Projected market trends for solid-state sodium battery materials

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid-State Sodium Battery Evolution and Objectives

Solid-state sodium batteries represent a significant evolution in energy storage technology, emerging as a promising alternative to conventional lithium-ion batteries. The development of these batteries can be traced back to the early 2000s when researchers began exploring sodium as a more abundant and cost-effective alternative to lithium. The fundamental principle behind this technology involves replacing the liquid electrolyte found in traditional batteries with solid-state materials, enhancing safety, energy density, and longevity.

The evolution of solid-state sodium batteries has progressed through several key phases. Initially, research focused on identifying suitable solid electrolyte materials with adequate ionic conductivity. By the mid-2010s, significant breakthroughs in sodium superionic conductor (NASICON) materials and beta-alumina solid electrolytes accelerated development efforts. Recent advancements have centered on addressing interface challenges between electrodes and electrolytes, as well as scaling up manufacturing processes for commercial viability.

Current technological trends indicate a shift toward multi-component electrolyte systems that combine the advantages of different materials to optimize performance. Researchers are increasingly focusing on room-temperature operation capabilities, which would significantly expand application possibilities. Additionally, there is growing interest in developing flexible solid-state sodium batteries to meet the demands of wearable electronics and other emerging applications.

The primary objective of solid-state sodium battery development is to create a commercially viable energy storage solution that addresses the limitations of lithium-ion technology. Specific goals include achieving energy densities exceeding 300 Wh/kg, cycle life of over 1,000 cycles, and significant cost reductions compared to current lithium-ion batteries. Safety enhancement remains a paramount objective, with the elimination of flammable liquid electrolytes addressing a critical weakness in conventional battery technologies.

Environmental sustainability constitutes another crucial objective, with sodium's greater abundance (approximately 1,000 times more plentiful than lithium) offering reduced resource constraints and potentially lower environmental impact. The technology aims to support grid-scale energy storage applications, electric vehicles, and consumer electronics, with each application presenting unique performance requirements and technical challenges.

Looking forward, the technology roadmap for solid-state sodium batteries envisions commercial deployment in specialized applications by 2025, followed by broader market penetration in consumer electronics by 2027-2028. Mass adoption in electric vehicles and grid storage is projected for the 2030-2035 timeframe, contingent upon overcoming remaining technical hurdles related to manufacturing scalability and long-term stability.

The evolution of solid-state sodium batteries has progressed through several key phases. Initially, research focused on identifying suitable solid electrolyte materials with adequate ionic conductivity. By the mid-2010s, significant breakthroughs in sodium superionic conductor (NASICON) materials and beta-alumina solid electrolytes accelerated development efforts. Recent advancements have centered on addressing interface challenges between electrodes and electrolytes, as well as scaling up manufacturing processes for commercial viability.

Current technological trends indicate a shift toward multi-component electrolyte systems that combine the advantages of different materials to optimize performance. Researchers are increasingly focusing on room-temperature operation capabilities, which would significantly expand application possibilities. Additionally, there is growing interest in developing flexible solid-state sodium batteries to meet the demands of wearable electronics and other emerging applications.

The primary objective of solid-state sodium battery development is to create a commercially viable energy storage solution that addresses the limitations of lithium-ion technology. Specific goals include achieving energy densities exceeding 300 Wh/kg, cycle life of over 1,000 cycles, and significant cost reductions compared to current lithium-ion batteries. Safety enhancement remains a paramount objective, with the elimination of flammable liquid electrolytes addressing a critical weakness in conventional battery technologies.

Environmental sustainability constitutes another crucial objective, with sodium's greater abundance (approximately 1,000 times more plentiful than lithium) offering reduced resource constraints and potentially lower environmental impact. The technology aims to support grid-scale energy storage applications, electric vehicles, and consumer electronics, with each application presenting unique performance requirements and technical challenges.

