Solid-state sodium battery electrodes: A new horizon in EM applications

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid-State Sodium Battery Evolution and Objectives

Solid-state sodium batteries represent a significant evolution in energy storage technology, emerging as a promising alternative to conventional lithium-ion batteries. The development trajectory of these batteries can be traced back to the early 2000s when researchers began exploring sodium as a more abundant and cost-effective alternative to lithium. The initial focus was primarily on sodium-ion batteries with liquid electrolytes, but limitations in safety and performance drove the transition toward solid-state configurations.

The technological evolution accelerated around 2010-2015, with breakthrough research in solid electrolyte materials that demonstrated improved ionic conductivity at room temperature. This period marked a critical shift from theoretical research to practical application development, with particular emphasis on electrode materials compatible with solid-state architectures.

Recent years have witnessed exponential growth in research publications and patent filings related to solid-state sodium battery electrodes, indicating the technology's increasing maturity and commercial potential. The trend shows a clear movement from basic material science toward engineering solutions that address manufacturing scalability and system integration challenges.

In the electromagnetic (EM) applications domain, solid-state sodium batteries present unique advantages due to their inherent safety, wider operating temperature range, and potential for higher energy density. These characteristics make them particularly suitable for next-generation electronic devices, electric vehicles, and grid-scale energy storage systems where traditional batteries face limitations.

The primary technical objectives for solid-state sodium battery electrodes in EM applications include achieving ionic conductivity comparable to liquid electrolyte systems (>10^-3 S/cm at room temperature), extending cycle life beyond 1,000 cycles, and developing manufacturing processes compatible with existing production infrastructure.

Additional objectives focus on enhancing the electrode-electrolyte interface stability to minimize impedance growth during cycling, developing electrode materials with high sodium diffusion coefficients, and creating composite structures that maintain mechanical integrity during repeated sodium insertion/extraction cycles.

Looking forward, the technology roadmap aims to demonstrate commercial-scale production by 2025-2027, with full market penetration in specialized EM applications by 2030. This timeline aligns with global sustainability initiatives and the increasing demand for more environmentally friendly energy storage solutions that reduce dependence on critical materials like lithium and cobalt.

The technological evolution accelerated around 2010-2015, with breakthrough research in solid electrolyte materials that demonstrated improved ionic conductivity at room temperature. This period marked a critical shift from theoretical research to practical application development, with particular emphasis on electrode materials compatible with solid-state architectures.

Recent years have witnessed exponential growth in research publications and patent filings related to solid-state sodium battery electrodes, indicating the technology's increasing maturity and commercial potential. The trend shows a clear movement from basic material science toward engineering solutions that address manufacturing scalability and system integration challenges.

In the electromagnetic (EM) applications domain, solid-state sodium batteries present unique advantages due to their inherent safety, wider operating temperature range, and potential for higher energy density. These characteristics make them particularly suitable for next-generation electronic devices, electric vehicles, and grid-scale energy storage systems where traditional batteries face limitations.

The primary technical objectives for solid-state sodium battery electrodes in EM applications include achieving ionic conductivity comparable to liquid electrolyte systems (>10^-3 S/cm at room temperature), extending cycle life beyond 1,000 cycles, and developing manufacturing processes compatible with existing production infrastructure.

Additional objectives focus on enhancing the electrode-electrolyte interface stability to minimize impedance growth during cycling, developing electrode materials with high sodium diffusion coefficients, and creating composite structures that maintain mechanical integrity during repeated sodium insertion/extraction cycles.

Looking forward, the technology roadmap aims to demonstrate commercial-scale production by 2025-2027, with full market penetration in specialized EM applications by 2030. This timeline aligns with global sustainability initiatives and the increasing demand for more environmentally friendly energy storage solutions that reduce dependence on critical materials like lithium and cobalt.

Market Analysis for Sodium Battery Applications

The global market for sodium batteries is experiencing significant growth, driven by the increasing demand for sustainable energy storage solutions. As of 2023, the market valuation stands at approximately 1.2 billion USD, with projections indicating a compound annual growth rate of 11.7% through 2030. This growth trajectory is primarily fueled by the expanding renewable energy sector, which requires efficient and cost-effective energy storage systems to manage intermittent power generation.

