Bio-based Barrier Coatings for Pharmaceutical and Nutraceutical Applications

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-based Barrier Coating Background and Objectives

Bio-based barrier coatings have emerged as a significant area of research and development in the pharmaceutical and nutraceutical packaging industry over the past two decades. The evolution of these materials represents a paradigm shift from traditional petroleum-based polymers toward sustainable alternatives derived from renewable resources. This transition has been driven by increasing environmental concerns, stricter regulations on plastic waste, and growing consumer demand for eco-friendly packaging solutions.

The development trajectory of bio-based barrier coatings began with simple starch-based films in the early 2000s, progressing through cellulose derivatives, protein-based coatings, and more recently, advanced nanocomposite structures incorporating biopolymers with enhanced barrier properties. Each evolutionary step has addressed specific limitations of previous generations, particularly regarding moisture resistance, oxygen permeability, and mechanical stability.

Current technological trends indicate a convergence of biopolymer science with nanotechnology, creating hybrid materials that can match or exceed the performance of conventional synthetic barriers. The integration of antimicrobial properties and controlled-release mechanisms represents another frontier, particularly relevant for pharmaceutical applications where package-product interactions must be carefully managed.

The primary objective of research in this field is to develop bio-based barrier coatings that provide equivalent or superior protection compared to conventional petroleum-based alternatives, while offering enhanced sustainability credentials. Specific technical goals include achieving oxygen transmission rates below 1 cc/m²/day, water vapor transmission rates under 10 g/m²/day, and maintaining these properties throughout the product shelf life under various environmental conditions.

Additional objectives encompass ensuring compatibility with existing manufacturing infrastructure to facilitate industry adoption, developing cost-effective production methods to achieve price parity with conventional materials, and creating formulations that comply with strict regulatory frameworks governing pharmaceutical and nutraceutical packaging.

The research also aims to address the unique challenges presented by pharmaceutical and nutraceutical products, including protection against light degradation, moisture sensitivity, and oxidation of active ingredients. For pharmaceuticals specifically, there is a focus on developing barrier coatings that maintain drug stability without leaching or migration of coating components into the product.

Long-term technological aspirations include the development of "smart" bio-based barriers with sensing capabilities for monitoring product quality and integrity, as well as coatings with programmable degradation profiles to optimize end-of-life management while maintaining in-use performance.

The development trajectory of bio-based barrier coatings began with simple starch-based films in the early 2000s, progressing through cellulose derivatives, protein-based coatings, and more recently, advanced nanocomposite structures incorporating biopolymers with enhanced barrier properties. Each evolutionary step has addressed specific limitations of previous generations, particularly regarding moisture resistance, oxygen permeability, and mechanical stability.

Current technological trends indicate a convergence of biopolymer science with nanotechnology, creating hybrid materials that can match or exceed the performance of conventional synthetic barriers. The integration of antimicrobial properties and controlled-release mechanisms represents another frontier, particularly relevant for pharmaceutical applications where package-product interactions must be carefully managed.

The primary objective of research in this field is to develop bio-based barrier coatings that provide equivalent or superior protection compared to conventional petroleum-based alternatives, while offering enhanced sustainability credentials. Specific technical goals include achieving oxygen transmission rates below 1 cc/m²/day, water vapor transmission rates under 10 g/m²/day, and maintaining these properties throughout the product shelf life under various environmental conditions.

Additional objectives encompass ensuring compatibility with existing manufacturing infrastructure to facilitate industry adoption, developing cost-effective production methods to achieve price parity with conventional materials, and creating formulations that comply with strict regulatory frameworks governing pharmaceutical and nutraceutical packaging.

The research also aims to address the unique challenges presented by pharmaceutical and nutraceutical products, including protection against light degradation, moisture sensitivity, and oxidation of active ingredients. For pharmaceuticals specifically, there is a focus on developing barrier coatings that maintain drug stability without leaching or migration of coating components into the product.

Long-term technological aspirations include the development of "smart" bio-based barriers with sensing capabilities for monitoring product quality and integrity, as well as coatings with programmable degradation profiles to optimize end-of-life management while maintaining in-use performance.

