What stands out in solid-state sodium battery patent filings?

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid-State Sodium Battery Development Background and Objectives

Solid-state sodium batteries have emerged as a promising alternative to lithium-ion batteries, driven by increasing concerns over lithium resource scarcity and cost. The development of these batteries can be traced back to the 1970s, when initial research on sodium-ion conductors began. However, significant progress has only been achieved in the last decade, with breakthrough innovations in solid electrolyte materials and interface engineering.

The evolution of solid-state sodium battery technology has followed a trajectory from liquid electrolyte systems to hybrid electrolytes, and finally to all-solid-state configurations. This progression has been motivated by the need to address safety concerns, enhance energy density, and improve cycle life. Patent filings in this domain have grown exponentially since 2015, reflecting the intensifying research and development efforts globally.

The primary technical objectives in solid-state sodium battery development include achieving high ionic conductivity in solid electrolytes (>10^-3 S/cm at room temperature), resolving interface stability issues between electrodes and electrolytes, and developing scalable manufacturing processes. These objectives align with the broader goal of creating energy storage solutions that are safer, more sustainable, and economically viable compared to conventional lithium-ion technologies.

Current patent landscapes reveal concentrated efforts in developing novel sodium superionic conductor (NASICON) materials, polymer-ceramic composite electrolytes, and innovative cathode formulations. Companies and research institutions from China, Japan, South Korea, and the United States dominate the patent filings, with a notable increase in European contributions in recent years.

The technological trajectory suggests a convergence toward multi-layered architectures that combine different types of solid electrolytes to optimize performance. This approach addresses the inherent trade-offs between ionic conductivity, mechanical stability, and electrochemical compatibility that have historically limited solid-state sodium battery development.

Looking forward, the field is expected to witness accelerated innovation in three key areas: advanced manufacturing techniques for thin-film solid electrolytes, novel interface engineering strategies to minimize resistance, and composite electrode designs that accommodate volume changes during cycling. These developments are crucial for solid-state sodium batteries to achieve performance metrics comparable to or exceeding those of current lithium-ion technologies.

The ultimate goal of this technological evolution is to establish solid-state sodium batteries as a commercially viable solution for grid-scale energy storage, electric vehicles, and portable electronics, leveraging sodium's abundance (2.6% of Earth's crust compared to lithium's 0.002%) and more sustainable supply chain.

The evolution of solid-state sodium battery technology has followed a trajectory from liquid electrolyte systems to hybrid electrolytes, and finally to all-solid-state configurations. This progression has been motivated by the need to address safety concerns, enhance energy density, and improve cycle life. Patent filings in this domain have grown exponentially since 2015, reflecting the intensifying research and development efforts globally.

The primary technical objectives in solid-state sodium battery development include achieving high ionic conductivity in solid electrolytes (>10^-3 S/cm at room temperature), resolving interface stability issues between electrodes and electrolytes, and developing scalable manufacturing processes. These objectives align with the broader goal of creating energy storage solutions that are safer, more sustainable, and economically viable compared to conventional lithium-ion technologies.

Current patent landscapes reveal concentrated efforts in developing novel sodium superionic conductor (NASICON) materials, polymer-ceramic composite electrolytes, and innovative cathode formulations. Companies and research institutions from China, Japan, South Korea, and the United States dominate the patent filings, with a notable increase in European contributions in recent years.

The technological trajectory suggests a convergence toward multi-layered architectures that combine different types of solid electrolytes to optimize performance. This approach addresses the inherent trade-offs between ionic conductivity, mechanical stability, and electrochemical compatibility that have historically limited solid-state sodium battery development.

Looking forward, the field is expected to witness accelerated innovation in three key areas: advanced manufacturing techniques for thin-film solid electrolytes, novel interface engineering strategies to minimize resistance, and composite electrode designs that accommodate volume changes during cycling. These developments are crucial for solid-state sodium batteries to achieve performance metrics comparable to or exceeding those of current lithium-ion technologies.

The ultimate goal of this technological evolution is to establish solid-state sodium batteries as a commercially viable solution for grid-scale energy storage, electric vehicles, and portable electronics, leveraging sodium's abundance (2.6% of Earth's crust compared to lithium's 0.002%) and more sustainable supply chain.

