Bio-based Barrier Coatings for Paper and Board Substrates

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-based Barrier Coatings Background and Objectives

Bio-based barrier coatings for paper and board substrates have emerged as a critical area of research in response to growing environmental concerns and sustainability demands across various industries. Historically, petroleum-based polymers and synthetic materials have dominated the packaging sector due to their excellent barrier properties against moisture, oxygen, and grease. However, these conventional solutions present significant environmental challenges, including poor biodegradability and reliance on non-renewable resources.

The evolution of bio-based barrier coatings can be traced back to early experiments with natural waxes and resins in the mid-20th century. Significant advancements occurred in the 1990s with the development of starch-based coatings, followed by cellulose derivatives in the early 2000s. The past decade has witnessed accelerated innovation in this field, driven by stricter environmental regulations and changing consumer preferences toward sustainable packaging solutions.

Current technological trends indicate a shift toward multi-functional bio-based coatings that not only provide barrier properties but also offer additional benefits such as antimicrobial activity, improved printability, and enhanced mechanical strength. Research is increasingly focused on developing hybrid systems that combine different bio-based materials to achieve synergistic effects and overcome individual limitations of natural polymers.

The primary objective of research in this field is to develop bio-based barrier coatings that match or exceed the performance of conventional petroleum-based alternatives while maintaining environmental compatibility. Specific technical goals include achieving water vapor transmission rates below 10 g/m²/day, oxygen permeability under 10 cm³/m²/day, and grease resistance comparable to fluorocarbon treatments, all while ensuring biodegradability and compostability.

Additionally, researchers aim to address scalability challenges by developing coating formulations compatible with existing industrial equipment and processes. Cost-effectiveness remains a critical consideration, as bio-based alternatives must approach price parity with conventional solutions to achieve widespread market adoption.

The technological trajectory suggests continued exploration of novel bio-polymers, including proteins, polysaccharides, and lipids, as well as their modifications and combinations. Nanotechnology applications, particularly the incorporation of cellulose nanocrystals and nanofibrillar cellulose, represent promising avenues for enhancing barrier properties while maintaining the renewable nature of these materials.

The evolution of bio-based barrier coatings can be traced back to early experiments with natural waxes and resins in the mid-20th century. Significant advancements occurred in the 1990s with the development of starch-based coatings, followed by cellulose derivatives in the early 2000s. The past decade has witnessed accelerated innovation in this field, driven by stricter environmental regulations and changing consumer preferences toward sustainable packaging solutions.

Current technological trends indicate a shift toward multi-functional bio-based coatings that not only provide barrier properties but also offer additional benefits such as antimicrobial activity, improved printability, and enhanced mechanical strength. Research is increasingly focused on developing hybrid systems that combine different bio-based materials to achieve synergistic effects and overcome individual limitations of natural polymers.

The primary objective of research in this field is to develop bio-based barrier coatings that match or exceed the performance of conventional petroleum-based alternatives while maintaining environmental compatibility. Specific technical goals include achieving water vapor transmission rates below 10 g/m²/day, oxygen permeability under 10 cm³/m²/day, and grease resistance comparable to fluorocarbon treatments, all while ensuring biodegradability and compostability.

Additionally, researchers aim to address scalability challenges by developing coating formulations compatible with existing industrial equipment and processes. Cost-effectiveness remains a critical consideration, as bio-based alternatives must approach price parity with conventional solutions to achieve widespread market adoption.

The technological trajectory suggests continued exploration of novel bio-polymers, including proteins, polysaccharides, and lipids, as well as their modifications and combinations. Nanotechnology applications, particularly the incorporation of cellulose nanocrystals and nanofibrillar cellulose, represent promising avenues for enhancing barrier properties while maintaining the renewable nature of these materials.

Market Demand Analysis for Sustainable Packaging

The global packaging industry is experiencing a significant shift towards sustainable solutions, driven by increasing environmental concerns and regulatory pressures. The market for sustainable packaging is projected to grow at a compound annual growth rate of 7.5% between 2021 and 2026, reaching a value of $440 billion by 2026. This growth is particularly evident in the food and beverage sector, where consumer demand for eco-friendly packaging solutions has surged by over 30% in the past five years.

