Bio-based Barrier Coatings with Enhanced Oil and Grease Resistance

OCT 13, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-based Barrier Coatings Background and Objectives

The evolution of packaging materials has been significantly influenced by environmental concerns and sustainability goals over the past few decades. Traditional petroleum-based barrier coatings, while effective in protecting food products from moisture, oxygen, and grease, have raised serious environmental issues due to their non-biodegradable nature and contribution to plastic pollution. This has catalyzed research into bio-based alternatives that can provide comparable barrier properties while reducing environmental impact.

Bio-based barrier coatings represent a promising frontier in sustainable packaging solutions, derived from renewable resources such as cellulose, chitosan, proteins, and plant-based polymers. The development trajectory of these materials has accelerated since the early 2000s, with significant breakthroughs in improving their functional properties, particularly water resistance and mechanical strength. However, achieving adequate oil and grease resistance has remained a persistent challenge in this field.

The global push toward circular economy principles and stricter regulations on single-use plastics have further intensified the focus on developing effective bio-based barrier materials. Countries across Europe, North America, and increasingly Asia have implemented policies encouraging or mandating the transition to more sustainable packaging solutions, creating both regulatory pressure and market opportunities for innovation in this space.

Recent technological advancements in biopolymer science, nanotechnology, and surface modification techniques have opened new pathways for enhancing the performance of bio-based coatings. These developments suggest that we are approaching a tipping point where bio-based solutions may achieve performance parity with conventional petroleum-based alternatives, particularly in oil and grease resistance applications.

The primary objective of research in bio-based barrier coatings with enhanced oil and grease resistance is to develop commercially viable alternatives to fluorinated compounds and petroleum-based polymers currently dominating the market. This includes identifying novel bio-based materials with inherent hydrophobic properties, developing effective composite structures that combine different biopolymers, and exploring surface modification techniques to enhance oleophobicity without compromising other functional properties or biodegradability.

Additional research goals include optimizing processing methods for industrial scalability, ensuring cost-competitiveness with conventional solutions, and maintaining or improving end-of-life options such as compostability or recyclability. The ultimate aim is to create a new generation of packaging materials that satisfy the technical requirements of food protection while aligning with sustainability principles and circular economy frameworks.

Bio-based barrier coatings represent a promising frontier in sustainable packaging solutions, derived from renewable resources such as cellulose, chitosan, proteins, and plant-based polymers. The development trajectory of these materials has accelerated since the early 2000s, with significant breakthroughs in improving their functional properties, particularly water resistance and mechanical strength. However, achieving adequate oil and grease resistance has remained a persistent challenge in this field.

The global push toward circular economy principles and stricter regulations on single-use plastics have further intensified the focus on developing effective bio-based barrier materials. Countries across Europe, North America, and increasingly Asia have implemented policies encouraging or mandating the transition to more sustainable packaging solutions, creating both regulatory pressure and market opportunities for innovation in this space.

Recent technological advancements in biopolymer science, nanotechnology, and surface modification techniques have opened new pathways for enhancing the performance of bio-based coatings. These developments suggest that we are approaching a tipping point where bio-based solutions may achieve performance parity with conventional petroleum-based alternatives, particularly in oil and grease resistance applications.

The primary objective of research in bio-based barrier coatings with enhanced oil and grease resistance is to develop commercially viable alternatives to fluorinated compounds and petroleum-based polymers currently dominating the market. This includes identifying novel bio-based materials with inherent hydrophobic properties, developing effective composite structures that combine different biopolymers, and exploring surface modification techniques to enhance oleophobicity without compromising other functional properties or biodegradability.

Additional research goals include optimizing processing methods for industrial scalability, ensuring cost-competitiveness with conventional solutions, and maintaining or improving end-of-life options such as compostability or recyclability. The ultimate aim is to create a new generation of packaging materials that satisfy the technical requirements of food protection while aligning with sustainability principles and circular economy frameworks.

Market Demand for Sustainable Packaging Solutions

The global packaging industry is experiencing a significant shift towards sustainable solutions, driven by increasing environmental concerns and regulatory pressures. The market for eco-friendly packaging materials has been growing at an unprecedented rate, with bio-based barrier coatings emerging as a critical component in this transformation. Consumer awareness regarding plastic pollution and its environmental impact has reached an all-time high, creating substantial demand for alternatives that maintain functionality while reducing ecological footprint.

