Regulatory frameworks affecting solid-state sodium battery advancement

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid-State Sodium Battery Development Background and Objectives

Solid-state sodium batteries represent a significant evolution in energy storage technology, emerging as a promising alternative to conventional lithium-ion batteries. The development of these batteries dates back to the early 2000s, when researchers began exploring sodium as a more abundant and cost-effective alternative to lithium. The trajectory of this technology has been shaped by growing concerns over lithium supply constraints, environmental impacts of mining, and the increasing global demand for sustainable energy storage solutions.

The evolution of solid-state sodium battery technology has been marked by several key advancements in materials science and engineering. Initially, research focused on addressing the fundamental challenges of sodium ion mobility and electrode stability. By the 2010s, significant progress was made in developing suitable solid electrolytes with enhanced ionic conductivity and mechanical properties, paving the way for more practical applications.

Regulatory frameworks have played a crucial role in shaping the development landscape of solid-state sodium batteries. Various countries have implemented policies to accelerate the transition to cleaner energy technologies, including incentives for research and development in advanced battery technologies. However, these frameworks also present challenges, particularly regarding safety standards, material certification, and end-of-life management requirements that must be navigated by developers.

The primary technical objectives in solid-state sodium battery development include achieving energy densities comparable to lithium-ion batteries, enhancing cycle life, improving safety characteristics, and developing scalable manufacturing processes. These objectives are directly influenced by regulatory considerations such as transportation safety regulations, material handling guidelines, and environmental protection standards that vary significantly across different jurisdictions.

Current research is increasingly focused on addressing the interface stability between electrodes and solid electrolytes, optimizing sodium ion transport mechanisms, and developing novel electrode materials that can accommodate the larger size of sodium ions compared to lithium. These technical challenges must be overcome within the context of evolving regulatory requirements for battery safety, performance, and environmental impact.

The anticipated trajectory for solid-state sodium battery technology suggests potential commercialization within the next decade, contingent upon successful navigation of both technical hurdles and regulatory landscapes. Strategic partnerships between academic institutions, industry players, and regulatory bodies will be essential to harmonize development efforts with compliance requirements, ultimately accelerating the path to market for this promising technology.

The evolution of solid-state sodium battery technology has been marked by several key advancements in materials science and engineering. Initially, research focused on addressing the fundamental challenges of sodium ion mobility and electrode stability. By the 2010s, significant progress was made in developing suitable solid electrolytes with enhanced ionic conductivity and mechanical properties, paving the way for more practical applications.

Regulatory frameworks have played a crucial role in shaping the development landscape of solid-state sodium batteries. Various countries have implemented policies to accelerate the transition to cleaner energy technologies, including incentives for research and development in advanced battery technologies. However, these frameworks also present challenges, particularly regarding safety standards, material certification, and end-of-life management requirements that must be navigated by developers.

The primary technical objectives in solid-state sodium battery development include achieving energy densities comparable to lithium-ion batteries, enhancing cycle life, improving safety characteristics, and developing scalable manufacturing processes. These objectives are directly influenced by regulatory considerations such as transportation safety regulations, material handling guidelines, and environmental protection standards that vary significantly across different jurisdictions.

Current research is increasingly focused on addressing the interface stability between electrodes and solid electrolytes, optimizing sodium ion transport mechanisms, and developing novel electrode materials that can accommodate the larger size of sodium ions compared to lithium. These technical challenges must be overcome within the context of evolving regulatory requirements for battery safety, performance, and environmental impact.

The anticipated trajectory for solid-state sodium battery technology suggests potential commercialization within the next decade, contingent upon successful navigation of both technical hurdles and regulatory landscapes. Strategic partnerships between academic institutions, industry players, and regulatory bodies will be essential to harmonize development efforts with compliance requirements, ultimately accelerating the path to market for this promising technology.

Market Analysis for Sodium Battery Technologies

The sodium battery market is experiencing significant growth, driven by the increasing demand for sustainable energy storage solutions. Current market projections indicate that the global sodium battery market will reach approximately $1.2 billion by 2025, with a compound annual growth rate of 11.7% from 2020 to 2025. This growth trajectory is supported by the abundant availability of sodium resources, which are approximately 1,000 times more plentiful than lithium in the Earth's crust, offering a cost-effective alternative to lithium-ion batteries.