Bio-based barrier coatings for paper and board substrates represent a critical segment within this expanding market. Traditional packaging materials often rely on petroleum-based plastics or aluminum foil to provide barrier properties against moisture, oxygen, and grease. However, these conventional solutions pose significant environmental challenges, including poor biodegradability and recycling difficulties.

Consumer awareness regarding packaging sustainability has reached unprecedented levels, with recent surveys indicating that 73% of consumers are willing to pay a premium for products with sustainable packaging. Major retail chains and food service companies have responded by establishing ambitious sustainability targets, many aiming to transition to 100% recyclable, reusable, or compostable packaging by 2025-2030.

Regulatory frameworks worldwide are increasingly favoring bio-based alternatives. The European Union's Single-Use Plastics Directive, China's plastic reduction policies, and similar regulations in North America have created strong market pull for innovative bio-based barrier solutions. These regulatory developments have accelerated research and development investments in the sector by approximately 25% annually since 2018.

The food packaging segment dominates the demand for bio-based barrier coatings, accounting for approximately 65% of market applications. This is followed by beverage packaging (15%), pharmaceutical packaging (10%), and other applications (10%). Within food packaging, fresh produce, bakery products, and ready-to-eat meals represent the fastest-growing application areas, with combined annual growth exceeding 9%.

Market analysis reveals significant regional variations in adoption patterns. Europe leads in market maturity and adoption rate, followed by North America, while Asia-Pacific represents the fastest-growing regional market with annual growth exceeding 10%. This regional disparity is largely attributed to differences in regulatory frameworks, consumer awareness, and industrial infrastructure.

Cost remains a significant market barrier, with bio-based solutions typically commanding a 15-30% premium over conventional alternatives. However, this gap is narrowing as production scales increase and technology advances. Industry experts project price parity for certain applications within the next 3-5 years, which would substantially accelerate market penetration and adoption rates across various packaging segments.

Bio-based barrier coatings for paper and board substrates represent a critical segment within this expanding market. Traditional packaging materials often rely on petroleum-based plastics or aluminum foil to provide barrier properties against moisture, oxygen, and grease. However, these conventional solutions pose significant environmental challenges, including poor biodegradability and recycling difficulties.

Consumer awareness regarding packaging sustainability has reached unprecedented levels, with recent surveys indicating that 73% of consumers are willing to pay a premium for products with sustainable packaging. Major retail chains and food service companies have responded by establishing ambitious sustainability targets, many aiming to transition to 100% recyclable, reusable, or compostable packaging by 2025-2030.

Regulatory frameworks worldwide are increasingly favoring bio-based alternatives. The European Union's Single-Use Plastics Directive, China's plastic reduction policies, and similar regulations in North America have created strong market pull for innovative bio-based barrier solutions. These regulatory developments have accelerated research and development investments in the sector by approximately 25% annually since 2018.

The food packaging segment dominates the demand for bio-based barrier coatings, accounting for approximately 65% of market applications. This is followed by beverage packaging (15%), pharmaceutical packaging (10%), and other applications (10%). Within food packaging, fresh produce, bakery products, and ready-to-eat meals represent the fastest-growing application areas, with combined annual growth exceeding 9%.

Market analysis reveals significant regional variations in adoption patterns. Europe leads in market maturity and adoption rate, followed by North America, while Asia-Pacific represents the fastest-growing regional market with annual growth exceeding 10%. This regional disparity is largely attributed to differences in regulatory frameworks, consumer awareness, and industrial infrastructure.

Cost remains a significant market barrier, with bio-based solutions typically commanding a 15-30% premium over conventional alternatives. However, this gap is narrowing as production scales increase and technology advances. Industry experts project price parity for certain applications within the next 3-5 years, which would substantially accelerate market penetration and adoption rates across various packaging segments.

Current Status and Challenges in Bio-based Barrier Technology

The global landscape of bio-based barrier technology has witnessed significant advancements in recent years, yet remains at a transitional stage between laboratory research and widespread commercial implementation. Currently, several bio-based materials have demonstrated promising barrier properties, including cellulose nanofibers (CNF), chitosan, alginate, and various plant-derived proteins and waxes. These materials have shown potential to replace conventional petroleum-based barriers in paper packaging applications, particularly for food contact materials.

