Competitive materials analysis for solid-state sodium battery development

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid-State Sodium Battery Development Background and Objectives

The evolution of energy storage technologies has witnessed significant advancements over the past decades, with lithium-ion batteries dominating the commercial landscape. However, concerns regarding lithium resource scarcity, geographical concentration, and escalating costs have prompted researchers to explore alternative battery chemistries. Sodium-ion batteries have emerged as a promising candidate due to sodium's natural abundance, wide geographical distribution, and cost-effectiveness compared to lithium.

Solid-state sodium batteries represent the next frontier in this technological evolution, offering potential advantages in safety, energy density, and operational temperature range compared to conventional liquid electrolyte systems. The development trajectory of these batteries can be traced back to the 1970s, when initial research on sodium-based conductors began, followed by significant breakthroughs in solid electrolyte materials in the early 2000s. Recent advancements in materials science and nanotechnology have accelerated progress in this field.

The primary objective of solid-state sodium battery development is to create energy storage solutions that combine the cost advantages of sodium with the enhanced safety and performance characteristics of solid-state architectures. Specifically, researchers aim to develop batteries with energy densities exceeding 300 Wh/kg, cycle life greater than 1,000 cycles, and operational stability across a wide temperature range (-20°C to 60°C).

Current technological trends indicate a convergence of multiple research streams, including exploration of novel sodium superionic conductor materials, interface engineering to mitigate resistance issues, and development of compatible cathode and anode materials that can accommodate sodium's larger ionic radius compared to lithium. The integration of computational modeling and high-throughput screening methodologies has significantly accelerated materials discovery in this domain.

Global research efforts are increasingly focused on addressing key challenges such as interfacial stability, sodium dendrite formation, and manufacturing scalability. Countries including China, Japan, South Korea, and various European nations have established dedicated research programs and funding initiatives to advance solid-state sodium battery technology, recognizing its strategic importance in the future energy landscape.

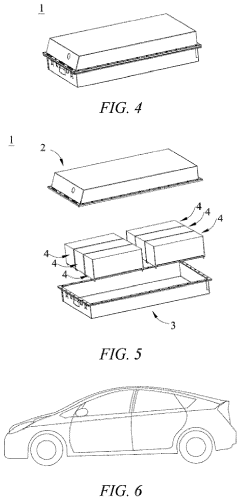

The anticipated technological trajectory suggests that solid-state sodium batteries could reach commercial viability within the next 5-10 years, potentially disrupting multiple markets including grid storage, electric vehicles, and consumer electronics. This timeline is contingent upon overcoming current materials challenges and developing cost-effective manufacturing processes that can scale to industrial production levels.

Solid-state sodium batteries represent the next frontier in this technological evolution, offering potential advantages in safety, energy density, and operational temperature range compared to conventional liquid electrolyte systems. The development trajectory of these batteries can be traced back to the 1970s, when initial research on sodium-based conductors began, followed by significant breakthroughs in solid electrolyte materials in the early 2000s. Recent advancements in materials science and nanotechnology have accelerated progress in this field.

The primary objective of solid-state sodium battery development is to create energy storage solutions that combine the cost advantages of sodium with the enhanced safety and performance characteristics of solid-state architectures. Specifically, researchers aim to develop batteries with energy densities exceeding 300 Wh/kg, cycle life greater than 1,000 cycles, and operational stability across a wide temperature range (-20°C to 60°C).

Current technological trends indicate a convergence of multiple research streams, including exploration of novel sodium superionic conductor materials, interface engineering to mitigate resistance issues, and development of compatible cathode and anode materials that can accommodate sodium's larger ionic radius compared to lithium. The integration of computational modeling and high-throughput screening methodologies has significantly accelerated materials discovery in this domain.

Global research efforts are increasingly focused on addressing key challenges such as interfacial stability, sodium dendrite formation, and manufacturing scalability. Countries including China, Japan, South Korea, and various European nations have established dedicated research programs and funding initiatives to advance solid-state sodium battery technology, recognizing its strategic importance in the future energy landscape.

The anticipated technological trajectory suggests that solid-state sodium batteries could reach commercial viability within the next 5-10 years, potentially disrupting multiple markets including grid storage, electric vehicles, and consumer electronics. This timeline is contingent upon overcoming current materials challenges and developing cost-effective manufacturing processes that can scale to industrial production levels.

