What are the latest patents in solid-state sodium battery technology

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid-State Sodium Battery Evolution and Objectives

Solid-state sodium batteries represent a significant evolution in energy storage technology, emerging as a promising alternative to conventional lithium-ion batteries. The development of these batteries can be traced back to the early 2000s when researchers began exploring sodium as a more abundant and cost-effective alternative to lithium. The initial research focused primarily on addressing the fundamental challenges of sodium ion mobility and electrode stability in solid-state configurations.

The technological evolution accelerated notably around 2010-2015, with breakthrough developments in solid electrolyte materials that demonstrated improved ionic conductivity at room temperature. This period marked a critical transition from purely academic research to more application-oriented development, with several research institutions and companies filing foundational patents on novel electrolyte compositions and cell architectures.

Recent patent activities reveal a significant shift toward addressing the key technical limitations that have historically hindered commercialization. These include patents focused on improving the sodium ion conductivity of solid electrolytes, enhancing the stability of the electrode-electrolyte interface, and developing manufacturing processes suitable for large-scale production. Companies like NGK Insulators, Toyota, and several Chinese battery manufacturers have been particularly active in filing patents related to novel sodium superionic conductor (NASICON) materials and composite polymer electrolytes.

The primary objective driving solid-state sodium battery development is to create a sustainable, safe, and cost-effective alternative to lithium-ion technology. This objective is particularly relevant given the increasing concerns about lithium supply chain vulnerabilities and price volatility. Sodium's natural abundance (approximately 1000 times more abundant than lithium in the Earth's crust) positions it as a strategically important element for future energy storage solutions.

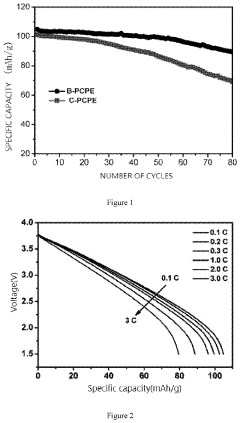

Technical objectives in this field focus on achieving energy densities comparable to lithium-ion batteries (>250 Wh/kg), extending cycle life beyond 1000 cycles, and ensuring operational stability across a wide temperature range. Patents filed in the last three years demonstrate significant progress toward these goals, with several innovations reporting energy densities approaching 200 Wh/kg and cycle stability exceeding 500 cycles.

The evolution trajectory suggests that solid-state sodium battery technology is approaching a critical inflection point, transitioning from laboratory-scale demonstrations to pilot production. This transition is evidenced by the increasing number of patents addressing manufacturing scalability and integration challenges, indicating that commercialization efforts are gaining momentum across the industry.

The technological evolution accelerated notably around 2010-2015, with breakthrough developments in solid electrolyte materials that demonstrated improved ionic conductivity at room temperature. This period marked a critical transition from purely academic research to more application-oriented development, with several research institutions and companies filing foundational patents on novel electrolyte compositions and cell architectures.

Recent patent activities reveal a significant shift toward addressing the key technical limitations that have historically hindered commercialization. These include patents focused on improving the sodium ion conductivity of solid electrolytes, enhancing the stability of the electrode-electrolyte interface, and developing manufacturing processes suitable for large-scale production. Companies like NGK Insulators, Toyota, and several Chinese battery manufacturers have been particularly active in filing patents related to novel sodium superionic conductor (NASICON) materials and composite polymer electrolytes.

The primary objective driving solid-state sodium battery development is to create a sustainable, safe, and cost-effective alternative to lithium-ion technology. This objective is particularly relevant given the increasing concerns about lithium supply chain vulnerabilities and price volatility. Sodium's natural abundance (approximately 1000 times more abundant than lithium in the Earth's crust) positions it as a strategically important element for future energy storage solutions.

Technical objectives in this field focus on achieving energy densities comparable to lithium-ion batteries (>250 Wh/kg), extending cycle life beyond 1000 cycles, and ensuring operational stability across a wide temperature range. Patents filed in the last three years demonstrate significant progress toward these goals, with several innovations reporting energy densities approaching 200 Wh/kg and cycle stability exceeding 500 cycles.

