Bio-based Barrier Coatings for Sustainable Packaging Applications

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-based Barrier Coatings Background and Objectives

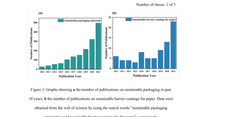

Bio-based barrier coatings have emerged as a critical innovation in sustainable packaging solutions over the past decade. The evolution of these materials can be traced back to early experiments with natural polymers in the 1990s, which laid the groundwork for today's advanced formulations. Initially limited by performance constraints, bio-based coatings have undergone significant technological advancement, particularly since 2010, when increased environmental concerns and regulatory pressures accelerated research in this field.

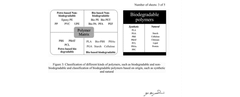

The technological trajectory has been characterized by a shift from simple starch-based coatings with limited barrier properties to sophisticated multi-layer systems incorporating cellulose nanocrystals, chitosan, protein-based materials, and modified biopolymers. This evolution reflects the industry's growing understanding of molecular interactions and barrier mechanisms in bio-based systems.

Current market drivers for bio-based barrier coatings include stringent regulations on single-use plastics, growing consumer demand for sustainable packaging, and corporate sustainability commitments from major brands. The European Union's Single-Use Plastics Directive and similar legislation worldwide have created regulatory imperatives for alternatives to conventional petroleum-based barrier materials.

The primary technical objectives in this field center on developing bio-based coatings that match or exceed the performance of synthetic alternatives while maintaining biodegradability and compostability. Specifically, researchers aim to achieve oxygen transmission rates below 10 cc/m²/day and water vapor transmission rates under 10 g/m²/day—performance metrics comparable to conventional petroleum-based barriers.

Additional objectives include enhancing processability for industrial-scale application, ensuring compatibility with existing converting equipment, extending shelf life of packaged products, and maintaining cost competitiveness with conventional solutions. The cost factor remains particularly challenging, with current bio-based solutions typically commanding a 15-30% premium over petroleum-based alternatives.

Looking forward, the technological roadmap focuses on several key areas: improving moisture resistance without compromising biodegradability, enhancing barrier stability under varying environmental conditions, developing multi-functional coatings with antimicrobial or antioxidant properties, and scaling production processes to achieve economic viability.

The ultimate goal of research in this field is to create a new generation of packaging materials that address the full lifecycle environmental impact while meeting the functional requirements of modern packaging applications across food, beverage, personal care, and pharmaceutical sectors.

The technological trajectory has been characterized by a shift from simple starch-based coatings with limited barrier properties to sophisticated multi-layer systems incorporating cellulose nanocrystals, chitosan, protein-based materials, and modified biopolymers. This evolution reflects the industry's growing understanding of molecular interactions and barrier mechanisms in bio-based systems.

Current market drivers for bio-based barrier coatings include stringent regulations on single-use plastics, growing consumer demand for sustainable packaging, and corporate sustainability commitments from major brands. The European Union's Single-Use Plastics Directive and similar legislation worldwide have created regulatory imperatives for alternatives to conventional petroleum-based barrier materials.

The primary technical objectives in this field center on developing bio-based coatings that match or exceed the performance of synthetic alternatives while maintaining biodegradability and compostability. Specifically, researchers aim to achieve oxygen transmission rates below 10 cc/m²/day and water vapor transmission rates under 10 g/m²/day—performance metrics comparable to conventional petroleum-based barriers.

Additional objectives include enhancing processability for industrial-scale application, ensuring compatibility with existing converting equipment, extending shelf life of packaged products, and maintaining cost competitiveness with conventional solutions. The cost factor remains particularly challenging, with current bio-based solutions typically commanding a 15-30% premium over petroleum-based alternatives.

Looking forward, the technological roadmap focuses on several key areas: improving moisture resistance without compromising biodegradability, enhancing barrier stability under varying environmental conditions, developing multi-functional coatings with antimicrobial or antioxidant properties, and scaling production processes to achieve economic viability.

The ultimate goal of research in this field is to create a new generation of packaging materials that address the full lifecycle environmental impact while meeting the functional requirements of modern packaging applications across food, beverage, personal care, and pharmaceutical sectors.

