Solid-state sodium battery electrode design in electric mobility

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid-State Sodium Battery Background and Objectives

Solid-state sodium batteries have emerged as a promising alternative to conventional lithium-ion batteries, particularly for electric mobility applications. The development of these batteries can be traced back to the early 2000s when researchers began exploring sodium as a potential substitute for lithium due to its abundance and cost-effectiveness. Sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, making it significantly more sustainable for large-scale battery production necessary for the growing electric vehicle market.

The evolution of solid-state sodium battery technology has accelerated in the past decade, driven by increasing concerns about lithium supply chain vulnerabilities and price volatility. Initial sodium-ion batteries faced challenges related to lower energy density compared to lithium-ion counterparts, but the introduction of solid-state electrolytes has opened new possibilities for enhanced performance and safety profiles.

Current technological trends point toward the development of advanced electrode materials that can accommodate the larger sodium ions (1.02Å versus 0.76Å for lithium ions) while maintaining structural stability during charge-discharge cycles. Research is increasingly focused on nanostructured electrodes and composite materials that can facilitate efficient sodium ion transport while preventing dendrite formation.

The primary technical objective for solid-state sodium batteries in electric mobility applications is to achieve energy densities exceeding 300 Wh/kg at the cell level, which would make them competitive with current lithium-ion technologies. Additionally, researchers aim to develop electrode designs that enable fast charging capabilities (80% charge in less than 15 minutes) without compromising cycle life or safety.

Safety enhancement represents another critical objective, with solid-state electrolytes expected to eliminate the flammability issues associated with liquid electrolytes in conventional batteries. This improvement is particularly valuable for electric vehicles, where thermal runaway events pose significant safety risks.

Cost reduction targets are equally important, with projections suggesting that sodium-based systems could potentially reduce battery costs by 30-40% compared to lithium-ion technologies when manufactured at scale. This cost advantage stems from both the lower raw material costs and potentially simplified manufacturing processes.

Long-term objectives include developing electrode designs that enable battery lifespans exceeding 2,000 cycles while retaining at least 80% of initial capacity, which would translate to approximately 10-15 years of service in electric mobility applications. Researchers are also exploring the integration of these batteries with advanced battery management systems to optimize performance across varying temperature ranges and usage patterns.

The evolution of solid-state sodium battery technology has accelerated in the past decade, driven by increasing concerns about lithium supply chain vulnerabilities and price volatility. Initial sodium-ion batteries faced challenges related to lower energy density compared to lithium-ion counterparts, but the introduction of solid-state electrolytes has opened new possibilities for enhanced performance and safety profiles.

Current technological trends point toward the development of advanced electrode materials that can accommodate the larger sodium ions (1.02Å versus 0.76Å for lithium ions) while maintaining structural stability during charge-discharge cycles. Research is increasingly focused on nanostructured electrodes and composite materials that can facilitate efficient sodium ion transport while preventing dendrite formation.

The primary technical objective for solid-state sodium batteries in electric mobility applications is to achieve energy densities exceeding 300 Wh/kg at the cell level, which would make them competitive with current lithium-ion technologies. Additionally, researchers aim to develop electrode designs that enable fast charging capabilities (80% charge in less than 15 minutes) without compromising cycle life or safety.

Safety enhancement represents another critical objective, with solid-state electrolytes expected to eliminate the flammability issues associated with liquid electrolytes in conventional batteries. This improvement is particularly valuable for electric vehicles, where thermal runaway events pose significant safety risks.

Cost reduction targets are equally important, with projections suggesting that sodium-based systems could potentially reduce battery costs by 30-40% compared to lithium-ion technologies when manufactured at scale. This cost advantage stems from both the lower raw material costs and potentially simplified manufacturing processes.

Long-term objectives include developing electrode designs that enable battery lifespans exceeding 2,000 cycles while retaining at least 80% of initial capacity, which would translate to approximately 10-15 years of service in electric mobility applications. Researchers are also exploring the integration of these batteries with advanced battery management systems to optimize performance across varying temperature ranges and usage patterns.

Market Analysis for EV Sodium Battery Applications

The electric vehicle (EV) market is experiencing unprecedented growth globally, with projections indicating a compound annual growth rate of 21.7% from 2023 to 2030. Within this expanding landscape, battery technology represents a critical component determining vehicle performance, cost, and sustainability. Solid-state sodium batteries are emerging as a promising alternative to conventional lithium-ion batteries, particularly in the electric mobility sector.