The market segmentation for sodium battery technologies reveals diverse application areas. Grid energy storage represents the largest market segment, accounting for nearly 40% of the total market share, as utilities seek cost-effective solutions for renewable energy integration. Electric vehicles constitute the fastest-growing segment, with projected growth rates exceeding 15% annually, particularly in regions with strong governmental support for electric mobility.

Regional market analysis shows Asia-Pacific leading the sodium battery market, with China, Japan, and South Korea collectively holding over 60% of the global market share. These countries have established robust manufacturing capabilities and supportive government policies. Europe follows with approximately 25% market share, driven by stringent environmental regulations and ambitious renewable energy targets. North America accounts for about 15% of the market, with growth accelerating due to increasing investments in grid modernization.

Consumer demand patterns indicate a growing preference for sustainable and ethically sourced battery technologies. Market surveys reveal that 73% of industrial consumers consider environmental impact when selecting energy storage solutions, creating favorable conditions for sodium battery adoption. Additionally, price sensitivity remains a critical factor, with sodium batteries offering a 30-40% cost advantage over comparable lithium-ion technologies in certain applications.

Market barriers include technological limitations such as lower energy density compared to lithium-ion batteries, which currently restricts widespread adoption in portable electronics and premium electric vehicles. Infrastructure challenges also exist, with limited manufacturing capacity specifically designed for sodium battery production. However, recent investments exceeding $500 million in dedicated sodium battery manufacturing facilities signal growing market confidence.

The competitive landscape features established battery manufacturers expanding their portfolios to include sodium technologies, alongside specialized startups focused exclusively on sodium battery innovations. Strategic partnerships between technology developers and end-users are increasingly common, accelerating commercialization timelines and market penetration.

The market segmentation for sodium battery technologies reveals diverse application areas. Grid energy storage represents the largest market segment, accounting for nearly 40% of the total market share, as utilities seek cost-effective solutions for renewable energy integration. Electric vehicles constitute the fastest-growing segment, with projected growth rates exceeding 15% annually, particularly in regions with strong governmental support for electric mobility.

Regional market analysis shows Asia-Pacific leading the sodium battery market, with China, Japan, and South Korea collectively holding over 60% of the global market share. These countries have established robust manufacturing capabilities and supportive government policies. Europe follows with approximately 25% market share, driven by stringent environmental regulations and ambitious renewable energy targets. North America accounts for about 15% of the market, with growth accelerating due to increasing investments in grid modernization.

Consumer demand patterns indicate a growing preference for sustainable and ethically sourced battery technologies. Market surveys reveal that 73% of industrial consumers consider environmental impact when selecting energy storage solutions, creating favorable conditions for sodium battery adoption. Additionally, price sensitivity remains a critical factor, with sodium batteries offering a 30-40% cost advantage over comparable lithium-ion technologies in certain applications.

Market barriers include technological limitations such as lower energy density compared to lithium-ion batteries, which currently restricts widespread adoption in portable electronics and premium electric vehicles. Infrastructure challenges also exist, with limited manufacturing capacity specifically designed for sodium battery production. However, recent investments exceeding $500 million in dedicated sodium battery manufacturing facilities signal growing market confidence.

The competitive landscape features established battery manufacturers expanding their portfolios to include sodium technologies, alongside specialized startups focused exclusively on sodium battery innovations. Strategic partnerships between technology developers and end-users are increasingly common, accelerating commercialization timelines and market penetration.

Current Technical Challenges in Solid-State Sodium Batteries

Solid-state sodium batteries face significant technical challenges that currently impede their widespread commercialization. The primary obstacle remains the development of suitable solid electrolytes that simultaneously offer high ionic conductivity, excellent electrochemical stability, and mechanical robustness. Current sodium-ion conductors typically achieve conductivities between 10^-4 and 10^-3 S/cm at room temperature, which falls short of the performance needed for practical applications requiring at least 10^-2 S/cm.