Sustainable Packaging Market Analysis

The sustainable packaging market has witnessed remarkable growth in recent years, driven by increasing environmental awareness, stringent regulations, and shifting consumer preferences. The global sustainable packaging market was valued at approximately $274 billion in 2020 and is projected to reach $470 billion by 2027, growing at a CAGR of around 7.9% during the forecast period. This growth trajectory underscores the significant market potential for bio-based barrier coatings as an integral component of sustainable packaging solutions.

Consumer demand for environmentally friendly packaging has become a primary market driver, with surveys indicating that over 70% of consumers are willing to pay premium prices for sustainable packaging options. Major retail chains and consumer goods companies have responded by establishing ambitious sustainability targets, many aiming to achieve 100% recyclable, reusable, or compostable packaging by 2025-2030. This corporate commitment has accelerated the transition away from conventional petroleum-based packaging materials.

The food and beverage sector represents the largest application segment for sustainable packaging, accounting for approximately 42% of the market share. This sector particularly benefits from bio-based barrier coatings that can provide comparable performance to traditional petroleum-based alternatives while offering enhanced biodegradability and recyclability. Other significant application segments include personal care products, pharmaceuticals, and e-commerce packaging.

Regionally, Europe leads the sustainable packaging market with approximately 34% market share, followed by North America and Asia-Pacific. European leadership stems from progressive environmental regulations, including the European Green Deal and the Circular Economy Action Plan, which have established clear frameworks for reducing packaging waste. The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization, urbanization, and increasing environmental awareness in countries like China and India.

The market for bio-based barrier coatings specifically is projected to grow at a CAGR of 8.5% through 2028, outpacing the broader sustainable packaging market. This accelerated growth reflects the critical role these coatings play in addressing the performance gap between conventional and sustainable packaging materials, particularly regarding moisture resistance, oxygen barrier properties, and product shelf life.

Challenges in the sustainable packaging market include cost premiums compared to conventional alternatives, technical performance limitations, and supply chain complexities. However, ongoing innovations in bio-based materials, economies of scale, and supportive policy frameworks are gradually addressing these barriers, creating favorable conditions for continued market expansion and technological advancement in bio-based barrier coatings.

Consumer demand for environmentally friendly packaging has become a primary market driver, with surveys indicating that over 70% of consumers are willing to pay premium prices for sustainable packaging options. Major retail chains and consumer goods companies have responded by establishing ambitious sustainability targets, many aiming to achieve 100% recyclable, reusable, or compostable packaging by 2025-2030. This corporate commitment has accelerated the transition away from conventional petroleum-based packaging materials.

The food and beverage sector represents the largest application segment for sustainable packaging, accounting for approximately 42% of the market share. This sector particularly benefits from bio-based barrier coatings that can provide comparable performance to traditional petroleum-based alternatives while offering enhanced biodegradability and recyclability. Other significant application segments include personal care products, pharmaceuticals, and e-commerce packaging.

Regionally, Europe leads the sustainable packaging market with approximately 34% market share, followed by North America and Asia-Pacific. European leadership stems from progressive environmental regulations, including the European Green Deal and the Circular Economy Action Plan, which have established clear frameworks for reducing packaging waste. The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization, urbanization, and increasing environmental awareness in countries like China and India.

The market for bio-based barrier coatings specifically is projected to grow at a CAGR of 8.5% through 2028, outpacing the broader sustainable packaging market. This accelerated growth reflects the critical role these coatings play in addressing the performance gap between conventional and sustainable packaging materials, particularly regarding moisture resistance, oxygen barrier properties, and product shelf life.

Challenges in the sustainable packaging market include cost premiums compared to conventional alternatives, technical performance limitations, and supply chain complexities. However, ongoing innovations in bio-based materials, economies of scale, and supportive policy frameworks are gradually addressing these barriers, creating favorable conditions for continued market expansion and technological advancement in bio-based barrier coatings.

Current Status and Challenges in Bio-based Barrier Technology

Bio-based barrier coatings represent a significant advancement in sustainable packaging solutions, yet the current global landscape reveals both promising developments and substantial challenges. Leading regions in this technology include Europe, North America, and parts of Asia, with European countries demonstrating particular strength in research and commercial applications due to stringent environmental regulations and consumer demand for eco-friendly packaging.

