Comparison of Ultrafiltration and Adsorption Techniques for Quality Assurance

SEP 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ultrafiltration and Adsorption Background and Objectives

Ultrafiltration and adsorption technologies represent two distinct yet complementary approaches in the field of separation science that have evolved significantly over the past several decades. Ultrafiltration, a pressure-driven membrane separation process, emerged in the 1960s as a promising technology for molecular separation based on size exclusion principles. Meanwhile, adsorption techniques, which rely on the affinity between solutes and solid surfaces, have roots dating back to ancient civilizations but saw scientific formalization in the 18th century with Scheele's work on charcoal.

The evolution of ultrafiltration has been marked by significant advancements in membrane materials, from cellulose acetate to modern polymeric and ceramic membranes with precisely controlled pore sizes and enhanced chemical resistance. Similarly, adsorption technology has progressed from simple activated carbon systems to sophisticated engineered adsorbents including zeolites, silica gels, and novel nanomaterials with tailored surface properties.

Current technological trends indicate a growing convergence of these separation methods, with hybrid systems becoming increasingly prevalent in industrial applications. The integration of ultrafiltration and adsorption processes offers synergistic benefits that address limitations inherent to each individual technique, particularly in handling complex feed streams with multiple contaminants of varying molecular sizes and chemical properties.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of ultrafiltration and adsorption techniques specifically in the context of quality assurance applications. This comparison aims to establish clear performance metrics across various parameters including separation efficiency, energy consumption, operational flexibility, scalability, and economic viability.

Furthermore, this research seeks to identify optimal implementation scenarios for each technology based on feed characteristics, required product specifications, and operational constraints. By mapping the strengths and limitations of each approach against specific quality assurance requirements, we aim to develop a decision framework that guides technology selection for diverse industrial applications.

An additional objective is to explore emerging innovations at the intersection of these technologies, including surface-modified ultrafiltration membranes with enhanced adsorptive properties, regenerable adsorbent systems with reduced waste generation, and intelligent control systems that optimize process parameters in real-time based on feed variations and quality targets.

Through this comprehensive analysis, we intend to provide actionable insights that support strategic technology investment decisions, process optimization efforts, and future research directions in the field of separation science for quality assurance applications across pharmaceutical, food and beverage, water treatment, and biotechnology sectors.

The evolution of ultrafiltration has been marked by significant advancements in membrane materials, from cellulose acetate to modern polymeric and ceramic membranes with precisely controlled pore sizes and enhanced chemical resistance. Similarly, adsorption technology has progressed from simple activated carbon systems to sophisticated engineered adsorbents including zeolites, silica gels, and novel nanomaterials with tailored surface properties.

Current technological trends indicate a growing convergence of these separation methods, with hybrid systems becoming increasingly prevalent in industrial applications. The integration of ultrafiltration and adsorption processes offers synergistic benefits that address limitations inherent to each individual technique, particularly in handling complex feed streams with multiple contaminants of varying molecular sizes and chemical properties.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of ultrafiltration and adsorption techniques specifically in the context of quality assurance applications. This comparison aims to establish clear performance metrics across various parameters including separation efficiency, energy consumption, operational flexibility, scalability, and economic viability.

Furthermore, this research seeks to identify optimal implementation scenarios for each technology based on feed characteristics, required product specifications, and operational constraints. By mapping the strengths and limitations of each approach against specific quality assurance requirements, we aim to develop a decision framework that guides technology selection for diverse industrial applications.

An additional objective is to explore emerging innovations at the intersection of these technologies, including surface-modified ultrafiltration membranes with enhanced adsorptive properties, regenerable adsorbent systems with reduced waste generation, and intelligent control systems that optimize process parameters in real-time based on feed variations and quality targets.

Through this comprehensive analysis, we intend to provide actionable insights that support strategic technology investment decisions, process optimization efforts, and future research directions in the field of separation science for quality assurance applications across pharmaceutical, food and beverage, water treatment, and biotechnology sectors.

Market Analysis for Quality Assurance Applications

The quality assurance market has witnessed significant growth in recent years, driven by increasing regulatory requirements across industries and growing consumer demand for high-quality products. The global quality assurance market was valued at approximately 8.25 billion USD in 2022 and is projected to reach 14.7 billion USD by 2028, growing at a CAGR of 9.2% during the forecast period.

