conductive adhesive technology encompass multiple dimensions. Primary objectives include eliminating toxic components such as lead and halogens, reducing energy consumption during manufacturing through lower processing temperatures, and enabling easier end-of-life recycling of electronic components. Additionally, there is growing emphasis on developing bio-based or renewable content adhesives that maintain the necessary performance characteristics while reducing dependence on petroleum-derived raw materials.

Another critical sustainability target involves extending product lifecycles through improved reliability. Conductive adhesives that offer enhanced resistance to thermal cycling, humidity, and mechanical stress can significantly prolong electronic device operational lifespans, thereby reducing electronic waste generation. This reliability-centered approach to sustainability represents a shift from focusing solely on material composition to considering the broader environmental impact throughout the product lifecycle.

The convergence of sustainability imperatives with technological innovation has positioned conductive adhesives as enabling technologies for emerging sustainable electronics platforms, including flexible electronics, printed electronics, and wearable devices. These applications typically require joining technologies compatible with temperature-sensitive substrates and components, where traditional soldering methods prove inadequate or damaging.

The technological trajectory of conductive adhesives has progressed from simple epoxy-silver composites to sophisticated formulations incorporating nanomaterials, specialized polymers, and engineered fillers. This progression reflects the industry's continuous pursuit of enhanced electrical performance, mechanical reliability, and processing compatibility. Recent advancements have focused on developing adhesives with improved thermal management capabilities, reduced curing temperatures, and enhanced durability under extreme operating conditions.

Environmental considerations have become increasingly central to conductive adhesive development. Traditional soldering processes rely heavily on lead-based alloys and high-temperature processing, contributing significantly to electronic manufacturing's environmental footprint. The transition toward lead-free electronics, mandated by regulations such as RoHS (Restriction of Hazardous Substances), has accelerated interest in conductive adhesives as sustainable alternatives.

The sustainability goals for conductive adhesive technology encompass multiple dimensions. Primary objectives include eliminating toxic components such as lead and halogens, reducing energy consumption during manufacturing through lower processing temperatures, and enabling easier end-of-life recycling of electronic components. Additionally, there is growing emphasis on developing bio-based or renewable content adhesives that maintain the necessary performance characteristics while reducing dependence on petroleum-derived raw materials.

Another critical sustainability target involves extending product lifecycles through improved reliability. Conductive adhesives that offer enhanced resistance to thermal cycling, humidity, and mechanical stress can significantly prolong electronic device operational lifespans, thereby reducing electronic waste generation. This reliability-centered approach to sustainability represents a shift from focusing solely on material composition to considering the broader environmental impact throughout the product lifecycle.

The convergence of sustainability imperatives with technological innovation has positioned conductive adhesives as enabling technologies for emerging sustainable electronics platforms, including flexible electronics, printed electronics, and wearable devices. These applications typically require joining technologies compatible with temperature-sensitive substrates and components, where traditional soldering methods prove inadequate or damaging.

Market Demand Analysis for Eco-friendly Interconnect Solutions

The global market for eco-friendly interconnect solutions has witnessed substantial growth in recent years, driven primarily by increasing environmental regulations and corporate sustainability initiatives. Conductive adhesives represent a significant segment within this market, offering viable alternatives to traditional soldering methods that often involve lead and other hazardous materials. Current market analysis indicates that the conductive adhesives market is expected to grow at a compound annual growth rate of 6.2% through 2028, with the eco-friendly segment growing even faster at approximately 8.5%.

Consumer electronics remains the largest application sector for eco-friendly interconnect solutions, accounting for nearly 40% of the total market share. This dominance stems from stringent regulations like RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives, particularly in regions like Europe and parts of Asia. The automotive industry represents the second-largest market segment, with increasing adoption of electronics in vehicles and the growth of electric vehicles driving demand for sustainable interconnect technologies.