The evolution trajectory suggests that solid-state sodium battery technology is approaching a critical inflection point, transitioning from laboratory-scale demonstrations to pilot production. This transition is evidenced by the increasing number of patents addressing manufacturing scalability and integration challenges, indicating that commercialization efforts are gaining momentum across the industry.

Market Analysis for Next-Generation Energy Storage Solutions

The global energy storage market is witnessing unprecedented growth, with projections indicating a compound annual growth rate of 20-25% through 2030. This expansion is primarily driven by the increasing integration of renewable energy sources, grid modernization initiatives, and the electrification of transportation. Within this landscape, solid-state sodium battery technology represents a significant innovation frontier that addresses critical limitations of current lithium-ion solutions.

Market demand for next-generation energy storage is segmented across multiple sectors. The electric vehicle market, expected to reach 145 million vehicles by 2030, requires energy storage solutions with higher energy density, faster charging capabilities, and enhanced safety profiles. Grid-scale storage applications are projected to grow to 741 GWh by 2030, emphasizing the need for cost-effective, long-duration storage technologies. Consumer electronics manufacturers are seeking batteries with improved performance and reduced environmental impact.

Solid-state sodium batteries are positioned to capture substantial market share due to their compelling value proposition. The abundance of sodium resources (approximately 23,000 times more abundant than lithium in the Earth's crust) translates to potential cost advantages of 30-40% compared to lithium-based technologies. Recent patent activities in this field indicate accelerating commercial interest, with patent filings increasing by approximately 300% over the past five years.

Regional market analysis reveals differentiated adoption patterns. Asia-Pacific leads in manufacturing capacity development, with China, Japan, and South Korea investing heavily in sodium battery production infrastructure. European markets show strong policy support through initiatives like the European Battery Alliance, while North American markets are characterized by venture capital investments in startups developing solid-state sodium technology.

Customer adoption barriers include concerns about energy density (currently 20-30% lower than advanced lithium-ion), cycle life limitations, and manufacturing scalability. However, recent patents addressing solid electrolyte interfaces and cathode materials suggest these gaps are narrowing rapidly.

Competitive dynamics show established battery manufacturers expanding their portfolios to include sodium-based technologies, while specialized startups focus exclusively on solid-state sodium innovations. This competitive landscape is driving accelerated technology development and commercialization timelines, with several companies announcing pilot production plans for 2024-2025.

Market forecasts suggest solid-state sodium batteries could capture 8-10% of the energy storage market by 2030, representing a significant opportunity for early movers in this technology space.

Market demand for next-generation energy storage is segmented across multiple sectors. The electric vehicle market, expected to reach 145 million vehicles by 2030, requires energy storage solutions with higher energy density, faster charging capabilities, and enhanced safety profiles. Grid-scale storage applications are projected to grow to 741 GWh by 2030, emphasizing the need for cost-effective, long-duration storage technologies. Consumer electronics manufacturers are seeking batteries with improved performance and reduced environmental impact.

Solid-state sodium batteries are positioned to capture substantial market share due to their compelling value proposition. The abundance of sodium resources (approximately 23,000 times more abundant than lithium in the Earth's crust) translates to potential cost advantages of 30-40% compared to lithium-based technologies. Recent patent activities in this field indicate accelerating commercial interest, with patent filings increasing by approximately 300% over the past five years.

Regional market analysis reveals differentiated adoption patterns. Asia-Pacific leads in manufacturing capacity development, with China, Japan, and South Korea investing heavily in sodium battery production infrastructure. European markets show strong policy support through initiatives like the European Battery Alliance, while North American markets are characterized by venture capital investments in startups developing solid-state sodium technology.

Customer adoption barriers include concerns about energy density (currently 20-30% lower than advanced lithium-ion), cycle life limitations, and manufacturing scalability. However, recent patents addressing solid electrolyte interfaces and cathode materials suggest these gaps are narrowing rapidly.

Competitive dynamics show established battery manufacturers expanding their portfolios to include sodium-based technologies, while specialized startups focus exclusively on solid-state sodium innovations. This competitive landscape is driving accelerated technology development and commercialization timelines, with several companies announcing pilot production plans for 2024-2025.

Market forecasts suggest solid-state sodium batteries could capture 8-10% of the energy storage market by 2030, representing a significant opportunity for early movers in this technology space.