Looking forward, the technology roadmap for solid-state sodium batteries envisions commercial deployment in specialized applications by 2025, followed by broader market penetration in consumer electronics by 2027-2028. Mass adoption in electric vehicles and grid storage is projected for the 2030-2035 timeframe, contingent upon overcoming remaining technical hurdles related to manufacturing scalability and long-term stability.

Market Demand Analysis for Na-ion Battery Materials

The global market for sodium-ion battery materials is experiencing significant growth, driven by the increasing demand for sustainable and cost-effective energy storage solutions. Current projections indicate that the sodium-ion battery market could reach $500 million by 2025, with a compound annual growth rate exceeding 20% over the next decade. This growth is primarily fueled by the escalating need for grid-scale energy storage systems, which are essential for integrating renewable energy sources into existing power infrastructures.

The electric vehicle (EV) sector represents another substantial market opportunity for sodium-ion battery materials. While lithium-ion batteries currently dominate this space, concerns regarding lithium supply constraints and geopolitical factors are prompting manufacturers to explore alternative technologies. Industry analysts predict that sodium-ion batteries could capture up to 15% of the EV battery market by 2030, particularly in applications where energy density requirements are less stringent, such as urban delivery vehicles and public transportation.

Consumer electronics manufacturers are also showing increased interest in sodium-ion technology, especially for devices where cost considerations outweigh the need for maximum energy density. Market research indicates that approximately 8% of portable electronic devices could incorporate sodium-ion batteries by 2028, creating a diverse application ecosystem for these materials.

Geographically, Asia-Pacific currently leads in sodium-ion battery material demand, with China at the forefront of both production and consumption. European markets are expected to show the fastest growth rate in the coming years, driven by stringent environmental regulations and substantial investments in renewable energy infrastructure. North American demand is projected to accelerate after 2025, as domestic supply chains develop and commercial applications expand.

From a materials perspective, cathode materials represent the largest segment of the sodium-ion battery materials market, accounting for approximately 40% of the total value. Hard carbon anodes constitute roughly 30% of the market, while electrolytes and separators make up the remainder. The cathode materials segment is expected to maintain its dominant position, with innovations in layered oxide and polyanionic compounds driving performance improvements.

Price sensitivity analysis reveals that sodium-ion battery materials offer a compelling value proposition, with raw material costs approximately 30-40% lower than comparable lithium-ion chemistries. This cost advantage is expected to widen as production scales and manufacturing processes mature, further accelerating market adoption across various applications.

The electric vehicle (EV) sector represents another substantial market opportunity for sodium-ion battery materials. While lithium-ion batteries currently dominate this space, concerns regarding lithium supply constraints and geopolitical factors are prompting manufacturers to explore alternative technologies. Industry analysts predict that sodium-ion batteries could capture up to 15% of the EV battery market by 2030, particularly in applications where energy density requirements are less stringent, such as urban delivery vehicles and public transportation.

Consumer electronics manufacturers are also showing increased interest in sodium-ion technology, especially for devices where cost considerations outweigh the need for maximum energy density. Market research indicates that approximately 8% of portable electronic devices could incorporate sodium-ion batteries by 2028, creating a diverse application ecosystem for these materials.

Geographically, Asia-Pacific currently leads in sodium-ion battery material demand, with China at the forefront of both production and consumption. European markets are expected to show the fastest growth rate in the coming years, driven by stringent environmental regulations and substantial investments in renewable energy infrastructure. North American demand is projected to accelerate after 2025, as domestic supply chains develop and commercial applications expand.

From a materials perspective, cathode materials represent the largest segment of the sodium-ion battery materials market, accounting for approximately 40% of the total value. Hard carbon anodes constitute roughly 30% of the market, while electrolytes and separators make up the remainder. The cathode materials segment is expected to maintain its dominant position, with innovations in layered oxide and polyanionic compounds driving performance improvements.

Price sensitivity analysis reveals that sodium-ion battery materials offer a compelling value proposition, with raw material costs approximately 30-40% lower than comparable lithium-ion chemistries. This cost advantage is expected to widen as production scales and manufacturing processes mature, further accelerating market adoption across various applications.

