Conductive Adhesives in Digital Displays: A Performance Review

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Adhesives Evolution and Objectives

Conductive adhesives have evolved significantly since their inception in the electronics industry in the 1960s. Initially developed as alternatives to traditional soldering methods, these materials have undergone substantial transformation to meet the increasingly demanding requirements of modern digital display technologies. The evolution trajectory has been characterized by continuous improvements in electrical conductivity, thermal stability, and adhesion strength to accommodate the miniaturization and performance enhancement of display devices.

The first generation of conductive adhesives primarily consisted of simple epoxy resins filled with silver particles, offering basic electrical connectivity but limited reliability under thermal stress. By the 1980s, advancements in polymer chemistry led to the development of second-generation adhesives with improved thermal management capabilities and reduced curing temperatures, making them more compatible with temperature-sensitive display components.

The 1990s witnessed the emergence of anisotropic conductive adhesives (ACAs) and anisotropic conductive films (ACFs), representing a paradigm shift in the industry. These materials provided directional conductivity, allowing for higher connection densities crucial for the evolving flat panel display technologies. This innovation enabled the production of thinner, lighter displays with enhanced resolution and performance characteristics.

The early 2000s marked the introduction of nano-enhanced conductive adhesives, incorporating carbon nanotubes, graphene, and metallic nanoparticles to achieve superior electrical and thermal conductivity while maintaining flexibility. These advancements coincided with the rapid growth of LCD and OLED display technologies, which demanded more sophisticated interconnection solutions.

Recent developments have focused on environmentally friendly formulations, replacing lead-based components with sustainable alternatives while maintaining or improving performance metrics. Additionally, research efforts have been directed toward developing adhesives with self-healing properties and enhanced resistance to environmental factors such as humidity and temperature fluctuations.

The primary objectives of modern conductive adhesives in digital displays include achieving uniform electrical conductivity across increasingly fine-pitch connections, maintaining reliable performance throughout the product lifecycle, and supporting the integration of flexible and stretchable display technologies. Furthermore, there is a growing emphasis on developing adhesives that can withstand the rigorous manufacturing processes of next-generation displays, including higher processing temperatures and compatibility with automated assembly systems.

As display technologies continue to evolve toward higher resolutions, greater flexibility, and enhanced durability, conductive adhesives must adapt to meet these challenges while addressing industry demands for cost-effectiveness, environmental sustainability, and process efficiency. The future trajectory points toward multi-functional adhesives that can simultaneously provide electrical connectivity, thermal management, and mechanical support in increasingly complex display architectures.

The first generation of conductive adhesives primarily consisted of simple epoxy resins filled with silver particles, offering basic electrical connectivity but limited reliability under thermal stress. By the 1980s, advancements in polymer chemistry led to the development of second-generation adhesives with improved thermal management capabilities and reduced curing temperatures, making them more compatible with temperature-sensitive display components.

The 1990s witnessed the emergence of anisotropic conductive adhesives (ACAs) and anisotropic conductive films (ACFs), representing a paradigm shift in the industry. These materials provided directional conductivity, allowing for higher connection densities crucial for the evolving flat panel display technologies. This innovation enabled the production of thinner, lighter displays with enhanced resolution and performance characteristics.

The early 2000s marked the introduction of nano-enhanced conductive adhesives, incorporating carbon nanotubes, graphene, and metallic nanoparticles to achieve superior electrical and thermal conductivity while maintaining flexibility. These advancements coincided with the rapid growth of LCD and OLED display technologies, which demanded more sophisticated interconnection solutions.

Recent developments have focused on environmentally friendly formulations, replacing lead-based components with sustainable alternatives while maintaining or improving performance metrics. Additionally, research efforts have been directed toward developing adhesives with self-healing properties and enhanced resistance to environmental factors such as humidity and temperature fluctuations.