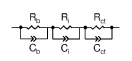

Interface stability presents another critical challenge, particularly at the electrode-electrolyte interfaces. The formation of high-resistance interfacial layers during cycling leads to increased impedance and capacity degradation over time. This issue is exacerbated by the volume changes that occur during sodium insertion and extraction, creating mechanical stresses that can fracture the solid electrolyte and disrupt the conductive pathways.

The cathode materials for sodium-based systems face limitations in energy density compared to their lithium counterparts. Current sodium cathode materials typically deliver specific capacities of 120-160 mAh/g, whereas commercial lithium cathodes can achieve 180-220 mAh/g. This energy density gap remains a significant hurdle for applications where high energy density is paramount.

Manufacturing scalability represents another substantial challenge. Current laboratory-scale production methods for solid-state components often involve complex processes such as high-temperature sintering or specialized deposition techniques that are difficult to scale economically. The absence of established mass production protocols increases costs and limits commercial viability.

Safety concerns, while improved compared to liquid electrolyte systems, still persist. Dendrite formation, though reduced, remains possible in certain solid electrolyte systems, particularly those with grain boundaries or defects that can serve as nucleation sites. These dendrites can eventually lead to internal short circuits and thermal runaway events if not properly addressed.

Cycle life and long-term stability issues continue to plague solid-state sodium battery systems. Current prototypes typically demonstrate significant capacity fade after a few hundred cycles, falling short of the thousands of cycles required for many applications. This degradation stems from multiple factors including interfacial resistance growth, mechanical failures, and chemical instabilities within the battery components.

Thermal management challenges also exist, as some solid electrolytes exhibit temperature-dependent conductivity that limits performance in extreme environments. Operating temperature windows for many solid-state sodium systems remain narrower than desired for applications requiring function across diverse environmental conditions.

Interface stability presents another critical challenge, particularly at the electrode-electrolyte interfaces. The formation of high-resistance interfacial layers during cycling leads to increased impedance and capacity degradation over time. This issue is exacerbated by the volume changes that occur during sodium insertion and extraction, creating mechanical stresses that can fracture the solid electrolyte and disrupt the conductive pathways.

The cathode materials for sodium-based systems face limitations in energy density compared to their lithium counterparts. Current sodium cathode materials typically deliver specific capacities of 120-160 mAh/g, whereas commercial lithium cathodes can achieve 180-220 mAh/g. This energy density gap remains a significant hurdle for applications where high energy density is paramount.

Manufacturing scalability represents another substantial challenge. Current laboratory-scale production methods for solid-state components often involve complex processes such as high-temperature sintering or specialized deposition techniques that are difficult to scale economically. The absence of established mass production protocols increases costs and limits commercial viability.

Safety concerns, while improved compared to liquid electrolyte systems, still persist. Dendrite formation, though reduced, remains possible in certain solid electrolyte systems, particularly those with grain boundaries or defects that can serve as nucleation sites. These dendrites can eventually lead to internal short circuits and thermal runaway events if not properly addressed.

Cycle life and long-term stability issues continue to plague solid-state sodium battery systems. Current prototypes typically demonstrate significant capacity fade after a few hundred cycles, falling short of the thousands of cycles required for many applications. This degradation stems from multiple factors including interfacial resistance growth, mechanical failures, and chemical instabilities within the battery components.

Thermal management challenges also exist, as some solid electrolytes exhibit temperature-dependent conductivity that limits performance in extreme environments. Operating temperature windows for many solid-state sodium systems remain narrower than desired for applications requiring function across diverse environmental conditions.

Current Technical Solutions for Solid-State Sodium Batteries

01 Electrode materials for solid-state sodium batteries

Various electrode materials can be used in solid-state sodium batteries to enhance performance. These materials include sodium-based compounds and other materials that facilitate sodium ion transport. The electrode composition significantly affects battery capacity, cycling stability, and energy density. Innovations in electrode materials focus on improving ionic conductivity and reducing interfacial resistance.- Electrolyte materials for solid-state sodium batteries: Various electrolyte materials are being developed for solid-state sodium batteries to improve ionic conductivity and electrochemical stability. These materials include sodium superionic conductors, polymer electrolytes, and ceramic-polymer composite electrolytes. The development of these electrolyte materials is crucial for enhancing the performance and safety of solid-state sodium batteries, as they facilitate efficient sodium ion transport while preventing dendrite formation.