Pharmaceutical Packaging Market Analysis

The global pharmaceutical packaging market is experiencing robust growth, valued at approximately $112 billion in 2022 and projected to reach $188 billion by 2028, with a compound annual growth rate (CAGR) of 9.1%. This growth is primarily driven by increasing pharmaceutical consumption worldwide, stringent regulations for drug safety, and rising demand for patient-centric packaging solutions.

North America currently dominates the market with about 38% share, followed by Europe (29%) and Asia-Pacific (24%), with the latter showing the fastest growth rate due to expanding healthcare infrastructure and increasing pharmaceutical manufacturing activities in countries like China and India. The COVID-19 pandemic has significantly accelerated market expansion, creating unprecedented demand for vaccine packaging and delivery systems.

The pharmaceutical packaging sector is segmented by material (plastics, glass, metal, paper), product type (bottles, blister packs, vials, ampoules), and drug delivery format (oral, injectable, topical). Plastic packaging currently holds the largest market share at 43%, though environmental concerns are driving a shift toward more sustainable alternatives, including bio-based materials.

Key market trends include the growing adoption of smart packaging technologies incorporating QR codes, RFID tags, and temperature sensors for enhanced traceability and patient compliance. Anti-counterfeiting features are becoming standard as pharmaceutical companies combat the global counterfeit drug market, estimated at $200 billion annually.

The nutraceutical packaging segment is emerging as a particularly dynamic sub-sector, growing at 10.3% annually, driven by increasing consumer focus on preventive healthcare and dietary supplements. This segment demands packaging that preserves product efficacy while communicating health benefits effectively.

Regulatory frameworks significantly impact market dynamics, with organizations like the FDA and EMA imposing strict guidelines on pharmaceutical packaging materials. The EU's Medical Device Regulation (MDR) and the Drug Supply Chain Security Act (DSCSA) in the US are reshaping compliance requirements, pushing manufacturers toward more transparent and traceable packaging solutions.

Market challenges include sustainability concerns, with increasing pressure to reduce plastic usage and develop recyclable or biodegradable alternatives. This has created a significant opportunity for bio-based barrier coatings as an environmentally friendly alternative to traditional petroleum-based packaging materials, potentially addressing both regulatory compliance and consumer demand for sustainable packaging solutions.

North America currently dominates the market with about 38% share, followed by Europe (29%) and Asia-Pacific (24%), with the latter showing the fastest growth rate due to expanding healthcare infrastructure and increasing pharmaceutical manufacturing activities in countries like China and India. The COVID-19 pandemic has significantly accelerated market expansion, creating unprecedented demand for vaccine packaging and delivery systems.

The pharmaceutical packaging sector is segmented by material (plastics, glass, metal, paper), product type (bottles, blister packs, vials, ampoules), and drug delivery format (oral, injectable, topical). Plastic packaging currently holds the largest market share at 43%, though environmental concerns are driving a shift toward more sustainable alternatives, including bio-based materials.

Key market trends include the growing adoption of smart packaging technologies incorporating QR codes, RFID tags, and temperature sensors for enhanced traceability and patient compliance. Anti-counterfeiting features are becoming standard as pharmaceutical companies combat the global counterfeit drug market, estimated at $200 billion annually.

The nutraceutical packaging segment is emerging as a particularly dynamic sub-sector, growing at 10.3% annually, driven by increasing consumer focus on preventive healthcare and dietary supplements. This segment demands packaging that preserves product efficacy while communicating health benefits effectively.

Regulatory frameworks significantly impact market dynamics, with organizations like the FDA and EMA imposing strict guidelines on pharmaceutical packaging materials. The EU's Medical Device Regulation (MDR) and the Drug Supply Chain Security Act (DSCSA) in the US are reshaping compliance requirements, pushing manufacturers toward more transparent and traceable packaging solutions.

Market challenges include sustainability concerns, with increasing pressure to reduce plastic usage and develop recyclable or biodegradable alternatives. This has created a significant opportunity for bio-based barrier coatings as an environmentally friendly alternative to traditional petroleum-based packaging materials, potentially addressing both regulatory compliance and consumer demand for sustainable packaging solutions.

Current Challenges in Bio-based Barrier Technologies

Despite significant advancements in bio-based barrier coating technologies for pharmaceutical and nutraceutical applications, several critical challenges continue to impede widespread commercial adoption. The primary obstacle remains achieving comparable barrier properties to synthetic polymers, particularly against oxygen and moisture. Bio-based materials typically demonstrate higher permeability rates, which can compromise the shelf life and efficacy of sensitive pharmaceutical and nutraceutical compounds.

