Regulations Governing Conductive Adhesives in Aviation Applications

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Aviation Conductive Adhesives Background and Objectives

Conductive adhesives have emerged as a critical component in modern aviation manufacturing, offering alternatives to traditional soldering and mechanical fastening methods. The evolution of these materials traces back to the 1950s, with significant advancements occurring in the 1980s and 1990s as electronics integration in aircraft systems accelerated. Today's aviation industry faces increasing pressure to adopt materials and processes that enhance performance while meeting stringent safety and environmental standards.

The regulatory landscape governing conductive adhesives in aviation applications has developed alongside technological advancements. Initially focused primarily on mechanical performance, regulations have expanded to encompass electrical conductivity, thermal stability, environmental resistance, and long-term reliability under extreme conditions. Key regulatory bodies including the Federal Aviation Administration (FAA), European Union Aviation Safety Agency (EASA), and International Civil Aviation Organization (ICAO) have established frameworks that manufacturers must navigate.

Current technical objectives in this field center on developing adhesive systems that maintain reliable electrical conductivity while withstanding the harsh environmental conditions encountered in aviation applications. These include temperature extremes ranging from -55°C to over 200°C, pressure variations, vibration, humidity, and exposure to various chemicals and fuels. Additionally, modern conductive adhesives must demonstrate long-term stability with minimal degradation over the operational lifetime of aircraft components, typically 20-30 years.

The aviation industry's shift toward more electric aircraft (MEA) and sustainable aviation technologies has intensified the need for advanced conductive adhesive solutions. These materials must support higher power densities, improved thermal management, and reduced weight compared to conventional joining methods. Furthermore, they must comply with increasingly stringent flame retardancy requirements and restrictions on hazardous substances.

Research and development efforts are currently focused on several key areas: nano-enhanced formulations that improve conductivity while maintaining mechanical properties; hybrid systems that combine the benefits of different adhesive chemistries; and "smart" conductive adhesives capable of self-healing or condition monitoring. The ultimate goal is to develop materials that not only meet current regulatory requirements but anticipate future standards as aviation technology continues to evolve.

Understanding the complex interplay between technical performance requirements and regulatory compliance is essential for manufacturers and operators in the aviation sector. This technical assessment aims to provide a comprehensive overview of the current state of regulations governing conductive adhesives in aviation applications and identify pathways for future development and compliance.

The regulatory landscape governing conductive adhesives in aviation applications has developed alongside technological advancements. Initially focused primarily on mechanical performance, regulations have expanded to encompass electrical conductivity, thermal stability, environmental resistance, and long-term reliability under extreme conditions. Key regulatory bodies including the Federal Aviation Administration (FAA), European Union Aviation Safety Agency (EASA), and International Civil Aviation Organization (ICAO) have established frameworks that manufacturers must navigate.

Current technical objectives in this field center on developing adhesive systems that maintain reliable electrical conductivity while withstanding the harsh environmental conditions encountered in aviation applications. These include temperature extremes ranging from -55°C to over 200°C, pressure variations, vibration, humidity, and exposure to various chemicals and fuels. Additionally, modern conductive adhesives must demonstrate long-term stability with minimal degradation over the operational lifetime of aircraft components, typically 20-30 years.

The aviation industry's shift toward more electric aircraft (MEA) and sustainable aviation technologies has intensified the need for advanced conductive adhesive solutions. These materials must support higher power densities, improved thermal management, and reduced weight compared to conventional joining methods. Furthermore, they must comply with increasingly stringent flame retardancy requirements and restrictions on hazardous substances.

Research and development efforts are currently focused on several key areas: nano-enhanced formulations that improve conductivity while maintaining mechanical properties; hybrid systems that combine the benefits of different adhesive chemistries; and "smart" conductive adhesives capable of self-healing or condition monitoring. The ultimate goal is to develop materials that not only meet current regulatory requirements but anticipate future standards as aviation technology continues to evolve.

Understanding the complex interplay between technical performance requirements and regulatory compliance is essential for manufacturers and operators in the aviation sector. This technical assessment aims to provide a comprehensive overview of the current state of regulations governing conductive adhesives in aviation applications and identify pathways for future development and compliance.

