Comparative Study of Solvent-Based and Water-Based Bio-barrier Coatings

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-barrier Coating Technology Evolution and Objectives

Bio-barrier coatings have evolved significantly over the past decades, transitioning from simple protective layers to sophisticated engineered materials designed to prevent microbial contamination and biofilm formation. The evolution began in the 1960s with rudimentary solvent-based formulations primarily used in marine applications to prevent biofouling on ship hulls. These early coatings relied heavily on toxic compounds such as tributyltin (TBT), which, while effective, posed significant environmental concerns.

The 1990s marked a pivotal shift in bio-barrier technology with increasing environmental regulations driving research toward more sustainable solutions. This period saw the emergence of the first generation of water-based alternatives, though they initially struggled to match the performance of their solvent-based counterparts. The technological trajectory has since been characterized by continuous improvements in both solvent-based and water-based systems, with particular focus on enhancing durability, adhesion properties, and antimicrobial efficacy.

Recent advancements have been propelled by nanotechnology integration, enabling the development of coatings with controlled release mechanisms for active ingredients. This has significantly improved the longevity and effectiveness of both coating types. Solvent-based systems have evolved to incorporate lower VOC (volatile organic compound) formulations, while water-based technologies have overcome many of their initial performance limitations through innovative polymer chemistry and dispersion techniques.

The current technological landscape reflects a convergence of multiple scientific disciplines, including polymer science, microbiology, and surface engineering. This interdisciplinary approach has facilitated the development of bio-barrier coatings capable of addressing specific application requirements across diverse sectors including healthcare, food processing, and industrial manufacturing.

The primary objectives of contemporary bio-barrier coating research center on achieving optimal balance between antimicrobial efficacy and environmental sustainability. For solvent-based systems, key goals include reducing VOC content while maintaining performance characteristics such as adhesion strength, chemical resistance, and barrier properties. Water-based formulations face different challenges, with research focused on improving drying times, enhancing substrate compatibility, and developing advanced crosslinking mechanisms to achieve comparable performance to solvent-based alternatives.

Looking forward, the field aims to develop next-generation bio-barrier coatings that combine the performance advantages of solvent-based systems with the environmental benefits of water-based formulations. This includes exploring bio-inspired antimicrobial mechanisms, smart responsive coatings that activate only when needed, and sustainable raw materials derived from renewable resources. The ultimate goal is to create coating technologies that provide effective microbial protection while aligning with global sustainability initiatives and increasingly stringent regulatory frameworks.

The 1990s marked a pivotal shift in bio-barrier technology with increasing environmental regulations driving research toward more sustainable solutions. This period saw the emergence of the first generation of water-based alternatives, though they initially struggled to match the performance of their solvent-based counterparts. The technological trajectory has since been characterized by continuous improvements in both solvent-based and water-based systems, with particular focus on enhancing durability, adhesion properties, and antimicrobial efficacy.

Recent advancements have been propelled by nanotechnology integration, enabling the development of coatings with controlled release mechanisms for active ingredients. This has significantly improved the longevity and effectiveness of both coating types. Solvent-based systems have evolved to incorporate lower VOC (volatile organic compound) formulations, while water-based technologies have overcome many of their initial performance limitations through innovative polymer chemistry and dispersion techniques.

The current technological landscape reflects a convergence of multiple scientific disciplines, including polymer science, microbiology, and surface engineering. This interdisciplinary approach has facilitated the development of bio-barrier coatings capable of addressing specific application requirements across diverse sectors including healthcare, food processing, and industrial manufacturing.

The primary objectives of contemporary bio-barrier coating research center on achieving optimal balance between antimicrobial efficacy and environmental sustainability. For solvent-based systems, key goals include reducing VOC content while maintaining performance characteristics such as adhesion strength, chemical resistance, and barrier properties. Water-based formulations face different challenges, with research focused on improving drying times, enhancing substrate compatibility, and developing advanced crosslinking mechanisms to achieve comparable performance to solvent-based alternatives.

Looking forward, the field aims to develop next-generation bio-barrier coatings that combine the performance advantages of solvent-based systems with the environmental benefits of water-based formulations. This includes exploring bio-inspired antimicrobial mechanisms, smart responsive coatings that activate only when needed, and sustainable raw materials derived from renewable resources. The ultimate goal is to create coating technologies that provide effective microbial protection while aligning with global sustainability initiatives and increasingly stringent regulatory frameworks.

