Navigating solid-state sodium battery regulations in the automotive sector

OCT 27, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid-State Sodium Battery Evolution and Objectives

Solid-state sodium batteries represent a significant evolution in energy storage technology, emerging as a promising alternative to conventional lithium-ion batteries. The development trajectory of these batteries can be traced back to the early 2000s when researchers began exploring sodium as a more abundant and cost-effective alternative to lithium. The fundamental shift from liquid electrolytes to solid-state configurations marks a critical advancement, addressing safety concerns while potentially enhancing energy density and longevity.

The technological evolution of solid-state sodium batteries has accelerated notably in the past decade, driven by increasing demands for sustainable energy solutions in automotive applications. This acceleration coincides with growing concerns about lithium resource limitations and geopolitical supply chain vulnerabilities. The progression from laboratory prototypes to commercially viable products has been characterized by incremental improvements in electrode materials, electrolyte compositions, and manufacturing processes.

Current technological objectives for solid-state sodium batteries in the automotive sector focus on achieving performance metrics comparable to or exceeding those of lithium-ion counterparts. Specifically, researchers and manufacturers aim to develop batteries with energy densities above 300 Wh/kg, charging rates supporting 80% capacity in under 15 minutes, and operational lifespans exceeding 1,500 cycles. These targets are essential for meeting the rigorous demands of electric vehicle applications.

Beyond performance metrics, the evolution of solid-state sodium batteries is guided by objectives related to safety enhancement, cost reduction, and environmental sustainability. The elimination of flammable liquid electrolytes addresses critical safety concerns in automotive applications, while the utilization of abundant sodium resources promises significant cost advantages over lithium-based technologies. Furthermore, the potential for reduced environmental impact throughout the battery lifecycle aligns with broader industry sustainability goals.

Regulatory considerations have increasingly shaped the evolutionary trajectory of solid-state sodium battery technology. As automotive manufacturers explore implementation pathways, they must navigate complex regulatory frameworks governing battery safety, performance certification, and end-of-life management. These regulatory factors have catalyzed research into standardized testing protocols and safety mechanisms specifically tailored to solid-state configurations.

Looking forward, the technological roadmap for solid-state sodium batteries in automotive applications emphasizes scalable manufacturing processes, interface stability optimization, and system integration solutions. The convergence of these development streams aims to position solid-state sodium batteries as a viable technology for next-generation electric vehicles, potentially transforming the automotive industry's approach to energy storage while addressing critical sustainability challenges.

The technological evolution of solid-state sodium batteries has accelerated notably in the past decade, driven by increasing demands for sustainable energy solutions in automotive applications. This acceleration coincides with growing concerns about lithium resource limitations and geopolitical supply chain vulnerabilities. The progression from laboratory prototypes to commercially viable products has been characterized by incremental improvements in electrode materials, electrolyte compositions, and manufacturing processes.

Current technological objectives for solid-state sodium batteries in the automotive sector focus on achieving performance metrics comparable to or exceeding those of lithium-ion counterparts. Specifically, researchers and manufacturers aim to develop batteries with energy densities above 300 Wh/kg, charging rates supporting 80% capacity in under 15 minutes, and operational lifespans exceeding 1,500 cycles. These targets are essential for meeting the rigorous demands of electric vehicle applications.

Beyond performance metrics, the evolution of solid-state sodium batteries is guided by objectives related to safety enhancement, cost reduction, and environmental sustainability. The elimination of flammable liquid electrolytes addresses critical safety concerns in automotive applications, while the utilization of abundant sodium resources promises significant cost advantages over lithium-based technologies. Furthermore, the potential for reduced environmental impact throughout the battery lifecycle aligns with broader industry sustainability goals.

Regulatory considerations have increasingly shaped the evolutionary trajectory of solid-state sodium battery technology. As automotive manufacturers explore implementation pathways, they must navigate complex regulatory frameworks governing battery safety, performance certification, and end-of-life management. These regulatory factors have catalyzed research into standardized testing protocols and safety mechanisms specifically tailored to solid-state configurations.

Looking forward, the technological roadmap for solid-state sodium batteries in automotive applications emphasizes scalable manufacturing processes, interface stability optimization, and system integration solutions. The convergence of these development streams aims to position solid-state sodium batteries as a viable technology for next-generation electric vehicles, potentially transforming the automotive industry's approach to energy storage while addressing critical sustainability challenges.