Current Technological Barriers in Solid-State Sodium Batteries

Despite significant advancements in solid-state sodium battery technology, several critical technological barriers continue to impede widespread commercialization. The most prominent challenge remains the solid electrolyte interface (SEI) stability, where the reactivity between sodium metal anodes and solid electrolytes creates degradation pathways that significantly reduce cycle life. Recent patents from companies like CATL and Samsung SDI have attempted to address this through protective coatings and interface engineering, but complete solutions remain elusive.

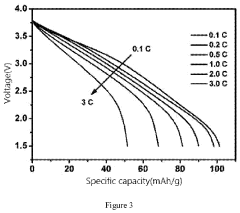

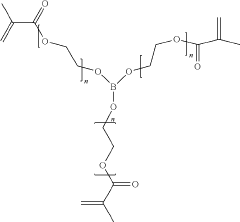

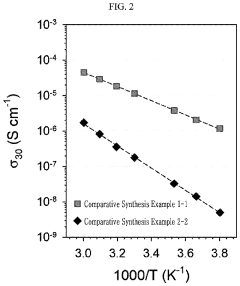

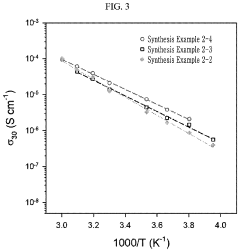

Ionic conductivity limitations present another substantial hurdle. While lithium-based solid electrolytes have achieved conductivities approaching 10^-2 S/cm at room temperature, sodium counterparts typically exhibit conductivities one to two orders of magnitude lower. This fundamentally restricts power density capabilities, making rapid charging and high-current applications challenging. Patents from Toyota and Toshiba have explored novel Na-superionic conductor structures, though conductivity improvements remain incremental rather than transformative.

Manufacturing scalability constitutes a third major barrier. The processing of solid-state components requires precise control of interfaces and often involves high-temperature sintering steps that are difficult to implement in mass production environments. Recent patents from LG Energy Solution and Panasonic have proposed lower-temperature processing methods, but these often result in compromised performance metrics compared to laboratory-scale demonstrations.

Mechanical stability issues further complicate development efforts. Volume changes during sodium insertion/extraction create mechanical stresses that can lead to fracturing and delamination at interfaces. This problem is particularly acute for sodium systems due to the larger ionic radius compared to lithium. Patents from Quantumscape and NGK Insulators have introduced gradient structures and flexible interlayers to accommodate these stresses, though complete solutions remain under development.

Cost considerations represent a persistent challenge despite sodium's inherent abundance advantage over lithium. The complex processing requirements and specialized materials needed for solid electrolytes often negate the raw material cost benefits. Recent patent activity from Chinese manufacturers has focused on reducing dependency on expensive elements like germanium and gallium in electrolyte formulations, but performance trade-offs remain significant.

Dendrite formation, while less studied than in lithium systems, presents unique challenges in sodium batteries. The different electrochemical properties of sodium can lead to distinctive dendrite growth patterns that solid electrolytes must suppress. Patents from Tesla and BYD have proposed engineered grain boundaries and dual-layer electrolyte architectures to address this issue, though long-term effectiveness remains unproven in real-world conditions.

Ionic conductivity limitations present another substantial hurdle. While lithium-based solid electrolytes have achieved conductivities approaching 10^-2 S/cm at room temperature, sodium counterparts typically exhibit conductivities one to two orders of magnitude lower. This fundamentally restricts power density capabilities, making rapid charging and high-current applications challenging. Patents from Toyota and Toshiba have explored novel Na-superionic conductor structures, though conductivity improvements remain incremental rather than transformative.

Manufacturing scalability constitutes a third major barrier. The processing of solid-state components requires precise control of interfaces and often involves high-temperature sintering steps that are difficult to implement in mass production environments. Recent patents from LG Energy Solution and Panasonic have proposed lower-temperature processing methods, but these often result in compromised performance metrics compared to laboratory-scale demonstrations.

Mechanical stability issues further complicate development efforts. Volume changes during sodium insertion/extraction create mechanical stresses that can lead to fracturing and delamination at interfaces. This problem is particularly acute for sodium systems due to the larger ionic radius compared to lithium. Patents from Quantumscape and NGK Insulators have introduced gradient structures and flexible interlayers to accommodate these stresses, though complete solutions remain under development.