Market Demand Analysis for Aerospace Conductive Adhesives

The aerospace industry has witnessed a significant surge in demand for conductive adhesives, driven primarily by the increasing adoption of composite materials in aircraft manufacturing. These advanced materials require specialized bonding solutions that can maintain electrical conductivity while meeting the stringent safety and performance requirements of aviation applications. The global market for aerospace conductive adhesives is currently valued at approximately $1.2 billion and is projected to grow at a compound annual growth rate of 6.8% through 2028.

The primary market drivers include the ongoing lightweighting initiatives across the aerospace sector, as manufacturers seek to reduce fuel consumption and carbon emissions. Conductive adhesives offer weight savings of up to 15% compared to traditional mechanical fastening methods, making them increasingly attractive for next-generation aircraft designs. Additionally, the rising integration of electronics in modern aircraft systems has created new application areas for conductive adhesives in avionics, radar systems, and electromagnetic interference (EMI) shielding.

Market research indicates that commercial aviation represents the largest segment for conductive adhesives, accounting for 58% of total demand. Military applications follow at 27%, with the remaining 15% distributed across space and general aviation sectors. Geographically, North America dominates the market with a 42% share, followed by Europe (31%) and Asia-Pacific (21%), with the latter showing the fastest growth trajectory.

Customer requirements in this market are increasingly focused on adhesives that can withstand extreme temperature variations (-65°C to +180°C), resist vibration and mechanical stress, and maintain consistent electrical conductivity throughout the aircraft's operational lifespan. Furthermore, there is growing demand for adhesives that comply with fire, smoke, and toxicity (FST) regulations while offering improved processing characteristics such as longer pot life and faster curing times.

The aftermarket segment presents a substantial opportunity, with maintenance, repair, and overhaul (MRO) operations increasingly adopting conductive adhesives for repairs and upgrades. This segment is expected to grow at 8.3% annually, outpacing the overall market growth rate.

Key challenges affecting market demand include the stringent certification requirements imposed by aviation authorities, which create high barriers to entry and extend product development cycles. Additionally, concerns regarding long-term durability and the potential for galvanic corrosion in certain applications have limited adoption in some critical systems.

Despite these challenges, the transition toward more electric aircraft (MEA) and the ongoing development of urban air mobility platforms are expected to create significant new demand for specialized conductive adhesives in the coming decade.

The primary market drivers include the ongoing lightweighting initiatives across the aerospace sector, as manufacturers seek to reduce fuel consumption and carbon emissions. Conductive adhesives offer weight savings of up to 15% compared to traditional mechanical fastening methods, making them increasingly attractive for next-generation aircraft designs. Additionally, the rising integration of electronics in modern aircraft systems has created new application areas for conductive adhesives in avionics, radar systems, and electromagnetic interference (EMI) shielding.

Market research indicates that commercial aviation represents the largest segment for conductive adhesives, accounting for 58% of total demand. Military applications follow at 27%, with the remaining 15% distributed across space and general aviation sectors. Geographically, North America dominates the market with a 42% share, followed by Europe (31%) and Asia-Pacific (21%), with the latter showing the fastest growth trajectory.

Customer requirements in this market are increasingly focused on adhesives that can withstand extreme temperature variations (-65°C to +180°C), resist vibration and mechanical stress, and maintain consistent electrical conductivity throughout the aircraft's operational lifespan. Furthermore, there is growing demand for adhesives that comply with fire, smoke, and toxicity (FST) regulations while offering improved processing characteristics such as longer pot life and faster curing times.

The aftermarket segment presents a substantial opportunity, with maintenance, repair, and overhaul (MRO) operations increasingly adopting conductive adhesives for repairs and upgrades. This segment is expected to grow at 8.3% annually, outpacing the overall market growth rate.

Key challenges affecting market demand include the stringent certification requirements imposed by aviation authorities, which create high barriers to entry and extend product development cycles. Additionally, concerns regarding long-term durability and the potential for galvanic corrosion in certain applications have limited adoption in some critical systems.

Despite these challenges, the transition toward more electric aircraft (MEA) and the ongoing development of urban air mobility platforms are expected to create significant new demand for specialized conductive adhesives in the coming decade.

