Comparative study of Hydrogen storage materials for EV and stationary energy storage

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hydrogen Storage Evolution and Research Objectives

Hydrogen storage technology has evolved significantly over the past decades, driven by the increasing need for clean energy solutions and the global push towards decarbonization. Initially, hydrogen storage research focused primarily on compressed gas and cryogenic liquid methods, which despite their technological simplicity, presented significant challenges in terms of energy density and safety. The 1970s energy crisis catalyzed research into alternative storage methods, leading to the exploration of solid-state materials as potential hydrogen carriers.

The evolution of hydrogen storage materials has progressed through several generations. First-generation materials included metal hydrides such as LaNi5 and TiFe, which offered improved volumetric density but suffered from weight limitations. Second-generation materials introduced complex hydrides and chemical hydrides, which demonstrated higher gravimetric capacities but faced challenges in reversibility and kinetics. The current third-generation materials encompass advanced nanostructured materials, metal-organic frameworks (MOFs), and hybrid systems that aim to optimize both gravimetric and volumetric storage capacities.

For electric vehicle (EV) applications, the evolution has been particularly focused on achieving the U.S. Department of Energy's targets for onboard hydrogen storage: 6.5 wt% system gravimetric capacity and 50 g H2/L system volumetric capacity. This has driven research toward lightweight materials with rapid hydrogen absorption/desorption kinetics at near-ambient conditions. Conversely, stationary storage evolution has prioritized cost-effectiveness, long-term stability, and safety over weight considerations.

The research objectives in this comparative study are multifaceted. First, to systematically evaluate and compare the performance metrics of various hydrogen storage materials specifically for EV and stationary applications, including gravimetric and volumetric capacities, operating conditions, cycling stability, and system integration challenges. Second, to identify material-specific limitations and potential optimization strategies for each application context. Third, to assess the technological readiness levels of promising materials and project their development trajectories.

Additionally, this study aims to establish a comprehensive framework for evaluating the economic viability of different storage solutions across the entire value chain, from production to end-use. Finally, the research seeks to identify cross-cutting technologies and synergistic approaches that could benefit both EV and stationary storage applications, potentially accelerating the commercial deployment of hydrogen storage systems in both sectors.

The evolution of hydrogen storage materials has progressed through several generations. First-generation materials included metal hydrides such as LaNi5 and TiFe, which offered improved volumetric density but suffered from weight limitations. Second-generation materials introduced complex hydrides and chemical hydrides, which demonstrated higher gravimetric capacities but faced challenges in reversibility and kinetics. The current third-generation materials encompass advanced nanostructured materials, metal-organic frameworks (MOFs), and hybrid systems that aim to optimize both gravimetric and volumetric storage capacities.

For electric vehicle (EV) applications, the evolution has been particularly focused on achieving the U.S. Department of Energy's targets for onboard hydrogen storage: 6.5 wt% system gravimetric capacity and 50 g H2/L system volumetric capacity. This has driven research toward lightweight materials with rapid hydrogen absorption/desorption kinetics at near-ambient conditions. Conversely, stationary storage evolution has prioritized cost-effectiveness, long-term stability, and safety over weight considerations.

The research objectives in this comparative study are multifaceted. First, to systematically evaluate and compare the performance metrics of various hydrogen storage materials specifically for EV and stationary applications, including gravimetric and volumetric capacities, operating conditions, cycling stability, and system integration challenges. Second, to identify material-specific limitations and potential optimization strategies for each application context. Third, to assess the technological readiness levels of promising materials and project their development trajectories.

Additionally, this study aims to establish a comprehensive framework for evaluating the economic viability of different storage solutions across the entire value chain, from production to end-use. Finally, the research seeks to identify cross-cutting technologies and synergistic approaches that could benefit both EV and stationary storage applications, potentially accelerating the commercial deployment of hydrogen storage systems in both sectors.

Market Analysis for Hydrogen Storage in EV and Stationary Applications

The hydrogen storage market for both electric vehicles (EVs) and stationary applications is experiencing significant growth driven by the global push toward decarbonization and renewable energy integration. Current market valuations place the global hydrogen storage market at approximately $15 billion, with projections indicating growth to reach $25 billion by 2030, representing a compound annual growth rate of 8.5%.

