Evaluation of Hydrogen storage materials for renewable energy storage integration

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hydrogen Storage Materials Background and Objectives

Hydrogen storage has emerged as a critical component in the global transition towards renewable energy systems. The concept of utilizing hydrogen as an energy carrier dates back to the early 20th century, but significant research momentum has only built up in recent decades as the urgency of climate change mitigation has intensified. The evolution of hydrogen storage technologies has progressed from conventional physical methods such as compression and liquefaction to more advanced material-based approaches that offer higher volumetric and gravimetric capacities.

The primary objective in hydrogen storage material development is to achieve systems that can store hydrogen safely and efficiently while meeting the U.S. Department of Energy's technical targets: 6.5 wt% gravimetric capacity and 50 g/L volumetric capacity by 2025. These benchmarks are established to ensure practical viability in various applications, particularly in transportation and grid-scale energy storage systems that require high energy density.

Current technological trajectories in hydrogen storage materials include metal hydrides, complex hydrides, chemical hydrogen carriers, and porous materials such as metal-organic frameworks (MOFs). Each category represents distinct approaches to the fundamental challenge of binding hydrogen molecules with sufficient strength to achieve high density storage while allowing for controlled release under practical operating conditions.

The integration of hydrogen storage with renewable energy systems presents unique technical requirements. Wind and solar power generation are inherently intermittent, necessitating storage solutions that can accommodate rapid charging during peak production periods and reliable discharge during demand spikes. This cyclical operation pattern imposes additional constraints on material durability and kinetic performance beyond those faced in traditional applications.

Global research efforts are increasingly focused on developing multifunctional materials that not only store hydrogen efficiently but also integrate catalytic properties to enhance conversion efficiency. The convergence of nanotechnology and computational materials science has accelerated the discovery process, enabling high-throughput screening of candidate materials and precise engineering of their structural and chemical properties.

The ultimate goal of this technological domain extends beyond mere storage capacity improvements to encompass system-level optimization. This includes addressing thermal management challenges, reducing material costs, extending operational lifetimes, and ensuring compatibility with existing energy infrastructure. Success in these objectives would position hydrogen storage as a cornerstone technology in renewable energy systems, enabling effective load balancing, seasonal storage, and sector coupling between electricity, transportation, and industrial applications.

The primary objective in hydrogen storage material development is to achieve systems that can store hydrogen safely and efficiently while meeting the U.S. Department of Energy's technical targets: 6.5 wt% gravimetric capacity and 50 g/L volumetric capacity by 2025. These benchmarks are established to ensure practical viability in various applications, particularly in transportation and grid-scale energy storage systems that require high energy density.

Current technological trajectories in hydrogen storage materials include metal hydrides, complex hydrides, chemical hydrogen carriers, and porous materials such as metal-organic frameworks (MOFs). Each category represents distinct approaches to the fundamental challenge of binding hydrogen molecules with sufficient strength to achieve high density storage while allowing for controlled release under practical operating conditions.

The integration of hydrogen storage with renewable energy systems presents unique technical requirements. Wind and solar power generation are inherently intermittent, necessitating storage solutions that can accommodate rapid charging during peak production periods and reliable discharge during demand spikes. This cyclical operation pattern imposes additional constraints on material durability and kinetic performance beyond those faced in traditional applications.

Global research efforts are increasingly focused on developing multifunctional materials that not only store hydrogen efficiently but also integrate catalytic properties to enhance conversion efficiency. The convergence of nanotechnology and computational materials science has accelerated the discovery process, enabling high-throughput screening of candidate materials and precise engineering of their structural and chemical properties.

The ultimate goal of this technological domain extends beyond mere storage capacity improvements to encompass system-level optimization. This includes addressing thermal management challenges, reducing material costs, extending operational lifetimes, and ensuring compatibility with existing energy infrastructure. Success in these objectives would position hydrogen storage as a cornerstone technology in renewable energy systems, enabling effective load balancing, seasonal storage, and sector coupling between electricity, transportation, and industrial applications.

