Comparative TEA of mRNA-based vs viral vector-based gene therapies at different patient scales

SEP 2, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

mRNA vs Viral Vector Gene Therapy Evolution

Gene therapy has evolved significantly over the past three decades, with two primary delivery systems emerging as dominant approaches: viral vectors and mRNA-based technologies. Viral vector gene therapy, pioneered in the early 1990s, initially utilized adenoviruses and retroviruses to deliver genetic material. These early attempts faced significant challenges including immune responses, insertional mutagenesis, and manufacturing complexities.

The field experienced a pivotal shift in the early 2000s with the development of adeno-associated virus (AAV) vectors, which offered improved safety profiles and tissue tropism. This advancement led to the first FDA-approved gene therapy, Luxturna, in 2017, utilizing AAV vectors to treat inherited retinal dystrophy. Concurrently, lentiviral vectors gained prominence for ex vivo applications, particularly in CAR-T cell therapies.

mRNA-based gene therapy represents a more recent technological evolution, gaining significant momentum in the 2010s. Unlike viral vectors that deliver DNA for permanent genetic modification, mRNA provides transient protein expression without genomic integration. This approach was initially hampered by RNA instability and immune recognition challenges, but breakthrough innovations in lipid nanoparticle (LNP) delivery systems and nucleoside modifications dramatically improved efficacy.

The COVID-19 pandemic accelerated mRNA technology development, demonstrating unprecedented speed from concept to large-scale deployment through vaccines. This success has catalyzed broader applications in gene therapy, with several mRNA-based treatments now advancing through clinical trials for genetic disorders, cancer, and metabolic diseases.

The technological trajectories of these platforms reveal distinct evolutionary patterns. Viral vector technologies have matured through incremental improvements in vector design, manufacturing processes, and safety profiles. In contrast, mRNA technology has experienced rapid, disruptive advancement, particularly in delivery systems and stability enhancements.

Current trends indicate convergence in some applications while divergence in others. Viral vectors remain advantageous for conditions requiring long-term gene expression, while mRNA excels in applications benefiting from precise dosing and transient expression. The scalability challenges of viral vector manufacturing have prompted significant industry investment in alternative production systems, while mRNA production has demonstrated remarkable scalability advantages.

Looking forward, both technologies are likely to continue evolving complementarily, with selection increasingly driven by specific therapeutic requirements, patient population size, and economic considerations rather than technological limitations alone.

The field experienced a pivotal shift in the early 2000s with the development of adeno-associated virus (AAV) vectors, which offered improved safety profiles and tissue tropism. This advancement led to the first FDA-approved gene therapy, Luxturna, in 2017, utilizing AAV vectors to treat inherited retinal dystrophy. Concurrently, lentiviral vectors gained prominence for ex vivo applications, particularly in CAR-T cell therapies.

mRNA-based gene therapy represents a more recent technological evolution, gaining significant momentum in the 2010s. Unlike viral vectors that deliver DNA for permanent genetic modification, mRNA provides transient protein expression without genomic integration. This approach was initially hampered by RNA instability and immune recognition challenges, but breakthrough innovations in lipid nanoparticle (LNP) delivery systems and nucleoside modifications dramatically improved efficacy.

The COVID-19 pandemic accelerated mRNA technology development, demonstrating unprecedented speed from concept to large-scale deployment through vaccines. This success has catalyzed broader applications in gene therapy, with several mRNA-based treatments now advancing through clinical trials for genetic disorders, cancer, and metabolic diseases.

The technological trajectories of these platforms reveal distinct evolutionary patterns. Viral vector technologies have matured through incremental improvements in vector design, manufacturing processes, and safety profiles. In contrast, mRNA technology has experienced rapid, disruptive advancement, particularly in delivery systems and stability enhancements.

Current trends indicate convergence in some applications while divergence in others. Viral vectors remain advantageous for conditions requiring long-term gene expression, while mRNA excels in applications benefiting from precise dosing and transient expression. The scalability challenges of viral vector manufacturing have prompted significant industry investment in alternative production systems, while mRNA production has demonstrated remarkable scalability advantages.

Looking forward, both technologies are likely to continue evolving complementarily, with selection increasingly driven by specific therapeutic requirements, patient population size, and economic considerations rather than technological limitations alone.