For the EV sector specifically, hydrogen fuel cell vehicles (FCEVs) currently represent less than 0.1% of the global vehicle market, with approximately 50,000 FCEVs on roads worldwide. However, this segment is expected to grow substantially, with forecasts suggesting 1.5 million FCEVs by 2030, primarily in commercial and heavy-duty transportation sectors where battery limitations become more pronounced.

The stationary storage market presents a more immediate opportunity, valued at approximately $7 billion currently. This sector is growing at 12% annually, faster than the overall hydrogen storage market, driven by grid-scale energy storage needs and industrial applications requiring long-duration storage capabilities.

Regional analysis reveals distinct market characteristics. Asia-Pacific, particularly Japan, South Korea, and China, leads in hydrogen storage technology deployment with 45% market share, supported by strong government initiatives. Europe follows with 30% market share, demonstrating robust growth in both mobility and stationary applications, while North America accounts for 20% of the market with increasing investment in hydrogen infrastructure.

Customer segmentation shows three primary markets: transportation (35%), industrial applications (40%), and power generation (25%). The transportation segment is expected to grow most rapidly as hydrogen fuel cell technology matures and infrastructure expands.

Key market drivers include increasingly stringent emissions regulations, declining renewable energy costs making green hydrogen production more economical, and technological advancements in storage materials. The cost trajectory for hydrogen storage systems shows promising trends, with material costs decreasing by approximately 30% over the past five years.

Market barriers remain significant, including high infrastructure costs, with hydrogen refueling stations costing between $1-2 million each, and limited economies of scale in production. Additionally, competition from rapidly improving battery technologies presents a challenge, particularly in the light-duty vehicle segment where battery electric vehicles maintain significant cost advantages.

For the EV sector specifically, hydrogen fuel cell vehicles (FCEVs) currently represent less than 0.1% of the global vehicle market, with approximately 50,000 FCEVs on roads worldwide. However, this segment is expected to grow substantially, with forecasts suggesting 1.5 million FCEVs by 2030, primarily in commercial and heavy-duty transportation sectors where battery limitations become more pronounced.

The stationary storage market presents a more immediate opportunity, valued at approximately $7 billion currently. This sector is growing at 12% annually, faster than the overall hydrogen storage market, driven by grid-scale energy storage needs and industrial applications requiring long-duration storage capabilities.

Regional analysis reveals distinct market characteristics. Asia-Pacific, particularly Japan, South Korea, and China, leads in hydrogen storage technology deployment with 45% market share, supported by strong government initiatives. Europe follows with 30% market share, demonstrating robust growth in both mobility and stationary applications, while North America accounts for 20% of the market with increasing investment in hydrogen infrastructure.

Customer segmentation shows three primary markets: transportation (35%), industrial applications (40%), and power generation (25%). The transportation segment is expected to grow most rapidly as hydrogen fuel cell technology matures and infrastructure expands.

Key market drivers include increasingly stringent emissions regulations, declining renewable energy costs making green hydrogen production more economical, and technological advancements in storage materials. The cost trajectory for hydrogen storage systems shows promising trends, with material costs decreasing by approximately 30% over the past five years.

Market barriers remain significant, including high infrastructure costs, with hydrogen refueling stations costing between $1-2 million each, and limited economies of scale in production. Additionally, competition from rapidly improving battery technologies presents a challenge, particularly in the light-duty vehicle segment where battery electric vehicles maintain significant cost advantages.

Technical Barriers and Global Development Status

Despite significant advancements in hydrogen storage technologies, several critical technical barriers continue to impede widespread adoption for both electric vehicle applications and stationary energy storage systems. For EVs, volumetric and gravimetric energy density remains a fundamental challenge, with current hydrogen storage systems struggling to meet the U.S. Department of Energy's targets of 6.5 wt% system gravimetric capacity and 50 g/L volumetric capacity. Material-based storage solutions face issues with hydrogen binding energies that are either too weak (physisorption) or too strong (chemisorption), resulting in impractical operating conditions.

Cost factors present another significant barrier, particularly for metal hydrides and complex hydrides which require expensive raw materials and complex synthesis processes. The current cost of hydrogen storage systems exceeds $500/kg H₂ stored, substantially higher than the DOE's target of $333/kg for automotive applications.

Durability and cycling stability pose additional challenges, especially for material-based storage systems. Metal hydrides typically demonstrate capacity degradation after repeated hydrogen absorption-desorption cycles, while carbon-based materials suffer from surface contamination issues that reduce adsorption capacity over time.