Market Analysis for Hydrogen Energy Storage Solutions

The global hydrogen energy storage market is experiencing significant growth, driven by the increasing focus on renewable energy integration and decarbonization efforts. As of 2023, the market was valued at approximately $15.4 billion, with projections indicating a compound annual growth rate (CAGR) of 11.2% through 2030, potentially reaching $32.9 billion by the end of the decade. This growth trajectory is primarily fueled by governmental commitments to carbon neutrality and substantial investments in hydrogen infrastructure across major economies.

The demand for efficient hydrogen storage materials is particularly pronounced in regions with ambitious renewable energy targets. The European Union, through its Hydrogen Strategy, has committed to installing at least 40 gigawatts of renewable hydrogen electrolyzers by 2030, creating substantial market opportunities for advanced storage solutions. Similarly, Japan's Basic Hydrogen Strategy and South Korea's Hydrogen Economy Roadmap have established clear pathways for hydrogen adoption, stimulating market growth in Asia-Pacific.

Market segmentation reveals distinct application sectors for hydrogen storage materials. The transportation sector currently represents the largest market share at approximately 35%, driven by the expanding fuel cell electric vehicle (FCEV) market, particularly in commercial vehicle applications. Industrial applications follow at 28%, with power generation and grid balancing applications growing rapidly at 22%, reflecting the increasing need for long-duration energy storage to complement intermittent renewable sources.

From a materials perspective, the market shows diverse technological approaches. Metal hydrides currently dominate with approximately 31% market share due to their established technology and relatively high volumetric storage capacity. Chemical hydrogen carriers (including liquid organic hydrogen carriers) represent 27% of the market, while carbon-based materials and complex hydrides are growing segments at 18% and 15% respectively. Emerging technologies such as metal-organic frameworks (MOFs) currently hold a smaller but rapidly expanding market share of 9%.

Key market drivers include the declining costs of renewable electricity generation, which improves the economics of green hydrogen production, and increasing carbon pricing mechanisms that enhance the competitiveness of hydrogen against fossil fuel alternatives. Additionally, the growing need for seasonal energy storage solutions to address the intermittency of renewable energy sources is creating new market opportunities for hydrogen storage materials with higher energy density and improved cycle stability.

Market barriers remain significant, including high costs associated with advanced storage materials, infrastructure limitations, and technical challenges related to hydrogen embrittlement and safety concerns. The cost of storage currently adds approximately $1-3/kg to hydrogen's overall cost structure, representing a critical area for improvement to achieve market competitiveness against conventional energy storage technologies.

The demand for efficient hydrogen storage materials is particularly pronounced in regions with ambitious renewable energy targets. The European Union, through its Hydrogen Strategy, has committed to installing at least 40 gigawatts of renewable hydrogen electrolyzers by 2030, creating substantial market opportunities for advanced storage solutions. Similarly, Japan's Basic Hydrogen Strategy and South Korea's Hydrogen Economy Roadmap have established clear pathways for hydrogen adoption, stimulating market growth in Asia-Pacific.

Market segmentation reveals distinct application sectors for hydrogen storage materials. The transportation sector currently represents the largest market share at approximately 35%, driven by the expanding fuel cell electric vehicle (FCEV) market, particularly in commercial vehicle applications. Industrial applications follow at 28%, with power generation and grid balancing applications growing rapidly at 22%, reflecting the increasing need for long-duration energy storage to complement intermittent renewable sources.

From a materials perspective, the market shows diverse technological approaches. Metal hydrides currently dominate with approximately 31% market share due to their established technology and relatively high volumetric storage capacity. Chemical hydrogen carriers (including liquid organic hydrogen carriers) represent 27% of the market, while carbon-based materials and complex hydrides are growing segments at 18% and 15% respectively. Emerging technologies such as metal-organic frameworks (MOFs) currently hold a smaller but rapidly expanding market share of 9%.