Market research reveals that end-users are increasingly willing to pay premium prices for products that demonstrate environmental responsibility. A recent industry survey showed that 67% of electronics manufacturers consider sustainability credentials when selecting interconnect solutions, compared to just 38% five years ago. This shift in procurement priorities has created significant market opportunities for conductive adhesives manufacturers who can effectively communicate their environmental benefits.

Regional analysis shows Asia-Pacific leading the market with approximately 45% share, followed by North America and Europe. China, Japan, and South Korea are particularly important manufacturing hubs driving demand. However, Europe leads in terms of regulatory pressure and adoption rates for eco-friendly alternatives, creating a sophisticated market for advanced sustainable solutions.

Supply chain considerations have become increasingly important in market dynamics. The COVID-19 pandemic exposed vulnerabilities in global supply chains, prompting many manufacturers to seek locally sourced materials. This trend has benefited regional producers of conductive adhesives who can demonstrate both environmental credentials and supply chain resilience.

Customer pain points identified through market research include concerns about the long-term reliability of eco-friendly alternatives, compatibility with existing manufacturing processes, and cost premiums compared to traditional solutions. Successful market entrants have addressed these concerns through comprehensive performance data, technical support services, and clear value propositions that highlight total cost of ownership rather than just unit pricing.

Consumer electronics remains the largest application sector for eco-friendly interconnect solutions, accounting for nearly 40% of the total market share. This dominance stems from stringent regulations like RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives, particularly in regions like Europe and parts of Asia. The automotive industry represents the second-largest market segment, with increasing adoption of electronics in vehicles and the growth of electric vehicles driving demand for sustainable interconnect technologies.

Market research reveals that end-users are increasingly willing to pay premium prices for products that demonstrate environmental responsibility. A recent industry survey showed that 67% of electronics manufacturers consider sustainability credentials when selecting interconnect solutions, compared to just 38% five years ago. This shift in procurement priorities has created significant market opportunities for conductive adhesives manufacturers who can effectively communicate their environmental benefits.

Regional analysis shows Asia-Pacific leading the market with approximately 45% share, followed by North America and Europe. China, Japan, and South Korea are particularly important manufacturing hubs driving demand. However, Europe leads in terms of regulatory pressure and adoption rates for eco-friendly alternatives, creating a sophisticated market for advanced sustainable solutions.

Supply chain considerations have become increasingly important in market dynamics. The COVID-19 pandemic exposed vulnerabilities in global supply chains, prompting many manufacturers to seek locally sourced materials. This trend has benefited regional producers of conductive adhesives who can demonstrate both environmental credentials and supply chain resilience.

Customer pain points identified through market research include concerns about the long-term reliability of eco-friendly alternatives, compatibility with existing manufacturing processes, and cost premiums compared to traditional solutions. Successful market entrants have addressed these concerns through comprehensive performance data, technical support services, and clear value propositions that highlight total cost of ownership rather than just unit pricing.

Current State and Challenges in Conductive Adhesive Technology

Conductive adhesives have emerged as a significant technological advancement in the field of electronics manufacturing, offering sustainable alternatives to traditional soldering methods. Currently, the global market for conductive adhesives is experiencing steady growth, with an estimated market value of $3.4 billion in 2023 and projected to reach $4.8 billion by 2028. This growth is primarily driven by increasing demand for miniaturized electronic devices and the global push toward environmentally friendly manufacturing processes.

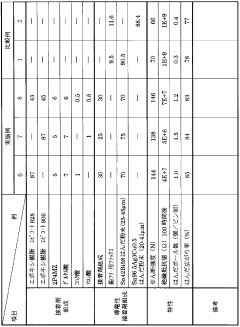

The technology landscape for conductive adhesives is divided into two main categories: isotropic conductive adhesives (ICAs) and anisotropic conductive adhesives (ACAs). ICAs conduct electricity in all directions and are widely used in die attachment applications, while ACAs conduct electricity only in one direction and are predominantly used in flat panel displays and fine-pitch interconnections. Silver-filled epoxy systems currently dominate the market due to their superior conductivity and reliability.