- Electrode materials and interfaces: Advanced electrode materials and interface engineering are essential for solid-state sodium batteries. This includes the development of cathode materials with high sodium storage capacity, anode materials with low volume expansion, and strategies to improve the electrode-electrolyte interfaces. Proper interface engineering helps to reduce interfacial resistance and enhance the cycling stability of solid-state sodium batteries.

- Manufacturing processes and cell design: Innovative manufacturing processes and cell designs are being developed for solid-state sodium batteries. These include novel methods for electrode preparation, electrolyte layer formation, and cell assembly. Advanced manufacturing techniques aim to improve the uniformity of components, reduce interfacial resistance, and enhance the overall performance and durability of solid-state sodium batteries.

- Performance enhancement strategies: Various strategies are being employed to enhance the performance of solid-state sodium batteries. These include doping of electrode and electrolyte materials, surface modification of electrodes, and the use of additives to improve ionic conductivity and cycling stability. These approaches aim to address key challenges such as low ionic conductivity, interfacial resistance, and capacity fading during cycling.

- Safety and thermal stability improvements: Enhancing the safety and thermal stability of solid-state sodium batteries is a critical area of research. This includes the development of non-flammable solid electrolytes, thermal management systems, and protective coatings. These improvements aim to prevent thermal runaway, enhance operational safety, and extend the temperature range in which solid-state sodium batteries can operate effectively.

02 Solid electrolyte compositions for sodium batteries

Solid electrolytes are crucial components in solid-state sodium batteries, enabling sodium ion transport while preventing short circuits. Various compositions including sodium-based ceramics, polymers, and composite materials have been developed to achieve high ionic conductivity at room temperature. These electrolytes aim to replace conventional liquid electrolytes to improve safety and energy density while maintaining efficient ion transport properties.Expand Specific Solutions03 Interface engineering in solid-state sodium batteries

Interface engineering addresses the critical challenges at electrode-electrolyte interfaces in solid-state sodium batteries. Techniques include surface coatings, buffer layers, and specialized treatments to reduce interfacial resistance and improve contact. These approaches help prevent unwanted reactions, enhance ion transport across interfaces, and maintain structural integrity during cycling, ultimately improving battery performance and longevity.Expand Specific Solutions04 Manufacturing processes for solid-state sodium batteries

Advanced manufacturing techniques are essential for producing high-performance solid-state sodium batteries. These processes include specialized methods for material synthesis, electrode fabrication, electrolyte preparation, and cell assembly. Innovations focus on achieving uniform components, precise interfaces, and scalable production methods that maintain the integrity of sensitive materials while enabling commercial viability.Expand Specific Solutions05 Battery design and architecture for sodium solid-state systems