The primary objectives of modern conductive adhesives in digital displays include achieving uniform electrical conductivity across increasingly fine-pitch connections, maintaining reliable performance throughout the product lifecycle, and supporting the integration of flexible and stretchable display technologies. Furthermore, there is a growing emphasis on developing adhesives that can withstand the rigorous manufacturing processes of next-generation displays, including higher processing temperatures and compatibility with automated assembly systems.

As display technologies continue to evolve toward higher resolutions, greater flexibility, and enhanced durability, conductive adhesives must adapt to meet these challenges while addressing industry demands for cost-effectiveness, environmental sustainability, and process efficiency. The future trajectory points toward multi-functional adhesives that can simultaneously provide electrical connectivity, thermal management, and mechanical support in increasingly complex display architectures.

Market Demand Analysis for Display Technologies

The global display technology market has witnessed significant growth in recent years, driven by increasing demand for high-resolution, flexible, and energy-efficient displays across various sectors. The market for digital displays reached approximately $148 billion in 2022 and is projected to grow at a CAGR of 7.2% through 2028, highlighting substantial opportunities for conductive adhesive technologies.

Consumer electronics continues to be the primary driver of display technology demand, with smartphones, tablets, and televisions accounting for over 65% of the market share. The trend toward larger screen sizes, higher resolutions, and thinner form factors has created specific requirements for conductive adhesives that can maintain electrical connectivity while accommodating mechanical stress in increasingly complex display architectures.

Automotive displays represent the fastest-growing segment, with a projected growth rate of 12.5% annually through 2027. The integration of multiple displays in modern vehicles, including instrument clusters, infotainment systems, and heads-up displays, has created new application scenarios for conductive adhesives that must withstand harsh environmental conditions while maintaining reliable performance.

The shift toward flexible and foldable displays has significantly altered market requirements for conductive adhesives. Industry analysts estimate that flexible display shipments will increase by 35% annually over the next five years, creating demand for adhesives that can maintain conductivity through thousands of folding cycles while providing sufficient mechanical support.

Environmental regulations are increasingly influencing market dynamics, with several regions implementing restrictions on traditional soldering materials containing lead and other hazardous substances. This regulatory landscape has accelerated the adoption of conductive adhesives as environmentally friendly alternatives, particularly in consumer electronics manufacturing hubs across Asia.

Regional analysis indicates that Asia-Pacific dominates the display technology market with approximately 70% share of global production, led by manufacturing powerhouses in South Korea, China, and Taiwan. North America and Europe follow with significant contributions in premium display segments and specialized applications such as medical and industrial displays.

The miniaturization trend in display technologies has created demand for conductive adhesives with increasingly fine pitch capabilities. Market research indicates that pitch requirements have decreased from 100μm to below 30μm in many applications over the past decade, challenging adhesive manufacturers to develop products with enhanced precision bonding capabilities.

Consumer electronics continues to be the primary driver of display technology demand, with smartphones, tablets, and televisions accounting for over 65% of the market share. The trend toward larger screen sizes, higher resolutions, and thinner form factors has created specific requirements for conductive adhesives that can maintain electrical connectivity while accommodating mechanical stress in increasingly complex display architectures.

Automotive displays represent the fastest-growing segment, with a projected growth rate of 12.5% annually through 2027. The integration of multiple displays in modern vehicles, including instrument clusters, infotainment systems, and heads-up displays, has created new application scenarios for conductive adhesives that must withstand harsh environmental conditions while maintaining reliable performance.

The shift toward flexible and foldable displays has significantly altered market requirements for conductive adhesives. Industry analysts estimate that flexible display shipments will increase by 35% annually over the next five years, creating demand for adhesives that can maintain conductivity through thousands of folding cycles while providing sufficient mechanical support.

Environmental regulations are increasingly influencing market dynamics, with several regions implementing restrictions on traditional soldering materials containing lead and other hazardous substances. This regulatory landscape has accelerated the adoption of conductive adhesives as environmentally friendly alternatives, particularly in consumer electronics manufacturing hubs across Asia.

