How Conductive Adhesives Drive Innovation in Smart Fabrics

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Adhesives Background and Innovation Goals

Conductive adhesives represent a transformative technology that has evolved significantly over the past three decades, emerging from simple electrical connection applications to becoming a cornerstone of smart textile innovation. Initially developed as alternatives to traditional soldering in electronics manufacturing, these specialized adhesives combine polymer matrices with conductive fillers such as silver, copper, or carbon particles to create flexible, durable electrical connections that maintain conductivity even under mechanical stress.

The evolution of conductive adhesives has been marked by several key technological breakthroughs. In the 1990s, the focus was primarily on creating reliable electrical connections for printed circuit boards. By the early 2000s, advancements in nanotechnology enabled the development of adhesives with enhanced conductivity using metallic nanoparticles. The 2010s witnessed the emergence of stretchable conductive adhesives specifically designed for wearable applications, addressing the unique requirements of textiles that undergo constant movement and deformation.

Today's conductive adhesives for smart fabrics represent a sophisticated convergence of materials science, polymer chemistry, and electrical engineering. Modern formulations must balance multiple competing properties: electrical conductivity, mechanical flexibility, washability, biocompatibility, and durability under repeated strain cycles. The technical challenges have driven innovation in particle morphology, dispersion techniques, and curing mechanisms to achieve optimal performance in textile applications.

The primary innovation goals in this field center around several critical parameters. First is the development of adhesives with improved conductivity-to-weight ratios, allowing for minimal material usage while maintaining reliable electrical connections. Second is the creation of formulations that can withstand hundreds of washing cycles without degradation, a necessity for commercial viability in everyday garments. Third is the advancement of environmentally sustainable options that reduce or eliminate toxic components while maintaining performance.

Another crucial innovation target is the development of adhesives compatible with high-volume manufacturing processes. Current smart textile production often relies on labor-intensive methods for applying conductive elements, creating a significant barrier to mass-market adoption. Adhesives that can be applied through automated processes such as screen printing, spray coating, or roll-to-roll manufacturing would dramatically reduce production costs and expand market potential.

The ultimate technological goal is to create "invisible integration" – conductive pathways that are imperceptible to the wearer in terms of comfort, appearance, and flexibility, while providing robust electrical functionality for powering sensors, actuators, and communication systems embedded within the fabric structure. This represents the convergence point where smart textiles can transition from specialized applications to mainstream consumer products.

The evolution of conductive adhesives has been marked by several key technological breakthroughs. In the 1990s, the focus was primarily on creating reliable electrical connections for printed circuit boards. By the early 2000s, advancements in nanotechnology enabled the development of adhesives with enhanced conductivity using metallic nanoparticles. The 2010s witnessed the emergence of stretchable conductive adhesives specifically designed for wearable applications, addressing the unique requirements of textiles that undergo constant movement and deformation.

Today's conductive adhesives for smart fabrics represent a sophisticated convergence of materials science, polymer chemistry, and electrical engineering. Modern formulations must balance multiple competing properties: electrical conductivity, mechanical flexibility, washability, biocompatibility, and durability under repeated strain cycles. The technical challenges have driven innovation in particle morphology, dispersion techniques, and curing mechanisms to achieve optimal performance in textile applications.

The primary innovation goals in this field center around several critical parameters. First is the development of adhesives with improved conductivity-to-weight ratios, allowing for minimal material usage while maintaining reliable electrical connections. Second is the creation of formulations that can withstand hundreds of washing cycles without degradation, a necessity for commercial viability in everyday garments. Third is the advancement of environmentally sustainable options that reduce or eliminate toxic components while maintaining performance.

Another crucial innovation target is the development of adhesives compatible with high-volume manufacturing processes. Current smart textile production often relies on labor-intensive methods for applying conductive elements, creating a significant barrier to mass-market adoption. Adhesives that can be applied through automated processes such as screen printing, spray coating, or roll-to-roll manufacturing would dramatically reduce production costs and expand market potential.

The ultimate technological goal is to create "invisible integration" – conductive pathways that are imperceptible to the wearer in terms of comfort, appearance, and flexibility, while providing robust electrical functionality for powering sensors, actuators, and communication systems embedded within the fabric structure. This represents the convergence point where smart textiles can transition from specialized applications to mainstream consumer products.