Market Analysis for Solid-State Sodium Battery Technologies

The solid-state sodium battery market is experiencing significant growth driven by increasing demand for sustainable energy storage solutions. Current market projections indicate the global solid-state sodium battery market could reach $500 million by 2025, with a compound annual growth rate exceeding 30% through 2030. This accelerated growth is primarily fueled by the inherent advantages of sodium-based technologies over traditional lithium-ion batteries, particularly in terms of resource availability and cost-effectiveness.

Demand analysis reveals several key market segments showing strong interest in solid-state sodium battery technologies. The grid-scale energy storage sector represents the largest potential market, with utilities seeking cost-effective solutions for renewable energy integration. Electric vehicles constitute another rapidly expanding segment, particularly in price-sensitive markets where the lower cost of sodium batteries provides a competitive advantage over lithium-ion alternatives.

Consumer electronics manufacturers are increasingly exploring sodium battery technologies for next-generation devices, attracted by improved safety profiles and potentially lower production costs. Industrial applications, including backup power systems and remote monitoring equipment, represent additional growth opportunities where the wider operating temperature range of sodium batteries offers significant advantages.

Regional market assessment indicates Asia-Pacific currently leads in both research activity and commercial development, with China, Japan, and South Korea making substantial investments in sodium battery manufacturing infrastructure. European markets show strong growth potential driven by stringent environmental regulations and renewable energy targets, while North American adoption is accelerating through strategic partnerships between technology developers and established battery manufacturers.

Market barriers include technical challenges related to energy density limitations compared to advanced lithium-ion batteries, manufacturing scalability issues, and consumer hesitancy toward adopting relatively unproven technologies. However, these barriers are gradually diminishing as research breakthroughs address performance limitations and demonstration projects validate real-world applications.

Customer demand analysis indicates price sensitivity remains the primary purchasing factor, with sodium batteries needing to demonstrate clear cost advantages over established technologies. Performance requirements vary significantly across applications, with grid storage prioritizing cycle life and cost, while automotive applications demand higher energy density and fast-charging capabilities.

The competitive landscape is evolving rapidly, with traditional battery manufacturers expanding their portfolios to include sodium-based technologies while specialized startups focus exclusively on solid-state sodium battery development. This market diversification is creating opportunities for strategic partnerships and technology licensing agreements across the value chain.

Demand analysis reveals several key market segments showing strong interest in solid-state sodium battery technologies. The grid-scale energy storage sector represents the largest potential market, with utilities seeking cost-effective solutions for renewable energy integration. Electric vehicles constitute another rapidly expanding segment, particularly in price-sensitive markets where the lower cost of sodium batteries provides a competitive advantage over lithium-ion alternatives.

Consumer electronics manufacturers are increasingly exploring sodium battery technologies for next-generation devices, attracted by improved safety profiles and potentially lower production costs. Industrial applications, including backup power systems and remote monitoring equipment, represent additional growth opportunities where the wider operating temperature range of sodium batteries offers significant advantages.

Regional market assessment indicates Asia-Pacific currently leads in both research activity and commercial development, with China, Japan, and South Korea making substantial investments in sodium battery manufacturing infrastructure. European markets show strong growth potential driven by stringent environmental regulations and renewable energy targets, while North American adoption is accelerating through strategic partnerships between technology developers and established battery manufacturers.

Market barriers include technical challenges related to energy density limitations compared to advanced lithium-ion batteries, manufacturing scalability issues, and consumer hesitancy toward adopting relatively unproven technologies. However, these barriers are gradually diminishing as research breakthroughs address performance limitations and demonstration projects validate real-world applications.

Customer demand analysis indicates price sensitivity remains the primary purchasing factor, with sodium batteries needing to demonstrate clear cost advantages over established technologies. Performance requirements vary significantly across applications, with grid storage prioritizing cycle life and cost, while automotive applications demand higher energy density and fast-charging capabilities.

The competitive landscape is evolving rapidly, with traditional battery manufacturers expanding their portfolios to include sodium-based technologies while specialized startups focus exclusively on solid-state sodium battery development. This market diversification is creating opportunities for strategic partnerships and technology licensing agreements across the value chain.