Regional analysis indicates that Asia-Pacific dominates the display technology market with approximately 70% share of global production, led by manufacturing powerhouses in South Korea, China, and Taiwan. North America and Europe follow with significant contributions in premium display segments and specialized applications such as medical and industrial displays.

The miniaturization trend in display technologies has created demand for conductive adhesives with increasingly fine pitch capabilities. Market research indicates that pitch requirements have decreased from 100μm to below 30μm in many applications over the past decade, challenging adhesive manufacturers to develop products with enhanced precision bonding capabilities.

Current State and Challenges in Conductive Adhesive Technology

Conductive adhesive technology has evolved significantly over the past decade, with global research efforts focused on enhancing performance characteristics for digital display applications. Currently, the market is dominated by two primary types: Anisotropic Conductive Adhesives (ACAs) and Isotropic Conductive Adhesives (ICAs), each serving distinct purposes in display manufacturing. ACAs provide directional conductivity, making them ideal for fine-pitch connections in modern high-resolution displays, while ICAs offer uniform conductivity in all directions, suitable for general bonding applications.

The current technical landscape reveals several limitations impeding wider adoption. Thermal stability remains a critical challenge, with many conductive adhesives exhibiting performance degradation at temperatures exceeding 150°C—a significant concern for displays operating in automotive environments or outdoor digital signage. Long-term reliability testing indicates that thermal cycling can lead to increased contact resistance over time, potentially resulting in display performance deterioration.

Conductivity-to-adhesion balance presents another fundamental challenge. Higher metal filler content improves electrical conductivity but often compromises mechanical adhesion strength. Recent industry data shows that achieving conductivity values above 10^4 S/cm while maintaining peel strengths greater than 8 N/mm remains difficult with conventional formulations.

Environmental considerations have emerged as a significant constraint, particularly regarding the transition away from lead-based solders. While silver-filled adhesives offer excellent conductivity, their cost remains prohibitively high for mass-market applications. Alternative fillers such as copper and nickel face oxidation issues that compromise long-term performance, necessitating complex surface treatments or protective coatings.

Manufacturing integration challenges persist across the industry. Current dispensing technologies struggle to achieve the precision required for ultra-fine pitch connections below 40μm, which are increasingly common in high-resolution OLED and microLED displays. Curing processes also present bottlenecks, with UV-curable adhesives requiring careful optimization to ensure complete polymerization without damaging temperature-sensitive display components.

Regional disparities in technology development are evident, with East Asian manufacturers—particularly in Japan, South Korea, and Taiwan—leading in high-performance formulations for consumer electronics. European research institutions focus predominantly on automotive and industrial applications requiring enhanced reliability under extreme conditions, while North American companies specialize in novel nanomaterial-based solutions.

The integration of new nanomaterials represents both an opportunity and a challenge. Carbon nanotubes and graphene have demonstrated promising electrical properties in laboratory settings, but scaling production while maintaining consistent dispersion quality remains problematic. Recent studies indicate that agglomeration of nanomaterials during storage can lead to unpredictable performance variations in finished displays.

The current technical landscape reveals several limitations impeding wider adoption. Thermal stability remains a critical challenge, with many conductive adhesives exhibiting performance degradation at temperatures exceeding 150°C—a significant concern for displays operating in automotive environments or outdoor digital signage. Long-term reliability testing indicates that thermal cycling can lead to increased contact resistance over time, potentially resulting in display performance deterioration.

Conductivity-to-adhesion balance presents another fundamental challenge. Higher metal filler content improves electrical conductivity but often compromises mechanical adhesion strength. Recent industry data shows that achieving conductivity values above 10^4 S/cm while maintaining peel strengths greater than 8 N/mm remains difficult with conventional formulations.