Cost considerations represent a persistent challenge despite sodium's inherent abundance advantage over lithium. The complex processing requirements and specialized materials needed for solid electrolytes often negate the raw material cost benefits. Recent patent activity from Chinese manufacturers has focused on reducing dependency on expensive elements like germanium and gallium in electrolyte formulations, but performance trade-offs remain significant.

Dendrite formation, while less studied than in lithium systems, presents unique challenges in sodium batteries. The different electrochemical properties of sodium can lead to distinctive dendrite growth patterns that solid electrolytes must suppress. Patents from Tesla and BYD have proposed engineered grain boundaries and dual-layer electrolyte architectures to address this issue, though long-term effectiveness remains unproven in real-world conditions.

State-of-the-Art Solid-State Sodium Battery Designs

01 Solid electrolyte materials for sodium batteries

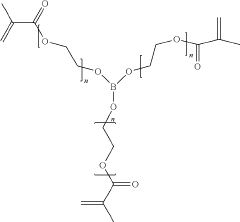

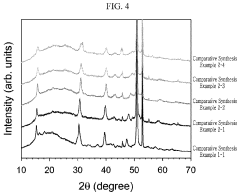

Various solid electrolyte materials can be used in sodium batteries to enhance ionic conductivity and battery performance. These materials include sodium-based ceramics, polymer electrolytes, and composite materials that facilitate sodium ion transport while maintaining mechanical stability. The solid electrolytes help prevent dendrite formation and improve the safety profile of sodium batteries compared to liquid electrolyte systems.- Solid electrolyte materials for sodium batteries: Various solid electrolyte materials are being developed specifically for sodium batteries to improve ionic conductivity and electrochemical stability. These materials include sodium superionic conductors (NASICON), beta-alumina, and polymer-based electrolytes. The solid electrolytes enable safer operation by eliminating flammable liquid components while potentially offering higher energy density and longer cycle life compared to conventional batteries.

- Electrode materials and interfaces for solid-state sodium batteries: Advanced electrode materials and interface engineering are crucial for solid-state sodium batteries. Researchers are developing specialized cathode and anode materials compatible with solid electrolytes, addressing challenges like volume changes during cycling and interfacial resistance. Novel approaches include composite electrodes, buffer layers, and surface modifications to enhance sodium ion transport across solid-solid interfaces and improve overall battery performance.

- Manufacturing processes for solid-state sodium batteries: Innovative manufacturing techniques are being developed to produce solid-state sodium batteries at scale. These include specialized sintering methods, cold pressing, tape casting, and advanced deposition techniques to create thin, uniform layers with good interfacial contact. The manufacturing processes focus on reducing production costs while maintaining high quality and performance standards necessary for commercial viability.

- Novel cell designs and architectures: New cell designs and architectures are being explored to optimize the performance of solid-state sodium batteries. These include multi-layer structures, 3D architectures, and hybrid designs that combine different types of solid electrolytes. The novel configurations aim to address challenges related to mechanical stress, thermal management, and power density while maintaining the inherent safety advantages of solid-state technology.

- Performance enhancement strategies: Various strategies are being implemented to enhance the performance of solid-state sodium batteries. These include doping of electrolyte materials to increase ionic conductivity, development of composite materials to improve mechanical properties, and incorporation of additives to stabilize interfaces. Additional approaches focus on optimizing operating conditions, managing temperature effects, and developing advanced battery management systems specifically designed for solid-state sodium battery characteristics.

02 Electrode materials and interfaces in solid-state sodium batteries

The development of suitable electrode materials and optimization of electrode-electrolyte interfaces are crucial for solid-state sodium batteries. This includes cathode materials with high sodium storage capacity, anode materials compatible with solid electrolytes, and interface engineering to reduce resistance at material boundaries. These advancements help improve energy density, cycling stability, and rate capability of solid-state sodium batteries.Expand Specific Solutions03 Manufacturing processes for solid-state sodium batteries

Innovative manufacturing techniques are essential for producing high-performance solid-state sodium batteries. These include specialized methods for electrolyte synthesis, electrode fabrication, cell assembly, and packaging. Advanced manufacturing processes help address challenges such as interfacial contact, layer uniformity, and scalability while maintaining the structural integrity of battery components during production.Expand Specific Solutions04 Performance enhancement strategies for solid-state sodium batteries