Current Technical Challenges in Solid-State Sodium Battery Development

Despite significant advancements in solid-state sodium battery technology, several critical technical challenges continue to impede widespread commercialization. The interface stability between solid electrolytes and electrodes remains one of the most formidable obstacles. Patent filings reveal persistent issues with high interfacial resistance and mechanical stress during charge-discharge cycles, leading to performance degradation over time. This challenge is particularly pronounced at the sodium metal anode interface, where dendrite formation and electrolyte decomposition frequently occur.

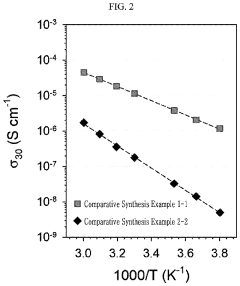

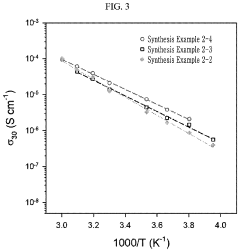

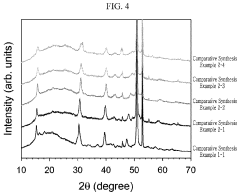

Electrolyte material development presents another significant hurdle. While patent activity shows increasing focus on NASICON-type and β-alumina solid electrolytes, achieving the optimal combination of high ionic conductivity (>10^-3 S/cm at room temperature), mechanical stability, and electrochemical stability within a wide voltage window remains elusive. Many promising materials exhibit excellent performance in one area but fall short in others, creating a complex optimization problem.

Manufacturing scalability emerges as a prominent challenge in recent patent filings. Current laboratory-scale production methods for solid electrolytes and electrode-electrolyte assemblies often involve complex, energy-intensive processes that are difficult to scale. Patents increasingly address sintering techniques, cold pressing methods, and novel composite approaches, yet cost-effective mass production remains unrealized.

Sodium dendrite growth and propagation through solid electrolytes represents another critical safety concern evident in patent literature. Unlike their lithium counterparts, sodium ions have larger radii and different electrochemical properties, requiring specialized approaches to dendrite suppression. Recent patents propose various interface engineering strategies and electrolyte additives, but a definitive solution remains undeveloped.

Cathode compatibility issues are frequently addressed in patent filings, with particular attention to volume changes during sodium insertion/extraction. These volumetric fluctuations create mechanical stress at the cathode-electrolyte interface, potentially leading to contact loss and capacity fading. While patents propose various buffer layers and gradient structures, achieving long-term stability remains challenging.

Temperature sensitivity presents another significant barrier, with many solid electrolytes showing dramatic conductivity drops at lower temperatures. This limitation severely restricts practical applications in variable climate conditions. Patent activity increasingly focuses on composite electrolytes and novel dopants to expand the operational temperature range, though breakthroughs remain limited.

Finally, analytical techniques for characterizing solid-state sodium battery components and interfaces in situ represent an emerging challenge area in patent filings. The development of specialized tools for monitoring interfacial phenomena, ion transport mechanisms, and degradation processes in real-time is critical for advancing fundamental understanding and accelerating technology development.

Electrolyte material development presents another significant hurdle. While patent activity shows increasing focus on NASICON-type and β-alumina solid electrolytes, achieving the optimal combination of high ionic conductivity (>10^-3 S/cm at room temperature), mechanical stability, and electrochemical stability within a wide voltage window remains elusive. Many promising materials exhibit excellent performance in one area but fall short in others, creating a complex optimization problem.

Manufacturing scalability emerges as a prominent challenge in recent patent filings. Current laboratory-scale production methods for solid electrolytes and electrode-electrolyte assemblies often involve complex, energy-intensive processes that are difficult to scale. Patents increasingly address sintering techniques, cold pressing methods, and novel composite approaches, yet cost-effective mass production remains unrealized.

Sodium dendrite growth and propagation through solid electrolytes represents another critical safety concern evident in patent literature. Unlike their lithium counterparts, sodium ions have larger radii and different electrochemical properties, requiring specialized approaches to dendrite suppression. Recent patents propose various interface engineering strategies and electrolyte additives, but a definitive solution remains undeveloped.