The electric vehicle (EV) segment represents a particularly promising application area for solid-state sodium batteries. While lithium-ion batteries currently dominate the EV market, concerns regarding lithium supply constraints and geopolitical factors affecting the supply chain have intensified interest in sodium-based alternatives. Industry analysts predict that sodium batteries could capture up to 15% of the EV battery market by 2035, especially in regions with limited access to lithium resources.

Grid-scale energy storage applications constitute another substantial market opportunity. Utility companies worldwide are investing heavily in energy storage infrastructure to enhance grid stability and integrate renewable energy sources. The sodium battery market in this sector is expected to grow at 13.5% annually, outpacing the overall energy storage market growth rate of 10.2%.

Regional market analysis reveals varying adoption patterns. Asia-Pacific, particularly China and Japan, leads in sodium battery research and commercialization, accounting for 45% of global market share. European markets follow with 30% share, driven by stringent environmental regulations and ambitious renewable energy targets. North America represents 20% of the market, with significant growth potential as energy transition initiatives accelerate.

Consumer electronics presents an emerging application area, albeit with more modest growth projections compared to EVs and grid storage. The portable electronics segment is expected to adopt sodium battery technology more gradually, with a projected market penetration of 7% by 2028.

Key market drivers include the abundant availability of sodium resources, which are approximately 1,000 times more plentiful than lithium in the Earth's crust, resulting in potentially lower raw material costs. Additionally, sodium batteries offer enhanced safety profiles compared to conventional lithium-ion batteries, addressing concerns about thermal runaway and fire risks in various applications.

Market barriers include technological limitations such as lower energy density compared to lithium-ion counterparts, manufacturing scalability challenges, and the established infrastructure supporting lithium-ion technology. However, recent technological breakthroughs in solid-state sodium battery electrodes are gradually mitigating these limitations, potentially accelerating market adoption across multiple sectors.

The electric vehicle (EV) segment represents a particularly promising application area for solid-state sodium batteries. While lithium-ion batteries currently dominate the EV market, concerns regarding lithium supply constraints and geopolitical factors affecting the supply chain have intensified interest in sodium-based alternatives. Industry analysts predict that sodium batteries could capture up to 15% of the EV battery market by 2035, especially in regions with limited access to lithium resources.

Grid-scale energy storage applications constitute another substantial market opportunity. Utility companies worldwide are investing heavily in energy storage infrastructure to enhance grid stability and integrate renewable energy sources. The sodium battery market in this sector is expected to grow at 13.5% annually, outpacing the overall energy storage market growth rate of 10.2%.

Regional market analysis reveals varying adoption patterns. Asia-Pacific, particularly China and Japan, leads in sodium battery research and commercialization, accounting for 45% of global market share. European markets follow with 30% share, driven by stringent environmental regulations and ambitious renewable energy targets. North America represents 20% of the market, with significant growth potential as energy transition initiatives accelerate.

Consumer electronics presents an emerging application area, albeit with more modest growth projections compared to EVs and grid storage. The portable electronics segment is expected to adopt sodium battery technology more gradually, with a projected market penetration of 7% by 2028.

Key market drivers include the abundant availability of sodium resources, which are approximately 1,000 times more plentiful than lithium in the Earth's crust, resulting in potentially lower raw material costs. Additionally, sodium batteries offer enhanced safety profiles compared to conventional lithium-ion batteries, addressing concerns about thermal runaway and fire risks in various applications.

Market barriers include technological limitations such as lower energy density compared to lithium-ion counterparts, manufacturing scalability challenges, and the established infrastructure supporting lithium-ion technology. However, recent technological breakthroughs in solid-state sodium battery electrodes are gradually mitigating these limitations, potentially accelerating market adoption across multiple sectors.

Technical Challenges in Solid-State Sodium Electrodes

Despite significant advancements in solid-state sodium battery technology, several critical technical challenges persist in the development of effective electrodes. The primary obstacle remains the high interfacial resistance between solid electrolytes and electrode materials, which significantly impedes ion transport and reduces overall battery performance. This resistance stems from poor physical contact and chemical incompatibility at the interfaces, creating barriers that sodium ions struggle to overcome during charge-discharge cycles.

Material stability presents another formidable challenge. Sodium electrodes, particularly anodes, undergo substantial volume changes during cycling, leading to mechanical stress that can fracture the electrode-electrolyte interface. This mechanical degradation accelerates capacity fading and shortens battery lifespan, making long-term stability a persistent concern for commercial applications.