The current technological maturity of bio-based barrier coatings varies considerably across different material types. Cellulose-based solutions have achieved commercial viability, while protein-based and lipid-based coatings remain predominantly in research and development phases. Chitosan and alginate derivatives show promising barrier properties but face scalability issues in industrial applications.

A primary technical challenge in this field is achieving comparable barrier performance to conventional petroleum-based materials, particularly regarding oxygen and moisture resistance. Bio-based coatings typically demonstrate excellent oxygen barrier properties under dry conditions but suffer significant performance degradation in humid environments. This humidity sensitivity represents a critical limitation for food packaging applications where moisture control is essential.

Processing challenges also persist, with many bio-based materials exhibiting poor compatibility with existing high-speed coating equipment. The rheological properties of these materials often differ substantially from conventional coatings, requiring modifications to processing parameters or entirely new application technologies. This incompatibility increases implementation costs and slows industry adoption.

Stability issues present another significant hurdle, as many bio-based coatings demonstrate shorter shelf life and reduced durability compared to synthetic alternatives. Microbial susceptibility and biodegradation—while beneficial for end-of-life scenarios—can be problematic during product storage and distribution phases.

Cost factors remain a substantial barrier to widespread adoption. Current production methods for bio-based barrier materials typically involve higher raw material costs and more complex processing than petroleum-based alternatives. The limited economy of scale further exacerbates this cost differential, though this gap has been narrowing as production volumes increase and technologies mature.

Regulatory frameworks present both opportunities and challenges. While sustainability initiatives drive interest in bio-based solutions, inconsistent global standards for biodegradability, compostability, and food contact safety create market fragmentation and compliance complexities for manufacturers operating across multiple regions.

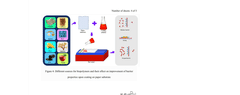

Despite these challenges, recent technological breakthroughs in nanotechnology applications, enzymatic modifications of natural polymers, and hybrid coating systems combining multiple bio-based materials show promising pathways toward overcoming current limitations and achieving performance parity with conventional solutions.

The current technological maturity of bio-based barrier coatings varies considerably across different material types. Cellulose-based solutions have achieved commercial viability, while protein-based and lipid-based coatings remain predominantly in research and development phases. Chitosan and alginate derivatives show promising barrier properties but face scalability issues in industrial applications.

A primary technical challenge in this field is achieving comparable barrier performance to conventional petroleum-based materials, particularly regarding oxygen and moisture resistance. Bio-based coatings typically demonstrate excellent oxygen barrier properties under dry conditions but suffer significant performance degradation in humid environments. This humidity sensitivity represents a critical limitation for food packaging applications where moisture control is essential.

Processing challenges also persist, with many bio-based materials exhibiting poor compatibility with existing high-speed coating equipment. The rheological properties of these materials often differ substantially from conventional coatings, requiring modifications to processing parameters or entirely new application technologies. This incompatibility increases implementation costs and slows industry adoption.

Stability issues present another significant hurdle, as many bio-based coatings demonstrate shorter shelf life and reduced durability compared to synthetic alternatives. Microbial susceptibility and biodegradation—while beneficial for end-of-life scenarios—can be problematic during product storage and distribution phases.

Cost factors remain a substantial barrier to widespread adoption. Current production methods for bio-based barrier materials typically involve higher raw material costs and more complex processing than petroleum-based alternatives. The limited economy of scale further exacerbates this cost differential, though this gap has been narrowing as production volumes increase and technologies mature.

Regulatory frameworks present both opportunities and challenges. While sustainability initiatives drive interest in bio-based solutions, inconsistent global standards for biodegradability, compostability, and food contact safety create market fragmentation and compliance complexities for manufacturers operating across multiple regions.

Despite these challenges, recent technological breakthroughs in nanotechnology applications, enzymatic modifications of natural polymers, and hybrid coating systems combining multiple bio-based materials show promising pathways toward overcoming current limitations and achieving performance parity with conventional solutions.