Market demand for sodium-based battery solutions is primarily driven by several factors. First, the increasing scarcity and rising costs of lithium and cobalt have prompted automotive manufacturers to seek alternative battery chemistries. Sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, offering significant cost advantages and supply chain security. This abundance translates to potential cost reductions of 30-40% compared to lithium-ion batteries.

Regional market analysis reveals varying adoption potentials. Europe leads in sodium battery research and development, with significant investments from both public and private sectors. The European Battery Alliance has allocated substantial funding specifically for sodium battery technology development. China follows closely, leveraging its manufacturing capabilities to scale production, while North America shows growing interest primarily through startup ventures and university research programs.

Consumer demand patterns indicate a strong preference for EVs with longer ranges, faster charging capabilities, and lower total ownership costs. Solid-state sodium batteries address these needs through improved energy density, enhanced safety profiles, and potentially longer cycle life. Market surveys suggest that 78% of potential EV buyers consider battery performance and longevity as decisive purchasing factors.

The commercial vehicle segment presents particularly promising opportunities for sodium battery adoption. Heavy-duty applications benefit from sodium batteries' improved thermal stability and safety characteristics. Fleet operators prioritize total cost of ownership, where sodium batteries' lower material costs and potentially longer service life offer compelling advantages.

Market barriers include technological maturity concerns, limited production infrastructure, and consumer hesitation regarding new battery technologies. However, these barriers are gradually diminishing as demonstration projects prove the viability of sodium battery technology in real-world applications.

Forecasts suggest that solid-state sodium batteries could capture 15-20% of the EV battery market by 2030, with initial adoption in specific vehicle segments where their characteristics offer distinct advantages. The market is expected to develop in phases, beginning with premium commercial vehicles and gradually expanding to passenger vehicles as manufacturing scales and costs decrease.

Market demand for sodium-based battery solutions is primarily driven by several factors. First, the increasing scarcity and rising costs of lithium and cobalt have prompted automotive manufacturers to seek alternative battery chemistries. Sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, offering significant cost advantages and supply chain security. This abundance translates to potential cost reductions of 30-40% compared to lithium-ion batteries.

Regional market analysis reveals varying adoption potentials. Europe leads in sodium battery research and development, with significant investments from both public and private sectors. The European Battery Alliance has allocated substantial funding specifically for sodium battery technology development. China follows closely, leveraging its manufacturing capabilities to scale production, while North America shows growing interest primarily through startup ventures and university research programs.

Consumer demand patterns indicate a strong preference for EVs with longer ranges, faster charging capabilities, and lower total ownership costs. Solid-state sodium batteries address these needs through improved energy density, enhanced safety profiles, and potentially longer cycle life. Market surveys suggest that 78% of potential EV buyers consider battery performance and longevity as decisive purchasing factors.

The commercial vehicle segment presents particularly promising opportunities for sodium battery adoption. Heavy-duty applications benefit from sodium batteries' improved thermal stability and safety characteristics. Fleet operators prioritize total cost of ownership, where sodium batteries' lower material costs and potentially longer service life offer compelling advantages.

Market barriers include technological maturity concerns, limited production infrastructure, and consumer hesitation regarding new battery technologies. However, these barriers are gradually diminishing as demonstration projects prove the viability of sodium battery technology in real-world applications.

Forecasts suggest that solid-state sodium batteries could capture 15-20% of the EV battery market by 2030, with initial adoption in specific vehicle segments where their characteristics offer distinct advantages. The market is expected to develop in phases, beginning with premium commercial vehicles and gradually expanding to passenger vehicles as manufacturing scales and costs decrease.

Current Challenges in Sodium Electrode Technology

Despite significant advancements in solid-state sodium battery technology, electrode design remains a critical bottleneck for widespread adoption in electric mobility applications. The primary challenge lies in the inherent properties of sodium ions, which are larger than lithium ions (1.02Å vs. 0.76Å), resulting in slower diffusion kinetics and greater volume changes during charge-discharge cycles. This fundamental limitation necessitates novel electrode architectures that can accommodate these characteristics while maintaining performance.

