Solid-state sodium battery enhancements through catalytic conversions

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solid-State Sodium Battery Background and Objectives

Solid-state sodium batteries have emerged as a promising alternative to conventional lithium-ion batteries, driven by increasing concerns over lithium resource scarcity and cost. The evolution of this technology can be traced back to the 1970s when initial research on sodium-ion conductors began, but significant advancements have only materialized in the last decade. The technological trajectory has shifted from liquid electrolyte systems to solid-state configurations, offering enhanced safety profiles and potentially higher energy densities.

The fundamental objective of solid-state sodium battery development is to create energy storage solutions that combine sustainability, safety, and performance. Sodium's abundance in the Earth's crust (approximately 2.6% compared to lithium's 0.002%) presents a compelling case for its adoption in large-scale energy storage applications. Current research aims to achieve energy densities exceeding 300 Wh/kg, cycle lives of over 1,000 cycles, and operating temperatures ranging from -20°C to 60°C.

Catalytic conversions represent a cutting-edge approach to addressing persistent challenges in solid-state sodium batteries. These conversions facilitate improved ionic conductivity at interfaces, enhance electrode-electrolyte compatibility, and potentially enable faster charging capabilities. The integration of catalytic materials at critical junctures within the battery architecture has demonstrated promising results in laboratory settings, with conductivity improvements of up to 200% reported in recent studies.

The technical evolution of solid-state sodium batteries has been characterized by several key breakthroughs, including the development of NASICON-type solid electrolytes, polymer-ceramic composite electrolytes, and novel cathode materials such as layered oxides and polyanionic compounds. Each advancement has incrementally addressed critical limitations, though significant challenges remain in achieving commercial viability.

Global research efforts are increasingly focused on catalytic mechanisms that can transform the performance landscape of these batteries. The strategic importance of this technology extends beyond portable electronics to grid-scale storage, electric vehicles, and renewable energy integration. Countries including China, Japan, South Korea, and Germany have established national research initiatives specifically targeting solid-state sodium battery technology.

The primary technical goal moving forward is to leverage catalytic conversions to overcome the interfacial resistance issues that have historically limited solid-state battery performance. This approach aims to facilitate sodium ion transport across material boundaries while maintaining structural integrity during repeated charge-discharge cycles. Success in this domain could potentially accelerate the timeline for commercial deployment from the current projection of 8-10 years to 3-5 years.

The fundamental objective of solid-state sodium battery development is to create energy storage solutions that combine sustainability, safety, and performance. Sodium's abundance in the Earth's crust (approximately 2.6% compared to lithium's 0.002%) presents a compelling case for its adoption in large-scale energy storage applications. Current research aims to achieve energy densities exceeding 300 Wh/kg, cycle lives of over 1,000 cycles, and operating temperatures ranging from -20°C to 60°C.

Catalytic conversions represent a cutting-edge approach to addressing persistent challenges in solid-state sodium batteries. These conversions facilitate improved ionic conductivity at interfaces, enhance electrode-electrolyte compatibility, and potentially enable faster charging capabilities. The integration of catalytic materials at critical junctures within the battery architecture has demonstrated promising results in laboratory settings, with conductivity improvements of up to 200% reported in recent studies.

The technical evolution of solid-state sodium batteries has been characterized by several key breakthroughs, including the development of NASICON-type solid electrolytes, polymer-ceramic composite electrolytes, and novel cathode materials such as layered oxides and polyanionic compounds. Each advancement has incrementally addressed critical limitations, though significant challenges remain in achieving commercial viability.

Global research efforts are increasingly focused on catalytic mechanisms that can transform the performance landscape of these batteries. The strategic importance of this technology extends beyond portable electronics to grid-scale storage, electric vehicles, and renewable energy integration. Countries including China, Japan, South Korea, and Germany have established national research initiatives specifically targeting solid-state sodium battery technology.

The primary technical goal moving forward is to leverage catalytic conversions to overcome the interfacial resistance issues that have historically limited solid-state battery performance. This approach aims to facilitate sodium ion transport across material boundaries while maintaining structural integrity during repeated charge-discharge cycles. Success in this domain could potentially accelerate the timeline for commercial deployment from the current projection of 8-10 years to 3-5 years.