Market Analysis for Eco-friendly Coating Solutions

The global market for eco-friendly coating solutions has experienced significant growth in recent years, driven by increasing environmental regulations, consumer awareness, and corporate sustainability initiatives. The bio-barrier coating segment, particularly the comparison between solvent-based and water-based formulations, represents a critical area of market development with distinct regional variations and adoption patterns.

North America currently leads the eco-friendly coatings market with approximately 35% market share, followed by Europe at 30% and Asia-Pacific at 25%. The remaining 10% is distributed across other regions. This distribution reflects regulatory stringency, with the European Union's REACH regulations and North America's VOC emission standards creating strong market drivers for water-based bio-barrier coatings.

Market valuation for eco-friendly coatings reached $38.5 billion in 2022, with projections indicating growth to $61.2 billion by 2027, representing a compound annual growth rate of 9.7%. Within this segment, water-based bio-barrier coatings are growing at 11.3% annually, outpacing solvent-based alternatives which are growing at only 6.2%.

Consumer demand patterns show distinct preferences across different sectors. The architectural coatings segment demonstrates the strongest preference for water-based solutions, with 78% of new applications favoring water-based formulations. Industrial applications show more balanced adoption, with water-based solutions accounting for 52% of new installations, while solvent-based solutions maintain stronger positions in specialized applications requiring enhanced chemical resistance.

Price sensitivity analysis reveals that despite higher initial costs for water-based bio-barrier coatings (averaging 15-20% premium over solvent-based alternatives), total lifecycle cost assessments often favor water-based solutions due to reduced ventilation requirements, lower insurance premiums, and extended maintenance intervals.

Market research indicates five primary customer segments driving demand: green building developers (27%), healthcare facilities (22%), food processing industries (18%), educational institutions (16%), and residential consumers (17%). Each segment prioritizes different performance attributes, with healthcare facilities emphasizing antimicrobial properties while food processing industries focus on chemical resistance and compliance with food safety regulations.

Competitive landscape analysis shows market consolidation among major coating manufacturers, with the top five companies controlling 47% of the eco-friendly coatings market. However, specialized niche players focusing exclusively on bio-barrier technologies are gaining market share through innovation and targeted application development.

Future market projections indicate continued shift toward water-based formulations, with solvent-based bio-barrier coatings likely to be increasingly restricted to specialized applications where performance requirements cannot yet be met by water-based alternatives.

North America currently leads the eco-friendly coatings market with approximately 35% market share, followed by Europe at 30% and Asia-Pacific at 25%. The remaining 10% is distributed across other regions. This distribution reflects regulatory stringency, with the European Union's REACH regulations and North America's VOC emission standards creating strong market drivers for water-based bio-barrier coatings.

Market valuation for eco-friendly coatings reached $38.5 billion in 2022, with projections indicating growth to $61.2 billion by 2027, representing a compound annual growth rate of 9.7%. Within this segment, water-based bio-barrier coatings are growing at 11.3% annually, outpacing solvent-based alternatives which are growing at only 6.2%.

Consumer demand patterns show distinct preferences across different sectors. The architectural coatings segment demonstrates the strongest preference for water-based solutions, with 78% of new applications favoring water-based formulations. Industrial applications show more balanced adoption, with water-based solutions accounting for 52% of new installations, while solvent-based solutions maintain stronger positions in specialized applications requiring enhanced chemical resistance.

Price sensitivity analysis reveals that despite higher initial costs for water-based bio-barrier coatings (averaging 15-20% premium over solvent-based alternatives), total lifecycle cost assessments often favor water-based solutions due to reduced ventilation requirements, lower insurance premiums, and extended maintenance intervals.

Market research indicates five primary customer segments driving demand: green building developers (27%), healthcare facilities (22%), food processing industries (18%), educational institutions (16%), and residential consumers (17%). Each segment prioritizes different performance attributes, with healthcare facilities emphasizing antimicrobial properties while food processing industries focus on chemical resistance and compliance with food safety regulations.

Competitive landscape analysis shows market consolidation among major coating manufacturers, with the top five companies controlling 47% of the eco-friendly coatings market. However, specialized niche players focusing exclusively on bio-barrier technologies are gaining market share through innovation and targeted application development.