Market Analysis for Smart Fabric Applications

The smart fabrics market has experienced significant growth in recent years, with a global market value reaching $3.6 billion in 2022 and projected to expand at a compound annual growth rate (CAGR) of 26.2% through 2030. This remarkable growth trajectory is driven by increasing consumer demand for wearable technology, advancements in textile engineering, and the integration of electronics into everyday clothing and fabrics.

The healthcare sector represents the largest application segment for smart fabrics, accounting for approximately 32% of the total market share. Medical applications include continuous health monitoring garments, therapeutic textiles, and rehabilitation supports. These products offer significant value in patient monitoring, preventive healthcare, and managing chronic conditions, particularly for aging populations in developed economies.

Sports and fitness applications follow closely behind, comprising about 28% of the market. Performance-enhancing sportswear, training analytics garments, and recovery textiles have gained substantial traction among professional athletes and fitness enthusiasts alike. Major sportswear brands have increasingly incorporated smart fabric technologies into their premium product lines.

The military and defense sector constitutes roughly 18% of smart fabric applications, with investments focused on developing protective gear, communication-enabled uniforms, and condition-monitoring textiles. Government contracts and defense budgets significantly influence this segment's growth patterns.

Fashion and entertainment applications represent an emerging segment at 12% of the market, with rapid growth potential as conductive adhesive technologies become more refined and aesthetically integrated. The remaining market share is distributed across automotive, home furnishings, and industrial applications.

Geographically, North America leads the smart fabrics market with 38% share, followed by Europe (31%), Asia-Pacific (24%), and rest of the world (7%). However, the Asia-Pacific region is experiencing the fastest growth rate at 29.8% annually, driven by expanding manufacturing capabilities in China, South Korea, and Taiwan, coupled with increasing consumer adoption in Japan and Australia.

Consumer willingness to pay premium prices for smart fabric products varies significantly by application. Healthcare applications command the highest price premiums (40-60% above conventional alternatives), followed by military applications (30-45%), sports applications (25-35%), and fashion applications (15-25%). This pricing structure reflects both the perceived value and the current cost structures associated with conductive adhesive integration technologies.

The healthcare sector represents the largest application segment for smart fabrics, accounting for approximately 32% of the total market share. Medical applications include continuous health monitoring garments, therapeutic textiles, and rehabilitation supports. These products offer significant value in patient monitoring, preventive healthcare, and managing chronic conditions, particularly for aging populations in developed economies.

Sports and fitness applications follow closely behind, comprising about 28% of the market. Performance-enhancing sportswear, training analytics garments, and recovery textiles have gained substantial traction among professional athletes and fitness enthusiasts alike. Major sportswear brands have increasingly incorporated smart fabric technologies into their premium product lines.

The military and defense sector constitutes roughly 18% of smart fabric applications, with investments focused on developing protective gear, communication-enabled uniforms, and condition-monitoring textiles. Government contracts and defense budgets significantly influence this segment's growth patterns.

Fashion and entertainment applications represent an emerging segment at 12% of the market, with rapid growth potential as conductive adhesive technologies become more refined and aesthetically integrated. The remaining market share is distributed across automotive, home furnishings, and industrial applications.

Geographically, North America leads the smart fabrics market with 38% share, followed by Europe (31%), Asia-Pacific (24%), and rest of the world (7%). However, the Asia-Pacific region is experiencing the fastest growth rate at 29.8% annually, driven by expanding manufacturing capabilities in China, South Korea, and Taiwan, coupled with increasing consumer adoption in Japan and Australia.

Consumer willingness to pay premium prices for smart fabric products varies significantly by application. Healthcare applications command the highest price premiums (40-60% above conventional alternatives), followed by military applications (30-45%), sports applications (25-35%), and fashion applications (15-25%). This pricing structure reflects both the perceived value and the current cost structures associated with conductive adhesive integration technologies.

Technical Challenges in Conductive Adhesive Integration

Despite the promising potential of conductive adhesives in smart fabrics, several significant technical challenges impede their widespread integration and commercial viability. The primary obstacle lies in achieving consistent electrical conductivity while maintaining flexibility. Conductive adhesives must preserve their electrical properties under repeated mechanical stress, including stretching, bending, and twisting—movements inherent to textile applications. Current formulations often exhibit conductivity degradation after multiple deformation cycles, resulting in unreliable performance in real-world wearable scenarios.