Within this broader market, filtration and purification technologies play a crucial role, particularly in industries such as pharmaceuticals, food and beverage, water treatment, and biotechnology. The ultrafiltration segment specifically has shown robust growth, with the global ultrafiltration membrane market expected to reach 5.8 billion USD by 2025.

Adsorption technologies have similarly experienced steady market expansion, with activated carbon adsorption solutions alone accounting for over 3.2 billion USD in 2021. This growth is primarily fueled by stringent environmental regulations and increasing industrial applications requiring precise contaminant removal.

Regional analysis reveals that North America and Europe currently dominate the quality assurance technology market, holding approximately 60% of the market share collectively. However, the Asia-Pacific region is emerging as the fastest-growing market, with China and India leading the charge due to rapid industrialization and increasing adoption of international quality standards.

Industry-specific demand patterns show that pharmaceutical and biotechnology sectors represent the largest application segments for both ultrafiltration and adsorption technologies, accounting for approximately 35% of the total market. These industries require exceptionally high purity standards and consistent quality control measures to ensure product safety and efficacy.

The water treatment sector follows closely, representing about 28% of the market, driven by increasing global water scarcity concerns and stricter regulations on water quality. Food and beverage applications account for approximately 20% of the market, with growing consumer awareness regarding food safety further propelling demand.

Market dynamics indicate a shift toward integrated quality assurance solutions that combine multiple purification technologies to achieve optimal results. This trend is creating new opportunities for technology providers who can offer comprehensive, customized solutions rather than standalone products.

Customer preference analysis reveals increasing demand for quality assurance technologies that not only meet regulatory requirements but also optimize operational efficiency and reduce overall production costs. This has led to the development of more energy-efficient ultrafiltration systems and regenerable adsorption materials that offer improved economic value over their lifecycle.

Within this broader market, filtration and purification technologies play a crucial role, particularly in industries such as pharmaceuticals, food and beverage, water treatment, and biotechnology. The ultrafiltration segment specifically has shown robust growth, with the global ultrafiltration membrane market expected to reach 5.8 billion USD by 2025.

Adsorption technologies have similarly experienced steady market expansion, with activated carbon adsorption solutions alone accounting for over 3.2 billion USD in 2021. This growth is primarily fueled by stringent environmental regulations and increasing industrial applications requiring precise contaminant removal.

Regional analysis reveals that North America and Europe currently dominate the quality assurance technology market, holding approximately 60% of the market share collectively. However, the Asia-Pacific region is emerging as the fastest-growing market, with China and India leading the charge due to rapid industrialization and increasing adoption of international quality standards.

Industry-specific demand patterns show that pharmaceutical and biotechnology sectors represent the largest application segments for both ultrafiltration and adsorption technologies, accounting for approximately 35% of the total market. These industries require exceptionally high purity standards and consistent quality control measures to ensure product safety and efficacy.

The water treatment sector follows closely, representing about 28% of the market, driven by increasing global water scarcity concerns and stricter regulations on water quality. Food and beverage applications account for approximately 20% of the market, with growing consumer awareness regarding food safety further propelling demand.

Market dynamics indicate a shift toward integrated quality assurance solutions that combine multiple purification technologies to achieve optimal results. This trend is creating new opportunities for technology providers who can offer comprehensive, customized solutions rather than standalone products.

Customer preference analysis reveals increasing demand for quality assurance technologies that not only meet regulatory requirements but also optimize operational efficiency and reduce overall production costs. This has led to the development of more energy-efficient ultrafiltration systems and regenerable adsorption materials that offer improved economic value over their lifecycle.

Technical Challenges in Separation Technologies

Separation technologies face significant technical challenges that impact their efficiency, cost-effectiveness, and applicability across various industries. Ultrafiltration and adsorption techniques, while established methods for quality assurance, encounter several persistent obstacles that limit their optimal performance and widespread adoption.

Membrane fouling represents one of the most critical challenges in ultrafiltration processes. The accumulation of particles, colloids, and biological materials on membrane surfaces progressively reduces flux rates and separation efficiency. This phenomenon necessitates frequent cleaning cycles or membrane replacement, increasing operational costs and system downtime. Additionally, the trade-off between selectivity and permeability remains a fundamental limitation, as higher selectivity membranes typically exhibit lower throughput.

For adsorption technologies, adsorbent capacity and selectivity present ongoing challenges. Many commercial adsorbents demonstrate limited capacity for target compounds, particularly at low concentrations, requiring larger equipment footprints and higher material costs. Competitive adsorption in complex mixtures further complicates separation processes, as multiple compounds may compete for active sites, reducing overall efficiency for target contaminants.