Cathode compatibility issues are frequently addressed in patent filings, with particular attention to volume changes during sodium insertion/extraction. These volumetric fluctuations create mechanical stress at the cathode-electrolyte interface, potentially leading to contact loss and capacity fading. While patents propose various buffer layers and gradient structures, achieving long-term stability remains challenging.

Temperature sensitivity presents another significant barrier, with many solid electrolytes showing dramatic conductivity drops at lower temperatures. This limitation severely restricts practical applications in variable climate conditions. Patent activity increasingly focuses on composite electrolytes and novel dopants to expand the operational temperature range, though breakthroughs remain limited.

Finally, analytical techniques for characterizing solid-state sodium battery components and interfaces in situ represent an emerging challenge area in patent filings. The development of specialized tools for monitoring interfacial phenomena, ion transport mechanisms, and degradation processes in real-time is critical for advancing fundamental understanding and accelerating technology development.

Leading Technical Solutions in Solid-State Sodium Battery Patents

01 Electrode materials for solid-state sodium batteries

Various electrode materials have been developed for solid-state sodium batteries to improve performance and stability. These materials include novel cathode compositions, anode structures, and interface modifications that enhance sodium ion transport and storage capabilities. Advanced electrode designs help overcome challenges related to volume changes during cycling and improve the overall energy density of solid-state sodium batteries.- Electrode materials for solid-state sodium batteries: Various electrode materials are being developed for solid-state sodium batteries to improve energy density and cycling stability. These materials include sodium-based compounds and composite structures that facilitate efficient sodium ion transport while maintaining structural integrity during charge-discharge cycles. Advanced electrode designs incorporate nanostructured materials and conductive additives to enhance electrochemical performance and reduce interfacial resistance.

- Solid electrolyte compositions for sodium batteries: Solid electrolytes for sodium batteries are being formulated to achieve high ionic conductivity at room temperature while maintaining mechanical stability. These electrolytes include ceramic materials, polymer composites, and glass-ceramic hybrids that enable efficient sodium ion transport between electrodes. Research focuses on reducing interfacial resistance and enhancing compatibility with electrode materials to improve overall battery performance and safety.

- Interface engineering in solid-state sodium batteries: Interface engineering techniques are being developed to address challenges at the electrode-electrolyte interfaces in solid-state sodium batteries. These approaches include surface coatings, buffer layers, and gradient structures that minimize interfacial resistance and prevent unwanted side reactions. Innovations in this area focus on maintaining stable interfaces during cycling to improve battery lifespan and performance.

- Manufacturing processes for solid-state sodium batteries: Novel manufacturing processes are being patented for the production of solid-state sodium batteries with improved scalability and cost-effectiveness. These processes include advanced powder processing techniques, thin-film deposition methods, and innovative cell assembly approaches. Developments focus on achieving uniform interfaces, reducing defects, and enabling mass production of solid-state sodium batteries with consistent performance.

- Battery management systems for solid-state sodium batteries: Specialized battery management systems are being developed for solid-state sodium batteries to optimize performance and ensure safety. These systems include advanced monitoring algorithms, thermal management solutions, and charging protocols tailored to the unique characteristics of sodium-based chemistry. Innovations focus on extending battery lifespan, preventing dendrite formation, and enabling efficient operation across various temperature ranges.

02 Solid electrolyte compositions for sodium batteries

Solid electrolyte materials specifically designed for sodium-ion conduction are critical components in solid-state sodium batteries. These electrolytes typically include sodium-containing ceramics, polymer composites, or glass-ceramic materials that facilitate efficient sodium ion transport while maintaining mechanical stability. Innovations in electrolyte composition focus on improving ionic conductivity at room temperature while preventing dendrite formation and maintaining compatibility with electrode materials.Expand Specific Solutions03 Manufacturing processes for solid-state sodium batteries

Novel manufacturing techniques have been developed to address the challenges in producing solid-state sodium batteries at scale. These processes include specialized methods for layer deposition, interface engineering, and cell assembly that ensure good contact between components while minimizing manufacturing defects. Advanced production methods aim to reduce costs and improve the consistency and reliability of solid-state sodium battery production.Expand Specific Solutions04 Interface engineering in solid-state sodium batteries