Material stability presents another significant hurdle, particularly at the electrode-electrolyte interface. Sodium's high reactivity leads to continuous side reactions that form resistive layers, degrading battery performance over time. Unlike lithium-based systems where protective SEI layers can stabilize, sodium electrodes often experience progressive degradation that limits cycle life—a critical parameter for automotive applications requiring 8-10 years of reliable operation.

Energy density limitations further complicate electrode design for mobility applications. Current sodium electrode materials deliver specific capacities of 300-350 mAh/g, substantially lower than state-of-the-art lithium counterparts (>500 mAh/g). This capacity gap, combined with sodium's lower operating voltage, results in energy densities 30-40% below lithium systems—problematic for vehicle range requirements.

Manufacturing scalability represents another significant challenge. Many promising sodium electrode materials require complex synthesis routes involving precise temperature control, inert atmospheres, and specialized equipment. These processes, while feasible in laboratory settings, face substantial barriers to industrial-scale production, particularly in achieving consistent quality across large batches necessary for vehicle battery packs.

Rate capability limitations further restrict sodium electrode technology in mobility applications. Current designs struggle to deliver acceptable power densities for acceleration and fast charging—critical consumer requirements for electric vehicles. Even advanced sodium electrode formulations typically achieve only 50-60% capacity retention at 2C rates, compared to 80-85% for commercial lithium systems.

Cost considerations, while theoretically favorable due to sodium's abundance, remain challenging in practice. The specialized materials required for high-performance sodium electrodes (advanced carbon frameworks, tailored binders, and stabilizing additives) often negate the raw material cost advantage, resulting in minimal economic benefit over lithium systems without the performance advantages.

Temperature sensitivity presents an additional challenge, with sodium electrode performance degrading more rapidly than lithium counterparts at both high (>45°C) and low (<0°C) temperatures—conditions routinely encountered in automotive environments. This sensitivity necessitates sophisticated thermal management systems that add complexity and weight to battery packs.

Material stability presents another significant hurdle, particularly at the electrode-electrolyte interface. Sodium's high reactivity leads to continuous side reactions that form resistive layers, degrading battery performance over time. Unlike lithium-based systems where protective SEI layers can stabilize, sodium electrodes often experience progressive degradation that limits cycle life—a critical parameter for automotive applications requiring 8-10 years of reliable operation.

Energy density limitations further complicate electrode design for mobility applications. Current sodium electrode materials deliver specific capacities of 300-350 mAh/g, substantially lower than state-of-the-art lithium counterparts (>500 mAh/g). This capacity gap, combined with sodium's lower operating voltage, results in energy densities 30-40% below lithium systems—problematic for vehicle range requirements.

Manufacturing scalability represents another significant challenge. Many promising sodium electrode materials require complex synthesis routes involving precise temperature control, inert atmospheres, and specialized equipment. These processes, while feasible in laboratory settings, face substantial barriers to industrial-scale production, particularly in achieving consistent quality across large batches necessary for vehicle battery packs.

Rate capability limitations further restrict sodium electrode technology in mobility applications. Current designs struggle to deliver acceptable power densities for acceleration and fast charging—critical consumer requirements for electric vehicles. Even advanced sodium electrode formulations typically achieve only 50-60% capacity retention at 2C rates, compared to 80-85% for commercial lithium systems.

Cost considerations, while theoretically favorable due to sodium's abundance, remain challenging in practice. The specialized materials required for high-performance sodium electrodes (advanced carbon frameworks, tailored binders, and stabilizing additives) often negate the raw material cost advantage, resulting in minimal economic benefit over lithium systems without the performance advantages.

Temperature sensitivity presents an additional challenge, with sodium electrode performance degrading more rapidly than lithium counterparts at both high (>45°C) and low (<0°C) temperatures—conditions routinely encountered in automotive environments. This sensitivity necessitates sophisticated thermal management systems that add complexity and weight to battery packs.