Despite significant advancements, conductive adhesive technology faces several critical challenges. The foremost issue is the conductivity gap between conductive adhesives and traditional solders. Even the best silver-filled adhesives typically achieve only 10-20% of the electrical conductivity of conventional tin-lead or lead-free solders, limiting their application in high-power electronics. This conductivity limitation becomes more pronounced under environmental stress conditions such as high temperature and humidity.

Mechanical reliability presents another significant challenge. Conductive adhesives often exhibit lower impact resistance and joint strength compared to metallic solders, making them less suitable for applications subjected to mechanical stress or vibration. The long-term stability of conductive adhesive joints under thermal cycling conditions remains problematic, with many formulations showing degradation after extended exposure to temperature fluctuations.

Cost factors also pose substantial barriers to widespread adoption. High-performance conductive adhesives typically contain precious metals like silver, making them considerably more expensive than conventional soldering materials. This cost differential is particularly prohibitive for mass-market consumer electronics applications.

From a geographical perspective, Asia-Pacific dominates the conductive adhesives market, accounting for approximately 65% of global production and consumption. Japan and South Korea lead in technological innovation, while China has emerged as the largest manufacturing base. North America and Europe focus primarily on high-end applications and research into next-generation formulations.

Recent technological developments have focused on addressing these limitations through nanomaterial incorporation, hybrid formulations, and process optimization. Researchers are exploring carbon nanotubes, graphene, and metallic nanoparticles to enhance conductivity while reducing precious metal content. Additionally, efforts are underway to develop bio-based conductive adhesives using renewable resources, aligning with global sustainability initiatives.

The technology landscape for conductive adhesives is divided into two main categories: isotropic conductive adhesives (ICAs) and anisotropic conductive adhesives (ACAs). ICAs conduct electricity in all directions and are widely used in die attachment applications, while ACAs conduct electricity only in one direction and are predominantly used in flat panel displays and fine-pitch interconnections. Silver-filled epoxy systems currently dominate the market due to their superior conductivity and reliability.

Despite significant advancements, conductive adhesive technology faces several critical challenges. The foremost issue is the conductivity gap between conductive adhesives and traditional solders. Even the best silver-filled adhesives typically achieve only 10-20% of the electrical conductivity of conventional tin-lead or lead-free solders, limiting their application in high-power electronics. This conductivity limitation becomes more pronounced under environmental stress conditions such as high temperature and humidity.

Mechanical reliability presents another significant challenge. Conductive adhesives often exhibit lower impact resistance and joint strength compared to metallic solders, making them less suitable for applications subjected to mechanical stress or vibration. The long-term stability of conductive adhesive joints under thermal cycling conditions remains problematic, with many formulations showing degradation after extended exposure to temperature fluctuations.

Cost factors also pose substantial barriers to widespread adoption. High-performance conductive adhesives typically contain precious metals like silver, making them considerably more expensive than conventional soldering materials. This cost differential is particularly prohibitive for mass-market consumer electronics applications.

From a geographical perspective, Asia-Pacific dominates the conductive adhesives market, accounting for approximately 65% of global production and consumption. Japan and South Korea lead in technological innovation, while China has emerged as the largest manufacturing base. North America and Europe focus primarily on high-end applications and research into next-generation formulations.

Recent technological developments have focused on addressing these limitations through nanomaterial incorporation, hybrid formulations, and process optimization. Researchers are exploring carbon nanotubes, graphene, and metallic nanoparticles to enhance conductivity while reducing precious metal content. Additionally, efforts are underway to develop bio-based conductive adhesives using renewable resources, aligning with global sustainability initiatives.