Interface engineering is crucial for improving the performance and longevity of solid-state sodium batteries. Techniques include surface coatings, buffer layers, and gradient structures that enhance the stability of the electrode-electrolyte interface. These innovations help reduce interfacial resistance, prevent unwanted side reactions, and maintain good mechanical contact between battery components during cycling.Expand Specific Solutions05 Battery management systems for solid-state sodium batteries

Specialized battery management systems have been developed to optimize the performance and safety of solid-state sodium batteries. These systems include advanced monitoring technologies, thermal management solutions, and control algorithms tailored to the unique characteristics of sodium-based chemistry. Effective battery management helps extend cycle life, improve safety, and maximize the energy efficiency of solid-state sodium battery systems.Expand Specific Solutions

Key Industry Players and Patent Holders Analysis

The solid-state sodium battery patent landscape reflects an industry in early growth phase, with market size expanding as companies seek alternatives to lithium-ion technology. Technical maturity remains developing, with significant R&D investment but limited commercialization. Key players include established battery manufacturers (CATL, BYD, LG Energy Solution, QuantumScape), automotive companies (Toyota, Honda, Samsung), and research institutions (Shanghai Institute of Ceramics, University of Houston, Cornell). Chinese and Japanese entities dominate filings, with companies focusing on electrolyte compositions, interface stability, and manufacturing processes. Academic-industry collaborations are accelerating development as the technology approaches commercial viability for energy storage applications.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL's solid-state sodium battery patents focus on novel electrolyte compositions that enable stable sodium ion transport while preventing dendrite formation. Their technology utilizes a composite solid electrolyte system combining polymer matrices with ceramic fillers (typically NASICON-type materials) to achieve optimal ionic conductivity at room temperature. CATL has developed proprietary interface engineering techniques to address the critical solid-electrolyte/electrode interface challenges, employing specialized coatings that minimize interfacial resistance. Their patents also cover innovative cathode materials based on layered oxide structures that accommodate sodium's larger ionic radius compared to lithium. CATL's manufacturing approach emphasizes scalability through adaptation of existing production lines, potentially enabling faster commercialization compared to competitors requiring entirely new manufacturing processes.

Strengths: Superior cost advantage due to abundant sodium resources; leverages existing manufacturing infrastructure; demonstrates good cycling stability. Weaknesses: Lower energy density compared to lithium-based systems; challenges with electrolyte stability at higher voltages; interface resistance issues still not fully resolved.

BYD Co., Ltd.

Technical Solution: BYD's solid-state sodium battery patents reveal a distinctive approach focusing on a hybrid electrolyte system that combines the advantages of both solid and quasi-solid components. Their technology employs a sodium superionic conductor framework with proprietary additives to enhance ionic conductivity at the critical electrode-electrolyte interfaces. BYD has developed specialized sodium-containing cathode materials with optimized crystal structures that facilitate rapid sodium ion diffusion while maintaining structural stability during cycling. Their patents also detail innovative anode designs using carbon-based materials with engineered porosity to accommodate sodium's volume changes during charge/discharge cycles. BYD's manufacturing patents indicate a dry-film preparation method that eliminates the need for toxic organic solvents, potentially reducing production costs and environmental impact while improving safety profiles.

Strengths: Excellent thermal stability reducing cooling system requirements; potentially lower manufacturing costs through solvent-free processing; good compatibility with existing production equipment. Weaknesses: Moderate energy density limitations compared to lithium systems; challenges with long-term cycling stability at elevated temperatures; interface degradation issues during extended cycling.

Critical Patent Innovations and Technical Breakthroughs

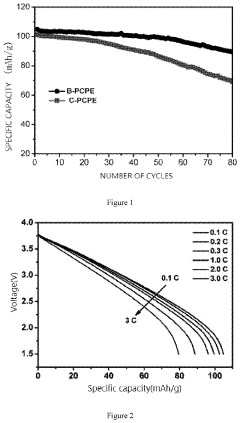

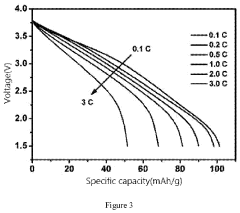

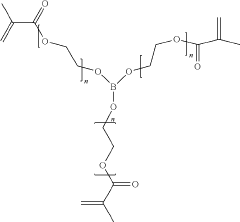

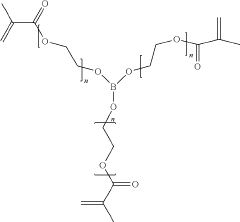

Boron-Containing Plastic Crystal Polymer and Preparation Method therefor and Application thereof