Manufacturing scalability presents another significant hurdle. Current production methods for bio-based barrier coatings often involve complex processes that are difficult to scale up economically. The inconsistency in raw material quality from natural sources further complicates standardization efforts, resulting in batch-to-batch variations that are unacceptable in pharmaceutical applications where regulatory compliance demands precise reproducibility.

Cost competitiveness remains a persistent challenge. Bio-based barrier materials generally command a premium of 20-30% over conventional petroleum-based alternatives. This price differential, though gradually narrowing, still represents a significant barrier to market penetration, particularly in cost-sensitive market segments where thin profit margins prevail.

Stability issues under various environmental conditions pose additional technical challenges. Many bio-based coatings exhibit sensitivity to humidity fluctuations and temperature variations, potentially compromising their structural integrity during storage and transportation. This vulnerability necessitates additional protective measures, further increasing complexity and cost.

Regulatory hurdles also present significant obstacles. The novel nature of many bio-based materials means they lack established regulatory pathways, requiring extensive safety testing and documentation. The pharmaceutical industry's stringent requirements for material consistency, traceability, and long-term stability data create additional barriers to entry for innovative bio-based solutions.

Compatibility with existing manufacturing infrastructure represents another challenge. Many pharmaceutical and nutraceutical producers have invested heavily in equipment optimized for conventional coating materials. Retrofitting these systems for bio-based alternatives often requires significant capital investment and process reengineering, creating resistance to adoption.

Technical limitations in specific performance attributes also persist. While some bio-based coatings excel in oxygen barrier properties, they may simultaneously demonstrate poor resistance to grease or UV light. This performance gap necessitates multi-layer systems or additives that can compromise the sustainability credentials of the final product and increase complexity.

Manufacturing scalability presents another significant hurdle. Current production methods for bio-based barrier coatings often involve complex processes that are difficult to scale up economically. The inconsistency in raw material quality from natural sources further complicates standardization efforts, resulting in batch-to-batch variations that are unacceptable in pharmaceutical applications where regulatory compliance demands precise reproducibility.

Cost competitiveness remains a persistent challenge. Bio-based barrier materials generally command a premium of 20-30% over conventional petroleum-based alternatives. This price differential, though gradually narrowing, still represents a significant barrier to market penetration, particularly in cost-sensitive market segments where thin profit margins prevail.

Stability issues under various environmental conditions pose additional technical challenges. Many bio-based coatings exhibit sensitivity to humidity fluctuations and temperature variations, potentially compromising their structural integrity during storage and transportation. This vulnerability necessitates additional protective measures, further increasing complexity and cost.

Regulatory hurdles also present significant obstacles. The novel nature of many bio-based materials means they lack established regulatory pathways, requiring extensive safety testing and documentation. The pharmaceutical industry's stringent requirements for material consistency, traceability, and long-term stability data create additional barriers to entry for innovative bio-based solutions.

Compatibility with existing manufacturing infrastructure represents another challenge. Many pharmaceutical and nutraceutical producers have invested heavily in equipment optimized for conventional coating materials. Retrofitting these systems for bio-based alternatives often requires significant capital investment and process reengineering, creating resistance to adoption.

Technical limitations in specific performance attributes also persist. While some bio-based coatings excel in oxygen barrier properties, they may simultaneously demonstrate poor resistance to grease or UV light. This performance gap necessitates multi-layer systems or additives that can compromise the sustainability credentials of the final product and increase complexity.

Current Bio-based Barrier Coating Solutions

01 Plant-derived polymers for barrier coatings

Bio-based barrier coatings can be formulated using plant-derived polymers such as cellulose, hemicellulose, lignin, and starch. These natural polymers provide effective barrier properties against oxygen, moisture, and grease while being environmentally sustainable. The coatings can be applied to various substrates including paper, paperboard, and plastic films to enhance their barrier properties while maintaining biodegradability.- Plant-derived polymers for barrier coatings: Bio-based barrier coatings can be formulated using plant-derived polymers such as cellulose, hemicellulose, lignin, and starch. These natural polymers provide effective barriers against oxygen, moisture, and grease while being environmentally sustainable. The coatings can be applied to various substrates including paper, cardboard, and plastic films to enhance their barrier properties while maintaining biodegradability.