Current Sustainable Conductive Adhesive Solutions

01 Eco-friendly conductive adhesive formulations

Sustainable conductive adhesives can be formulated using environmentally friendly materials such as bio-based polymers, renewable resources, and non-toxic conductive fillers. These formulations reduce environmental impact while maintaining electrical conductivity properties. The adhesives are designed to minimize harmful emissions during manufacturing and application processes, contributing to greener electronics assembly methods.- Eco-friendly conductive adhesive formulations: Sustainable conductive adhesives can be formulated using environmentally friendly materials such as bio-based polymers, renewable resources, and non-toxic conductive fillers. These formulations reduce environmental impact while maintaining electrical conductivity properties. The adhesives are designed to minimize harmful emissions during manufacturing and application processes, contributing to greener electronics assembly solutions.

- Recyclable conductive adhesive systems: Recyclable conductive adhesives incorporate design features that allow for disassembly and recovery of valuable materials at end-of-life. These systems use reversible bonding mechanisms or thermally reworkable formulations that can be separated without damaging electronic components. This approach supports circular economy principles by enabling the reuse of precious metals and reducing electronic waste.

- Energy-efficient curing methods for conductive adhesives: Innovative curing technologies for conductive adhesives focus on reducing energy consumption during the manufacturing process. These methods include low-temperature curing, UV-activated systems, and microwave curing that require significantly less energy compared to traditional thermal curing processes. The energy-efficient approaches maintain or improve bond strength and conductivity while reducing the carbon footprint of electronic assembly operations.

- Nanomaterial-enhanced sustainable conductive adhesives: Advanced nanomaterials are incorporated into conductive adhesives to enhance performance while using less material. Carbon nanotubes, graphene, and other nanoscale conductive fillers allow for higher conductivity at lower loading levels, reducing resource consumption. These nanomaterial-enhanced formulations offer improved thermal management, electrical performance, and mechanical properties while supporting sustainability goals through material efficiency.

- Sustainable manufacturing processes for conductive adhesives: Sustainable manufacturing approaches for conductive adhesives focus on reducing waste, water usage, and harmful emissions during production. These processes employ solvent-free formulations, water-based systems, and additive manufacturing techniques to minimize environmental impact. Advanced quality control methods ensure consistent performance while optimizing material usage and extending product lifespan, contributing to overall sustainability in electronics manufacturing.

02 Recyclable conductive adhesive systems

Recyclable conductive adhesives incorporate design features that allow for disassembly and recovery of valuable materials at end-of-life. These systems use reversible bonding mechanisms or thermally reworkable formulations that can be separated from electronic components without damaging them. This approach supports circular economy principles by enabling the reuse of electronic components and reducing electronic waste.Expand Specific Solutions03 Low-carbon footprint manufacturing processes

Sustainable manufacturing processes for conductive adhesives focus on reducing energy consumption and carbon emissions. These include room-temperature curing systems, solvent-free formulations, and energy-efficient production methods. By eliminating high-temperature processing requirements and reducing the need for energy-intensive steps, these processes significantly lower the carbon footprint associated with adhesive production and application.Expand Specific Solutions04 Biodegradable conductive adhesive components

Biodegradable elements can be incorporated into conductive adhesive formulations to reduce long-term environmental impact. These components break down naturally after their useful life while maintaining required performance during the product lifecycle. The biodegradable portions may include matrix materials, certain additives, or encapsulants that surround the conductive elements, allowing for partial environmental decomposition while preserving critical electronic connections.Expand Specific Solutions05 Reduced hazardous substance content

Sustainable conductive adhesives are formulated to minimize or eliminate hazardous substances such as lead, halogens, and volatile organic compounds. These formulations comply with global environmental regulations like RoHS and REACH while maintaining electrical performance. Alternative conductive fillers such as silver-coated copper, carbon nanotubes, or graphene derivatives replace traditional toxic materials, resulting in safer products for both manufacturing workers and end-users.Expand Specific Solutions

Key Industry Players in Conductive Adhesive Development

The conductive adhesives market is experiencing significant growth in the sustainable technology sector, currently in a mature development phase with increasing adoption across electronics, automotive, and renewable energy applications. The global market size is expanding rapidly, driven by demand for environmentally friendly alternatives to traditional soldering methods. Leading players like Henkel AG & Co. KGaA, 3M Innovative Properties, and DuPont de Nemours have established strong technological foundations, while Asian manufacturers including Shin-Etsu Chemical, Nitto Denko, and Samsung Electronics are gaining market share through innovative formulations. The technology has reached commercial viability with ongoing advancements in thermal conductivity, electrical performance, and processing techniques, positioning conductive adhesives as a key enabler for miniaturization, flexible electronics, and reduced environmental impact in manufacturing processes.