Future market projections indicate continued shift toward water-based formulations, with solvent-based bio-barrier coatings likely to be increasingly restricted to specialized applications where performance requirements cannot yet be met by water-based alternatives.

Current Challenges in Solvent vs Water-Based Formulations

The development of bio-barrier coatings faces a critical juncture in the ongoing transition from solvent-based to water-based formulations. Both systems present distinct technical challenges that significantly impact their performance, application methods, and environmental footprint. Solvent-based formulations continue to struggle with volatile organic compound (VOC) emissions, which face increasingly stringent regulatory restrictions worldwide. These regulations have accelerated in recent years, with the European Union's REACH program and similar initiatives in North America and Asia imposing lower VOC thresholds specifically targeting coating applications.

Performance disparities remain a substantial hurdle in the widespread adoption of water-based alternatives. Solvent-based bio-barrier coatings typically demonstrate superior barrier properties against moisture, oxygen, and microbial penetration—critical factors for effective protection. The molecular arrangement and film formation characteristics of solvent-based systems create more uniform, hydrophobic barriers with excellent adhesion to various substrates. Water-based formulations often exhibit reduced performance in high-humidity environments and on hydrophobic surfaces, limiting their application range.

Stability issues present another significant challenge. Water-based bio-barrier formulations are inherently more susceptible to microbial contamination during storage, requiring additional preservatives that may compromise their "green" credentials. Conversely, solvent-based systems face challenges with component separation and viscosity changes during extended storage periods, particularly under variable temperature conditions.

Application technology represents a critical technical barrier. Solvent-based coatings typically provide better wetting and flow characteristics, allowing for thinner, more uniform film application. Water-based alternatives often require specialized application equipment and techniques to achieve comparable results, presenting adoption barriers for established manufacturing operations. The drying and curing processes also differ substantially, with water-based formulations generally requiring longer drying times and more controlled environmental conditions.

Cost structures between the two systems continue to evolve. While raw material costs for water-based formulations have decreased with scale, the specialized additives required for performance enhancement (such as coalescents, defoamers, and rheology modifiers) often offset these savings. Additionally, the energy requirements for drying water-based coatings can be significantly higher than their solvent-based counterparts, creating a complex cost-benefit equation that varies by application environment.

Technical innovation gaps persist in developing water-based bio-barrier coatings that match the performance of solvent-based systems without compromising application ease or increasing costs. Current research focuses on novel polymer architectures, bio-based additives, and hybrid systems that combine the advantages of both approaches while minimizing their respective limitations.

Performance disparities remain a substantial hurdle in the widespread adoption of water-based alternatives. Solvent-based bio-barrier coatings typically demonstrate superior barrier properties against moisture, oxygen, and microbial penetration—critical factors for effective protection. The molecular arrangement and film formation characteristics of solvent-based systems create more uniform, hydrophobic barriers with excellent adhesion to various substrates. Water-based formulations often exhibit reduced performance in high-humidity environments and on hydrophobic surfaces, limiting their application range.

Stability issues present another significant challenge. Water-based bio-barrier formulations are inherently more susceptible to microbial contamination during storage, requiring additional preservatives that may compromise their "green" credentials. Conversely, solvent-based systems face challenges with component separation and viscosity changes during extended storage periods, particularly under variable temperature conditions.

Application technology represents a critical technical barrier. Solvent-based coatings typically provide better wetting and flow characteristics, allowing for thinner, more uniform film application. Water-based alternatives often require specialized application equipment and techniques to achieve comparable results, presenting adoption barriers for established manufacturing operations. The drying and curing processes also differ substantially, with water-based formulations generally requiring longer drying times and more controlled environmental conditions.

Cost structures between the two systems continue to evolve. While raw material costs for water-based formulations have decreased with scale, the specialized additives required for performance enhancement (such as coalescents, defoamers, and rheology modifiers) often offset these savings. Additionally, the energy requirements for drying water-based coatings can be significantly higher than their solvent-based counterparts, creating a complex cost-benefit equation that varies by application environment.

Technical innovation gaps persist in developing water-based bio-barrier coatings that match the performance of solvent-based systems without compromising application ease or increasing costs. Current research focuses on novel polymer architectures, bio-based additives, and hybrid systems that combine the advantages of both approaches while minimizing their respective limitations.