Current State and Challenges in Solid Electrolyte Development

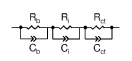

The development of solid electrolytes represents one of the most critical challenges in advancing solid-state sodium battery technology. Currently, three main categories of solid electrolytes dominate research efforts: polymer electrolytes, oxide-based ceramic electrolytes, and sulfide-based electrolytes. Each category presents distinct advantages and limitations that influence their commercial viability.

Polymer electrolytes offer excellent flexibility and processability but suffer from low ionic conductivity at room temperature (typically 10^-7 to 10^-5 S/cm), significantly limiting their practical application. Recent research has focused on incorporating ceramic fillers to create composite polymer electrolytes, which has improved conductivity but introduced new interface management challenges.

Oxide-based ceramic electrolytes, particularly NASICON-type structures, demonstrate good chemical stability and moderate ionic conductivity (10^-4 to 10^-3 S/cm at room temperature). However, they require high-temperature sintering processes that complicate manufacturing and increase production costs. The brittle nature of these materials also presents challenges for large-scale battery production.

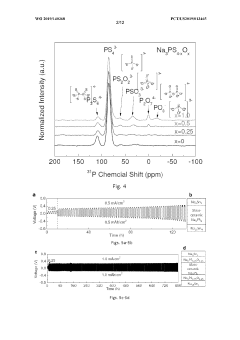

Sulfide-based electrolytes currently show the most promising ionic conductivity values (up to 10^-2 S/cm at room temperature), approaching those of liquid electrolytes. Despite this advantage, they remain highly sensitive to moisture and air, necessitating stringent manufacturing conditions. The interface stability between sulfide electrolytes and electrode materials also presents significant challenges.

A major technical hurdle across all solid electrolyte types is the solid-solid interface management. Unlike liquid electrolytes that naturally conform to electrode surfaces, solid electrolytes create resistance at interfaces that impedes ion transport. This challenge is compounded by volume changes during cycling, which can create microcracks and further increase resistance.

Geographically, research leadership in solid electrolytes shows distinct patterns. Japan leads in sulfide-based electrolytes with companies like Toyota and academic institutions making significant breakthroughs. European research centers excel in oxide-based systems, while North American institutions focus heavily on polymer and composite electrolyte development. China has rapidly increased its research output across all electrolyte types, particularly in scaling up manufacturing processes.

The economic viability of solid electrolytes remains constrained by high production costs. Current manufacturing methods for high-performance solid electrolytes are approximately 5-10 times more expensive than conventional liquid electrolyte production. This cost differential represents a significant barrier to commercialization that must be addressed through process innovation and economies of scale.

Polymer electrolytes offer excellent flexibility and processability but suffer from low ionic conductivity at room temperature (typically 10^-7 to 10^-5 S/cm), significantly limiting their practical application. Recent research has focused on incorporating ceramic fillers to create composite polymer electrolytes, which has improved conductivity but introduced new interface management challenges.

Oxide-based ceramic electrolytes, particularly NASICON-type structures, demonstrate good chemical stability and moderate ionic conductivity (10^-4 to 10^-3 S/cm at room temperature). However, they require high-temperature sintering processes that complicate manufacturing and increase production costs. The brittle nature of these materials also presents challenges for large-scale battery production.

Sulfide-based electrolytes currently show the most promising ionic conductivity values (up to 10^-2 S/cm at room temperature), approaching those of liquid electrolytes. Despite this advantage, they remain highly sensitive to moisture and air, necessitating stringent manufacturing conditions. The interface stability between sulfide electrolytes and electrode materials also presents significant challenges.

A major technical hurdle across all solid electrolyte types is the solid-solid interface management. Unlike liquid electrolytes that naturally conform to electrode surfaces, solid electrolytes create resistance at interfaces that impedes ion transport. This challenge is compounded by volume changes during cycling, which can create microcracks and further increase resistance.