Food service packaging represents one of the largest segments demanding sustainable solutions with oil and grease resistance properties. The global food packaging market, valued at approximately $305 billion in 2022, is projected to grow substantially over the next decade, with sustainable packaging solutions expected to capture an increasing market share. Quick-service restaurants, delivery services, and consumer packaged goods companies are actively seeking alternatives to traditional plastic-coated paper and perfluorinated compounds (PFCs).

Regulatory developments have become a significant market driver, with many regions implementing restrictions on single-use plastics and fluorinated chemicals. The European Union's Single-Use Plastics Directive, along with similar legislation in North America and Asia-Pacific regions, has accelerated the transition toward bio-based alternatives. Additionally, the FDA's increased scrutiny of per- and polyfluoroalkyl substances (PFAS) in food packaging has created urgent market demand for safe, biodegradable alternatives that maintain oil and grease resistance.

Consumer preferences have evolved dramatically, with sustainability becoming a key purchasing factor. Recent market surveys indicate that over 70% of consumers are willing to pay a premium for environmentally friendly packaging. Major brands have responded by establishing ambitious sustainability goals, often including commitments to eliminate conventional plastic packaging within the next 5-10 years, creating substantial market pull for bio-based barrier solutions.

The food delivery sector's explosive growth, accelerated by the global pandemic, has further intensified the need for sustainable packaging with effective oil and grease resistance. This segment requires solutions that maintain food quality and presentation while addressing environmental concerns, representing a high-value application for bio-based barrier coatings.

Industrial applications beyond food service are also emerging as significant market opportunities. The personal care, cosmetics, and pharmaceutical sectors are increasingly seeking sustainable packaging solutions that provide barrier properties against oils and moisture while maintaining product integrity throughout the supply chain.

Cost considerations remain a critical factor influencing market adoption. While consumers and brands express willingness to pay premiums for sustainable solutions, the price differential between conventional and bio-based alternatives must narrow to achieve widespread market penetration. Current bio-based barrier coatings typically command a 15-30% premium over conventional alternatives, presenting both a challenge and opportunity for innovation in cost-effective production methods.

Food service packaging represents one of the largest segments demanding sustainable solutions with oil and grease resistance properties. The global food packaging market, valued at approximately $305 billion in 2022, is projected to grow substantially over the next decade, with sustainable packaging solutions expected to capture an increasing market share. Quick-service restaurants, delivery services, and consumer packaged goods companies are actively seeking alternatives to traditional plastic-coated paper and perfluorinated compounds (PFCs).

Regulatory developments have become a significant market driver, with many regions implementing restrictions on single-use plastics and fluorinated chemicals. The European Union's Single-Use Plastics Directive, along with similar legislation in North America and Asia-Pacific regions, has accelerated the transition toward bio-based alternatives. Additionally, the FDA's increased scrutiny of per- and polyfluoroalkyl substances (PFAS) in food packaging has created urgent market demand for safe, biodegradable alternatives that maintain oil and grease resistance.

Consumer preferences have evolved dramatically, with sustainability becoming a key purchasing factor. Recent market surveys indicate that over 70% of consumers are willing to pay a premium for environmentally friendly packaging. Major brands have responded by establishing ambitious sustainability goals, often including commitments to eliminate conventional plastic packaging within the next 5-10 years, creating substantial market pull for bio-based barrier solutions.

The food delivery sector's explosive growth, accelerated by the global pandemic, has further intensified the need for sustainable packaging with effective oil and grease resistance. This segment requires solutions that maintain food quality and presentation while addressing environmental concerns, representing a high-value application for bio-based barrier coatings.

Industrial applications beyond food service are also emerging as significant market opportunities. The personal care, cosmetics, and pharmaceutical sectors are increasingly seeking sustainable packaging solutions that provide barrier properties against oils and moisture while maintaining product integrity throughout the supply chain.

Cost considerations remain a critical factor influencing market adoption. While consumers and brands express willingness to pay premiums for sustainable solutions, the price differential between conventional and bio-based alternatives must narrow to achieve widespread market penetration. Current bio-based barrier coatings typically command a 15-30% premium over conventional alternatives, presenting both a challenge and opportunity for innovation in cost-effective production methods.