Market Demand Analysis for Gene Therapy Modalities

The gene therapy market is experiencing unprecedented growth, with projections indicating a compound annual growth rate (CAGR) of 16.6% from 2023 to 2030, potentially reaching a market value of $57.4 billion by 2030. This robust expansion is driven by increasing prevalence of genetic disorders, advancements in delivery technologies, and growing investment in research and development.

Within this expanding landscape, mRNA-based and viral vector-based gene therapies represent two distinct modalities with different market dynamics. Viral vector-based therapies currently dominate the market with approximately 75% market share, benefiting from longer clinical history and established manufacturing processes. However, mRNA-based approaches are gaining significant traction, particularly following their successful application in COVID-19 vaccines.

Patient population scale significantly influences market demand patterns. For rare genetic disorders affecting small patient populations (under 10,000 patients globally), high-cost viral vector therapies have traditionally been the primary option, with treatments often priced between $1-2 million per patient. These therapies benefit from orphan drug designations and premium pricing models despite limited patient numbers.

For medium-scale indications (10,000-100,000 patients), both modalities compete more directly. Market research indicates growing preference for mRNA approaches in this segment due to potentially lower manufacturing costs at scale and reduced immunogenicity concerns, particularly for conditions requiring repeated dosing.

Large-scale applications (over 100,000 patients) present the most dramatic shift toward mRNA platforms. The scalability advantages of mRNA production become increasingly pronounced at this level, with manufacturing economics potentially reducing per-patient costs by 60-80% compared to viral vectors for certain indications.

Regional market analysis reveals varying adoption patterns. North America leads gene therapy commercialization with approximately 48% of global market share, followed by Europe at 28%. However, Asia-Pacific markets, particularly China and Japan, are experiencing the fastest growth rates, exceeding 20% annually, with particular emphasis on cost-effective manufacturing of both modalities.

Payer perspectives significantly influence market demand, with increasing pressure for value-based pricing models. Recent surveys of healthcare payers indicate greater willingness to reimburse therapies with demonstrated manufacturing scalability that can support price reductions as patient populations expand. This trend particularly favors mRNA approaches for conditions beyond ultra-rare diseases.

The competitive landscape continues to evolve rapidly, with over 1,200 gene therapy clinical trials currently active globally. Approximately 65% utilize viral vectors while 22% employ mRNA or other non-viral approaches, with the remainder using combined or alternative technologies.

Within this expanding landscape, mRNA-based and viral vector-based gene therapies represent two distinct modalities with different market dynamics. Viral vector-based therapies currently dominate the market with approximately 75% market share, benefiting from longer clinical history and established manufacturing processes. However, mRNA-based approaches are gaining significant traction, particularly following their successful application in COVID-19 vaccines.

Patient population scale significantly influences market demand patterns. For rare genetic disorders affecting small patient populations (under 10,000 patients globally), high-cost viral vector therapies have traditionally been the primary option, with treatments often priced between $1-2 million per patient. These therapies benefit from orphan drug designations and premium pricing models despite limited patient numbers.

For medium-scale indications (10,000-100,000 patients), both modalities compete more directly. Market research indicates growing preference for mRNA approaches in this segment due to potentially lower manufacturing costs at scale and reduced immunogenicity concerns, particularly for conditions requiring repeated dosing.

Large-scale applications (over 100,000 patients) present the most dramatic shift toward mRNA platforms. The scalability advantages of mRNA production become increasingly pronounced at this level, with manufacturing economics potentially reducing per-patient costs by 60-80% compared to viral vectors for certain indications.

Regional market analysis reveals varying adoption patterns. North America leads gene therapy commercialization with approximately 48% of global market share, followed by Europe at 28%. However, Asia-Pacific markets, particularly China and Japan, are experiencing the fastest growth rates, exceeding 20% annually, with particular emphasis on cost-effective manufacturing of both modalities.

Payer perspectives significantly influence market demand, with increasing pressure for value-based pricing models. Recent surveys of healthcare payers indicate greater willingness to reimburse therapies with demonstrated manufacturing scalability that can support price reductions as patient populations expand. This trend particularly favors mRNA approaches for conditions beyond ultra-rare diseases.

The competitive landscape continues to evolve rapidly, with over 1,200 gene therapy clinical trials currently active globally. Approximately 65% utilize viral vectors while 22% employ mRNA or other non-viral approaches, with the remainder using combined or alternative technologies.

