Hydrogen storage materials patent evaluation and global technology landscape

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hydrogen Storage Materials Evolution and Research Objectives

Hydrogen storage materials have evolved significantly over the past several decades, transitioning from conventional physical storage methods to advanced chemical and material-based solutions. The journey began in the 1970s with metal hydrides, which represented the first generation of solid-state hydrogen storage materials. These early materials, while groundbreaking, suffered from limitations in storage capacity and release kinetics.

The 1990s witnessed the emergence of carbon-based materials, particularly after the discovery of carbon nanotubes in 1991. This period marked a paradigm shift in hydrogen storage research, expanding the material palette beyond traditional metal hydrides to include various nanostructured carbon forms.

A significant breakthrough occurred in the early 2000s with the development of complex hydrides and chemical hydrogen storage materials. These materials offered higher theoretical storage capacities but presented challenges in terms of reversibility and operating conditions. Simultaneously, metal-organic frameworks (MOFs) emerged as promising candidates due to their exceptional surface areas and tunable pore structures.

The 2010s have been characterized by hybrid systems and nanoscale engineering approaches. Researchers have increasingly focused on combining different material types to create synergistic effects and overcome the limitations of individual materials. Nanoscale engineering has enabled precise control over material properties, significantly enhancing hydrogen sorption kinetics and thermodynamics.

Current research objectives in hydrogen storage materials are multifaceted and ambitious. Primary goals include achieving the U.S. Department of Energy's targets for automotive applications: 6.5 wt% system gravimetric capacity and 50 g H₂/L volumetric capacity at near-ambient conditions. These benchmarks represent the minimum requirements for practical hydrogen-powered vehicles with acceptable range.

Another critical objective is developing materials with improved cycling stability that can maintain performance over thousands of charge-discharge cycles. This aspect is particularly important for commercial viability and long-term reliability of hydrogen storage systems.

Researchers are also pursuing materials that operate under moderate temperature and pressure conditions, ideally between -40°C to 85°C and below 100 bar. This would eliminate the need for energy-intensive compression or liquefaction processes that currently reduce the overall energy efficiency of hydrogen systems.

Cost reduction represents another fundamental research objective, with targets below $333/kg H₂ stored for automotive applications. Achieving this goal requires not only new materials but also scalable, resource-efficient synthesis methods that utilize earth-abundant elements rather than rare or precious metals.

The 1990s witnessed the emergence of carbon-based materials, particularly after the discovery of carbon nanotubes in 1991. This period marked a paradigm shift in hydrogen storage research, expanding the material palette beyond traditional metal hydrides to include various nanostructured carbon forms.

A significant breakthrough occurred in the early 2000s with the development of complex hydrides and chemical hydrogen storage materials. These materials offered higher theoretical storage capacities but presented challenges in terms of reversibility and operating conditions. Simultaneously, metal-organic frameworks (MOFs) emerged as promising candidates due to their exceptional surface areas and tunable pore structures.

The 2010s have been characterized by hybrid systems and nanoscale engineering approaches. Researchers have increasingly focused on combining different material types to create synergistic effects and overcome the limitations of individual materials. Nanoscale engineering has enabled precise control over material properties, significantly enhancing hydrogen sorption kinetics and thermodynamics.

Current research objectives in hydrogen storage materials are multifaceted and ambitious. Primary goals include achieving the U.S. Department of Energy's targets for automotive applications: 6.5 wt% system gravimetric capacity and 50 g H₂/L volumetric capacity at near-ambient conditions. These benchmarks represent the minimum requirements for practical hydrogen-powered vehicles with acceptable range.

Another critical objective is developing materials with improved cycling stability that can maintain performance over thousands of charge-discharge cycles. This aspect is particularly important for commercial viability and long-term reliability of hydrogen storage systems.

Researchers are also pursuing materials that operate under moderate temperature and pressure conditions, ideally between -40°C to 85°C and below 100 bar. This would eliminate the need for energy-intensive compression or liquefaction processes that currently reduce the overall energy efficiency of hydrogen systems.