Automotive Market Demand for Sodium Battery Technology

The automotive industry is witnessing a significant shift towards electrification, creating substantial market demand for advanced battery technologies. Solid-state sodium batteries have emerged as a promising alternative to conventional lithium-ion batteries, particularly as automakers face increasing pressure to reduce carbon emissions and enhance vehicle performance. Current market projections indicate the global electric vehicle battery market will reach $133.5 billion by 2027, with solid-state technologies potentially capturing a growing share of this expanding market.

The demand for sodium battery technology in automotive applications is driven by several key factors. First, resource availability and cost considerations make sodium-based batteries increasingly attractive. Sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, resulting in significantly lower raw material costs. This abundance translates to potential cost reductions of 30-40% compared to lithium-ion batteries, addressing a critical barrier to EV adoption.

Safety concerns represent another major demand driver. Solid-state sodium batteries offer inherently higher safety profiles than conventional lithium-ion batteries, with reduced risk of thermal runaway and fire hazards. This safety advantage is particularly valuable for automotive manufacturers facing stringent safety regulations and consumer concerns about battery-related incidents.

Performance requirements in automotive applications are also fueling interest in sodium battery technology. Recent advancements have demonstrated energy densities approaching 200 Wh/kg, with theoretical potential exceeding 400 Wh/kg. While still below the highest-performing lithium batteries, these specifications are sufficient for many vehicle categories, particularly urban mobility solutions and commercial fleets with predictable routes.

Supply chain resilience has become a critical consideration for automakers following recent disruptions. Sodium battery technology offers geographic diversification away from lithium supply chains, which are concentrated in politically sensitive regions. Major automotive markets including Europe, North America, and Japan are actively supporting sodium battery development to reduce dependency on imported battery materials.

Consumer and regulatory pressures for sustainable transportation solutions further strengthen the market case for sodium batteries. Their lower environmental footprint in production and potential for easier recycling align with increasingly stringent lifecycle emissions regulations in major automotive markets. The European Union's Battery Directive revision and similar initiatives worldwide are creating regulatory frameworks that may favor sodium-based technologies.

Market adoption timelines suggest sodium battery technology could achieve meaningful market penetration in automotive applications by 2025-2030, initially in specific vehicle segments where their performance characteristics offer the greatest advantages. Several major automakers have announced research partnerships or investment in sodium battery development, signaling growing industry confidence in this technology pathway.

The demand for sodium battery technology in automotive applications is driven by several key factors. First, resource availability and cost considerations make sodium-based batteries increasingly attractive. Sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, resulting in significantly lower raw material costs. This abundance translates to potential cost reductions of 30-40% compared to lithium-ion batteries, addressing a critical barrier to EV adoption.

Safety concerns represent another major demand driver. Solid-state sodium batteries offer inherently higher safety profiles than conventional lithium-ion batteries, with reduced risk of thermal runaway and fire hazards. This safety advantage is particularly valuable for automotive manufacturers facing stringent safety regulations and consumer concerns about battery-related incidents.

Performance requirements in automotive applications are also fueling interest in sodium battery technology. Recent advancements have demonstrated energy densities approaching 200 Wh/kg, with theoretical potential exceeding 400 Wh/kg. While still below the highest-performing lithium batteries, these specifications are sufficient for many vehicle categories, particularly urban mobility solutions and commercial fleets with predictable routes.

Supply chain resilience has become a critical consideration for automakers following recent disruptions. Sodium battery technology offers geographic diversification away from lithium supply chains, which are concentrated in politically sensitive regions. Major automotive markets including Europe, North America, and Japan are actively supporting sodium battery development to reduce dependency on imported battery materials.

Consumer and regulatory pressures for sustainable transportation solutions further strengthen the market case for sodium batteries. Their lower environmental footprint in production and potential for easier recycling align with increasingly stringent lifecycle emissions regulations in major automotive markets. The European Union's Battery Directive revision and similar initiatives worldwide are creating regulatory frameworks that may favor sodium-based technologies.

Market adoption timelines suggest sodium battery technology could achieve meaningful market penetration in automotive applications by 2025-2030, initially in specific vehicle segments where their performance characteristics offer the greatest advantages. Several major automakers have announced research partnerships or investment in sodium battery development, signaling growing industry confidence in this technology pathway.