Durability against environmental factors presents another substantial challenge. Smart textiles are regularly exposed to moisture, varying temperatures, and washing processes. Conductive adhesives must withstand these conditions without delamination, corrosion, or conductivity loss. Most existing formulations demonstrate inadequate resistance to washing cycles, with significant performance deterioration after 5-10 standard machine washes, falling short of consumer expectations for everyday garments.

Adhesion compatibility across diverse textile substrates remains problematic. Different fabric compositions—natural fibers, synthetics, and blends—exhibit varying surface energies and chemical properties. Developing a universal conductive adhesive that bonds effectively to multiple substrate types while maintaining consistent electrical performance has proven elusive. Current solutions often require substrate-specific formulations, complicating manufacturing processes and increasing production costs.

Manufacturing scalability constitutes a significant barrier to commercial implementation. Traditional conductive adhesive application methods like screen printing and stenciling face challenges in maintaining precise deposition patterns on textiles with inherent surface irregularities. Additionally, curing processes often require high temperatures or specialized equipment incompatible with heat-sensitive textile materials, limiting mass production capabilities.

Biocompatibility and safety concerns emerge as critical considerations for wearable applications. Many conductive adhesives contain potentially harmful components like silver particles, solvents, or curing agents that may cause skin irritation or toxicity concerns with prolonged skin contact. Developing formulations that meet both technical performance requirements and stringent safety standards for prolonged skin contact remains challenging.

Cost-effectiveness represents a persistent obstacle to widespread adoption. High-performance conductive adhesives typically incorporate expensive materials like silver, gold, or specialized polymers. The current price point for these materials makes large-scale integration economically unfeasible for many consumer applications, restricting smart fabric technologies to premium market segments rather than mainstream adoption.

Durability against environmental factors presents another substantial challenge. Smart textiles are regularly exposed to moisture, varying temperatures, and washing processes. Conductive adhesives must withstand these conditions without delamination, corrosion, or conductivity loss. Most existing formulations demonstrate inadequate resistance to washing cycles, with significant performance deterioration after 5-10 standard machine washes, falling short of consumer expectations for everyday garments.

Adhesion compatibility across diverse textile substrates remains problematic. Different fabric compositions—natural fibers, synthetics, and blends—exhibit varying surface energies and chemical properties. Developing a universal conductive adhesive that bonds effectively to multiple substrate types while maintaining consistent electrical performance has proven elusive. Current solutions often require substrate-specific formulations, complicating manufacturing processes and increasing production costs.

Manufacturing scalability constitutes a significant barrier to commercial implementation. Traditional conductive adhesive application methods like screen printing and stenciling face challenges in maintaining precise deposition patterns on textiles with inherent surface irregularities. Additionally, curing processes often require high temperatures or specialized equipment incompatible with heat-sensitive textile materials, limiting mass production capabilities.

Biocompatibility and safety concerns emerge as critical considerations for wearable applications. Many conductive adhesives contain potentially harmful components like silver particles, solvents, or curing agents that may cause skin irritation or toxicity concerns with prolonged skin contact. Developing formulations that meet both technical performance requirements and stringent safety standards for prolonged skin contact remains challenging.

Cost-effectiveness represents a persistent obstacle to widespread adoption. High-performance conductive adhesives typically incorporate expensive materials like silver, gold, or specialized polymers. The current price point for these materials makes large-scale integration economically unfeasible for many consumer applications, restricting smart fabric technologies to premium market segments rather than mainstream adoption.

Current Conductive Bonding Solutions

01 Metal-filled conductive adhesives

Metal-filled conductive adhesives incorporate metallic particles such as silver, gold, copper, or nickel to create electrical conductivity. These particles form conductive pathways when the adhesive cures, allowing for electrical connections between components. The concentration and type of metal filler significantly impact the conductivity, with silver typically providing the highest conductivity. These adhesives are widely used in electronics assembly, particularly for applications requiring both mechanical bonding and electrical connectivity.- Conductive fillers in adhesive compositions: Conductive adhesives incorporate various conductive fillers to achieve electrical conductivity. These fillers include metal particles (such as silver, gold, copper), carbon-based materials (like carbon nanotubes, graphene), and metal-coated particles. The type, size, shape, and concentration of these fillers significantly impact the adhesive's conductivity, viscosity, and mechanical properties. Proper dispersion of these fillers within the polymer matrix is crucial for optimal electrical performance while maintaining adhesive properties.