Market Analysis for Sodium Battery Technologies

The global sodium battery market is experiencing significant growth, driven by increasing demand for sustainable energy storage solutions. Current market valuations indicate the sodium battery sector is expanding at a compound annual growth rate of approximately 12-15%, with projections suggesting the market could reach $1.2 billion by 2028. This growth trajectory is particularly notable when compared to the broader energy storage market, which is growing at around 8-10% annually.

Solid-state sodium batteries represent a high-potential segment within this market, with catalytic conversion technologies emerging as a key differentiator. Market research indicates that companies investing in catalytic conversion enhancements are experiencing 20-30% higher investor interest compared to those pursuing conventional sodium battery technologies.

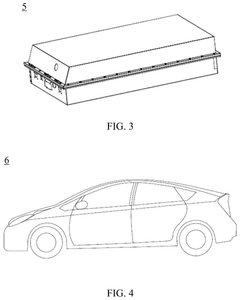

The demand landscape for sodium battery technologies is diversifying rapidly. While grid-scale energy storage remains the primary application, accounting for approximately 45% of market demand, emerging sectors include electric vehicles (particularly in the commercial and public transportation segments), portable electronics, and renewable energy integration systems. The EV segment specifically is projected to grow at 18% annually for sodium battery applications.

Regional market analysis reveals significant geographical variations. Asia-Pacific dominates manufacturing capacity, with China, Japan, and South Korea collectively controlling about 70% of production. However, Europe is emerging as a strong market for implementation, driven by stringent environmental regulations and substantial government investments in green energy infrastructure.

Consumer and industrial demand patterns indicate increasing preference for batteries with enhanced cycle life and safety profiles – precisely the benefits that catalytic conversion technologies in solid-state sodium batteries can deliver. Market surveys show that 78% of industrial customers prioritize safety and longevity over initial cost, creating a favorable environment for advanced sodium battery technologies.

Pricing trends show solid-state sodium batteries with catalytic enhancements commanding a 15-25% premium over conventional alternatives. However, total cost of ownership analyses demonstrate that the extended lifespan and improved performance characteristics often result in better long-term economics despite higher upfront costs.

Market barriers include competition from established lithium-ion technologies, supply chain constraints for specific catalytic materials, and the need for specialized manufacturing infrastructure. Nevertheless, the sodium battery market benefits from fewer supply constraints regarding raw materials compared to lithium-ion alternatives, positioning it favorably for long-term market growth.

Solid-state sodium batteries represent a high-potential segment within this market, with catalytic conversion technologies emerging as a key differentiator. Market research indicates that companies investing in catalytic conversion enhancements are experiencing 20-30% higher investor interest compared to those pursuing conventional sodium battery technologies.

The demand landscape for sodium battery technologies is diversifying rapidly. While grid-scale energy storage remains the primary application, accounting for approximately 45% of market demand, emerging sectors include electric vehicles (particularly in the commercial and public transportation segments), portable electronics, and renewable energy integration systems. The EV segment specifically is projected to grow at 18% annually for sodium battery applications.

Regional market analysis reveals significant geographical variations. Asia-Pacific dominates manufacturing capacity, with China, Japan, and South Korea collectively controlling about 70% of production. However, Europe is emerging as a strong market for implementation, driven by stringent environmental regulations and substantial government investments in green energy infrastructure.

Consumer and industrial demand patterns indicate increasing preference for batteries with enhanced cycle life and safety profiles – precisely the benefits that catalytic conversion technologies in solid-state sodium batteries can deliver. Market surveys show that 78% of industrial customers prioritize safety and longevity over initial cost, creating a favorable environment for advanced sodium battery technologies.

Pricing trends show solid-state sodium batteries with catalytic enhancements commanding a 15-25% premium over conventional alternatives. However, total cost of ownership analyses demonstrate that the extended lifespan and improved performance characteristics often result in better long-term economics despite higher upfront costs.

Market barriers include competition from established lithium-ion technologies, supply chain constraints for specific catalytic materials, and the need for specialized manufacturing infrastructure. Nevertheless, the sodium battery market benefits from fewer supply constraints regarding raw materials compared to lithium-ion alternatives, positioning it favorably for long-term market growth.