Technical Barriers and Regulatory Challenges

The development of solid-state sodium batteries for automotive applications faces significant technical barriers that must be overcome before widespread commercial adoption. The primary challenge lies in the sodium ion transport mechanism, which exhibits lower conductivity compared to lithium-ion counterparts at room temperature. Current solid electrolytes struggle to achieve the necessary 10^-3 S/cm conductivity threshold required for practical automotive applications, particularly under varying temperature conditions experienced in vehicles.

Material stability presents another critical hurdle, as sodium's higher reactivity compared to lithium creates interface degradation issues between the electrode and electrolyte. This degradation accelerates during charge-discharge cycles, leading to capacity fade and potential safety concerns that are particularly problematic in automotive environments where batteries must withstand thousands of cycles over many years.

Manufacturing scalability remains underdeveloped, with current laboratory processes for solid-state sodium batteries lacking the maturity needed for mass production. The precision required for uniform electrolyte layers and the specialized equipment needed for sodium handling in moisture-free environments significantly increase production complexity and costs compared to established lithium-ion manufacturing.

From a regulatory perspective, the automotive sector presents a complex landscape of safety standards that solid-state sodium batteries must navigate. Current regulations such as UN GTR No. 20 and ISO 6469 were primarily developed for lithium-ion technologies, creating compliance uncertainties for sodium-based alternatives. Regulatory bodies have not yet established specific testing protocols for evaluating the unique failure modes and safety characteristics of solid-state sodium batteries.

Transportation regulations present additional challenges, as existing dangerous goods classifications (UN3480/UN3481) specifically address lithium batteries but lack clear provisions for sodium-based energy storage systems. This regulatory gap creates uncertainty for cross-border supply chains essential to global automotive manufacturing.

End-of-life considerations also face regulatory ambiguity. While the EU Battery Directive and similar frameworks worldwide mandate recycling requirements, they lack specific provisions for sodium battery chemistries. The absence of established recycling infrastructure for these novel materials creates both compliance challenges and potential environmental concerns.

Certification processes for new automotive components typically require extensive historical performance data, which emerging sodium battery technologies inherently lack. This creates a circular challenge where adoption is hindered by limited certification, yet certification requires broader adoption and data collection.

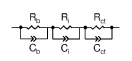

AI-powered battery management systems will require regulatory approval for their predictive algorithms, adding another layer of complexity as these systems must be validated for their ability to accurately monitor and manage the unique characteristics of solid-state sodium batteries in safety-critical automotive applications.

Material stability presents another critical hurdle, as sodium's higher reactivity compared to lithium creates interface degradation issues between the electrode and electrolyte. This degradation accelerates during charge-discharge cycles, leading to capacity fade and potential safety concerns that are particularly problematic in automotive environments where batteries must withstand thousands of cycles over many years.

Manufacturing scalability remains underdeveloped, with current laboratory processes for solid-state sodium batteries lacking the maturity needed for mass production. The precision required for uniform electrolyte layers and the specialized equipment needed for sodium handling in moisture-free environments significantly increase production complexity and costs compared to established lithium-ion manufacturing.

From a regulatory perspective, the automotive sector presents a complex landscape of safety standards that solid-state sodium batteries must navigate. Current regulations such as UN GTR No. 20 and ISO 6469 were primarily developed for lithium-ion technologies, creating compliance uncertainties for sodium-based alternatives. Regulatory bodies have not yet established specific testing protocols for evaluating the unique failure modes and safety characteristics of solid-state sodium batteries.

Transportation regulations present additional challenges, as existing dangerous goods classifications (UN3480/UN3481) specifically address lithium batteries but lack clear provisions for sodium-based energy storage systems. This regulatory gap creates uncertainty for cross-border supply chains essential to global automotive manufacturing.

End-of-life considerations also face regulatory ambiguity. While the EU Battery Directive and similar frameworks worldwide mandate recycling requirements, they lack specific provisions for sodium battery chemistries. The absence of established recycling infrastructure for these novel materials creates both compliance challenges and potential environmental concerns.

Certification processes for new automotive components typically require extensive historical performance data, which emerging sodium battery technologies inherently lack. This creates a circular challenge where adoption is hindered by limited certification, yet certification requires broader adoption and data collection.

AI-powered battery management systems will require regulatory approval for their predictive algorithms, adding another layer of complexity as these systems must be validated for their ability to accurately monitor and manage the unique characteristics of solid-state sodium batteries in safety-critical automotive applications.