Energy consumption poses a significant constraint for both technologies. Ultrafiltration systems require substantial pumping energy to maintain transmembrane pressure, while adsorption processes demand considerable energy inputs for regeneration cycles. These energy requirements not only increase operational costs but also contribute to the environmental footprint of these separation technologies.

Scalability challenges affect implementation across different production volumes. Laboratory-scale successes often encounter difficulties when scaled to industrial applications due to flow distribution problems, pressure drop issues, and reduced separation efficiency. This scale-up gap frequently delays commercial deployment of promising separation technologies.

Material limitations constrain performance boundaries for both techniques. Current membrane materials struggle with chemical compatibility, temperature resistance, and mechanical durability under industrial conditions. Similarly, adsorbent materials face challenges related to stability during regeneration cycles, mechanical strength, and long-term performance consistency.

Process integration represents another significant hurdle, as separation technologies must function effectively within complex production systems. Compatibility with upstream and downstream processes, control system integration, and process optimization across varying feed compositions all present technical difficulties that require sophisticated engineering solutions.

Emerging contaminants and increasingly stringent quality standards continuously push the boundaries of separation capabilities, requiring ongoing innovation to address new separation challenges while maintaining economic viability.

Membrane fouling represents one of the most critical challenges in ultrafiltration processes. The accumulation of particles, colloids, and biological materials on membrane surfaces progressively reduces flux rates and separation efficiency. This phenomenon necessitates frequent cleaning cycles or membrane replacement, increasing operational costs and system downtime. Additionally, the trade-off between selectivity and permeability remains a fundamental limitation, as higher selectivity membranes typically exhibit lower throughput.

For adsorption technologies, adsorbent capacity and selectivity present ongoing challenges. Many commercial adsorbents demonstrate limited capacity for target compounds, particularly at low concentrations, requiring larger equipment footprints and higher material costs. Competitive adsorption in complex mixtures further complicates separation processes, as multiple compounds may compete for active sites, reducing overall efficiency for target contaminants.

Energy consumption poses a significant constraint for both technologies. Ultrafiltration systems require substantial pumping energy to maintain transmembrane pressure, while adsorption processes demand considerable energy inputs for regeneration cycles. These energy requirements not only increase operational costs but also contribute to the environmental footprint of these separation technologies.

Scalability challenges affect implementation across different production volumes. Laboratory-scale successes often encounter difficulties when scaled to industrial applications due to flow distribution problems, pressure drop issues, and reduced separation efficiency. This scale-up gap frequently delays commercial deployment of promising separation technologies.

Material limitations constrain performance boundaries for both techniques. Current membrane materials struggle with chemical compatibility, temperature resistance, and mechanical durability under industrial conditions. Similarly, adsorbent materials face challenges related to stability during regeneration cycles, mechanical strength, and long-term performance consistency.

Process integration represents another significant hurdle, as separation technologies must function effectively within complex production systems. Compatibility with upstream and downstream processes, control system integration, and process optimization across varying feed compositions all present technical difficulties that require sophisticated engineering solutions.

Emerging contaminants and increasingly stringent quality standards continuously push the boundaries of separation capabilities, requiring ongoing innovation to address new separation challenges while maintaining economic viability.

Current Implementation Strategies

01 Quality control systems for ultrafiltration processes

Quality assurance systems specifically designed for ultrafiltration processes involve automated monitoring and control mechanisms to ensure consistent filtration performance. These systems incorporate sensors and analytical tools to monitor parameters such as flow rates, pressure differentials, and membrane integrity. Real-time data collection enables immediate detection of deviations from established quality standards, allowing for prompt corrective actions to maintain filtration efficiency and product quality.- Quality control systems for ultrafiltration processes: Quality assurance systems for ultrafiltration processes involve automated monitoring and control mechanisms to ensure consistent filtration performance. These systems typically include sensors for measuring parameters such as pressure, flow rate, and filtrate quality. Real-time data analysis allows for immediate detection of deviations from optimal operating conditions, enabling prompt corrective actions to maintain product quality and process efficiency.

- Adsorption quality verification methods: Methods for verifying the quality of adsorption processes include analytical techniques to assess adsorbent performance and capacity. These methods involve measuring breakthrough curves, adsorption isotherms, and contaminant removal efficiency. Advanced imaging and spectroscopic techniques can be used to characterize adsorbent materials and their interaction with target compounds, ensuring optimal adsorption performance and product purity.