Geographically, research leadership in solid electrolytes shows distinct patterns. Japan leads in sulfide-based electrolytes with companies like Toyota and academic institutions making significant breakthroughs. European research centers excel in oxide-based systems, while North American institutions focus heavily on polymer and composite electrolyte development. China has rapidly increased its research output across all electrolyte types, particularly in scaling up manufacturing processes.

The economic viability of solid electrolytes remains constrained by high production costs. Current manufacturing methods for high-performance solid electrolytes are approximately 5-10 times more expensive than conventional liquid electrolyte production. This cost differential represents a significant barrier to commercialization that must be addressed through process innovation and economies of scale.

Current Material Solutions for Solid-State Sodium Batteries

01 Solid electrolyte materials for sodium batteries

Various solid electrolyte materials are being developed for sodium batteries to improve safety and performance. These materials include sodium-ion conducting ceramics, polymer electrolytes, and composite materials that offer high ionic conductivity while preventing dendrite formation. The development of these solid electrolytes is crucial for the commercialization of solid-state sodium batteries as they address key challenges related to interface stability and ion transport.- Solid electrolyte materials for sodium batteries: Various solid electrolyte materials are being developed for sodium batteries to improve safety and energy density. These materials include sodium superionic conductors, polymer-based electrolytes, and ceramic composites that facilitate sodium ion transport while preventing dendrite formation. Recent innovations focus on materials with high ionic conductivity at room temperature and improved interfacial stability with electrode materials.

- Electrode materials and interfaces for solid-state sodium batteries: Advanced electrode materials for solid-state sodium batteries are being developed to enhance performance and cycle life. These include novel cathode materials with high sodium storage capacity, anode materials with reduced volume expansion, and engineered interfaces that minimize resistance. Research is focused on improving the electrode-electrolyte interface to enhance ion transfer and prevent degradation during cycling.

- Manufacturing processes and scalability: Innovative manufacturing techniques are emerging to enable commercial production of solid-state sodium batteries. These include advanced coating methods, dry processing techniques, and assembly processes that ensure uniform interfaces between components. The focus is on developing cost-effective, scalable production methods that maintain performance while reducing manufacturing complexity and environmental impact.

- Market growth and commercial applications: The solid-state sodium battery market is experiencing significant growth driven by increasing demand for sustainable energy storage solutions. These batteries are finding applications in grid storage, electric vehicles, and portable electronics due to their potential cost advantages over lithium-ion technologies. Market trends indicate expanding investment in research and development, with several companies moving toward commercialization and large-scale production.

- Next-generation sodium battery technologies: Emerging technologies in solid-state sodium batteries include hybrid electrolyte systems, multi-layer architectures, and novel cell designs that address current limitations. Research is focused on room-temperature operation, fast charging capabilities, and extended cycle life. These next-generation technologies aim to surpass conventional lithium-ion batteries in terms of safety, sustainability, and cost-effectiveness for various applications.

02 Cathode materials for solid-state sodium batteries

Advanced cathode materials for solid-state sodium batteries are being developed to enhance energy density and cycling stability. These materials include layered oxide compounds, polyanionic compounds, and Prussian blue analogs that can accommodate sodium ions efficiently. Research is focused on improving the structural stability of these materials during repeated sodium insertion and extraction, which is essential for long-term battery performance.Expand Specific Solutions03 Anode materials innovation for sodium batteries

Novel anode materials are being developed to replace traditional graphite anodes that are less effective for sodium-ion storage. These include hard carbons, alloy-based materials, and sodium titanate compounds that offer higher capacity and better compatibility with solid electrolytes. The market is seeing increased interest in materials that can accommodate the larger sodium ions while maintaining structural integrity during cycling.Expand Specific Solutions04 Manufacturing processes and scalability

Innovations in manufacturing processes are addressing the scalability challenges of solid-state sodium battery production. These include new coating techniques, interface engineering methods, and assembly processes that can be implemented at industrial scale. The market is witnessing the development of cost-effective production methods that maintain the quality and performance of these advanced battery materials while enabling mass production.Expand Specific Solutions05 Market growth and commercial applications