Current Regulatory Framework and Technical Challenges

The aviation industry operates under stringent regulatory frameworks that govern the use of materials in aircraft manufacturing and maintenance. For conductive adhesives, these regulations are particularly complex due to the critical safety requirements and performance standards in aviation applications. Currently, the primary regulatory bodies overseeing these materials include the Federal Aviation Administration (FAA), European Union Aviation Safety Agency (EASA), and International Civil Aviation Organization (ICAO), each with specific requirements for material qualification and certification.

The FAA's Advisory Circular AC 43-13-1B provides guidelines for acceptable methods and practices for aircraft repair, including the use of adhesives. However, these guidelines were developed primarily for traditional mechanical fastening systems and have not been fully updated to address the unique properties of modern conductive adhesives. This regulatory gap presents a significant challenge for manufacturers and maintenance organizations seeking to implement these advanced materials.

RTCA DO-160 standards, which specify environmental conditions and test procedures for airborne equipment, include requirements for electromagnetic compatibility that directly impact the use of conductive adhesives. Meeting these standards requires adhesives to maintain consistent electrical conductivity under various environmental stresses, including temperature extremes, humidity, and vibration.

Technical challenges in the regulatory landscape stem from the dual nature of conductive adhesives as both structural and electrical components. Traditional qualification methods often evaluate these properties separately, failing to account for their interdependence in real-world applications. For instance, mechanical stress can alter electrical conductivity, while electrical current can affect bond strength over time—interactions not adequately addressed in current testing protocols.

Material aging and long-term reliability present another regulatory challenge. Aviation components must maintain performance over decades of service, yet accelerated aging tests for conductive adhesives often fail to accurately predict real-world degradation patterns. This discrepancy creates uncertainty in certification processes and hampers industry adoption.

Flammability and toxicity regulations further complicate the use of conductive adhesives in aviation. FAR 25.853 establishes strict flammability requirements, while REACH and other chemical regulations limit the use of certain conductive fillers, particularly heavy metals and some carbon-based materials. These restrictions narrow the formulation options for adhesive manufacturers while still requiring them to meet demanding performance specifications.

Harmonization between international regulatory frameworks remains incomplete, creating compliance challenges for global supply chains. Materials certified under FAA standards may require additional testing or modification to meet EASA requirements, increasing costs and development timelines for new adhesive technologies.

The FAA's Advisory Circular AC 43-13-1B provides guidelines for acceptable methods and practices for aircraft repair, including the use of adhesives. However, these guidelines were developed primarily for traditional mechanical fastening systems and have not been fully updated to address the unique properties of modern conductive adhesives. This regulatory gap presents a significant challenge for manufacturers and maintenance organizations seeking to implement these advanced materials.

RTCA DO-160 standards, which specify environmental conditions and test procedures for airborne equipment, include requirements for electromagnetic compatibility that directly impact the use of conductive adhesives. Meeting these standards requires adhesives to maintain consistent electrical conductivity under various environmental stresses, including temperature extremes, humidity, and vibration.

Technical challenges in the regulatory landscape stem from the dual nature of conductive adhesives as both structural and electrical components. Traditional qualification methods often evaluate these properties separately, failing to account for their interdependence in real-world applications. For instance, mechanical stress can alter electrical conductivity, while electrical current can affect bond strength over time—interactions not adequately addressed in current testing protocols.

Material aging and long-term reliability present another regulatory challenge. Aviation components must maintain performance over decades of service, yet accelerated aging tests for conductive adhesives often fail to accurately predict real-world degradation patterns. This discrepancy creates uncertainty in certification processes and hampers industry adoption.

Flammability and toxicity regulations further complicate the use of conductive adhesives in aviation. FAR 25.853 establishes strict flammability requirements, while REACH and other chemical regulations limit the use of certain conductive fillers, particularly heavy metals and some carbon-based materials. These restrictions narrow the formulation options for adhesive manufacturers while still requiring them to meet demanding performance specifications.

Harmonization between international regulatory frameworks remains incomplete, creating compliance challenges for global supply chains. Materials certified under FAA standards may require additional testing or modification to meet EASA requirements, increasing costs and development timelines for new adhesive technologies.