Safety concerns persist across all hydrogen storage technologies. High-pressure tanks (350-700 bar) used in current EVs present risks of mechanical failure, while material-based systems face challenges with heat management during rapid charging and discharging processes, potentially leading to dangerous temperature excursions.

Globally, hydrogen storage development shows regional specialization patterns. Japan and South Korea lead in metal hydride research, with Toyota and Hyundai making significant investments in solid-state storage technologies. European efforts, particularly in Germany and Scandinavia, focus on complex hydrides and chemical hydrogen carriers, supported by substantial EU funding through initiatives like Horizon Europe.

The United States maintains strength in fundamental materials research through DOE-funded programs at national laboratories, while China has rapidly expanded its research capacity, becoming the leading publisher of hydrogen storage research papers since 2018, with particular emphasis on low-cost manufacturing processes for advanced materials.

Commercial development remains fragmented, with automotive applications seeing faster progress than stationary storage. Companies like Hydrogenious Technologies (LOHC technology) and McPhy Energy (solid-state storage) have demonstrated promising pilot projects, but widespread commercialization awaits further technical breakthroughs to overcome the identified barriers.

Cost factors present another significant barrier, particularly for metal hydrides and complex hydrides which require expensive raw materials and complex synthesis processes. The current cost of hydrogen storage systems exceeds $500/kg H₂ stored, substantially higher than the DOE's target of $333/kg for automotive applications.

Durability and cycling stability pose additional challenges, especially for material-based storage systems. Metal hydrides typically demonstrate capacity degradation after repeated hydrogen absorption-desorption cycles, while carbon-based materials suffer from surface contamination issues that reduce adsorption capacity over time.

Safety concerns persist across all hydrogen storage technologies. High-pressure tanks (350-700 bar) used in current EVs present risks of mechanical failure, while material-based systems face challenges with heat management during rapid charging and discharging processes, potentially leading to dangerous temperature excursions.

Globally, hydrogen storage development shows regional specialization patterns. Japan and South Korea lead in metal hydride research, with Toyota and Hyundai making significant investments in solid-state storage technologies. European efforts, particularly in Germany and Scandinavia, focus on complex hydrides and chemical hydrogen carriers, supported by substantial EU funding through initiatives like Horizon Europe.

The United States maintains strength in fundamental materials research through DOE-funded programs at national laboratories, while China has rapidly expanded its research capacity, becoming the leading publisher of hydrogen storage research papers since 2018, with particular emphasis on low-cost manufacturing processes for advanced materials.

Commercial development remains fragmented, with automotive applications seeing faster progress than stationary storage. Companies like Hydrogenious Technologies (LOHC technology) and McPhy Energy (solid-state storage) have demonstrated promising pilot projects, but widespread commercialization awaits further technical breakthroughs to overcome the identified barriers.

Current Hydrogen Storage Material Solutions Comparison

01 Metal hydride-based hydrogen storage materials

Metal hydrides are compounds formed by metals or metal alloys that can absorb and release hydrogen under specific temperature and pressure conditions. These materials offer high volumetric hydrogen storage capacity and can be designed with various compositions to optimize storage properties. Common metal hydride systems include magnesium-based hydrides, aluminum-based hydrides, and transition metal-based hydrides, which can be enhanced through catalysts and nanostructuring to improve kinetics and cycling stability.- Metal hydride-based hydrogen storage materials: Metal hydrides are compounds formed by metals or metal alloys that can absorb and release hydrogen under specific temperature and pressure conditions. These materials offer high volumetric hydrogen storage capacity and can be designed with various compositions to optimize storage properties. Common metal hydride systems include magnesium-based hydrides, aluminum-based hydrides, and transition metal-based hydrides that provide efficient and reversible hydrogen storage solutions.

- Carbon-based hydrogen storage materials: Carbon-based materials such as carbon nanotubes, graphene, and activated carbon offer promising hydrogen storage capabilities through adsorption mechanisms. These materials provide large surface areas for hydrogen molecules to adsorb onto, with the advantage of lightweight structures and tunable porosity. Various modifications including doping with metals or creating specific pore architectures can enhance the hydrogen uptake capacity and kinetics of these carbon-based storage systems.