Current Bio-based Barrier Coating Solutions

01 Cellulose-based barrier coatings

Cellulose derivatives and nanocellulose materials are used to create bio-based barrier coatings with excellent oxygen and moisture barrier properties. These renewable materials can be modified or combined with other bio-polymers to enhance their barrier performance. The cellulose-based coatings provide sustainable alternatives to petroleum-based barriers while maintaining comparable protection against gas permeation and moisture transmission.- Cellulose-based barrier coatings: Cellulose-derived materials are used to create bio-based barrier coatings with excellent oxygen and moisture barrier properties. These coatings utilize nanocellulose, cellulose nanofibrils, or modified cellulose derivatives to form dense, crystalline structures that prevent gas permeation. The renewable nature of cellulose makes these coatings environmentally friendly while providing comparable performance to petroleum-based alternatives for food packaging and other applications requiring high barrier properties.

- Protein and starch-based barrier materials: Proteins and starches derived from agricultural sources can be formulated into effective barrier coatings. These biomaterials can be modified through various processes including crosslinking, blending with plasticizers, or chemical modification to enhance their barrier properties against oxygen, moisture, and grease. The coatings are particularly valuable for food packaging applications where biodegradability and sustainability are required alongside functional barrier performance.

- Lignin and plant oil-based barrier systems: Lignin, a by-product of paper production, and plant oils can be utilized to create hydrophobic barrier coatings with excellent water resistance. These materials can be chemically modified or combined with other bio-based polymers to enhance their barrier properties. The natural hydrophobicity of lignin and plant oils makes them particularly effective for applications requiring water vapor barriers, while their antioxidant properties provide additional benefits for extending shelf life of packaged products.

- Biodegradable multilayer barrier structures: Multilayer structures combining different bio-based materials can achieve enhanced barrier properties through synergistic effects. These structures typically consist of layers with complementary properties - one providing oxygen barrier, another providing moisture resistance. The multilayer approach allows for customization of barrier properties while maintaining biodegradability. Advanced coating techniques ensure good adhesion between layers and uniform coverage, resulting in superior barrier performance compared to single-layer bio-based coatings.

- Bio-based barrier coatings with functional additives: Incorporating functional additives into bio-based barrier formulations can significantly enhance their performance. These additives include nanoclays, silicates, waxes, and antimicrobial compounds that can improve barrier properties while adding functionality such as antimicrobial activity or UV protection. The proper dispersion of these additives within the bio-based matrix is crucial for optimizing barrier performance. These enhanced coatings can meet specific industry requirements while maintaining their renewable and sustainable characteristics.

02 Protein and starch-based barrier formulations

Proteins (such as soy, whey, and zein) and starches can be formulated into effective barrier coatings. These natural polymers can be modified through various processes to improve their water resistance and barrier properties. The formulations often include plasticizers and cross-linking agents to enhance film formation and durability, resulting in renewable coatings that provide protection against oxygen, moisture, and grease penetration.Expand Specific Solutions03 Chitosan and alginate barrier systems

Marine-derived biopolymers like chitosan and alginate offer excellent film-forming capabilities and inherent antimicrobial properties. These materials can be processed into barrier coatings that not only restrict gas and moisture transmission but also provide active protection against microbial growth. Various modification techniques can enhance their water resistance and mechanical properties, making them suitable for food packaging and medical applications.Expand Specific Solutions04 Bio-based composite barrier coatings

Composite systems combining multiple bio-based materials create synergistic barrier properties. These formulations often incorporate nanoclays, cellulose nanocrystals, or other bio-fillers to create tortuous paths that impede gas and moisture migration. The layered structure of these composites enhances barrier performance while maintaining biodegradability. Various processing techniques like layer-by-layer assembly or nanocomposite formation are used to optimize the barrier efficiency.Expand Specific Solutions05 Lignin and plant oil-based barrier technologies

Lignin, a by-product of paper production, and plant oils can be transformed into effective barrier coatings. These materials provide hydrophobic properties and can be chemically modified to enhance their barrier performance against oxygen and water vapor. The coatings are often applied through conventional methods like spray coating or roll-to-roll processes. Their renewable nature and biodegradability make them environmentally friendly alternatives to synthetic barrier materials.Expand Specific Solutions

Key Industry Players in Sustainable Packaging

The bio-based barrier coatings market for sustainable packaging is in a growth phase, driven by increasing environmental concerns and regulatory pressures. The market is expanding rapidly with an estimated value of several billion dollars, expected to grow significantly in the next decade. Technologically, the field shows varying maturity levels, with companies like Tetra Laval, Stora Enso, and UPM-Kymmene leading commercial applications, while research institutions such as VTT, Delft University of Technology, and Shaanxi University of Science & Technology advance fundamental innovations. Chemical industry players including BASF, Kemira, and Solenis are developing specialized formulations, while packaging end-users like Procter & Gamble and Frito-Lay are implementing these solutions to meet sustainability goals. The competitive landscape reflects a collaborative ecosystem where cross-sector partnerships are accelerating technology commercialization.