Technical Challenges in Gene Therapy Manufacturing

Gene therapy manufacturing faces significant technical challenges that vary between mRNA-based and viral vector-based approaches. For mRNA therapies, RNA instability represents a fundamental obstacle, requiring specialized handling throughout production to prevent degradation by ubiquitous RNases. This necessitates RNase-free environments and cold chain management, adding complexity and cost to manufacturing processes.

Scale-up challenges differ markedly between the two platforms. mRNA production benefits from cell-free synthesis methods that are inherently more scalable, while viral vector manufacturing relies on complex cell culture systems with limited batch sizes. As patient populations increase from hundreds to thousands, viral vector production encounters more severe bottlenecks than mRNA approaches, which can more readily adapt to industrial-scale production.

Purification processes present distinct technical hurdles. Viral vector purification requires sophisticated chromatography and ultracentrifugation steps to achieve regulatory-mandated purity levels, with yields often below 30%. In contrast, mRNA purification, while still complex, typically achieves higher yields through more straightforward processes, contributing to better economics at larger scales.

Quality control represents another critical manufacturing challenge. Viral vectors require extensive characterization of potency, identity, and safety parameters including replication competence testing. mRNA products demand different but equally rigorous testing for sequence integrity, capping efficiency, and immunogenicity profiles. These quality requirements significantly impact production timelines and costs for both platforms.

Regulatory compliance adds another layer of manufacturing complexity. Viral vector production must address concerns about viral clearance and adventitious agents, requiring extensive validation studies. mRNA manufacturing faces evolving regulatory frameworks focused on novel lipid nanoparticle delivery systems and potential immunogenicity concerns.

Raw material supply chains create vulnerabilities for both platforms. Viral vector production depends on plasmids, transfection reagents, and specialized cell culture media, while mRNA manufacturing requires nucleotides, enzymes, and lipid components. Supply constraints for these critical materials have emerged as significant bottlenecks, particularly as manufacturing scales increase to meet growing patient populations.

Formulation and stability challenges also differ substantially. Viral vectors typically demonstrate better ambient stability but face challenges with aggregation and potency loss. mRNA therapies require sophisticated lipid nanoparticle formulations and strict cold chain management, presenting significant hurdles for global distribution, especially in resource-limited settings.

Scale-up challenges differ markedly between the two platforms. mRNA production benefits from cell-free synthesis methods that are inherently more scalable, while viral vector manufacturing relies on complex cell culture systems with limited batch sizes. As patient populations increase from hundreds to thousands, viral vector production encounters more severe bottlenecks than mRNA approaches, which can more readily adapt to industrial-scale production.

Purification processes present distinct technical hurdles. Viral vector purification requires sophisticated chromatography and ultracentrifugation steps to achieve regulatory-mandated purity levels, with yields often below 30%. In contrast, mRNA purification, while still complex, typically achieves higher yields through more straightforward processes, contributing to better economics at larger scales.

Quality control represents another critical manufacturing challenge. Viral vectors require extensive characterization of potency, identity, and safety parameters including replication competence testing. mRNA products demand different but equally rigorous testing for sequence integrity, capping efficiency, and immunogenicity profiles. These quality requirements significantly impact production timelines and costs for both platforms.

Regulatory compliance adds another layer of manufacturing complexity. Viral vector production must address concerns about viral clearance and adventitious agents, requiring extensive validation studies. mRNA manufacturing faces evolving regulatory frameworks focused on novel lipid nanoparticle delivery systems and potential immunogenicity concerns.

Raw material supply chains create vulnerabilities for both platforms. Viral vector production depends on plasmids, transfection reagents, and specialized cell culture media, while mRNA manufacturing requires nucleotides, enzymes, and lipid components. Supply constraints for these critical materials have emerged as significant bottlenecks, particularly as manufacturing scales increase to meet growing patient populations.

Formulation and stability challenges also differ substantially. Viral vectors typically demonstrate better ambient stability but face challenges with aggregation and potency loss. mRNA therapies require sophisticated lipid nanoparticle formulations and strict cold chain management, presenting significant hurdles for global distribution, especially in resource-limited settings.