Current Status and Challenges in Oil-Resistant Biopolymers

The global landscape of oil-resistant biopolymers has witnessed significant advancements in recent years, yet substantial challenges remain. Currently, the most widely utilized bio-based polymers for oil and grease resistance include modified cellulose derivatives, chitosan, alginate, and protein-based materials. These biopolymers have demonstrated varying degrees of effectiveness in creating barrier properties, with modified cellulose showing particular promise due to its inherent structural stability and compatibility with various modification techniques.

Research institutions across Europe, North America, and Asia have made considerable progress in enhancing the oil resistance of these biopolymers through chemical modification, crosslinking, and nanocomposite formation. Notable achievements include the development of cellulose nanocrystal reinforced coatings that exhibit oil resistance comparable to synthetic alternatives while maintaining biodegradability.

Despite these advancements, several critical challenges persist in the development of bio-based oil-resistant coatings. The inherent hydrophilic nature of most biopolymers contradicts the hydrophobic properties required for effective oil repellency, creating a fundamental material science challenge. Researchers are actively exploring various surface modification techniques and hybrid systems to overcome this limitation.

Performance consistency remains another significant hurdle. Bio-based materials often exhibit greater variability in their barrier properties compared to synthetic counterparts due to natural variations in the raw materials and sensitivity to environmental conditions during processing and application. This inconsistency complicates quality control and hampers widespread industrial adoption.

Scalability and cost-effectiveness present additional barriers to commercialization. Current production methods for high-performance bio-based barrier coatings frequently involve complex multi-step processes that are difficult to scale economically. The cost differential between these sustainable alternatives and established petroleum-based solutions remains substantial, particularly for applications requiring high-performance specifications.

Durability under various environmental conditions represents another challenge. Many bio-based coatings demonstrate excellent initial oil resistance but experience performance degradation when exposed to humidity, temperature fluctuations, or mechanical stress. This limitation restricts their application in demanding environments where long-term stability is essential.

Regulatory frameworks and standardization efforts are still evolving for these materials. The lack of universally accepted testing protocols specifically designed for bio-based barrier coatings creates uncertainty in performance claims and complicates comparative assessments across different solutions. Industry stakeholders are actively working with regulatory bodies to establish appropriate standards that accurately reflect the unique properties and environmental benefits of these materials.

Research institutions across Europe, North America, and Asia have made considerable progress in enhancing the oil resistance of these biopolymers through chemical modification, crosslinking, and nanocomposite formation. Notable achievements include the development of cellulose nanocrystal reinforced coatings that exhibit oil resistance comparable to synthetic alternatives while maintaining biodegradability.

Despite these advancements, several critical challenges persist in the development of bio-based oil-resistant coatings. The inherent hydrophilic nature of most biopolymers contradicts the hydrophobic properties required for effective oil repellency, creating a fundamental material science challenge. Researchers are actively exploring various surface modification techniques and hybrid systems to overcome this limitation.

Performance consistency remains another significant hurdle. Bio-based materials often exhibit greater variability in their barrier properties compared to synthetic counterparts due to natural variations in the raw materials and sensitivity to environmental conditions during processing and application. This inconsistency complicates quality control and hampers widespread industrial adoption.

Scalability and cost-effectiveness present additional barriers to commercialization. Current production methods for high-performance bio-based barrier coatings frequently involve complex multi-step processes that are difficult to scale economically. The cost differential between these sustainable alternatives and established petroleum-based solutions remains substantial, particularly for applications requiring high-performance specifications.

Durability under various environmental conditions represents another challenge. Many bio-based coatings demonstrate excellent initial oil resistance but experience performance degradation when exposed to humidity, temperature fluctuations, or mechanical stress. This limitation restricts their application in demanding environments where long-term stability is essential.

Regulatory frameworks and standardization efforts are still evolving for these materials. The lack of universally accepted testing protocols specifically designed for bio-based barrier coatings creates uncertainty in performance claims and complicates comparative assessments across different solutions. Industry stakeholders are actively working with regulatory bodies to establish appropriate standards that accurately reflect the unique properties and environmental benefits of these materials.