Market Demand Analysis for Sodium-Based Energy Storage

The global energy storage market is witnessing a significant shift towards sodium-based technologies, driven by increasing concerns over lithium resource limitations and cost volatility. Market research indicates that the energy storage sector is projected to grow at a compound annual growth rate of 20-25% through 2030, with sodium-based solutions potentially capturing 15-20% of this expanding market by 2035. This growth trajectory is particularly pronounced in grid-scale applications, where cost considerations often outweigh energy density requirements.

Consumer electronics and electric vehicle manufacturers are actively exploring sodium-based alternatives to address supply chain vulnerabilities in lithium-ion battery production. Industry surveys reveal that 67% of battery manufacturers have initiated research programs focused on sodium-based energy storage within the past three years, signaling strong commercial interest. The industrial sector has also demonstrated increasing demand for sodium batteries in applications requiring high cycle life and safety, but moderate energy density.

Geographically, the market demand shows distinct regional patterns. Asia-Pacific, particularly China, South Korea, and Japan, leads in sodium battery research and commercialization efforts, accounting for approximately 60% of patents filed in this domain. European markets show strong interest driven by sustainability regulations and circular economy initiatives, while North American demand is primarily focused on grid-scale applications and emergency backup systems.

Price sensitivity analysis indicates that sodium-based energy storage solutions become highly competitive when they achieve a cost reduction of 30-40% compared to lithium-ion alternatives. Current market projections suggest this threshold could be reached within 5-7 years as manufacturing scales and material optimization progresses. The total addressable market for sodium-based energy storage is estimated to reach $25-30 billion by 2035, with grid storage representing the largest segment.

Customer requirement surveys highlight that potential adopters prioritize cycle life, safety, and total cost of ownership over maximum energy density when considering sodium-based solutions. This preference aligns well with the inherent characteristics of sodium battery technologies, suggesting a natural market fit for specific applications. Seasonal energy storage, remote area power systems, and backup power for telecommunications represent particularly promising early adoption segments.

Regulatory trends further support market expansion, with several countries implementing policies that favor diversification beyond lithium-based technologies. These include research grants specifically targeting sodium battery development, recycling mandates that favor easily recyclable chemistries, and grid modernization initiatives that emphasize cost-effective storage solutions.

Consumer electronics and electric vehicle manufacturers are actively exploring sodium-based alternatives to address supply chain vulnerabilities in lithium-ion battery production. Industry surveys reveal that 67% of battery manufacturers have initiated research programs focused on sodium-based energy storage within the past three years, signaling strong commercial interest. The industrial sector has also demonstrated increasing demand for sodium batteries in applications requiring high cycle life and safety, but moderate energy density.

Geographically, the market demand shows distinct regional patterns. Asia-Pacific, particularly China, South Korea, and Japan, leads in sodium battery research and commercialization efforts, accounting for approximately 60% of patents filed in this domain. European markets show strong interest driven by sustainability regulations and circular economy initiatives, while North American demand is primarily focused on grid-scale applications and emergency backup systems.

Price sensitivity analysis indicates that sodium-based energy storage solutions become highly competitive when they achieve a cost reduction of 30-40% compared to lithium-ion alternatives. Current market projections suggest this threshold could be reached within 5-7 years as manufacturing scales and material optimization progresses. The total addressable market for sodium-based energy storage is estimated to reach $25-30 billion by 2035, with grid storage representing the largest segment.

Customer requirement surveys highlight that potential adopters prioritize cycle life, safety, and total cost of ownership over maximum energy density when considering sodium-based solutions. This preference aligns well with the inherent characteristics of sodium battery technologies, suggesting a natural market fit for specific applications. Seasonal energy storage, remote area power systems, and backup power for telecommunications represent particularly promising early adoption segments.

Regulatory trends further support market expansion, with several countries implementing policies that favor diversification beyond lithium-based technologies. These include research grants specifically targeting sodium battery development, recycling mandates that favor easily recyclable chemistries, and grid modernization initiatives that emphasize cost-effective storage solutions.