Key market drivers include the declining costs of renewable electricity generation, which improves the economics of green hydrogen production, and increasing carbon pricing mechanisms that enhance the competitiveness of hydrogen against fossil fuel alternatives. Additionally, the growing need for seasonal energy storage solutions to address the intermittency of renewable energy sources is creating new market opportunities for hydrogen storage materials with higher energy density and improved cycle stability.

Market barriers remain significant, including high costs associated with advanced storage materials, infrastructure limitations, and technical challenges related to hydrogen embrittlement and safety concerns. The cost of storage currently adds approximately $1-3/kg to hydrogen's overall cost structure, representing a critical area for improvement to achieve market competitiveness against conventional energy storage technologies.

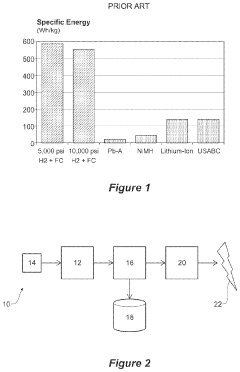

Current Status and Technical Barriers in H2 Storage

Hydrogen storage technology has evolved significantly over the past decades, yet remains a critical bottleneck in the hydrogen energy ecosystem. Currently, several storage methods dominate the landscape: physical-based storage (compressed gas, liquid hydrogen, and cryo-compressed), material-based storage (metal hydrides, chemical hydrogen carriers, and surface adsorption materials), and geological storage for large-scale applications. Compressed gas storage at 350-700 bar represents the most mature technology, widely deployed in hydrogen refueling stations and fuel cell vehicles, while liquid hydrogen storage at -253°C offers higher volumetric density but suffers from energy-intensive liquefaction processes and boil-off challenges.

Material-based storage solutions have shown promising developments but face significant commercialization barriers. Metal hydrides offer high volumetric density and operational safety but struggle with slow kinetics, heat management issues, and material degradation over multiple cycles. Chemical hydrogen carriers like ammonia and liquid organic hydrogen carriers (LOHCs) provide excellent volumetric capacity but require substantial energy for hydrogen release and sophisticated catalyst systems that remain cost-prohibitive for widespread adoption.

The technical barriers in hydrogen storage are multifaceted and interconnected. Weight efficiency remains a primary challenge, with the U.S. Department of Energy targeting 6.5 wt% system-level storage for transportation applications—a benchmark few technologies can currently achieve. Volumetric efficiency similarly presents obstacles, particularly for mobile applications where space constraints are significant. Even the most advanced metal hydrides and MOF materials struggle to meet both weight and volume targets simultaneously.

Cost factors represent perhaps the most formidable barrier to widespread adoption. Current hydrogen storage systems range from $300-500/kWh, significantly higher than the DOE's long-term target of $8/kWh. Material costs, manufacturing complexity, and system integration expenses all contribute to this economic challenge. Additionally, durability and cycling stability remain problematic, with many promising materials showing performance degradation after repeated hydrogen absorption-desorption cycles.

Safety concerns and infrastructure compatibility further complicate implementation. High-pressure systems require specialized materials and rigorous safety protocols, while material-based storage often involves reactive compounds that present their own safety challenges. The lack of standardized interfaces between storage systems and end-use applications creates additional integration barriers.

Geographically, research leadership in hydrogen storage technologies shows distinct patterns. Japan and Germany lead in metal hydride research, the United States pioneers in advanced sorbent materials and system integration, while China has rapidly expanded its research footprint across multiple storage technologies, particularly in the last five years.

Material-based storage solutions have shown promising developments but face significant commercialization barriers. Metal hydrides offer high volumetric density and operational safety but struggle with slow kinetics, heat management issues, and material degradation over multiple cycles. Chemical hydrogen carriers like ammonia and liquid organic hydrogen carriers (LOHCs) provide excellent volumetric capacity but require substantial energy for hydrogen release and sophisticated catalyst systems that remain cost-prohibitive for widespread adoption.