Current Electrode Design Solutions for Electric Mobility

01 Electrode materials for solid-state sodium batteries

Various materials can be used as electrodes in solid-state sodium batteries to enhance performance. These materials include sodium-based compounds and other specialized compositions that facilitate sodium ion transport. The selection of appropriate electrode materials is crucial for achieving high energy density, good cycling stability, and improved safety in solid-state sodium batteries.- Sodium-ion battery electrode materials: Various materials can be used as electrodes in solid-state sodium batteries, including sodium-based compounds and other materials that can intercalate sodium ions. These materials are designed to provide high energy density, good cycling stability, and efficient sodium ion transport. The electrode materials can be engineered to have specific structures and compositions to optimize battery performance.

- Solid electrolyte interfaces for sodium batteries: Solid electrolyte interfaces play a crucial role in solid-state sodium batteries by facilitating ion transport between the electrodes and the electrolyte while preventing unwanted side reactions. These interfaces can be modified or engineered to improve the stability and performance of the battery. Various coating materials and interface engineering techniques are employed to enhance the electrochemical properties of the battery.

- Manufacturing processes for sodium battery electrodes: Specific manufacturing processes are employed to produce electrodes for solid-state sodium batteries. These processes may include techniques such as powder processing, coating, sintering, and other methods to create electrodes with desired properties. The manufacturing processes are designed to ensure uniform distribution of active materials, good adhesion to current collectors, and optimal porosity for ion transport.

- Composite electrode structures for sodium batteries: Composite electrode structures combine multiple materials to enhance the performance of solid-state sodium batteries. These structures may include active materials, conductive additives, binders, and other components that work together to improve the electrochemical properties of the electrode. The composite structures are designed to provide high capacity, good rate capability, and long cycle life.

- Novel electrode designs for improved sodium-ion transport: Innovative electrode designs are developed to enhance sodium-ion transport in solid-state batteries. These designs may include nanostructured materials, hierarchical porous structures, and other architectures that facilitate ion diffusion and electron transport. The novel electrode designs aim to address challenges such as volume changes during cycling, interfacial resistance, and limited ion mobility in solid-state systems.

02 Composite electrode structures for enhanced performance

Composite electrode structures combine multiple materials to optimize the performance of solid-state sodium batteries. These structures typically include active materials, conductive additives, and binders that work together to improve ionic and electronic conductivity. The composite approach helps overcome limitations of individual materials and enhances overall battery performance including capacity retention and rate capability.Expand Specific Solutions03 Interface engineering for solid-state sodium electrodes

Interface engineering focuses on optimizing the contact between electrodes and solid electrolytes in sodium batteries. This involves surface modifications, buffer layers, and specialized coatings to reduce interfacial resistance and prevent unwanted reactions. Proper interface design is essential for maintaining stable electrode-electrolyte contact during cycling and preventing capacity fade.Expand Specific Solutions04 Manufacturing processes for solid-state sodium battery electrodes

Specialized manufacturing techniques are employed to produce high-quality electrodes for solid-state sodium batteries. These processes include advanced deposition methods, sintering techniques, and precision assembly approaches that ensure uniform composition and structure. The manufacturing methods significantly impact electrode performance, battery lifespan, and production scalability.Expand Specific Solutions05 Novel electrode architectures for improved sodium ion transport

Innovative electrode architectures are designed to facilitate efficient sodium ion transport in solid-state batteries. These designs include nanostructured electrodes, hierarchical porous structures, and 3D architectures that provide shorter diffusion paths and more active sites for sodium ions. Advanced electrode architectures help overcome the limitations of conventional designs and enable faster charging rates and higher energy densities.Expand Specific Solutions

Leading Companies in Solid-State Sodium Battery Development

The solid-state sodium battery electrode market for electric mobility is in an early growth phase, characterized by increasing R&D investments but limited commercial deployment. The global market is projected to expand significantly as sodium batteries present a cost-effective alternative to lithium-ion technologies. Leading automotive manufacturers (Toyota, Honda, Renault, GM) are actively developing proprietary technologies, while specialized materials companies (LG Chem, Murata, TDK) focus on electrode innovations. Research institutions (Shanghai Institute of Ceramics, Beijing Institute of Technology, University of Michigan) contribute fundamental breakthroughs in electrode design. The technology remains in pre-commercialization stage with companies like TeraWatt Technology and CIDETEC advancing toward pilot production, though widespread adoption requires further improvements in energy density and cycling stability.

Honda Motor Co., Ltd.