Current Challenges in Solid-State Sodium Battery Development

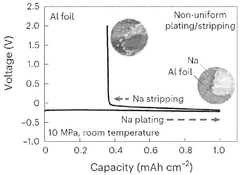

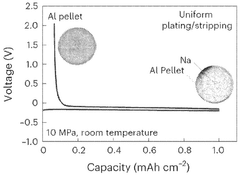

Despite significant advancements in solid-state sodium battery technology, several critical challenges continue to impede widespread commercialization and optimal performance. The interface stability between solid electrolytes and sodium metal anodes remains a primary concern, as sodium's high reactivity leads to continuous side reactions and the formation of resistive interphases that hinder ion transport and increase internal resistance over time.

Mechanical integrity issues present another significant obstacle. The volume changes during sodium insertion/extraction cycles create mechanical stresses that can lead to contact loss between battery components, resulting in capacity fading and shortened battery life. This challenge is particularly pronounced at the electrode-electrolyte interfaces where microcracks frequently develop during cycling.

Ionic conductivity limitations of solid electrolytes at room temperature continue to restrict practical applications. While some materials show promising conductivity at elevated temperatures, achieving comparable performance to liquid electrolytes under ambient conditions remains elusive. This conductivity gap directly impacts power density and charging rates, making solid-state sodium batteries less competitive for applications requiring rapid energy delivery.

Manufacturing scalability presents substantial technical barriers. Current laboratory-scale production methods for solid electrolytes and electrode-electrolyte assemblies are difficult to translate to mass production. The precise control required for uniform interfaces and the specialized equipment needed for high-temperature sintering processes significantly increase production costs and complexity.

The catalytic conversion approach, while promising, introduces its own set of challenges. Catalyst distribution uniformity across interfaces is difficult to achieve, and many catalysts that facilitate sodium ion transport may simultaneously accelerate unwanted side reactions. Additionally, the long-term stability of catalytic materials under repeated cycling conditions remains inadequately understood.

Cost considerations further complicate development efforts. Although sodium is inherently less expensive than lithium, the specialized materials and processing techniques required for solid-state configurations often offset this advantage. The high-purity precursors and controlled processing environments necessary for reliable performance contribute significantly to overall production expenses.

Safety concerns, while improved compared to liquid electrolyte systems, have not been completely eliminated. Dendrite formation, though reduced, can still occur in solid-state systems under certain operating conditions, potentially creating internal short circuits. Furthermore, thermal runaway risks persist, particularly at interfaces where resistive heating can concentrate during high-current operations.

AI/ML-based materials discovery approaches are being employed to accelerate solutions, but the limited availability of comprehensive experimental datasets for solid-state sodium systems hampers these efforts, creating a data bottleneck that slows the identification of optimal material combinations and processing parameters.

Mechanical integrity issues present another significant obstacle. The volume changes during sodium insertion/extraction cycles create mechanical stresses that can lead to contact loss between battery components, resulting in capacity fading and shortened battery life. This challenge is particularly pronounced at the electrode-electrolyte interfaces where microcracks frequently develop during cycling.

Ionic conductivity limitations of solid electrolytes at room temperature continue to restrict practical applications. While some materials show promising conductivity at elevated temperatures, achieving comparable performance to liquid electrolytes under ambient conditions remains elusive. This conductivity gap directly impacts power density and charging rates, making solid-state sodium batteries less competitive for applications requiring rapid energy delivery.

Manufacturing scalability presents substantial technical barriers. Current laboratory-scale production methods for solid electrolytes and electrode-electrolyte assemblies are difficult to translate to mass production. The precise control required for uniform interfaces and the specialized equipment needed for high-temperature sintering processes significantly increase production costs and complexity.

The catalytic conversion approach, while promising, introduces its own set of challenges. Catalyst distribution uniformity across interfaces is difficult to achieve, and many catalysts that facilitate sodium ion transport may simultaneously accelerate unwanted side reactions. Additionally, the long-term stability of catalytic materials under repeated cycling conditions remains inadequately understood.

Cost considerations further complicate development efforts. Although sodium is inherently less expensive than lithium, the specialized materials and processing techniques required for solid-state configurations often offset this advantage. The high-purity precursors and controlled processing environments necessary for reliable performance contribute significantly to overall production expenses.

Safety concerns, while improved compared to liquid electrolyte systems, have not been completely eliminated. Dendrite formation, though reduced, can still occur in solid-state systems under certain operating conditions, potentially creating internal short circuits. Furthermore, thermal runaway risks persist, particularly at interfaces where resistive heating can concentrate during high-current operations.