Kemira Oyj

Technical Solution: Kemira has developed FennoGuard™, a comprehensive portfolio of bio-based barrier coating solutions specifically designed for sustainable packaging applications. Their technology utilizes modified biopolymers including starches, cellulose derivatives, and chitosan to create water-based dispersions that provide excellent barrier properties against oxygen, water vapor, and grease[1]. Kemira's approach involves surface modification of natural polymers to enhance their barrier performance while maintaining biodegradability. Their proprietary cross-linking technology creates a dense polymer network that significantly improves barrier properties without compromising the material's end-of-life recyclability or compostability[3]. The company has also developed bio-based additives that enhance the performance of conventional barrier coatings, allowing for gradual transition to fully sustainable solutions. Kemira's water-based formulations can be applied using standard coating equipment, making implementation straightforward for packaging manufacturers.

Strengths: Extensive expertise in chemistry and surface treatments; global production capacity; strong technical service capabilities to support customer implementation. Weaknesses: Some formulations still require synthetic components to achieve performance targets; higher cost compared to conventional petroleum-based alternatives; performance consistency can vary with raw material sources.

UPM-Kymmene Oyj

Technical Solution: UPM has developed advanced bio-based barrier technologies centered around their proprietary UPM BioVerno naphtha, derived from crude tall oil, a residue of pulp production. This renewable raw material serves as the foundation for their barrier coatings that deliver excellent moisture, oxygen, and grease resistance. Their technology incorporates cellulose nanofibrils (CNF) modified with functional groups to enhance barrier properties while maintaining biodegradability[2]. UPM's barrier solutions include multi-layer structures where each layer provides specific functionality - mechanical strength from the fiber substrate, barrier properties from the bio-coating, and heat-sealability from the top layer. The company has successfully commercialized these solutions through their UPM Specialty Papers division, which produces packaging papers with integrated bio-barriers that can replace plastic in various food packaging applications[4]. Their coatings are applied using conventional equipment, facilitating adoption by converters.

Strengths: Integrated production from forest to finished products ensures consistent raw material quality; strong patent portfolio in bio-based materials; established commercial production capacity. Weaknesses: Some applications still require hybrid solutions combining bio-based and synthetic components; performance in extreme temperature conditions can be challenging compared to fully synthetic alternatives.

Critical Patents and Innovations in Bio-based Barriers

A biodegradable and water repellent based coating material for packaging applications and preparation

PatentPendingIN202341052665A

Innovation

- The use of biodegradable polymers such as polylactic acid (PLA), polyhydroxy alkanoates (PHA), polybutylene succinate (PBS), polycaprolactone (PCL), starch, cellulose, and chitosan as barrier coatings on paper to enhance its barrier properties against water vapor and oxygen, addressing the limitations of paper's porous structure.