Current Bio-based Solutions for Oil and Grease Resistance

01 Bio-based polymers for barrier coatings

Bio-based polymers derived from renewable resources can be formulated into barrier coatings that provide effective oil and grease resistance for packaging materials. These polymers include polylactic acid (PLA), polyhydroxyalkanoates (PHA), and modified starches that create a physical barrier preventing oil and grease penetration. The renewable nature of these materials makes them environmentally preferable to petroleum-based alternatives while maintaining comparable performance characteristics.- Plant-derived polymers for barrier coatings: Bio-based polymers derived from plant sources such as cellulose, starch, and lignin can be formulated into barrier coatings that provide effective oil and grease resistance. These natural polymers can be modified or combined with other bio-based materials to enhance their barrier properties. The resulting coatings offer environmentally friendly alternatives to petroleum-based products while maintaining comparable performance in preventing oil and grease penetration in packaging applications.

- Protein-based barrier formulations: Proteins from various biological sources can be utilized to create effective oil and grease resistant barrier coatings. These protein-based formulations can be derived from plant proteins (soy, pea, wheat), animal proteins, or microbial sources. When properly processed and applied, these protein structures create a dense network that inhibits the penetration of oils and greases. The coatings can be further enhanced through crosslinking or combination with other bio-based materials to improve their barrier performance and durability.

- Polysaccharide-based barrier systems: Polysaccharides such as chitosan, alginate, pectin, and modified starches can be formulated into effective barrier coatings with excellent oil and grease resistance. These naturally occurring polymers can be processed into films or coatings that create a physical barrier against lipid penetration. The hydroxyl and other functional groups in polysaccharides can be modified to enhance hydrophobicity and improve barrier properties. These systems are particularly valuable for food packaging applications where biodegradability and sustainability are important considerations.

- Bio-based waxes and lipids for barrier properties: Natural waxes, oils, and lipids can be processed and formulated into effective barrier coatings that provide resistance to oils and greases. These materials, which can be derived from plant sources such as carnauba, candelilla, and various seed oils, create hydrophobic surfaces that repel oils and fats. The natural lipid structure of these materials makes them particularly effective at creating barriers against other lipids. These coatings can be applied to paper, cardboard, and other substrates to create sustainable packaging with good grease resistance.

- Composite and hybrid bio-based barrier coatings: Hybrid systems combining multiple bio-based materials can create synergistic barrier properties superior to single-component systems. These composite coatings may incorporate combinations of proteins, polysaccharides, lipids, and other bio-based materials to optimize oil and grease resistance while maintaining other desirable properties such as flexibility, transparency, and biodegradability. Nanomaterials derived from biological sources, such as nanocellulose or nano-chitin, can also be incorporated to enhance barrier performance. These sophisticated formulations represent the cutting edge of sustainable packaging technology.

02 Cellulose-based barrier materials

Cellulose derivatives and nanocellulose materials can be incorporated into coating formulations to enhance oil and grease resistance properties. These materials, including microfibrillated cellulose, cellulose nanocrystals, and modified cellulose derivatives, create tortuous paths that impede the migration of oil and grease through the coating. The high aspect ratio and crystallinity of these materials contribute to their effectiveness as barrier components in sustainable packaging solutions.Expand Specific Solutions03 Plant-based waxes and lipids as barrier components

Natural waxes and lipids extracted from plants can be formulated into barrier coatings that provide excellent resistance to oil and grease penetration. These materials, including carnauba wax, candelilla wax, and various plant oils modified through processes like epoxidation or polymerization, create hydrophobic surfaces that repel oils and fats. The crystalline structure of these waxes contributes to their barrier properties while maintaining the bio-based nature of the coating system.Expand Specific Solutions04 Protein-based barrier coatings

Proteins derived from agricultural sources such as soy, whey, zein (corn), and gluten can be processed into effective barrier coatings with good oil and grease resistance. These proteins can be modified through various methods including crosslinking, denaturation, or blending with other bio-based materials to enhance their barrier properties. The amphiphilic nature of proteins allows them to form cohesive films that restrict the migration of lipophilic substances through packaging materials.Expand Specific Solutions05 Composite and multilayer bio-based barrier systems

Multilayer structures combining different bio-based materials can create synergistic barrier effects against oil and grease penetration. These composite systems may incorporate layers of different bio-polymers, nanoparticles, and functional additives to achieve enhanced barrier properties. The strategic combination of hydrophobic and hydrophilic layers creates an effective barrier system that maintains the renewable and sustainable characteristics desired in modern packaging materials while providing performance comparable to conventional petroleum-based barriers.Expand Specific Solutions