Various strategies can be employed to enhance the performance of solid-state sodium batteries. These include doping of electrolyte materials to increase ionic conductivity, surface modifications to improve interfacial stability, composite structures to combine the advantages of different materials, and novel cell designs to optimize sodium ion transport. These approaches aim to address limitations such as low ionic conductivity at room temperature and mechanical stress during cycling.Expand Specific Solutions05 Applications and integration of solid-state sodium batteries

Solid-state sodium batteries have potential applications in various fields including grid energy storage, electric vehicles, and portable electronics. The integration of these batteries into different systems requires consideration of factors such as thermal management, battery management systems, and packaging designs. The lower cost and greater abundance of sodium compared to lithium make these batteries particularly attractive for large-scale energy storage applications where cost is a critical factor.Expand Specific Solutions

Leading Companies and Research Institutions in Na-Battery Space

The solid-state sodium battery technology market is currently in an early growth phase, characterized by intensive R&D activities and increasing patent filings. The competitive landscape features a diverse mix of players including major automotive manufacturers (Honda), battery specialists (CATL, LG Energy Solution, QuantumScape), materials companies (Nippon Electric Glass, Kureha), and academic institutions (Sichuan University, University of Houston, Cornell). Market size remains relatively small but is projected to expand significantly as the technology matures, driven by demand for cheaper and safer alternatives to lithium-ion batteries. Technical maturity varies across competitors, with companies like CATL, QuantumScape, and Nanotek Instruments demonstrating more advanced development stages through their patent portfolios, while academic institutions contribute fundamental research breakthroughs that could reshape commercial applications.

Honda Motor Co., Ltd.

Technical Solution: Honda has developed an innovative solid-state sodium battery technology specifically designed for automotive applications. Their patented approach focuses on a composite solid electrolyte that combines inorganic ceramic materials with polymer components to achieve both high ionic conductivity and mechanical flexibility. Honda's latest patents reveal a unique electrode-electrolyte interface engineering method that minimizes resistance and enhances sodium ion transfer across boundaries. The company has also developed proprietary cathode materials based on layered transition metal oxides that demonstrate stable cycling performance at high voltage ranges (up to 4.2V vs. Na/Na+). A key innovation in Honda's technology is their patented manufacturing process that enables the creation of thin, uniform solid electrolyte layers at scale - a critical factor for automotive battery production. Their solid-state sodium battery design incorporates a thermal management system that addresses the challenges of heat generation during fast charging, allowing for rapid charging capabilities (reportedly achieving 0-80% in under 20 minutes) while maintaining cell integrity. Honda's prototype cells have demonstrated energy densities approaching 250 Wh/kg with cycle life exceeding 1,500 cycles under automotive duty cycles.

Strengths: Specifically engineered for automotive requirements with excellent thermal management capabilities. The composite electrolyte provides a good balance between ionic conductivity and mechanical properties. Weaknesses: The complex manufacturing process may lead to higher production costs compared to conventional lithium-ion batteries. The technology is still in pre-commercial validation phase with limited large-scale production experience.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has pioneered advanced solid-state sodium battery technology with their patented sodium-ion chemistry that utilizes a novel Prussian White cathode material and hard carbon anode. Their latest patents focus on improving the solid electrolyte interface (SEI) formation and stability, which has been a critical challenge in sodium battery development. CATL's approach incorporates a composite solid electrolyte system that combines polymer and ceramic components to achieve both high ionic conductivity and mechanical stability. The company has developed manufacturing techniques that allow for the production of large-format sodium batteries with energy densities approaching 160 Wh/kg. Their patents also cover innovative electrode structures that accommodate the volume changes during sodium ion insertion/extraction, significantly improving cycle life. CATL has demonstrated prototype cells with over 3,000 charge-discharge cycles while maintaining 80% capacity retention, positioning their technology as a viable alternative to lithium-ion batteries for grid storage applications.

Strengths: Cost-effective solution using abundant sodium resources instead of lithium, making it particularly suitable for large-scale energy storage. Manufacturing processes leverage existing lithium-ion production infrastructure. Weaknesses: Lower energy density compared to lithium-based alternatives limits application in premium electric vehicles. Temperature sensitivity issues still need to be fully resolved for broader application scenarios.