Coatings and methods of making and use thereof

PatentPendingUS20240400854A1

Innovation

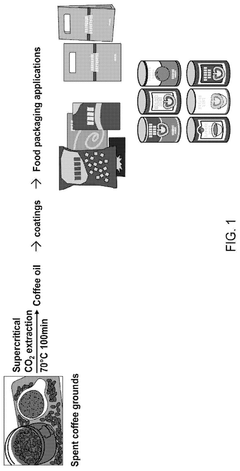

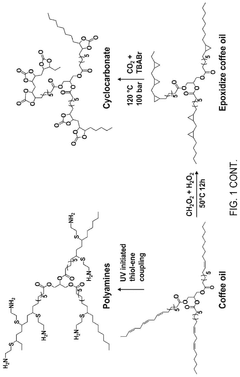

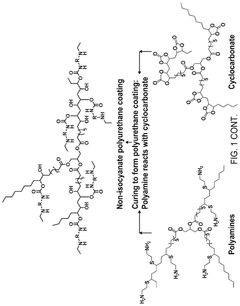

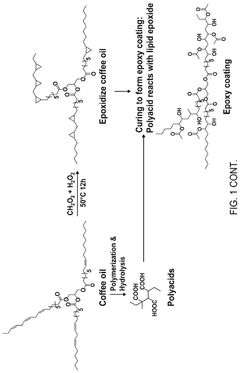

- The development of bio-based biodegradable coatings using oil extracted from spent coffee grounds, which is epoxidized and used to create epoxy and polyurethane coatings with tailored mechanical, thermal, and barrier properties suitable for various packaging materials such as plastics, paper, and metals, utilizing polyacids, polyamines, and cyclocarbonates as curing agents.

Environmental Impact Assessment

The environmental impact assessment of bio-based barrier coatings reveals significant advantages over conventional petroleum-based alternatives. Life cycle assessments (LCAs) indicate that bio-based coatings generally produce 30-45% lower greenhouse gas emissions throughout their lifecycle compared to traditional plastic coatings. This reduction stems primarily from the renewable nature of the raw materials and their ability to sequester carbon during growth phases.

Water consumption patterns vary considerably depending on the specific bio-based material. While some cellulose-based coatings demonstrate water efficiency advantages, certain starch-based alternatives may require more intensive irrigation during crop cultivation. Recent innovations in agricultural practices have shown potential to reduce the water footprint by up to 25% for crops destined for coating production.

Land use considerations present both challenges and opportunities. The cultivation of feedstock for bio-based coatings requires dedicated agricultural land, potentially competing with food production. However, research indicates that second-generation feedstocks utilizing agricultural waste streams can mitigate this concern while providing additional income streams for farmers and reducing waste disposal issues.

Biodegradability and end-of-life scenarios offer perhaps the most compelling environmental advantage. Studies demonstrate that properly formulated bio-based barrier coatings can decompose in industrial composting facilities within 90-180 days, compared to centuries for conventional plastics. This characteristic significantly reduces persistent environmental pollution, particularly in marine environments where packaging waste often accumulates.

Chemical safety profiles of bio-based coatings generally show reduced toxicity compared to petroleum-based alternatives. The absence of bisphenol A, phthalates, and other endocrine-disrupting chemicals commonly found in conventional coatings represents a substantial environmental and public health benefit. However, certain bio-based formulations may still contain additives requiring careful assessment and regulation.

Energy consumption during manufacturing remains a challenge, with some bio-based coating processes requiring 10-20% more energy than conventional coating production. This gap is gradually narrowing as processing technologies mature and economies of scale develop. Integration of renewable energy sources in manufacturing facilities has demonstrated potential to offset these differences.

Regulatory frameworks worldwide are increasingly recognizing the environmental benefits of bio-based materials through incentive programs, extended producer responsibility schemes, and restrictions on conventional plastics. These policy developments are accelerating market adoption while encouraging further environmental optimization of bio-based coating technologies.

Water consumption patterns vary considerably depending on the specific bio-based material. While some cellulose-based coatings demonstrate water efficiency advantages, certain starch-based alternatives may require more intensive irrigation during crop cultivation. Recent innovations in agricultural practices have shown potential to reduce the water footprint by up to 25% for crops destined for coating production.

Land use considerations present both challenges and opportunities. The cultivation of feedstock for bio-based coatings requires dedicated agricultural land, potentially competing with food production. However, research indicates that second-generation feedstocks utilizing agricultural waste streams can mitigate this concern while providing additional income streams for farmers and reducing waste disposal issues.

Biodegradability and end-of-life scenarios offer perhaps the most compelling environmental advantage. Studies demonstrate that properly formulated bio-based barrier coatings can decompose in industrial composting facilities within 90-180 days, compared to centuries for conventional plastics. This characteristic significantly reduces persistent environmental pollution, particularly in marine environments where packaging waste often accumulates.

Chemical safety profiles of bio-based coatings generally show reduced toxicity compared to petroleum-based alternatives. The absence of bisphenol A, phthalates, and other endocrine-disrupting chemicals commonly found in conventional coatings represents a substantial environmental and public health benefit. However, certain bio-based formulations may still contain additives requiring careful assessment and regulation.