The solid-state sodium battery materials market is experiencing significant growth driven by increasing demand for sustainable energy storage solutions. These batteries are finding applications in grid storage, electric vehicles, and portable electronics due to their potential cost advantages over lithium-ion technologies. Market trends indicate growing investments in research and development, strategic partnerships between material suppliers and battery manufacturers, and increasing patent activities in regions focusing on energy transition.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The solid-state sodium battery materials market is currently in an early growth phase, characterized by increasing R&D investments and emerging commercial applications. Market size is projected to expand significantly, driven by the need for sustainable energy storage alternatives to lithium-ion batteries. While still developing, the technology is advancing rapidly with key players like Toyota Motor Corp. and Ningde Amperex Technology Ltd. leading commercial development, alongside research institutions such as The University of Michigan and Centre National de la Recherche Scientifique providing foundational innovations. Companies like GEM Co. and Guangdong Bangpu are positioning in the materials recycling segment, while established manufacturers including Panasonic and Corning are exploring component development, indicating a maturing ecosystem across the value chain.

Toyota Motor Corp.

Technical Solution: Toyota has developed a proprietary solid-state sodium battery technology focusing on safety and longevity rather than solely on energy density. Their approach utilizes a beta-alumina solid electrolyte (BASE) combined with a sodium metal anode and a specialized cathode material. Toyota's research has yielded sodium batteries with operational stability across a wide temperature range (-30°C to 60°C) and a projected lifespan exceeding 3,000 charge cycles. The company has integrated this technology into their broader energy storage strategy, positioning sodium batteries as complementary to their lithium and hydrogen technologies. Toyota has established partnerships with material suppliers to secure sodium resources, which are approximately 1000 times more abundant than lithium in the earth's crust, supporting their sustainability goals and reducing supply chain vulnerabilities.

Strengths: Extensive manufacturing expertise, strong supply chain management, and significant R&D resources allow Toyota to accelerate commercialization. Their diversified energy storage portfolio reduces technology risk. Weaknesses: As an automotive company, their primary focus remains on lithium technologies for vehicles, potentially limiting resources allocated to sodium battery development compared to pure battery manufacturers.

Uchicago Argonne LLC

Technical Solution: Argonne National Laboratory has developed advanced sodium-ion battery materials through their comprehensive research program. Their technology focuses on a novel class of layered oxide cathode materials (P2-type Na2/3Fe1/2Mn1/2O2) that delivers high capacity retention and structural stability during cycling. Argonne's research has yielded sodium-ion cells with energy densities approaching 130Wh/kg while maintaining 80% capacity after 2000 cycles. Their materials science approach includes atomic-level characterization using advanced synchrotron techniques to understand sodium ion transport mechanisms and structural evolution during cycling. Argonne has also developed computational models to predict material performance and accelerate screening of new sodium battery compositions. Their technology roadmap indicates potential for reaching 160Wh/kg by 2025 through optimization of electrode architectures and electrolyte formulations. Argonne collaborates with multiple industrial partners to transition these technologies from lab to commercial scale.

Strengths: World-class research facilities and scientific expertise enable fundamental breakthroughs in materials science. Their government-backed research provides stable funding for long-term innovation without immediate commercial pressure. Weaknesses: As a research institution, Argonne lacks manufacturing capabilities and must rely on industry partners for commercialization, potentially slowing market entry of their technologies.

Critical Patents and Innovations in Na-ion Technology

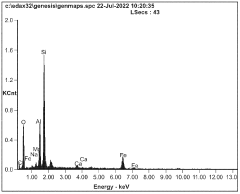

Solid electrolyte for sodium batteries

PatentWO2019140368A1

Innovation

- A new class of sodium oxy-sulfide solid-state electrolytes with a microstructure approaching a continuous glass is developed, providing enhanced chemical stability and mechanical strength, achieved through a low-temperature ball-milling and pressing process, allowing for the formation of a nearly flawless glassy structure that is stable with sodium metal or alloys.