Current Compliance Solutions and Implementation Strategies

01 Conductive fillers in adhesive compositions

Conductive adhesives incorporate various conductive fillers to achieve electrical conductivity. These fillers include metal particles (such as silver, copper, nickel), carbon-based materials (like carbon nanotubes, graphene), and metal-coated particles. The type, size, shape, and concentration of these fillers significantly impact the adhesive's conductivity, mechanical properties, and processing characteristics. Optimizing the filler loading is crucial to balance conductivity with adhesion strength and flexibility.- Metal-filled conductive adhesives: Metal-filled conductive adhesives incorporate metallic particles such as silver, gold, or copper to create electrical conductivity. These adhesives typically consist of a polymer matrix loaded with metal fillers that form conductive pathways when cured. The concentration and distribution of metal particles directly affect the conductivity level. These adhesives are widely used in electronics assembly, providing both mechanical bonding and electrical connectivity between components.

- Carbon-based conductive adhesives: Carbon-based conductive adhesives utilize carbon materials such as graphite, carbon black, carbon nanotubes, or graphene as conductive fillers. These materials offer advantages including lower cost compared to precious metals, lighter weight, and resistance to oxidation. Carbon-based adhesives provide moderate conductivity suitable for applications requiring EMI shielding, static dissipation, or moderate current flow. The unique properties of carbon nanomaterials can enhance both electrical and mechanical performance of the adhesive.

- Thermally conductive adhesives: Thermally conductive adhesives are formulated to efficiently transfer heat while maintaining electrical insulation or conductivity as required. These adhesives typically contain ceramic fillers like aluminum oxide, boron nitride, or aluminum nitride that enhance thermal conductivity. They are essential in electronic assemblies where heat dissipation is critical for device performance and reliability. Advanced formulations balance thermal conductivity with other properties such as flexibility, adhesion strength, and processing characteristics.

- Anisotropic conductive adhesives: Anisotropic conductive adhesives (ACAs) provide electrical conductivity in one direction while maintaining insulation in others. These specialized adhesives contain conductive particles suspended in an insulating adhesive matrix. When compressed between components, the particles form conductive pathways only in the direction of compression. This technology enables high-density interconnections without short circuits between adjacent conductors, making them valuable for fine-pitch electronics, display technologies, and flexible circuit connections.

- Environmentally friendly conductive adhesives: Environmentally friendly conductive adhesives address health and environmental concerns by eliminating or reducing hazardous materials like lead, halogens, and volatile organic compounds. These formulations use bio-based polymers, water-based systems, or renewable materials as alternatives to traditional petroleum-based adhesives. They maintain necessary electrical and mechanical properties while complying with regulations such as RoHS and REACH. These adhesives support sustainable manufacturing practices and reduce environmental impact throughout the product lifecycle.

02 Polymer matrices for conductive adhesives

The polymer matrix serves as the binding component in conductive adhesives, providing adhesion while allowing electrical conductivity through the embedded conductive fillers. Common polymer matrices include epoxies, silicones, acrylics, and polyurethanes. Each polymer type offers different advantages in terms of curing conditions, temperature resistance, flexibility, and compatibility with various substrates. The selection of polymer matrix significantly affects the final performance characteristics of the conductive adhesive.Expand Specific Solutions03 Anisotropic conductive adhesives

Anisotropic conductive adhesives (ACAs) provide electrical conductivity in one direction while maintaining insulation in others. These specialized adhesives typically contain conductive particles dispersed in an insulating adhesive matrix. When compressed between electrical contacts, the particles form conductive pathways in the direction of compression only. ACAs are particularly valuable in fine-pitch electronics assembly, display technologies, and flexible circuit connections where directional conductivity is required.Expand Specific Solutions04 Thermal management in conductive adhesives

Conductive adhesives often serve dual purposes of electrical connection and thermal management. Formulations may incorporate thermally conductive fillers such as ceramic particles, metal oxides, or specialized carbon materials to enhance heat dissipation. These adhesives are critical in electronic assemblies where heat buildup can affect performance and reliability. The balance between electrical conductivity, thermal conductivity, and mechanical properties is carefully engineered for specific application requirements.Expand Specific Solutions05 Processing and curing methods