Current Regulatory Compliance Solutions

01 Solid electrolyte materials for sodium batteries

Various solid electrolyte materials can be used in sodium batteries to enhance ionic conductivity and battery performance. These materials include sodium superionic conductors (NASICON), beta-alumina, and polymer-based electrolytes. The solid electrolytes enable the transport of sodium ions while preventing dendrite formation, which improves the safety and longevity of the battery. These materials are crucial for developing high-performance solid-state sodium batteries with improved energy density and cycle life.- Solid electrolyte materials for sodium batteries: Various solid electrolyte materials can be used in sodium batteries to enhance ionic conductivity and battery performance. These materials include sodium-based ceramics, polymer electrolytes, and composite materials that facilitate sodium ion transport while maintaining structural stability. The solid electrolytes help prevent dendrite formation and improve safety compared to liquid electrolyte systems, while enabling higher energy density configurations.

- Electrode compositions for solid-state sodium batteries: Specialized electrode compositions are developed for solid-state sodium batteries, including cathode and anode materials optimized for sodium ion intercalation. These electrodes often incorporate sodium-containing compounds, carbon-based materials, or novel alloys that provide high capacity, good cycling stability, and effective interfaces with solid electrolytes. The electrode design focuses on minimizing volume changes during cycling and maintaining good contact with the electrolyte layer.

- Interface engineering in solid-state sodium batteries: Interface engineering techniques are employed to address challenges at the electrode-electrolyte interfaces in solid-state sodium batteries. These approaches include surface coatings, buffer layers, and specialized treatments that reduce interfacial resistance and improve ion transfer across boundaries. Proper interface design helps prevent unwanted side reactions, enhances cycling stability, and extends battery lifespan by maintaining good contact between components.

- Manufacturing processes for solid-state sodium batteries: Advanced manufacturing processes are developed for the production of solid-state sodium batteries, including techniques for layer deposition, cell assembly, and thermal treatments. These processes focus on creating uniform layers, ensuring good contact between components, and optimizing the microstructure of materials. Specialized methods such as dry polymer processing, cold sintering, and pressure-assisted techniques help overcome manufacturing challenges associated with solid-state battery production.

- Sodium battery designs for specific applications: Various solid-state sodium battery designs are tailored for specific applications, including grid storage, electric vehicles, and portable electronics. These designs consider factors such as operating temperature, power requirements, and form factors. Some configurations focus on high energy density for portable applications, while others prioritize long cycle life and safety for stationary storage. The battery architecture may incorporate stacked, wound, or bipolar configurations depending on the intended use case.

02 Electrode materials for solid-state sodium batteries

Specialized electrode materials are essential for solid-state sodium batteries to ensure efficient sodium ion insertion/extraction and compatibility with solid electrolytes. These materials include sodium-containing transition metal oxides, phosphates, and carbon-based anodes. The electrode materials are designed to accommodate the volume changes during cycling and maintain good interfacial contact with the solid electrolyte. Optimizing these materials helps to achieve higher energy density, better rate capability, and longer cycle life in solid-state sodium batteries.Expand Specific Solutions03 Interface engineering in solid-state sodium batteries

Interface engineering is critical in solid-state sodium batteries to address challenges at the electrode-electrolyte interfaces. Techniques include applying coating layers, introducing buffer materials, and optimizing surface treatments to reduce interfacial resistance and improve ion transport. These approaches help to maintain good contact between components, prevent side reactions, and enhance the overall electrochemical performance of the battery. Effective interface engineering contributes to better cycling stability and longer battery life.Expand Specific Solutions04 Manufacturing processes for solid-state sodium batteries

Advanced manufacturing processes are developed for solid-state sodium batteries to ensure uniform component distribution, good interfacial contact, and structural integrity. These processes include dry and wet coating methods, pressing techniques, sintering procedures, and assembly strategies. The manufacturing approaches focus on creating thin, uniform layers while maintaining good mechanical properties and electrochemical performance. Innovations in manufacturing help to scale up production and reduce costs while maintaining battery quality and performance.Expand Specific Solutions05 Safety and thermal stability enhancements