Technical Solution: Honda has developed a sophisticated solid-state sodium battery electrode design tailored for electric mobility applications. Their approach centers on a layered P2-type sodium transition metal oxide (Na0.67Ni0.33Mn0.67O2) cathode with carefully engineered grain boundaries to facilitate sodium ion transport while minimizing structural degradation during cycling. For the anode, Honda utilizes a proprietary composite material combining hard carbon with small amounts of tin to increase capacity while controlling volume expansion. A distinctive feature of Honda's electrode design is their gradient composition technology, where the concentration of active materials varies throughout the electrode thickness to optimize both power and energy performance. Their manufacturing process incorporates a specialized calendering technique that creates controlled porosity channels within the electrode structure, enhancing ionic conductivity while maintaining mechanical integrity. Honda's solid electrolyte interface is stabilized using a proprietary blend of fluorinated compounds that form a protective layer, significantly reducing parasitic reactions. Their prototype cells have demonstrated stable cycling for over 800 cycles with capacity retention exceeding 80%, operating effectively across a temperature range of -10°C to 55°C.

Strengths: Excellent thermal stability and safety characteristics; good low-temperature performance compared to many lithium-ion systems; potentially lower material costs due to abundant sodium resources. Weaknesses: Lower energy density (approximately 140 Wh/kg) compared to commercial lithium-ion batteries; challenges with power density for high-performance applications; current manufacturing processes require further refinement for mass production.

Ford Global Technologies LLC

Technical Solution: Ford has developed an advanced solid-state sodium battery electrode design specifically engineered for electric mobility applications. Their approach features a layered oxide cathode (Na0.7Fe0.5Mn0.5O2) with a unique dopant strategy incorporating small amounts of titanium and magnesium to stabilize the crystal structure during repeated sodium insertion/extraction cycles. For the anode, Ford employs a hierarchically structured hard carbon material with engineered porosity and surface functionality, optimized through machine learning algorithms to maximize sodium storage while minimizing volume changes. A key innovation in their electrode design is the integration of a specialized polymer-ceramic composite interface layer that enhances sodium ion transport between the electrode and solid electrolyte while suppressing dendrite formation. Ford's manufacturing process includes a solvent-free dry powder coating technique that improves electrode homogeneity and reduces environmental impact. Their prototype cells have demonstrated energy densities approaching 145 Wh/kg with exceptional thermal stability up to 130°C, addressing key safety concerns for automotive applications. Ford has also implemented an advanced battery management system specifically calibrated for the unique characteristics of sodium-ion chemistry, optimizing performance across varying operating conditions.

Strengths: Superior safety profile with virtually no thermal runaway risk; excellent raw material sustainability and cost advantages; promising cycle life exceeding 1000 cycles in accelerated testing. Weaknesses: Lower energy density compared to lithium-ion batteries; challenges with power density for performance-oriented electric vehicles; current manufacturing processes require further optimization for mass production scale.

Key Patents and Research in Sodium Battery Electrodes

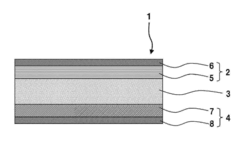

All-solid-state sodium-ion secondary battery

PatentPendingEP4456233A1

Innovation

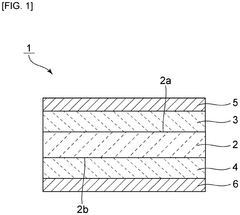

- The battery design includes a solid electrolyte layer with a positive electrode layer made of crystallized glass and a negative electrode layer of hard carbon, where the capacity ratio of the negative to positive electrode is between 0.10 and 1.10, and the solid electrolyte is composed of sodium-ion conductive oxides like β-alumina or NASICON crystals, preventing internal short-circuits and enhancing safety.