Leading Companies and Research Institutions in Bio-coatings

The bio-based barrier coatings market for oil and grease resistance is in a growth phase, driven by increasing demand for sustainable packaging solutions. The market is expanding rapidly with an estimated value of $2-3 billion and projected annual growth of 8-10%. From a technological maturity perspective, the field is transitioning from early development to commercial scaling. Leading players include established chemical companies like Kemira Oyj, Dow Global Technologies, and Henkel AG, who leverage their R&D capabilities and market presence. Academic institutions (University of Maine, Delft University of Technology) contribute fundamental research, while specialized firms like OrganoClick AB and Nano & Advanced Materials Institute focus on innovative bio-based solutions. Asian players, particularly Wanhua Chemical and Red Avenue New Materials, are increasingly active in this space, indicating the global nature of competition.

Kemira Oyj

Technical Solution: Kemira has developed FennoGuard™, an advanced bio-based barrier coating technology utilizing modified starches and cellulose derivatives. Their approach involves chemical modification of these natural polymers to introduce hydrophobic functional groups while maintaining biodegradability. The company's proprietary crosslinking system creates a tight molecular network that effectively blocks oil and grease penetration. Kemira's formulations incorporate bio-based waxes and fatty acid derivatives strategically dispersed throughout the coating matrix to enhance barrier properties. Their water-based technology achieves OGR (Oil and Grease Resistance) values of 8-10 on standard tests while maintaining recyclability of the coated substrates. Kemira has also developed specialized application methods that optimize coating coverage and performance at lower coat weights, making the technology more economically viable for commercial applications. The coatings feature excellent heat resistance, maintaining barrier properties at temperatures up to 220°C.

Strengths: Excellent compatibility with paper recycling systems; Good heat resistance maintaining barrier properties during hot-fill applications; Water-based formulation with low environmental impact. Weaknesses: Moderate barrier performance compared to fluorochemical alternatives; May require higher coat weights for demanding applications; Performance can be affected by high humidity conditions.

Sun Chemical Corp. (New Jersey)

Technical Solution: Sun Chemical has pioneered SunBar® Oxygen Barrier Coatings, a bio-based solution that combines modified cellulose with proprietary bio-polymers to create effective oil and grease barriers for packaging applications. Their technology utilizes a unique dispersion method that creates a uniform coating with exceptional coverage at lower application weights. The company has developed a multi-layer approach where different bio-based materials work synergistically - a base layer provides adhesion to the substrate, while subsequent layers create the barrier effect through carefully engineered porosity and surface chemistry. Sun Chemical's coatings incorporate natural clay minerals as reinforcing agents, which significantly enhance the tortuous path effect for oil molecules. Their water-based formulations achieve OGR ratings of 10-12 on standard tests while maintaining heat-sealability and printability of the coated substrates.

Strengths: Excellent barrier properties while maintaining heat-sealability; Compatible with existing converting equipment; Good printability and visual appearance. Weaknesses: Performance may degrade under high humidity conditions; Slightly higher cost compared to conventional petroleum-based alternatives; May require specialized application techniques for optimal performance.

Key Patents and Innovations in Bio-barrier Materials

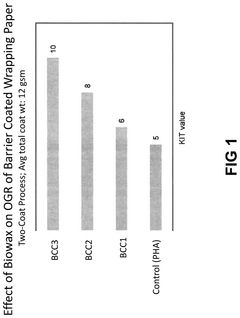

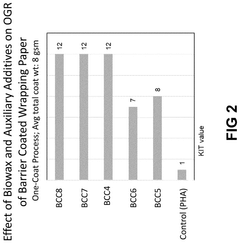

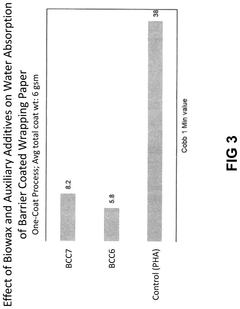

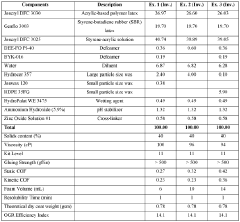

Biowax polyhydroxyalkanoate dispersions as bio-based barrier coatings

PatentPendingUS20240344272A1

Innovation

- The development of biowax emulsions combined with polyhydroxyalkanoate (PHA) dispersions and auxiliary additives, such as clay and microcrystalline cellulose, to form barrier coatings that can be applied at room temperature, achieving enhanced oil and water resistance with a high bio-based content.