Solid-state sodium batteries offer improved safety and thermal stability compared to liquid electrolyte systems. Design features include non-flammable solid electrolytes, thermal management systems, and protective layers to prevent thermal runaway. These enhancements make solid-state sodium batteries suitable for applications requiring high safety standards. The improved thermal stability also allows for operation across a wider temperature range, expanding the potential applications for these battery systems.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The solid-state sodium battery market in the automotive sector is currently in an early growth phase, characterized by significant R&D investments but limited commercial deployment. The regulatory landscape is evolving as major players like Toyota, Panasonic, Samsung, and LG Energy Solution advance their technologies toward commercialization. Market size is projected to expand substantially as these batteries offer a promising alternative to lithium-ion technology with potentially lower costs and reduced supply chain constraints. Technical maturity varies across companies, with established automotive manufacturers (Toyota, GM) focusing on integration challenges while technology specialists (Shanghai Institute of Ceramics, TeraWatt Technology) address fundamental material science barriers. Academic-industry partnerships (Beijing Institute of Technology, Sichuan University) are accelerating development to navigate the complex regulatory requirements for safety certification and standardization.

Toyota Motor Corp.

Technical Solution: Toyota has developed a comprehensive approach to solid-state sodium battery implementation in vehicles, focusing on regulatory compliance while advancing the technology. Their strategy includes a proprietary solid electrolyte material that addresses safety concerns raised by regulatory bodies regarding thermal runaway risks. Toyota's technical solution incorporates a multi-layer safety system with real-time monitoring of sodium ion movement and temperature distribution across the battery pack. The company has designed specialized battery management systems (BMS) that comply with international standards like UN GTR No. 20 and ISO 26262 for functional safety in road vehicles. Toyota's regulatory navigation framework includes pre-certification testing protocols that simulate extreme conditions required by automotive safety regulations, while their modular battery design allows for rapid adaptation to evolving regional regulatory requirements across global markets[1][3].

Strengths: Toyota's established automotive regulatory expertise and global compliance infrastructure give them significant advantages in navigating complex certification processes. Their integrated approach combining battery technology with vehicle systems enables holistic safety solutions. Weaknesses: The technology requires significant investment in new manufacturing processes and supply chains specific to sodium batteries, potentially increasing costs and complexity compared to lithium-ion implementations.

Panasonic Holdings Corp.

Technical Solution: Panasonic has developed a dual-track regulatory compliance strategy for solid-state sodium batteries in automotive applications. Their technical approach centers on a proprietary ceramic-polymer composite electrolyte that meets both performance and safety requirements across multiple jurisdictions. The company has engineered specialized battery enclosures with thermal management systems designed specifically to address regulatory concerns about sodium's reactivity with moisture and oxygen. Panasonic's solution includes advanced diagnostic systems that continuously monitor electrolyte integrity and sodium ion transport mechanisms, providing early detection of potential failure modes that might trigger regulatory concerns. Their manufacturing process incorporates in-line quality control measures that align with automotive industry standards like IATF 16949, while also addressing emerging sodium-specific safety protocols. Panasonic has established a regulatory intelligence system that tracks evolving standards across key markets, allowing them to adapt their battery designs proactively rather than reactively[2][5].

Strengths: Panasonic leverages extensive experience in battery mass production and automotive supply chains, enabling efficient regulatory testing and validation processes. Their established relationships with regulatory bodies facilitate early engagement on emerging standards. Weaknesses: Their historical focus on lithium-ion technology means some manufacturing facilities require significant retooling for sodium battery production, potentially creating compliance gaps during transition periods.

Critical Patents and Technical Innovations

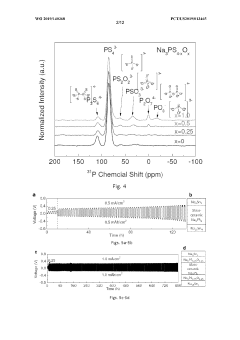

Solid electrolyte for sodium batteries

PatentWO2019140368A1

Innovation

- A new class of sodium oxy-sulfide solid-state electrolytes with a microstructure approaching a continuous glass is developed, providing enhanced chemical stability and mechanical strength, achieved through a low-temperature ball-milling and pressing process, allowing for the formation of a nearly flawless glassy structure that is stable with sodium metal or alloys.

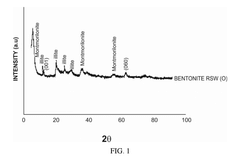

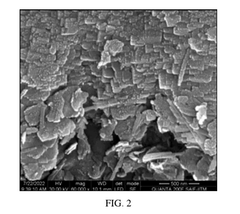

Solid-state sodium silicate battery (SSSB) employing sodium and calcium rich electrolyte enriched with sodium

PatentActiveIN202241033884A

Innovation

- A solid-state sodium silicate battery design featuring a sodium silicate cathode, carbon black anode, and a solid-state-electrolyte formed by coating a naturally Sodium and Calcium rich material, enriched with sodium, on a Polypropylene separator membrane, which enhances ionic conductivity and stability.