The technical barriers in hydrogen storage are multifaceted and interconnected. Weight efficiency remains a primary challenge, with the U.S. Department of Energy targeting 6.5 wt% system-level storage for transportation applications—a benchmark few technologies can currently achieve. Volumetric efficiency similarly presents obstacles, particularly for mobile applications where space constraints are significant. Even the most advanced metal hydrides and MOF materials struggle to meet both weight and volume targets simultaneously.

Cost factors represent perhaps the most formidable barrier to widespread adoption. Current hydrogen storage systems range from $300-500/kWh, significantly higher than the DOE's long-term target of $8/kWh. Material costs, manufacturing complexity, and system integration expenses all contribute to this economic challenge. Additionally, durability and cycling stability remain problematic, with many promising materials showing performance degradation after repeated hydrogen absorption-desorption cycles.

Safety concerns and infrastructure compatibility further complicate implementation. High-pressure systems require specialized materials and rigorous safety protocols, while material-based storage often involves reactive compounds that present their own safety challenges. The lack of standardized interfaces between storage systems and end-use applications creates additional integration barriers.

Geographically, research leadership in hydrogen storage technologies shows distinct patterns. Japan and Germany lead in metal hydride research, the United States pioneers in advanced sorbent materials and system integration, while China has rapidly expanded its research footprint across multiple storage technologies, particularly in the last five years.

State-of-the-Art Hydrogen Storage Material Solutions

01 Metal hydrides for hydrogen storage

Metal hydrides are compounds formed by hydrogen and metals that can store hydrogen at high densities. These materials can absorb and release hydrogen through chemical reactions, offering advantages such as high volumetric storage capacity and safety. Various metal hydride systems, including magnesium-based, aluminum-based, and transition metal-based hydrides, have been developed to optimize hydrogen storage capacity under practical operating conditions.- Metal hydrides for hydrogen storage: Metal hydrides are compounds formed by hydrogen and metals that can store hydrogen at high densities. These materials can absorb and release hydrogen through chemical reactions, offering advantages such as high volumetric storage capacity and safety. Various metal hydride systems including magnesium-based, aluminum-based, and transition metal-based hydrides have been developed to optimize hydrogen storage capacity while addressing challenges related to weight, operating temperatures, and cycling stability.

- Carbon-based hydrogen storage materials: Carbon-based materials such as carbon nanotubes, graphene, activated carbon, and carbon aerogels can store hydrogen through physisorption mechanisms. These materials offer advantages including lightweight structure, high surface area, and tunable pore sizes that can enhance hydrogen adsorption. Research focuses on modifying carbon structures through doping, functionalization, and creating hierarchical pore structures to increase hydrogen storage capacity at practical temperatures and pressures.

- Metal-organic frameworks (MOFs) for hydrogen storage: Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated with organic ligands. Their extremely high surface areas, tunable pore sizes, and modifiable chemical properties make them promising candidates for hydrogen storage. MOFs can be designed with specific metal centers and organic linkers to optimize hydrogen binding energy and maximize storage capacity under various temperature and pressure conditions.

- Complex hydrides and chemical hydrogen storage: Complex hydrides, including borohydrides, alanates, and amides, store hydrogen through chemical bonds in solid-state materials. These compounds can achieve high gravimetric hydrogen storage capacities through reversible chemical reactions. Research focuses on catalysts to improve kinetics, reducing dehydrogenation temperatures, and addressing challenges related to reversibility and cycling stability to make these materials practical for hydrogen storage applications.

- Nanostructured and composite hydrogen storage materials: Nanostructuring and creating composite materials can significantly enhance hydrogen storage properties by combining the advantages of different storage mechanisms. These approaches include creating core-shell structures, nanoconfined hydrides, and multi-component systems that integrate catalysts with storage materials. Nanostructuring can improve kinetics, reduce operating temperatures, and enhance cycling stability while maintaining high storage capacities through synergistic effects between components.