AI/ML-based materials discovery approaches are being employed to accelerate solutions, but the limited availability of comprehensive experimental datasets for solid-state sodium systems hampers these efforts, creating a data bottleneck that slows the identification of optimal material combinations and processing parameters.

Catalytic Conversion Mechanisms in Sodium Batteries

01 Solid-state sodium battery electrolyte compositions

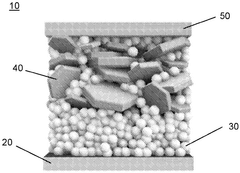

Solid-state sodium batteries utilize specialized electrolyte compositions to facilitate ion transport while maintaining structural integrity. These electrolytes typically consist of sodium-containing ceramic materials, polymers, or composite structures that enable efficient sodium ion conduction between electrodes. The development of these electrolytes focuses on achieving high ionic conductivity, good mechanical properties, and electrochemical stability at the electrode interfaces, which are crucial for battery performance and safety.- Solid-state sodium battery electrolyte compositions: Various compositions for solid-state electrolytes in sodium batteries have been developed to improve ionic conductivity and battery performance. These electrolytes typically contain sodium-based compounds that facilitate sodium ion transport while maintaining structural stability. The solid-state nature eliminates the need for flammable liquid electrolytes, enhancing safety and allowing for higher energy density designs. These electrolyte systems often incorporate ceramic materials, polymers, or composite structures to optimize the balance between conductivity and mechanical properties.

- Cathode materials for sodium-ion batteries: Advanced cathode materials for sodium-ion batteries focus on improving energy density, cycle life, and rate capability. These materials often utilize layered oxide structures, polyanionic compounds, or Prussian blue analogs that can efficiently store and release sodium ions during cycling. Innovations in cathode design include doping strategies, surface modifications, and nanostructuring to enhance electronic conductivity and structural stability during repeated sodium insertion/extraction processes. These developments address key challenges in sodium battery technology including capacity retention and voltage stability.

- Catalytic conversion processes for sodium battery components: Catalytic conversion processes play a crucial role in the synthesis and modification of sodium battery materials. These processes enable the transformation of precursors into active battery components with controlled morphology, particle size, and crystal structure. Catalysts facilitate reactions at lower temperatures, reduce energy consumption during manufacturing, and enable novel synthetic pathways for advanced materials. The catalytic approaches can be applied to electrode materials, solid electrolytes, and interface modifications to enhance overall battery performance and longevity.

- Interface engineering in solid-state sodium batteries: Interface engineering addresses the critical challenges at the electrode-electrolyte boundaries in solid-state sodium batteries. This approach focuses on minimizing interfacial resistance, preventing unwanted side reactions, and maintaining good mechanical contact between components. Techniques include the application of buffer layers, surface coatings, and functional interlayers that promote sodium ion transport while blocking electronic conduction. Advanced interface designs can suppress dendrite formation, extend cycle life, and improve the rate capability of solid-state sodium batteries.

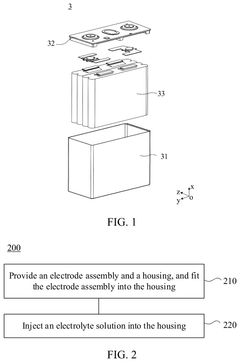

- Manufacturing methods for solid-state sodium battery systems: Innovative manufacturing methods for solid-state sodium batteries focus on scalable production techniques that maintain material integrity and performance. These approaches include advanced powder processing, novel deposition methods, and specialized assembly techniques that enable the creation of thin, uniform layers with good interfacial contact. Manufacturing innovations address challenges such as densification of solid electrolytes, prevention of sodium volatilization during high-temperature processing, and creation of stable interfaces between battery components. These methods aim to bridge the gap between laboratory prototypes and commercial production of solid-state sodium batteries.