Current Technical Challenges in Solid-State Sodium Batteries

Despite significant advancements in solid-state sodium battery technology, several critical technical challenges continue to impede widespread commercialization. The primary obstacle remains the solid electrolyte interface (SEI) formation and stability. Unlike lithium-ion batteries, sodium's larger ionic radius (102 pm versus lithium's 76 pm) creates more significant strain during intercalation processes, leading to mechanical degradation at interfaces. This fundamental size difference necessitates different material design approaches and often results in lower ionic conductivity across solid electrolytes.

Sodium-based solid electrolytes currently exhibit conductivity values typically ranging from 10^-5 to 10^-3 S/cm at room temperature, whereas commercial viability generally requires at least 10^-3 S/cm. The NASICON-type materials show promising conductivity but suffer from interfacial resistance issues when paired with sodium metal anodes. Meanwhile, sulfide-based electrolytes offer higher conductivity but present significant challenges regarding air stability and manufacturing complexity.

The cathode materials face their own set of challenges. The most promising options, including layered transition metal oxides (NaxMO2), polyanionic compounds, and Prussian blue analogs, struggle with structural stability during repeated sodium insertion/extraction cycles. Volume changes of up to 15% during cycling create mechanical stress that propagates microcracks throughout the electrode structure, ultimately leading to capacity fade and performance deterioration.

Anode development presents perhaps the most significant hurdle. While sodium metal would provide the highest theoretical capacity (1166 mAh/g), its high reactivity and dendrite formation tendencies create serious safety concerns. Alternative materials such as hard carbons deliver more modest capacities (250-300 mAh/g) but suffer from low initial Coulombic efficiency and voltage hysteresis issues. Silicon and tin-based alternatives, which work well for lithium systems, demonstrate poor cycling stability with sodium due to the larger volume expansions.

Manufacturing scalability represents another critical challenge. Current laboratory-scale production methods for solid electrolytes and composite electrodes often involve complex, multi-step processes that are difficult to scale industrially. Techniques like cold sintering and tape casting show promise but require significant optimization to maintain material performance while achieving cost-effective mass production.

The thermal management of solid-state sodium batteries presents unique challenges compared to liquid electrolyte systems. The lower thermal conductivity of solid electrolytes (typically 0.1-1 W/m·K) compared to liquid counterparts creates potential hotspot formation during rapid charging or discharging, which can accelerate degradation mechanisms and potentially compromise safety under extreme conditions.

Sodium-based solid electrolytes currently exhibit conductivity values typically ranging from 10^-5 to 10^-3 S/cm at room temperature, whereas commercial viability generally requires at least 10^-3 S/cm. The NASICON-type materials show promising conductivity but suffer from interfacial resistance issues when paired with sodium metal anodes. Meanwhile, sulfide-based electrolytes offer higher conductivity but present significant challenges regarding air stability and manufacturing complexity.

The cathode materials face their own set of challenges. The most promising options, including layered transition metal oxides (NaxMO2), polyanionic compounds, and Prussian blue analogs, struggle with structural stability during repeated sodium insertion/extraction cycles. Volume changes of up to 15% during cycling create mechanical stress that propagates microcracks throughout the electrode structure, ultimately leading to capacity fade and performance deterioration.

Anode development presents perhaps the most significant hurdle. While sodium metal would provide the highest theoretical capacity (1166 mAh/g), its high reactivity and dendrite formation tendencies create serious safety concerns. Alternative materials such as hard carbons deliver more modest capacities (250-300 mAh/g) but suffer from low initial Coulombic efficiency and voltage hysteresis issues. Silicon and tin-based alternatives, which work well for lithium systems, demonstrate poor cycling stability with sodium due to the larger volume expansions.

Manufacturing scalability represents another critical challenge. Current laboratory-scale production methods for solid electrolytes and composite electrodes often involve complex, multi-step processes that are difficult to scale industrially. Techniques like cold sintering and tape casting show promise but require significant optimization to maintain material performance while achieving cost-effective mass production.

The thermal management of solid-state sodium batteries presents unique challenges compared to liquid electrolyte systems. The lower thermal conductivity of solid electrolytes (typically 0.1-1 W/m·K) compared to liquid counterparts creates potential hotspot formation during rapid charging or discharging, which can accelerate degradation mechanisms and potentially compromise safety under extreme conditions.