- Protein-based barrier formulations: Proteins derived from agricultural sources such as soy, corn, wheat gluten, and milk can be used to create effective barrier coatings. These protein-based formulations can be modified through crosslinking or blending with other bio-based materials to enhance their water resistance, mechanical strength, and barrier properties. The resulting coatings provide sustainable alternatives to petroleum-based barriers for food packaging and other applications.

- Biodegradable composite barrier systems: Composite barrier systems combining multiple bio-based materials can achieve enhanced barrier properties through synergistic effects. These systems often incorporate layers of different bio-polymers, each contributing specific barrier functions against oxygen, moisture, or UV light. Additives such as natural waxes, oils, or nanoparticles can further improve the performance of these composite barriers while maintaining their biodegradability and compostability.

- Bio-based waxes and lipids for moisture barriers: Natural waxes, oils, and lipids derived from plants and animals can be formulated into effective moisture barrier coatings. These hydrophobic materials create water-repellent surfaces that protect substrates from moisture damage. Carnauba wax, beeswax, and plant oils can be processed and applied as thin coatings that provide both water resistance and natural gloss to packaging materials, agricultural products, and construction materials.

- Nanocellulose and bio-based nanocomposites: Nanocellulose materials, including cellulose nanofibrils and nanocrystals, can be incorporated into barrier coatings to create high-performance bio-based barriers. These nanomaterials create tortuous paths that significantly reduce gas and vapor permeability. When combined with other bio-polymers, they form nanocomposite structures with exceptional barrier properties while maintaining transparency and flexibility. These advanced materials represent the cutting edge of sustainable barrier technology.

02 Protein-based barrier formulations

Proteins derived from renewable sources such as soy, whey, zein (corn), and gelatin can be used to create effective barrier coatings. These protein-based formulations can be modified with cross-linking agents or plasticizers to improve their mechanical properties and water resistance. The resulting coatings provide good oxygen and aroma barrier properties while being fully biodegradable and compostable.Expand Specific Solutions03 Polysaccharide-based barrier systems

Polysaccharides such as chitosan, alginate, pectin, and carrageenan can be formulated into effective barrier coatings. These natural polymers can be modified or blended to enhance their barrier properties against gases, moisture, and oils. The coatings are particularly effective for food packaging applications, providing protection while being derived from renewable resources and offering biodegradability at end-of-life.Expand Specific Solutions04 Bio-based composite barrier coatings

Composite barrier coatings combining multiple bio-based materials can achieve enhanced performance. These formulations typically incorporate nanomaterials such as cellulose nanocrystals, clay, or silica with bio-polymers to create synergistic effects. The resulting composite structures provide superior barrier properties against oxygen, water vapor, and UV light while maintaining the renewable and sustainable nature of the coating system.Expand Specific Solutions05 Wax and lipid-based barrier coatings

Natural waxes, oils, and lipids can be formulated into effective barrier coatings with excellent water resistance properties. These materials, derived from plants and other renewable sources, can be applied as emulsions or dispersions to create hydrophobic surfaces. The coatings are particularly effective for paper packaging applications where water and moisture resistance is required while maintaining compostability.Expand Specific Solutions

Leading Companies in Bio-based Pharmaceutical Packaging

The bio-based barrier coatings market for pharmaceutical and nutraceutical applications is in its growth phase, characterized by increasing demand for sustainable packaging solutions. The market is expanding rapidly, driven by regulatory pressures and consumer preference for eco-friendly alternatives, with projections suggesting a CAGR of 7-9% through 2030. Technologically, the field shows varying maturity levels, with companies like BASF Beauty Care Solutions, Lamberti SpA, and Michelman leading commercial applications, while academic institutions such as Jiangnan University and Delft University of Technology focus on fundamental research. Collaborations between industry players like Sun Chemical and research organizations like CSIRO are accelerating innovation, particularly in cellulose-based and biopolymer technologies. The competitive landscape features both specialty chemical companies and packaging material manufacturers working to overcome performance and cost challenges.