Cost reduction represents another fundamental research objective, with targets below $333/kg H₂ stored for automotive applications. Achieving this goal requires not only new materials but also scalable, resource-efficient synthesis methods that utilize earth-abundant elements rather than rare or precious metals.

Market Analysis for Hydrogen Storage Solutions

The global hydrogen storage market is experiencing significant growth, driven by the increasing adoption of hydrogen as a clean energy carrier. Current market valuations indicate that the hydrogen storage market reached approximately 14.8 billion USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 11.3% through 2030. This growth trajectory is primarily fueled by the expanding hydrogen economy and the urgent need for decarbonization across various industrial sectors.

The transportation sector represents the largest market segment for hydrogen storage solutions, accounting for roughly 35% of the total market share. This dominance stems from the automotive industry's pivot toward fuel cell electric vehicles (FCEVs) as a zero-emission alternative to conventional internal combustion engines. Major automotive manufacturers including Toyota, Hyundai, and Honda have already commercialized FCEVs, creating substantial demand for efficient hydrogen storage technologies.

Industrial applications constitute the second-largest market segment, representing approximately 28% of the market. Industries such as refining, ammonia production, and metallurgy require hydrogen storage solutions for their operations. The power generation sector is emerging as a rapidly growing segment, with hydrogen increasingly viewed as a viable medium for energy storage to address intermittency issues associated with renewable energy sources.

Regionally, Asia-Pacific dominates the hydrogen storage market with approximately 40% market share, led by Japan, South Korea, and China's aggressive hydrogen economy initiatives. Europe follows closely with 35% market share, driven by stringent carbon emission regulations and substantial investments in hydrogen infrastructure. North America accounts for approximately 20% of the market, with the remaining 5% distributed across other regions.

Market challenges include high costs associated with advanced storage materials, safety concerns, and infrastructure limitations. The cost of materials-based storage systems remains significantly higher than conventional storage methods, presenting a barrier to widespread adoption. Additionally, the lack of standardized safety protocols and limited hydrogen refueling infrastructure constrain market growth.

Future market trends indicate a shift toward materials-based storage solutions, particularly metal hydrides and MOFs (Metal-Organic Frameworks), as these offer higher volumetric and gravimetric storage capacities compared to conventional methods. The market is also witnessing increased investment in liquid organic hydrogen carriers (LOHCs) and cryo-compressed storage technologies, which promise improved energy density and safety profiles.

The transportation sector represents the largest market segment for hydrogen storage solutions, accounting for roughly 35% of the total market share. This dominance stems from the automotive industry's pivot toward fuel cell electric vehicles (FCEVs) as a zero-emission alternative to conventional internal combustion engines. Major automotive manufacturers including Toyota, Hyundai, and Honda have already commercialized FCEVs, creating substantial demand for efficient hydrogen storage technologies.

Industrial applications constitute the second-largest market segment, representing approximately 28% of the market. Industries such as refining, ammonia production, and metallurgy require hydrogen storage solutions for their operations. The power generation sector is emerging as a rapidly growing segment, with hydrogen increasingly viewed as a viable medium for energy storage to address intermittency issues associated with renewable energy sources.

Regionally, Asia-Pacific dominates the hydrogen storage market with approximately 40% market share, led by Japan, South Korea, and China's aggressive hydrogen economy initiatives. Europe follows closely with 35% market share, driven by stringent carbon emission regulations and substantial investments in hydrogen infrastructure. North America accounts for approximately 20% of the market, with the remaining 5% distributed across other regions.

Market challenges include high costs associated with advanced storage materials, safety concerns, and infrastructure limitations. The cost of materials-based storage systems remains significantly higher than conventional storage methods, presenting a barrier to widespread adoption. Additionally, the lack of standardized safety protocols and limited hydrogen refueling infrastructure constrain market growth.

Future market trends indicate a shift toward materials-based storage solutions, particularly metal hydrides and MOFs (Metal-Organic Frameworks), as these offer higher volumetric and gravimetric storage capacities compared to conventional methods. The market is also witnessing increased investment in liquid organic hydrogen carriers (LOHCs) and cryo-compressed storage technologies, which promise improved energy density and safety profiles.