Technical Comparison of Existing Bio-barrier Solutions

01 Antimicrobial bio-barrier coatings

Bio-barrier coatings with antimicrobial properties can be formulated to prevent microbial growth and biofilm formation on various surfaces. These coatings typically incorporate antimicrobial agents that inhibit bacterial, fungal, and algal growth. The formulations may include natural or synthetic biocides, silver nanoparticles, or other antimicrobial compounds that provide long-lasting protection against microbial colonization. These coatings are particularly useful in medical devices, food processing equipment, and marine applications where microbial contamination is a concern.- Antimicrobial bio-barrier coatings: Bio-barrier coatings with antimicrobial properties can be formulated to prevent microbial growth and biofilm formation on various surfaces. These coatings typically incorporate active antimicrobial agents that inhibit bacterial, fungal, and algal growth. The formulations may include natural or synthetic biocides, silver nanoparticles, or other antimicrobial compounds that provide long-lasting protection against microbial colonization, making them suitable for medical devices, food packaging, and high-touch surfaces.

- Environmentally friendly bio-barrier formulations: Sustainable and environmentally friendly bio-barrier coatings utilize biodegradable polymers and natural compounds to create protective barriers without harmful environmental impacts. These formulations often incorporate plant-derived materials, chitosan, or other renewable resources as alternatives to traditional petroleum-based polymers. The coatings provide effective protection while reducing environmental footprint and offering improved biodegradability at the end of their useful life.

- Multi-layer bio-barrier coating systems: Advanced bio-barrier protection can be achieved through multi-layer coating systems that combine different functional layers to enhance performance. These systems typically include a base layer for adhesion, intermediate layers with specific barrier properties, and a top layer for durability and surface functionality. The multi-layer approach allows for customization of properties such as moisture resistance, gas permeability, and mechanical strength, making these coatings suitable for complex applications in medical, food, and industrial sectors.

- Self-healing bio-barrier coatings: Self-healing bio-barrier coatings incorporate responsive materials that can repair minor damage automatically, extending the coating's effective lifespan. These innovative formulations may contain microcapsules with healing agents that release upon damage, or reversible chemical bonds that can reform after being broken. The self-healing capability maintains the integrity of the protective barrier even after mechanical abrasion or environmental stress, reducing maintenance requirements and improving long-term performance.

- Nanocomposite-enhanced bio-barrier coatings: Incorporating nanomaterials into bio-barrier coatings significantly enhances their protective properties. Nanocomposite formulations may include nanoparticles, nanofibers, or nanoclays dispersed within a polymer matrix to improve barrier properties against moisture, gases, and microorganisms. These advanced materials can create tortuous paths that impede the movement of molecules through the coating, while also potentially improving mechanical strength, thermal stability, and durability of the protective layer.

02 Environmentally friendly bio-barrier coatings

Eco-friendly bio-barrier coatings are developed using sustainable materials and processes to minimize environmental impact while providing effective protection. These coatings often utilize biodegradable polymers, plant-based compounds, or naturally derived materials as alternatives to traditional petroleum-based or toxic components. The formulations are designed to offer comparable performance to conventional coatings while reducing ecological footprint and potential harm to aquatic ecosystems. Applications include marine antifouling coatings, agricultural protective films, and construction materials requiring environmental compliance.Expand Specific Solutions03 Self-healing bio-barrier coatings

Self-healing bio-barrier coatings incorporate advanced materials that can repair minor damage automatically, extending the coating's protective lifespan. These coatings typically contain encapsulated healing agents that are released when the coating is scratched or damaged, initiating a repair process that restores the protective barrier. The technology may utilize microcapsules, vascular networks, or intrinsically self-healing polymers to achieve this functionality. Self-healing bio-barriers are particularly valuable in applications where maintenance access is difficult or where continuous protection is critical.Expand Specific Solutions04 Multi-functional bio-barrier coatings

Multi-functional bio-barrier coatings provide multiple protective properties simultaneously, such as antimicrobial activity, corrosion resistance, and thermal insulation. These advanced coating systems often employ layered structures or composite materials to achieve diverse functionalities. The formulations may combine various active ingredients, nanoparticles, and polymer matrices to create synergistic effects that enhance overall performance. These versatile coatings find applications in aerospace, healthcare, electronics, and industrial equipment where multiple protection requirements exist.Expand Specific Solutions05 Nano-engineered bio-barrier coatings