Jiangnan University

Technical Solution: Jiangnan University has developed advanced bio-based barrier coatings utilizing modified cellulose nanocrystals (CNCs) and protein composites specifically engineered for pharmaceutical applications. Their research focuses on creating hierarchical structures where CNCs provide exceptional oxygen barrier properties while protein matrices contribute flexibility and water resistance. The university's proprietary cross-linking technology enables the formation of covalent bonds between these components, resulting in stable barrier properties even under fluctuating humidity conditions. Their coatings demonstrate oxygen transmission rates below 0.5 cc/m²/day and water vapor transmission rates of approximately 2-5 g/m²/day, making them suitable for moisture-sensitive pharmaceuticals. The formulations incorporate natural antioxidants derived from tea polyphenols, providing additional protection against oxidative degradation of sensitive compounds. Notably, their technology allows for controlled biodegradation rates, enabling customization based on specific shelf-life requirements of pharmaceutical products.

Strengths: Exceptional oxygen barrier properties; incorporation of natural antioxidants for enhanced product protection; tunable biodegradation rates for different applications. Weaknesses: Complex manufacturing process requiring specialized equipment; higher cost compared to conventional alternatives; limited commercial-scale production experience.

Commonwealth Scientific & Industrial Research Organisation

Technical Solution: CSIRO has developed innovative bio-based barrier coatings using cellulose nanofibrils (CNF) and chitosan composites for pharmaceutical packaging. Their approach involves creating multi-layered structures where CNF provides mechanical strength while chitosan delivers antimicrobial properties and oxygen barrier functionality. The technology incorporates natural cross-linking agents to enhance water resistance without compromising biodegradability. CSIRO's research demonstrates that these coatings can achieve oxygen transmission rates below 1 cc/m²/day and water vapor transmission rates comparable to synthetic alternatives. Their formulations have been specifically optimized for pharmaceutical applications, ensuring compatibility with drug stability requirements and regulatory compliance. The coatings can be applied using conventional industrial equipment, facilitating commercial adoption without significant capital investment.

Strengths: Excellent oxygen barrier properties combined with antimicrobial functionality; environmentally sustainable solution with biodegradability; compatible with existing manufacturing processes. Weaknesses: Water barrier properties still lag behind some petroleum-based alternatives; higher production costs compared to conventional coatings; potential variability in raw material quality affecting performance consistency.

Key Patents and Innovations in Bio-based Barriers

Biowax polyhydroxyalkanoate dispersions as bio-based barrier coatings

PatentPendingUS20240344272A1

Innovation

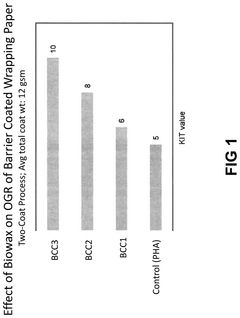

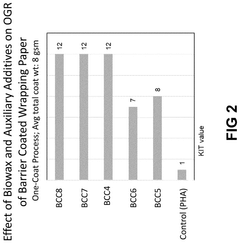

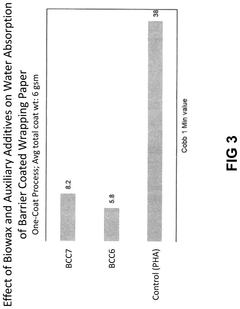

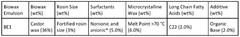

- The development of biowax emulsions combined with polyhydroxyalkanoate (PHA) dispersions and auxiliary additives, such as clay and microcrystalline cellulose, to form barrier coatings that can be applied at room temperature, achieving enhanced oil and water resistance with a high bio-based content.

Biowax emulsions as BIO-based barrier coating dispersions

PatentWO2024206605A1

Innovation

- Development of biowax emulsions derived from hydrogenated bio-based oils (such as castor oil) as sustainable alternatives to petroleum-based barrier coatings.

- Creation of a barrier coating composition by dispersing biowax emulsion into a polyacrylate carrier dispersion that can be applied using conventional industrial methods at ambient temperatures.

- Application of the bio-based barrier coating on paper and board substrates, including those made from recycled fibers, expanding sustainable packaging options.

Regulatory Framework for Pharmaceutical Packaging Materials

The regulatory landscape governing pharmaceutical packaging materials is complex and multifaceted, with stringent requirements designed to ensure patient safety and product efficacy. For bio-based barrier coatings in pharmaceutical and nutraceutical applications, compliance with these regulations is paramount for market acceptance and commercial viability.