Henkel AG & Co. KGaA

Technical Solution: Henkel has developed a comprehensive portfolio of conductive adhesives focused on sustainability, particularly their LOCTITE ABLESTIK ECO series. These adhesives utilize bio-based materials and reduced silver content while maintaining electrical performance comparable to traditional formulations. Their technology incorporates renewable carbon sources that replace up to 30% of fossil-based raw materials, significantly reducing carbon footprint. Henkel's conductive adhesives feature lead-free formulations that comply with RoHS and REACH regulations, making them environmentally preferable alternatives to traditional soldering. The company has also pioneered low-temperature curing adhesives that reduce energy consumption during electronics manufacturing by approximately 30%, while their advanced formulations enable thinner bond lines that use less material overall. Henkel's water-based conductive adhesives eliminate the need for volatile organic compounds (VOCs), further enhancing their sustainability profile.

Strengths: Industry-leading bio-based content integration; comprehensive sustainability approach addressing multiple environmental factors; strong global manufacturing and distribution network. Weaknesses: Higher initial cost compared to traditional conductive materials; some formulations may have slightly lower conductivity than pure silver alternatives; requires manufacturing process adjustments for optimal implementation.

3M Innovative Properties Co.

Technical Solution: 3M has developed advanced Electrically Conductive Adhesive (ECA) technologies that significantly contribute to sustainable electronics manufacturing. Their innovative anisotropic conductive films (ACFs) and pastes enable fine-pitch connections without the environmental concerns associated with lead-based solders. 3M's conductive adhesives incorporate proprietary polymer systems with reduced silver content (typically 15-30% less than conventional formulations) while maintaining electrical performance. Their water-cleanable formulations eliminate the need for solvent-based cleaning processes, reducing VOC emissions by up to 90% compared to traditional methods. 3M has also pioneered room-temperature curing conductive adhesives that reduce energy consumption in electronics assembly by eliminating high-temperature reflow processes, cutting energy usage by approximately 40-60%. Their adhesives support thinner, more flexible electronic designs that use fewer raw materials overall, and enable the recycling of electronic components by allowing for clean separation at end-of-life through specially designed debonding mechanisms.

Strengths: Exceptional R&D capabilities with extensive intellectual property portfolio; strong expertise in both adhesive and electronic materials; global manufacturing scale with consistent quality control. Weaknesses: Some formulations require specialized application equipment; higher initial investment compared to traditional soldering; limited high-temperature performance in certain applications requiring extreme operating conditions.

Core Innovations in Eco-friendly Conductive Materials

Conductive adhesive, and utilizing the same, conductive section and electronic part module

PatentWO2006064849A1

Innovation

- A conductive adhesive is developed by mixing epoxy-based adhesive with SnBi-based solder powder, using a dibasic acid with an alkyl group as an organic acid, and incorporating additives like Ag, Ni, or Ge, which allows for low-temperature bonding and improved conductivity and bonding strength without solvents.

Electrically conductive adhesive and electrically conductive material

PatentActiveUS20220017793A1

Innovation

- A polyether polymer-based electrically conductive adhesive incorporating silver particles, which allows for high electrical conductivity and flexibility by enabling silver sintering at low temperatures, along with optional additives like condensation catalysts and antioxidants, to create a material with low resistivity and elastic modulus.