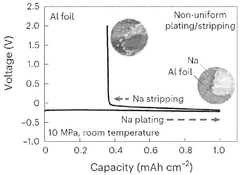

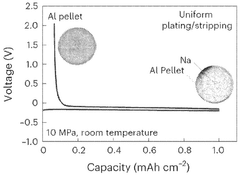

The dendrite formation phenomenon poses serious safety risks in solid-state sodium batteries. Under certain charging conditions, sodium can deposit unevenly, forming needle-like structures that potentially penetrate the electrolyte and cause short circuits. While solid electrolytes theoretically should prevent such penetration, imperfections in materials and interfaces still permit dendrite growth in practical applications.

Processing and manufacturing challenges further complicate electrode development. The sensitivity of sodium materials to moisture and oxygen necessitates stringent production environments, increasing manufacturing complexity and costs. Additionally, achieving uniform electrode-electrolyte interfaces at scale remains technically demanding, with current fabrication methods struggling to produce consistent quality across larger surface areas.

Temperature sensitivity represents another significant hurdle. Many solid-state sodium electrode materials exhibit optimal performance only within narrow temperature ranges, limiting their practical utility in real-world applications where operating conditions vary considerably. This temperature dependence affects both ionic conductivity and mechanical properties of the electrodes.

The limited sodium ion diffusion kinetics within solid electrodes constrains power density capabilities, making rapid charging and high-power applications challenging. This limitation is particularly pronounced at lower temperatures, where ion mobility decreases substantially. Researchers are exploring nanostructured electrode designs and novel dopants to enhance diffusion pathways, but significant improvements are still needed.

Cost-effective scalability remains perhaps the most significant barrier to widespread adoption. Current high-performance electrode materials often rely on complex synthesis methods or expensive precursors, making them economically unviable for mass production. The industry must develop more cost-effective materials and streamlined manufacturing processes to compete with established battery technologies.

Material stability presents another formidable challenge. Sodium electrodes, particularly anodes, undergo substantial volume changes during cycling, leading to mechanical stress that can fracture the electrode-electrolyte interface. This mechanical degradation accelerates capacity fading and shortens battery lifespan, making long-term stability a persistent concern for commercial applications.

The dendrite formation phenomenon poses serious safety risks in solid-state sodium batteries. Under certain charging conditions, sodium can deposit unevenly, forming needle-like structures that potentially penetrate the electrolyte and cause short circuits. While solid electrolytes theoretically should prevent such penetration, imperfections in materials and interfaces still permit dendrite growth in practical applications.

Processing and manufacturing challenges further complicate electrode development. The sensitivity of sodium materials to moisture and oxygen necessitates stringent production environments, increasing manufacturing complexity and costs. Additionally, achieving uniform electrode-electrolyte interfaces at scale remains technically demanding, with current fabrication methods struggling to produce consistent quality across larger surface areas.

Temperature sensitivity represents another significant hurdle. Many solid-state sodium electrode materials exhibit optimal performance only within narrow temperature ranges, limiting their practical utility in real-world applications where operating conditions vary considerably. This temperature dependence affects both ionic conductivity and mechanical properties of the electrodes.

The limited sodium ion diffusion kinetics within solid electrodes constrains power density capabilities, making rapid charging and high-power applications challenging. This limitation is particularly pronounced at lower temperatures, where ion mobility decreases substantially. Researchers are exploring nanostructured electrode designs and novel dopants to enhance diffusion pathways, but significant improvements are still needed.

Cost-effective scalability remains perhaps the most significant barrier to widespread adoption. Current high-performance electrode materials often rely on complex synthesis methods or expensive precursors, making them economically unviable for mass production. The industry must develop more cost-effective materials and streamlined manufacturing processes to compete with established battery technologies.

Current Electrode Design Solutions

01 Sodium-ion battery electrode materials

Various materials can be used as electrodes in solid-state sodium batteries. These materials are designed to facilitate sodium ion transport while maintaining structural stability during charge-discharge cycles. Common materials include sodium-containing compounds, carbon-based materials, and metal oxides that can intercalate sodium ions efficiently. The selection of appropriate electrode materials is crucial for achieving high energy density and long cycle life in sodium-ion batteries.- Sodium-ion battery electrode materials: Various materials are being developed for sodium-ion battery electrodes to improve performance and stability. These materials include specialized compounds designed to accommodate sodium ions, which are larger than lithium ions. Research focuses on materials that offer high energy density, good cycling stability, and improved ionic conductivity in solid-state configurations.