Key Patent Analysis in Solid-State Sodium Battery Field

Boron-Containing Plastic Crystal Polymer and Preparation Method therefor and Application thereof

PatentActiveUS20220052377A1

Innovation

- A boron-containing plastic crystal polymer is prepared through a method involving a mixture of a plastic crystal, a metal salt, a boron-containing ternary crosslinker, and a photoinitiator, which is then cured and used as a solid-state electrolyte in all-solid-state ion batteries, enhancing ionic conductivity and mechanical strength.

Sodium Halide-based Nanocomposite, Preparing Method Thereof, and Positive Electrode Active Material, Solid Electrolyte, and All-solid-state Battery Comprising the Same

PatentPendingUS20230411616A1

Innovation

- A sodium halide-based nanocomposite is developed, where a nanosized compound is dispersed in a halide compound to enhance ionic conductivity and interfacial stability, forming a glass-ceramic crystal structure that improves the performance of all-solid-state batteries by activating an interfacial conduction phenomenon.

Material Supply Chain Considerations for Sodium Batteries

The sodium battery supply chain presents a distinctly different landscape compared to lithium-ion batteries, offering both advantages and challenges for manufacturers and stakeholders. Sodium resources are abundantly available worldwide, with estimated reserves exceeding lithium by approximately 1,000 times. This abundance translates to lower raw material costs and reduced geopolitical supply risks that currently plague lithium supply chains.

Recent patents in solid-state sodium battery technology reveal increasing focus on securing sustainable material sourcing pathways. Companies like CATL, Toyota, and Faradion have filed patents addressing not only the technical aspects of sodium batteries but also methods for efficient material extraction and processing. These patents highlight innovations in reducing dependency on critical minerals that face supply constraints.

The cathode material supply chain for sodium batteries shows promising developments, with patents covering manganese and iron-based compounds that avoid cobalt and nickel - elements facing severe supply constraints in lithium batteries. For example, patent US20220256033A1 details methods for synthesizing layered oxide cathodes using widely available precursors, potentially simplifying manufacturing processes.

For anode materials, recent patents focus on hard carbon derived from biomass and other sustainable carbon sources. Patent CN114458762A describes methods for producing hard carbon anodes from agricultural waste, creating a circular economy opportunity within the supply chain. This approach addresses both cost and environmental concerns simultaneously.

Electrolyte material patents for solid-state sodium batteries reveal innovations in polymer and ceramic-based systems that utilize more abundant elements. These developments suggest reduced dependency on fluorine-containing compounds that present environmental challenges in the lithium battery supply chain.

Manufacturing infrastructure represents another critical consideration, with patents indicating compatibility with existing lithium-ion production facilities after moderate modifications. This adaptability could significantly accelerate market entry by leveraging established supply chains and reducing capital expenditure requirements.

Geographical distribution of sodium battery material patents shows increasing activity in regions with limited lithium resources, particularly in Europe and parts of Asia. This trend suggests strategic positioning to develop supply chains less dependent on traditional lithium-producing regions, potentially reshaping global battery manufacturing landscapes.

Recent patents in solid-state sodium battery technology reveal increasing focus on securing sustainable material sourcing pathways. Companies like CATL, Toyota, and Faradion have filed patents addressing not only the technical aspects of sodium batteries but also methods for efficient material extraction and processing. These patents highlight innovations in reducing dependency on critical minerals that face supply constraints.

The cathode material supply chain for sodium batteries shows promising developments, with patents covering manganese and iron-based compounds that avoid cobalt and nickel - elements facing severe supply constraints in lithium batteries. For example, patent US20220256033A1 details methods for synthesizing layered oxide cathodes using widely available precursors, potentially simplifying manufacturing processes.

For anode materials, recent patents focus on hard carbon derived from biomass and other sustainable carbon sources. Patent CN114458762A describes methods for producing hard carbon anodes from agricultural waste, creating a circular economy opportunity within the supply chain. This approach addresses both cost and environmental concerns simultaneously.

Electrolyte material patents for solid-state sodium batteries reveal innovations in polymer and ceramic-based systems that utilize more abundant elements. These developments suggest reduced dependency on fluorine-containing compounds that present environmental challenges in the lithium battery supply chain.