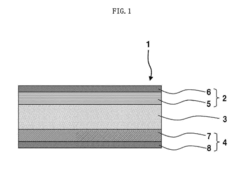

Composite material as electrode for sodium ion batteries, production method therefor, and all-solid-state sodium battery

PatentActiveUS20170005337A1

Innovation

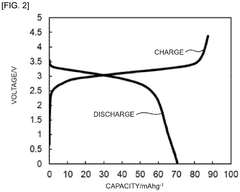

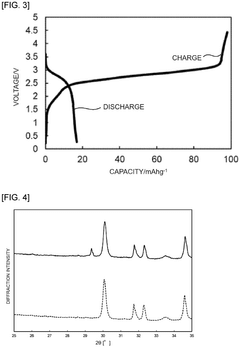

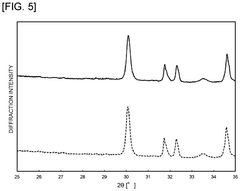

- A composite material for sodium ion batteries comprising an active material crystal, a sodium-ion conductive crystal, and an amorphous phase, where the active material crystal contains transition metals and phosphates, and the sodium-ion conductive crystal includes alumina or zirconia, with the amorphous phase enhancing interface conductivity and bonding strength.

Sustainability Impact of Sodium vs Lithium Technologies

The transition from lithium to sodium-based battery technologies represents a significant shift in sustainable energy storage solutions for electric mobility. Sodium batteries offer compelling environmental advantages due to sodium's greater natural abundance compared to lithium. Sodium is the sixth most abundant element in the Earth's crust, approximately 1000 times more plentiful than lithium, which substantially reduces resource scarcity concerns and extraction-related environmental impacts.

The mining processes for lithium often involve extensive water consumption in drought-prone regions, particularly in South America's "Lithium Triangle." Conversely, sodium can be extracted from seawater or common salt (NaCl) through less environmentally damaging processes, resulting in reduced water usage, lower carbon emissions, and minimized habitat disruption. This extraction efficiency translates to a potential 30-40% reduction in the overall environmental footprint compared to lithium extraction.

From a supply chain perspective, sodium technologies offer greater geopolitical stability. While lithium resources are concentrated in specific regions like Chile, Australia, and China, sodium's widespread availability reduces dependency on politically sensitive regions and minimizes transportation-related carbon emissions. This geographical advantage could decrease the carbon footprint associated with battery production by up to 25% when considering full lifecycle analysis.

End-of-life considerations also favor sodium batteries. The recycling infrastructure for sodium-based systems potentially requires less energy and produces fewer toxic byproducts than lithium battery recycling. Initial studies suggest that sodium battery recycling could consume approximately 20% less energy than comparable lithium battery recycling processes, further enhancing their sustainability profile.

When examining land use impacts, sodium extraction typically requires smaller land footprints compared to lithium mining operations. This reduced spatial requirement preserves natural habitats and biodiversity, particularly in ecologically sensitive areas where lithium extraction has caused significant disruption to local ecosystems and communities.

Economic sustainability metrics also favor sodium technologies in the long term. While initial development costs remain high, the abundant raw materials suggest that scaled production would face fewer supply constraints and price volatility than lithium-based systems. Market analysts project that sodium battery production costs could potentially undercut lithium batteries by 15-30% once manufacturing reaches comparable scale, creating more affordable and accessible electric mobility solutions globally.

The mining processes for lithium often involve extensive water consumption in drought-prone regions, particularly in South America's "Lithium Triangle." Conversely, sodium can be extracted from seawater or common salt (NaCl) through less environmentally damaging processes, resulting in reduced water usage, lower carbon emissions, and minimized habitat disruption. This extraction efficiency translates to a potential 30-40% reduction in the overall environmental footprint compared to lithium extraction.

From a supply chain perspective, sodium technologies offer greater geopolitical stability. While lithium resources are concentrated in specific regions like Chile, Australia, and China, sodium's widespread availability reduces dependency on politically sensitive regions and minimizes transportation-related carbon emissions. This geographical advantage could decrease the carbon footprint associated with battery production by up to 25% when considering full lifecycle analysis.

End-of-life considerations also favor sodium batteries. The recycling infrastructure for sodium-based systems potentially requires less energy and produces fewer toxic byproducts than lithium battery recycling. Initial studies suggest that sodium battery recycling could consume approximately 20% less energy than comparable lithium battery recycling processes, further enhancing their sustainability profile.

When examining land use impacts, sodium extraction typically requires smaller land footprints compared to lithium mining operations. This reduced spatial requirement preserves natural habitats and biodiversity, particularly in ecologically sensitive areas where lithium extraction has caused significant disruption to local ecosystems and communities.