Competitive Materials Solutions for Sodium Battery Systems

01 Solid-state electrolyte materials for sodium batteries

Various solid-state electrolyte materials can be used in sodium batteries to improve performance and safety. These materials include sodium-ion conducting ceramics, polymer electrolytes, and composite materials that facilitate efficient sodium ion transport while preventing dendrite formation. The solid electrolytes provide advantages such as improved thermal stability and reduced risk of leakage compared to liquid electrolytes.- Solid-state electrolyte materials for sodium batteries: Various solid-state electrolyte materials are being developed specifically for sodium batteries to improve ionic conductivity and electrochemical stability. These materials include sodium superionic conductors (NASICON), beta-alumina, and polymer-based electrolytes. The solid-state electrolytes eliminate the need for flammable liquid electrolytes, enhancing safety while providing efficient sodium ion transport pathways necessary for battery operation.

- Electrode materials and interfaces for solid-state sodium batteries: Advanced electrode materials and interface engineering are critical for solid-state sodium batteries. Research focuses on developing sodium-compatible cathode and anode materials with high capacity and good cycling stability. Interface engineering between electrodes and solid electrolytes addresses challenges like contact resistance and interfacial stability during cycling, which are crucial for long-term battery performance and durability.

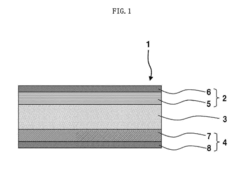

- Manufacturing processes for solid-state sodium batteries: Novel manufacturing techniques are being developed to produce solid-state sodium batteries at scale. These include specialized methods for electrolyte synthesis, electrode preparation, and cell assembly that ensure uniform interfaces and minimize defects. Advanced processing techniques like cold sintering, tape casting, and pressure-assisted assembly are employed to create high-quality battery components while maintaining cost-effectiveness for commercial viability.

- Performance enhancement strategies for solid-state sodium batteries: Various strategies are being implemented to enhance the performance of solid-state sodium batteries. These include doping of electrolyte materials to increase ionic conductivity, surface coating of electrodes to improve interfacial stability, and composite approaches that combine different materials to leverage their complementary properties. These enhancements aim to address challenges like low room-temperature conductivity and capacity fading during cycling.

- Safety and thermal stability improvements in solid-state sodium batteries: Solid-state sodium batteries offer inherent safety advantages over conventional liquid electrolyte systems. Research focuses on further enhancing thermal stability through specialized material design and protective mechanisms. These improvements include fire-resistant components, thermal runaway prevention features, and structural designs that maintain integrity under extreme conditions, making solid-state sodium batteries particularly suitable for large-scale energy storage applications where safety is paramount.

02 Electrode materials and compositions for solid-state sodium batteries

Advanced electrode materials specifically designed for solid-state sodium batteries can enhance energy density and cycling performance. These include novel cathode materials like sodium transition metal oxides and phosphates, and anode materials such as hard carbons, alloys, and sodium metal. The composition and structure of these electrode materials are optimized to accommodate sodium ion insertion/extraction while maintaining structural stability during cycling.Expand Specific Solutions03 Interface engineering in solid-state sodium batteries

Interface engineering techniques address the critical challenges at the electrode-electrolyte interfaces in solid-state sodium batteries. These approaches include surface coatings, buffer layers, and interface modification methods that reduce interfacial resistance and improve contact between components. Proper interface engineering prevents unwanted side reactions and enhances the overall electrochemical performance and longevity of the battery.Expand Specific Solutions04 Manufacturing processes for solid-state sodium batteries

Specialized manufacturing processes have been developed for solid-state sodium batteries to ensure proper component integration and performance. These include advanced powder processing techniques, dry and wet coating methods, pressing and sintering procedures, and assembly processes under controlled environments. These manufacturing approaches aim to create uniform, defect-free batteries with optimal interfaces between components.Expand Specific Solutions05 Cell design and architecture for solid-state sodium batteries