Environmental considerations have emerged as a significant constraint, particularly regarding the transition away from lead-based solders. While silver-filled adhesives offer excellent conductivity, their cost remains prohibitively high for mass-market applications. Alternative fillers such as copper and nickel face oxidation issues that compromise long-term performance, necessitating complex surface treatments or protective coatings.

Manufacturing integration challenges persist across the industry. Current dispensing technologies struggle to achieve the precision required for ultra-fine pitch connections below 40μm, which are increasingly common in high-resolution OLED and microLED displays. Curing processes also present bottlenecks, with UV-curable adhesives requiring careful optimization to ensure complete polymerization without damaging temperature-sensitive display components.

Regional disparities in technology development are evident, with East Asian manufacturers—particularly in Japan, South Korea, and Taiwan—leading in high-performance formulations for consumer electronics. European research institutions focus predominantly on automotive and industrial applications requiring enhanced reliability under extreme conditions, while North American companies specialize in novel nanomaterial-based solutions.

The integration of new nanomaterials represents both an opportunity and a challenge. Carbon nanotubes and graphene have demonstrated promising electrical properties in laboratory settings, but scaling production while maintaining consistent dispersion quality remains problematic. Recent studies indicate that agglomeration of nanomaterials during storage can lead to unpredictable performance variations in finished displays.

Current Conductive Adhesive Solutions for Digital Displays

01 Conductive fillers for enhanced electrical performance

Various conductive fillers can be incorporated into adhesives to enhance electrical conductivity. These fillers include metal particles (such as silver, copper, and nickel), carbon-based materials (like carbon nanotubes and graphene), and hybrid fillers. The type, size, shape, and concentration of these fillers significantly impact the electrical conductivity, thermal stability, and mechanical strength of the adhesive. Optimizing the filler loading can achieve the desired balance between conductivity and adhesive properties.- Conductive fillers for enhanced electrical performance: Various conductive fillers can be incorporated into adhesives to enhance electrical conductivity. These fillers include metal particles (such as silver, copper, and nickel), carbon-based materials (like carbon nanotubes and graphene), and hybrid fillers. The type, size, shape, and concentration of these fillers significantly impact the electrical conductivity, thermal stability, and mechanical strength of the adhesive. Optimizing filler loading can achieve the desired balance between conductivity and adhesive properties.

- Thermal performance and stability of conductive adhesives: Thermal performance is a critical aspect of conductive adhesives, especially in electronic applications. Formulations can be enhanced with thermally conductive materials to improve heat dissipation. Adhesives designed for high-temperature environments incorporate stabilizers and cross-linking agents that maintain structural integrity and conductivity under thermal stress. The thermal expansion coefficient can be adjusted to match substrate materials, reducing stress at interfaces during temperature cycling and improving long-term reliability.

- Adhesion strength and mechanical properties: The mechanical performance of conductive adhesives involves balancing adhesion strength with flexibility and durability. Formulations can be modified with coupling agents to improve bonding to various substrates including metals, ceramics, and polymers. Elastomeric components can be added to enhance flexibility and impact resistance, while maintaining electrical conductivity. Cross-linking density can be controlled to achieve the desired balance between rigidity and flexibility, which is crucial for applications subjected to mechanical stress or vibration.

- Environmental resistance and reliability: Conductive adhesives can be formulated to withstand harsh environmental conditions including humidity, temperature fluctuations, and chemical exposure. Moisture-resistant additives help prevent conductivity degradation in high-humidity environments. Corrosion inhibitors protect metal fillers and substrates from oxidation and chemical attack. UV stabilizers extend the service life of adhesives exposed to sunlight. These enhancements improve the long-term reliability of electrical connections in outdoor, automotive, and industrial applications.