- Automated inspection systems for filtration equipment: Automated inspection systems for filtration equipment utilize machine vision and artificial intelligence to detect defects or irregularities in filtration membranes and adsorption media. These systems can identify microscopic imperfections that might compromise filtration efficiency or product quality. By implementing continuous monitoring during manufacturing and operation, these systems ensure the integrity of filtration components and help maintain consistent performance standards.

- Data management for quality assurance in separation processes: Data management systems for quality assurance in separation processes involve collecting, analyzing, and storing process data to ensure compliance with quality standards. These systems integrate data from multiple sources, including sensors, analytical instruments, and production records, to provide comprehensive quality documentation. Advanced analytics and machine learning algorithms can identify trends and predict potential quality issues before they affect product specifications.

- Validation protocols for ultrafiltration and adsorption systems: Validation protocols for ultrafiltration and adsorption systems establish standardized procedures for qualifying equipment and processes to ensure consistent performance. These protocols include installation qualification, operational qualification, and performance qualification steps that verify system functionality and reliability. Regular performance testing, calibration verification, and challenge testing with known contaminants help maintain the validated state and ensure ongoing compliance with quality requirements.

02 Adsorption quality verification methods

Methods for verifying the quality of adsorption techniques involve specialized testing protocols to assess adsorption efficiency and capacity. These methods include analytical procedures for measuring adsorption isotherms, breakthrough curves, and contaminant removal rates. Advanced imaging and spectroscopic techniques are employed to characterize adsorbent materials and their interaction with target substances. Quality assurance in adsorption processes requires systematic validation of adsorbent performance under various operating conditions to ensure consistent purification results.Expand Specific Solutions03 Automated inspection systems for filtration equipment

Automated inspection systems utilize machine vision and artificial intelligence to detect defects or irregularities in filtration and adsorption equipment. These systems employ high-resolution cameras and image processing algorithms to identify membrane defects, adsorbent degradation, or equipment malfunctions. Continuous monitoring capabilities allow for non-destructive testing during operation, reducing downtime while ensuring compliance with quality standards. The integration of these inspection systems with manufacturing execution systems enables comprehensive quality documentation and traceability.Expand Specific Solutions04 Data management for quality assurance in separation processes

Specialized data management systems are essential for quality assurance in ultrafiltration and adsorption processes. These systems collect, analyze, and store critical process parameters and quality indicators throughout the separation process. Advanced analytics and statistical process control methods are applied to identify trends, predict potential quality issues, and optimize process parameters. Comprehensive documentation capabilities ensure regulatory compliance and facilitate quality audits by maintaining detailed records of process conditions, test results, and corrective actions.Expand Specific Solutions05 Thermal monitoring for separation process validation

Thermal monitoring systems provide critical quality assurance for temperature-sensitive ultrafiltration and adsorption processes. These systems employ precision temperature sensors and thermal imaging technologies to detect temperature variations that could affect separation efficiency or product quality. Continuous thermal profiling throughout the process ensures that optimal temperature conditions are maintained for maximum adsorption capacity and membrane performance. Integration with process control systems allows for automated adjustments to maintain thermal parameters within validated ranges, ensuring consistent product quality.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The ultrafiltration and adsorption techniques market for quality assurance is currently in a growth phase, with an estimated global market size of $5-7 billion and expanding at 8-10% annually. The competitive landscape features established players like EMD Millipore, Sartorius Stedim Biotech, and Waters Technology dominating with comprehensive solution portfolios, while specialized firms such as Organo Corp. and Suntar Membrane Technology focus on niche applications. Technical maturity varies significantly between segments, with ultrafiltration being more standardized while adsorption techniques continue to evolve. Research institutions including Harbin Institute of Technology and Beijing University of Chemical Technology are driving innovation through collaborative projects with industry leaders like BASF and JSR Corp., particularly in developing hybrid systems that combine both technologies for enhanced quality assurance outcomes.

EMD Millipore Corp.