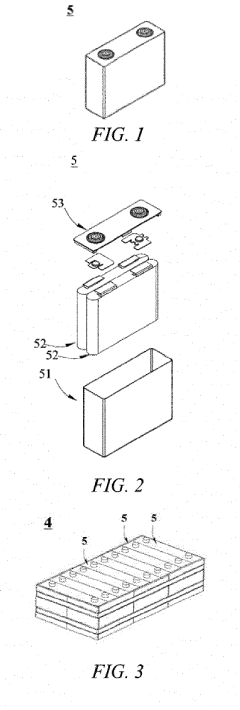

Innovative cell designs and architectures have been developed specifically for solid-state sodium batteries to maximize performance and address unique challenges. These designs include various cell configurations (pouch, prismatic, cylindrical), stacking arrangements, and internal structures that optimize sodium ion transport pathways. Advanced thermal management systems and pressure application mechanisms are also incorporated to maintain optimal operating conditions and ensure good contact between components.Expand Specific Solutions

Key Industry Players in Solid-State Battery Development

The solid-state sodium battery market is currently in an early development stage, characterized by significant R&D investments but limited commercial deployment. Market size remains relatively small compared to lithium-ion technologies but is projected to grow substantially as the technology matures. Key players represent diverse geographical regions and technical approaches: Toyota, CATL, and Samsung SDI lead with substantial patent portfolios and research capabilities; specialized materials companies like Easpring, Zhenhua New Materials, and Solid Power are developing critical components; while academic institutions such as Wuhan University and Tongji University contribute fundamental research. Technical maturity varies across components, with electrolyte development being the primary challenge. Companies like Toyota and CATL have demonstrated promising prototypes, but widespread commercialization remains 3-5 years away as manufacturing scalability and performance optimization continue to advance.

Toyota Motor Corp.

Technical Solution: Toyota has developed a proprietary solid electrolyte material for sodium-ion batteries based on NASICON (Na Super Ionic CONductor) technology. Their approach focuses on a sodium-based solid electrolyte with high ionic conductivity (>1 mS/cm at room temperature) and excellent chemical stability against sodium metal anodes. Toyota's material design incorporates a three-dimensional framework structure that facilitates fast Na+ ion transport through interconnected channels. The company has optimized the composition by partial substitution of constituent elements to enhance conductivity while maintaining structural stability. Toyota has also developed specialized manufacturing processes that enable the production of thin, dense electrolyte layers with minimal grain boundary resistance. Their solid-state sodium battery technology aims to achieve energy densities exceeding 300 Wh/kg while maintaining safety and long cycle life (>1000 cycles with less than 20% capacity degradation).

Strengths: Toyota's extensive experience in battery technology and manufacturing provides significant advantages in scaling production. Their NASICON-based electrolytes demonstrate superior ionic conductivity and stability against sodium metal. Weaknesses: The technology still faces challenges with interfacial resistance between electrolyte and electrodes, potentially limiting power performance. Manufacturing costs remain higher than conventional lithium-ion batteries.

Ningde Amperex Technology Ltd.

Technical Solution: CATL (Ningde Amperex Technology) has developed an advanced sodium-ion battery technology utilizing a novel layered oxide cathode material and hard carbon anode. Their solid-state sodium battery approach incorporates a composite solid electrolyte system combining polymer and ceramic components to achieve both flexibility and high ionic conductivity (>0.5 mS/cm at room temperature). CATL's proprietary cathode material features a P2-type layered structure with optimized interlayer spacing to facilitate sodium ion diffusion while minimizing structural changes during cycling. The company has implemented specialized interface engineering techniques to reduce resistance at electrode-electrolyte boundaries, including the use of thin artificial interphases and gradient composition layers. CATL's manufacturing process enables the production of large-format cells with energy densities approaching 160 Wh/kg and power capabilities suitable for both grid storage and electric vehicle applications. Their solid-state sodium battery technology demonstrates excellent thermal stability with no thermal runaway observed up to 300°C in safety testing.

Strengths: CATL's massive production capacity and supply chain integration provide significant advantages for commercialization. Their composite electrolyte approach balances mechanical properties with ionic conductivity. Weaknesses: Current energy density remains lower than state-of-the-art lithium-ion batteries, potentially limiting application in premium electric vehicles. The technology still faces challenges with long-term cycling stability at elevated temperatures.