- Application-specific performance optimization: Conductive adhesives can be tailored for specific applications such as flexible electronics, die-attach, EMI shielding, and printed electronics. Viscosity and rheological properties can be adjusted to suit different application methods including screen printing, dispensing, and stencil printing. Curing conditions (temperature, time, and atmosphere) significantly impact final performance properties. Fast-curing formulations enable rapid manufacturing processes, while low-temperature curing options allow bonding of temperature-sensitive components without damage.

02 Thermal performance and stability of conductive adhesives

Thermal performance is a critical aspect of conductive adhesives, especially in electronic applications. Adhesives with good thermal conductivity can efficiently dissipate heat from electronic components, preventing overheating and failure. Thermal stability ensures that the adhesive maintains its performance across a wide temperature range and during thermal cycling. Incorporating thermally conductive fillers and using temperature-resistant polymer matrices can significantly improve the thermal performance and reliability of conductive adhesives in high-temperature environments.Expand Specific Solutions03 Mechanical properties and adhesion strength

The mechanical properties of conductive adhesives, including tensile strength, flexibility, and impact resistance, are crucial for their performance in various applications. Strong adhesion to different substrates ensures reliable connections in electronic assemblies. Factors affecting mechanical properties include the polymer matrix composition, curing conditions, and the interface between the adhesive and substrate. Balancing mechanical strength with electrical conductivity is essential, as higher filler loadings for conductivity can sometimes compromise mechanical integrity.Expand Specific Solutions04 Environmental resistance and reliability

Conductive adhesives must maintain their performance under various environmental conditions, including humidity, temperature fluctuations, and chemical exposure. Environmental resistance affects the long-term reliability of electronic connections. Moisture resistance is particularly important as water absorption can degrade both electrical conductivity and adhesion strength. Additives and specialized formulations can enhance resistance to environmental factors, improving the durability and service life of conductive adhesive joints in challenging operating conditions.Expand Specific Solutions05 Processing and application techniques

The performance of conductive adhesives is significantly influenced by processing and application methods. Factors such as mixing procedures, dispensing techniques, curing conditions, and storage stability affect the final properties of the adhesive. Advanced dispensing technologies enable precise application for fine-pitch electronics. Optimized curing protocols ensure complete polymerization and maximum conductivity. Proper surface preparation of substrates before adhesive application is also critical for achieving strong bonds and reliable electrical connections in electronic assemblies.Expand Specific Solutions

Leading Manufacturers and Competitive Landscape

The conductive adhesives market in digital displays is currently in a growth phase, with increasing demand driven by the evolution of flexible and advanced display technologies. Market size is expanding steadily as manufacturers seek alternatives to traditional soldering methods. Technologically, the field shows varying maturity levels, with companies like 3M, Henkel, and Nitto Denko leading with established product portfolios. Display manufacturers including Samsung Display, E Ink, and Sharp are driving innovation through specialized requirements. CSOT and other Asian players are rapidly advancing their capabilities, while materials specialists such as RESONAC and Dongwoo Fine-Chem are developing next-generation formulations with enhanced conductivity and reliability for increasingly complex display architectures.

Nitto Denko Corp.

Technical Solution: Nitto Denko has developed specialized ELEP (Electro-conductive Epoxy Polymer) adhesives for digital display applications. Their technology utilizes a hybrid approach combining silver nanoparticles with carbon nanotubes to achieve superior conductivity while minimizing silver content (reducing cost by approximately 30% compared to traditional silver-filled adhesives). Nitto's proprietary surface treatment technology enables strong adhesion to difficult substrates like polyimide and glass, critical for modern display constructions. Their latest generation products feature self-aligning properties through precisely engineered viscoelastic behavior during curing, which compensates for minor misalignments in high-precision display assembly. The company's formulations achieve volume resistivity as low as 3×10^-4 Ω·cm while maintaining flexibility (elongation >10%) to withstand thermal cycling in display applications.

Strengths: Excellent balance of electrical conductivity and mechanical flexibility; proprietary hybrid filler technology reduces precious metal content while maintaining performance; compatible with roll-to-roll processing for flexible displays. Weaknesses: Some formulations require specialized storage conditions; performance can degrade under extreme humidity conditions; requires precise process control during application and curing.