- Complex hydrides for hydrogen storage: Complex hydrides, including borohydrides, alanates, and amides, represent advanced hydrogen storage materials with high gravimetric hydrogen content. These compounds typically contain light elements bonded with hydrogen in complex structures, allowing for significant hydrogen storage capacity. Research focuses on improving their dehydrogenation/rehydrogenation kinetics, reducing operating temperatures, and enhancing cycling stability through catalysts and compositional modifications.

- Nanostructured hydrogen storage materials: Nanostructured materials offer enhanced hydrogen storage properties due to their high surface-to-volume ratio and shortened diffusion paths. These materials include nanoparticles, nanowires, and core-shell structures that can significantly improve hydrogen absorption/desorption kinetics. The nanoscale architecture allows for better control of thermodynamics and kinetics of hydrogen storage reactions, while also potentially reducing operating temperatures and pressures required for practical applications.

- Composite and hybrid hydrogen storage systems: Composite and hybrid hydrogen storage systems combine different types of storage materials to overcome limitations of individual components. These systems may integrate metal hydrides with carbon materials, incorporate catalysts to enhance kinetics, or use supporting matrices to improve heat transfer and mechanical stability. Such hybrid approaches aim to achieve synergistic effects that optimize hydrogen storage capacity, operating conditions, and cycling durability for practical applications in energy storage and transportation.

02 Carbon-based hydrogen storage materials

Carbon-based materials such as activated carbon, carbon nanotubes, graphene, and carbon aerogels can store hydrogen through physisorption mechanisms. These materials offer advantages including light weight, high surface area, and tunable pore structures. The hydrogen storage capacity can be enhanced through surface functionalization, doping with metals, and optimizing pore size distribution. Carbon-based materials are particularly attractive for their potential low cost and environmental compatibility.Expand Specific Solutions03 Complex hydrides for hydrogen storage

Complex hydrides, including borohydrides, alanates, and amides, offer high gravimetric hydrogen storage capacity. These materials store hydrogen through chemical bonds and can release hydrogen through thermal decomposition or hydrolysis reactions. Research focuses on improving their reversibility, reducing dehydrogenation temperatures, and enhancing kinetics through catalysts and compositional modifications. Multi-component systems combining different complex hydrides have shown promising results in overcoming individual limitations.Expand Specific Solutions04 Nanostructured hydrogen storage materials

Nanostructuring of hydrogen storage materials significantly improves hydrogen sorption kinetics and cycling stability by reducing diffusion distances and creating more active sites. Techniques include ball milling, thin film deposition, and template-assisted synthesis to create nanopowders, nanocomposites, and core-shell structures. Nanostructured materials often demonstrate enhanced performance compared to their bulk counterparts, with faster absorption/desorption rates and lower operating temperatures.Expand Specific Solutions05 Hydrogen storage systems and applications

Integrated hydrogen storage systems combine storage materials with heat management, pressure regulation, and safety components for practical applications. These systems are designed for specific use cases including fuel cells, transportation, stationary power, and portable devices. Engineering considerations include thermal management during hydrogen absorption/desorption, system weight and volume optimization, and integration with hydrogen production and utilization technologies. Recent developments focus on modular designs and hybrid systems combining multiple storage technologies.Expand Specific Solutions

Leading Companies and Research Institutions in Hydrogen Storage

The hydrogen storage materials market for EV and stationary energy storage is in a growth phase, with increasing market size driven by clean energy transitions. The technology shows varying maturity levels across applications, with major automotive players like Toyota, Hyundai, and Nissan leading innovation in vehicle applications. Companies such as Japan Metals & Chemicals and Hydrogenious LOHC Technologies are advancing material-specific solutions, while research institutions like Southwest Research Institute and Oxford University Innovation contribute fundamental breakthroughs. The competitive landscape features diverse approaches including metal hydrides, chemical carriers, and advanced composites, with BASF and Santoku developing commercial-scale materials. Collaboration between automotive manufacturers and materials specialists is accelerating development toward higher storage densities and lower costs required for mass adoption.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered metal hydride storage systems for hydrogen, particularly focusing on their application in fuel cell electric vehicles (FCEVs). Their technology utilizes specialized alloys (typically based on lanthanum-nickel or titanium-iron compositions) that can absorb hydrogen atoms within their crystalline structure. Toyota's approach involves optimizing the alloy composition to achieve higher gravimetric and volumetric storage densities while maintaining favorable kinetics for hydrogen absorption and desorption. Their latest generation systems incorporate advanced heat management techniques to address the exothermic nature of hydrogen absorption, using the vehicle's cooling system to regulate temperature during refueling[1]. Toyota has also developed specialized tank designs that can withstand high pressures (700 bar) for compressed hydrogen storage, utilizing carbon fiber reinforcement techniques that minimize weight while maximizing safety[3]. Their dual-approach strategy allows them to leverage both chemical storage (metal hydrides) and physical storage (compression) depending on the specific vehicle requirements.