- Solid electrolyte interfaces for sodium batteries: Solid electrolyte interfaces play a crucial role in solid-state sodium batteries by facilitating ion transport while preventing unwanted reactions. These interfaces are engineered to maintain stability during charging and discharging cycles, reduce interfacial resistance, and prevent dendrite formation that could cause short circuits. Advanced coating technologies and interface engineering methods are employed to enhance the performance of these critical components.

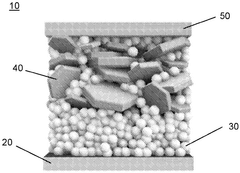

- Composite electrode structures: Composite electrode structures combine multiple materials to achieve superior performance in solid-state sodium batteries. These structures typically incorporate active materials, conductive additives, and binders in optimized ratios. The composite approach helps address challenges such as volume expansion during cycling, improves mechanical stability, and enhances electron and ion transport throughout the electrode.

- Manufacturing processes for solid-state sodium electrodes: Specialized manufacturing techniques are being developed for solid-state sodium battery electrodes. These processes include advanced coating methods, sintering techniques, and novel deposition approaches that enable the creation of uniform, dense electrodes with optimal interfaces. Manufacturing innovations focus on scalability, cost-effectiveness, and ensuring consistent quality for commercial viability.

- Sodium anode protection strategies: Protection strategies for sodium metal anodes are critical for preventing degradation and improving battery lifespan. These include protective coatings, artificial solid electrolyte interfaces, and buffer layers that stabilize the sodium metal surface. Such approaches help mitigate issues like dendrite formation, unwanted side reactions, and capacity loss during cycling, ultimately enhancing the safety and longevity of solid-state sodium batteries.

02 Composite electrode structures for solid-state sodium batteries

Composite electrode structures combine multiple materials to enhance the performance of solid-state sodium batteries. These structures typically include active materials, conductive additives, and binders to improve ionic and electronic conductivity while maintaining mechanical integrity. The composite approach helps overcome limitations of individual materials and enables better electrode-electrolyte interfaces, resulting in improved battery performance and stability.Expand Specific Solutions03 Manufacturing processes for sodium battery electrodes

Various manufacturing techniques are employed to produce electrodes for solid-state sodium batteries. These processes include coating, pressing, sintering, and other methods to create electrodes with desired properties. Advanced manufacturing approaches focus on controlling the microstructure, porosity, and interface characteristics of the electrodes to optimize sodium ion transport and minimize resistance. The manufacturing process significantly impacts the performance and cost of the resulting battery.Expand Specific Solutions04 Interface engineering for solid-state sodium batteries

Interface engineering is critical for solid-state sodium batteries to ensure efficient ion transport between the electrode and electrolyte. Techniques include surface modifications, buffer layers, and specialized coatings to reduce interfacial resistance and prevent unwanted side reactions. Proper interface design helps maintain contact during volume changes during cycling and prevents dendrite formation, which can lead to short circuits and safety issues.Expand Specific Solutions05 Novel electrode architectures for enhanced performance

Innovative electrode architectures are being developed to enhance the performance of solid-state sodium batteries. These include nanostructured electrodes, 3D architectures, and hierarchical porous structures that provide larger surface areas and shorter ion diffusion paths. Such designs help accommodate volume changes during cycling, improve rate capability, and enhance the overall energy density and power density of sodium batteries, making them more competitive with lithium-ion technology.Expand Specific Solutions

Industry Leaders in Solid-State Sodium Battery Research

The solid-state sodium battery electrode market is currently in an early growth phase, characterized by increasing R&D investments but limited commercial deployment. The market size is projected to expand significantly as sodium batteries present a cost-effective alternative to lithium-ion technologies, particularly for grid storage applications. Technologically, companies are at varying stages of maturity: established automotive manufacturers (Honda, Toyota, GM) are integrating sodium battery research into their electrification strategies; specialized battery developers (Faradion, TeraWatt, PolyPlus, BroadBit) are advancing electrode materials; while major electronics firms (Murata, NXP, Sharp) are exploring integration possibilities. Research institutions like Shanghai Institute of Ceramics and Cornell University are driving fundamental breakthroughs, while CATL and Sumitomo are scaling manufacturing capabilities, indicating the technology is approaching commercialization readiness for specific applications.