In Europe, research institutions and companies have made substantial progress in developing cellulose-based barriers with water vapor transmission rates (WVTR) approaching those of synthetic polymers. However, these solutions still lag behind traditional petroleum-based barriers in terms of oxygen barrier properties under varying humidity conditions, presenting a significant technical challenge.

The North American market has seen increased investment in starch-based coatings enhanced with nanomaterials, while Asian manufacturers have advanced the commercial application of chitosan and seaweed-derived barriers. Despite these regional developments, scalability remains a universal challenge across the industry.

A critical technical limitation is the inherent hydrophilicity of most bio-based materials, which compromises their barrier performance in humid environments. Current research focuses on chemical modifications and composite formulations to overcome this weakness, but achieving consistent performance across varying environmental conditions remains elusive.

Production scalability presents another significant hurdle. Laboratory-scale processes for bio-based barrier coatings often involve complex preparation methods that are difficult to translate to industrial production lines. The viscosity control of bio-based coating formulations during high-speed application processes represents a particular challenge for manufacturers attempting to maintain production efficiency.

Cost competitiveness continues to be a major constraint. Bio-based barrier materials typically cost 30-50% more than their petroleum-based counterparts, primarily due to limited production volumes and complex processing requirements. This price differential has slowed adoption, particularly in price-sensitive market segments.

Regulatory frameworks across different regions show inconsistencies in the approval and certification of bio-based materials for food contact applications. While the EU has established clear guidelines through regulations such as EC 1935/2004, other regions have less defined approaches, creating market entry barriers for innovative solutions.

The environmental impact assessment of these materials presents another challenge. While bio-based barriers offer advantages in biodegradability and renewable sourcing, comprehensive life cycle analyses reveal complexities in water usage, land use, and energy consumption during production that must be addressed to ensure true sustainability.

In Europe, research institutions and companies have made substantial progress in developing cellulose-based barriers with water vapor transmission rates (WVTR) approaching those of synthetic polymers. However, these solutions still lag behind traditional petroleum-based barriers in terms of oxygen barrier properties under varying humidity conditions, presenting a significant technical challenge.

The North American market has seen increased investment in starch-based coatings enhanced with nanomaterials, while Asian manufacturers have advanced the commercial application of chitosan and seaweed-derived barriers. Despite these regional developments, scalability remains a universal challenge across the industry.

A critical technical limitation is the inherent hydrophilicity of most bio-based materials, which compromises their barrier performance in humid environments. Current research focuses on chemical modifications and composite formulations to overcome this weakness, but achieving consistent performance across varying environmental conditions remains elusive.

Production scalability presents another significant hurdle. Laboratory-scale processes for bio-based barrier coatings often involve complex preparation methods that are difficult to translate to industrial production lines. The viscosity control of bio-based coating formulations during high-speed application processes represents a particular challenge for manufacturers attempting to maintain production efficiency.

Cost competitiveness continues to be a major constraint. Bio-based barrier materials typically cost 30-50% more than their petroleum-based counterparts, primarily due to limited production volumes and complex processing requirements. This price differential has slowed adoption, particularly in price-sensitive market segments.

Regulatory frameworks across different regions show inconsistencies in the approval and certification of bio-based materials for food contact applications. While the EU has established clear guidelines through regulations such as EC 1935/2004, other regions have less defined approaches, creating market entry barriers for innovative solutions.

The environmental impact assessment of these materials presents another challenge. While bio-based barriers offer advantages in biodegradability and renewable sourcing, comprehensive life cycle analyses reveal complexities in water usage, land use, and energy consumption during production that must be addressed to ensure true sustainability.

Current Bio-based Barrier Coating Solutions

01 Cellulose-based barrier coatings

Cellulose-derived materials are used to create bio-based barrier coatings with excellent oxygen and moisture barrier properties. These coatings utilize nanocellulose, cellulose nanofibrils, or modified cellulose derivatives to form dense, crystalline structures that effectively block gas permeation. The renewable nature of cellulose makes these coatings environmentally friendly while providing comparable performance to synthetic alternatives. These coatings can be applied to various substrates including paper, paperboard, and flexible packaging materials.- Cellulose-based barrier coatings: Cellulose-derived materials are used to create bio-based barrier coatings with excellent oxygen and moisture barrier properties. These coatings utilize nanocellulose, cellulose nanofibrils, or modified cellulose derivatives to form dense, crystalline networks that restrict gas and vapor transmission. The renewable nature of cellulose makes these coatings environmentally friendly while providing competitive barrier performance compared to conventional petroleum-based alternatives.