Energy consumption during manufacturing remains a challenge, with some bio-based coating processes requiring 10-20% more energy than conventional coating production. This gap is gradually narrowing as processing technologies mature and economies of scale develop. Integration of renewable energy sources in manufacturing facilities has demonstrated potential to offset these differences.

Regulatory frameworks worldwide are increasingly recognizing the environmental benefits of bio-based materials through incentive programs, extended producer responsibility schemes, and restrictions on conventional plastics. These policy developments are accelerating market adoption while encouraging further environmental optimization of bio-based coating technologies.

Regulatory Framework for Food Contact Materials

The regulatory landscape governing food contact materials (FCMs) plays a crucial role in the development and commercialization of bio-based barrier coatings for sustainable packaging. In the United States, the Food and Drug Administration (FDA) regulates FCMs under the Federal Food, Drug, and Cosmetic Act, requiring manufacturers to ensure that materials in contact with food are safe for their intended use. The FDA's Food Contact Notification (FCN) program provides a pathway for new materials to enter the market, with specific requirements for migration testing and safety assessments.

In the European Union, Regulation (EC) No 1935/2004 establishes the overarching framework for FCMs, stipulating that materials must not transfer constituents to food in quantities that could endanger human health or bring unacceptable changes to food composition. For bio-based barrier coatings, compliance with Commission Regulation (EU) No 10/2011 on plastic materials is often required, even for non-plastic biopolymers, creating regulatory challenges for innovative materials.

Japan implements a positive list system through the Food Sanitation Act, specifying substances permitted in food packaging. China has been strengthening its regulatory framework through GB standards that address food safety requirements for packaging materials. These regional differences in regulatory approaches create complexity for global market access of bio-based barrier coatings.

Migration testing represents a critical regulatory requirement across jurisdictions. For bio-based coatings, standard migration protocols may need adaptation to account for the unique properties of natural polymers and their degradation products. Overall migration limits (OML) and specific migration limits (SML) must be met, with testing conducted using food simulants under conditions representing worst-case scenarios of food contact.

Sustainability claims for bio-based packaging materials are increasingly subject to regulatory scrutiny. The EU's Single-Use Plastics Directive and various national regulations on compostability and biodegradability set specific standards that bio-based coatings must meet to make environmental claims. Third-party certification schemes like TÜV Austria's OK Compost and the Biodegradable Products Institute (BPI) certification provide standardized verification of these properties.

Emerging regulatory trends include the development of specific frameworks for novel bio-based materials, harmonization efforts to reduce regulatory barriers to innovation, and increased focus on the entire lifecycle assessment of packaging materials. Companies developing bio-based barrier coatings must maintain regulatory intelligence capabilities to navigate this complex and evolving landscape effectively.

In the European Union, Regulation (EC) No 1935/2004 establishes the overarching framework for FCMs, stipulating that materials must not transfer constituents to food in quantities that could endanger human health or bring unacceptable changes to food composition. For bio-based barrier coatings, compliance with Commission Regulation (EU) No 10/2011 on plastic materials is often required, even for non-plastic biopolymers, creating regulatory challenges for innovative materials.

Japan implements a positive list system through the Food Sanitation Act, specifying substances permitted in food packaging. China has been strengthening its regulatory framework through GB standards that address food safety requirements for packaging materials. These regional differences in regulatory approaches create complexity for global market access of bio-based barrier coatings.

Migration testing represents a critical regulatory requirement across jurisdictions. For bio-based coatings, standard migration protocols may need adaptation to account for the unique properties of natural polymers and their degradation products. Overall migration limits (OML) and specific migration limits (SML) must be met, with testing conducted using food simulants under conditions representing worst-case scenarios of food contact.

Sustainability claims for bio-based packaging materials are increasingly subject to regulatory scrutiny. The EU's Single-Use Plastics Directive and various national regulations on compostability and biodegradability set specific standards that bio-based coatings must meet to make environmental claims. Third-party certification schemes like TÜV Austria's OK Compost and the Biodegradable Products Institute (BPI) certification provide standardized verification of these properties.

Emerging regulatory trends include the development of specific frameworks for novel bio-based materials, harmonization efforts to reduce regulatory barriers to innovation, and increased focus on the entire lifecycle assessment of packaging materials. Companies developing bio-based barrier coatings must maintain regulatory intelligence capabilities to navigate this complex and evolving landscape effectively.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!