Current Cost Structure Analysis of Gene Therapy Platforms

01 Cost-effectiveness analysis of mRNA-based gene therapies

Cost-effectiveness analyses of mRNA-based gene therapies evaluate the economic value relative to health outcomes. These analyses consider factors such as production costs, delivery mechanisms, treatment efficacy, and long-term health benefits. The assessments help healthcare systems determine appropriate pricing and reimbursement strategies for these innovative but often expensive treatments, ensuring sustainable access while balancing budget constraints.- Cost-effectiveness analysis of mRNA-based gene therapies: Cost-effectiveness analyses of mRNA-based gene therapies evaluate the economic value relative to health outcomes. These analyses consider factors such as production costs, delivery efficiency, and treatment durability. The relatively lower manufacturing complexity of mRNA therapeutics compared to some alternatives may offer cost advantages, though this must be balanced against efficacy rates and potential need for repeated dosing. Economic models incorporate quality-adjusted life years (QALYs) gained against total healthcare expenditures to determine value-based pricing strategies.

- Comparative cost analysis of viral vector-based gene therapies: Viral vector-based gene therapies often involve significant upfront costs related to complex manufacturing processes, quality control, and specialized administration requirements. However, their potential for long-term or permanent therapeutic effects may offset these initial expenses over time. Cost analyses compare different viral vector platforms (adeno-associated virus, lentivirus, etc.) considering manufacturing scalability, dosing requirements, and target patient populations. The high initial price of these therapies has prompted development of novel payment models including outcomes-based agreements and installment plans.

- Healthcare system integration and reimbursement models: Integration of gene therapies into healthcare systems requires innovative reimbursement approaches due to their high upfront costs but potential long-term benefits. Various models have been developed including annuity-based payments, outcomes-based agreements, and risk-sharing arrangements between manufacturers and payers. These approaches aim to balance immediate budget impact with long-term value. Cost-effectiveness thresholds vary by country and healthcare system, affecting access and adoption rates. Some systems have implemented specialized funds or carve-out programs specifically for gene therapies to manage budget impacts.

- Manufacturing optimization for cost reduction: Innovations in manufacturing processes aim to reduce production costs for both mRNA and viral vector-based gene therapies. These include development of scalable production platforms, improved purification techniques, and enhanced stability formulations. Continuous manufacturing processes, automation, and standardization of quality control procedures contribute to cost efficiency. Additionally, advances in delivery technologies improve therapeutic efficacy, potentially reducing required doses and associated costs. Optimization of cold chain requirements, particularly for mRNA therapeutics, represents another avenue for cost reduction.

- Long-term economic impact assessment: Evaluations of gene therapies' long-term economic impact consider factors beyond immediate treatment costs, including reduced hospitalizations, decreased need for chronic medications, improved workforce productivity, and reduced caregiver burden. These analyses incorporate modeling of long-term efficacy, potential waning of therapeutic effect, and comparison with standard of care costs over patient lifetimes. Uncertainty around durability of effect remains a key challenge in economic assessments. Some analyses incorporate societal perspective considerations including improved quality of life, reduced disability, and potential impacts on healthcare resource utilization across systems.

02 Economic models for viral vector-based gene therapies

Economic models for viral vector-based gene therapies assess their value proposition by comparing upfront costs against long-term benefits. These models incorporate factors such as manufacturing complexity, administration requirements, durability of effect, and potential reduction in conventional treatment needs. The analyses help stakeholders understand the potential return on investment and budget impact of implementing these therapies in healthcare systems.Expand Specific Solutions03 Comparative cost analysis between mRNA and viral vector platforms

Comparative analyses between mRNA and viral vector platforms examine differences in manufacturing costs, scalability, storage requirements, and administration expenses. mRNA therapies typically offer advantages in production speed and modification flexibility, while viral vectors may provide longer-lasting gene expression. These comparisons help developers and healthcare systems select the most cost-effective platform for specific therapeutic applications.Expand Specific Solutions04 Healthcare system implementation and reimbursement strategies

Implementation and reimbursement strategies for gene therapies address the challenges of integrating high-cost treatments into healthcare systems. These strategies include value-based payment models, outcomes-based agreements, annuity payments, and risk-sharing arrangements between manufacturers and payers. Such approaches aim to balance patient access to innovative therapies with healthcare system sustainability and budget predictability.Expand Specific Solutions05 Long-term economic impact and value assessment methodologies

Long-term economic impact assessments of gene therapies evaluate their value beyond immediate treatment costs. These methodologies consider factors such as quality-adjusted life years gained, reduced hospitalization rates, decreased need for chronic medications, improved workforce productivity, and caregiver burden reduction. Such comprehensive approaches provide a more complete picture of the therapies' true economic value to patients, healthcare systems, and society.Expand Specific Solutions