The processing and curing methods for conductive adhesives significantly impact their performance characteristics. Various approaches include thermal curing, UV curing, moisture curing, and pressure-assisted curing. The curing process affects the final conductivity, adhesion strength, and reliability of the connection. Advanced formulations may incorporate dual-cure systems or specialized additives to enhance processing efficiency and final properties. The development of low-temperature curing systems has enabled applications on temperature-sensitive substrates.Expand Specific Solutions

Key Industry Players and Certification Bodies

The aviation conductive adhesives market is in a growth phase, characterized by increasing demand for lightweight materials and advanced electronics in aircraft. The market size is expanding due to rising aircraft production and retrofitting activities, with projections indicating significant growth over the next decade. Technologically, conductive adhesives are evolving from basic formulations to advanced solutions meeting stringent aviation safety and performance requirements. Leading players include Henkel AG & Co. KGaA, which dominates with comprehensive adhesive technology solutions, 3M Innovative Properties offering specialized formulations, and PPG Industries and PRC-DeSoto International providing aviation-specific products. Boeing and Airbus drive requirements as major end-users, while companies like RESONAC CORP and Namics Corp. focus on high-performance electronic adhesives meeting aviation regulations.

Henkel AG & Co. KGaA

Technical Solution: Henkel has developed LOCTITE EA 9394 AERO, a two-component structural adhesive specifically designed for aviation applications that meets stringent regulatory requirements. This epoxy-based conductive adhesive provides excellent electrical conductivity while maintaining high mechanical strength in extreme aerospace environments. The formulation complies with FAA regulations for flame retardancy (FAR 25.853) and smoke emission standards, while also meeting the Boeing BMS 5-101 and Airbus AIMS 10-01-006 specifications for structural adhesives. Henkel's solution incorporates silver particles at optimized loading levels to achieve conductivity without compromising adhesion strength or increasing weight. The company has also developed manufacturing processes that ensure consistent electrical properties across production batches, with documented reliability testing showing stable performance after 3,000 hours of thermal cycling between -55°C and 125°C.

Strengths: Superior balance between electrical conductivity and structural performance; extensive aviation certification portfolio; proven long-term reliability in extreme aerospace environments. Weaknesses: Higher cost compared to non-conductive alternatives; requires precise application techniques to ensure consistent electrical properties; limited repairability once cured.

3M Innovative Properties Co.

Technical Solution: 3M has pioneered electrically conductive adhesive (ECA) technology for aviation applications with their 3M™ Electrically Conductive Adhesive Transfer Tapes series. These adhesives utilize proprietary anisotropic conductive particle technology that provides electrical conductivity in the z-axis while maintaining insulation in the x and y directions. This approach addresses the critical aviation requirement for controlled conductivity paths that prevent unintended electrical shorts. The formulations meet FAA flammability requirements per 14 CFR 25.853(a) and are compliant with REACH and RoHS regulations. 3M's aviation-grade ECAs incorporate flame-retardant additives that don't compromise electrical performance, maintaining conductivity stability across temperatures ranging from -65°F to 400°F (-54°C to 204°C). The company has developed specialized manufacturing processes that ensure uniform particle distribution, resulting in consistent electrical performance across production lots with resistance variations of less than 10%, critical for aviation reliability standards.

Strengths: Anisotropic conductivity provides precise electrical pathways while preventing shorts; excellent temperature stability suitable for extreme aviation environments; consistent manufacturing quality with tight tolerance control. Weaknesses: Limited shear strength compared to structural adhesives; requires specific surface preparation protocols; higher cost compared to consumer-grade conductive adhesives.

Critical Regulatory Documents and Technical Specifications

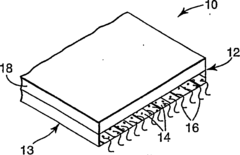

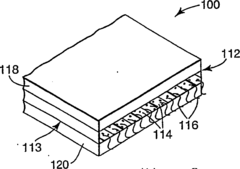

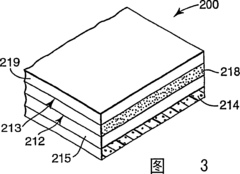

Cleanly removable tapes and methods for the manufacture thereof

PatentInactiveCN1268706C

Innovation

- Developed a multi-layer adhesive tape containing first and second adhesive layers of pressure-sensitive adhesive dispersed with fiber reinforcement using foaming flame retardants and brominated phosphate flame retardants , can be easily peeled off from the substrate by stretch peeling methods, and meets the flame retardant requirements of the aerospace industry.