- Polymer matrices for conductive adhesives: The polymer matrix serves as the adhesive base in conductive adhesives, providing mechanical strength and adhesion properties. Common matrices include epoxy resins, silicones, acrylics, and polyurethanes. These polymers can be formulated as thermosetting or thermoplastic systems, each offering different processing and performance characteristics. The selection of polymer matrix affects curing conditions, temperature resistance, flexibility, and compatibility with various substrates, which is crucial for electronic applications.

- Anisotropic conductive adhesives: Anisotropic conductive adhesives (ACAs) provide electrical conductivity in one direction while maintaining insulation in others. These specialized adhesives contain conductive particles dispersed in an insulating adhesive matrix at concentrations below the percolation threshold. When compressed between electrical contacts, the particles form conductive pathways only in the compression direction. ACAs are particularly valuable in fine-pitch electronics assembly, display technologies, and flexible circuit connections where directional conductivity is required.

- Thermal management in conductive adhesives: Conductive adhesives often serve dual purposes of electrical connection and thermal management. Formulations can be designed to enhance thermal conductivity through the incorporation of thermally conductive fillers such as aluminum oxide, boron nitride, or metal particles. These adhesives help dissipate heat in electronic assemblies, preventing overheating of components. The balance between electrical conductivity, thermal conductivity, and mechanical properties is critical in applications like LED packaging, power electronics, and high-performance computing devices.

- Environmental considerations and specialized applications: Modern conductive adhesive formulations address environmental concerns by eliminating lead and other hazardous materials found in traditional solders. These eco-friendly alternatives incorporate bio-based components or recyclable materials. Specialized conductive adhesives are developed for specific applications such as flexible electronics, wearable devices, automotive electronics, and medical implants. These formulations may include additives for enhanced moisture resistance, chemical stability, biocompatibility, or operation under extreme conditions, expanding the application range beyond conventional electronics assembly.

02 Carbon-based conductive adhesives

Carbon-based conductive adhesives utilize carbon materials such as graphite, carbon black, carbon nanotubes, or graphene as conductive fillers. These materials provide moderate conductivity at lower cost compared to precious metals. Carbon nanotubes and graphene offer excellent electrical properties while requiring lower loading levels, which helps maintain better mechanical properties. These adhesives are particularly useful in applications where moderate conductivity is sufficient and cost considerations are important.Expand Specific Solutions03 Anisotropic conductive adhesives

Anisotropic conductive adhesives (ACAs) provide electrical conductivity in one direction while maintaining insulation in other directions. These specialized adhesives contain conductive particles dispersed in an insulating matrix that, when compressed between components, create conductive pathways only in the direction of compression. This unique property makes them ideal for fine-pitch electronics connections, flat panel displays, and flexible circuit applications where preventing short circuits between adjacent connections is critical.Expand Specific Solutions04 Thermally conductive adhesives

Thermally conductive adhesives are designed to transfer heat while providing adhesion between components. These formulations incorporate thermally conductive fillers such as aluminum oxide, boron nitride, or aluminum nitride in a polymer matrix. They are essential in electronic applications where heat dissipation is critical for device performance and reliability. These adhesives provide an alternative to mechanical fastening methods while ensuring efficient thermal management in electronic assemblies, LED applications, and power electronics.Expand Specific Solutions05 Environmentally friendly conductive adhesives

Environmentally friendly conductive adhesives are formulated to reduce or eliminate hazardous materials while maintaining electrical performance. These adhesives often replace lead-based solders and other toxic components with more sustainable alternatives. Innovations include bio-based polymers, water-soluble formulations, and reduced-silver content systems that minimize environmental impact. These green alternatives address increasing regulatory requirements while providing reliable electrical connections for consumer electronics, automotive applications, and medical devices.Expand Specific Solutions

Leading Companies in Smart Textile Industry

The conductive adhesives market in smart fabrics is experiencing rapid growth, currently in an early expansion phase with increasing adoption across wearable technology applications. The global market is projected to reach approximately $3-4 billion by 2025, driven by demand for flexible, washable electronic textiles. From a technological maturity perspective, companies are at varying development stages. Industry leaders like Henkel AG and Robert Bosch GmbH have established advanced conductive adhesive solutions, while innovative players such as AiQ Smart Clothing and Interactive Wear AG are pioneering specialized applications for smart textiles. Toray Industries and Toyobo are leveraging their materials expertise to develop next-generation conductive materials, while technology companies like Infineon Technologies are focusing on integration capabilities. The competitive landscape reflects a blend of established materials manufacturers and specialized smart textile innovators.