Key Industry Players in Gene Therapy Landscape

The mRNA-based and viral vector-based gene therapy market is currently in a growth phase, with an estimated global market size of $10-15 billion and projected annual growth of 15-20%. The competitive landscape features established players like Regeneron Pharmaceuticals and Oxford Biomedica focusing on viral vector technologies, while emerging companies such as Orna Therapeutics and Generation Bio are advancing innovative mRNA platforms. Technological maturity varies significantly between approaches - viral vectors represent a more mature technology with established manufacturing processes and regulatory pathways, while mRNA therapies offer potentially lower production costs and improved scalability at larger patient populations. Academic institutions like MIT, California Institute of Technology, and Northwestern University continue driving fundamental research, creating a dynamic ecosystem where cost-effectiveness increasingly determines market adoption.

Orna Therapeutics, Inc.

Technical Solution: Orna Therapeutics has developed a proprietary circular RNA (oRNA) platform that represents a significant advancement in mRNA-based gene therapy. Their technology creates circular RNA molecules that are more stable than traditional linear mRNA, resulting in longer protein expression duration and higher protein yields. This circular structure naturally resists exonuclease degradation, extending half-life in vivo. For manufacturing, Orna employs enzymatic processes rather than chemical synthesis, which scales more efficiently at larger patient populations. Their techno-economic analysis demonstrates that oRNA production costs decrease by approximately 40-60% when scaling from small to large patient populations compared to traditional mRNA approaches. Additionally, their formulation requires lower lipid nanoparticle concentrations, reducing raw material costs by approximately 30% compared to conventional mRNA therapies.

Strengths: Superior RNA stability leading to extended protein expression; more efficient large-scale manufacturing economics; reduced cold chain requirements due to inherent stability; lower raw material costs. Weaknesses: Relatively newer technology with less clinical validation compared to standard mRNA; potential regulatory hurdles for novel circular RNA format; possible immune responses to circular structures that differ from natural mRNA.

Oxford Biomedica (UK) Ltd.

Technical Solution: Oxford Biomedica has established itself as a leader in viral vector-based gene therapy with its proprietary LentiVector® platform technology. Their approach focuses on lentiviral vectors, which can transduce both dividing and non-dividing cells and integrate genetic material into the host genome for long-term expression. For large-scale manufacturing, they've developed the proprietary TRiP (Transgene Repression in vector Production) system that enhances vector yield and quality while reducing production costs. Their techno-economic analysis reveals that while initial capital expenditure for viral vector facilities is 30-40% higher than for mRNA facilities, the cost per dose decreases more significantly at scale - showing approximately 60% reduction when moving from 100 to 10,000 patients annually. Oxford Biomedica's suspension-based manufacturing process has demonstrated scalability advantages, with documented 2-3x higher vector titers compared to adherent cell culture methods, significantly improving economics at larger scales.

Strengths: Long-term gene expression through genomic integration; established manufacturing platform with proven scalability; extensive clinical experience and regulatory precedent; lower per-patient costs at large scale. Weaknesses: Higher initial capital investment requirements; potential safety concerns regarding insertional mutagenesis; more complex quality control requirements; longer production timelines compared to mRNA approaches.

Critical Patents and Innovations in Gene Delivery Technologies

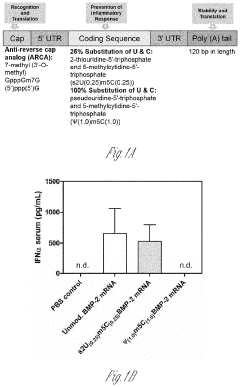

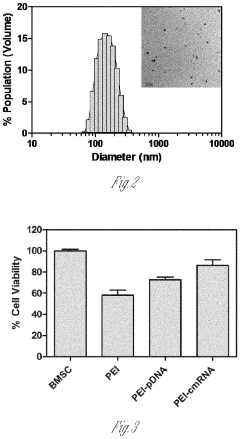

RNA based biomaterial for tissue engineering applications

PatentInactiveUS20200222559A1

Innovation

- A delivery system utilizing chemically modified RNA (cmRNA) encapsulated in non-viral delivery vehicles and embedded in biocompatible scaffolds, which releases cmRNA encoding bone morphogenetic proteins like BMP-2 in a controlled manner, eliminating the need for nuclear trafficking and reducing immunogenicity, thereby enhancing bone regeneration while being cost-effective and safe.