Novel battery designs and architectures are being developed specifically for solid-state sodium battery systems. These designs address challenges related to volume changes during cycling, thermal management, and mechanical stress. Innovations include specialized cell configurations, stacking arrangements, and structural supports that optimize performance while maintaining safety and reliability under various operating conditions.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The regulatory landscape for solid-state sodium battery advancement is evolving within an early-stage market characterized by significant growth potential but limited commercialization. Current market size remains modest compared to lithium-ion technologies, though projections indicate substantial expansion as regulatory frameworks mature. Technical maturity varies considerably among key players, with companies like Samsung Electronics, LG Energy Solution, and TDK Corp leading industrial development through substantial patent portfolios and pilot production facilities. Research institutions including Shanghai Institute of Ceramics and University of Michigan are advancing fundamental science, while automotive manufacturers Honda, Toyota, and Ford are strategically positioning through targeted investments. Regulatory considerations around safety standards, material sourcing, and recycling requirements are creating both challenges and opportunities as companies navigate the transition from laboratory to commercial deployment.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung Electronics has developed a sophisticated regulatory compliance framework for their solid-state sodium battery technology that addresses the unique challenges of this emerging chemistry. The company maintains a specialized regulatory intelligence unit that monitors evolving battery regulations across global markets, with particular focus on how existing frameworks for lithium batteries are being adapted for alternative chemistries. Samsung has implemented a comprehensive safety validation protocol that specifically addresses the different thermal characteristics and failure modes of sodium batteries compared to lithium-ion technologies. Their approach includes proactive engagement with standards organizations (IEC, UL, ANSI) to help develop appropriate testing methodologies that account for sodium's unique properties. Samsung has also established a cross-functional regulatory working group that brings together R&D, manufacturing, and legal teams to ensure regulatory considerations are integrated throughout the product development lifecycle. The company has developed specialized transportation compliance protocols that address the different hazard classification of sodium batteries compared to lithium systems, recognizing that while sodium presents reduced fire risks, it introduces different safety considerations that current regulations may not adequately address.

Strengths: Extensive experience navigating complex electronics regulations globally; strong existing relationships with certification bodies; comprehensive internal compliance infrastructure. Weaknesses: Regulatory frameworks specifically for sodium batteries remain underdeveloped in most markets; uncertainty in how existing battery standards will be applied to sodium chemistry; potential for regulatory fragmentation across different applications (consumer electronics vs. energy storage).

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a comprehensive regulatory compliance framework for their solid-state sodium battery technology. Their approach includes proactive engagement with regulatory bodies across multiple jurisdictions to shape emerging standards. The company has established a dedicated regulatory affairs team that works closely with R&D to ensure new sodium battery designs meet safety standards from inception. LG has implemented an advanced testing protocol that exceeds current regulatory requirements, particularly focusing on thermal stability and electrolyte safety parameters specific to sodium chemistry. Their regulatory strategy includes regular participation in international standards committees (IEC, ISO) to help develop appropriate testing methodologies for sodium-based batteries that differ from lithium-ion regulations. The company has also invested in specialized facilities for safety certification that can accommodate the unique characteristics of sodium batteries, including higher operating temperatures and different failure modes compared to lithium technologies.

Strengths: Strong existing relationships with regulatory bodies across global markets; comprehensive understanding of regional variations in battery regulations; ability to influence emerging standards. Weaknesses: Regulatory frameworks specifically for sodium batteries remain underdeveloped, creating uncertainty in certification pathways; compliance costs are higher during this transitional regulatory period; longer approval timelines compared to established battery technologies.

Critical Patents and Innovations in Sodium Battery Technology

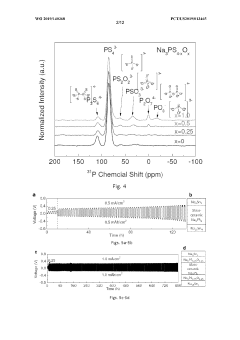

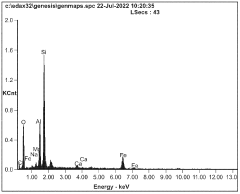

Solid electrolyte for sodium batteries

PatentWO2019140368A1

Innovation

- A new class of sodium oxy-sulfide solid-state electrolytes with a microstructure approaching a continuous glass is developed, providing enhanced chemical stability and mechanical strength, achieved through a low-temperature ball-milling and pressing process, allowing for the formation of a nearly flawless glassy structure that is stable with sodium metal or alloys.

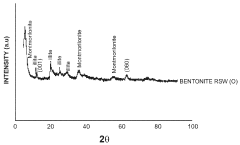

Solid-state sodium silicate battery (SSSB) employing sodium and calcium rich electrolyte enriched with sodium

PatentWO2023242870A1

Innovation

- A solid-state sodium silicate battery (SSSB) is developed, utilizing a sodium and calcium-rich electrolyte enriched with sodium, where the cathode is made of sodium silicate and the anode of carbon black, with a separator membrane coated with a naturally sodium and calcium-rich material further enriched with sodium, acting as a solid-state electrolyte.