02 Carbon-based hydrogen storage materials

Carbon-based materials such as carbon nanotubes, graphene, and activated carbon have been investigated for hydrogen storage applications. These materials store hydrogen through physisorption mechanisms, where hydrogen molecules adhere to the surface of the carbon structure. The high surface area and tunable pore structures of carbon-based materials make them promising candidates for hydrogen storage, though they typically require low temperatures to achieve significant storage capacities.Expand Specific Solutions03 Metal-organic frameworks (MOFs) for hydrogen storage

Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated with organic ligands. Their exceptionally high surface areas, tunable pore sizes, and chemical versatility make them promising for hydrogen storage applications. MOFs can store hydrogen through both physisorption and chemisorption mechanisms, and their storage capacity can be enhanced through strategies such as introducing open metal sites, incorporating light metals, and optimizing pore geometry.Expand Specific Solutions04 Complex hydrides and chemical hydrogen storage

Complex hydrides, including borohydrides, alanates, and amides, store hydrogen through chemical bonds rather than physical adsorption. These materials can achieve high gravimetric hydrogen storage capacities but often face challenges related to reaction kinetics and reversibility. Research focuses on catalysts to improve hydrogen release and uptake rates, as well as developing multi-component systems that can operate under moderate temperature and pressure conditions while maintaining high storage capacities.Expand Specific Solutions05 Nanostructured and composite hydrogen storage materials

Nanostructuring and creating composite materials represent important strategies for enhancing hydrogen storage capacity. By reducing particle size to nanoscale dimensions, the kinetics of hydrogen absorption and desorption can be significantly improved. Composite materials combine different types of storage mechanisms or materials to overcome limitations of individual components. These approaches can lead to synergistic effects that enhance overall storage capacity, improve cycling stability, and optimize operating conditions for practical applications.Expand Specific Solutions

Leading Companies and Research Institutions in H2 Storage

Hydrogen storage materials for renewable energy integration are currently in an early growth phase, with the market expected to expand significantly as clean energy transitions accelerate. The global hydrogen storage market is projected to reach multi-billion dollar valuation by 2030, driven by decarbonization initiatives. Technologically, the field shows varying maturity levels across different storage approaches. Companies like Hydrogenious LOHC Technologies and GRZ Technologies are pioneering liquid organic carriers and metal hydride solutions, while established players such as General Motors, Hitachi, and Nissan are developing automotive-focused storage systems. Research institutions including Friedrich Alexander Universität Erlangen-Nürnberg and Georgia Tech are advancing fundamental materials science, while energy giants like General Electric and IFP Energies Nouvelles are scaling technologies for industrial applications.

Hydrogenious Lohc Technologies GmbH

Technical Solution: Hydrogenious specializes in Liquid Organic Hydrogen Carrier (LOHC) technology, which chemically binds hydrogen to a carrier oil (dibenzyltoluene) through an exothermic hydrogenation process. This allows hydrogen to be stored and transported under ambient conditions without pressurization or cooling. Their StorageBOX and ReleaseBOX systems enable efficient hydrogen loading (storing up to 57 kg H₂/m³) and controlled release through catalytic dehydrogenation. The LOHC medium can be reused over hundreds of cycles without degradation, creating a closed-loop system. Their technology has been demonstrated in industrial-scale applications with storage capacities ranging from 5 to 1,000+ kg of hydrogen, and the company has established partnerships with major energy companies for renewable hydrogen integration projects across Europe and Asia[1][2].

Strengths: Ambient condition storage eliminates need for high-pressure or cryogenic infrastructure; carrier oil is non-toxic and flame-resistant; system allows for long-term storage without losses; compatible with existing liquid fuel infrastructure. Weaknesses: Energy-intensive dehydrogenation process (requires heat input of 30-40% of hydrogen energy content); relatively lower volumetric density compared to compressed hydrogen; catalyst materials may contain precious metals increasing system costs.