- Protein and starch-based barrier materials: Proteins and starches derived from agricultural sources can be formulated into effective barrier coatings. These biomaterials can be modified through various processes including crosslinking, blending with plasticizers, or chemical modification to enhance their barrier properties against oxygen, moisture, and grease. The formulations typically leverage the natural film-forming abilities of proteins like zein, soy, or whey, while starches provide structural integrity and additional barrier functionality.

- Lignin and plant oil-based barrier coatings: Lignin, a byproduct of paper production, and plant oils can be utilized to create hydrophobic barrier coatings with excellent water resistance. These materials can be chemically modified or polymerized to enhance their barrier properties. The natural phenolic structure of lignin provides inherent UV protection and antioxidant properties, while plant oils contribute flexibility and water repellency to the coating formulations.

- Bio-based composite barrier systems: Composite systems combining multiple bio-based materials can create synergistic barrier properties. These multilayer or blended systems often incorporate nanomaterials, clay, or other mineral reinforcements to enhance barrier performance. The composite approach allows for customization of barrier properties by leveraging the strengths of different biomaterials while minimizing their individual weaknesses, resulting in coatings that can effectively block oxygen, moisture, and other permeants.

- Processing techniques for bio-based barrier coatings: Specialized processing techniques are crucial for optimizing the barrier properties of bio-based coatings. Methods such as solvent casting, extrusion, spray drying, and layer-by-layer deposition can significantly impact the final barrier performance. Post-processing treatments including heat curing, UV irradiation, or plasma treatment can further enhance barrier properties by promoting crosslinking, increasing crystallinity, or modifying surface characteristics of the bio-based coating materials.

02 Protein and polysaccharide composite barriers

Composite barrier coatings combining proteins (such as whey, soy, or zein) with polysaccharides (like chitosan, pectin, or alginate) create synergistic barrier properties against oxygen, moisture, and grease. These multi-component systems leverage the complementary properties of different bio-polymers to overcome the limitations of single-component barriers. The protein components typically provide good oxygen barriers while polysaccharides enhance moisture resistance. Cross-linking agents are often incorporated to improve the mechanical strength and barrier performance of these composite coatings.Expand Specific Solutions03 Plant oil-derived barrier coatings

Barrier coatings derived from plant oils such as soybean, linseed, and palm oil offer excellent water resistance and moderate oxygen barrier properties. These coatings utilize the hydrophobic nature of fatty acids and their derivatives to create water-repellent surfaces. Epoxidation, polymerization, or other chemical modifications of plant oils enhance their barrier performance and mechanical properties. These coatings are particularly effective for applications requiring grease resistance and water repellency while maintaining biodegradability.Expand Specific Solutions04 Starch-based barrier formulations

Starch-based barrier coatings provide cost-effective, biodegradable alternatives to synthetic barriers. These formulations typically incorporate modified starches (acetylated, hydroxypropylated, or cross-linked) to overcome the inherent hydrophilicity of native starch. Plasticizers like glycerol or sorbitol are added to improve flexibility, while hydrophobic additives enhance moisture resistance. These coatings can be applied using conventional coating methods and are particularly suitable for food packaging applications where compostability is desired alongside barrier functionality.Expand Specific Solutions05 Biopolymer-nanoparticle hybrid barriers

Hybrid barrier coatings combining biopolymers with nanoparticles create high-performance barriers with enhanced properties. Nanomaterials such as clay, silica, or metal oxide nanoparticles are dispersed within biopolymer matrices to create tortuous paths that impede gas and moisture diffusion. These nanocomposite structures significantly improve barrier properties while maintaining the biodegradability of the base biopolymer. The nanoparticles also often enhance mechanical strength, thermal stability, and UV resistance of the coating, making these hybrid systems suitable for demanding packaging applications.Expand Specific Solutions

Key Industry Players in Sustainable Packaging Materials

The bio-based barrier coatings market for paper and board substrates is in a growth phase, driven by increasing demand for sustainable packaging solutions. The market is expanding rapidly with an estimated value of over $1 billion and projected annual growth of 7-9%. Technologically, the field is advancing from early commercial applications toward maturity, with key players demonstrating varying levels of innovation. Companies like Kemira Oyj, Stora Enso, and UPM-Kymmene lead with comprehensive solutions, while research institutions such as VTT and China National Pulp & Paper Research Institute provide critical R&D support. Chemical specialists including BASF, Solenis, and Dow are developing specialized formulations, creating a competitive landscape where collaboration between paper manufacturers and chemical suppliers is increasingly common.