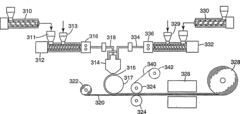

Aircraft adhesive

PatentInactiveCN101193993A

Innovation

- A multi-component aircraft adhesive composition is used, including Part A containing plasticizers, cross-linking agents and adhesion promoters, Part B containing moisture-proofing agents and anti-wear agents, and substantially free of sulfide, by mixing and freezing storage. Provides rapid cure and improved water vapor barrier properties.

Environmental Impact and Sustainability Requirements

The aviation industry faces increasing pressure to reduce its environmental footprint while maintaining stringent safety standards. Conductive adhesives used in aircraft manufacturing and maintenance are subject to rigorous environmental regulations due to their potential ecological impact. Traditional conductive adhesives often contain heavy metals, volatile organic compounds (VOCs), and other environmentally hazardous substances that pose significant risks to ecosystems and human health throughout their lifecycle.

Recent regulatory frameworks, including the European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH), have established strict limitations on hazardous materials in adhesive formulations. The aviation sector must comply with these regulations while also addressing industry-specific requirements outlined in standards such as AS5003 and MIL-STD-883. These standards increasingly incorporate sustainability metrics alongside traditional performance parameters.

Manufacturers are now required to conduct comprehensive lifecycle assessments (LCAs) for conductive adhesives, evaluating environmental impacts from raw material extraction through disposal. These assessments typically reveal that traditional silver-filled epoxy adhesives generate significant carbon emissions during production and present end-of-life disposal challenges. Consequently, regulatory bodies are implementing more stringent waste management protocols for adhesives containing precious metals and potentially toxic compounds.

The industry is witnessing a transition toward water-based conductive adhesive systems with reduced VOC content and bio-based alternatives derived from renewable resources. These environmentally preferable options must still meet the demanding thermal stability, electrical conductivity, and mechanical strength requirements essential for aviation applications. Regulatory frameworks increasingly incentivize these sustainable innovations through certification programs and preferential procurement policies.

End-of-life considerations have become a critical component of aviation adhesive regulations, with requirements for recyclability, biodegradability, or safe disposal pathways. Manufacturers must now document disposal procedures and provide evidence of compliance with waste management regulations specific to the aviation sector. This includes detailed material safety data sheets (MSDS) that outline environmental hazards and proper handling procedures.

Carbon footprint reduction targets are increasingly incorporated into aviation industry standards, with some regulatory bodies establishing maximum allowable greenhouse gas emission levels for adhesive manufacturing processes. These requirements are driving innovation in production methods, including energy-efficient curing technologies and localized manufacturing to reduce transportation emissions.

Recent regulatory frameworks, including the European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH), have established strict limitations on hazardous materials in adhesive formulations. The aviation sector must comply with these regulations while also addressing industry-specific requirements outlined in standards such as AS5003 and MIL-STD-883. These standards increasingly incorporate sustainability metrics alongside traditional performance parameters.

Manufacturers are now required to conduct comprehensive lifecycle assessments (LCAs) for conductive adhesives, evaluating environmental impacts from raw material extraction through disposal. These assessments typically reveal that traditional silver-filled epoxy adhesives generate significant carbon emissions during production and present end-of-life disposal challenges. Consequently, regulatory bodies are implementing more stringent waste management protocols for adhesives containing precious metals and potentially toxic compounds.

The industry is witnessing a transition toward water-based conductive adhesive systems with reduced VOC content and bio-based alternatives derived from renewable resources. These environmentally preferable options must still meet the demanding thermal stability, electrical conductivity, and mechanical strength requirements essential for aviation applications. Regulatory frameworks increasingly incentivize these sustainable innovations through certification programs and preferential procurement policies.

End-of-life considerations have become a critical component of aviation adhesive regulations, with requirements for recyclability, biodegradability, or safe disposal pathways. Manufacturers must now document disposal procedures and provide evidence of compliance with waste management regulations specific to the aviation sector. This includes detailed material safety data sheets (MSDS) that outline environmental hazards and proper handling procedures.