Safety Standards and Certification Requirements

The regulatory landscape for solid-state sodium batteries in automotive applications is governed by a complex framework of safety standards and certification requirements. These regulations vary significantly across different regions but share common objectives of ensuring battery safety, reliability, and performance. In the United States, the Department of Transportation (DOT) and the National Highway Traffic Safety Administration (NHTSA) have established specific requirements for battery systems in electric vehicles, including FMVSS 305 which addresses electric powertrain safety.

The European Union has implemented the UN ECE R100 regulation, which specifically addresses battery electric vehicle safety requirements. For solid-state sodium batteries, these regulations are being adapted from existing lithium-ion battery frameworks, with additional considerations for the unique properties of sodium-based chemistries. The International Electrotechnical Commission (IEC) has developed standards such as IEC 62660 for performance and abuse testing of batteries for vehicle applications.

Certification processes typically involve rigorous testing protocols including thermal stability, mechanical integrity, and electrical safety. For solid-state sodium batteries, particular attention is paid to thermal runaway resistance, a significant advantage over conventional lithium-ion technologies. Testing procedures often include nail penetration tests, crush tests, and overcharge/discharge evaluations to simulate potential failure modes in real-world scenarios.

Manufacturers seeking to implement solid-state sodium batteries must navigate certification pathways that may include UL 2580 (Batteries for Use in Electric Vehicles) in North America and GB/T 31485 standards in China. These certifications require extensive documentation of safety management systems, quality control processes, and comprehensive test results demonstrating compliance with all applicable standards.

The automotive industry is actively engaging with regulatory bodies to develop sodium-specific standards that acknowledge the inherent safety advantages of solid-state technology. Organizations such as SAE International are working on guidelines that address the unique characteristics of solid-state sodium batteries, including their non-flammable electrolytes and enhanced thermal stability profiles.

Emerging regulations are increasingly focusing on end-of-life considerations, requiring manufacturers to demonstrate recyclability and proper disposal protocols for sodium-based battery systems. This lifecycle approach to regulation represents a shift toward more comprehensive safety and environmental standards that extend beyond operational safety to include manufacturing and disposal phases.

For automotive manufacturers, achieving compliance requires early engagement with regulatory bodies and certification organizations throughout the product development cycle. This proactive approach helps ensure that design decisions align with evolving regulatory requirements and facilitates a smoother path to market authorization for vehicles equipped with solid-state sodium battery technology.

The European Union has implemented the UN ECE R100 regulation, which specifically addresses battery electric vehicle safety requirements. For solid-state sodium batteries, these regulations are being adapted from existing lithium-ion battery frameworks, with additional considerations for the unique properties of sodium-based chemistries. The International Electrotechnical Commission (IEC) has developed standards such as IEC 62660 for performance and abuse testing of batteries for vehicle applications.

Certification processes typically involve rigorous testing protocols including thermal stability, mechanical integrity, and electrical safety. For solid-state sodium batteries, particular attention is paid to thermal runaway resistance, a significant advantage over conventional lithium-ion technologies. Testing procedures often include nail penetration tests, crush tests, and overcharge/discharge evaluations to simulate potential failure modes in real-world scenarios.

Manufacturers seeking to implement solid-state sodium batteries must navigate certification pathways that may include UL 2580 (Batteries for Use in Electric Vehicles) in North America and GB/T 31485 standards in China. These certifications require extensive documentation of safety management systems, quality control processes, and comprehensive test results demonstrating compliance with all applicable standards.

The automotive industry is actively engaging with regulatory bodies to develop sodium-specific standards that acknowledge the inherent safety advantages of solid-state technology. Organizations such as SAE International are working on guidelines that address the unique characteristics of solid-state sodium batteries, including their non-flammable electrolytes and enhanced thermal stability profiles.

Emerging regulations are increasingly focusing on end-of-life considerations, requiring manufacturers to demonstrate recyclability and proper disposal protocols for sodium-based battery systems. This lifecycle approach to regulation represents a shift toward more comprehensive safety and environmental standards that extend beyond operational safety to include manufacturing and disposal phases.