Technical Solution: EMD Millipore has developed advanced ultrafiltration systems utilizing their Ultracel® membrane technology with regenerated cellulose membranes that offer exceptional protein retention while minimizing non-specific binding. Their technology employs tangential flow filtration (TFF) systems that maintain high flux rates even with challenging feed streams. The company's Pellicon® cassette systems incorporate their proprietary feed channel design that creates controlled turbulence, significantly reducing membrane fouling and extending operational lifetimes. EMD Millipore's ultrafiltration solutions feature automated process control systems that continuously monitor transmembrane pressure and adjust flow parameters to maintain optimal separation conditions throughout the filtration cycle. Their integrated quality assurance protocols include integrity testing capabilities and validation packages that meet pharmaceutical industry requirements.

Strengths: Superior protein retention with minimal product loss, reduced fouling through advanced feed channel design, comprehensive validation documentation for regulated industries. Weaknesses: Higher initial capital investment compared to basic filtration systems, requires specialized training for operators, membrane replacement costs can be significant over system lifetime.

Sartorius Stedim Biotech GmbH

Technical Solution: Sartorius Stedim Biotech has pioneered single-use ultrafiltration technology with their Sartocon® platform, which integrates disposable flow paths to eliminate cross-contamination risks in biopharmaceutical processing. Their membrane technology utilizes polyethersulfone (PES) materials with asymmetric pore structures that provide exceptional selectivity while maintaining high flux rates. The company's BIOSTAT® systems combine ultrafiltration with integrated process analytical technology (PAT) sensors that enable real-time monitoring of critical quality attributes. Sartorius has developed specialized adsorption chromatography solutions with their Sartobind® membrane adsorbers that offer higher throughput than traditional resin-based columns while reducing buffer consumption by up to 80%. Their comprehensive approach includes software-controlled automation systems that ensure reproducible performance across manufacturing batches and facilitate compliance with quality assurance requirements.

Strengths: Single-use technology eliminates cleaning validation requirements, integrated PAT sensors enable real-time quality monitoring, reduced buffer consumption lowers operational costs. Weaknesses: Environmental concerns with disposable components, limited pressure tolerance compared to traditional stainless steel systems, higher cost-per-batch for small-scale operations.

Key Patents and Scientific Breakthroughs

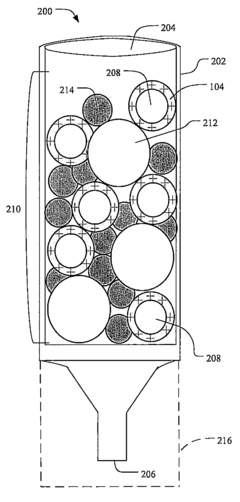

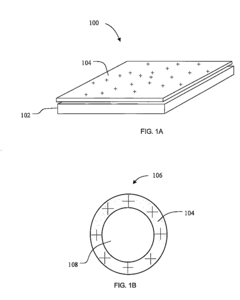

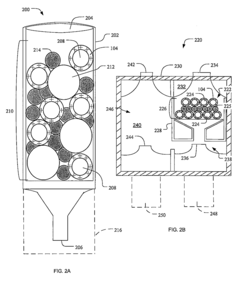

Methods and apparatus to capture and release microbe particles using amino-functionalized silica

PatentInactiveUS20080237134A1

Innovation

- Amino-functionalized silica particles with positively charged aminopropyl groups are used to capture and release microbe particles, allowing for efficient filtration and concentration of viruses across a wide range of pH levels and densities, using elution solutions containing soluble proteins and amino acids to facilitate release and compatibility with assay procedures.

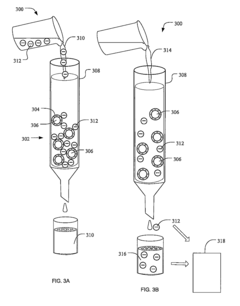

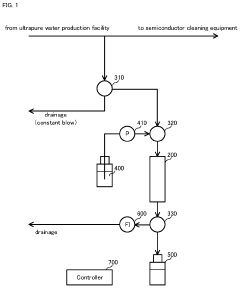

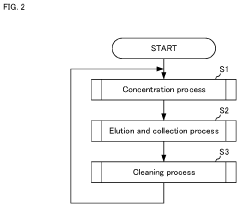

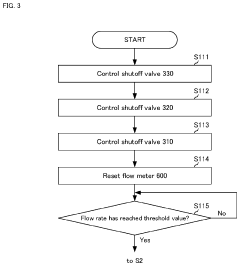

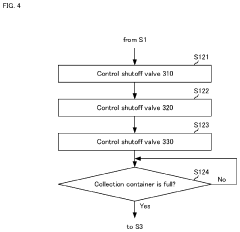

Impurity acquisition system, water quality testing system, and liquid production and supply system

PatentPendingUS20240101448A1

Innovation

- An impurity acquisition system that uses adsorbents to capture impurities in ultrapure water, with a controller switching between the water flow and eluent flow to elute impurities, allowing for continuous testing without removing the ion exchanger, and an information processing device to analyze the eluent concentration and calculate the impurity concentration in the water.