Nano-engineered bio-barrier coatings utilize nanotechnology to create highly effective protective barriers with enhanced properties. These coatings incorporate nanomaterials such as nanoparticles, nanotubes, or nanosheets to improve adhesion, durability, and barrier properties at the molecular level. The nano-scale components can create superhydrophobic surfaces, improve mechanical strength, or provide targeted release of active ingredients. The precise control of surface properties at the nanoscale enables the development of thinner yet more effective coatings for applications in electronics, medical devices, and high-performance industrial equipment.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The bio-barrier coatings market is in a growth phase, driven by increasing environmental regulations and sustainability demands. The market is expanding as industries shift from traditional solvent-based to water-based formulations, with the global eco-friendly coatings sector projected to reach significant value in coming years. Technologically, water-based solutions are rapidly maturing but still face performance challenges compared to solvent-based alternatives. Key players shaping this competitive landscape include BASF SE and Nippon Paint Holdings with advanced polymer technologies, Sun Chemical and PPG Industries focusing on bio-based innovations, while Akzo Nobel and DAW SE lead in commercial applications. Research partnerships between companies like Lonza AG and institutions such as Delft University of Technology are accelerating development of next-generation sustainable coating solutions.

BASF SE

Technical Solution: BASF SE has developed advanced bio-barrier coating technologies that compare both solvent-based and water-based formulations. Their proprietary PermaSafe® technology incorporates biocides with controlled release mechanisms in water-based systems, achieving comparable performance to traditional solvent-based alternatives. BASF's water-based bio-barrier coatings utilize acrylic dispersions with specially engineered particle morphology that creates a tight film formation upon drying, providing excellent barrier properties against microbial penetration. The company has implemented nano-encapsulation techniques for active ingredients in their water-based formulations, allowing for prolonged antimicrobial efficacy while maintaining environmental compliance. Their research has demonstrated that optimized water-based formulations can achieve similar or superior resistance to biodegradation compared to solvent-based systems, particularly in high-humidity environments where traditional solvent-based coatings may show limitations.

Strengths: Superior environmental profile with reduced VOC emissions; enhanced worker safety; improved compatibility with sensitive substrates; better performance in humid conditions. Weaknesses: Potentially slower drying times compared to solvent-based alternatives; may require more sophisticated application equipment; some formulations show reduced chemical resistance in extreme environments.

Lonza AG

Technical Solution: Lonza AG has pioneered comparative research between solvent-based and water-based bio-barrier coatings through their Materialized™ technology platform. Their water-based systems incorporate their patented BioLink™ technology, which creates covalent bonds between antimicrobial agents and polymer matrices, resulting in long-lasting protection even after repeated cleaning cycles. Lonza's comparative studies have shown that their advanced water-based formulations can achieve equivalent or superior microbial resistance compared to traditional solvent systems while reducing VOC emissions by up to 85%. Their technology incorporates specialized surfactant systems that enable proper wetting and adhesion on difficult substrates, traditionally a challenge for water-based systems. Lonza has developed hybrid technologies that combine the benefits of both approaches - using minimal solvent content to enhance certain performance characteristics while maintaining predominantly water-based formulations. Their research demonstrates that properly formulated water-based bio-barrier coatings can achieve comparable durability to solvent-based alternatives, with accelerated weathering tests showing less than 5% difference in performance after 2000 hours of exposure.

Strengths: Industry-leading durability in water-based formulations; excellent leaching resistance; comprehensive antimicrobial spectrum; reduced environmental impact. Weaknesses: Higher initial cost compared to conventional systems; more complex formulation requirements; potential compatibility issues with certain substrate types; may require specialized application techniques.

Key Patents and Innovations in Coating Chemistry

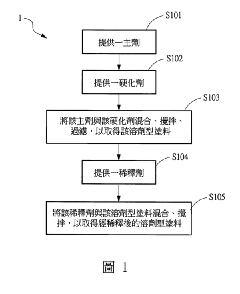

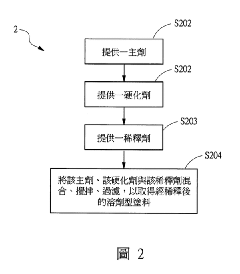

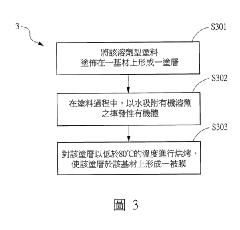

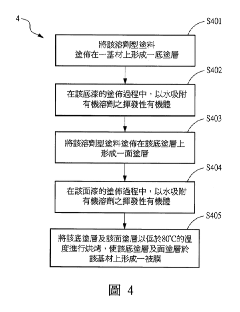

Solvent-based coating material and primary ingredient, curing agent, manufacturing method and coating method thereof