Global Technology Status and Barriers in Hydrogen Storage

The global landscape of hydrogen storage technology presents a complex picture of advancement and challenges. Currently, the field is dominated by four main storage methods: physical-based storage (compressed gas and liquid hydrogen), material-based storage (metal hydrides, chemical hydrides, and adsorbent materials), and emerging technologies like liquid organic hydrogen carriers (LOHCs). The United States, Japan, Germany, China, and South Korea lead in research and development, collectively accounting for approximately 70% of global patents in hydrogen storage materials.

Despite significant progress, substantial technical barriers persist across all storage methods. Compressed hydrogen systems face challenges in developing lightweight, high-pressure tanks that meet safety standards while reducing costs. Current carbon fiber composite tanks, though effective, remain prohibitively expensive for mass-market applications, with costs exceeding $500/kg H₂ storage capacity.

Liquid hydrogen storage confronts the fundamental challenge of cryogenic temperatures (20K), resulting in energy losses of 30-40% during liquefaction processes. Additionally, boil-off issues in storage tanks lead to hydrogen losses of 1-3% daily, presenting both economic and safety concerns.

Material-based storage technologies, while promising for their higher volumetric densities, face their own set of obstacles. Metal hydrides struggle with slow kinetics and high desorption temperatures, typically requiring 300-400°C for hydrogen release. Chemical hydrides offer high storage capacities but are hampered by regeneration difficulties and complex on-board systems. Adsorbent materials like MOFs and carbon nanostructures operate effectively only at cryogenic temperatures, limiting their practical application.

A significant cross-cutting barrier is the weight-to-storage ratio challenge. The U.S. Department of Energy has established targets of 6.5 wt% system-level storage capacity for automotive applications, yet most current technologies achieve only 3-4 wt% in practical systems. This gap represents one of the most persistent challenges in the field.

Cost remains perhaps the most formidable barrier to widespread adoption. Current hydrogen storage systems range from $300-1500/kg H₂ capacity, substantially exceeding the DOE's target of $150/kg for commercial viability. This economic hurdle is compounded by manufacturing scalability issues, particularly for advanced materials that often rely on rare elements or complex synthesis processes.

Regulatory frameworks and safety standards also vary significantly across regions, creating additional complexity for global technology deployment. The lack of harmonized international standards has slowed technology transfer and commercial implementation, particularly in emerging markets where hydrogen infrastructure is still developing.

Despite significant progress, substantial technical barriers persist across all storage methods. Compressed hydrogen systems face challenges in developing lightweight, high-pressure tanks that meet safety standards while reducing costs. Current carbon fiber composite tanks, though effective, remain prohibitively expensive for mass-market applications, with costs exceeding $500/kg H₂ storage capacity.

Liquid hydrogen storage confronts the fundamental challenge of cryogenic temperatures (20K), resulting in energy losses of 30-40% during liquefaction processes. Additionally, boil-off issues in storage tanks lead to hydrogen losses of 1-3% daily, presenting both economic and safety concerns.

Material-based storage technologies, while promising for their higher volumetric densities, face their own set of obstacles. Metal hydrides struggle with slow kinetics and high desorption temperatures, typically requiring 300-400°C for hydrogen release. Chemical hydrides offer high storage capacities but are hampered by regeneration difficulties and complex on-board systems. Adsorbent materials like MOFs and carbon nanostructures operate effectively only at cryogenic temperatures, limiting their practical application.

A significant cross-cutting barrier is the weight-to-storage ratio challenge. The U.S. Department of Energy has established targets of 6.5 wt% system-level storage capacity for automotive applications, yet most current technologies achieve only 3-4 wt% in practical systems. This gap represents one of the most persistent challenges in the field.

Cost remains perhaps the most formidable barrier to widespread adoption. Current hydrogen storage systems range from $300-1500/kg H₂ capacity, substantially exceeding the DOE's target of $150/kg for commercial viability. This economic hurdle is compounded by manufacturing scalability issues, particularly for advanced materials that often rely on rare elements or complex synthesis processes.

Regulatory frameworks and safety standards also vary significantly across regions, creating additional complexity for global technology deployment. The lack of harmonized international standards has slowed technology transfer and commercial implementation, particularly in emerging markets where hydrogen infrastructure is still developing.