Regulatory Compliance Standards

Regulatory compliance for ultrafiltration and adsorption techniques in quality assurance is governed by a complex framework of international, regional, and national standards. The FDA's Code of Federal Regulations Title 21 (21 CFR) provides comprehensive guidelines for pharmaceutical manufacturing processes in the United States, with specific sections addressing filtration and purification technologies. Similarly, the European Medicines Agency (EMA) has established the EU GMP Annex 1, which outlines requirements for sterile medicinal products and includes specific provisions for filtration processes.

ISO 13485 for medical devices and ISO 9001 for quality management systems provide standardized frameworks that manufacturers must adhere to when implementing ultrafiltration or adsorption techniques in their production processes. These standards emphasize validation protocols, documentation requirements, and quality control measures essential for regulatory compliance.

The International Conference on Harmonisation (ICH) Q7 guidelines for Good Manufacturing Practice (GMP) of active pharmaceutical ingredients specifically address purification techniques, including detailed requirements for validation of adsorption and filtration processes. These guidelines emphasize the need for consistent performance, reproducibility, and appropriate documentation of process parameters.

Regulatory bodies increasingly focus on process analytical technology (PAT) as outlined in FDA's PAT Framework, requiring real-time monitoring and control of critical process parameters in both ultrafiltration and adsorption techniques. This approach demands sophisticated monitoring systems and validation protocols to ensure compliance.

Water quality standards, including USP <1231> Water for Pharmaceutical Purposes and European Pharmacopoeia standards, are particularly relevant for ultrafiltration processes used in water purification systems. These standards define acceptable limits for contaminants and specify testing methodologies to verify compliance.

Environmental regulations, including EPA guidelines in the US and similar regulations in other regions, govern waste disposal from adsorption and ultrafiltration processes, particularly when hazardous materials are involved in manufacturing or as byproducts of purification processes.

Validation requirements differ significantly between ultrafiltration and adsorption techniques. Ultrafiltration typically requires validation of membrane integrity, pore size consistency, and cleaning procedures, while adsorption techniques demand validation of binding capacity, selectivity, and regeneration protocols. Both techniques must demonstrate consistent removal of specified contaminants to predetermined acceptance criteria.

Regulatory trends indicate increasing scrutiny of extractables and leachables from filtration materials and adsorption media, with particular attention to potential impact on product quality and patient safety. This has led to more stringent requirements for material qualification and compatibility testing in both technologies.

ISO 13485 for medical devices and ISO 9001 for quality management systems provide standardized frameworks that manufacturers must adhere to when implementing ultrafiltration or adsorption techniques in their production processes. These standards emphasize validation protocols, documentation requirements, and quality control measures essential for regulatory compliance.

The International Conference on Harmonisation (ICH) Q7 guidelines for Good Manufacturing Practice (GMP) of active pharmaceutical ingredients specifically address purification techniques, including detailed requirements for validation of adsorption and filtration processes. These guidelines emphasize the need for consistent performance, reproducibility, and appropriate documentation of process parameters.

Regulatory bodies increasingly focus on process analytical technology (PAT) as outlined in FDA's PAT Framework, requiring real-time monitoring and control of critical process parameters in both ultrafiltration and adsorption techniques. This approach demands sophisticated monitoring systems and validation protocols to ensure compliance.

Water quality standards, including USP <1231> Water for Pharmaceutical Purposes and European Pharmacopoeia standards, are particularly relevant for ultrafiltration processes used in water purification systems. These standards define acceptable limits for contaminants and specify testing methodologies to verify compliance.

Environmental regulations, including EPA guidelines in the US and similar regulations in other regions, govern waste disposal from adsorption and ultrafiltration processes, particularly when hazardous materials are involved in manufacturing or as byproducts of purification processes.

Validation requirements differ significantly between ultrafiltration and adsorption techniques. Ultrafiltration typically requires validation of membrane integrity, pore size consistency, and cleaning procedures, while adsorption techniques demand validation of binding capacity, selectivity, and regeneration protocols. Both techniques must demonstrate consistent removal of specified contaminants to predetermined acceptance criteria.