GRZ Technologies SA

Technical Solution: GRZ Technologies has developed an advanced metal hydride-based hydrogen storage system that operates at near-ambient pressures (10-30 bar) and temperatures. Their proprietary metal alloy formulation achieves volumetric hydrogen densities exceeding 100 kg H₂/m³, significantly higher than compressed gas storage. The system features a thermal management architecture that efficiently handles the heat released during hydrogen absorption and required for desorption, using this thermal energy exchange to improve overall system efficiency. GRZ's technology incorporates a modular design allowing scalability from kilogram to ton-scale storage capacities, with demonstrated cycle stability exceeding 10,000 charge-discharge cycles without significant capacity degradation. Their HYCO product line integrates this storage technology with compression capabilities, enabling hydrogen purification, compression, and storage in a single unit that can interface directly with renewable energy sources like solar and wind for green hydrogen production and storage[3][4].

Strengths: Higher volumetric storage density than compressed hydrogen; operates at much lower pressures than conventional storage (safer); excellent cycling stability; integrated thermal management improves energy efficiency; modular and scalable design. Weaknesses: Metal hydride materials can be expensive and may contain rare earth elements; system weight is higher than some competing technologies; thermal management systems add complexity; performance can be sensitive to impurities in hydrogen stream.

Critical Patents and Research in Storage Materials

Hydrogen storage materials and hydrogen fuel cells

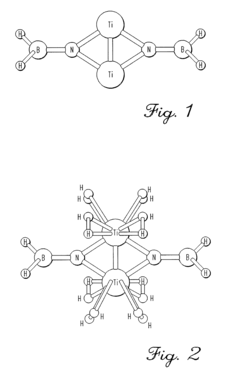

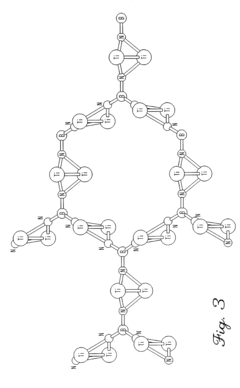

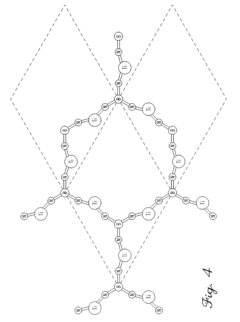

PatentActiveUS8883371B2

Innovation

- Development of solid-state hydrogen storage materials comprising transition metal atoms bonded to elements from period 2 of the periodic table, which form stable hydrogenated states capable of adsorbing and desorbing hydrogen at temperatures below 200°C and pressures of 1 atm or less, achieving over 6.5% hydrogen weight percentage.

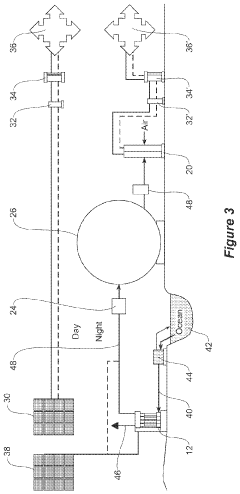

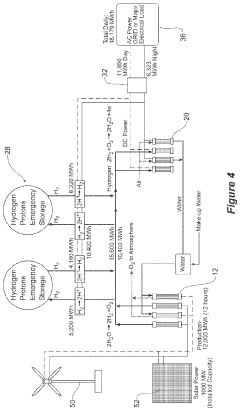

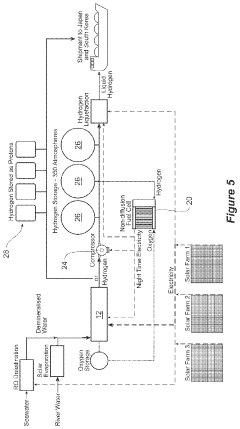

Hydrogen Based Renewable Energy Storage System

PatentInactiveUS20220109173A1

Innovation

- A renewable energy storage system using hydrogen as a medium, where renewable energy is used for electrolyzing water to produce hydrogen, which is stored and converted back into electricity using a hydrogen fuel cell, enabling efficient grid-scale energy storage and release.