Strengths: Toyota's hydrogen storage technologies benefit from extensive real-world testing in their commercial FCEV fleet, providing valuable operational data. Their metal hydride systems offer improved safety compared to high-pressure storage. Weaknesses: Metal hydride systems still face challenges with weight penalties, limiting driving range, and their hydrogen absorption/desorption kinetics can be affected by cycling degradation over time, potentially reducing storage capacity.

Japan Metals & Chemicals Co. Ltd.

Technical Solution: Japan Metals & Chemicals (JMC) has specialized in developing advanced metal hydride materials for hydrogen storage applications in both EV and stationary contexts. Their core technology revolves around AB5-type rare earth-based alloys (primarily using mischmetal, nickel, aluminum, cobalt, and manganese) that have been optimized through precise compositional control to achieve hydrogen storage capacities of 1.5-1.8 wt% with exceptional cycling stability[2]. JMC's innovation lies in their manufacturing process, which includes vacuum induction melting followed by specialized heat treatment and mechanical activation processes that enhance hydrogen absorption kinetics. For EV applications, they've developed composite materials that incorporate their metal hydrides into a conductive matrix to improve heat transfer during hydrogen charging and discharging, addressing one of the key limitations of metal hydride systems. Their stationary storage solutions utilize larger format metal hydride beds with integrated heat exchangers that can operate at pressures below 10 bar, making them significantly safer than compressed hydrogen systems[4]. JMC has also pioneered the development of Ti-Mn based AB2-type alloys that demonstrate improved gravimetric capacity (up to 2.2 wt%) while maintaining the favorable operating temperature range (0-80°C) and pressure conditions that make metal hydrides attractive for certain applications.

Strengths: JMC's metal hydride systems offer exceptional safety advantages by storing hydrogen at low pressures and ambient temperatures. Their materials demonstrate excellent cycling durability, with some formulations maintaining over 90% capacity after 10,000 cycles. The technology enables compact storage systems with good volumetric efficiency. Weaknesses: The gravimetric hydrogen storage capacity remains limited compared to high-pressure or cryogenic systems, making them less suitable for light-duty vehicles where weight is critical. The materials require significant amounts of rare earth and transition metals, raising concerns about resource availability and cost for large-scale deployment.

Key Patents and Scientific Breakthroughs in Storage Materials

Hydrogen storage materials containing liquid electrolytes

PatentActiveUS11050075B1

Innovation

- A hydrogen-storage material formulation comprising a solid hydrogen-storage material bonded ionically, covalently, or interstitially with a metal or metalloid, combined with a liquid electrolyte that is ionically conductive, enhancing hydrogen evolution rates and allowing for reversible dehydrogenation-hydrogenation cycles at practical temperatures and pressures.

High-capacity complex hydrogen storage materials and a process of releasing hydrogen

PatentInactiveUS8961819B2

Innovation

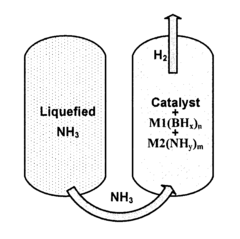

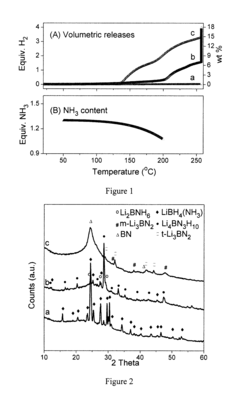

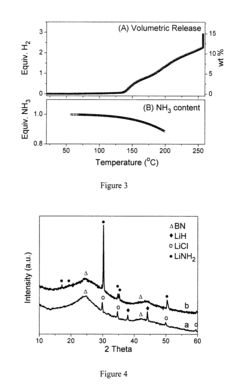

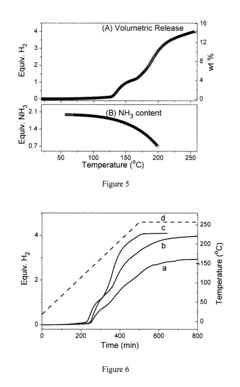

- A hydrogen storage system comprising borohydride and ammonia with a metal catalyst, where the molar ratio of ammonia to borohydride is optimized, and transition metal catalysts are introduced to improve dehydrogenation kinetics, allowing for hydrogen release in a closed system at mild conditions through equilibrium-vapor-pressure control.