Regulatory trends indicate increasing scrutiny of extractables and leachables from filtration materials and adsorption media, with particular attention to potential impact on product quality and patient safety. This has led to more stringent requirements for material qualification and compatibility testing in both technologies.

Cost-Benefit Analysis of Implementation

Implementing ultrafiltration or adsorption techniques for quality assurance requires substantial financial investment and operational considerations. Initial capital expenditure for ultrafiltration systems typically ranges from $50,000 to $500,000 depending on scale and complexity, with membrane costs accounting for 30-40% of this investment. Adsorption systems generally require lower initial capital, ranging from $30,000 to $300,000, but often demand more expensive consumables over time.

Operational expenses differ significantly between these technologies. Ultrafiltration systems consume more energy, with electricity costs averaging $0.05-0.15 per cubic meter of processed fluid. Membrane replacement, occurring every 3-5 years, represents a recurring cost of approximately 20-30% of the initial investment. Conversely, adsorption systems require more frequent media replacement—typically every 6-18 months—with adsorbent materials costing $500-5,000 per replacement cycle depending on system capacity.

Labor requirements also vary between technologies. Ultrafiltration systems generally require less daily operational oversight but demand specialized maintenance skills. Studies indicate maintenance costs average 5-8% of capital expenditure annually. Adsorption systems often require more frequent monitoring and media replacement, translating to higher labor costs but potentially lower technical expertise requirements.

Return on investment timelines differ substantially based on application. For pharmaceutical applications, ultrafiltration systems typically achieve ROI within 2-3 years due to higher throughput and reduced product loss. Adsorption systems may show faster ROI (1.5-2.5 years) in applications targeting specific contaminants at lower volumes, particularly when selective adsorption provides unique value.

Regulatory compliance costs must also be considered. Ultrafiltration systems often provide more comprehensive documentation of removal efficiency, potentially reducing validation costs by 15-25% compared to adsorption systems. However, this advantage may be offset by higher energy consumption and associated environmental compliance expenses.

Scalability represents another critical cost factor. Ultrafiltration systems demonstrate better economies of scale, with per-unit processing costs decreasing by approximately 30% when capacity doubles. Adsorption systems show less dramatic scaling benefits, with cost reductions closer to 15-20% at similar capacity increases.

When evaluating total cost of ownership over a 10-year operational period, ultrafiltration typically proves more economical for high-volume, continuous operations, while adsorption often presents advantages for intermittent or specialized applications with specific target compounds.

Operational expenses differ significantly between these technologies. Ultrafiltration systems consume more energy, with electricity costs averaging $0.05-0.15 per cubic meter of processed fluid. Membrane replacement, occurring every 3-5 years, represents a recurring cost of approximately 20-30% of the initial investment. Conversely, adsorption systems require more frequent media replacement—typically every 6-18 months—with adsorbent materials costing $500-5,000 per replacement cycle depending on system capacity.

Labor requirements also vary between technologies. Ultrafiltration systems generally require less daily operational oversight but demand specialized maintenance skills. Studies indicate maintenance costs average 5-8% of capital expenditure annually. Adsorption systems often require more frequent monitoring and media replacement, translating to higher labor costs but potentially lower technical expertise requirements.

Return on investment timelines differ substantially based on application. For pharmaceutical applications, ultrafiltration systems typically achieve ROI within 2-3 years due to higher throughput and reduced product loss. Adsorption systems may show faster ROI (1.5-2.5 years) in applications targeting specific contaminants at lower volumes, particularly when selective adsorption provides unique value.

Regulatory compliance costs must also be considered. Ultrafiltration systems often provide more comprehensive documentation of removal efficiency, potentially reducing validation costs by 15-25% compared to adsorption systems. However, this advantage may be offset by higher energy consumption and associated environmental compliance expenses.

Scalability represents another critical cost factor. Ultrafiltration systems demonstrate better economies of scale, with per-unit processing costs decreasing by approximately 30% when capacity doubles. Adsorption systems show less dramatic scaling benefits, with cost reductions closer to 15-20% at similar capacity increases.

When evaluating total cost of ownership over a 10-year operational period, ultrafiltration typically proves more economical for high-volume, continuous operations, while adsorption often presents advantages for intermittent or specialized applications with specific target compounds.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!