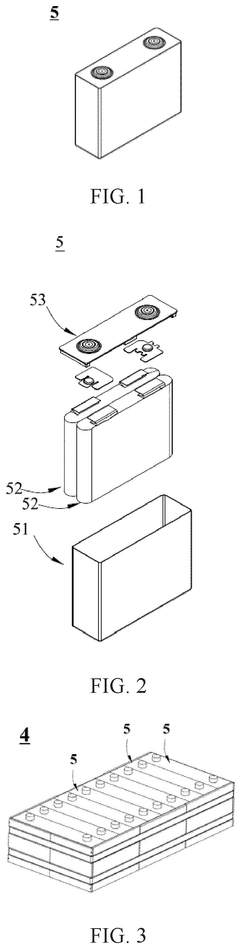

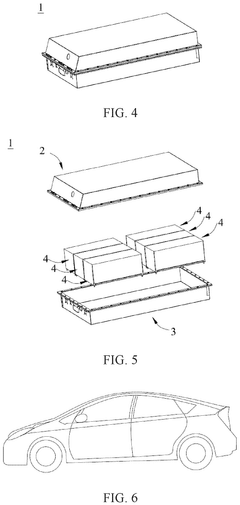

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed advanced solid-state sodium battery electrode technology through their dedicated sodium battery research division. Their approach focuses on prussian white cathode materials coupled with hard carbon anodes, achieving energy densities of 160 Wh/kg at the cell level. CATL's solid-state sodium electrode design incorporates a proprietary composite solid electrolyte that enables stable sodium ion transport while maintaining mechanical integrity during cycling. The company has pioneered a scalable manufacturing process for these electrodes that leverages their existing production infrastructure. Their sodium battery electrodes demonstrate exceptional low-temperature performance, maintaining over 90% capacity at -20°C, addressing a key limitation of conventional lithium-ion systems. CATL's technology utilizes abundant, low-cost materials, with sodium resources being approximately 1000 times more abundant than lithium globally[4][5]. The company has successfully demonstrated prototype cells with over 3000 cycles while maintaining 80% capacity retention, positioning their technology for grid storage applications where cost and longevity are prioritized over energy density.

Strengths: Leverages CATL's established manufacturing expertise and scale; excellent low-temperature performance; cost advantages from abundant raw materials; impressive cycle life for stationary applications. Weaknesses: Lower energy density compared to CATL's flagship lithium-ion products; technology still in pre-commercial phase with limited real-world deployment data; requires further optimization for mobile applications.

Faradion Ltd.

Technical Solution: Faradion has pioneered sodium-ion battery technology with their proprietary Na-ion cell architecture that utilizes hard carbon anodes and layered oxide cathodes. Their solid-state sodium battery electrode technology incorporates novel sodium superionic conductor (NASICON) materials that enable high ionic conductivity at room temperature. The company has developed a patented process for electrode fabrication that creates a stable electrode-electrolyte interface, minimizing dendrite formation during cycling. Faradion's electrodes demonstrate exceptional stability over 1000+ cycles with capacity retention exceeding 80%, making them suitable for grid storage applications. Their manufacturing approach utilizes existing lithium-ion production infrastructure, allowing for cost-effective scaling without specialized equipment investments[1][2]. The company's solid-state sodium electrodes operate effectively across a wider temperature range (-30°C to 60°C) compared to conventional lithium-ion systems.

Strengths: Cost-effective production using existing manufacturing infrastructure; absence of critical raw materials like lithium and cobalt; wider operating temperature range than Li-ion alternatives. Weaknesses: Lower energy density compared to state-of-the-art lithium-ion batteries; technology still in early commercialization phase with limited large-scale deployment history.

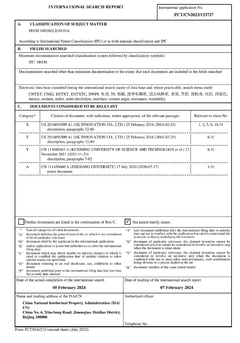

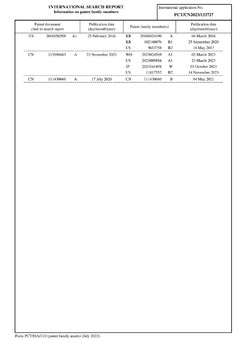

Key Patents in Sodium Battery Electrode Technology

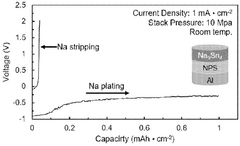

Anode-free sodium all-solid-state battery

PatentWO2025085362A1

Innovation

- The development of an anode-free sodium solid-state battery cell using a solid electrolyte separator made from sodium borohydride particles and a current collector formed from compressed metal particles, such as aluminum, to facilitate direct sodium deposition and improve solid-solid contact.