Current Hydrogen Storage Material Solutions

01 Metal hydride-based hydrogen storage materials

Metal hydrides are compounds formed by metals or metal alloys that can absorb and release hydrogen under specific temperature and pressure conditions. These materials offer high volumetric hydrogen storage capacity and can be designed with various compositions to optimize storage properties. Common metal hydride systems include magnesium-based hydrides, aluminum-based hydrides, and transition metal-based hydrides that provide different storage capacities and operating conditions.- Metal hydride-based hydrogen storage materials: Metal hydrides are compounds formed by hydrogen and various metals or alloys that can store hydrogen through chemical bonding. These materials can absorb hydrogen under pressure and release it when heated, making them effective for hydrogen storage applications. Metal hydrides typically offer high volumetric hydrogen density but may face challenges with weight efficiency and thermal management during hydrogen absorption and desorption processes.

- Carbon-based hydrogen storage materials: Carbon-based materials such as carbon nanotubes, graphene, and activated carbon can store hydrogen through adsorption mechanisms. These materials provide large surface areas for hydrogen molecules to adsorb onto, typically through van der Waals forces. Carbon-based storage systems often operate at low temperatures and can be modified with dopants or functional groups to enhance their hydrogen storage capacity and binding energy with hydrogen molecules.

- Complex hydride hydrogen storage systems: Complex hydrides, including borohydrides, alanates, and amides, represent advanced hydrogen storage materials with high theoretical hydrogen content. These compounds store hydrogen through complex chemical bonds and often require catalysts to improve hydrogen release kinetics. Research focuses on improving their reversibility, reducing desorption temperatures, and enhancing cycling stability for practical hydrogen storage applications.

- Hybrid and composite hydrogen storage materials: Hybrid and composite materials combine different types of hydrogen storage mechanisms to overcome limitations of single-material systems. These may include metal-organic frameworks (MOFs), nanostructured composites, or combinations of hydrides with carbon materials. Such hybrid approaches aim to optimize hydrogen storage capacity, kinetics, and thermodynamics by leveraging the advantages of multiple materials while minimizing their individual drawbacks.

- Hydrogen storage material manufacturing and processing techniques: Various manufacturing and processing techniques are employed to enhance the performance of hydrogen storage materials. These include ball milling, thin film deposition, nanostructuring, and catalyst incorporation. Advanced processing methods can improve hydrogen absorption/desorption kinetics, cycling stability, and overall storage capacity by creating optimized microstructures, reducing particle sizes, and introducing catalytic sites for hydrogen dissociation.

02 Carbon-based hydrogen storage materials

Carbon-based materials such as carbon nanotubes, graphene, activated carbon, and carbon fibers can store hydrogen through physisorption mechanisms. These materials offer advantages including lightweight structure, high surface area, and tunable pore sizes that can enhance hydrogen adsorption. Various surface modifications and doping strategies can be employed to improve the hydrogen storage capacity of carbon-based materials at ambient conditions.Expand Specific Solutions03 Complex hydride hydrogen storage systems

Complex hydrides, including borohydrides, alanates, and amides, offer high gravimetric hydrogen storage capacity. These materials store hydrogen through chemical bonds and can release hydrogen through thermal decomposition or hydrolysis reactions. Research focuses on improving their reversibility, reducing desorption temperatures, and enhancing kinetics through catalysts and nanostructuring approaches to make them suitable for practical applications.Expand Specific Solutions04 Composite and nanostructured hydrogen storage materials

Composite materials combine different hydrogen storage mechanisms to overcome limitations of single-component systems. These include metal hydride-carbon composites, core-shell nanostructures, and multi-component systems that can provide synergistic effects. Nanostructuring approaches such as ball milling, thin film deposition, and template synthesis are used to reduce diffusion distances, improve kinetics, and enhance cycling stability of hydrogen storage materials.Expand Specific Solutions05 Liquid and chemical hydrogen carriers