Kemira Oyj

Technical Solution: Kemira has developed FennoGuard™, a comprehensive suite of bio-based barrier coating solutions specifically designed for paper and board packaging applications. Their technology utilizes modified biopolymers derived from agricultural sources combined with functional additives to create water-based dispersions that can be applied using conventional coating equipment. Kemira's approach focuses on creating multi-layer barrier systems where each layer provides specific functionality – water resistance, oxygen barrier, grease resistance, or heat-sealability[7]. Their proprietary cross-linking technology enhances the performance of natural polymers like starches and proteins to achieve barrier properties comparable to synthetic alternatives. Kemira has also developed bio-based additives that improve the coating rheology and application properties, ensuring uniform coverage and adhesion to various paper and board substrates. Their recent innovations include water-based barrier dispersions with improved heat-sealability, enabling the production of fully recyclable and biodegradable packaging materials suitable for food contact applications[8].

Strengths: Extensive expertise in paper chemistry and coating technologies enables tailored solutions for specific customer requirements. Their water-based formulations are compatible with existing coating equipment, facilitating industry adoption. Weaknesses: Some formulations may require higher coat weights compared to synthetic alternatives to achieve equivalent barrier properties, potentially impacting material efficiency. Performance in high-humidity environments remains challenging for certain applications.

Stora Enso Oyj

Technical Solution: Stora Enso has developed advanced bio-based barrier coatings utilizing lignin and hemicellulose extracted from wood pulp processing. Their proprietary MFC (Microfibrillated Cellulose) technology creates dense, oxygen-impermeable networks that serve as effective barriers against oxygen, water vapor, and grease. The company has successfully commercialized Natura™, a plastic-free, biodegradable barrier board for food packaging that combines MFC with bio-based polymers derived from agricultural by-products[1]. Their recent innovation includes a water-based dispersion coating that creates a recyclable alternative to traditional plastic-coated food packaging materials. This technology employs bio-based polymers extracted from side streams of the pulping process, creating a circular economy approach while maintaining barrier properties comparable to fossil-based alternatives[2]. Stora Enso has also developed a bio-based barrier coating that is heat-sealable, allowing for complete plastic replacement in packaging applications.

Strengths: Fully integrated supply chain from forest to finished product gives them control over raw material quality and sustainability. Their solutions are commercially scaled and market-proven with established recycling streams. Weaknesses: Higher production costs compared to conventional plastic barriers may limit market penetration in price-sensitive segments. Some applications still require performance improvements to match petroleum-based alternatives in extreme conditions.

Critical Patents and Innovations in Bio-based Coatings

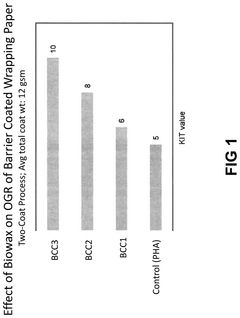

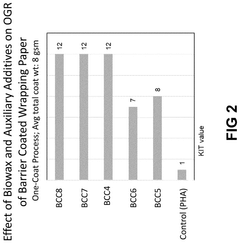

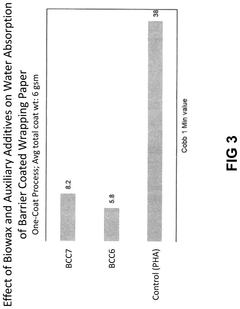

Biowax polyhydroxyalkanoate dispersions as bio-based barrier coatings

PatentPendingUS20240344272A1

Innovation

- The development of biowax emulsions combined with polyhydroxyalkanoate (PHA) dispersions and auxiliary additives, such as clay and microcrystalline cellulose, to form barrier coatings that can be applied at room temperature, achieving enhanced oil and water resistance with a high bio-based content.