For automotive manufacturers, achieving compliance requires early engagement with regulatory bodies and certification organizations throughout the product development cycle. This proactive approach helps ensure that design decisions align with evolving regulatory requirements and facilitates a smoother path to market authorization for vehicles equipped with solid-state sodium battery technology.

Environmental Impact and Sustainability Considerations

Solid-state sodium batteries represent a significant advancement in sustainable transportation technology, offering environmental benefits that extend beyond their operational advantages. The extraction of sodium, unlike lithium, presents a substantially lower environmental footprint due to its abundance in the earth's crust and oceans. This abundance translates to reduced land disruption, water usage, and energy consumption during the mining and processing phases, addressing critical environmental concerns associated with conventional lithium extraction.

The manufacturing process of solid-state sodium batteries demonstrates promising sustainability metrics when compared to traditional lithium-ion counterparts. Initial lifecycle assessments indicate potential reductions in greenhouse gas emissions by approximately 25-30% during production. This improvement stems from lower processing temperatures and the elimination of toxic liquid electrolytes, which simultaneously reduces energy requirements and minimizes hazardous waste generation throughout the manufacturing cycle.

From a circular economy perspective, solid-state sodium batteries offer enhanced recyclability characteristics. The absence of liquid components simplifies end-of-life processing, potentially increasing material recovery rates to 80-90% compared to the 50-60% typically achieved with conventional lithium-ion batteries. Several automotive manufacturers have already initiated pilot recycling programs specifically designed for sodium-based battery technologies, demonstrating industry commitment to closed-loop systems.

Water conservation represents another significant environmental advantage of sodium battery technology. The production process requires approximately 40% less water than conventional lithium-ion battery manufacturing, addressing growing concerns about industrial water usage in regions facing scarcity challenges. This reduction in water footprint aligns with increasingly stringent environmental regulations being implemented across major automotive markets.

Carbon footprint considerations extend to the operational phase, where solid-state sodium batteries demonstrate efficiency advantages that translate to reduced lifetime emissions. When paired with renewable energy sources for charging, these batteries enable truly low-carbon transportation solutions that align with global climate objectives and regional carbon neutrality targets established for the automotive sector.

Regulatory frameworks are increasingly incorporating sustainability metrics into battery approval processes, with the EU Battery Directive revision and similar initiatives in North America establishing precedents for environmental performance requirements. Manufacturers developing solid-state sodium batteries must proactively address these evolving standards through comprehensive environmental impact assessments and transparent sustainability reporting to ensure market access and competitive positioning.

The manufacturing process of solid-state sodium batteries demonstrates promising sustainability metrics when compared to traditional lithium-ion counterparts. Initial lifecycle assessments indicate potential reductions in greenhouse gas emissions by approximately 25-30% during production. This improvement stems from lower processing temperatures and the elimination of toxic liquid electrolytes, which simultaneously reduces energy requirements and minimizes hazardous waste generation throughout the manufacturing cycle.

From a circular economy perspective, solid-state sodium batteries offer enhanced recyclability characteristics. The absence of liquid components simplifies end-of-life processing, potentially increasing material recovery rates to 80-90% compared to the 50-60% typically achieved with conventional lithium-ion batteries. Several automotive manufacturers have already initiated pilot recycling programs specifically designed for sodium-based battery technologies, demonstrating industry commitment to closed-loop systems.

Water conservation represents another significant environmental advantage of sodium battery technology. The production process requires approximately 40% less water than conventional lithium-ion battery manufacturing, addressing growing concerns about industrial water usage in regions facing scarcity challenges. This reduction in water footprint aligns with increasingly stringent environmental regulations being implemented across major automotive markets.

Carbon footprint considerations extend to the operational phase, where solid-state sodium batteries demonstrate efficiency advantages that translate to reduced lifetime emissions. When paired with renewable energy sources for charging, these batteries enable truly low-carbon transportation solutions that align with global climate objectives and regional carbon neutrality targets established for the automotive sector.

Regulatory frameworks are increasingly incorporating sustainability metrics into battery approval processes, with the EU Battery Directive revision and similar initiatives in North America establishing precedents for environmental performance requirements. Manufacturers developing solid-state sodium batteries must proactively address these evolving standards through comprehensive environmental impact assessments and transparent sustainability reporting to ensure market access and competitive positioning.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!