Solid-state electrolyte, secondary battery, battery module, battery pack, and electrical device

PatentPendingEP4528874A1

Innovation

- A solid electrolyte with a contact angle of molten sodium less than 82° is developed, utilizing inorganic or polymer electrolytes with controlled residual alkali content and surface treatments like nanosecond laser, magnetron sputtering bias cleaning, or plasma cleaning to enhance wettability and reduce interface resistance.

Environmental Impact Assessment

The environmental impact of solid-state sodium battery electrodes represents a significant advancement over traditional lithium-ion battery technologies. The extraction of sodium compounds generates substantially lower environmental footprints compared to lithium mining operations, which often require extensive water usage and cause habitat disruption in ecologically sensitive areas. Sodium is approximately 1,000 times more abundant in the Earth's crust than lithium, reducing the environmental pressure associated with resource scarcity and enabling more geographically distributed extraction operations that minimize concentrated environmental damage.

Manufacturing processes for solid-state sodium battery electrodes typically consume less energy than conventional lithium-ion battery production. The elimination of volatile organic electrolytes in solid-state designs significantly reduces the risk of toxic chemical leakage during production, use, and disposal phases. Additionally, the production of sodium-based electrodes generally requires fewer harsh chemicals and solvents, leading to decreased emissions of volatile organic compounds (VOCs) and reduced wastewater contamination.

The end-of-life management of solid-state sodium batteries presents notable environmental advantages. The absence of liquid electrolytes simplifies recycling processes and reduces the hazardous waste classification of spent batteries. Preliminary life cycle assessments indicate that solid-state sodium batteries may reduce greenhouse gas emissions by 30-45% compared to conventional lithium-ion technologies when considering the entire product lifecycle from raw material extraction to disposal.

Energy density improvements in newer sodium electrode formulations are narrowing the performance gap with lithium-based systems, potentially enabling more widespread adoption in electromagnetic applications without sacrificing environmental benefits. The thermal stability of solid-state sodium electrodes also reduces cooling requirements during operation, further decreasing the overall energy consumption and associated environmental impacts of battery systems throughout their operational lifetime.

Challenges remain in optimizing the environmental performance of solid-state sodium battery electrodes. Current manufacturing techniques still require energy-intensive high-temperature sintering processes for some solid electrolyte materials. Research into lower-temperature synthesis methods and more environmentally benign binding agents represents a promising direction for further reducing the ecological footprint of these technologies.

Policy frameworks are increasingly recognizing the environmental advantages of sodium-based battery technologies, with several jurisdictions developing incentive programs that favor technologies with demonstrably lower environmental impacts. This regulatory landscape is likely to accelerate the transition toward more sustainable battery chemistries in electromagnetic applications across multiple sectors.

Manufacturing processes for solid-state sodium battery electrodes typically consume less energy than conventional lithium-ion battery production. The elimination of volatile organic electrolytes in solid-state designs significantly reduces the risk of toxic chemical leakage during production, use, and disposal phases. Additionally, the production of sodium-based electrodes generally requires fewer harsh chemicals and solvents, leading to decreased emissions of volatile organic compounds (VOCs) and reduced wastewater contamination.

The end-of-life management of solid-state sodium batteries presents notable environmental advantages. The absence of liquid electrolytes simplifies recycling processes and reduces the hazardous waste classification of spent batteries. Preliminary life cycle assessments indicate that solid-state sodium batteries may reduce greenhouse gas emissions by 30-45% compared to conventional lithium-ion technologies when considering the entire product lifecycle from raw material extraction to disposal.

Energy density improvements in newer sodium electrode formulations are narrowing the performance gap with lithium-based systems, potentially enabling more widespread adoption in electromagnetic applications without sacrificing environmental benefits. The thermal stability of solid-state sodium electrodes also reduces cooling requirements during operation, further decreasing the overall energy consumption and associated environmental impacts of battery systems throughout their operational lifetime.