Grease, oil, and water resistant coating compositions

PatentWO2018081764A1

Innovation

- Aqueous coating compositions comprising an acrylic-based polymer latex, styrene-butadiene rubber (SBR) latex, styrene-acrylic resin solution, and large particle size wax, which are free of fluorocarbons and VOCs, offering improved printability, lower coefficients of friction, and enhanced resistance to oil and grease, while being safe for food contact and recyclable.

Environmental Impact and Biodegradability Assessment

The environmental impact of bio-based barrier coatings represents a critical dimension in their development and application, particularly as industries seek sustainable alternatives to conventional petroleum-based materials. Life cycle assessment (LCA) studies indicate that bio-based barrier coatings generally demonstrate reduced carbon footprints compared to their synthetic counterparts, with potential reductions of 30-60% in greenhouse gas emissions depending on feedstock selection and processing methods.

Biodegradability characteristics of these coatings vary significantly based on their composition. Coatings derived from cellulose, chitosan, and certain proteins exhibit superior biodegradation rates in both industrial composting conditions and natural environments. Research indicates that optimized formulations can achieve over 90% degradation within 180 days under standardized composting conditions (ISO 14855), while maintaining their functional barrier properties during product use.

The end-of-life scenarios for bio-based barrier coatings present both opportunities and challenges. While these materials offer improved biodegradability, their integration into existing recycling streams requires careful consideration. Current recycling infrastructure may face difficulties in processing mixed materials, potentially compromising the overall sustainability benefits. Studies suggest that dedicated collection and processing systems could maximize environmental advantages.

Water usage and land use impacts represent important environmental considerations. Agricultural feedstocks for bio-based coatings may require significant water resources and arable land, potentially competing with food production. However, innovations utilizing agricultural by-products and waste streams (such as corn stover, rice husks, or food processing residues) demonstrate promising pathways to minimize these impacts while creating value-added applications.

Ecotoxicological assessments of bio-based barrier coatings show generally favorable profiles compared to conventional alternatives. Leaching studies indicate minimal release of harmful compounds into aquatic environments, with significantly reduced persistence of any released materials. This advantage becomes particularly relevant for food packaging applications where migration of coating components may occur.

Regulatory frameworks worldwide are increasingly recognizing the environmental benefits of bio-based materials, with policies in the EU, Japan, and parts of North America providing incentives for their development and adoption. These frameworks typically evaluate both the renewable content and end-of-life environmental impacts, creating market drivers for continued innovation in this space.

Biodegradability characteristics of these coatings vary significantly based on their composition. Coatings derived from cellulose, chitosan, and certain proteins exhibit superior biodegradation rates in both industrial composting conditions and natural environments. Research indicates that optimized formulations can achieve over 90% degradation within 180 days under standardized composting conditions (ISO 14855), while maintaining their functional barrier properties during product use.

The end-of-life scenarios for bio-based barrier coatings present both opportunities and challenges. While these materials offer improved biodegradability, their integration into existing recycling streams requires careful consideration. Current recycling infrastructure may face difficulties in processing mixed materials, potentially compromising the overall sustainability benefits. Studies suggest that dedicated collection and processing systems could maximize environmental advantages.

Water usage and land use impacts represent important environmental considerations. Agricultural feedstocks for bio-based coatings may require significant water resources and arable land, potentially competing with food production. However, innovations utilizing agricultural by-products and waste streams (such as corn stover, rice husks, or food processing residues) demonstrate promising pathways to minimize these impacts while creating value-added applications.

Ecotoxicological assessments of bio-based barrier coatings show generally favorable profiles compared to conventional alternatives. Leaching studies indicate minimal release of harmful compounds into aquatic environments, with significantly reduced persistence of any released materials. This advantage becomes particularly relevant for food packaging applications where migration of coating components may occur.

Regulatory frameworks worldwide are increasingly recognizing the environmental benefits of bio-based materials, with policies in the EU, Japan, and parts of North America providing incentives for their development and adoption. These frameworks typically evaluate both the renewable content and end-of-life environmental impacts, creating market drivers for continued innovation in this space.