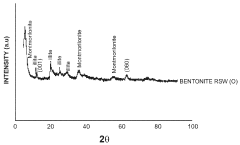

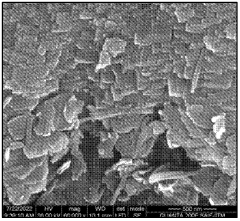

Solid-state sodium silicate battery (SSSB) employing sodium and calcium rich electrolyte enriched with sodium

PatentWO2023242870A1

Innovation

- A solid-state sodium silicate battery (SSSB) is developed, utilizing a sodium and calcium-rich electrolyte enriched with sodium, where the cathode is made of sodium silicate and the anode of carbon black, with a separator membrane coated with a naturally sodium and calcium-rich material further enriched with sodium, acting as a solid-state electrolyte.

Supply Chain Analysis of Critical Raw Materials

The sodium battery materials supply chain presents a complex ecosystem with distinct challenges compared to lithium-based technologies. Raw material availability for sodium-ion batteries offers significant advantages, with sodium being the sixth most abundant element in the Earth's crust (2.6%), vastly exceeding lithium's scarcity (0.006%). This abundance translates to more geographically distributed resources, reducing geopolitical supply risks that currently plague lithium supply chains.

Critical materials for sodium battery production include sodium salts (carbonates and hydroxides), cathode materials (primarily layered oxides containing transition metals like iron, manganese, and nickel), anode materials (hard carbon derived from biomass or petroleum coke), and solid electrolytes (NASICON-type ceramics, sodium beta-alumina, and polymer-based systems). Unlike lithium batteries, sodium technologies can utilize aluminum instead of copper for current collectors, representing significant cost advantages.

The geographical distribution of these materials presents a more balanced picture than lithium supply chains. While China currently dominates processing capabilities for most battery materials, sodium's widespread availability enables more countries to participate in the supply ecosystem. Australia, Chile, and the United States possess significant sodium resources that remain largely untapped for battery applications, creating opportunities for supply chain diversification.

Processing infrastructure represents a critical bottleneck in the sodium battery supply chain. Current facilities optimized for lithium battery materials require modifications to accommodate sodium chemistry specifications. However, many existing lithium battery manufacturing facilities can be adapted for sodium battery production with moderate investment, potentially accelerating market entry.

Sustainability considerations provide another advantage for sodium battery supply chains. The extraction of sodium compounds generally has lower environmental impact than lithium extraction, particularly compared to water-intensive lithium brine operations. Additionally, the potential for using biomass-derived hard carbon as anode material creates circular economy opportunities that could further enhance supply chain resilience.

Market volatility presents less risk for sodium battery materials compared to lithium counterparts. Sodium compounds have established industrial applications beyond batteries, creating more stable pricing mechanisms. This stability could provide manufacturers with more predictable cost structures as production scales, though specialized battery-grade sodium compounds may develop premium pricing as demand increases.

Critical materials for sodium battery production include sodium salts (carbonates and hydroxides), cathode materials (primarily layered oxides containing transition metals like iron, manganese, and nickel), anode materials (hard carbon derived from biomass or petroleum coke), and solid electrolytes (NASICON-type ceramics, sodium beta-alumina, and polymer-based systems). Unlike lithium batteries, sodium technologies can utilize aluminum instead of copper for current collectors, representing significant cost advantages.

The geographical distribution of these materials presents a more balanced picture than lithium supply chains. While China currently dominates processing capabilities for most battery materials, sodium's widespread availability enables more countries to participate in the supply ecosystem. Australia, Chile, and the United States possess significant sodium resources that remain largely untapped for battery applications, creating opportunities for supply chain diversification.

Processing infrastructure represents a critical bottleneck in the sodium battery supply chain. Current facilities optimized for lithium battery materials require modifications to accommodate sodium chemistry specifications. However, many existing lithium battery manufacturing facilities can be adapted for sodium battery production with moderate investment, potentially accelerating market entry.