PatentInactiveTW201643225A

Innovation

- A solvent-based coating formulation with a high hydrophilicity ratio of organic solvents, utilizing solvents with high water solubility to absorb VOCs during the coating process, reducing emissions and allowing for lower baking temperatures without altering the coating's physical and chemical properties.

Water-based coatings for cellulosic substrates

PatentInactiveUS20240218600A1

Innovation

- A water-based coating composition comprising 25 wt % to 99 wt % polymer binders with a glass transition temperature less than 10° C and a heat seal onset temperature of less than 200° C, combined with 0.1 wt % to 50 wt % particles having an average particle size greater than 4 μm, which imparts liquid resistance, heat sealability, and minimal roll blocking.

Environmental Impact Assessment

The environmental impact assessment of bio-barrier coatings reveals significant differences between solvent-based and water-based formulations across their entire lifecycle. Solvent-based coatings typically contain volatile organic compounds (VOCs) that contribute to air pollution, photochemical smog formation, and potential health hazards for workers during application. These formulations often release between 250-400g/L of VOCs during curing processes, substantially exceeding regulatory thresholds in many jurisdictions.

Water-based bio-barrier alternatives demonstrate markedly reduced environmental footprints, with VOC emissions typically below 50g/L. Recent lifecycle assessment studies indicate that water-based formulations reduce carbon emissions by approximately 60-70% compared to their solvent-based counterparts when considering manufacturing, application, and disposal phases collectively.

Manufacturing processes for solvent-based coatings require more energy inputs and generate hazardous waste streams that necessitate specialized disposal protocols. Conversely, water-based production facilities report 30-45% lower energy consumption and significantly reduced hazardous waste generation, translating to diminished environmental impact and lower regulatory compliance costs.

Biodegradability assessments demonstrate that water-based bio-barrier coatings typically decompose 2-3 times faster in natural environments than solvent-based alternatives. This accelerated degradation reduces long-term ecological persistence and potential bioaccumulation of coating components in aquatic ecosystems and soil matrices.

Aquatic toxicity testing reveals that leachates from solvent-based coatings can cause adverse effects on indicator organisms at concentrations as low as 5-10 ppm, while water-based formulations generally require concentrations exceeding 100 ppm to induce similar responses. This order-of-magnitude difference significantly reduces ecological risk profiles for water-based systems.

Regulatory compliance trajectories indicate increasingly stringent limitations on solvent-based coating applications globally. The European Union's VOC Directive, California's SCAQMD regulations, and similar frameworks in Asia-Pacific markets are progressively restricting solvent-based formulations, creating market advantages for water-based alternatives that meet or exceed environmental performance standards.

Resource efficiency metrics favor water-based systems, with raw material utilization rates approximately 15-20% higher than solvent-based production processes. This translates to reduced resource extraction impacts and lower overall material footprints across product lifecycles, contributing to circular economy objectives and sustainability goals.

Water-based bio-barrier alternatives demonstrate markedly reduced environmental footprints, with VOC emissions typically below 50g/L. Recent lifecycle assessment studies indicate that water-based formulations reduce carbon emissions by approximately 60-70% compared to their solvent-based counterparts when considering manufacturing, application, and disposal phases collectively.

Manufacturing processes for solvent-based coatings require more energy inputs and generate hazardous waste streams that necessitate specialized disposal protocols. Conversely, water-based production facilities report 30-45% lower energy consumption and significantly reduced hazardous waste generation, translating to diminished environmental impact and lower regulatory compliance costs.

Biodegradability assessments demonstrate that water-based bio-barrier coatings typically decompose 2-3 times faster in natural environments than solvent-based alternatives. This accelerated degradation reduces long-term ecological persistence and potential bioaccumulation of coating components in aquatic ecosystems and soil matrices.

Aquatic toxicity testing reveals that leachates from solvent-based coatings can cause adverse effects on indicator organisms at concentrations as low as 5-10 ppm, while water-based formulations generally require concentrations exceeding 100 ppm to induce similar responses. This order-of-magnitude difference significantly reduces ecological risk profiles for water-based systems.