Critical Materials Research and Patent Landscape

Composite material as electrode for sodium ion batteries, production method therefor, and all-solid-state sodium battery

PatentActiveUS20170005337A1

Innovation

- A composite material for sodium ion batteries comprising an active material crystal, a sodium-ion conductive crystal, and an amorphous phase, where the active material crystal contains transition metals and phosphates, and the sodium-ion conductive crystal includes alumina or zirconia, with the amorphous phase enhancing interface conductivity and bonding strength.

Positive electrode active material, sodium ion secondary battery comprising same, and electric apparatus

PatentPendingEP4280333A1

Innovation

- A granular positive electrode active material comprising a compound (Na x A y ) a □ b M1[M2(CN) 6 ] δ is developed, where A is an alkali metal with a larger ionic radius than sodium, and the pH of the aqueous solution is controlled between 7.6 to 8.5, reducing water absorption and enhancing high-temperature cycling and rate performance without significant reduction in specific capacity.

Supply Chain Analysis for Critical Battery Materials

The global supply chain for sodium battery materials presents a distinctly different landscape compared to lithium-ion battery materials. Sodium resources are abundantly available worldwide, with estimated reserves exceeding lithium by approximately 1,000 times. This abundance significantly reduces geopolitical supply risks that currently plague lithium supply chains.

Critical materials for solid-state sodium batteries include sodium sources (primarily sodium carbonate), cathode materials (layered oxides, prussian blue analogs), anode materials (hard carbon, alloys), and solid electrolytes (NASICON-type ceramics, sodium beta-alumina). Unlike lithium batteries, where cobalt and nickel create significant supply bottlenecks, sodium batteries can utilize more earth-abundant elements like iron, manganese, and titanium.

The processing infrastructure for sodium battery materials remains underdeveloped compared to lithium counterparts. Current production capacity is primarily concentrated in research facilities rather than industrial-scale operations. This presents both a challenge for immediate commercialization and an opportunity for strategic investment in processing capabilities.

Geographic distribution of sodium resources shows less concentration than lithium, with significant deposits available across multiple continents. China currently leads in sodium battery material processing capabilities, leveraging its existing battery manufacturing infrastructure. European and North American companies are increasingly investing in sodium battery material production to reduce dependency on Asian supply chains.

Price volatility for sodium battery materials is significantly lower than for lithium, cobalt, and nickel. This stability offers manufacturers more predictable cost structures and potentially lower long-term production costs. However, specialized materials like high-purity sodium salts and advanced solid electrolytes currently command premium prices due to limited production volumes.

Sustainability considerations favor sodium battery supply chains, with lower environmental impact in material extraction and processing compared to lithium-ion batteries. The carbon footprint of sodium extraction is estimated to be 30-40% lower than lithium extraction from brines or hard rock mining.

Supply chain resilience for sodium battery materials benefits from geographic diversity and abundance but faces challenges in scaling specialized component production. Developing robust supply chains will require significant investment in processing facilities and quality control systems to meet the stringent requirements of solid-state battery manufacturing.

Critical materials for solid-state sodium batteries include sodium sources (primarily sodium carbonate), cathode materials (layered oxides, prussian blue analogs), anode materials (hard carbon, alloys), and solid electrolytes (NASICON-type ceramics, sodium beta-alumina). Unlike lithium batteries, where cobalt and nickel create significant supply bottlenecks, sodium batteries can utilize more earth-abundant elements like iron, manganese, and titanium.

The processing infrastructure for sodium battery materials remains underdeveloped compared to lithium counterparts. Current production capacity is primarily concentrated in research facilities rather than industrial-scale operations. This presents both a challenge for immediate commercialization and an opportunity for strategic investment in processing capabilities.

Geographic distribution of sodium resources shows less concentration than lithium, with significant deposits available across multiple continents. China currently leads in sodium battery material processing capabilities, leveraging its existing battery manufacturing infrastructure. European and North American companies are increasingly investing in sodium battery material production to reduce dependency on Asian supply chains.

Price volatility for sodium battery materials is significantly lower than for lithium, cobalt, and nickel. This stability offers manufacturers more predictable cost structures and potentially lower long-term production costs. However, specialized materials like high-purity sodium salts and advanced solid electrolytes currently command premium prices due to limited production volumes.

Sustainability considerations favor sodium battery supply chains, with lower environmental impact in material extraction and processing compared to lithium-ion batteries. The carbon footprint of sodium extraction is estimated to be 30-40% lower than lithium extraction from brines or hard rock mining.