Sustainability considerations provide another advantage for sodium battery supply chains. The extraction of sodium compounds generally has lower environmental impact than lithium extraction, particularly compared to water-intensive lithium brine operations. Additionally, the potential for using biomass-derived hard carbon as anode material creates circular economy opportunities that could further enhance supply chain resilience.

Market volatility presents less risk for sodium battery materials compared to lithium counterparts. Sodium compounds have established industrial applications beyond batteries, creating more stable pricing mechanisms. This stability could provide manufacturers with more predictable cost structures as production scales, though specialized battery-grade sodium compounds may develop premium pricing as demand increases.

Environmental Impact and Sustainability Assessment

The environmental impact of solid-state sodium battery materials represents a significant advantage over conventional lithium-ion technologies. Sodium resources are approximately 1,000 times more abundant than lithium in the Earth's crust, with widespread global distribution that reduces geopolitical supply risks. This abundance translates to substantially lower environmental degradation from mining operations compared to lithium extraction, which often involves water-intensive processes in ecologically sensitive areas.

The manufacturing processes for sodium battery materials generally require lower energy inputs than their lithium counterparts, potentially reducing the carbon footprint of battery production by 15-20% according to recent lifecycle assessments. Additionally, the elimination of flammable liquid electrolytes in solid-state designs significantly reduces fire hazards and the environmental risks associated with thermal runaway incidents.

End-of-life considerations further highlight the sustainability advantages of sodium-based technologies. The materials used in solid-state sodium batteries are generally less toxic than those in conventional batteries, facilitating safer recycling processes. Current research indicates recovery rates of up to 90% for sodium compounds from spent batteries, compared to approximately 50-70% for lithium-ion technologies.

Water consumption metrics also favor sodium battery production, with preliminary studies suggesting a 30-40% reduction in water usage throughout the manufacturing lifecycle. This represents a critical sustainability advantage in regions facing water scarcity challenges, which often coincide with areas of high battery production.

Carbon emissions analysis reveals that the transition to sodium-based energy storage could potentially reduce lifecycle greenhouse gas emissions by 25-35% compared to current lithium-ion technologies when accounting for raw material extraction, processing, manufacturing, and end-of-life management. This reduction becomes even more significant when considering the lower energy requirements for recycling sodium battery components.

The sustainability profile of solid-state sodium batteries is further enhanced by their potential longevity. Laboratory tests indicate cycle life improvements of 30-50% over conventional lithium-ion batteries, reducing the frequency of replacement and associated environmental impacts. This extended operational lifespan translates directly to reduced material consumption and waste generation over time.

The manufacturing processes for sodium battery materials generally require lower energy inputs than their lithium counterparts, potentially reducing the carbon footprint of battery production by 15-20% according to recent lifecycle assessments. Additionally, the elimination of flammable liquid electrolytes in solid-state designs significantly reduces fire hazards and the environmental risks associated with thermal runaway incidents.

End-of-life considerations further highlight the sustainability advantages of sodium-based technologies. The materials used in solid-state sodium batteries are generally less toxic than those in conventional batteries, facilitating safer recycling processes. Current research indicates recovery rates of up to 90% for sodium compounds from spent batteries, compared to approximately 50-70% for lithium-ion technologies.

Water consumption metrics also favor sodium battery production, with preliminary studies suggesting a 30-40% reduction in water usage throughout the manufacturing lifecycle. This represents a critical sustainability advantage in regions facing water scarcity challenges, which often coincide with areas of high battery production.

Carbon emissions analysis reveals that the transition to sodium-based energy storage could potentially reduce lifecycle greenhouse gas emissions by 25-35% compared to current lithium-ion technologies when accounting for raw material extraction, processing, manufacturing, and end-of-life management. This reduction becomes even more significant when considering the lower energy requirements for recycling sodium battery components.

The sustainability profile of solid-state sodium batteries is further enhanced by their potential longevity. Laboratory tests indicate cycle life improvements of 30-50% over conventional lithium-ion batteries, reducing the frequency of replacement and associated environmental impacts. This extended operational lifespan translates directly to reduced material consumption and waste generation over time.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!