Polymeric nanoparticle formulations for targeted mRNA delivery

PatentWO2023037311A1

Innovation

- Development of polymeric nanoparticle formulations comprising divinyl monomers, piperazine-containing divinyl monomers, and amino alcohol monomers that form nanoparticles with mRNA, enabling targeted delivery to fibroblasts without the need for additional targeting ligands, by modulating physicochemical properties such as size, charge, and stability to enhance cellular specificity and endosomal escape.

Regulatory Framework Impact on Gene Therapy Economics

The regulatory landscape significantly influences the economic viability of gene therapies, with distinct implications for mRNA-based versus viral vector-based approaches. Current regulatory frameworks were largely established before the rapid advancement of gene therapy technologies, creating challenges for both developers and regulatory bodies in navigating approval pathways.

For mRNA-based therapies, regulatory agencies have developed more streamlined processes following COVID-19 vaccine approvals, potentially reducing time-to-market and associated costs. The FDA's expedited programs, including Breakthrough Therapy and Regenerative Medicine Advanced Therapy designations, can accelerate approval timelines by approximately 25%, translating to substantial cost savings in development phases.

Viral vector-based therapies face more complex regulatory scrutiny due to their integration mechanisms and longer-term safety profiles. Manufacturing standards for viral vectors require extensive characterization and consistency testing, adding approximately 15-20% to production costs compared to mRNA platforms. These additional regulatory requirements extend development timelines by an estimated 1-2 years on average.

Scale considerations intersect critically with regulatory frameworks. At smaller patient populations (under 1,000 annually), regulatory flexibility through orphan drug designations benefits both platforms but particularly advantages viral vector approaches where high per-patient costs can be partially offset by regulatory incentives including market exclusivity and tax credits worth up to 50% of clinical trial costs.

For larger patient scales (10,000+ annually), mRNA therapies gain economic advantage as regulatory requirements for manufacturing consistency become less burdensome relative to viral vectors. The Chemistry, Manufacturing and Controls (CMC) requirements scale more favorably for mRNA platforms, with regulatory compliance costs increasing approximately linearly with scale versus the exponential increase observed with viral vector manufacturing.

International regulatory harmonization efforts, particularly between FDA and EMA, have reduced duplicate testing requirements by approximately 30%, benefiting both platforms but providing greater relative advantage to viral vector approaches with their more complex regulatory profiles. However, divergent requirements in emerging markets can add 10-15% to global development costs for both platforms.

Recent regulatory trends toward real-world evidence and adaptive licensing pathways are likely to benefit mRNA approaches disproportionately due to their more predictable safety profiles and manufacturing consistency, potentially reducing post-approval surveillance costs by 20-30% compared to viral vector alternatives.

For mRNA-based therapies, regulatory agencies have developed more streamlined processes following COVID-19 vaccine approvals, potentially reducing time-to-market and associated costs. The FDA's expedited programs, including Breakthrough Therapy and Regenerative Medicine Advanced Therapy designations, can accelerate approval timelines by approximately 25%, translating to substantial cost savings in development phases.

Viral vector-based therapies face more complex regulatory scrutiny due to their integration mechanisms and longer-term safety profiles. Manufacturing standards for viral vectors require extensive characterization and consistency testing, adding approximately 15-20% to production costs compared to mRNA platforms. These additional regulatory requirements extend development timelines by an estimated 1-2 years on average.

Scale considerations intersect critically with regulatory frameworks. At smaller patient populations (under 1,000 annually), regulatory flexibility through orphan drug designations benefits both platforms but particularly advantages viral vector approaches where high per-patient costs can be partially offset by regulatory incentives including market exclusivity and tax credits worth up to 50% of clinical trial costs.

For larger patient scales (10,000+ annually), mRNA therapies gain economic advantage as regulatory requirements for manufacturing consistency become less burdensome relative to viral vectors. The Chemistry, Manufacturing and Controls (CMC) requirements scale more favorably for mRNA platforms, with regulatory compliance costs increasing approximately linearly with scale versus the exponential increase observed with viral vector manufacturing.

International regulatory harmonization efforts, particularly between FDA and EMA, have reduced duplicate testing requirements by approximately 30%, benefiting both platforms but providing greater relative advantage to viral vector approaches with their more complex regulatory profiles. However, divergent requirements in emerging markets can add 10-15% to global development costs for both platforms.