Safety and Regulatory Framework for Hydrogen Storage Systems

The regulatory landscape for hydrogen storage systems is complex and evolving rapidly as hydrogen gains prominence in clean energy transitions. International standards such as ISO/TC 197 and IEC/TC 105 provide foundational frameworks for hydrogen technologies, establishing safety parameters for storage systems in both mobile and stationary applications. These standards address critical aspects including material compatibility, pressure management, leak detection, and emergency response protocols.

In the automotive sector, regulations like UN GTR No. 13 and EU Regulation 79/2009 specifically govern hydrogen fuel cell vehicles, mandating rigorous testing protocols for onboard storage systems. These include requirements for crash safety, pressure cycling durability, and fire resistance that exceed conventional fuel storage standards. Storage systems must withstand extreme conditions while maintaining structural integrity to prevent catastrophic failures.

For stationary applications, building codes and fire safety regulations vary significantly across jurisdictions, creating compliance challenges for widespread deployment. The International Fire Code and NFPA 2 (Hydrogen Technologies Code) in the United States provide comprehensive guidelines for facility design, while similar frameworks exist in Europe through the ATEX directive and in Japan through the High Pressure Gas Safety Act.

Material-specific regulations present another layer of complexity, with different requirements for metal hydrides, chemical hydrides, and high-pressure tanks. Metal hydrides face scrutiny regarding thermal management during hydrogen absorption/desorption cycles, while compressed hydrogen systems must comply with pressure vessel codes like ASME BPVC or equivalent international standards.

Risk assessment methodologies have become increasingly standardized, with HAZOP (Hazard and Operability) studies and FMEA (Failure Mode and Effects Analysis) now mandatory for many hydrogen installations. These approaches help identify potential failure points and establish appropriate mitigation measures throughout the system lifecycle.

Insurance requirements represent a significant barrier to hydrogen technology adoption, with many insurers demanding extensive safety documentation and risk management plans before providing coverage. This challenge is particularly acute for novel storage materials that lack long-term operational data.

Regulatory harmonization efforts are underway through initiatives like the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE), which aims to create consistent global standards. However, significant regional differences persist, creating market fragmentation that complicates technology development and commercialization pathways for innovative storage solutions.

In the automotive sector, regulations like UN GTR No. 13 and EU Regulation 79/2009 specifically govern hydrogen fuel cell vehicles, mandating rigorous testing protocols for onboard storage systems. These include requirements for crash safety, pressure cycling durability, and fire resistance that exceed conventional fuel storage standards. Storage systems must withstand extreme conditions while maintaining structural integrity to prevent catastrophic failures.

For stationary applications, building codes and fire safety regulations vary significantly across jurisdictions, creating compliance challenges for widespread deployment. The International Fire Code and NFPA 2 (Hydrogen Technologies Code) in the United States provide comprehensive guidelines for facility design, while similar frameworks exist in Europe through the ATEX directive and in Japan through the High Pressure Gas Safety Act.

Material-specific regulations present another layer of complexity, with different requirements for metal hydrides, chemical hydrides, and high-pressure tanks. Metal hydrides face scrutiny regarding thermal management during hydrogen absorption/desorption cycles, while compressed hydrogen systems must comply with pressure vessel codes like ASME BPVC or equivalent international standards.

Risk assessment methodologies have become increasingly standardized, with HAZOP (Hazard and Operability) studies and FMEA (Failure Mode and Effects Analysis) now mandatory for many hydrogen installations. These approaches help identify potential failure points and establish appropriate mitigation measures throughout the system lifecycle.

Insurance requirements represent a significant barrier to hydrogen technology adoption, with many insurers demanding extensive safety documentation and risk management plans before providing coverage. This challenge is particularly acute for novel storage materials that lack long-term operational data.