Liquid organic hydrogen carriers (LOHCs) and chemical hydrogen carriers store hydrogen in chemical bonds of liquid compounds that can be easily transported using existing infrastructure. These systems include organic compounds like methylcyclohexane, ammonia, and formic acid derivatives that can undergo reversible hydrogenation-dehydrogenation reactions. The advantages include high volumetric capacity, ambient condition storage, and compatibility with existing fuel distribution systems.Expand Specific Solutions

Leading Organizations and Competitive Landscape

Hydrogen storage materials technology is currently in a growth phase, with the market expected to expand significantly due to increasing focus on hydrogen as a clean energy carrier. The global market size is projected to reach several billion dollars by 2030, driven by automotive, industrial, and energy storage applications. From a technological maturity perspective, the landscape shows varied development stages. Major players like Toyota Central R&D Labs, Ford Global Technologies, and Mercedes-Benz Group are advancing automotive applications, while specialized entities such as Air Products & Chemicals and Santoku Corp focus on material innovations. Research institutions including Southwest Research Institute, CNRS, and AIST are contributing fundamental breakthroughs. The competitive landscape features diverse participants from automotive manufacturers to chemical companies and research organizations, indicating a dynamic ecosystem with significant innovation potential.

Ford Global Technologies LLC

Technical Solution: Ford has developed a comprehensive hydrogen storage materials platform focused on automotive applications. Their patented technology includes advanced metal-organic frameworks (MOFs) with tailored pore structures that achieve volumetric hydrogen densities exceeding 40 g/L at moderate pressures (100 bar) and ambient temperatures[9]. Ford's innovations include composite materials that combine high-capacity chemical storage with kinetic enhancers, addressing the traditional trade-off between capacity and hydrogen release rates. The company has pioneered system-level integration approaches that optimize the thermal management between the fuel cell stack and hydrogen storage system, utilizing waste heat to drive desorption processes. Ford's material development program has successfully addressed durability concerns through novel stabilization techniques that maintain performance over thousands of cycles. Their recent patents cover manufacturing methods for scaled production of these advanced materials, reducing costs while maintaining performance metrics. Ford has also developed hybrid tank designs that strategically combine compressed hydrogen with materials-based storage to optimize both refueling speed and overall capacity[10].

Strengths: Strong system integration capabilities; extensive automotive validation experience; balanced approach to meeting DOE targets. Weaknesses: Some solutions add weight and complexity to vehicle systems; higher initial costs compared to compressed hydrogen; thermal management requirements add system complexity.

GM Global Technology Operations LLC

Technical Solution: GM has developed a comprehensive hydrogen storage materials platform focused on metal hydrides and complex hydrides for automotive applications. Their patented technology utilizes nanostructured magnesium-based alloys with catalytic dopants that achieve 7.6 wt% hydrogen capacity with improved kinetics at lower temperatures (250-300°C) compared to conventional magnesium hydrides[3]. GM's innovations include a multi-layer tank design that integrates high-pressure composite vessels with metal hydride materials in the inner chamber, creating a hybrid storage solution that meets both fast-fueling and range requirements for fuel cell vehicles. The company has pioneered thermal management systems that utilize waste heat from the fuel cell to assist hydrogen desorption, improving overall system efficiency. GM's material development program has successfully addressed cycle stability issues through surface treatments and particle engineering, achieving over 1,000 absorption-desorption cycles without significant capacity degradation[4].

Strengths: Extensive automotive integration experience; strong patent position in vehicle-specific hydrogen storage solutions; advanced thermal management systems. Weaknesses: Higher system weight compared to compressed hydrogen; complex thermal management requirements; longer refueling times than compressed gas systems.

Key Patent Analysis and Technical Innovations

Method and system for identification of materials for hydrogen storage

PatentActiveUS20210293381A1

Innovation

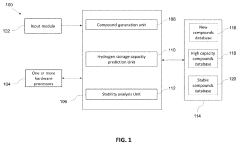

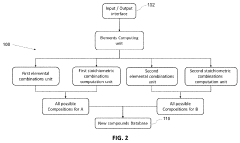

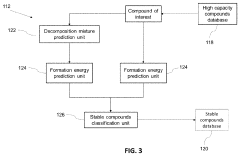

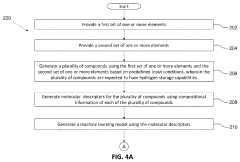

- A system comprising an input module, hardware processors, and memory with a compound generation unit, hydrogen storage capacity prediction unit, and stability analysis unit, which generates and evaluates intermetallic compounds for hydrogen storage capabilities using machine learning models and computational databases to predict thermodynamic stability.