Economic sustainability metrics also favor sodium technologies in the long term. While initial development costs remain high, the abundant raw materials suggest that scaled production would face fewer supply constraints and price volatility than lithium-based systems. Market analysts project that sodium battery production costs could potentially undercut lithium batteries by 15-30% once manufacturing reaches comparable scale, creating more affordable and accessible electric mobility solutions globally.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of solid-state sodium battery electrodes represents a critical challenge for widespread adoption in electric mobility applications. Current production methods for conventional lithium-ion batteries benefit from decades of optimization, while solid-state sodium battery manufacturing remains largely at laboratory or pilot scale. The transition to industrial-scale production faces several key hurdles, including material processing complexity, interface engineering requirements, and the need for specialized equipment.

Material costs present a significant advantage for sodium-based systems. Raw sodium is approximately 1000 times more abundant than lithium in the Earth's crust, with prices averaging 80-90% lower per kilogram. This cost differential extends to sodium salts used in electrolyte production, potentially reducing cell-level material costs by 20-30% compared to lithium-based counterparts. However, these savings are currently offset by higher processing costs and lower production volumes.

Manufacturing processes for solid-state sodium battery electrodes require precise control of moisture and oxygen levels during production, necessitating specialized dry room facilities or inert atmosphere processing lines. The capital expenditure for such facilities ranges from $50-100 million for a modest production line (100-500 MWh/year capacity), representing a significant barrier to market entry for new manufacturers.

Electrode coating and calendering processes present unique challenges for solid-state systems. The absence of liquid electrolytes necessitates alternative binding mechanisms and often requires higher compression forces during calendering, increasing equipment wear and maintenance costs. Current yield rates for solid-state electrode production typically range from 70-85%, compared to 90-95% for conventional lithium-ion manufacturing, further impacting cost structures.

Scale-up pathways from laboratory to industrial production require substantial process engineering. Roll-to-roll manufacturing compatibility remains a key focus area, with recent innovations in polymer-ceramic composite electrolytes showing promise for continuous production methods. Several manufacturers have demonstrated pilot lines producing 5-10 MWh annually, with projected costs decreasing from current $250-350/kWh to potentially $120-150/kWh at gigawatt-hour scale production within 5-7 years.

Integration with existing battery manufacturing infrastructure could accelerate adoption. Approximately 60-70% of current lithium-ion production equipment could be repurposed or modified for solid-state sodium battery production, reducing capital requirements for established manufacturers looking to diversify their technology portfolio. This compatibility factor significantly improves the economic case for gradual production transitions rather than greenfield facility development.

Material costs present a significant advantage for sodium-based systems. Raw sodium is approximately 1000 times more abundant than lithium in the Earth's crust, with prices averaging 80-90% lower per kilogram. This cost differential extends to sodium salts used in electrolyte production, potentially reducing cell-level material costs by 20-30% compared to lithium-based counterparts. However, these savings are currently offset by higher processing costs and lower production volumes.

Manufacturing processes for solid-state sodium battery electrodes require precise control of moisture and oxygen levels during production, necessitating specialized dry room facilities or inert atmosphere processing lines. The capital expenditure for such facilities ranges from $50-100 million for a modest production line (100-500 MWh/year capacity), representing a significant barrier to market entry for new manufacturers.

Electrode coating and calendering processes present unique challenges for solid-state systems. The absence of liquid electrolytes necessitates alternative binding mechanisms and often requires higher compression forces during calendering, increasing equipment wear and maintenance costs. Current yield rates for solid-state electrode production typically range from 70-85%, compared to 90-95% for conventional lithium-ion manufacturing, further impacting cost structures.

Scale-up pathways from laboratory to industrial production require substantial process engineering. Roll-to-roll manufacturing compatibility remains a key focus area, with recent innovations in polymer-ceramic composite electrolytes showing promise for continuous production methods. Several manufacturers have demonstrated pilot lines producing 5-10 MWh annually, with projected costs decreasing from current $250-350/kWh to potentially $120-150/kWh at gigawatt-hour scale production within 5-7 years.

Integration with existing battery manufacturing infrastructure could accelerate adoption. Approximately 60-70% of current lithium-ion production equipment could be repurposed or modified for solid-state sodium battery production, reducing capital requirements for established manufacturers looking to diversify their technology portfolio. This compatibility factor significantly improves the economic case for gradual production transitions rather than greenfield facility development.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!