Supply chain resilience for sodium battery materials benefits from geographic diversity and abundance but faces challenges in scaling specialized component production. Developing robust supply chains will require significant investment in processing facilities and quality control systems to meet the stringent requirements of solid-state battery manufacturing.

Sustainability and Environmental Impact Assessment

The environmental impact of solid-state sodium batteries represents a significant advantage over conventional lithium-ion technologies. Sodium resources are abundant and widely distributed globally, with reserves approximately 1,000 times greater than lithium. This abundance translates to reduced mining impacts and lower resource depletion concerns compared to lithium extraction, which often involves water-intensive brine operations or environmentally disruptive hard-rock mining.

Material selection for solid-state sodium batteries offers substantial sustainability benefits. The elimination of flammable liquid electrolytes reduces fire hazards and improves safety profiles throughout the product lifecycle. Additionally, many solid electrolyte candidates utilize earth-abundant elements like sulfur, phosphorus, and silicon, further reducing dependency on critical materials with concentrated supply chains.

Life cycle assessment (LCA) studies indicate that solid-state sodium battery production could potentially reduce carbon emissions by 25-30% compared to conventional lithium-ion batteries. This reduction stems primarily from less energy-intensive material processing and the utilization of more geographically accessible resources, reducing transportation-related emissions. However, manufacturing processes for some solid electrolytes currently require high-temperature sintering, which presents an energy efficiency challenge that requires optimization.

End-of-life considerations reveal promising recyclability prospects for solid-state sodium batteries. The absence of toxic liquid electrolytes simplifies recycling processes and reduces hazardous waste management requirements. Research indicates recovery rates for sodium and other constituent materials could potentially exceed 90% with appropriate recycling infrastructure, compared to 50-70% for conventional lithium-ion technologies.

Regulatory frameworks worldwide are increasingly emphasizing battery sustainability metrics. The European Battery Directive revision and similar initiatives in North America and Asia are establishing requirements for carbon footprint declarations, recycled content minimums, and extended producer responsibility. Solid-state sodium batteries are well-positioned to meet these evolving standards due to their inherently lower environmental impact profile.

Water usage represents another critical sustainability metric where solid-state sodium batteries demonstrate advantages. Conventional lithium extraction can consume 500,000 gallons of water per ton of lithium in brine operations, while sodium extraction typically requires 50-70% less water. This difference becomes increasingly significant as water scarcity affects more regions globally.

Material selection for solid-state sodium batteries offers substantial sustainability benefits. The elimination of flammable liquid electrolytes reduces fire hazards and improves safety profiles throughout the product lifecycle. Additionally, many solid electrolyte candidates utilize earth-abundant elements like sulfur, phosphorus, and silicon, further reducing dependency on critical materials with concentrated supply chains.

Life cycle assessment (LCA) studies indicate that solid-state sodium battery production could potentially reduce carbon emissions by 25-30% compared to conventional lithium-ion batteries. This reduction stems primarily from less energy-intensive material processing and the utilization of more geographically accessible resources, reducing transportation-related emissions. However, manufacturing processes for some solid electrolytes currently require high-temperature sintering, which presents an energy efficiency challenge that requires optimization.

End-of-life considerations reveal promising recyclability prospects for solid-state sodium batteries. The absence of toxic liquid electrolytes simplifies recycling processes and reduces hazardous waste management requirements. Research indicates recovery rates for sodium and other constituent materials could potentially exceed 90% with appropriate recycling infrastructure, compared to 50-70% for conventional lithium-ion technologies.

Regulatory frameworks worldwide are increasingly emphasizing battery sustainability metrics. The European Battery Directive revision and similar initiatives in North America and Asia are establishing requirements for carbon footprint declarations, recycled content minimums, and extended producer responsibility. Solid-state sodium batteries are well-positioned to meet these evolving standards due to their inherently lower environmental impact profile.

Water usage represents another critical sustainability metric where solid-state sodium batteries demonstrate advantages. Conventional lithium extraction can consume 500,000 gallons of water per ton of lithium in brine operations, while sodium extraction typically requires 50-70% less water. This difference becomes increasingly significant as water scarcity affects more regions globally.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!