In the United States, the Food and Drug Administration (FDA) regulates pharmaceutical packaging materials primarily through 21 CFR 174-186, which addresses food contact substances that may also apply to certain pharmaceutical packaging components. Additionally, the FDA's Inactive Ingredient Guide (IIG) lists materials considered safe for use in drug formulations and packaging. Bio-based barrier coatings must undergo thorough safety assessments and demonstrate that they do not interact with or migrate into the pharmaceutical products they protect.

The European Union employs a more comprehensive approach through the European Medicines Agency (EMA). Regulation (EC) No 1935/2004 establishes the general principles for materials intended to contact food, which often serves as a reference for pharmaceutical packaging. The EU also implements specific measures for certain materials through Regulation (EU) No 10/2011 for plastics. Novel bio-based coatings must comply with these frameworks and may require specific authorization before market introduction.

Japan's regulatory system operates under the Pharmaceutical and Medical Device Agency (PMDA), which enforces the Pharmaceutical Affairs Law. This framework includes specific provisions for packaging materials that come into direct contact with pharmaceutical products, requiring extensive stability and compatibility testing.

International harmonization efforts are led by the International Conference on Harmonisation (ICH), particularly through guidelines such as ICH Q8 (Pharmaceutical Development) and ICH Q3 (Impurities). These guidelines address packaging considerations and potential interactions between packaging materials and pharmaceutical products.

For bio-based barrier coatings specifically, additional considerations include sustainability certifications such as ASTM D6866 for bio-based content verification and EN 13432 for compostability. These standards, while not strictly regulatory requirements, are increasingly important for market differentiation and consumer acceptance.

Regulatory compliance pathways for novel bio-based barrier coatings typically involve extensive migration studies, extractables and leachables assessments, and stability testing under various environmental conditions. Manufacturers must demonstrate that their coatings maintain barrier properties throughout the product's shelf life while ensuring no harmful substances migrate into the pharmaceutical or nutraceutical product.

Recent regulatory trends indicate increasing acceptance of sustainable packaging solutions, provided they meet or exceed the performance and safety standards of conventional materials. This presents both an opportunity and challenge for bio-based barrier coating developers, who must navigate complex regulatory frameworks while delivering innovative, environmentally friendly solutions.

In the United States, the Food and Drug Administration (FDA) regulates pharmaceutical packaging materials primarily through 21 CFR 174-186, which addresses food contact substances that may also apply to certain pharmaceutical packaging components. Additionally, the FDA's Inactive Ingredient Guide (IIG) lists materials considered safe for use in drug formulations and packaging. Bio-based barrier coatings must undergo thorough safety assessments and demonstrate that they do not interact with or migrate into the pharmaceutical products they protect.

The European Union employs a more comprehensive approach through the European Medicines Agency (EMA). Regulation (EC) No 1935/2004 establishes the general principles for materials intended to contact food, which often serves as a reference for pharmaceutical packaging. The EU also implements specific measures for certain materials through Regulation (EU) No 10/2011 for plastics. Novel bio-based coatings must comply with these frameworks and may require specific authorization before market introduction.

Japan's regulatory system operates under the Pharmaceutical and Medical Device Agency (PMDA), which enforces the Pharmaceutical Affairs Law. This framework includes specific provisions for packaging materials that come into direct contact with pharmaceutical products, requiring extensive stability and compatibility testing.

International harmonization efforts are led by the International Conference on Harmonisation (ICH), particularly through guidelines such as ICH Q8 (Pharmaceutical Development) and ICH Q3 (Impurities). These guidelines address packaging considerations and potential interactions between packaging materials and pharmaceutical products.

For bio-based barrier coatings specifically, additional considerations include sustainability certifications such as ASTM D6866 for bio-based content verification and EN 13432 for compostability. These standards, while not strictly regulatory requirements, are increasingly important for market differentiation and consumer acceptance.

Regulatory compliance pathways for novel bio-based barrier coatings typically involve extensive migration studies, extractables and leachables assessments, and stability testing under various environmental conditions. Manufacturers must demonstrate that their coatings maintain barrier properties throughout the product's shelf life while ensuring no harmful substances migrate into the pharmaceutical or nutraceutical product.

Recent regulatory trends indicate increasing acceptance of sustainable packaging solutions, provided they meet or exceed the performance and safety standards of conventional materials. This presents both an opportunity and challenge for bio-based barrier coating developers, who must navigate complex regulatory frameworks while delivering innovative, environmentally friendly solutions.