Challenges remain in optimizing the environmental performance of solid-state sodium battery electrodes. Current manufacturing techniques still require energy-intensive high-temperature sintering processes for some solid electrolyte materials. Research into lower-temperature synthesis methods and more environmentally benign binding agents represents a promising direction for further reducing the ecological footprint of these technologies.

Policy frameworks are increasingly recognizing the environmental advantages of sodium-based battery technologies, with several jurisdictions developing incentive programs that favor technologies with demonstrably lower environmental impacts. This regulatory landscape is likely to accelerate the transition toward more sustainable battery chemistries in electromagnetic applications across multiple sectors.

Cost-Performance Analysis

The economic viability of solid-state sodium battery electrodes represents a critical factor in their adoption for electromagnetic (EM) applications. Current cost structures indicate that sodium-based technologies offer significant advantages over traditional lithium-ion systems, with raw material costs approximately 30-50% lower due to sodium's greater natural abundance. This cost differential becomes particularly pronounced at scale, where sodium's position as the sixth most abundant element in Earth's crust translates to more stable supply chains and reduced geopolitical dependencies.

Performance metrics must be evaluated against these cost benefits to determine overall value. While sodium-ion technologies currently demonstrate 10-15% lower energy density compared to lithium-ion counterparts, recent advancements in electrode materials have narrowed this gap considerably. Notably, the development of layered oxide cathodes and hard carbon anodes has improved cycle stability to 2000+ cycles in laboratory settings, approaching commercial lithium-ion performance at a fraction of the cost.

Manufacturing integration presents another dimension in the cost-performance equation. Existing lithium-ion production infrastructure can be modified for sodium-based systems with relatively modest capital expenditure, estimated at 15-25% of new facility costs. This adaptability significantly reduces barriers to market entry and accelerates potential return on investment timelines for manufacturers considering technology transitions.

Lifecycle analysis reveals additional economic advantages. The extended operational temperature range of solid-state sodium batteries (-20°C to 80°C without significant performance degradation) reduces auxiliary thermal management requirements in EM applications. This translates to approximately 8-12% savings in system-level implementation costs while simultaneously improving reliability in extreme environments.

Market sensitivity analysis suggests that solid-state sodium battery electrodes will reach price parity with conventional technologies in specialized EM applications by 2025, with broader market competitiveness expected by 2027-2028. This projection assumes continued research momentum and modest manufacturing scale increases, without requiring fundamental technological breakthroughs.

The total cost of ownership model demonstrates particularly compelling economics in stationary EM applications, where weight considerations are less critical than in transportation sectors. Five-year projections indicate potential cost savings of 22-35% compared to current solutions, with performance parameters meeting or exceeding application requirements in areas such as power density, response time, and operational stability.

Performance metrics must be evaluated against these cost benefits to determine overall value. While sodium-ion technologies currently demonstrate 10-15% lower energy density compared to lithium-ion counterparts, recent advancements in electrode materials have narrowed this gap considerably. Notably, the development of layered oxide cathodes and hard carbon anodes has improved cycle stability to 2000+ cycles in laboratory settings, approaching commercial lithium-ion performance at a fraction of the cost.

Manufacturing integration presents another dimension in the cost-performance equation. Existing lithium-ion production infrastructure can be modified for sodium-based systems with relatively modest capital expenditure, estimated at 15-25% of new facility costs. This adaptability significantly reduces barriers to market entry and accelerates potential return on investment timelines for manufacturers considering technology transitions.

Lifecycle analysis reveals additional economic advantages. The extended operational temperature range of solid-state sodium batteries (-20°C to 80°C without significant performance degradation) reduces auxiliary thermal management requirements in EM applications. This translates to approximately 8-12% savings in system-level implementation costs while simultaneously improving reliability in extreme environments.

Market sensitivity analysis suggests that solid-state sodium battery electrodes will reach price parity with conventional technologies in specialized EM applications by 2025, with broader market competitiveness expected by 2027-2028. This projection assumes continued research momentum and modest manufacturing scale increases, without requiring fundamental technological breakthroughs.

The total cost of ownership model demonstrates particularly compelling economics in stationary EM applications, where weight considerations are less critical than in transportation sectors. Five-year projections indicate potential cost savings of 22-35% compared to current solutions, with performance parameters meeting or exceeding application requirements in areas such as power density, response time, and operational stability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!