Toray Industries, Inc.

Technical Solution: Toray Industries has developed an advanced conductive adhesive technology called "RAYTEX" specifically engineered for smart fabric applications. Their approach utilizes nano-scale conductive particles dispersed in a proprietary polymer matrix that creates stable electrical pathways while maintaining textile flexibility and comfort. The RAYTEX system features graduated adhesion that bonds strongly to conductive elements while interfacing gently with textile fibers, preventing damage during flexing and washing. Toray's technology enables the creation of complex electronic textile circuits with resistance stability of ±3% after 100 washing cycles. Their manufacturing process incorporates precision screen printing techniques that can deposit conductive adhesive patterns with resolution down to 100 microns. The company has successfully implemented this technology in commercial applications including healthcare monitoring garments, heated textiles, and industrial smart fabrics. Toray's latest generation of conductive adhesives incorporates self-healing properties that can restore electrical connections after mechanical damage.

Strengths: Exceptional durability under washing and mechanical stress; compatibility with high-speed textile manufacturing processes; excellent adhesion to both metallic conductors and textile substrates. Weaknesses: Higher material costs compared to conventional textile adhesives; requires specialized application equipment for optimal results; some formulations have temperature limitations.

AiQ Smart Clothing, Inc.

Technical Solution: AiQ Smart Clothing has pioneered a proprietary conductive adhesive system called "SoftTex" that enables the integration of electronic components directly into fabric structures. Their technology utilizes a combination of conductive polymers and specialized adhesives that maintain electrical connectivity while preserving the textile's natural properties. The SoftTex system creates interconnections between conductive yarns and conventional electronic components through a patented low-temperature bonding process that doesn't damage delicate fabrics. AiQ's approach allows for the creation of textile circuits with resistance stability across thousands of flex cycles, making it suitable for garments that undergo regular movement and washing. Their technology has been implemented in commercial products including heated garments, biometric monitoring clothing, and EMI-shielding textiles. The company has developed specialized application techniques that can be integrated into existing textile manufacturing lines, enabling scalable production of smart fabrics.

Strengths: Exceptional flexibility and comfort preservation in the finished textile; proprietary formulations specifically optimized for textile applications; proven durability in commercial products. Weaknesses: Limited compatibility with some synthetic fabrics; requires specialized application equipment; higher initial implementation costs compared to conventional textile manufacturing.

Key Patents in Conductive Adhesive Technology

Conductive yarn/sewing thread capable of data/signal transmission having reduced or eliminated crosstalk, coupled with one or more devices for satellite positioning and accelerometer measurements in a smart fabric, and garment made therefrom

PatentActiveUS20200255984A1

Innovation

- A conductive composite yarn/sewing thread is developed with a core of at least two strands of high-gauge conductive metal wrapped around each other, covered by inner and outer synthetic or natural fibers, and treated with a bonding agent and lubricant, reducing crosstalk and enhancing durability and conductivity.

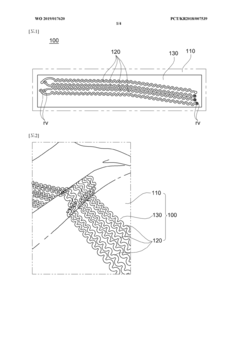

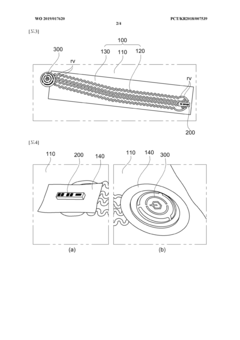

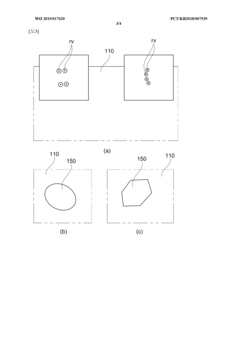

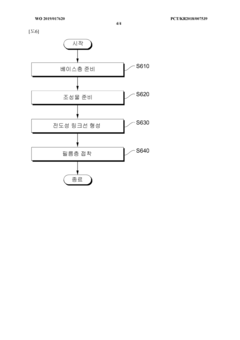

Fabric for multifunctional clothing and method for manufacturing same

PatentWO2019017620A2

Innovation

- A multifunctional clothing fabric with a base layer, a conductive link line made from materials like metal, metal nanowires, or graphene, and a film layer for improved insulation and durability, along with a conductive fixing member to secure electronic devices, is developed. The conductive link line is designed with a sine wave shape and perforated ends to enhance flexibility and prevent damage.