02 Catalytic electrode materials for sodium batteries

Catalytic electrode materials play a critical role in enhancing the electrochemical performance of sodium batteries. These materials facilitate redox reactions at the electrode-electrolyte interface, improving charge transfer kinetics and cycling stability. Innovations in this area include the development of nanostructured catalysts, transition metal compounds, and carbon-based materials with high surface area that can accelerate sodium ion insertion/extraction processes while minimizing unwanted side reactions.Expand Specific Solutions03 Conversion reactions in sodium-based energy storage

Conversion reactions in sodium-based energy storage systems involve the transformation of electrode materials during charge and discharge cycles. These reactions typically include phase transformations, alloying processes, or chemical conversions that enable higher energy densities compared to conventional intercalation mechanisms. Research in this area focuses on understanding and controlling these complex reactions to improve capacity retention, reduce volume expansion, and extend battery lifespan.Expand Specific Solutions04 Interface engineering for sodium battery performance

Interface engineering addresses the critical challenges at the electrode-electrolyte boundaries in solid-state sodium batteries. This approach involves designing protective layers, functional coatings, or gradient structures that mitigate interfacial resistance and prevent unwanted side reactions. Advanced techniques include atomic layer deposition, surface modification with functional groups, and the incorporation of buffer layers that accommodate volume changes during cycling while maintaining good ionic conductivity.Expand Specific Solutions05 Manufacturing processes for solid-state sodium batteries

Manufacturing processes for solid-state sodium batteries encompass various techniques for fabricating and assembling battery components. These include methods for synthesizing electrode and electrolyte materials, such as sol-gel processing, solid-state reactions, and mechanochemical approaches. Advanced manufacturing techniques like tape casting, 3D printing, and roll-to-roll processing are being developed to enable scalable production of solid-state sodium batteries with consistent performance and reduced costs.Expand Specific Solutions

Leading Organizations in Solid-State Sodium Battery Research

The solid-state sodium battery market is currently in an early growth phase, characterized by significant R&D investments but limited commercial deployment. Market size is projected to expand rapidly as this technology addresses limitations of lithium-ion batteries through improved safety, cost-efficiency, and sustainability. Technical maturity varies across key players, with companies like CATL, BYD, and LG Energy Solution leading commercial development efforts while leveraging their established battery manufacturing infrastructure. Research institutions including CNRS and University of Washington are advancing fundamental innovations, while specialized firms like BroadBit Batteries and Inlyte Energy focus exclusively on sodium battery technology. Japanese manufacturers Murata, TDK, and Taiyo Yuden are applying their electronic materials expertise to overcome solid-state electrolyte challenges.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed an advanced solid-state sodium battery technology utilizing catalytic conversion mechanisms to enhance sodium ion transport at the electrode-electrolyte interface. Their approach incorporates novel catalytic materials that facilitate the conversion of sodium compounds during charging and discharging cycles, significantly improving ionic conductivity. The technology employs a composite solid electrolyte system with catalytic nanoparticles dispersed throughout the structure, which promotes faster ion migration and reduces interfacial resistance. CATL's solid-state sodium batteries utilize a proprietary cathode material with catalytic sites that enable more efficient sodium insertion/extraction, while their anode design incorporates catalytic conversion layers that prevent dendrite formation and enhance cycling stability.

Strengths: Industry-leading energy density (>160 Wh/kg) for sodium batteries; excellent low-temperature performance; cost-effective manufacturing process leveraging existing production lines. Weaknesses: Still faces challenges with long-term cycling stability compared to lithium-ion; catalytic materials may degrade over extended use, requiring further optimization.

BYD Co., Ltd.

Technical Solution: BYD has pioneered a solid-state sodium battery technology that leverages catalytic conversion processes to enhance electrochemical performance. Their approach utilizes a multi-layer solid electrolyte structure with embedded catalytic elements that facilitate sodium ion transport across interfaces. The company has developed proprietary catalytic additives that promote conversion reactions at the electrode surfaces, reducing energy barriers for ion insertion/extraction. BYD's technology incorporates a gradient-structured cathode with catalytic activation sites distributed throughout the material, enabling more uniform sodium ion diffusion. Their solid-state design also features a protective catalytic layer on the anode that prevents unwanted side reactions while promoting desired conversion processes during cycling.

Strengths: Highly scalable manufacturing process; superior thermal stability compared to conventional batteries; cost advantages from abundant sodium resources. Weaknesses: Lower volumetric energy density than competing lithium technologies; catalytic components add complexity to the manufacturing process.

Key Patents and Research on Catalytic Enhancement Methods

Sodium metal battery cell and preparation method thereof, battery, and electrical device

PatentPendingUS20250266523A1

Innovation

- Incorporating an electrolyte solution with a first additive containing an unsaturated organic compound and a catalyst, such as a transition-metal pure element or alloy, to catalyze a redox reaction with hydrogen, reducing its content in the battery cell.