Safety and Regulatory Framework for Hydrogen Storage

The regulatory landscape for hydrogen storage systems is complex and multifaceted, requiring adherence to various international, national, and local standards. Key regulatory bodies include the International Organization for Standardization (ISO), which has developed ISO 16111 for hydrogen absorbed in reversible metal hydride, and the International Electrotechnical Commission (IEC), which addresses electrical safety aspects of hydrogen systems. In the United States, the Department of Energy (DOE) has established comprehensive safety guidelines, while the European Union operates under the framework of Directive 2014/94/EU for alternative fuels infrastructure.

Safety considerations for hydrogen storage materials are paramount due to hydrogen's wide flammability range (4-75% in air) and low ignition energy (0.02 mJ). Material-specific safety protocols must address potential hazards including pressure build-up during absorption/desorption cycles, pyrophoricity of certain metal hydrides when exposed to air, and thermal management during rapid hydrogen uptake. For metal hydride systems, particular attention must be paid to heat dissipation during charging to prevent overheating and potential structural damage.

Risk assessment methodologies for hydrogen storage installations typically employ Failure Mode and Effects Analysis (FMEA) and Hazard and Operability Study (HAZOP) approaches. These systematic evaluations identify potential failure points and establish appropriate mitigation strategies. The implementation of multiple redundant safety systems is standard practice, including pressure relief devices, hydrogen sensors, and emergency shutdown mechanisms.

Certification requirements vary by jurisdiction but generally include rigorous testing for mechanical integrity, cycle durability, and performance under extreme conditions. Materials must demonstrate stability across thousands of absorption-desorption cycles and maintain structural integrity during temperature fluctuations. The European Pressure Equipment Directive (PED) and ASME Boiler and Pressure Vessel Code in the US provide frameworks for pressure vessel certification that often apply to hydrogen storage systems.

Training and operational safety protocols constitute another critical regulatory component. Personnel working with hydrogen storage systems require specialized training in handling procedures, emergency response, and system maintenance. Standard Operating Procedures (SOPs) must be established for routine operations, maintenance activities, and emergency scenarios.

Future regulatory developments are likely to focus on harmonizing international standards to facilitate global market development. Emerging areas of regulatory interest include integration of hydrogen storage with renewable energy systems, development of specific codes for novel storage materials, and adaptation of existing frameworks to accommodate higher storage pressures and densities as technology advances. The regulatory landscape will need to evolve in parallel with technological innovations to ensure safety without impeding commercial deployment.

Safety considerations for hydrogen storage materials are paramount due to hydrogen's wide flammability range (4-75% in air) and low ignition energy (0.02 mJ). Material-specific safety protocols must address potential hazards including pressure build-up during absorption/desorption cycles, pyrophoricity of certain metal hydrides when exposed to air, and thermal management during rapid hydrogen uptake. For metal hydride systems, particular attention must be paid to heat dissipation during charging to prevent overheating and potential structural damage.

Risk assessment methodologies for hydrogen storage installations typically employ Failure Mode and Effects Analysis (FMEA) and Hazard and Operability Study (HAZOP) approaches. These systematic evaluations identify potential failure points and establish appropriate mitigation strategies. The implementation of multiple redundant safety systems is standard practice, including pressure relief devices, hydrogen sensors, and emergency shutdown mechanisms.

Certification requirements vary by jurisdiction but generally include rigorous testing for mechanical integrity, cycle durability, and performance under extreme conditions. Materials must demonstrate stability across thousands of absorption-desorption cycles and maintain structural integrity during temperature fluctuations. The European Pressure Equipment Directive (PED) and ASME Boiler and Pressure Vessel Code in the US provide frameworks for pressure vessel certification that often apply to hydrogen storage systems.

Training and operational safety protocols constitute another critical regulatory component. Personnel working with hydrogen storage systems require specialized training in handling procedures, emergency response, and system maintenance. Standard Operating Procedures (SOPs) must be established for routine operations, maintenance activities, and emergency scenarios.