Durability and Washability Considerations

The durability and washability of conductive adhesives represent critical challenges in the development of smart fabrics. Traditional electronic components typically fail when subjected to mechanical stress, moisture, and repeated washing cycles - conditions that are unavoidable in everyday textile applications. Conductive adhesives must maintain their electrical properties and structural integrity throughout the garment's lifecycle to ensure consistent performance and consumer satisfaction.

Current generation conductive adhesives demonstrate varying levels of wash resistance, with most commercial solutions withstanding between 10-30 washing cycles before significant degradation occurs. This limitation stems from the inherent vulnerability of the interface between rigid conductive materials and flexible textile substrates. During washing, mechanical agitation, temperature fluctuations, and chemical interactions with detergents accelerate the breakdown of adhesive bonds and conductive pathways.

Advanced encapsulation techniques have emerged as a promising approach to enhance durability. Multilayer protective coatings using hydrophobic polymers such as polydimethylsiloxane (PDMS) and fluoropolymers create effective barriers against moisture penetration while maintaining flexibility. These protective layers must be carefully engineered to avoid compromising the fabric's breathability, drape, and comfort characteristics that consumers expect.

Mechanical durability presents another significant challenge, as smart fabrics experience continuous flexing, stretching, and compression during normal wear. Recent innovations have focused on developing stretchable conductive adhesives that incorporate elastomeric components to accommodate mechanical deformation without fracturing. Nanocomposite adhesives containing carbon nanotubes or silver nanowires embedded in elastic matrices have demonstrated remarkable resilience, maintaining conductivity even after thousands of stretching cycles.

Testing protocols for durability assessment have become increasingly standardized, with ISO 6330 and AATCC Test Method 135 providing frameworks for evaluating washing durability. However, these standards require adaptation for smart textile applications to account for the unique requirements of electronic components. Accelerated aging tests that simulate multiple years of use within compressed timeframes are essential for predicting long-term performance and establishing realistic consumer expectations.

The environmental impact of conductive adhesives must also be considered within durability assessments. More durable solutions reduce electronic waste by extending product lifespans, but may incorporate materials that complicate end-of-life recycling. Biodegradable conductive adhesives represent an emerging research direction, with preliminary studies exploring cellulose-based formulations enhanced with conductive nanoparticles that maintain performance while offering improved environmental compatibility.

Current generation conductive adhesives demonstrate varying levels of wash resistance, with most commercial solutions withstanding between 10-30 washing cycles before significant degradation occurs. This limitation stems from the inherent vulnerability of the interface between rigid conductive materials and flexible textile substrates. During washing, mechanical agitation, temperature fluctuations, and chemical interactions with detergents accelerate the breakdown of adhesive bonds and conductive pathways.

Advanced encapsulation techniques have emerged as a promising approach to enhance durability. Multilayer protective coatings using hydrophobic polymers such as polydimethylsiloxane (PDMS) and fluoropolymers create effective barriers against moisture penetration while maintaining flexibility. These protective layers must be carefully engineered to avoid compromising the fabric's breathability, drape, and comfort characteristics that consumers expect.

Mechanical durability presents another significant challenge, as smart fabrics experience continuous flexing, stretching, and compression during normal wear. Recent innovations have focused on developing stretchable conductive adhesives that incorporate elastomeric components to accommodate mechanical deformation without fracturing. Nanocomposite adhesives containing carbon nanotubes or silver nanowires embedded in elastic matrices have demonstrated remarkable resilience, maintaining conductivity even after thousands of stretching cycles.

Testing protocols for durability assessment have become increasingly standardized, with ISO 6330 and AATCC Test Method 135 providing frameworks for evaluating washing durability. However, these standards require adaptation for smart textile applications to account for the unique requirements of electronic components. Accelerated aging tests that simulate multiple years of use within compressed timeframes are essential for predicting long-term performance and establishing realistic consumer expectations.