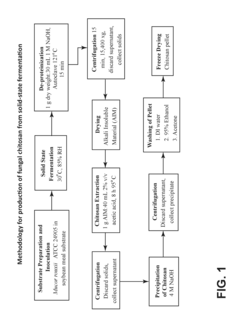

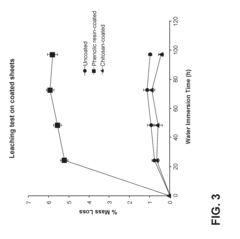

Chitosan as a biobased barrier coating for functional paperboard products

PatentActiveUS20170016182A1

Innovation

- Chitosan coatings derived from fungal solid-state fermentation using soybean meal, which provide enhanced wet stiffness, water absorption, and durability, while being recyclable and cost-effective, are applied to paper and paperboard products.

Environmental Impact Assessment and Lifecycle Analysis

The environmental impact of bio-based barrier coatings represents a critical dimension in evaluating their viability as alternatives to conventional petroleum-based materials. Life Cycle Assessment (LCA) studies indicate that bio-based coatings generally demonstrate reduced carbon footprints compared to their synthetic counterparts, with potential reductions of 30-60% in greenhouse gas emissions depending on feedstock selection and processing methods.

Raw material sourcing constitutes a significant factor in environmental performance. Agricultural feedstocks for bio-based coatings must be evaluated for land use impacts, water consumption, and biodiversity effects. Notably, second-generation feedstocks derived from agricultural residues or by-products present superior environmental profiles by avoiding competition with food production and utilizing waste streams.

Manufacturing processes for bio-based barrier coatings typically consume less energy than conventional coating production, though this advantage may be partially offset by more complex processing requirements for certain bio-based materials. Water-based application systems further enhance environmental benefits by eliminating volatile organic compound (VOC) emissions associated with solvent-based alternatives.

End-of-life considerations strongly favor bio-based coatings, as many formulations demonstrate enhanced biodegradability in industrial composting facilities. Recent studies indicate that certain starch and cellulose-based coatings can decompose by over 90% within 180 days under controlled composting conditions, compared to negligible degradation for conventional petroleum-based barriers.

Recyclability presents both challenges and opportunities. While some bio-based coatings may impede traditional paper recycling processes, innovations in coating design increasingly focus on repulpability. Advanced enzymatic treatments show promise in facilitating the separation of bio-based barriers during recycling operations without compromising fiber quality.

Water footprint analyses reveal that production of bio-based coatings typically requires more water than petroleum-based alternatives during the agricultural phase. However, this is often counterbalanced by reduced water pollution impacts during manufacturing and disposal stages, resulting in a more favorable overall water impact profile when assessed across the complete lifecycle.

Regulatory frameworks increasingly incorporate lifecycle thinking, with policies in Europe and North America beginning to mandate lifecycle assessments for packaging materials. The EU's Circular Economy Action Plan specifically identifies bio-based packaging as a priority area, creating market incentives for solutions with demonstrable environmental benefits across their complete lifecycle.

Raw material sourcing constitutes a significant factor in environmental performance. Agricultural feedstocks for bio-based coatings must be evaluated for land use impacts, water consumption, and biodiversity effects. Notably, second-generation feedstocks derived from agricultural residues or by-products present superior environmental profiles by avoiding competition with food production and utilizing waste streams.

Manufacturing processes for bio-based barrier coatings typically consume less energy than conventional coating production, though this advantage may be partially offset by more complex processing requirements for certain bio-based materials. Water-based application systems further enhance environmental benefits by eliminating volatile organic compound (VOC) emissions associated with solvent-based alternatives.

End-of-life considerations strongly favor bio-based coatings, as many formulations demonstrate enhanced biodegradability in industrial composting facilities. Recent studies indicate that certain starch and cellulose-based coatings can decompose by over 90% within 180 days under controlled composting conditions, compared to negligible degradation for conventional petroleum-based barriers.

Recyclability presents both challenges and opportunities. While some bio-based coatings may impede traditional paper recycling processes, innovations in coating design increasingly focus on repulpability. Advanced enzymatic treatments show promise in facilitating the separation of bio-based barriers during recycling operations without compromising fiber quality.

Water footprint analyses reveal that production of bio-based coatings typically requires more water than petroleum-based alternatives during the agricultural phase. However, this is often counterbalanced by reduced water pollution impacts during manufacturing and disposal stages, resulting in a more favorable overall water impact profile when assessed across the complete lifecycle.