3M Innovative Properties Co.

Technical Solution: 3M has pioneered Anisotropic Conductive Films (ACFs) and Anisotropic Conductive Adhesives (ACAs) specifically engineered for digital display interconnections. Their proprietary technology features precisely dispersed conductive particles (typically gold-coated polymer spheres or nickel particles) in a proprietary adhesive matrix that creates electrical connections only in the z-axis when compressed. This enables ultra-fine pitch connections (down to 30μm) critical for high-resolution displays while preventing lateral short circuits. 3M's latest generation products incorporate thermally conductive fillers that simultaneously manage heat dissipation, addressing a key challenge in modern high-brightness displays. Their formulations achieve connection resistance stability below 300mΩ after 1000 hours of environmental testing, with some premium products maintaining performance even after 2000 hours at 85°C/85% RH conditions.

Strengths: Excellent fine-pitch capability enabling higher resolution displays; simultaneous electrical and thermal management properties; compatible with flexible display technologies. Weaknesses: Requires precise application equipment and controlled bonding parameters; higher initial investment compared to traditional interconnect methods; some formulations have temperature limitations affecting compatibility with certain manufacturing processes.

Key Patents and Technical Innovations in Conductive Adhesives

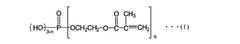

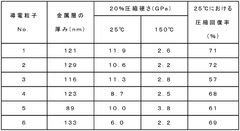

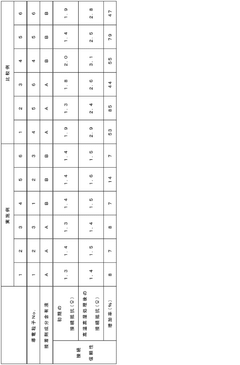

Conductive adhesive, method for producing circuit connection structure, and circuit connection structure

PatentWO2021230212A1

Innovation

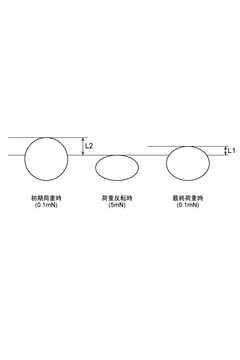

- A conductive adhesive with conductive particles having specific compression hardness and recovery rates, combined with a thermosetting or photocurable adhesive composition, is used for thermocompression bonding to connect circuit electrodes, ensuring low resistance and reliability even with titanium-coated electrodes.

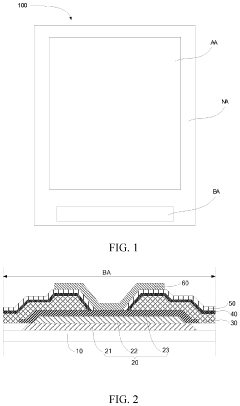

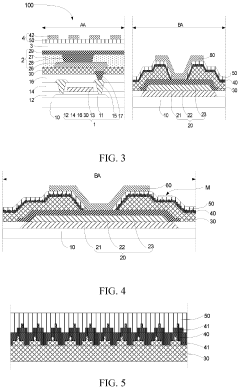

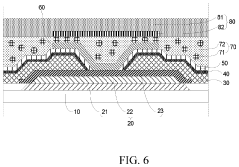

Display panel and display device

PatentActiveUS20230060896A1

Innovation

- A display panel design with an adhesive layer of amorphous silicon between the organic and inorganic layers, featuring concave-convex structures on the surfaces in contact with the adhesive layer to enhance bonding force and prevent slippage, along with an insulating protection layer that exposes the signal line pattern, ensuring strong interfacial bonding.