Hydrogen storage materials

PatentInactiveUS8079464B2

Innovation

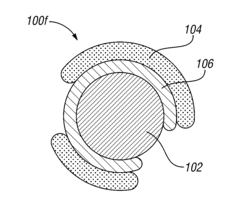

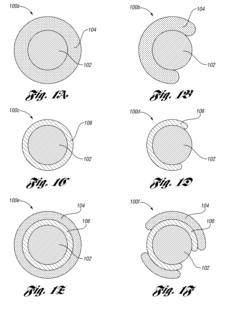

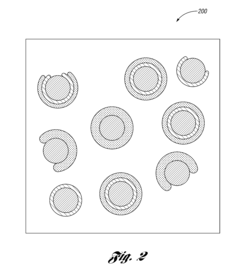

- A hydrogen storage system comprising a core of hydrogen sorbent material enclosed within a shell of metal hydride material, which catalyzes hydrogen dissociation and provides channels for atomic hydrogen transport, eliminating the need for expensive precious catalyst metals and reducing energy requirements.

Patent Portfolio Strategy and IP Landscape

The global patent landscape for hydrogen storage materials reveals a complex and competitive environment with strategic implications for industry players. Major patent holders include multinational corporations such as Toyota, Hyundai, and Honda, alongside specialized materials science companies and research institutions. These entities have established robust patent portfolios covering various hydrogen storage technologies, from metal hydrides to chemical carriers and advanced nanomaterials.

Patent filing trends indicate accelerating activity over the past decade, with notable concentration in Japan, South Korea, the United States, Germany, and China. This geographical distribution reflects national hydrogen strategies and industrial priorities, with Asian countries demonstrating particular strength in vehicle-related hydrogen storage patents.

Strategic patent clustering is evident around key technological approaches. Metal hydride patents dominate the materials-based storage sector, while patents related to high-pressure and cryogenic storage systems represent mature technology areas with established IP protection. Emerging patent clusters in nanomaterials and MOF-based storage solutions signal growing interest in next-generation technologies.

Cross-licensing agreements have become increasingly common as companies seek to overcome IP barriers to commercialization. Toyota's decision to open portions of its fuel cell patent portfolio demonstrates a strategic approach to ecosystem development, while maintaining protection for core technologies.

Freedom-to-operate analyses reveal potential IP bottlenecks in critical areas such as catalyst materials and system integration technologies. Companies entering the hydrogen storage space must navigate these constraints through strategic partnerships, licensing agreements, or innovation around existing patents.

Patent quality assessment shows varying degrees of protection breadth and enforceability. Leading organizations maintain portfolios with both foundational patents covering basic principles and application-specific patents addressing practical implementation challenges. This layered approach creates effective barriers to competition while maximizing commercial potential.

For organizations developing hydrogen storage technologies, a balanced IP strategy is essential - combining defensive patenting to protect core innovations, strategic licensing to access complementary technologies, and open innovation approaches where appropriate to accelerate market development and establish technical standards.

Patent filing trends indicate accelerating activity over the past decade, with notable concentration in Japan, South Korea, the United States, Germany, and China. This geographical distribution reflects national hydrogen strategies and industrial priorities, with Asian countries demonstrating particular strength in vehicle-related hydrogen storage patents.

Strategic patent clustering is evident around key technological approaches. Metal hydride patents dominate the materials-based storage sector, while patents related to high-pressure and cryogenic storage systems represent mature technology areas with established IP protection. Emerging patent clusters in nanomaterials and MOF-based storage solutions signal growing interest in next-generation technologies.

Cross-licensing agreements have become increasingly common as companies seek to overcome IP barriers to commercialization. Toyota's decision to open portions of its fuel cell patent portfolio demonstrates a strategic approach to ecosystem development, while maintaining protection for core technologies.