PatentActiveUS20220052377A1

Innovation

- A boron-containing plastic crystal polymer is prepared through a method involving a mixture of a plastic crystal, a metal salt, a boron-containing ternary crosslinker, and a photoinitiator, which is then cured and used as a solid-state electrolyte in all-solid-state ion batteries, enhancing ionic conductivity and mechanical strength.

Sodium Halide-based Nanocomposite, Preparing Method Thereof, and Positive Electrode Active Material, Solid Electrolyte, and All-solid-state Battery Comprising the Same

PatentPendingUS20230411616A1

Innovation

- A sodium halide-based nanocomposite is developed, where a nanosized compound is dispersed in a halide compound to enhance ionic conductivity and interfacial stability, forming a glass-ceramic crystal structure that improves the performance of all-solid-state batteries by activating an interfacial conduction phenomenon.

Intellectual Property Landscape and Strategic Patent Positioning

The solid-state sodium battery patent landscape reveals significant strategic positioning by key industry players. Analysis of recent filings shows a concentrated effort among major corporations and research institutions to secure intellectual property rights in this emerging technology space. Companies like Toyota, Samsung, and CATL have established substantial patent portfolios, indicating their commitment to commercializing solid-state sodium battery technology as a viable alternative to lithium-ion systems.

Patent filing trends demonstrate a notable increase in activity over the past five years, with particular emphasis on electrolyte materials and interface engineering. These areas represent critical technological barriers to commercial viability. The geographical distribution of patent filings shows strong activity in East Asia, particularly Japan, South Korea, and China, followed by the United States and Europe, reflecting the global competition in this space.

Strategic patent positioning reveals different approaches among key players. Established battery manufacturers tend to focus on incremental improvements to existing technologies, while automotive companies prioritize integration and system-level innovations. Research institutions and startups often pursue more radical innovations in materials science and manufacturing processes, creating a diverse innovation ecosystem.

Cross-licensing agreements and patent pools are beginning to emerge as companies recognize the complex interdependencies within the technology stack. This collaborative approach to intellectual property management suggests a maturing field where stakeholders acknowledge that no single entity controls all necessary patents for commercial deployment.

Defensive patenting strategies are evident in the filing patterns of several major players who are creating broad patent families to protect their core innovations while establishing barriers to competitors. This approach includes the strategic use of continuation applications and divisional patents to extend protection timelines and coverage scope.

The quality of patents, measured by citation rates and legal validity challenges, varies significantly across the landscape. Leading organizations demonstrate a preference for fewer, higher-quality patents with broader claims rather than numerous narrow filings. This suggests a shift toward strategic quality over quantity in patent portfolio development for solid-state sodium battery technology.

Emerging white space opportunities exist in manufacturing scalability, recycling methodologies, and system integration techniques, representing potential areas for new entrants to establish intellectual property positions without directly challenging established players' core patents.

Patent filing trends demonstrate a notable increase in activity over the past five years, with particular emphasis on electrolyte materials and interface engineering. These areas represent critical technological barriers to commercial viability. The geographical distribution of patent filings shows strong activity in East Asia, particularly Japan, South Korea, and China, followed by the United States and Europe, reflecting the global competition in this space.

Strategic patent positioning reveals different approaches among key players. Established battery manufacturers tend to focus on incremental improvements to existing technologies, while automotive companies prioritize integration and system-level innovations. Research institutions and startups often pursue more radical innovations in materials science and manufacturing processes, creating a diverse innovation ecosystem.

Cross-licensing agreements and patent pools are beginning to emerge as companies recognize the complex interdependencies within the technology stack. This collaborative approach to intellectual property management suggests a maturing field where stakeholders acknowledge that no single entity controls all necessary patents for commercial deployment.