Environmental Impact and Sustainability Considerations

The environmental impact of conductive adhesives in digital display manufacturing has become increasingly significant as the industry faces mounting pressure to adopt sustainable practices. Traditional conductive bonding technologies often rely on lead-based solders and other hazardous materials that pose substantial environmental and health risks throughout the product lifecycle. Conductive adhesives, particularly those based on silver and copper, offer promising alternatives with reduced environmental footprints.

Recent life cycle assessments reveal that isotropic conductive adhesives (ICAs) can reduce carbon emissions by up to 35% compared to conventional soldering processes. This reduction stems primarily from lower curing temperatures, which significantly decrease energy consumption during manufacturing. While the production of metal fillers for these adhesives does require resource extraction, the overall environmental impact remains lower than traditional methods when considering the complete product lifecycle.

Water pollution concerns associated with conductive adhesives primarily relate to silver nanoparticles that may leach into aquatic ecosystems during improper disposal. Research indicates that silver ions can be toxic to aquatic organisms at concentrations as low as 1-5 ppb. However, emerging formulations incorporating biodegradable polymers and environmentally benign fillers are addressing these concerns, with some newer adhesives demonstrating up to 80% biodegradability under controlled conditions.

Regulatory frameworks worldwide are increasingly targeting electronic waste management, with the EU's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives specifically addressing conductive materials in electronics. Manufacturers adopting conductive adhesives that comply with these regulations gain competitive advantages in global markets while contributing to circular economy objectives.

End-of-life considerations for displays using conductive adhesives present both challenges and opportunities. While traditional solder connections can be more readily separated during recycling processes, advances in selective dissolution technologies are improving the recoverability of precious metals from adhesive bonds. Some manufacturers have reported recovery rates exceeding 85% for silver from properly processed adhesive connections, significantly reducing the demand for virgin materials.

Industry leaders are now developing bio-based conductive adhesives derived from renewable resources such as lignin and cellulose nanofibers. These materials show promise in reducing dependence on petroleum-based polymers while maintaining essential electrical and mechanical properties. Though currently at lower technology readiness levels, these sustainable alternatives represent the next frontier in environmentally responsible display manufacturing.

Recent life cycle assessments reveal that isotropic conductive adhesives (ICAs) can reduce carbon emissions by up to 35% compared to conventional soldering processes. This reduction stems primarily from lower curing temperatures, which significantly decrease energy consumption during manufacturing. While the production of metal fillers for these adhesives does require resource extraction, the overall environmental impact remains lower than traditional methods when considering the complete product lifecycle.

Water pollution concerns associated with conductive adhesives primarily relate to silver nanoparticles that may leach into aquatic ecosystems during improper disposal. Research indicates that silver ions can be toxic to aquatic organisms at concentrations as low as 1-5 ppb. However, emerging formulations incorporating biodegradable polymers and environmentally benign fillers are addressing these concerns, with some newer adhesives demonstrating up to 80% biodegradability under controlled conditions.

Regulatory frameworks worldwide are increasingly targeting electronic waste management, with the EU's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives specifically addressing conductive materials in electronics. Manufacturers adopting conductive adhesives that comply with these regulations gain competitive advantages in global markets while contributing to circular economy objectives.

End-of-life considerations for displays using conductive adhesives present both challenges and opportunities. While traditional solder connections can be more readily separated during recycling processes, advances in selective dissolution technologies are improving the recoverability of precious metals from adhesive bonds. Some manufacturers have reported recovery rates exceeding 85% for silver from properly processed adhesive connections, significantly reducing the demand for virgin materials.

Industry leaders are now developing bio-based conductive adhesives derived from renewable resources such as lignin and cellulose nanofibers. These materials show promise in reducing dependence on petroleum-based polymers while maintaining essential electrical and mechanical properties. Though currently at lower technology readiness levels, these sustainable alternatives represent the next frontier in environmentally responsible display manufacturing.