The environmental impact of conductive adhesives must also be considered within durability assessments. More durable solutions reduce electronic waste by extending product lifespans, but may incorporate materials that complicate end-of-life recycling. Biodegradable conductive adhesives represent an emerging research direction, with preliminary studies exploring cellulose-based formulations enhanced with conductive nanoparticles that maintain performance while offering improved environmental compatibility.

Manufacturing Scalability Assessment

The scalability of manufacturing processes for conductive adhesives in smart fabrics represents a critical factor in their commercial viability and widespread adoption. Current production methods for conductive adhesive integration into textiles predominantly operate at laboratory or small-batch scales, creating significant challenges for mass-market implementation. The transition from prototype to high-volume manufacturing requires substantial process optimization and equipment adaptation to maintain consistent electrical performance while meeting cost targets.

Traditional textile manufacturing equipment requires modification to accommodate conductive adhesive application without compromising production speeds. Roll-to-roll processing shows particular promise, with recent advancements enabling continuous deposition of silver-based conductive adhesives at speeds approaching 50 meters per minute. However, maintaining uniform adhesive distribution and consistent electrical properties at these speeds remains problematic, with defect rates increasing exponentially beyond certain production thresholds.

Material waste during manufacturing presents another significant challenge. Conventional application methods result in 15-30% material wastage, substantially impacting production economics given the high cost of conductive materials. Emerging precision deposition technologies utilizing digital printing approaches have demonstrated potential to reduce waste to below 10%, though these systems currently operate at speeds incompatible with high-volume textile production.

Curing processes represent a notable bottleneck in manufacturing scalability. Traditional thermal curing methods require extended dwell times (typically 10-30 minutes), severely limiting production throughput. UV-curable conductive adhesive formulations have emerged as a promising alternative, reducing curing times to under 60 seconds, though these formulations generally exhibit lower conductivity than their thermal counterparts. Recent developments in hybrid curing systems combining UV initiation with short thermal post-processing show promise for balancing throughput and performance requirements.

Quality control and testing methodologies present additional scaling challenges. Current electrical performance verification methods are predominantly manual and time-consuming, unsuitable for high-volume production environments. Automated inline testing systems are under development, utilizing non-contact impedance measurement techniques, though their accuracy and reliability require further validation across diverse fabric substrates and environmental conditions.

Cost modeling indicates that economies of scale can potentially reduce conductive adhesive integration costs by 60-70% at high production volumes, primarily through reduced material waste and process optimization. However, achieving these economies requires significant capital investment in specialized equipment, creating barriers to entry for smaller manufacturers and potentially limiting innovation diversity in the smart fabrics ecosystem.

Traditional textile manufacturing equipment requires modification to accommodate conductive adhesive application without compromising production speeds. Roll-to-roll processing shows particular promise, with recent advancements enabling continuous deposition of silver-based conductive adhesives at speeds approaching 50 meters per minute. However, maintaining uniform adhesive distribution and consistent electrical properties at these speeds remains problematic, with defect rates increasing exponentially beyond certain production thresholds.

Material waste during manufacturing presents another significant challenge. Conventional application methods result in 15-30% material wastage, substantially impacting production economics given the high cost of conductive materials. Emerging precision deposition technologies utilizing digital printing approaches have demonstrated potential to reduce waste to below 10%, though these systems currently operate at speeds incompatible with high-volume textile production.

Curing processes represent a notable bottleneck in manufacturing scalability. Traditional thermal curing methods require extended dwell times (typically 10-30 minutes), severely limiting production throughput. UV-curable conductive adhesive formulations have emerged as a promising alternative, reducing curing times to under 60 seconds, though these formulations generally exhibit lower conductivity than their thermal counterparts. Recent developments in hybrid curing systems combining UV initiation with short thermal post-processing show promise for balancing throughput and performance requirements.

Quality control and testing methodologies present additional scaling challenges. Current electrical performance verification methods are predominantly manual and time-consuming, unsuitable for high-volume production environments. Automated inline testing systems are under development, utilizing non-contact impedance measurement techniques, though their accuracy and reliability require further validation across diverse fabric substrates and environmental conditions.

Cost modeling indicates that economies of scale can potentially reduce conductive adhesive integration costs by 60-70% at high production volumes, primarily through reduced material waste and process optimization. However, achieving these economies requires significant capital investment in specialized equipment, creating barriers to entry for smaller manufacturers and potentially limiting innovation diversity in the smart fabrics ecosystem.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!