Regulatory harmonization efforts are underway through initiatives like the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE), which aims to create consistent global standards. However, significant regional differences persist, creating market fragmentation that complicates technology development and commercialization pathways for innovative storage solutions.

Environmental Impact and Lifecycle Assessment

The environmental impact of hydrogen storage materials represents a critical dimension in evaluating their suitability for both electric vehicle applications and stationary energy storage systems. Life cycle assessment (LCA) studies reveal that different hydrogen storage technologies exhibit varying environmental footprints across their production, use, and disposal phases.

Metal hydrides, while offering high volumetric storage capacity, often require energy-intensive manufacturing processes. The extraction and processing of rare earth elements and transition metals used in these materials contribute significantly to their environmental burden. However, their long cycle life and potential for recycling partially offset these initial impacts when assessed over complete lifecycle periods.

Chemical hydrogen carriers such as ammonia and liquid organic hydrogen carriers (LOHCs) present complex environmental profiles. While they enable hydrogen storage at ambient conditions, reducing energy requirements for compression or liquefaction, the synthesis of these carriers often involves carbon-intensive processes. The environmental benefits of these systems heavily depend on the source of hydrogen and energy used in their production cycles.

Carbon-based materials like activated carbon and carbon nanotubes demonstrate promising environmental characteristics due to their potential for production from renewable or waste carbon sources. Nevertheless, current manufacturing methods for advanced nanomaterials often involve energy-intensive processes and hazardous chemicals, creating environmental trade-offs that require careful consideration.

For stationary applications, the environmental impact assessment must account for longer operational lifetimes compared to mobile applications. Materials with lower efficiency but greater durability may present better overall environmental performance in these contexts. Additionally, the integration of these storage systems with renewable energy sources significantly influences their net environmental impact.

In the EV sector, weight considerations amplify the importance of energy density in the environmental equation. Heavier storage systems increase vehicle energy consumption, potentially negating benefits gained from cleaner hydrogen production. The environmental assessment must therefore include these indirect effects on vehicle efficiency and range.

End-of-life management represents another crucial aspect of environmental assessment. While metal hydrides offer good recyclability potential, composite materials and chemical carriers present more complex recycling challenges. Developing effective recycling pathways for these materials remains essential for minimizing their lifecycle environmental impact.

Water consumption during hydrogen production and storage material manufacturing also warrants attention, particularly in water-stressed regions. Some storage technologies require significant water inputs, adding another dimension to their environmental assessment beyond carbon emissions and energy consumption.

Metal hydrides, while offering high volumetric storage capacity, often require energy-intensive manufacturing processes. The extraction and processing of rare earth elements and transition metals used in these materials contribute significantly to their environmental burden. However, their long cycle life and potential for recycling partially offset these initial impacts when assessed over complete lifecycle periods.

Chemical hydrogen carriers such as ammonia and liquid organic hydrogen carriers (LOHCs) present complex environmental profiles. While they enable hydrogen storage at ambient conditions, reducing energy requirements for compression or liquefaction, the synthesis of these carriers often involves carbon-intensive processes. The environmental benefits of these systems heavily depend on the source of hydrogen and energy used in their production cycles.

Carbon-based materials like activated carbon and carbon nanotubes demonstrate promising environmental characteristics due to their potential for production from renewable or waste carbon sources. Nevertheless, current manufacturing methods for advanced nanomaterials often involve energy-intensive processes and hazardous chemicals, creating environmental trade-offs that require careful consideration.

For stationary applications, the environmental impact assessment must account for longer operational lifetimes compared to mobile applications. Materials with lower efficiency but greater durability may present better overall environmental performance in these contexts. Additionally, the integration of these storage systems with renewable energy sources significantly influences their net environmental impact.

In the EV sector, weight considerations amplify the importance of energy density in the environmental equation. Heavier storage systems increase vehicle energy consumption, potentially negating benefits gained from cleaner hydrogen production. The environmental assessment must therefore include these indirect effects on vehicle efficiency and range.

End-of-life management represents another crucial aspect of environmental assessment. While metal hydrides offer good recyclability potential, composite materials and chemical carriers present more complex recycling challenges. Developing effective recycling pathways for these materials remains essential for minimizing their lifecycle environmental impact.

Water consumption during hydrogen production and storage material manufacturing also warrants attention, particularly in water-stressed regions. Some storage technologies require significant water inputs, adding another dimension to their environmental assessment beyond carbon emissions and energy consumption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!