Environmental Impact Assessment and Life Cycle Analysis

The environmental impact assessment of conductive adhesives reveals significant advantages over traditional soldering methods. Conductive adhesives typically contain fewer hazardous substances compared to lead-based solders, with reduced volatile organic compound (VOC) emissions during application and curing processes. This characteristic substantially decreases air pollution and associated health risks in manufacturing environments, contributing to improved workplace safety standards.

Life cycle analysis demonstrates that conductive adhesives require lower processing temperatures (typically 120-150°C) compared to conventional soldering (approximately 250-350°C), resulting in substantial energy savings during production. Research indicates energy consumption reductions of up to 70% when implementing conductive adhesive technology in electronics assembly processes. This energy efficiency translates directly into reduced carbon emissions throughout the manufacturing phase.

The raw material extraction phase for conductive adhesives shows mixed environmental impacts. While some formulations utilize silver, which has significant mining-related environmental concerns, newer generations incorporate more sustainable alternatives such as copper, carbon nanotubes, or graphene derivatives. These alternatives reduce dependence on rare or precious metals, minimizing ecological disruption from mining activities.

End-of-life considerations present another significant advantage for conductive adhesive technology. Unlike traditional solders that complicate electronic waste processing due to lead content, properly formulated conductive adhesives can facilitate easier component separation and material recovery. Some advanced formulations feature reversible bonding properties, allowing for disassembly at specific temperatures or through application of particular solvents, enhancing repairability and recyclability of electronic devices.

Water footprint analysis indicates that conductive adhesive manufacturing generally requires less water compared to traditional soldering processes. This advantage becomes particularly relevant in regions facing water scarcity challenges, where industrial water consumption represents a significant environmental concern. Studies suggest water usage reductions of approximately 30-45% across the production lifecycle.

Comprehensive toxicity assessments of modern conductive adhesive formulations show promising results regarding bioaccumulation and environmental persistence. Most contemporary formulations avoid persistent organic pollutants and heavy metals, resulting in reduced ecological risk when products eventually enter waste streams. This characteristic aligns with global regulatory trends toward stricter chemical management policies in manufacturing industries.

Life cycle analysis demonstrates that conductive adhesives require lower processing temperatures (typically 120-150°C) compared to conventional soldering (approximately 250-350°C), resulting in substantial energy savings during production. Research indicates energy consumption reductions of up to 70% when implementing conductive adhesive technology in electronics assembly processes. This energy efficiency translates directly into reduced carbon emissions throughout the manufacturing phase.

The raw material extraction phase for conductive adhesives shows mixed environmental impacts. While some formulations utilize silver, which has significant mining-related environmental concerns, newer generations incorporate more sustainable alternatives such as copper, carbon nanotubes, or graphene derivatives. These alternatives reduce dependence on rare or precious metals, minimizing ecological disruption from mining activities.

End-of-life considerations present another significant advantage for conductive adhesive technology. Unlike traditional solders that complicate electronic waste processing due to lead content, properly formulated conductive adhesives can facilitate easier component separation and material recovery. Some advanced formulations feature reversible bonding properties, allowing for disassembly at specific temperatures or through application of particular solvents, enhancing repairability and recyclability of electronic devices.

Water footprint analysis indicates that conductive adhesive manufacturing generally requires less water compared to traditional soldering processes. This advantage becomes particularly relevant in regions facing water scarcity challenges, where industrial water consumption represents a significant environmental concern. Studies suggest water usage reductions of approximately 30-45% across the production lifecycle.

Comprehensive toxicity assessments of modern conductive adhesive formulations show promising results regarding bioaccumulation and environmental persistence. Most contemporary formulations avoid persistent organic pollutants and heavy metals, resulting in reduced ecological risk when products eventually enter waste streams. This characteristic aligns with global regulatory trends toward stricter chemical management policies in manufacturing industries.

Regulatory Framework for Sustainable Electronic Materials

The regulatory landscape governing conductive adhesives in sustainable electronics is increasingly complex and stringent. International frameworks such as the European Union's Restriction of Hazardous Substances (RoHS) Directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have established critical benchmarks for material composition in electronic components. These regulations specifically target the reduction of lead, mercury, and other hazardous substances that have traditionally been used in electronic interconnections.