Defensive patenting strategies are evident in the filing patterns of several major players who are creating broad patent families to protect their core innovations while establishing barriers to competitors. This approach includes the strategic use of continuation applications and divisional patents to extend protection timelines and coverage scope.

The quality of patents, measured by citation rates and legal validity challenges, varies significantly across the landscape. Leading organizations demonstrate a preference for fewer, higher-quality patents with broader claims rather than numerous narrow filings. This suggests a shift toward strategic quality over quantity in patent portfolio development for solid-state sodium battery technology.

Emerging white space opportunities exist in manufacturing scalability, recycling methodologies, and system integration techniques, representing potential areas for new entrants to establish intellectual property positions without directly challenging established players' core patents.

Sustainability and Resource Considerations for Sodium Battery Technology

The sustainability profile of sodium battery technology represents a significant advantage in patent filings, with numerous innovations focusing on reducing environmental impact compared to lithium-ion alternatives. Patent analysis reveals that sodium's abundance—approximately 1000 times more plentiful than lithium in the Earth's crust—is consistently highlighted as a primary sustainability benefit. This abundance translates to lower extraction impacts and reduced geopolitical supply risks, factors prominently featured in recent patent applications.

Material sourcing considerations appear prominently in solid-state sodium battery patents, with innovations targeting the replacement of critical materials found in lithium batteries. Patents increasingly focus on eliminating cobalt and nickel dependencies—metals associated with ethical mining concerns and supply chain vulnerabilities. Instead, filings demonstrate preference for manganese, iron, and other more abundant elements as cathode components, reflecting a deliberate shift toward more sustainable material selections.

Manufacturing process innovations represent another sustainability theme in patent filings. Documents reveal techniques requiring lower processing temperatures and less energy-intensive production methods compared to conventional lithium-ion manufacturing. Several patents specifically address reduced solvent usage and water consumption during production, highlighting the potential for decreased environmental footprint throughout the battery lifecycle.

End-of-life considerations are gaining prominence in recent sodium battery patents. Recycling-focused innovations appear with increasing frequency, with patents describing specialized processes for recovering sodium and other components from spent batteries. These filings often emphasize the simpler recycling pathways for sodium batteries compared to lithium technologies, potentially offering circular economy advantages that strengthen the sustainability proposition.

Carbon footprint reduction claims feature prominently in patent justifications, with quantitative assessments suggesting 15-30% lower lifecycle emissions compared to lithium-ion counterparts. These environmental benefits derive from the combination of abundant raw materials, less energy-intensive processing, and improved recyclability. Such sustainability advantages are increasingly positioned as key competitive differentiators in patent applications, reflecting market recognition of environmental performance as a critical factor in next-generation battery development.

Material sourcing considerations appear prominently in solid-state sodium battery patents, with innovations targeting the replacement of critical materials found in lithium batteries. Patents increasingly focus on eliminating cobalt and nickel dependencies—metals associated with ethical mining concerns and supply chain vulnerabilities. Instead, filings demonstrate preference for manganese, iron, and other more abundant elements as cathode components, reflecting a deliberate shift toward more sustainable material selections.

Manufacturing process innovations represent another sustainability theme in patent filings. Documents reveal techniques requiring lower processing temperatures and less energy-intensive production methods compared to conventional lithium-ion manufacturing. Several patents specifically address reduced solvent usage and water consumption during production, highlighting the potential for decreased environmental footprint throughout the battery lifecycle.

End-of-life considerations are gaining prominence in recent sodium battery patents. Recycling-focused innovations appear with increasing frequency, with patents describing specialized processes for recovering sodium and other components from spent batteries. These filings often emphasize the simpler recycling pathways for sodium batteries compared to lithium technologies, potentially offering circular economy advantages that strengthen the sustainability proposition.

Carbon footprint reduction claims feature prominently in patent justifications, with quantitative assessments suggesting 15-30% lower lifecycle emissions compared to lithium-ion counterparts. These environmental benefits derive from the combination of abundant raw materials, less energy-intensive processing, and improved recyclability. Such sustainability advantages are increasingly positioned as key competitive differentiators in patent applications, reflecting market recognition of environmental performance as a critical factor in next-generation battery development.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!