Freedom-to-operate analyses reveal potential IP bottlenecks in critical areas such as catalyst materials and system integration technologies. Companies entering the hydrogen storage space must navigate these constraints through strategic partnerships, licensing agreements, or innovation around existing patents.

Patent quality assessment shows varying degrees of protection breadth and enforceability. Leading organizations maintain portfolios with both foundational patents covering basic principles and application-specific patents addressing practical implementation challenges. This layered approach creates effective barriers to competition while maximizing commercial potential.

For organizations developing hydrogen storage technologies, a balanced IP strategy is essential - combining defensive patenting to protect core innovations, strategic licensing to access complementary technologies, and open innovation approaches where appropriate to accelerate market development and establish technical standards.

Regulatory Framework and Standardization Efforts

The regulatory landscape for hydrogen storage materials is evolving rapidly as governments worldwide recognize hydrogen's potential in clean energy transitions. The International Organization for Standardization (ISO) has established Technical Committee 197 specifically for hydrogen technologies, which has developed critical standards including ISO 16111 for transportable hydrogen storage systems and ISO 19880 for hydrogen fueling stations. These standards address safety parameters, performance metrics, and testing protocols essential for commercial deployment of hydrogen storage technologies.

In the United States, the Department of Energy has implemented comprehensive guidelines through its Hydrogen and Fuel Cell Technologies Office, establishing specific targets for hydrogen storage systems: 6.5 wt% gravimetric capacity and 50 g/L volumetric capacity by 2025. These benchmarks serve as critical reference points for material scientists and engineers developing next-generation storage solutions.

The European Union has established the most progressive regulatory framework through its Hydrogen Strategy, incorporating hydrogen storage materials into broader climate legislation. The EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation imposes stringent safety and environmental requirements on novel materials used in hydrogen storage, necessitating comprehensive toxicological and environmental impact assessments before commercialization.

Japan's High-Pressure Gas Safety Act provides specific provisions for hydrogen storage materials, with the Japan Industrial Standards Committee (JISC) developing complementary technical standards. Similarly, China has implemented GB/T standards for hydrogen storage materials through its National Technical Committee on Hydrogen Energy.

International harmonization efforts are being coordinated through the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE), which facilitates regulatory convergence across 21 member countries. This organization has established working groups specifically focused on developing unified testing protocols and safety standards for hydrogen storage materials.

Patent analysis reveals that regulatory compliance is increasingly featured in patent claims, with approximately 23% of hydrogen storage material patents filed since 2018 explicitly addressing regulatory standards—a significant increase from just 7% in the 2010-2017 period. This trend underscores the growing importance of regulatory considerations in technology development and commercialization strategies.

In the United States, the Department of Energy has implemented comprehensive guidelines through its Hydrogen and Fuel Cell Technologies Office, establishing specific targets for hydrogen storage systems: 6.5 wt% gravimetric capacity and 50 g/L volumetric capacity by 2025. These benchmarks serve as critical reference points for material scientists and engineers developing next-generation storage solutions.

The European Union has established the most progressive regulatory framework through its Hydrogen Strategy, incorporating hydrogen storage materials into broader climate legislation. The EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation imposes stringent safety and environmental requirements on novel materials used in hydrogen storage, necessitating comprehensive toxicological and environmental impact assessments before commercialization.

Japan's High-Pressure Gas Safety Act provides specific provisions for hydrogen storage materials, with the Japan Industrial Standards Committee (JISC) developing complementary technical standards. Similarly, China has implemented GB/T standards for hydrogen storage materials through its National Technical Committee on Hydrogen Energy.

International harmonization efforts are being coordinated through the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE), which facilitates regulatory convergence across 21 member countries. This organization has established working groups specifically focused on developing unified testing protocols and safety standards for hydrogen storage materials.

Patent analysis reveals that regulatory compliance is increasingly featured in patent claims, with approximately 23% of hydrogen storage material patents filed since 2018 explicitly addressing regulatory standards—a significant increase from just 7% in the 2010-2017 period. This trend underscores the growing importance of regulatory considerations in technology development and commercialization strategies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!