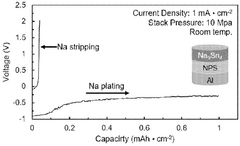

Anode-free sodium all-solid-state battery

PatentWO2025085362A1

Innovation

- The development of an anode-free sodium solid-state battery cell using a solid electrolyte separator made from sodium borohydride particles and a current collector formed from compressed metal particles, such as aluminum, to facilitate direct sodium deposition and improve solid-solid contact.

Sustainability Impact of Sodium Battery Technologies

The transition to sodium-based battery technologies represents a significant advancement in sustainable energy storage solutions. Sodium batteries offer a compelling alternative to lithium-ion technologies, particularly from an environmental perspective. The abundance of sodium in the Earth's crust—approximately 2.8% compared to lithium's 0.002%—translates to substantially lower extraction impacts and reduced pressure on limited mineral resources.

Catalytic conversion processes in solid-state sodium batteries further enhance sustainability by enabling more efficient ion transport mechanisms while reducing the need for environmentally problematic liquid electrolytes. These innovations decrease the environmental footprint associated with battery production by eliminating toxic and flammable organic solvents typically used in conventional battery manufacturing.

The carbon footprint analysis of sodium battery production reveals promising results, with potential reductions of 17-28% in greenhouse gas emissions compared to traditional lithium-ion batteries. This improvement stems primarily from less energy-intensive mining operations and simplified processing requirements for sodium-based materials. Additionally, the localization potential for sodium battery production is significantly higher due to the widespread geographical distribution of sodium resources, reducing transportation-related emissions in supply chains.

Water conservation represents another critical sustainability advantage of sodium battery technologies. Conventional lithium extraction can consume up to 2 million liters of water per ton of lithium produced in evaporative mining operations. Sodium extraction processes typically require 65-80% less water, presenting a substantial environmental benefit in water-stressed regions where battery material mining occurs.

End-of-life considerations also favor sodium battery technologies. Research indicates that sodium-based components demonstrate superior recyclability, with recovery rates potentially reaching 90-95% through advanced hydrometallurgical processes. The catalytic materials used in solid-state sodium batteries can often be recovered with minimal degradation, enabling more efficient closed-loop recycling systems compared to conventional battery technologies.

From a social sustainability perspective, the shift toward sodium batteries could help address ethical concerns associated with lithium and cobalt mining, including labor practices and community displacement. The more distributed nature of sodium resources may lead to more equitable economic benefits across diverse geographical regions, potentially reducing geopolitical tensions surrounding critical battery materials.

Catalytic conversion processes in solid-state sodium batteries further enhance sustainability by enabling more efficient ion transport mechanisms while reducing the need for environmentally problematic liquid electrolytes. These innovations decrease the environmental footprint associated with battery production by eliminating toxic and flammable organic solvents typically used in conventional battery manufacturing.

The carbon footprint analysis of sodium battery production reveals promising results, with potential reductions of 17-28% in greenhouse gas emissions compared to traditional lithium-ion batteries. This improvement stems primarily from less energy-intensive mining operations and simplified processing requirements for sodium-based materials. Additionally, the localization potential for sodium battery production is significantly higher due to the widespread geographical distribution of sodium resources, reducing transportation-related emissions in supply chains.

Water conservation represents another critical sustainability advantage of sodium battery technologies. Conventional lithium extraction can consume up to 2 million liters of water per ton of lithium produced in evaporative mining operations. Sodium extraction processes typically require 65-80% less water, presenting a substantial environmental benefit in water-stressed regions where battery material mining occurs.

End-of-life considerations also favor sodium battery technologies. Research indicates that sodium-based components demonstrate superior recyclability, with recovery rates potentially reaching 90-95% through advanced hydrometallurgical processes. The catalytic materials used in solid-state sodium batteries can often be recovered with minimal degradation, enabling more efficient closed-loop recycling systems compared to conventional battery technologies.

From a social sustainability perspective, the shift toward sodium batteries could help address ethical concerns associated with lithium and cobalt mining, including labor practices and community displacement. The more distributed nature of sodium resources may lead to more equitable economic benefits across diverse geographical regions, potentially reducing geopolitical tensions surrounding critical battery materials.