For conductive adhesives to gain wider adoption as sustainable alternatives, manufacturers must navigate compliance with these evolving standards. The EU's Waste Electrical and Electronic Equipment (WEEE) Directive further emphasizes end-of-life considerations, requiring manufacturers to design products with recyclability and material recovery in mind. This has accelerated the development of conductive adhesives with improved environmental profiles and disassembly characteristics.

In North America, the United States Environmental Protection Agency (EPA) has implemented the Toxic Substances Control Act (TSCA), which regulates the introduction of new chemical substances and oversees existing chemicals that pose unreasonable risks. This regulatory framework has significant implications for conductive adhesive formulations, particularly those containing nanomaterials or novel conductive fillers that may require additional safety assessments.

Asian markets, particularly Japan and South Korea, have established their own versions of RoHS-like regulations, creating a global patchwork of compliance requirements that manufacturers must address. China's Restriction of Hazardous Substances (China RoHS) specifically impacts electronic product design and material selection for the world's largest electronics manufacturing hub.

Industry standards organizations such as IPC (Association Connecting Electronics Industries) have developed specific guidelines for environmentally preferable materials in electronics assembly, including standards for conductive adhesives as alternatives to traditional soldering. These standards provide technical benchmarks for performance, reliability, and environmental impact.

Carbon footprint regulations and emerging extended producer responsibility (EPR) laws are creating additional incentives for sustainable material choices. Several jurisdictions now require lifecycle assessments that account for the environmental impact of materials from extraction through disposal, favoring solutions like conductive adhesives that can demonstrate reduced energy consumption and greenhouse gas emissions during manufacturing and application processes.

The regulatory trend is clearly moving toward stricter controls on material toxicity, resource efficiency, and circular economy principles, positioning environmentally responsible conductive adhesives as strategically advantageous solutions for forward-thinking electronics manufacturers seeking long-term regulatory compliance.

For conductive adhesives to gain wider adoption as sustainable alternatives, manufacturers must navigate compliance with these evolving standards. The EU's Waste Electrical and Electronic Equipment (WEEE) Directive further emphasizes end-of-life considerations, requiring manufacturers to design products with recyclability and material recovery in mind. This has accelerated the development of conductive adhesives with improved environmental profiles and disassembly characteristics.

In North America, the United States Environmental Protection Agency (EPA) has implemented the Toxic Substances Control Act (TSCA), which regulates the introduction of new chemical substances and oversees existing chemicals that pose unreasonable risks. This regulatory framework has significant implications for conductive adhesive formulations, particularly those containing nanomaterials or novel conductive fillers that may require additional safety assessments.

Asian markets, particularly Japan and South Korea, have established their own versions of RoHS-like regulations, creating a global patchwork of compliance requirements that manufacturers must address. China's Restriction of Hazardous Substances (China RoHS) specifically impacts electronic product design and material selection for the world's largest electronics manufacturing hub.

Industry standards organizations such as IPC (Association Connecting Electronics Industries) have developed specific guidelines for environmentally preferable materials in electronics assembly, including standards for conductive adhesives as alternatives to traditional soldering. These standards provide technical benchmarks for performance, reliability, and environmental impact.

Carbon footprint regulations and emerging extended producer responsibility (EPR) laws are creating additional incentives for sustainable material choices. Several jurisdictions now require lifecycle assessments that account for the environmental impact of materials from extraction through disposal, favoring solutions like conductive adhesives that can demonstrate reduced energy consumption and greenhouse gas emissions during manufacturing and application processes.

The regulatory trend is clearly moving toward stricter controls on material toxicity, resource efficiency, and circular economy principles, positioning environmentally responsible conductive adhesives as strategically advantageous solutions for forward-thinking electronics manufacturers seeking long-term regulatory compliance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!