Future regulatory developments are likely to focus on harmonizing international standards to facilitate global market development. Emerging areas of regulatory interest include integration of hydrogen storage with renewable energy systems, development of specific codes for novel storage materials, and adaptation of existing frameworks to accommodate higher storage pressures and densities as technology advances. The regulatory landscape will need to evolve in parallel with technological innovations to ensure safety without impeding commercial deployment.

Economic Viability and Scalability Assessment

The economic viability of hydrogen storage materials for renewable energy integration hinges on several critical factors. Current cost analyses indicate that materials-based hydrogen storage systems remain significantly more expensive than conventional energy storage solutions, with production costs ranging from $400-800/kWh compared to $100-300/kWh for lithium-ion batteries. This cost differential primarily stems from expensive raw materials, complex manufacturing processes, and limited economies of scale in production.

Material selection substantially impacts economic feasibility. Metal hydrides offer high storage density but require costly rare earth elements and complex thermal management systems. Metal-organic frameworks (MOFs) present lower material costs but face challenges in manufacturing scalability. Carbon-based materials show promise for cost reduction but currently deliver lower volumetric efficiency, necessitating larger storage systems.

Infrastructure requirements present another economic hurdle. The integration of hydrogen storage materials into existing energy systems requires substantial capital investment in specialized handling equipment, safety systems, and compatible infrastructure. Current estimates suggest infrastructure costs add 30-45% to overall system implementation expenses, significantly affecting return on investment calculations.

Scalability assessment reveals promising pathways despite current limitations. Laboratory-scale production of advanced materials like nanoporous carbons and optimized MOFs demonstrates potential for cost reduction through manufacturing innovation. Recent advancements in continuous flow synthesis and additive manufacturing techniques could reduce production costs by 25-40% when implemented at industrial scale.

Market adoption scenarios indicate that economic viability will likely follow a segmented pattern. Initial commercial viability appears most promising in specialized applications where performance requirements outweigh cost considerations, such as remote power systems, critical infrastructure backup, and specialized transportation. Mass market viability for grid-scale applications requires further cost reductions of approximately 60-70% to compete with alternative storage technologies.

Lifecycle economic analysis reveals that while initial capital costs remain high, operational expenses for materials-based hydrogen storage can be competitive due to longer cycle life (potentially 10,000+ cycles compared to 1,000-3,000 for batteries) and minimal degradation in storage capacity over time. This favorable total cost of ownership could accelerate adoption in applications requiring frequent cycling and long service life.

Material selection substantially impacts economic feasibility. Metal hydrides offer high storage density but require costly rare earth elements and complex thermal management systems. Metal-organic frameworks (MOFs) present lower material costs but face challenges in manufacturing scalability. Carbon-based materials show promise for cost reduction but currently deliver lower volumetric efficiency, necessitating larger storage systems.

Infrastructure requirements present another economic hurdle. The integration of hydrogen storage materials into existing energy systems requires substantial capital investment in specialized handling equipment, safety systems, and compatible infrastructure. Current estimates suggest infrastructure costs add 30-45% to overall system implementation expenses, significantly affecting return on investment calculations.

Scalability assessment reveals promising pathways despite current limitations. Laboratory-scale production of advanced materials like nanoporous carbons and optimized MOFs demonstrates potential for cost reduction through manufacturing innovation. Recent advancements in continuous flow synthesis and additive manufacturing techniques could reduce production costs by 25-40% when implemented at industrial scale.

Market adoption scenarios indicate that economic viability will likely follow a segmented pattern. Initial commercial viability appears most promising in specialized applications where performance requirements outweigh cost considerations, such as remote power systems, critical infrastructure backup, and specialized transportation. Mass market viability for grid-scale applications requires further cost reductions of approximately 60-70% to compete with alternative storage technologies.

Lifecycle economic analysis reveals that while initial capital costs remain high, operational expenses for materials-based hydrogen storage can be competitive due to longer cycle life (potentially 10,000+ cycles compared to 1,000-3,000 for batteries) and minimal degradation in storage capacity over time. This favorable total cost of ownership could accelerate adoption in applications requiring frequent cycling and long service life.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!