Sustainability Impact Assessment

The adoption of bio-based barrier coatings in pharmaceutical and nutraceutical packaging represents a significant shift toward environmental sustainability in these industries. When assessing the sustainability impact of these innovative materials, multiple dimensions must be considered across the entire lifecycle of the products.

From a raw material perspective, bio-based coatings derived from renewable resources such as cellulose, chitosan, and plant proteins significantly reduce dependence on fossil fuel-based polymers. This transition can potentially decrease carbon footprint by 30-60% compared to conventional petroleum-based alternatives, according to recent lifecycle assessment studies. The cultivation of these biological feedstocks, however, requires careful management to prevent negative land-use impacts and competition with food production.

Manufacturing processes for bio-based barrier coatings typically consume less energy and generate fewer greenhouse gas emissions than traditional synthetic coating production. Research indicates potential energy savings of 15-40% depending on the specific bio-based formulation and processing technology employed. Water consumption patterns also generally favor bio-based alternatives, though regional water stress factors must be considered in comprehensive assessments.

End-of-life considerations reveal perhaps the most significant sustainability advantages. Bio-based barrier coatings can be designed for biodegradability or compostability, addressing the growing pharmaceutical packaging waste challenge. This characteristic potentially reduces the estimated 85,000 tons of pharmaceutical packaging waste entering landfills annually in developed countries alone. Additionally, these materials can minimize microplastic pollution, an emerging concern with conventional polymer coatings.

Economic sustainability analysis indicates that while current bio-based solutions may carry 10-30% price premiums, scaling effects and technological improvements are rapidly narrowing this gap. The total cost of ownership, including disposal and environmental remediation costs, increasingly favors bio-based alternatives as regulatory frameworks evolve to internalize environmental externalities.

Social sustainability dimensions include reduced exposure to potentially harmful synthetic chemicals for both consumers and production workers. Furthermore, the development of bio-based coating industries creates opportunities for agricultural communities and biorefinery operations, potentially supporting rural economic development and diversification.

Regulatory recognition of these sustainability benefits is evidenced by preferential treatment in green procurement policies and emerging extended producer responsibility frameworks in multiple jurisdictions, creating additional market drivers for adoption beyond the inherent environmental advantages.

From a raw material perspective, bio-based coatings derived from renewable resources such as cellulose, chitosan, and plant proteins significantly reduce dependence on fossil fuel-based polymers. This transition can potentially decrease carbon footprint by 30-60% compared to conventional petroleum-based alternatives, according to recent lifecycle assessment studies. The cultivation of these biological feedstocks, however, requires careful management to prevent negative land-use impacts and competition with food production.

Manufacturing processes for bio-based barrier coatings typically consume less energy and generate fewer greenhouse gas emissions than traditional synthetic coating production. Research indicates potential energy savings of 15-40% depending on the specific bio-based formulation and processing technology employed. Water consumption patterns also generally favor bio-based alternatives, though regional water stress factors must be considered in comprehensive assessments.

End-of-life considerations reveal perhaps the most significant sustainability advantages. Bio-based barrier coatings can be designed for biodegradability or compostability, addressing the growing pharmaceutical packaging waste challenge. This characteristic potentially reduces the estimated 85,000 tons of pharmaceutical packaging waste entering landfills annually in developed countries alone. Additionally, these materials can minimize microplastic pollution, an emerging concern with conventional polymer coatings.

Economic sustainability analysis indicates that while current bio-based solutions may carry 10-30% price premiums, scaling effects and technological improvements are rapidly narrowing this gap. The total cost of ownership, including disposal and environmental remediation costs, increasingly favors bio-based alternatives as regulatory frameworks evolve to internalize environmental externalities.

Social sustainability dimensions include reduced exposure to potentially harmful synthetic chemicals for both consumers and production workers. Furthermore, the development of bio-based coating industries creates opportunities for agricultural communities and biorefinery operations, potentially supporting rural economic development and diversification.

Regulatory recognition of these sustainability benefits is evidenced by preferential treatment in green procurement policies and emerging extended producer responsibility frameworks in multiple jurisdictions, creating additional market drivers for adoption beyond the inherent environmental advantages.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!