Regulatory compliance trajectories indicate increasingly stringent limitations on solvent-based coating applications globally. The European Union's VOC Directive, California's SCAQMD regulations, and similar frameworks in Asia-Pacific markets are progressively restricting solvent-based formulations, creating market advantages for water-based alternatives that meet or exceed environmental performance standards.

Resource efficiency metrics favor water-based systems, with raw material utilization rates approximately 15-20% higher than solvent-based production processes. This translates to reduced resource extraction impacts and lower overall material footprints across product lifecycles, contributing to circular economy objectives and sustainability goals.

Regulatory Compliance Framework

The regulatory landscape for bio-barrier coatings is complex and varies significantly across different regions, with solvent-based and water-based formulations facing distinct compliance challenges. In the United States, the Environmental Protection Agency (EPA) regulates volatile organic compound (VOC) emissions under the Clean Air Act, imposing stricter limitations on solvent-based coatings which typically contain higher VOC levels. The EPA's National Emission Standards for Hazardous Air Pollutants (NESHAP) specifically targets the coating industry, with water-based formulations generally finding easier compliance pathways.

The European Union implements more stringent regulations through the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) framework and the Biocidal Products Regulation (BPR). These regulations require extensive safety documentation and efficacy testing for active ingredients in bio-barrier coatings. Water-based formulations typically contain fewer substances of very high concern (SVHCs) under REACH, providing manufacturers with reduced regulatory burden compared to their solvent-based counterparts.

In Asia, regulatory frameworks show considerable variation. Japan's Chemical Substances Control Law (CSCL) and China's Measures for Environmental Management of New Chemical Substances both impose notification requirements that affect bio-barrier coating formulations. Recent policy shifts in these markets demonstrate a clear preference for water-based technologies, with accelerated approval processes and tax incentives becoming increasingly common.

Industry-specific regulations add another layer of complexity. Food contact materials face scrutiny under the FDA's Food Contact Substance Notification program in the US and the EU's Framework Regulation (EC) No 1935/2004. Healthcare applications must adhere to medical device regulations, with water-based coatings often preferred due to reduced toxicity concerns and easier sterilization validation.

Certification systems like LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) provide market advantages for environmentally preferable products. Water-based bio-barrier coatings typically earn higher points in these systems, creating market-driven regulatory incentives beyond mandatory compliance requirements.

Looking forward, regulatory trends indicate increasing restrictions on solvent-based formulations globally. The International Maritime Organization's (IMO) regulations on biocidal antifouling coatings and various national phase-out programs for specific solvents suggest that water-based technologies will face fewer regulatory hurdles in coming years, potentially accelerating their market adoption despite current performance limitations in certain applications.

The European Union implements more stringent regulations through the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) framework and the Biocidal Products Regulation (BPR). These regulations require extensive safety documentation and efficacy testing for active ingredients in bio-barrier coatings. Water-based formulations typically contain fewer substances of very high concern (SVHCs) under REACH, providing manufacturers with reduced regulatory burden compared to their solvent-based counterparts.

In Asia, regulatory frameworks show considerable variation. Japan's Chemical Substances Control Law (CSCL) and China's Measures for Environmental Management of New Chemical Substances both impose notification requirements that affect bio-barrier coating formulations. Recent policy shifts in these markets demonstrate a clear preference for water-based technologies, with accelerated approval processes and tax incentives becoming increasingly common.

Industry-specific regulations add another layer of complexity. Food contact materials face scrutiny under the FDA's Food Contact Substance Notification program in the US and the EU's Framework Regulation (EC) No 1935/2004. Healthcare applications must adhere to medical device regulations, with water-based coatings often preferred due to reduced toxicity concerns and easier sterilization validation.

Certification systems like LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) provide market advantages for environmentally preferable products. Water-based bio-barrier coatings typically earn higher points in these systems, creating market-driven regulatory incentives beyond mandatory compliance requirements.

Looking forward, regulatory trends indicate increasing restrictions on solvent-based formulations globally. The International Maritime Organization's (IMO) regulations on biocidal antifouling coatings and various national phase-out programs for specific solvents suggest that water-based technologies will face fewer regulatory hurdles in coming years, potentially accelerating their market adoption despite current performance limitations in certain applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!