Regulatory frameworks increasingly incorporate lifecycle thinking, with policies in Europe and North America beginning to mandate lifecycle assessments for packaging materials. The EU's Circular Economy Action Plan specifically identifies bio-based packaging as a priority area, creating market incentives for solutions with demonstrable environmental benefits across their complete lifecycle.

Regulatory Framework for Food-Contact Bio-based Materials

The regulatory landscape for food-contact bio-based materials is complex and continuously evolving, reflecting growing concerns about food safety and environmental sustainability. In the European Union, Regulation (EC) No. 1935/2004 serves as the cornerstone legislation, establishing that materials in contact with food must not transfer constituents to food in quantities that could endanger human health or bring unacceptable changes to food composition. This framework is particularly relevant for bio-based barrier coatings on paper and board substrates intended for food packaging applications.

The EU has further refined these requirements through Regulation (EU) No. 10/2011 for plastic materials, which includes provisions that may apply to certain bio-based polymers used in barrier coatings. Additionally, the German Recommendation BfR XXXVI specifically addresses paper and board for food contact, providing guidelines that manufacturers of bio-based coatings must consider.

In the United States, the Food and Drug Administration (FDA) regulates food-contact materials under the Federal Food, Drug, and Cosmetic Act. Bio-based materials must comply with FDA's Food Contact Notification (FCN) program or be Generally Recognized as Safe (GRAS). The FDA has established specific migration limits for various substances that might be present in bio-based coatings, ensuring consumer safety.

Japan's regulatory system operates under the Food Sanitation Law, which includes the Positive List System for food-contact materials. This system specifies substances permitted for use in food packaging, including bio-based materials, and establishes migration limits for these substances.

Emerging regulations are increasingly focusing on sustainability aspects of packaging materials. The EU's Single-Use Plastics Directive (Directive 2019/904) promotes the transition to circular economy models, indirectly encouraging the development of sustainable alternatives like bio-based barrier coatings. Similarly, various national initiatives are implementing extended producer responsibility (EPR) schemes that favor environmentally friendly packaging solutions.

Certification systems such as EN 13432 for compostability and biodegradability provide standardized frameworks for validating environmental claims of bio-based materials. These certifications are becoming increasingly important as consumers and regulators demand transparent sustainability credentials.

The regulatory landscape also includes emerging concerns about specific chemicals in food packaging. Per- and polyfluoroalkyl substances (PFAS), commonly used in conventional barrier coatings, face increasing restrictions globally, creating regulatory drivers for bio-based alternatives that can deliver similar performance without the associated health and environmental concerns.

The EU has further refined these requirements through Regulation (EU) No. 10/2011 for plastic materials, which includes provisions that may apply to certain bio-based polymers used in barrier coatings. Additionally, the German Recommendation BfR XXXVI specifically addresses paper and board for food contact, providing guidelines that manufacturers of bio-based coatings must consider.

In the United States, the Food and Drug Administration (FDA) regulates food-contact materials under the Federal Food, Drug, and Cosmetic Act. Bio-based materials must comply with FDA's Food Contact Notification (FCN) program or be Generally Recognized as Safe (GRAS). The FDA has established specific migration limits for various substances that might be present in bio-based coatings, ensuring consumer safety.

Japan's regulatory system operates under the Food Sanitation Law, which includes the Positive List System for food-contact materials. This system specifies substances permitted for use in food packaging, including bio-based materials, and establishes migration limits for these substances.

Emerging regulations are increasingly focusing on sustainability aspects of packaging materials. The EU's Single-Use Plastics Directive (Directive 2019/904) promotes the transition to circular economy models, indirectly encouraging the development of sustainable alternatives like bio-based barrier coatings. Similarly, various national initiatives are implementing extended producer responsibility (EPR) schemes that favor environmentally friendly packaging solutions.

Certification systems such as EN 13432 for compostability and biodegradability provide standardized frameworks for validating environmental claims of bio-based materials. These certifications are becoming increasingly important as consumers and regulators demand transparent sustainability credentials.

The regulatory landscape also includes emerging concerns about specific chemicals in food packaging. Per- and polyfluoroalkyl substances (PFAS), commonly used in conventional barrier coatings, face increasing restrictions globally, creating regulatory drivers for bio-based alternatives that can deliver similar performance without the associated health and environmental concerns.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!