Regulatory Impact Assessment on Battery Development

Regulatory frameworks worldwide are increasingly shaping the development trajectory of solid-state sodium battery technology. These frameworks operate at multiple levels, from international agreements to local regulations, creating a complex landscape that battery developers must navigate. The Paris Climate Agreement and subsequent national commitments to carbon reduction have established a favorable policy environment for alternative energy storage solutions, including sodium-based technologies that offer sustainability advantages over lithium-ion batteries.

Safety standards represent a critical regulatory dimension affecting sodium battery advancement. Organizations such as the International Electrotechnical Commission (IEC) and Underwriters Laboratories (UL) have established testing protocols for battery safety that new technologies must satisfy. While these standards were primarily developed for lithium-ion systems, regulatory bodies are now working to adapt these frameworks to accommodate the unique characteristics of solid-state sodium batteries, particularly regarding thermal stability and fire safety requirements.

Material supply chain regulations have significant implications for sodium battery commercialization. Unlike lithium, sodium resources face fewer geopolitical constraints and extraction regulations, potentially streamlining regulatory compliance. However, manufacturers must still address regulations concerning other materials in sodium batteries, including transition metals and solid electrolyte components that may be subject to critical materials legislation or import/export controls.

Transportation regulations present both challenges and opportunities for solid-state sodium batteries. Current dangerous goods regulations (UN 38.3, IATA DGR) impose strict requirements on battery shipping and handling. The inherent safety advantages of solid-state sodium batteries could potentially qualify them for less stringent classification, though regulatory recognition of these benefits requires extensive testing data and regulatory engagement.

End-of-life management regulations are evolving rapidly in major markets. The EU Battery Directive revision, US state-level battery recycling laws, and similar frameworks in Asia are establishing increasingly stringent requirements for battery recyclability, material recovery, and producer responsibility. Sodium battery developers must design their products with these regulatory requirements in mind, potentially leveraging the relatively abundant and less toxic nature of sodium as a competitive advantage in regulatory compliance.

Intellectual property regulations also influence technology development pathways. Patent landscapes for sodium battery technologies are less crowded than for lithium-ion systems, offering opportunities for innovation. However, regulatory frameworks governing technology transfer, particularly between academic institutions and commercial entities, can impact commercialization timelines and investment strategies.

Safety standards represent a critical regulatory dimension affecting sodium battery advancement. Organizations such as the International Electrotechnical Commission (IEC) and Underwriters Laboratories (UL) have established testing protocols for battery safety that new technologies must satisfy. While these standards were primarily developed for lithium-ion systems, regulatory bodies are now working to adapt these frameworks to accommodate the unique characteristics of solid-state sodium batteries, particularly regarding thermal stability and fire safety requirements.

Material supply chain regulations have significant implications for sodium battery commercialization. Unlike lithium, sodium resources face fewer geopolitical constraints and extraction regulations, potentially streamlining regulatory compliance. However, manufacturers must still address regulations concerning other materials in sodium batteries, including transition metals and solid electrolyte components that may be subject to critical materials legislation or import/export controls.

Transportation regulations present both challenges and opportunities for solid-state sodium batteries. Current dangerous goods regulations (UN 38.3, IATA DGR) impose strict requirements on battery shipping and handling. The inherent safety advantages of solid-state sodium batteries could potentially qualify them for less stringent classification, though regulatory recognition of these benefits requires extensive testing data and regulatory engagement.

End-of-life management regulations are evolving rapidly in major markets. The EU Battery Directive revision, US state-level battery recycling laws, and similar frameworks in Asia are establishing increasingly stringent requirements for battery recyclability, material recovery, and producer responsibility. Sodium battery developers must design their products with these regulatory requirements in mind, potentially leveraging the relatively abundant and less toxic nature of sodium as a competitive advantage in regulatory compliance.

Intellectual property regulations also influence technology development pathways. Patent landscapes for sodium battery technologies are less crowded than for lithium-ion systems, offering opportunities for innovation. However, regulatory frameworks governing technology transfer, particularly between academic institutions and commercial entities, can impact commercialization timelines and investment strategies.