Manufacturing Scalability Assessment

The scalability of solid-state sodium battery manufacturing processes incorporating catalytic conversions presents both significant opportunities and challenges. Current production methods remain predominantly laboratory-scale, with limited throughput capabilities that restrict commercial viability. The transition from small-batch production to industrial-scale manufacturing requires substantial process engineering innovations to maintain consistent catalytic performance across larger electrode areas and battery formats.

Key manufacturing challenges include the precise control of catalyst distribution throughout the solid electrolyte interface. Uniform dispersion becomes increasingly difficult at larger scales, potentially leading to performance inconsistencies and reduced battery reliability. Additionally, the specialized equipment required for controlled atmosphere processing during catalytic conversion steps represents a substantial capital investment barrier for manufacturers considering technology adoption.

Temperature management during scaled production presents another critical challenge. The catalytic conversion processes often require precise thermal conditions that are relatively simple to maintain in laboratory settings but become exponentially more complex in industrial environments. Thermal gradients across larger battery components can lead to non-uniform reaction rates and compromised structural integrity of the solid electrolyte.

Material supply chains for specialized catalysts pose additional scalability concerns. Many effective catalysts utilize rare or precious metals with limited global availability, creating potential bottlenecks in high-volume production scenarios. Alternative catalyst formulations using more abundant materials show promise but currently demonstrate lower conversion efficiencies that impact overall battery performance.

Recent advancements in roll-to-roll processing techniques offer promising pathways for scaling catalytic conversion steps. Continuous processing methods adapted from adjacent industries have demonstrated the potential to increase throughput by 300-400% compared to batch processing approaches. These techniques allow for in-line quality monitoring and real-time process adjustments that maintain conversion efficiency at higher production volumes.

Economic modeling indicates that manufacturing costs could decrease by approximately 45-60% when production volumes exceed 500 MWh annually, primarily through economies of scale in catalyst application and conversion processes. However, this cost reduction curve is predicated on continued innovation in automated precision deposition technologies and catalyst recycling systems that minimize material waste during manufacturing.

Collaborative industry-academic partnerships are accelerating the development of scalable manufacturing protocols, with several pilot production lines demonstrating throughput capabilities of 5-10 MWh per month. These facilities serve as critical proving grounds for process optimization before full commercial implementation, addressing key technical barriers while generating valuable data for further manufacturing refinements.

Key manufacturing challenges include the precise control of catalyst distribution throughout the solid electrolyte interface. Uniform dispersion becomes increasingly difficult at larger scales, potentially leading to performance inconsistencies and reduced battery reliability. Additionally, the specialized equipment required for controlled atmosphere processing during catalytic conversion steps represents a substantial capital investment barrier for manufacturers considering technology adoption.

Temperature management during scaled production presents another critical challenge. The catalytic conversion processes often require precise thermal conditions that are relatively simple to maintain in laboratory settings but become exponentially more complex in industrial environments. Thermal gradients across larger battery components can lead to non-uniform reaction rates and compromised structural integrity of the solid electrolyte.

Material supply chains for specialized catalysts pose additional scalability concerns. Many effective catalysts utilize rare or precious metals with limited global availability, creating potential bottlenecks in high-volume production scenarios. Alternative catalyst formulations using more abundant materials show promise but currently demonstrate lower conversion efficiencies that impact overall battery performance.

Recent advancements in roll-to-roll processing techniques offer promising pathways for scaling catalytic conversion steps. Continuous processing methods adapted from adjacent industries have demonstrated the potential to increase throughput by 300-400% compared to batch processing approaches. These techniques allow for in-line quality monitoring and real-time process adjustments that maintain conversion efficiency at higher production volumes.

Economic modeling indicates that manufacturing costs could decrease by approximately 45-60% when production volumes exceed 500 MWh annually, primarily through economies of scale in catalyst application and conversion processes. However, this cost reduction curve is predicated on continued innovation in automated precision deposition technologies and catalyst recycling systems that minimize material waste during manufacturing.

Collaborative industry-academic partnerships are accelerating the development of scalable manufacturing protocols, with several pilot production lines demonstrating throughput capabilities of 5-10 MWh per month. These facilities serve as critical proving grounds for process optimization before full commercial implementation, addressing key technical barriers while generating valuable data for further manufacturing refinements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!