Reliability Testing Methodologies for Display Applications

Reliability testing methodologies for conductive adhesives in display applications must be comprehensive and rigorous to ensure long-term performance under various operating conditions. These methodologies typically include environmental stress testing, mechanical durability assessment, and electrical performance evaluation over time.

Temperature cycling tests represent a critical component of reliability assessment, where adhesive bonds are subjected to repeated thermal excursions between extreme temperatures (-40°C to 85°C) for hundreds or thousands of cycles. This simulates the thermal expansion and contraction stresses that occur during normal device operation and storage conditions, revealing potential delamination or cracking issues that may develop over time.

Humidity resistance testing exposes conductive adhesive bonds to high humidity environments (85% relative humidity) at elevated temperatures (85°C) for extended periods, typically 1000 hours or more. This test, often referred to as "85/85 testing," evaluates the adhesive's resistance to moisture ingress which can lead to oxidation of conductive particles and subsequent increases in electrical resistance.

Mechanical shock and vibration testing subjects display assemblies to controlled impact forces and vibrational stresses that simulate transportation conditions and everyday handling. These tests are particularly important for portable display devices where conductive adhesive connections must maintain integrity despite frequent physical stresses.

Accelerated aging protocols expose adhesives to elevated temperatures (typically 125°C to 150°C) for extended periods to simulate years of normal operation in a compressed timeframe. The Arrhenius equation is commonly applied to correlate accelerated test results with expected real-world performance, providing estimates of long-term reliability.

Electrical performance monitoring throughout these stress tests is essential, with measurements of resistance, current-carrying capacity, and signal integrity taken at regular intervals. Increases in resistance beyond 20% of initial values are typically considered failure indicators for conductive adhesive connections in display applications.

Adhesion strength testing using standardized pull or shear tests quantifies the mechanical bond strength before and after environmental exposure. This provides critical data on the adhesive's ability to maintain structural integrity throughout the display's operational lifetime.

Specialized tests for display-specific requirements include UV exposure testing for adhesives used in outdoor displays and chemical compatibility testing to ensure resistance to cleaning agents and other chemicals commonly used in display manufacturing and maintenance processes.

Temperature cycling tests represent a critical component of reliability assessment, where adhesive bonds are subjected to repeated thermal excursions between extreme temperatures (-40°C to 85°C) for hundreds or thousands of cycles. This simulates the thermal expansion and contraction stresses that occur during normal device operation and storage conditions, revealing potential delamination or cracking issues that may develop over time.

Humidity resistance testing exposes conductive adhesive bonds to high humidity environments (85% relative humidity) at elevated temperatures (85°C) for extended periods, typically 1000 hours or more. This test, often referred to as "85/85 testing," evaluates the adhesive's resistance to moisture ingress which can lead to oxidation of conductive particles and subsequent increases in electrical resistance.

Mechanical shock and vibration testing subjects display assemblies to controlled impact forces and vibrational stresses that simulate transportation conditions and everyday handling. These tests are particularly important for portable display devices where conductive adhesive connections must maintain integrity despite frequent physical stresses.

Accelerated aging protocols expose adhesives to elevated temperatures (typically 125°C to 150°C) for extended periods to simulate years of normal operation in a compressed timeframe. The Arrhenius equation is commonly applied to correlate accelerated test results with expected real-world performance, providing estimates of long-term reliability.

Electrical performance monitoring throughout these stress tests is essential, with measurements of resistance, current-carrying capacity, and signal integrity taken at regular intervals. Increases in resistance beyond 20% of initial values are typically considered failure indicators for conductive adhesive connections in display applications.

Adhesion strength testing using standardized pull or shear tests quantifies the mechanical bond strength before and after environmental exposure. This provides critical data on the adhesive's ability to maintain structural integrity throughout the display's operational lifetime.

Specialized tests for display-specific requirements include UV exposure testing for adhesives used in outdoor displays and chemical compatibility testing to ensure resistance to cleaning agents and other chemicals commonly used in display manufacturing and maintenance processes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!