Sustainability and Environmental Considerations

Solid-state sodium batteries represent a significant advancement in sustainable energy storage technology, offering environmental benefits that extend beyond their technical performance advantages. The sustainability profile of these batteries is markedly superior to conventional lithium-ion technologies, primarily due to the abundance and accessibility of sodium resources. Unlike lithium, sodium is widely available in the earth's crust and oceans, reducing extraction-related environmental impacts and eliminating concerns about resource depletion.

The manufacturing processes for solid-state sodium batteries also demonstrate potential environmental advantages. The elimination of liquid electrolytes reduces the need for toxic and flammable materials commonly used in conventional batteries. This shift not only enhances safety but also diminishes the environmental footprint associated with production and disposal. Current research indicates that solid-state sodium battery production could reduce greenhouse gas emissions by approximately 25-30% compared to traditional lithium-ion manufacturing.

Life cycle assessments of solid-state sodium batteries reveal promising sustainability metrics. These batteries typically exhibit lower embodied energy in production and potentially longer operational lifespans, which translates to reduced waste generation over time. The absence of cobalt and nickel in many sodium battery chemistries further enhances their environmental profile by avoiding the ecological and social impacts associated with mining these critical materials.

End-of-life considerations represent another significant sustainability advantage. Sodium batteries generally contain fewer toxic components than their lithium counterparts, potentially simplifying recycling processes. Emerging recycling technologies specifically designed for sodium batteries demonstrate recovery rates exceeding 90% for key materials, creating opportunities for closed-loop material systems that further reduce environmental impact.

Regulatory frameworks increasingly recognize these environmental benefits, with several jurisdictions developing incentive structures that favor technologies with demonstrable sustainability advantages. The European Union's Battery Directive revisions specifically acknowledge sodium-based technologies as potential pathways to meeting increasingly stringent environmental performance requirements. Similarly, the United States Department of Energy has incorporated sustainability metrics into funding priorities for next-generation battery technologies.

Water usage represents another critical environmental consideration where solid-state sodium batteries offer advantages. Manufacturing processes typically require 30-40% less water compared to conventional battery production, an increasingly important factor as water scarcity concerns grow globally. This reduced water footprint enhances the technology's viability in regions facing water stress challenges.

The manufacturing processes for solid-state sodium batteries also demonstrate potential environmental advantages. The elimination of liquid electrolytes reduces the need for toxic and flammable materials commonly used in conventional batteries. This shift not only enhances safety but also diminishes the environmental footprint associated with production and disposal. Current research indicates that solid-state sodium battery production could reduce greenhouse gas emissions by approximately 25-30% compared to traditional lithium-ion manufacturing.

Life cycle assessments of solid-state sodium batteries reveal promising sustainability metrics. These batteries typically exhibit lower embodied energy in production and potentially longer operational lifespans, which translates to reduced waste generation over time. The absence of cobalt and nickel in many sodium battery chemistries further enhances their environmental profile by avoiding the ecological and social impacts associated with mining these critical materials.

End-of-life considerations represent another significant sustainability advantage. Sodium batteries generally contain fewer toxic components than their lithium counterparts, potentially simplifying recycling processes. Emerging recycling technologies specifically designed for sodium batteries demonstrate recovery rates exceeding 90% for key materials, creating opportunities for closed-loop material systems that further reduce environmental impact.

Regulatory frameworks increasingly recognize these environmental benefits, with several jurisdictions developing incentive structures that favor technologies with demonstrable sustainability advantages. The European Union's Battery Directive revisions specifically acknowledge sodium-based technologies as potential pathways to meeting increasingly stringent environmental performance requirements. Similarly, the United States Department of Energy has incorporated sustainability metrics into funding priorities for next-generation battery technologies.

Water usage represents another critical environmental consideration where solid-state sodium batteries offer advantages. Manufacturing processes typically require 30-40% less water compared to conventional battery production, an increasingly important factor as water scarcity concerns grow globally. This reduced water footprint enhances the technology's viability in regions facing water stress challenges.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!