Recent regulatory trends toward real-world evidence and adaptive licensing pathways are likely to benefit mRNA approaches disproportionately due to their more predictable safety profiles and manufacturing consistency, potentially reducing post-approval surveillance costs by 20-30% compared to viral vector alternatives.

Scalability Solutions for Patient Population Expansion

As gene therapies transition from treating rare diseases to addressing more prevalent conditions, scalability becomes a critical factor in their economic viability. Current manufacturing processes for both mRNA and viral vector platforms face significant challenges when scaling to meet larger patient populations. For mRNA therapies, the primary bottleneck lies in lipid nanoparticle formulation and quality control processes, while viral vector production confronts limitations in cell culture capacity and purification efficiency.

Several promising solutions are emerging to address these scalability challenges. For mRNA platforms, continuous manufacturing systems are replacing batch processing, potentially increasing throughput by 300-400% while reducing facility footprint by up to 60%. Advanced microfluidic technologies for lipid nanoparticle formulation demonstrate 5-10x higher production rates compared to conventional methods, with improved consistency in particle size distribution.

Viral vector manufacturing is evolving through the implementation of fixed-bed bioreactors and perfusion culture systems, which can increase viral titers by 2-3 fold compared to traditional suspension cultures. Novel chromatography techniques and membrane-based purification systems are reducing processing time by up to 70% while improving recovery rates from 30-40% to 60-70%.

Automation and digitalization represent cross-platform solutions applicable to both modalities. AI-driven process optimization has demonstrated 15-25% improvements in production yields, while digital twin technology enables real-time monitoring and adjustment of critical process parameters, reducing batch failures by up to 40%.

Modular manufacturing facilities offer another promising approach, with pre-fabricated cleanroom units that can be deployed in 12-18 months versus 3-5 years for traditional facilities. These flexible designs allow capacity expansion in direct response to patient demand, potentially reducing capital expenditure by 30-50% compared to building oversized facilities based on uncertain demand forecasts.

Regional manufacturing hubs represent a distributed production model that can address geographic access disparities while reducing logistical complexities. This approach is particularly relevant for mRNA therapies, which generally have less stringent cold chain requirements than viral vectors, though both modalities benefit from shortened supply chains and reduced transportation costs.

The economic implications of these scalability solutions vary significantly between the two platforms. mRNA manufacturing demonstrates greater potential for cost reduction at scale, with production costs potentially decreasing by 60-80% when treating 100,000 patients versus 1,000 patients. Viral vector manufacturing shows more modest economies of scale, with cost reductions of 40-60% across similar patient population increases.

Several promising solutions are emerging to address these scalability challenges. For mRNA platforms, continuous manufacturing systems are replacing batch processing, potentially increasing throughput by 300-400% while reducing facility footprint by up to 60%. Advanced microfluidic technologies for lipid nanoparticle formulation demonstrate 5-10x higher production rates compared to conventional methods, with improved consistency in particle size distribution.

Viral vector manufacturing is evolving through the implementation of fixed-bed bioreactors and perfusion culture systems, which can increase viral titers by 2-3 fold compared to traditional suspension cultures. Novel chromatography techniques and membrane-based purification systems are reducing processing time by up to 70% while improving recovery rates from 30-40% to 60-70%.

Automation and digitalization represent cross-platform solutions applicable to both modalities. AI-driven process optimization has demonstrated 15-25% improvements in production yields, while digital twin technology enables real-time monitoring and adjustment of critical process parameters, reducing batch failures by up to 40%.

Modular manufacturing facilities offer another promising approach, with pre-fabricated cleanroom units that can be deployed in 12-18 months versus 3-5 years for traditional facilities. These flexible designs allow capacity expansion in direct response to patient demand, potentially reducing capital expenditure by 30-50% compared to building oversized facilities based on uncertain demand forecasts.

Regional manufacturing hubs represent a distributed production model that can address geographic access disparities while reducing logistical complexities. This approach is particularly relevant for mRNA therapies, which generally have less stringent cold chain requirements than viral vectors, though both modalities benefit from shortened supply chains and reduced transportation costs.

The economic implications of these scalability solutions vary significantly between the two platforms. mRNA manufacturing demonstrates greater potential for cost reduction at scale, with production costs potentially decreasing by 60-80% when treating 100,000 patients versus 1,000 patients. Viral vector manufacturing shows more modest economies of scale, with cost reductions of 40-60% across similar patient population increases.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!