Carbon footprint reduction targets are increasingly incorporated into aviation industry standards, with some regulatory bodies establishing maximum allowable greenhouse gas emission levels for adhesive manufacturing processes. These requirements are driving innovation in production methods, including energy-efficient curing technologies and localized manufacturing to reduce transportation emissions.

International Harmonization of Aviation Adhesive Standards

The harmonization of aviation adhesive standards across international regulatory bodies represents a critical challenge in the global aerospace industry. Currently, major aviation authorities including the Federal Aviation Administration (FAA), European Union Aviation Safety Agency (EASA), Civil Aviation Administration of China (CAAC), and Transport Canada maintain distinct certification requirements for conductive adhesives used in aircraft manufacturing and maintenance.

These disparate standards create significant compliance burdens for manufacturers operating in multiple jurisdictions. For example, a conductive adhesive approved under FAA's AC 43.13-1B may require additional testing and documentation to meet EASA's CS-25 requirements, despite serving identical functional purposes. This regulatory fragmentation increases development costs, extends time-to-market, and creates supply chain complexities.

Recent initiatives through the International Civil Aviation Organization (ICAO) have begun addressing these inconsistencies. The Adhesives Technical Working Group, established in 2019, has made progress in developing common test methodologies for electrical conductivity, thermal stability, and environmental resistance properties specific to aviation applications. Their framework proposal aims to establish mutually recognized certification pathways across major jurisdictions.

Industry consortia like the Aerospace Industries Association (AIA) and International Coordinating Council of Aerospace Industries Associations (ICCAIA) have been instrumental in facilitating dialogue between regulatory bodies and manufacturers. Their 2022 joint position paper outlined potential harmonization approaches, including recognition of equivalent test data and standardized documentation formats for conductive adhesive certification.

The SAE International's AMS3132 standard has emerged as a potential foundation for harmonization efforts, with its comprehensive specifications for electrically conductive adhesives in aircraft applications gaining acceptance across multiple regulatory environments. Several bilateral agreements, such as the 2021 Technical Implementation Procedures between FAA and EASA, have begun incorporating provisions for mutual recognition of conductive adhesive certifications based on aligned technical standards.

Challenges to full harmonization persist, including differing regional approaches to environmental regulations affecting adhesive chemistry, varying interpretations of electrical safety requirements, and legacy certification processes embedded in national regulatory frameworks. The roadmap toward comprehensive international standards alignment suggests a phased approach over the next 3-5 years, with initial focus on standardizing test methodologies before addressing broader certification requirements.

These disparate standards create significant compliance burdens for manufacturers operating in multiple jurisdictions. For example, a conductive adhesive approved under FAA's AC 43.13-1B may require additional testing and documentation to meet EASA's CS-25 requirements, despite serving identical functional purposes. This regulatory fragmentation increases development costs, extends time-to-market, and creates supply chain complexities.

Recent initiatives through the International Civil Aviation Organization (ICAO) have begun addressing these inconsistencies. The Adhesives Technical Working Group, established in 2019, has made progress in developing common test methodologies for electrical conductivity, thermal stability, and environmental resistance properties specific to aviation applications. Their framework proposal aims to establish mutually recognized certification pathways across major jurisdictions.

Industry consortia like the Aerospace Industries Association (AIA) and International Coordinating Council of Aerospace Industries Associations (ICCAIA) have been instrumental in facilitating dialogue between regulatory bodies and manufacturers. Their 2022 joint position paper outlined potential harmonization approaches, including recognition of equivalent test data and standardized documentation formats for conductive adhesive certification.

The SAE International's AMS3132 standard has emerged as a potential foundation for harmonization efforts, with its comprehensive specifications for electrically conductive adhesives in aircraft applications gaining acceptance across multiple regulatory environments. Several bilateral agreements, such as the 2021 Technical Implementation Procedures between FAA and EASA, have begun incorporating provisions for mutual recognition of conductive adhesive certifications based on aligned technical standards.

Challenges to full harmonization persist, including differing regional approaches to environmental regulations affecting adhesive chemistry, varying interpretations of electrical safety requirements, and legacy certification processes embedded in national regulatory frameworks. The roadmap toward comprehensive international standards alignment suggests a phased approach over the next 3-5 years, with initial focus on standardizing test methodologies before addressing broader certification requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!