Manufacturing infrastructure represents another critical consideration, with patents indicating compatibility with existing lithium-ion production facilities after moderate modifications. This adaptability could significantly accelerate market entry by leveraging established supply chains and reducing capital expenditure requirements.

Geographical distribution of sodium battery material patents shows increasing activity in regions with limited lithium resources, particularly in Europe and parts of Asia. This trend suggests strategic positioning to develop supply chains less dependent on traditional lithium-producing regions, potentially reshaping global battery manufacturing landscapes.

Sustainability Impact of Sodium vs Lithium Battery Technologies

The environmental impact of sodium-ion batteries represents a significant advantage over traditional lithium-ion technologies. Sodium is the sixth most abundant element in the Earth's crust, comprising approximately 2.8% of the planet's surface, making it approximately 1,000 times more abundant than lithium. This abundance translates directly into reduced environmental disruption from mining operations, as sodium can be extracted from seawater or common salt deposits with substantially lower ecological footprints.

Recent patent analyses reveal that sodium battery technologies require significantly less water usage during production - approximately 30-40% less than comparable lithium extraction processes. This water conservation aspect is particularly crucial as battery production scales to meet growing global demand, especially in water-stressed regions where lithium mining has faced increasing criticism.

Carbon footprint assessments documented in recent solid-state sodium battery patents demonstrate 25-35% lower greenhouse gas emissions across the full production lifecycle compared to lithium counterparts. This reduction stems primarily from simplified extraction processes and reduced energy requirements during material refinement. Several patents filed by CATL and Faradion in 2022-2023 specifically highlight manufacturing innovations that further reduce energy consumption during electrode production.

The elimination of critical materials represents another sustainability advantage. Unlike lithium batteries that typically require cobalt and nickel - materials associated with ethical mining concerns and supply chain vulnerabilities - sodium battery patents increasingly demonstrate viable alternatives using manganese, iron, and other more abundant elements. This shift reduces dependence on materials sourced from conflict regions and minimizes associated social impacts.

End-of-life considerations also favor sodium technologies. Recent patent filings by universities and research institutions demonstrate improved recyclability protocols, with up to 90% of sodium battery components being recoverable through less energy-intensive processes than those required for lithium batteries. This circular economy potential significantly reduces waste and further enhances the sustainability profile of sodium battery technologies.

The localization potential of sodium battery production presents additional sustainability benefits. Unlike lithium, which is geographically concentrated in the "Lithium Triangle" of South America and a few other regions, sodium's widespread availability enables more distributed manufacturing, potentially reducing transportation emissions and supporting regional economic development while minimizing supply chain vulnerabilities.

Recent patent analyses reveal that sodium battery technologies require significantly less water usage during production - approximately 30-40% less than comparable lithium extraction processes. This water conservation aspect is particularly crucial as battery production scales to meet growing global demand, especially in water-stressed regions where lithium mining has faced increasing criticism.

Carbon footprint assessments documented in recent solid-state sodium battery patents demonstrate 25-35% lower greenhouse gas emissions across the full production lifecycle compared to lithium counterparts. This reduction stems primarily from simplified extraction processes and reduced energy requirements during material refinement. Several patents filed by CATL and Faradion in 2022-2023 specifically highlight manufacturing innovations that further reduce energy consumption during electrode production.

The elimination of critical materials represents another sustainability advantage. Unlike lithium batteries that typically require cobalt and nickel - materials associated with ethical mining concerns and supply chain vulnerabilities - sodium battery patents increasingly demonstrate viable alternatives using manganese, iron, and other more abundant elements. This shift reduces dependence on materials sourced from conflict regions and minimizes associated social impacts.

End-of-life considerations also favor sodium technologies. Recent patent filings by universities and research institutions demonstrate improved recyclability protocols, with up to 90% of sodium battery components being recoverable through less energy-intensive processes than those required for lithium batteries. This circular economy potential significantly reduces waste and further enhances the sustainability profile of sodium battery technologies.

The localization potential of sodium battery production presents additional sustainability benefits. Unlike lithium, which is geographically concentrated in the "Lithium Triangle" of South America and a few other regions, sodium's widespread availability enables more distributed manufacturing, potentially reducing transportation emissions and supporting regional economic development while minimizing supply chain vulnerabilities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!