Regulatory Framework for Food-Contact Bio-based Materials

The regulatory landscape for food-contact bio-based materials is complex and continuously evolving, with significant implications for the development and commercialization of bio-based barrier coatings with enhanced oil and grease resistance. In the United States, the Food and Drug Administration (FDA) regulates these materials under the Food Contact Notification (FCN) program and the Generally Recognized as Safe (GRAS) framework. Bio-based materials must demonstrate safety and compliance with migration limits, ensuring no harmful substances transfer to food products during contact.

The European Union implements more stringent regulations through the Framework Regulation (EC) No 1935/2004 and the Plastics Regulation (EU) No 10/2011, which establish specific migration limits and positive lists of authorized substances. The EU's emphasis on the precautionary principle often results in more conservative approval processes compared to other regions, particularly for novel bio-based materials.

Japan's regulatory system operates under the Food Sanitation Law, requiring compliance with positive lists and specific testing protocols for food-contact materials. China has recently strengthened its regulatory framework through GB standards that address food-contact materials, with increasing attention to bio-based alternatives.

Notably, regulatory bodies worldwide are showing growing interest in sustainable alternatives to conventional petroleum-based materials. The FDA's Chemistry and Environmental Review Team has established specialized protocols for evaluating bio-based food-contact materials, while the EU's Circular Economy Action Plan explicitly encourages the development of sustainable packaging solutions, including bio-based barrier coatings.

Certification systems like the USDA BioPreferred program and the European Bioplastics certification provide market recognition for compliant bio-based materials, though these do not replace regulatory approval requirements. These certifications can facilitate market acceptance and consumer recognition of bio-based packaging solutions.

A significant regulatory challenge for bio-based barrier coatings concerns the variability of natural raw materials, which can complicate consistency in safety assessments. Regulatory frameworks increasingly require robust characterization of starting materials and processing conditions to ensure reproducible safety profiles.

Recent regulatory trends indicate a shift toward lifecycle assessment requirements, with some jurisdictions beginning to incorporate end-of-life considerations into approval processes. This holistic approach evaluates not only the safety of materials during use but also their environmental impact throughout their lifecycle, from production to disposal or recycling.

For manufacturers developing bio-based barrier coatings with enhanced oil and grease resistance, early engagement with regulatory authorities through pre-submission consultations has proven valuable in navigating approval pathways efficiently and addressing potential concerns proactively.

The European Union implements more stringent regulations through the Framework Regulation (EC) No 1935/2004 and the Plastics Regulation (EU) No 10/2011, which establish specific migration limits and positive lists of authorized substances. The EU's emphasis on the precautionary principle often results in more conservative approval processes compared to other regions, particularly for novel bio-based materials.

Japan's regulatory system operates under the Food Sanitation Law, requiring compliance with positive lists and specific testing protocols for food-contact materials. China has recently strengthened its regulatory framework through GB standards that address food-contact materials, with increasing attention to bio-based alternatives.

Notably, regulatory bodies worldwide are showing growing interest in sustainable alternatives to conventional petroleum-based materials. The FDA's Chemistry and Environmental Review Team has established specialized protocols for evaluating bio-based food-contact materials, while the EU's Circular Economy Action Plan explicitly encourages the development of sustainable packaging solutions, including bio-based barrier coatings.

Certification systems like the USDA BioPreferred program and the European Bioplastics certification provide market recognition for compliant bio-based materials, though these do not replace regulatory approval requirements. These certifications can facilitate market acceptance and consumer recognition of bio-based packaging solutions.

A significant regulatory challenge for bio-based barrier coatings concerns the variability of natural raw materials, which can complicate consistency in safety assessments. Regulatory frameworks increasingly require robust characterization of starting materials and processing conditions to ensure reproducible safety profiles.

Recent regulatory trends indicate a shift toward lifecycle assessment requirements, with some jurisdictions beginning to incorporate end-of-life considerations into approval processes. This holistic approach evaluates not only the safety of materials during use but also their environmental impact throughout their lifecycle, from production to disposal or recycling.

For manufacturers developing bio-based barrier coatings with enhanced oil and grease resistance, early engagement with regulatory authorities through pre-submission consultations has proven valuable in navigating approval pathways efficiently and addressing potential concerns proactively.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!